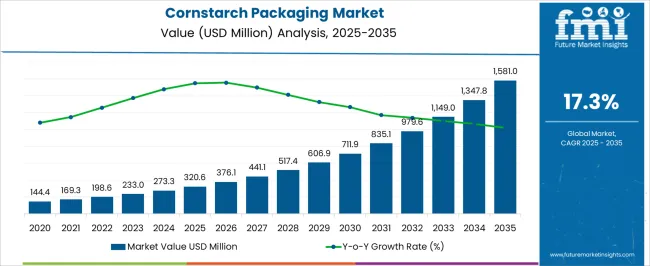

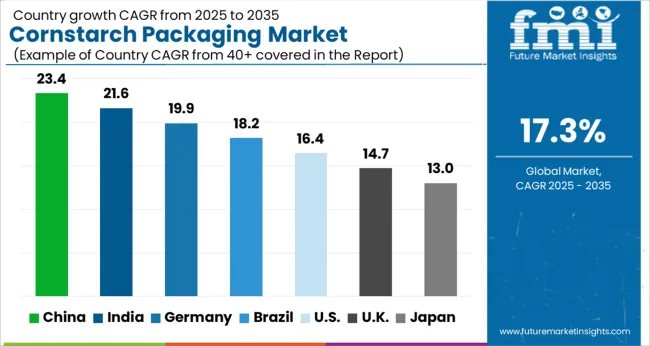

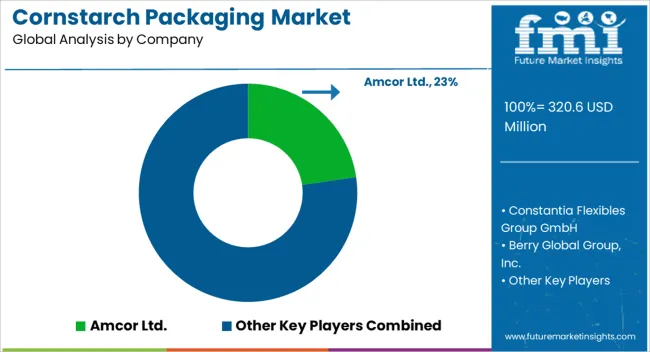

The Cornstarch Packaging Market is estimated to be valued at USD 320.6 million in 2025 and is projected to reach USD 1581.0 million by 2035, registering a compound annual growth rate (CAGR) of 17.3% over the forecast period.

| Metric | Value |

|---|---|

| Cornstarch Packaging Market Estimated Value in (2025 E) | USD 320.6 million |

| Cornstarch Packaging Market Forecast Value in (2035 F) | USD 1581.0 million |

| Forecast CAGR (2025 to 2035) | 17.3% |

The cornstarch packaging market is gaining strong traction as industries and consumers shift toward biodegradable and eco friendly alternatives to conventional plastic packaging. Rising concerns over environmental degradation and mounting regulatory restrictions on single use plastics have accelerated the adoption of cornstarch based materials.

These products provide biodegradability, compostability, and sufficient durability, making them suitable for multiple packaging applications. Food and beverage brands are particularly investing in sustainable packaging formats that align with consumer preferences for eco friendly solutions.

Advances in biopolymer processing and cost optimization strategies are further supporting commercialization at scale. As governments, retailers, and manufacturers continue to implement sustainability initiatives, the demand for cornstarch packaging is projected to expand consistently, creating opportunities for innovation in product design, performance enhancement, and e commerce packaging applications.

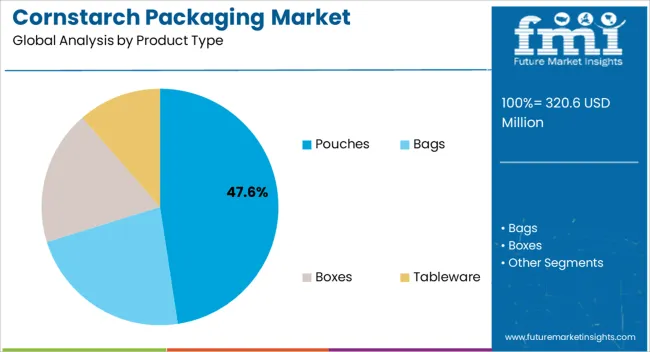

The pouches segment is projected to hold 47.60% of the total revenue by 2025 within the product type category, making it the leading segment. Growth in this segment is driven by the rising popularity of flexible and lightweight packaging formats that reduce material consumption and transportation costs.

Pouches provide convenience in terms of storage, handling, and disposal while maintaining the eco friendly appeal of cornstarch based materials.

Their adaptability across various food and retail applications has further reinforced adoption, positioning pouches as the most dominant product type within the cornstarch packaging market.

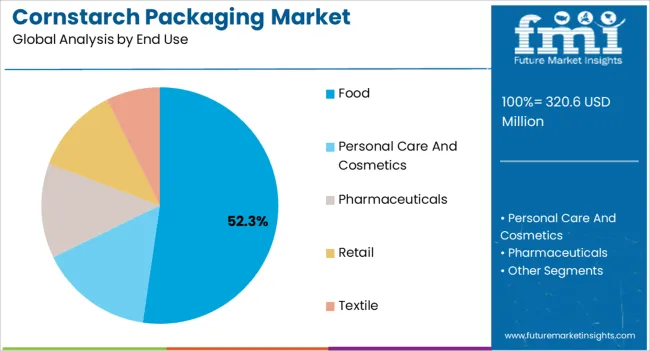

The food segment is expected to account for 52.30% of total market revenue by 2025 within the end use category, establishing itself as the primary contributor. Increasing consumer demand for sustainable packaging solutions in food delivery, ready to eat products, and retail packaging has been the main driver of this growth.

Food producers are prioritizing packaging that maintains freshness and safety while meeting regulatory and consumer sustainability expectations.

Cornstarch packaging has proven to be an effective alternative to plastic trays, wraps, and containers in the food industry, leading to its significant share in this category.

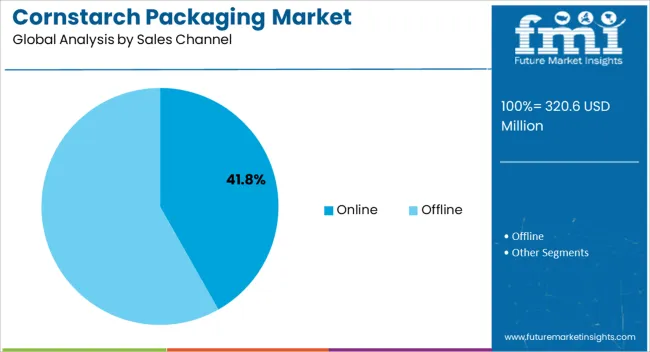

The online sales channel segment is anticipated to contribute 41.80% of overall market revenue by 2025 within the sales channel category, positioning it as a key growth driver. Expansion of e commerce platforms and rising consumer preference for direct to doorstep delivery have accelerated demand for sustainable packaging.

Cornstarch based solutions are being increasingly adopted by online retailers to align with corporate sustainability commitments and to reduce packaging waste.

The durability, compostability, and adaptability of cornstarch packaging make it highly suitable for shipping and delivery requirements, reinforcing the dominance of the online sales channel in this market.

Food takeaway and food orders have become standard practices worldwide due to people's busy lifestyles. Resulting in a surge in demand for the biodegradable food packaging market. Another trend that is driving sales of biodegradable food packaging is food on the go.

The market is estimated to expand at 17.3% CAGR between 2025 and 2035, in comparison to the 8.5% CAGR registered from 2020 to 2025.

In recent years, the cornstarch packaging business has grown significantly. The fundamental driver of this increase has been the desire for sustainable and eco-friendly packaging solutions. Consumer preferences are shifting towards biodegradable packaging solutions as people become more aware of environmental issues and the environmental impact of plastic waste.

The food and beverage industry, which is the leading contributor to plastic waste, has predominantly fueled the market for cornstarch packaging. Cornstarch packaging is widely utilized in this business for snacks, baked items, and fresh produce. Cornstarch packaging is also being used in the cosmetics and personal care industries for items like soap and shampoo bars.

The growth of the cornstarch packaging market is also expected to be influenced by technological advancements. Such as, in the production of biodegradable materials and the development of new and innovative packaging solutions. As more companies declare their commitment to the environment, scaling up packaging options is essential to the success of both the product and the business.

The above-mentioned factors are likely to assist the market to surpass the value of USD 1,145.0 million by 2035.

Cornstarch-based tableware, such as disposable plates, cups, and silverware, accounts for a substantial portion of the cornstarch packaging business. These biodegradable and compostable goods have become a popular alternative to standard petroleum-based plastics for single-use items.

Tableware made of cornstarch has various advantages over standard plastic tableware. They are constructed of renewable resources and are biodegradable and compostable. This means they can be broken down into natural components and do not contribute to environmental plastic waste. Furthermore, cornstarch-based tableware is microwave and freezer safe, making it ideal for a variety of uses.

Cornstarch-based packaging goods are widely used in the food business. Cornstarch-based packaging can be utilized in a variety of food packaging applications, including bags, containers, trays, and films.

The cornstarch packaging for the food sector is biodegradable and compostable, which means that it can be disposed of in an ecologically sound manner. Lowering the amount of plastic waste that ends up in landfills or seas. Furthermore, cornstarch-based packaging can be created with a variety of barrier qualities. Making it useful for packing a variety of food items such as dry goods, snacks, and fresh produce.

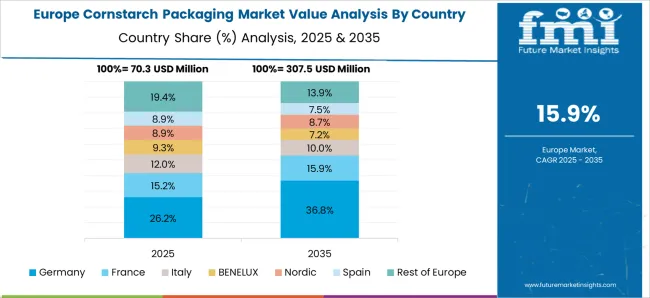

Europe is a significant market for cornstarch-based packaging because of rising consumer demand and government requirements. The region has been at the forefront of the transition to sustainable packaging solutions.

Several European countries have put regulations in place to limit plastic waste. Such as banning single-use plastic goods and incentivizing the use of sustainable packaging alternatives. This has increased demand for biodegradable and compostable cornstarch-based packaging goods, which are an appealing alternative to standard petroleum-based plastics.

The European cornstarch packaging market is also known for its high degree of innovation. Where manufacturers always produce new and improved products to fulfill the changing needs of consumers and the industry.

The United Kingdom is one of the top countries in Europe, with an increasing need for biodegradable packaging. The increased awareness of the sustainability elements of packaging products, together with recent government measures, is providing a favorable market setting for the country's growth of the researched industry.

The restriction on single-use plastics is one of the key factors influencing demand for biodegradable packaging. To combat plastic pollution, the United Kingdom government announced plans in 2024 to ban single-use plastic cutlery, plates, and polystyrene cups in England.

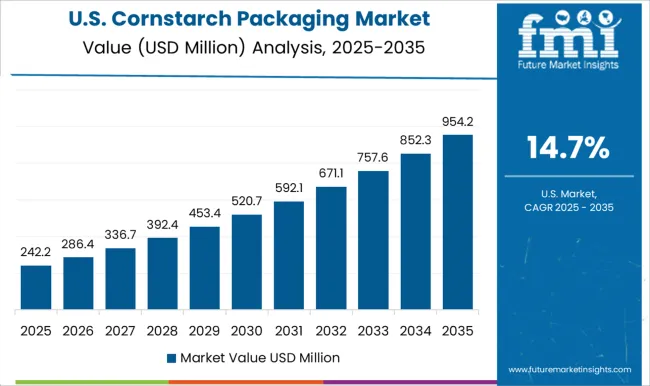

The food sector in the United States is vast, and many businesses are seeking sustainable packaging solutions. To reduce their environmental effect and meet consumer demand for eco-friendly products. Cornstarch-based packaging is a biodegradable and compostable alternative to standard petroleum-based plastics, making it an appealing choice for businesses trying to lessen their environmental impact. Furthermore, numerous jurisdictions in the United States have established regulations to limit plastic waste. Such as prohibitions on certain single-use plastic products and plastic bag levies. These policies have raised the demand for environmentally friendly packaging solutions, such as cornstarch packaging.

Given the region's vast population and expanding middle class, demand for packaged food and beverages has soared. As a result, there is a greater demand for environmentally friendly packaging alternatives, such as cornstarch-based packaging.

Many cornstarch-based packaging producers are also situated in China. The country has a substantial corn sector, which provides a convenient and low-cost source of raw materials for the manufacture of cornstarch-based packaging solutions. Chinese producers are investing in R&D to create new and novel cornstarch-based packaging goods with enhanced features such as strength, durability, and heat resistance.

The abundance of raw materials and rapid technological advancement in the field of cornstarch packaging are expected to be key market drivers.

According to the Packaging Industry Association of India (PIAI), the Indian packaging market is likely to be worth more than USD 320.6 billion by the end of 2025. Rising per capita spending and high demand for superior products with lightweight and durable cornstarch packaging that protects them from contamination drive market growth over the forecast period.

Some key players in the market include:

Other notable players in the cornstarch packaging market include Cargill Inc., PSM Biodegradable Packaging, LLC, and Eco-Products, Inc.

The market is characterized by intense competition, with players focusing on innovation and product differentiation to gain a competitive edge. Manufacturers are investing in research and development to create new and improved cornstarch-based packaging products with enhanced properties such as increased strength, durability, and heat resistance. Additionally, players are focusing on developing customized packaging solutions for specific applications, such as food packaging, to cater to the specific needs of their customers.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 17.3% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends, and Pricing Analysis |

| Key Segments Covered | By Product type, By Sales Channel, By End User Industry, By Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; The Middle East & Africa; Oceania |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, Italy, France, The United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | Amcor Ltd.; Constantia Flexibles Group GmbH; Berry Global Group, Inc.; Huhtamäki Oyj; Sonoco Products Company; Bemis Company, Inc.; Sealed Air Corporation; AR Packaging Group AB; Mondi Group; DS Smith Plc; CCL Industries Inc. |

| Customization & Pricing | Available upon Request |

The global cornstarch packaging market is estimated to be valued at USD 320.6 million in 2025.

The market size for the cornstarch packaging market is projected to reach USD 1,581.0 million by 2035.

The cornstarch packaging market is expected to grow at a 17.3% CAGR between 2025 and 2035.

The key product types in cornstarch packaging market are pouches, bags, boxes and tableware.

In terms of end use, food segment to command 52.3% share in the cornstarch packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Packaging Bins Market Trends - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA