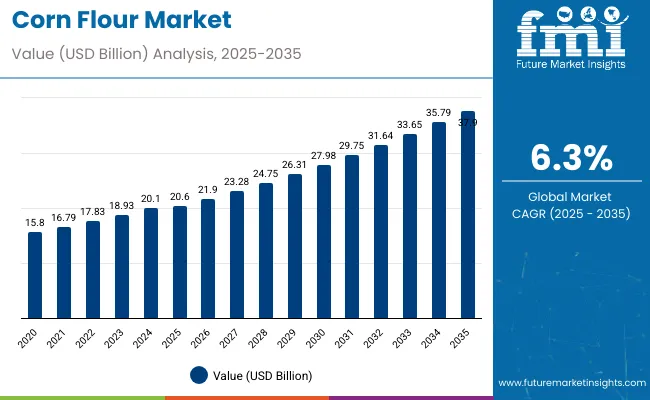

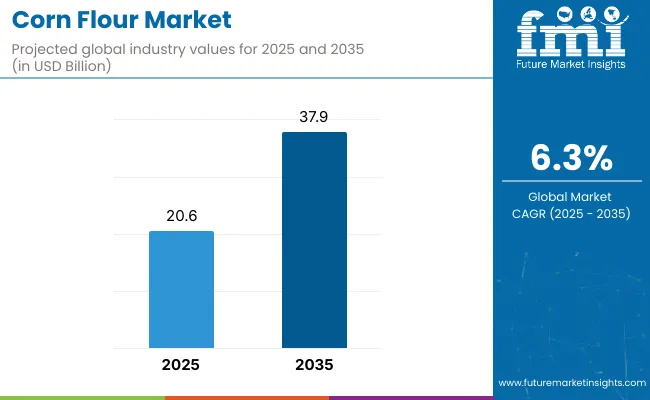

The corn flour market is estimated to be valued at USD 20.6 billion in 2025. It is projected to reach USD 37.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 17.3 billion over the forecast period. This reflects a 1.84 times growth at a compound annual growth rate of 6.3%. The market's evolution is expected to be shaped by increasing demand for gluten-free and health-conscious food alternatives, the rising popularity of convenient food formats, and the growing influence of Western-style bakery consumption across developing economies.

By 2030, the market is likely to reach USD 28.8 billion, reflecting USD 8.2 billion growth from 2025. The remaining USD 9.1 billion will be added from 2030 to 2035, suggesting a moderately back-loaded growth pattern. Product innovation in corn separation and processing technologies is gaining traction due to corn flour’s favorable nutritional advantages and enhanced product quality profiles.

Companies such as Archer Daniels Midland Company and Ardent Mills LLC are advancing their competitive positions through investment in advanced processing technologies and scalable production systems. Health-conscious procurement models are supporting expansion into gluten-free bakery, functional food, and snack applications. Market performance will remain anchored in nutritional efficacy, processing innovation, and clean-label compliance benchmarks.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 20.6 billion |

| Projected Value (2035F) | USD 37.9 billion |

| CAGR (2025 to 2035) | 6.3% |

The market holds varying shares across its parent markets. Within the broader flour market, it accounts for 12% due to rising demand for gluten-free alternatives. Within the corn products segment, corn flour represents around 22%, with the remainder consisting of corn starch and cornmeal. Its share in the gluten-free products market is estimated at 8%, driven by bakery and snack applications. Within the food ingredients market, corn flour represents nearly 5%, while in the bakery ingredients segment, it holds a 10% share. In functional and grain-based products markets, its share ranges from 6% to 9%.

The market is undergoing structural change driven by rising demand for gluten-free, health-conscious, and convenient food alternatives. Advanced processing technologies using enzymatic corn separation and bio-based extraction methods have enhanced nutritional profiles and product quality, making corn flour a viable substitute for traditional wheat-based ingredients. Manufacturers are introducing specialized formulations tailored for specific applications, expanding beyond basic baking into functional foods and wellness segments. Government initiatives promoting food security in India and the United States have widened consumer acceptance, reshaping traditional flour sourcing. Innovations such as enzymatic separation by Novozymes and upcycled corn flour by Renewal Mill are contributing to sustainability while expanding health applications.

Corn flour's gluten-free properties, superior nutritional profile, and functional versatility make it an attractive ingredient for health-conscious consumers and food manufacturers seeking wheat alternatives and clean-label solutions. Its high fiber content, low glycemic index, and allergen-free characteristics align perfectly with rising demand for diabetic-friendly and celiac-appropriate food products.

Growing awareness of gluten-free diets and functional foods is further propelling adoption, especially in the bakery, confectionery, and snack food sectors. Government initiatives promoting food security and healthy eating in key markets like India and the United States, along with innovations in enzymatic separation and bio-based processing technologies, are also enhancing product quality and application versatility.

As health and wellness trends accelerate across demographics and clean-label preferences become critical, the market outlook remains favorable. With consumers and manufacturers prioritizing nutritional density, gluten-free formulations, and sustainable sourcing, corn flour is well-positioned to expand across various food, beverage, and specialty nutrition applications.

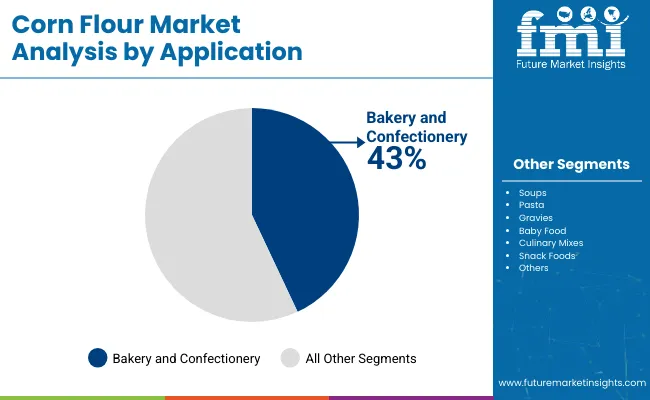

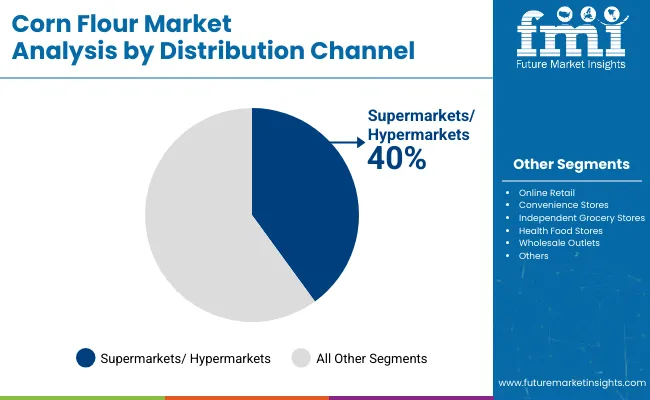

The market is segmented by application, distribution channel, and region. By application, the market is categorized into bakery and confectionery products, snack foods, and other applications (soups, pasta, gravies, baby food, and culinary mixes). Based on distribution channel, the market is divided into online retail, supermarkets/hypermarkets, convenience stores, and other distribution channels (independent grocery stores, health food stores, and wholesale outlets). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, the Middle East and Africa.

The bakery and confectionery segment holds a dominant position with 43% of the market share in the application category, owing to rising health awareness and increasing demand for gluten-free baked goods. Corn flour blends seamlessly with other flours, making it ideal for producing cookies, cakes, and pastries while delivering superior nutritional benefits, including high fiber content and low glycemic index properties.

Consumer preference for nutritious, allergen-free bakery items is reinforcing demand within this segment, especially in Western markets and urban Asia. The ingredient's functional versatility supports product innovation in gluten-free formulations, celiac-friendly products, and diabetic-appropriate baked goods.

Manufacturers are leveraging corn flour's binding properties and neutral taste profile to create premium bakery products that cater to health-conscious consumers. The segment is poised to expand further as gluten-free baking continues to gain mainstream acceptance across developed and emerging markets.

Supermarkets and hypermarkets dominate the corn flour distribution landscape with 40% of the market share in 2025, as these outlets offer a wide product variety, competitive pricing, and the convenience of physical inspection before purchase. Consumer preference for trusted brands and fresh stock increases foot traffic in these retail environments.

These channels facilitate in-store promotions, product sampling, and higher visibility for new gluten-free products through dedicated specialty aisles that attract health-conscious shoppers. Their one-stop shopping convenience allows consumers to access multiple corn flour brands and compare options effectively.

Modern retail expansion, especially in urban and semi-urban zones of Asia and Latin America, is supporting this segment's continued dominance in the corn flour distribution ecosystem.

In 2024, global corn flour consumption grew by 14% year-on-year, with North America and Asia-Pacific taking a combined 55% share. Applications include gluten-free bakery formulations, health-conscious snack production, and functional food enhancement. Manufacturers are introducing specialized corn flour grades and multi-functional blends that deliver superior binding properties and nutritional density. Clean-label formulations now support transparent ingredient positioning for allergen-free products. Gluten-free consumption trends and nutritional efficacy support consumer confidence. Technology providers increasingly supply ready-to-use corn flour solutions with integrated nutritional profiles to reduce formulation complexity.

Gluten-Free Preferences and Nutritional Benefits Accelerate Market Growth

Food manufacturers and bakery companies are choosing corn flour ingredients to achieve gluten-free certification, enhance nutritional profiles, and meet consumer demands for allergen-free food products. In nutritional testing, high-quality corn flour delivers up to 12% protein content and 7-9% fiber compared to refined wheat flour at 10-11% protein and 2-3% fiber. Products formulated with corn flour maintain structural integrity throughout processing and baking cycles. In gluten-free formats, corn flour-enhanced baked goods help achieve texture and taste profiles comparable to wheat-based products while reducing glycemic impact by up to 25%. Corn flour applications are now being deployed for clean-label positioning, increasing adoption in sectors demanding natural gluten alternatives. These advantages help explain why corn flour adoption rates in food manufacturing rose 28% in 2024 across North America and Europe.

Raw Material Costs, Infrastructure Gaps and Market Competition Limit Growth Potential

Growth faces constraints due to corn price fluctuations, specialized processing requirements, and competition from alternative flours. Raw corn costs can vary from USD 4 to USD 7 per bushel, depending on seasonal factors and regional supply conditions, impacting flour pricing and leading to procurement delays of up to 15% in industrial applications. Specialized milling technology requirements and quality control standards add 3 to 5 weeks to product development cycles. Transportation logistics and storage conditions extend distribution costs by 12-18% compared to conventional wheat flour. Limited availability among fine-milling capable processing facilities limits scalable production, especially for specialty grade projects. These constraints make corn flour adoption challenging in price-sensitive markets despite growing gluten-free benefits and commercial interest.

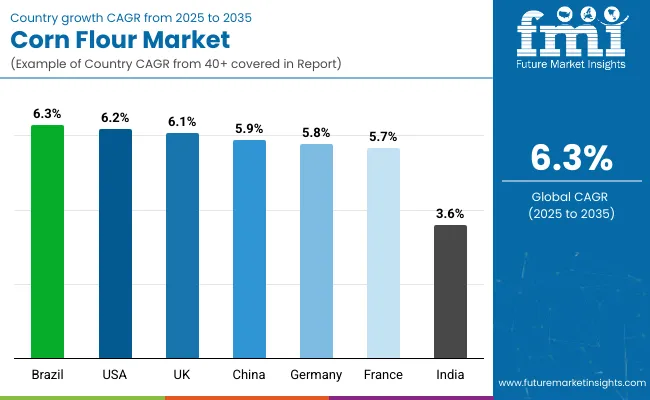

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 6.3% |

| USA | 6.2% |

| UK | 6.1% |

| China | 5.9% |

| Germany | 5.8% |

| France | 5.7% |

| India | 3.6% |

In the corn flour market, Brazil leads with the highest projected CAGR of 6.3% from 2025 to 2035, driven by the expansion of gluten-free food segments and rising health consciousness. The USA follows closely with a 6.2% CAGR, supported by strong demand for allergen-free baking ingredients and clean-label products. The UK shows solid growth at 6.1%, benefiting from premium gluten-free market expansion. China demonstrates robust performance at 5.9% CAGR, fueled by the adoption of Western-style bakeries and urbanization trends. Germany and France exhibit steady growth at 5.8% and 5.7% respectively, supported by functional food innovations. India shows the lowest increase at 3.6%, reflecting market maturity despite strong agricultural foundations.

The report covers a comprehensive analysis of 40+ countries; seven top-performing markets are highlighted below.

Revenue from corn flour in Brazil is projected to grow at a CAGR of 6.3% from 2025 to 2035, matching the global average. Growth is fueled by increasing demand for gluten-free products and health-conscious food alternatives across major urban centers like São Paulo, Rio de Janeiro, and Brasília. Brazilian food manufacturers are investing in advanced corn processing technologies to improve product quality and nutritional profiles. Strong domestic corn production capabilities and rising export activity to neighboring Latin American markets are reinforcing Brazil's position as a regional leader in corn flour manufacturing and distribution.

Key Statistics:

The corn flour market in the USA is anticipated to expand at a CAGR of 6.2% from 2025 to 2035, slightly below the global rate. Growth is centered on gluten-free product innovation and clean-label food applications in major markets, including California, Texas, and Illinois. Advanced milling technologies and enzymatic processing methods are being deployed for specialty corn flour production targeting health-conscious consumers. Strategic partnerships between USA corn processors and food manufacturers have strengthened significantly, with particular focus on organic certifications and sustainable sourcing practices in premium dietary segments.

Key Statistics:

Sales of corn flour in the UK are projected to flourish at a CAGR of 6.1% from 2025 to 2035, marginally below the global average. Growth is concentrated in premium gluten-free applications and specialty food production across the London, Manchester, and Birmingham regions. Corn flour adoption is shifting toward health-focused bakery products and functional food enhancement. Custom milling services and specialized processing capabilities lead commercial deployment strategies. Domestic partnerships between UK food manufacturers and European corn suppliers have strengthened, supported by increasing demand for allergen-free ingredients in mainstream retail channels.

Key Statistics:

Revenue from corn flour in China is expected to grow at a CAGR of 5.9% from 2025 to 2035, underperforming the global average by 0.4%. Demand is driven by Western-style bakery expansion and processed food development in major cities like Beijing, Shanghai, and Guangzhou. Food manufacturers are increasingly adopting corn flour for product diversification and nutritional enhancement in traditional and modern food applications. However, strong competition from conventional wheat flour and rice-based alternatives limits market penetration.

Key Statistics:

Demand for corn flour in Germany is anticipated to increase at a CAGR of 5.8% from 2025 to 2035, supported by strong demand for gluten-free products and functional food applications. Urban markets like Berlin, Munich, and Hamburg are experiencing increased adoption of corn flour in artisanal bakeries and health food production. German food manufacturers are leveraging advanced milling technologies to meet stringent quality standards for organic and clean-label products.

Key Statistics:

The corn flour market in France is anticipated to expand at a CAGR of 5.7% from 2025 to 2035, driven by artisanal food production and premium bakery applications in Paris, Lyon, and Marseille regions. French food manufacturers are focusing on traditional and gourmet applications, integrating corn flour into high-end patisserie and specialty food products. Market growth is supported by increasing consumer awareness of gluten intolerance and French culinary traditions adapting to include alternative flour ingredients in traditional recipes and modern food innovations.

Key Statistics:

Sales of corn flour in India are estimated to increase at a CAGR of 3.6% from 2025 to 2035, significantly underperforming the global average. Growth is limited by a strong preference for traditional wheat flour and established regional grain consumption patterns across major markets, including Delhi, Mumbai, and Bangalore. Indian food manufacturers face challenges from low consumer awareness of corn flour benefits and price sensitivity in mass market segments. However, urban health-conscious consumers and diabetic population segments are driving modest demand growth, particularly in metropolitan areas.

Key Statistics:

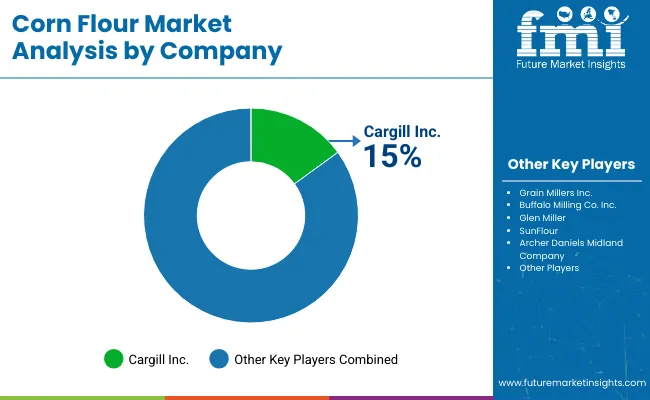

The market is moderately consolidated, featuring a mix of global agribusiness corporations, specialized milling companies, and regional processors with varying degrees of processing technology, product innovation, and application expertise. Archer Daniels Midland Company and Cargill Inc. lead the industrial corn flour segment, supplying high-volume ingredients for food manufacturing, bakery applications, and processed food production. Their strength lies in comprehensive corn processing capabilities, global distribution networks, and established relationships with major food manufacturers.

General Mills Inc. and Ardent Mills LLC differentiate through advanced milling technologies, custom flour formulations, and application-specific solutions that cater to premium bakery, gluten-free, and specialty food applications. King Arthur Flour and Bob's Red Mill Natural Foods focus on organic and specialty corn flour production, addressing growing demand for clean-label, non-GMO, and artisanal baking ingredient applications.

Regional specialists such as Grain Millers Inc., Grain Craft, and Ingredion Incorporated emphasize processing innovation, sustainable sourcing practices, and functional flour development, creating value in health-focused ingredient markets and specialized dietary applications.

Entry barriers remain significant, driven by challenges in advanced milling technology, corn supply chain integration, and compliance with food safety and quality standards across multiple application categories. Competitiveness increasingly depends on milling efficiency, nutritional enhancement capabilities, and product development expertise for diverse food manufacturing and consumer retail environments.

| Items | Value |

|---|---|

| Quantitative Units | USD 20.6 billion |

| By Application | Bakery and Confectionery Products, Snack Foods, Other Applications (Soups, Pasta, Gravies, Baby Food, and Culinary Mixes) |

| By Distribution Channel | Hypermarkets/Supermarkets, Online Retail, Convenience Stores, Other Distribution Channels ( Independent Grocery Stores, Health Food Stores, and Wholesale Outlets) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia , the Pacific, East Asia, the Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia , India and 40+ countries |

| Key Companies Profiled | Grain Millers Inc., Buffalo Milling Co. Inc., Glen Miller, SunFlour , Archer Daniels Midland Company, General Mills Inc., Bob’s Red Mill Natural Foods, King Arthur Flour, Ardent Mills LLC, Grain Craft, Italgrani USA, Miller Milling |

| Additional Attributes | Dollar sales by application and distribution channel; regional demand trends; competitive landscape; consumer preferences for whole-grain, gluten-free, and fortified variants; integration with sustainable and non-GMO sourcing; innovations in milling and formulation; and quality & safety standardization across retail and foodservice channels |

The global corn flour market is estimated to be valued at USD 20.6 billion in 2025.

The market size for the corn flour market is projected to reach USD 37.9 billion by 2035.

The corn flour market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in corn flour market are bakery and confectionery products, snack foods and other applications.

In terms of distribution channel, sales via online retail segment to command 42.6% share in the corn flour market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nixtamalized Corn Flour Market Analysis by Product Type and End Use Through 2035

Corn-Based Plastics for Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cornstarch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corneal Ulcer Treatment Market Size, Growth, and Forecast for 2025 to 2035

Corn Puff Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Corn Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Corner Pads Market Insights - Growth & Demand 2025 to 2035

Corn Steep Powder Market Size, Growth, and Forecast for 2025 to 2035

Corn Wet Milling Services Market Size, Growth, and Forecast for 2025 to 2035

Flour Mixes Market Growth – Specialty Baking & Industry Trends 2025 to 2035

Corn Sweeteners Market Outlook - Growth, Demand & Forecast 2025 to 2035

Corn Fiber Market Trends - Functional Fibers & Industry Demand 2025 to 2035

Corn Protein Market Outlook - Growth, Demand & Forecast 2025 to 2035

Corn and Callus Remover Market Insights-Size, trends and Forecast 2025-2035

Flour Substitutes Market Analysis by Baked Goods, Noodles, Pastry, Fried Food, Pasta, Bread, Crackers Applications Through 2035

Corn Silage Market Analysis – Growth, Trends & Forecast 2024-2034

Flour Conditioner Market

Corn Co-Products Market

Corn-Based Protein Market

Corneal Edema Treatment Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA