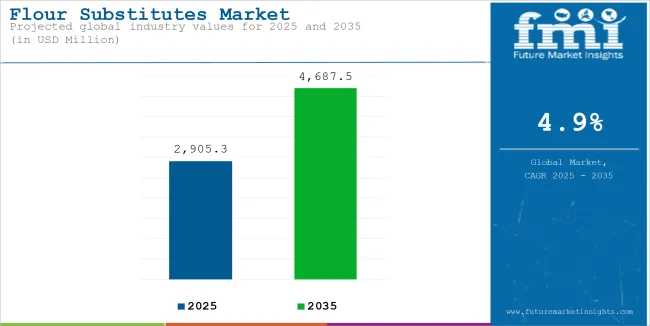

The global flour substitutes market is estimated to be worth USD 2,905.3 million by 2025. It is projected to reach USD 4,687.5 million by 2035, reflecting a CAGR of 4.9% over the assessment period 2025 to 2035.

The flour substitutes market lately got a lot of interest compared to previous years because this was recognized as an exposure to becoming a large market in the future due to increasing public demand for good health and diets. Increasing importance of health and wellness in consumer purchase habits has a great impact on baking. The constant rise in the prevalence of individuals who are gluten intolerant and those diagnosed with celiac disease has made Flour Substitutes the most popular product.

The evidence speaks for itself; the necessity for alternative flours is skyrocketing, as the number of customers finding out they have an intolerance to gluten and related diseases has not stopped increasing. Conversely, as products abound with substitute ingredients on retail racks and e-platforms, this boom is largely arranged by innovative product development as well as an increase in availability.

The rising buzz around natural or functional consumer furtherly boosts marketing potential as manufacturers put options on the retail racks-tasting products like traditional wheat-flour items.

The Flour Substitutes market is manifesting accelerated growth due to the impact of several primary factors. The demand for these products has increased as more people rely on gluten-free diets and low-carb foods, which are the basic choices of consumers who prefer to be healthier and allergy-friendly. The escalating incidences of celiac disease and food allergies are another reason for the expansion of this sector. Besides, the plant-based and vegan diets trend is igniting interest in the non-conventional flours such as almond, coconut, and chickpea.

The high protein flour market has been experiencing significant growth, this is due to the contribution of various vital driving factors. One of the main drivers is the population's rising health consciousness, people are concerned about their health, and they crave gluten-free and low-carb and high-nutrient flour options. Also, this trend of gluten intolerance and various food allergies leads to the market extension.

Moreover, the trend of veganism and plant-based diets becoming very popular has automatically led to the corresponding demand for flour made from beans, nuts, and other alternative sources. Innovations in food technology and product lines have transformed the producers into making flour with better nutritional values and the best taste.

Consequently, they have been able to increase their sales among the health-conscious people. Meanwhile, the new methods of food processing have not only resulted in easier production of enriched flour containing more nutrients but have also appealed to those who are health-conscious.

| Attributes | Description |

|---|---|

| Estimated Global Flour Substitutes Industry Size (2025E) | USD 2,905.3 million |

| Projected Global Flour Substitutes Industry Value (2035F) | USD 4,687.5 million |

| Value-based CAGR (2025 to 2035) | 4.9% |

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global Flour Substitutes market. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 4.6% (2024 to 2034) |

| H2 | 5.1% (2024 to 2034) |

| H1 | 4.9% (2025 to 2035) |

| H2 | 5.6% (2025 to 2035) |

In the first half (H1) of the decade from 2025 to 2035, the business is predicted to surge at a CAGR of 4.9%, followed by a slightly higher growth rate of 5.6% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2024 to H2 2034, the CAGR is projected to increase slightly to 4.6% in the first half and remain relatively moderate at 5.1% in the second half.

| Segment | Value Share (2025) |

|---|---|

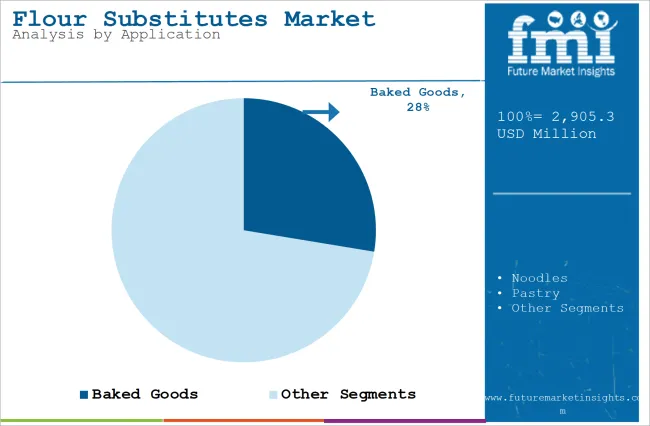

| Baked Goods (By Application) | 27.6% |

The demand for baked products is increasing due to the health awareness of people, delicately increasing the demand for gluten free options. People are now actively seeking out wheat free flour options such as almond, coconut, and chickpea flour which leads to the growth of the global substitutes flour market.

These flour substitutes not only cater to gluten-sensitive individuals but also provide added nutrition with more protein and fiber. Despite the need for gluten-free flours, these substitutes are versatile enough to provide nutrients while allowing bakers to diversify their products such as bread, muffins, cookies and pastries, broadening the range of diets.

Another reason for growth of the global flour substitute demand is the increase in health awareness. The need for transparency in the source of products is met with a desire for clean products. As a result, consumers are more willing to buy alternative flours that are cheaper to grow. Innovations that improve the baking properties of these flours also aid in shifting the market towards these products.

| Segment | Value Share (2025) |

|---|---|

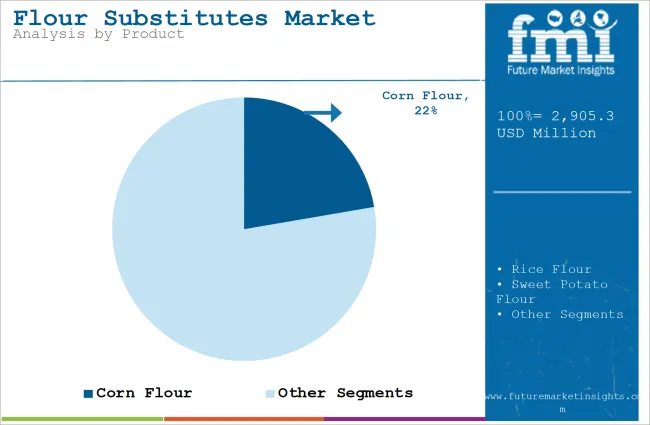

| Corn Flour (By Product) | 22.3% |

It is expected that corn flour will find its way in the flour substitutes flat because of its acceptability along with nutritional values among the different type it in the global flour substitutes exception to the flour. In baking and cooking, corn flour (finely ground cornmeal) is gaining in popularity, as well as its use as a thickening agent, in different dishes, etc. Because it is gluten-free, it is often a choice of those who are sensitive or partake in gluten-free diets.

Corn flour has an impressive nutrient profile, as it contains some B vitamins, magnesium, and iron. It imparts a faintly sweet flavor, and a bright yellow color to baked goods, thus improving its taste and appearance. Its use in food production is further enhanced by the trends toward healthier eating and the desire for natural ingredients. As consumers seek alternatives to traditional wheat flour, the corn flour segment is well-positioned for growth, catering to health-conscious individuals and those looking for diverse culinary experiences.

| Segment | Value Share (2025) |

|---|---|

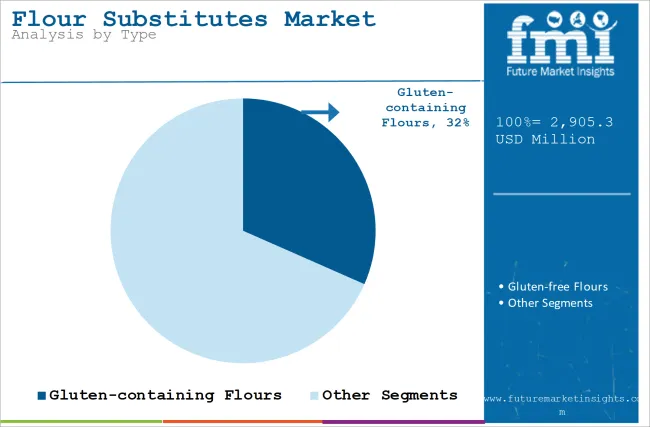

| Gluten-Containing Flours (By Type) | 31.6% |

Flours containing gluten are expected to remain a dominant segment of the global flour substitutes market, given its importance in baked goods and various preparation methods. Wheat, rye, and barley, for example, are popular for their baking properties, providing elasticity and structure in foods like bread, pastries, and pasta. These restaurant-quality flours appeal to both general consumers who still love getting creative in the kitchen, and who are gluten free. Additionally, their versatility supports various formulations in both commercial and home baking.

As health trends change, whole grain and ancient grain flours that retain gluten are rising in popularity because they provide more nutrition. It reflects consumer demands for clean ingredients. Gluten-containing flours continue to be relevant through innovations in processing techniques that improve their quality and usability. With the boom of gluten-free availability, this part of the market may seem irrelevant but it is still a necessary facet to fulfill demand for textured and tasty baked goods.

Consumers Shifting Towards Clean Label Products is Increasing the Demand for Flour Substitutes

The growing health issues of the customers have been the primary cause for the higher attention that they are paying to the food products. This has resulted in the phenomenon of the clean label products. The growth in the clean label products has been connected with the increase in the demand of Flour Substitutes in the food products as the consumers become aware of the ingredients used in the food.

Flour being a potential health hazard to humans if it is eaten too much has considerably pulled the market for all flour products down. The food industry has changed Flour Substitution: by using the flour substitutes in food products, flour has been replaced almost completely with substitutes which maintain the same taste and add value to the food products.

Flour Substitutes Market: Driven by Consumer Demand for Healthier Alternatives and Innovative Distribution Channels

The Flour Substitutes, as thr new term implies, are each and all different kinds of flours used that substitute the all-purpose white flour. Introduction of the product on the market is launching with buyers switching to this new Flour Substitutes as a result of the negatives of the all-purpose white flour. Among the Flour Substitutes that are as of now in stock are rice, wheat, almond, coconut, rye, among other types. In addition, organic forms of Flour Substitutes are widely available, especially in North America and Europe.

Even at home, consumers have made the switch to Flour Substitutes by omitting the all-purpose flour from their dishes, and still, they were able to get the same taste. There is a lot of investigation on the part of other alternatives that could be Flour Substitutes for this and at once also to make the taste and the nutritional factor of the product that it is used in better.

The Flour Substitutes are easily obtained in various distribution channels such as retail and B2B. On the other hand, the rapid development of online platforms makes additional use of Flour Substitutes for distribution very apparent.

The Rapid Shift Towards Gluten-Free Products is Driving Growth in the Global Flour Substitutes Market

Flour alternatives are very much in demand due to the increasing usage of gluten-free products. The global market for flour substitutes is characterized by increasing glutineness awareness, as with celiac disease and gluten sensitivity, consumers have been on the lookout for healthier alternatives to the tradition of wheat flours. This trend is fed further by rising rates of gluten-free diets, which do not appeal only to those with medical conditions, but also to individuals who prefer eating clean and reducing their carbohydrate intake.

Having higher protein and fibre contents, flours like almond, flax, and chickpea are among the trending foods being appreciated for all such nutrients. This trend is being supported by several reports, one being elaborated when Ian godwin, from the University of Queensland, stressed that plant-based flours such as grain and root types are playing a critical role in enhancing dietary diversity and nutrition across the globe.

Totally, the USDA states that the gluten-free products are also becoming commonplace in the mainstream food processing as well as baking segments. This trend might be, in the future expected, to fuel further expansion of the market.

Global sales increased at a CAGR of 5.1% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on such products will rise at 4.9% CAGR.

From 2020 to 2024 is a real tipping point for the sector, as increasing consumer preference for healthier and gluten-free options has turned it into a booming market: Alternatives have been increasing in popularity such as almond, coconut, and quinoa flours alongside growing interests of people in leading gluten-free and low-carb diets.

Such evidence suggests great reqsentience but not surprising at all that the growth of concern due to the health advantages which the flour substitute product this have stirred was also in the creativity and diversity of the products that manufacturers hatched to be meeting the new stipulated dietary routines.

The flourishing of digital trade, and towards delivery services as emphasized by the outbreak of the pandemic, have made the alternative products available at a single click by the masses, thus contributing directly to the high increase in sales.

In the year 2025 to 2035, the Flour Substitutes Market is expected to obtain the most traction, and for the major part it is driven by the nutritional and technological advances. Manufacturers will impose new ingredient formulations in terms of prescription to move forward an increased attempt to better taste and nutritional value in the first place and in the Flour Substitutes.

The pilot will then be sustainability, a conflation of the eco-friendly methods and the messaging within the package. Once customer demand from the upper-echelons then spikes the product at a top shelf price, product lines will once more widen with new aromas and textures.

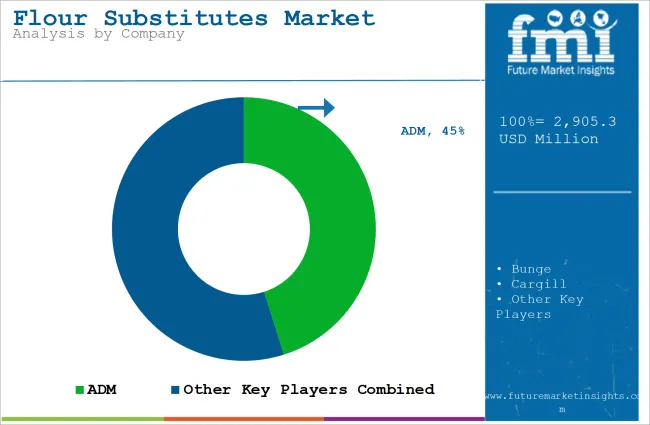

The tier 1 companies which are industry leaders like ADM, Cargill, and Bunge, the global traders well-known for their extensive offshore operations and their major market share is these companies. These companies have flourished because they are actively pursuing research and development projects, which focus largely on the production of flour from diverse sources. For instance, ADM has introduced various items into its product range that are suggested for plant-based individuals and contain plant-based proteins like gluten, brown rice, and millet.

Tier 2 companies, on the other hand, refer to those that concentrate on their niche markets and offer distinct product ranges. For instance, specialty mills like Bob's Red Mill and King Arthur Flour aim to appeal to particular lucrative markets, like organic or gluten-free flours. Their business strategy always seeks to integrate some level of environmentalism that can be achieved through local sourcing, which makes them more appealing to the market.

Tier 3 companies, on the other hand, comprise smaller enterprises operating primarily in local or regional markets. Traditional shops such as Hodgson Mill and Arrowhead Mills serve a local population who request products they specialize in. These companies might not possess the necessary R&D infrastructure, but their focus on customer care together with their local range of products has enabled them to meet the regional demand and stay competitive in the markets.

The following table shows the estimated growth rates of the top three territories. Germany, Japan and China are set to exhibit high consumption, recording CAGRs of 7.0%, 6.0% and 5.6% respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| United States | 4.1% |

| Germany | 7.0% |

| India | 5.6% |

| China | 5.1% |

| Japan | 6.0% |

The usage and market of flour substitutes is increasing in China due to growing digital platforms as well as increasing awareness concerning health and diet. There is an increase in individuals looking for nutritious food options which is raising the demand for alternative gluten free plant based flour. The addition to this is the increase in raw and clean handing label diet trends which minimize processing of food.

The addition of ecommerce grocery services like JD.com and Alibaba has made the access to these products much easier. Companies are taking advantage of this opportunity by launching localised and nutritional relevant substitutes within the region. As a result, sales are on the rise alongside product innovation creating a diversification for options including almond, rice and chickpeas flour.

India, is on a gradual flourish when it comes to substitutes of flour due to improved health concerns and inclination towards convenience. The nation’s consumers are increasingly more health conscious, and the demand for flour substitutes that are gluten-free, low-carb, and nutritious is higher than ever. This comes hand in hand with the rising trends of ‘clean-label’ products which demonstrates shift towards healthier options.

Furthermore, to aid convenience, there is an increased supply of packaged flour products due to consumers’ desire to get rid of the tedious task of grinding wheat at local mills. Fast-paced urbanization and more hectic lifestyles are boosting the demand for ready to use flour substitutes in household kitchens.

These developments have helped shape the market, increase innovation and boost sales. The predictions suggest that the Indian flower substitutes market will keep growing with increased consumer awareness and higher demand for health-focused products.

The market for flour alternatives in China is escalating rapidly due to a number of factors. There is a higher awareness about healthy eating among the general population, which has led to an increased market for gluten-free, low-carbohydrate, and even plant derived substitutes to typical wheat and rice flours. This change is also driven by the increased rate of gluten intolerance in combination with the growth of restrictive diets such as keto or paleo which prioritize factors like alternative flour (for example: almond, chickpea, or resistant starch).

E-commerce channels such as JD.Com and Alibaba are also key contributors in promoting the use of products further, as well as the innovation of variety in products due to improved processing technologies. Additionally, the development of flor products for the local market is also encouraged by Urbanization, higher incomes, and greater interest in functional foods.

The flour substitutes market is expected to grow as suppliers shift their attention to product development, clean-label ingredients, and marketing best practices in remittance to the health and sustainability concerns of consumers.

The competition is ferocious in the Flour Substitutes market with players such as ADM, Bunge, Cargill, Louis Dreyfus, COFCO Group, and Wilmar International pouring in the resources to satisfy consumer demand through innovation. These companies are focusing on the research and development of healthy and sustainable flour substitutes due to the rising demand for gluten-free and nutritious products.

New market phenomena, like an increase of preference for plant products and clean-label ingredients, are encouraging manufacturers to branch out. For example, COFCO Group isnow using alternative grains to create new products while Wilmar International is working on increasing production output to keep up with demand. Moreover, Live Glean and Jinshahe Group are producing healthier flours made from legumes and nuts to appeal to more health-conscious consumers.

The flour alternatives market is also seeing growth in the segments of M & A such as how withdrawal and merger add to efficiency as a organization such as ADM together with Bunge strengthens their competitiveness by buying local firms to serve their global appetite. Combined actions set the Flour Substitutes Market to steady advances as brands respond to new emerging dietary patterns and consumer demands.

For instance

As per product, the industry has been categorized into Corn Flour, Rice Flour, Sweet, Potato Flour, Spelt flour, Buckwheat flour, Quinoa Flour, Oat flour, Coconut flour, Chickpea flour, Brown rice flour, Rye flour, Amaranth flour, Teff flour, Millet flour and Almond Flour.

As per Type, the industry has been categorized into Gluten-containing flours and Gluten-free flours.

As per Application, the industry has been categorized into Baked Goods, Noodles, Pastry, Fried Food, Pasta, Bread and Crackers.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The global industry is estimated at a value of USD 2,905.3 million in 2025.

Sales increased at 5.1% CAGR between 2020 and 2024.

Some of the leaders in this industry include ADM, Bunge, Cargill, Louis Dreyfus, Live Glean, COFCO Group, Wilmar International, Jinshahe Group, GoodMills Group and Milne MicroDried and Others.

The North America region is projected to hold a revenue share of 30.1% over the forecast period.

The industry is projected to grow at a forecast CAGR of 4.9% from 2025 to 2035.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (MT) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Product, 2017 to 2032

Table 4: Global Market Volume (MT) Forecast by Product, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 6: Global Market Volume (MT) Forecast by Application, 2017 to 2032

Table 7: Global Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 8: Global Market Volume (MT) Forecast by Type, 2017 to 2032

Table 9: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 10: North America Market Volume (MT) Forecast by Country, 2017 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Product, 2017 to 2032

Table 12: North America Market Volume (MT) Forecast by Product, 2017 to 2032

Table 13: North America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 14: North America Market Volume (MT) Forecast by Application, 2017 to 2032

Table 15: North America Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 16: North America Market Volume (MT) Forecast by Type, 2017 to 2032

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 18: Latin America Market Volume (MT) Forecast by Country, 2017 to 2032

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2017 to 2032

Table 20: Latin America Market Volume (MT) Forecast by Product, 2017 to 2032

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 22: Latin America Market Volume (MT) Forecast by Application, 2017 to 2032

Table 23: Latin America Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 24: Latin America Market Volume (MT) Forecast by Type, 2017 to 2032

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: Europe Market Volume (MT) Forecast by Country, 2017 to 2032

Table 27: Europe Market Value (US$ Million) Forecast by Product, 2017 to 2032

Table 28: Europe Market Volume (MT) Forecast by Product, 2017 to 2032

Table 29: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 30: Europe Market Volume (MT) Forecast by Application, 2017 to 2032

Table 31: Europe Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 32: Europe Market Volume (MT) Forecast by Type, 2017 to 2032

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 34: East Asia Market Volume (MT) Forecast by Country, 2017 to 2032

Table 35: East Asia Market Value (US$ Million) Forecast by Product, 2017 to 2032

Table 36: East Asia Market Volume (MT) Forecast by Product, 2017 to 2032

Table 37: East Asia Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 38: East Asia Market Volume (MT) Forecast by Application, 2017 to 2032

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 40: East Asia Market Volume (MT) Forecast by Type, 2017 to 2032

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 42: South Asia Market Volume (MT) Forecast by Country, 2017 to 2032

Table 43: South Asia Market Value (US$ Million) Forecast by Product, 2017 to 2032

Table 44: South Asia Market Volume (MT) Forecast by Product, 2017 to 2032

Table 45: South Asia Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 46: South Asia Market Volume (MT) Forecast by Application, 2017 to 2032

Table 47: South Asia Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 48: South Asia Market Volume (MT) Forecast by Type, 2017 to 2032

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 50: Oceania Market Volume (MT) Forecast by Country, 2017 to 2032

Table 51: Oceania Market Value (US$ Million) Forecast by Product, 2017 to 2032

Table 52: Oceania Market Volume (MT) Forecast by Product, 2017 to 2032

Table 53: Oceania Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 54: Oceania Market Volume (MT) Forecast by Application, 2017 to 2032

Table 55: Oceania Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 56: Oceania Market Volume (MT) Forecast by Type, 2017 to 2032

Table 57: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 58: MEA Market Volume (MT) Forecast by Country, 2017 to 2032

Table 59: MEA Market Value (US$ Million) Forecast by Product, 2017 to 2032

Table 60: MEA Market Volume (MT) Forecast by Product, 2017 to 2032

Table 61: MEA Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 62: MEA Market Volume (MT) Forecast by Application, 2017 to 2032

Table 63: MEA Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 64: MEA Market Volume (MT) Forecast by Type, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Product, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Application, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Type, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 6: Global Market Volume (MT) Analysis by Region, 2017 to 2032

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2017 to 2032

Figure 10: Global Market Volume (MT) Analysis by Product, 2017 to 2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2022 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2022 to 2032

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 14: Global Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 17: Global Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 18: Global Market Volume (MT) Analysis by Type, 2017 to 2032

Figure 19: Global Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 20: Global Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 21: Global Market Attractiveness by Product, 2022 to 2032

Figure 22: Global Market Attractiveness by Application, 2022 to 2032

Figure 23: Global Market Attractiveness by Type, 2022 to 2032

Figure 24: Global Market Attractiveness by Region, 2022 to 2032

Figure 25: North America Market Value (US$ Million) by Product, 2022 to 2032

Figure 26: North America Market Value (US$ Million) by Application, 2022 to 2032

Figure 27: North America Market Value (US$ Million) by Type, 2022 to 2032

Figure 28: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 30: North America Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2017 to 2032

Figure 34: North America Market Volume (MT) Analysis by Product, 2017 to 2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2022 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2022 to 2032

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 38: North America Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 41: North America Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 42: North America Market Volume (MT) Analysis by Type, 2017 to 2032

Figure 43: North America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 44: North America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 45: North America Market Attractiveness by Product, 2022 to 2032

Figure 46: North America Market Attractiveness by Application, 2022 to 2032

Figure 47: North America Market Attractiveness by Type, 2022 to 2032

Figure 48: North America Market Attractiveness by Country, 2022 to 2032

Figure 49: Latin America Market Value (US$ Million) by Product, 2022 to 2032

Figure 50: Latin America Market Value (US$ Million) by Application, 2022 to 2032

Figure 51: Latin America Market Value (US$ Million) by Type, 2022 to 2032

Figure 52: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2017 to 2032

Figure 58: Latin America Market Volume (MT) Analysis by Product, 2017 to 2032

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2022 to 2032

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2022 to 2032

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 62: Latin America Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 65: Latin America Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 66: Latin America Market Volume (MT) Analysis by Type, 2017 to 2032

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 69: Latin America Market Attractiveness by Product, 2022 to 2032

Figure 70: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 71: Latin America Market Attractiveness by Type, 2022 to 2032

Figure 72: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 73: Europe Market Value (US$ Million) by Product, 2022 to 2032

Figure 74: Europe Market Value (US$ Million) by Application, 2022 to 2032

Figure 75: Europe Market Value (US$ Million) by Type, 2022 to 2032

Figure 76: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 78: Europe Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 81: Europe Market Value (US$ Million) Analysis by Product, 2017 to 2032

Figure 82: Europe Market Volume (MT) Analysis by Product, 2017 to 2032

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product, 2022 to 2032

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product, 2022 to 2032

Figure 85: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 86: Europe Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 87: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 89: Europe Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 90: Europe Market Volume (MT) Analysis by Type, 2017 to 2032

Figure 91: Europe Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 93: Europe Market Attractiveness by Product, 2022 to 2032

Figure 94: Europe Market Attractiveness by Application, 2022 to 2032

Figure 95: Europe Market Attractiveness by Type, 2022 to 2032

Figure 96: Europe Market Attractiveness by Country, 2022 to 2032

Figure 97: East Asia Market Value (US$ Million) by Product, 2022 to 2032

Figure 98: East Asia Market Value (US$ Million) by Application, 2022 to 2032

Figure 99: East Asia Market Value (US$ Million) by Type, 2022 to 2032

Figure 100: East Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 105: East Asia Market Value (US$ Million) Analysis by Product, 2017 to 2032

Figure 106: East Asia Market Volume (MT) Analysis by Product, 2017 to 2032

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Product, 2022 to 2032

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Product, 2022 to 2032

Figure 109: East Asia Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 110: East Asia Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 113: East Asia Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 114: East Asia Market Volume (MT) Analysis by Type, 2017 to 2032

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 117: East Asia Market Attractiveness by Product, 2022 to 2032

Figure 118: East Asia Market Attractiveness by Application, 2022 to 2032

Figure 119: East Asia Market Attractiveness by Type, 2022 to 2032

Figure 120: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 121: South Asia Market Value (US$ Million) by Product, 2022 to 2032

Figure 122: South Asia Market Value (US$ Million) by Application, 2022 to 2032

Figure 123: South Asia Market Value (US$ Million) by Type, 2022 to 2032

Figure 124: South Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 125: South Asia Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 129: South Asia Market Value (US$ Million) Analysis by Product, 2017 to 2032

Figure 130: South Asia Market Volume (MT) Analysis by Product, 2017 to 2032

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Product, 2022 to 2032

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Product, 2022 to 2032

Figure 133: South Asia Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 134: South Asia Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 137: South Asia Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 138: South Asia Market Volume (MT) Analysis by Type, 2017 to 2032

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 141: South Asia Market Attractiveness by Product, 2022 to 2032

Figure 142: South Asia Market Attractiveness by Application, 2022 to 2032

Figure 143: South Asia Market Attractiveness by Type, 2022 to 2032

Figure 144: South Asia Market Attractiveness by Country, 2022 to 2032

Figure 145: Oceania Market Value (US$ Million) by Product, 2022 to 2032

Figure 146: Oceania Market Value (US$ Million) by Application, 2022 to 2032

Figure 147: Oceania Market Value (US$ Million) by Type, 2022 to 2032

Figure 148: Oceania Market Value (US$ Million) by Country, 2022 to 2032

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 153: Oceania Market Value (US$ Million) Analysis by Product, 2017 to 2032

Figure 154: Oceania Market Volume (MT) Analysis by Product, 2017 to 2032

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Product, 2022 to 2032

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Product, 2022 to 2032

Figure 157: Oceania Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 158: Oceania Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 161: Oceania Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 162: Oceania Market Volume (MT) Analysis by Type, 2017 to 2032

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 165: Oceania Market Attractiveness by Product, 2022 to 2032

Figure 166: Oceania Market Attractiveness by Application, 2022 to 2032

Figure 167: Oceania Market Attractiveness by Type, 2022 to 2032

Figure 168: Oceania Market Attractiveness by Country, 2022 to 2032

Figure 169: MEA Market Value (US$ Million) by Product, 2022 to 2032

Figure 170: MEA Market Value (US$ Million) by Application, 2022 to 2032

Figure 171: MEA Market Value (US$ Million) by Type, 2022 to 2032

Figure 172: MEA Market Value (US$ Million) by Country, 2022 to 2032

Figure 173: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 174: MEA Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 177: MEA Market Value (US$ Million) Analysis by Product, 2017 to 2032

Figure 178: MEA Market Volume (MT) Analysis by Product, 2017 to 2032

Figure 179: MEA Market Value Share (%) and BPS Analysis by Product, 2022 to 2032

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Product, 2022 to 2032

Figure 181: MEA Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 182: MEA Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 183: MEA Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 184: MEA Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 185: MEA Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 186: MEA Market Volume (MT) Analysis by Type, 2017 to 2032

Figure 187: MEA Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 188: MEA Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 189: MEA Market Attractiveness by Product, 2022 to 2032

Figure 190: MEA Market Attractiveness by Application, 2022 to 2032

Figure 191: MEA Market Attractiveness by Type, 2022 to 2032

Figure 192: MEA Market Attractiveness by Country, 2022 to 2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flour Mixes Market Growth – Specialty Baking & Industry Trends 2025 to 2035

Flour Conditioner Market

Flour Improvers Market

Corn Flour Market Size and Share Forecast Outlook 2025 to 2035

Bean Flour Market Size and Share Forecast Outlook 2025 to 2035

Dura Substitutes Market Size and Share Forecast Outlook 2025 to 2035

Meat Substitutes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Market Share Breakdown of Bean Flour Manufacturers

Pulse Flours Market Size and Share Forecast Outlook 2025 to 2035

Vegan Flour Market Growth - Plant-Based Innovation & Industry Demand 2025 to 2035

Cereal Flour Market Size and Share Forecast Outlook 2025 to 2035

Silica Flour Market Size and Share Forecast Outlook 2025 to 2035

Banana Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Almond Flour Market Analysis - Size, Share, and Forecast 2025 to 2035

Millet Flour Market Analysis by Pearl Millet, Finger Millet, Foxtail Millet, Proso Millet, Kodo Millet, and Others Through 2035

Konjac Flour Market Analysis by Applications and Functions Through 2025 to 2035

Peanut Flour Market

Gelatin Substitutes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Sorghum Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coconut Flour Market Analysis by End-Use, Application, Product Form, Technology, Nature, and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA