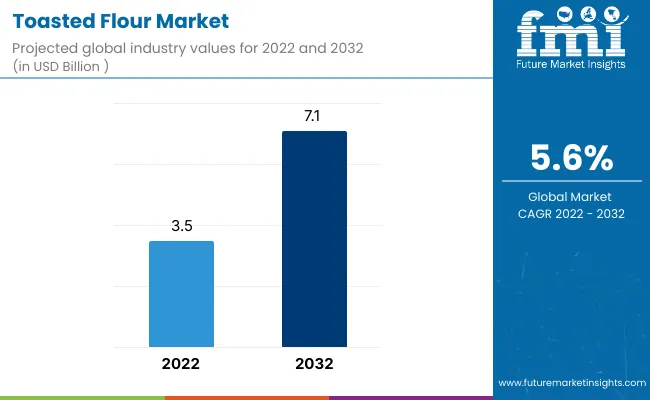

The global toasted flour market size is expected to be valued at US$ 7.1 Billion in 2032 and exhibit astonishing growth at a CAGR of 5.6% in the forecast period from 2022 to 2032. Increasing demand for toasted flour in the bakery and confectionery industry is likely to drive the market in the upcoming years. As per FMI, the global toasted flour market reached US$ 3.5 Billion in 2022.

| Report Attribute | Details |

| Toasted Flour Market Estimated Base Year Value (2021) | US$ 2.8 Billion |

| Toasted Flour Market Expected Market Value (2022) | US$ 3.5 Billion |

| Toasted Flour Market Anticipated Forecast Value (2032) | US$ 7.1 Billion |

| Toasted Flour Market Projected Growth Rate (2022-2032) | 5.6% CAGR |

When the flour is toasted in the microwave, oven, or on the stovetop, its raw taste disappears and it becomes golden brown. The darker the color of the toasted flour, the thick and nuttier the flavor.

Sales of toasted flour are expected to grow at a fast pace in future years owing to its ability to add a velvety and soft texture to various food items. Numerous types of flour benefit from this toasting process, including gluten-free, whole grain, whole wheat, and all-purpose flour.

As flour is a raw ingredient, the raw dough has a high risk of becoming the home to various pathogens, such as E. coli. Thus, heating or toasting the flour helps in killing the bacteria that may be otherwise present on it and prevent the spreading of chronic diseases.

Increasing usage of toasted flour in the preparation of pizza dough, brownies, roux, edible cookie dough, and cookies is likely to propel the market in future years. The rising demand for chocolate cookies in developed countries, such as the U.K., the U.S., and Germany is anticipated to bolster the toasted flour market growth in future. Several bakery goods manufacturers are striving to attract customers by creating novel packaging solutions, as well as by introducing new cookie flavors.

Increasing trend of gifting bakery and confectionery products on numerous occasions is another crucial factor that is likely to drive the market. In addition to that, the high demand for digestive and oats cookies owing to the surging awareness of health and wellness among consumers is set to augment growth.

Toasted flour has had many of their nutrients and fibers removed during the heating process. It can be quickly metabolized by the body and can surge one’s blood sugar level. Baked goods manufacturers often use trans fats while preparing their products as they can extend the product’s shelf life and are relatively low cost. Trans fats can raise one’s level of cholesterol, thereby increasing the risk of diabetes, strokes, and heart disease. Spurred by the aforementioned factors, sales of toasted flour may decline in future.

North America is projected to generate the largest toasted flour market share in the assessment period. The higher consumption of sandwich biscuits in the U.S. and Canada, especially among the working class population is expected to bolster the regional market. The easy availability of a large number of cookie flavors, such as peanut butter, chocolate, and buttercream is another vital factor that is set to accelerate the market.

Moreover, the increasing desire for customization in food items, as well as convenience foods is likely to augur well for the North America market. The high disposable income of people and the rising number of bakeries across this region is also projected to aid growth.

Asia Pacific is estimated to remain in the second position in the projected period backed by the rising demand for pizza in developing countries, such as India and China. The presence of several large- and mid-scale pizzerias across these countries is also expected to drive the market in future.

The rising popularity of numerous mobile applications and websites to order food at the convenience of an individual’s home is one of the current trends pushing the consumption of pizzas and other fast food items across Asia Pacific. Besides, new product launches by reputed companies, such as Oreo and Dunkin in this region are likely to foster the demand for toasted flour.

Some of the leading companies operating in the toasted flour market include Montana, Nutrigerm, Archer-Daniels-Midland Company, ITC Limited, Cargill Inc., Bob’s Red Mill Natural Foods Inc., Ardent Mills Corporate, King Arthur Flour Company Inc., Conagra Brands Inc., Bunge Milling Inc., Hodgson Mill, Smucker Company, and General Mills Inc. among others.

Leading players are increasingly adopting various organic and inorganic growth strategies to strengthen their positions in the market. The majority of these key players are aiming to adopt organic growth strategies, including product approvals and new product launches to cater to the ever-increasing demand from consumers. Meanwhile, a few other companies are engaging in the expansion of their customer base, as well as distribution networks to generate high shares.

| Report Attribute | Details |

| Growth Rate | CAGR of 5.6% from 2022 to 2032 |

| Base Year for Estimation | 2021 |

| Historical Data | 2015-2020 |

| Forecast Period | 2022-2032 |

| Quantitative Units | Revenue in USD Billion, Volume in Kilotons and CAGR from 2022-2032 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered |

|

| Regions Covered |

|

| Key Countries Profiled |

|

| Key Companies Profiled |

|

| Customization | Available Upon Request |

By Product:

By End User:

By Application:

By Distribution Channel:

By Region:

The global toasted flour market is set to exceed US$ 7.1 Billion in 2032.

North America is set to lead the toasted flour market in the forecast period.

Montana, Nutrigerm, Archer-Daniels-Midland Company, ITC Limited, Cargill Inc., Bob’s Red Mill Natural Foods Inc., and Ardent Mills Corporate are some of the renowned companies in the toasted flour market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flour Mixes Market Growth – Specialty Baking & Industry Trends 2025 to 2035

Flour Substitutes Market Analysis by Baked Goods, Noodles, Pastry, Fried Food, Pasta, Bread, Crackers Applications Through 2035

Flour Conditioner Market

Flour Improvers Market

Corn Flour Market Size and Share Forecast Outlook 2025 to 2035

Bean Flour Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Bean Flour Manufacturers

Pulse Flours Market Size and Share Forecast Outlook 2025 to 2035

Vegan Flour Market Growth - Plant-Based Innovation & Industry Demand 2025 to 2035

Cereal Flour Market Size and Share Forecast Outlook 2025 to 2035

Silica Flour Market Size and Share Forecast Outlook 2025 to 2035

Banana Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Almond Flour Market Analysis - Size, Share, and Forecast 2025 to 2035

Millet Flour Market Analysis by Pearl Millet, Finger Millet, Foxtail Millet, Proso Millet, Kodo Millet, and Others Through 2035

Konjac Flour Market Analysis by Applications and Functions Through 2025 to 2035

Peanut Flour Market

Sorghum Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coconut Flour Market Analysis by End-Use, Application, Product Form, Technology, Nature, and Region from 2025 to 2035

Cassava Flour Market Trends – Size, Share & Forecast 2025-2035

Lentils Flour Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA