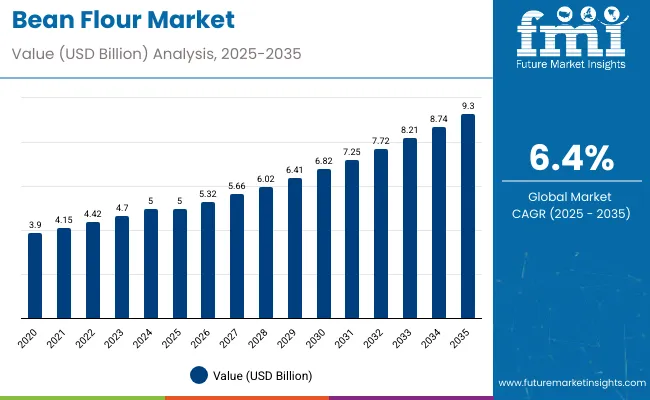

The bean flour market is estimated to be valued at USD 5.0 billion in 2025 and is projected to reach USD 9.3 billion by 2035, registering a CAGR of 6.4% over the forecast period. The market is expected to add an absolute dollar opportunity of USD 4.3 billion during this time, representing steady growth driven by increasing consumer preference for plant-based, gluten-free, and organic food products.

By 2030, the market is likely to reach USD 7.0 billion, which reflects an increase of USD 2.0 billion from 2025. The remaining USD 2.3 billion growth is anticipated during the second half, indicating a consistent expansion trajectory. Key factors shaping the market include rising demand for healthy bakery and snack products, increased adoption of organic bean flour, and growing awareness of bean flour’s nutritional benefits such as high protein and fiber content. Innovation in product applications across bakery, snacks, and functional foods further propels the market forward.

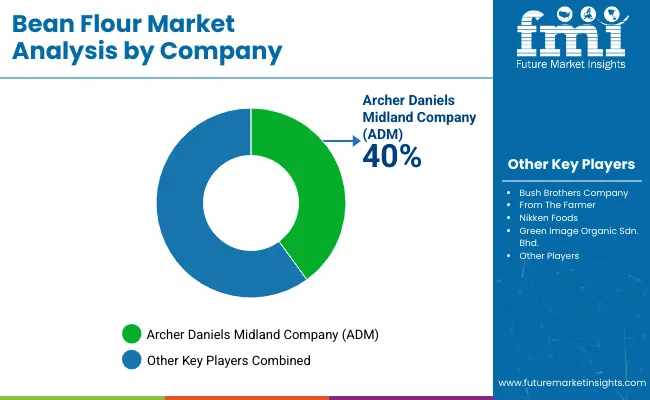

Companies such as Archer Daniels Midland Company (ADM) and Ingredion Incorporated are consolidating their positions by expanding processing capacities and investing in advanced milling and production technologies. Their innovative efforts focus on developing organic and gluten-free bean flour products, as well as fortified and protein-enriched variants, enabling stronger penetration into health-conscious and premium market segments. Market performance will continue to be influenced by stringent quality control measures, sustainable agricultural sourcing practices, and compliance with regulatory standards, which will be critical factors shaping competitive dynamics across different regions.

| Metric | Value |

|---|---|

| Estimated Value in 2025 (E) | USD 5.0 billion |

| Forecast Value in 2035 (F) | USD 9.3 billion |

| Forecast CAGR (2025-2035) | 6.4% |

The market holds a significant position across multiple food segments, accounting for 50% of the bakery products market, driven by its use in breads, muffins, and other baked goods that cater to health-conscious consumers. It represents around 40% of the protein-rich and plant-based food ingredients market, fueled by rising demand for high-protein, gluten-free alternatives among balanced nutrition enthusiasts.

The market contributes nearly 35% to the gluten-free ingredients sector, supported by its natural absence of gluten and growing incorporation in specialty and functional food products. Bean flour holds close to 30% of the snacks and convenience foods market, where its usage in protein bars, snack mixes, and healthy formulations reinforces its growing popularity. In the broader legume and pulse flour market, it captures about 25%, highlighting its versatility as a nutritious ingredient in both commercial and household food applications.

The market is evolving with advancements in milling and processing technologies that improve flavor, texture, and nutritional profiles. Manufacturers are expanding into ready-to-eat snacks, organic, and fortified bean flour products, supported by increasing consumer interest in plant-based and clean-label options. Strategic collaborations with foodservice providers and retail chains, coupled with the rising adoption of online grocery shopping, are enhancing market reach and transforming traditional distribution channels, thereby challenging conventional flour and grain-based product categories.

Bean flour’s nutritional benefits, cost-effectiveness, and versatility across food applications are driving its adoption. Rich in protein, fiber, vitamins, and minerals, beans flour is becoming an essential ingredient in bakery products, snacks, sauces, and gluten-free foods. Its functional properties, including improved texture, binding, and flavor enhancement, make it highly valuable for both industrial food processors and household consumers seeking healthier alternatives to refined flour.

Rising consumer demand for plant-based, protein-rich, and gluten-free food products is further accelerating market adoption. Growing health awareness, dietary shifts toward sustainable proteins, and the rising prevalence of lifestyle-related health issues such as obesity and diabetes are pushing consumers to incorporate beans flour into their diets. The expansion of clean-label, allergen-free, and vegan product lines in supermarkets and e-commerce platforms is also fueling demand.

Government support for nutritional programs, coupled with innovations in food processing technologies, is enhancing product quality, safety, and accessibility. Increased investments in sustainable agriculture, along with the rising use of beans flour in packaged foods, bakery chains, and quick-service restaurants, are strengthening the market outlook. As manufacturers and consumers alike prioritize health, affordability, and scalability, beans flour continues to gain traction as a functional, nutritious, and versatile ingredient driving long-term market growth.

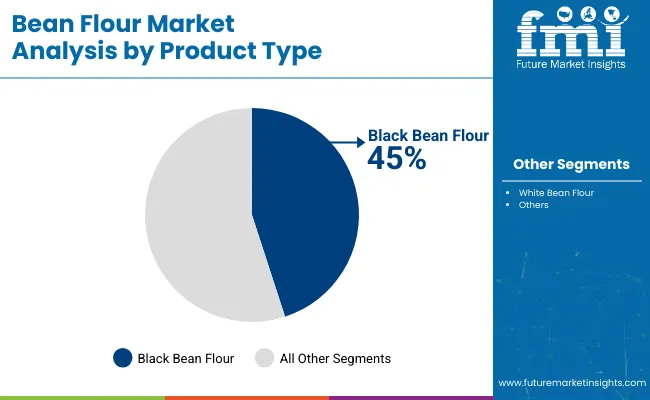

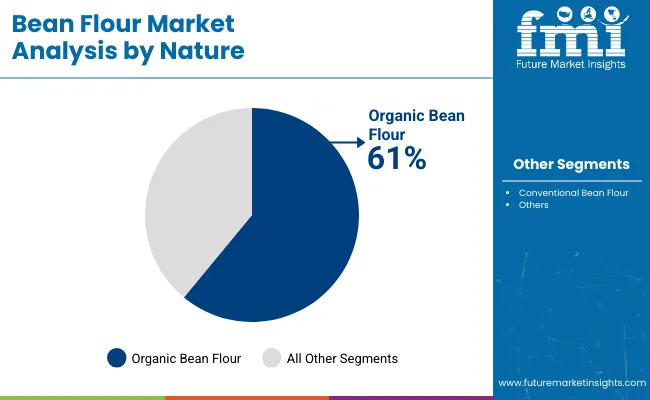

The market is segmented by product type, nature, and region. By product type, the market is bifurcated into black bean flour and white bean flour. Based on nature, the market is divided into conventional bean flour and organic bean flour. Regionally, the market spans across North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

Black bean flour is set to dominate the product type segment in 2025 with a commanding market share of 45%. Its popularity stems from its rich nutritional profile, including high levels of protein, dietary fiber, and antioxidants, making it a favored choice among health-conscious consumers. The flour’s intrinsic attributes position well for gluten-free and vegan food formulations, catering to the rising demand for plant-based and allergen-free products. Its earthy flavor enhances a variety of applications, fueling its widespread use in bakery items and ready-to-eat meals.

The segment continues to gain traction in North America and Europe, where consumer preferences increasingly favor functional and health-oriented foods. Black bean flour’s versatility allows its inclusion in snacks, tortillas, and bakery mixes, reinforcing its role in innovative product development. The growing acceptance by both commercial manufacturers and home bakers highlights its potential to maintain strong growth, driven by evolving dietary trends and increased awareness of the benefits of plant-derived ingredients.

The most lucrative segment by nature in the market is the organic bean flour segment, expected to dominate with 61% market share by 2025 and projected to grow strongly from 2025 to 2035. The organic segment benefits from multiple growth drivers, including increasing consumer preference for clean-label, sustainable, and chemical-free food products. Organic bean flour appeals to health-conscious and environmentally aware consumers due to its higher nutritional value, absence of synthetic chemicals and pesticides, and support for sustainable farming practices such as soil health and biodiversity preservation.

Moreover, supportive government policies and organic certification standards enhance consumer trust and drive demand for organic bean flour. Manufacturers are continuously innovating, introducing new organic bean flour varieties that cater to diverse culinary preferences. The rising popularity of plant-based diets and gluten-free lifestyles further accelerates the segment's growth. As awareness of environmental sustainability and health benefits increases, organic bean flour is positioned for sustained expansion, reinforcing its dominant and lucrative status in the global bean flour market from 2025 to 2035 and beyond.

From 2025 to 2035, rising consumer demand for gluten-free, plant-based, and nutrient-rich food products has fueled substantial growth in the bean flour market. Increasing preference for organic, fortified, and clean-label bean flours has positioned manufacturers investing in advanced processing and sustainable sourcing technologies as industry leaders in meeting evolving dietary needs and expanding product portfolios.

Growing Consumer Health Awareness Drives Market Growth

The steady rise in consumer focus on health and wellness is a primary growth driver for the bean flour market. Greater demand for high-protein, fiber-rich, and antioxidant-packed bean flours, alongside convenience through ready-to-eat bakery and snack products, is boosting sales. By 2025, producers are expected to enhance product quality via improved milling, fortification, and organic certification processes to meet consumer expectations for nutrition and flavor.

Innovation in Product Development Expands Market Opportunities

Advancements in processing technologies, including gluten-free, organic, and vegan bean flour formulations, have expanded market reach beyond traditional consumers. These innovations improve texture, nutritional content, and shelf life, opening new opportunities in retail and foodservice sectors. Companies emphasizing sustainable sourcing and quality certifications are gaining competitive advantages, appealing to environmentally conscious and health-focused consumers, thus driving long-term market growth.

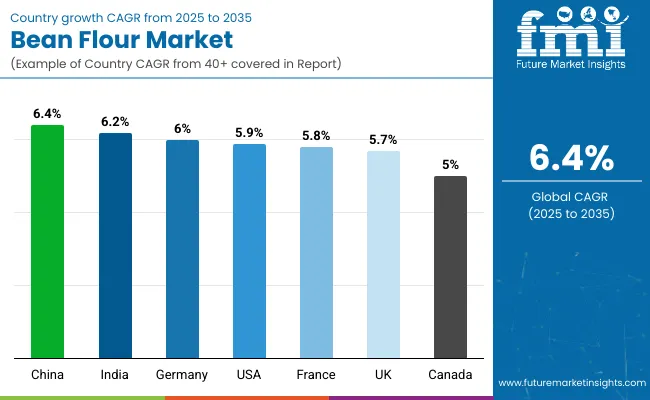

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.4% |

| India | 6.2% |

| Germany | 6.0% |

| United States | 5.9% |

| France | 5.8% |

| United Kingdom | 5.7% |

| Canada | 5.0% |

The market shows dynamic growth across key countries from 2025 to 2035, with China leading at a CAGR of 6.4%, driven by rapid urbanization, rising incomes, and government initiatives supporting sustainable agriculture. India follows closely with a 6.2% CAGR, bolstered by pulse production and growing demand for gluten-free and plant-based foods.

Germany maintains strong growth at 6.0%, propelled by advanced manufacturing technologies and a strong consumer preference for organic, high-protein flours. The United States records a 5.9% CAGR, supported by rising demand for gluten-free, clean-label, and plant-based products alongside strategic distribution partnerships. France grows at 5.8%, focusing on artisanal and health-conscious segments, while Canada expands steadily at 5.0%, driven by multicultural demand and sustainability awareness. The United Kingdom, with a CAGR of 5.7%, benefits from trends in veganism and allergen-free foods.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from bean flour in China is projected to grow at a CAGR of 6.4% from 2025 to 2035, driven by rapid urbanization, rising disposable incomes, and increased health awareness among consumers. Manufacturers are making significant investments in advanced processing technologies, expanding production capacities to meet both domestic and export demands.

Government initiatives promoting sustainable agriculture and food security further bolster market expansion. The growing middle class favors nutritious, fortified, and convenient bean flour products, driving diverse retail and e-commerce distribution channels. Both multinational corporations and local companies are aggressively increasing output, fostering innovation and wider market penetration. These factors collectively position China as a dominant force in the global bean flour market.

The bean flour market in India is expected to expand at a CAGR of 6.2% from 2025 to 2035, driven by large-scale pulse production and supportive government nutrition programs. The growth of urban populations and rising health consciousness are propelling demand for gluten-free, vegan, and fortified food products.

Production capacity is rapidly expanding to meet increasing consumption of bakery items, healthy snacks, and ready-to-eat meals. Investments in organic processing help boost India’s export potential and meet global standards. The expansion of branded retail and modern supply chains is enhancing market reach. Together, these factors balance traditional dietary preferences with innovative food trends, supporting sustained growth.

Demand for bean flour in Germany is expected to grow at a CAGR of 6.0% from 2025 to 2035, driven by strong consumer demand for organic and high-protein flours aligned with health and sustainability trends. The country emphasizes innovation through the adoption of cutting-edge manufacturing technologies and capacity expansions.

Quality assurance and organic certifications improve consumer trust and product acceptance. Government incentives promote organic farming and environmentally friendly production methods. Export growth to neighboring European markets further supports capacity increases. The growing trend toward plant-based diets and functional foods continues to fuel deeper structural adoption and innovation. Germany stands as a major hub for sustainable bean flour production and distribution in Europe.

Revenue from bean flour in the USA is projected to grow at a CAGR of 5.9% from 2025 to 2035, supported by increasing demand for gluten-free, plant-based, and clean-label products. Producers are enhancing production capacity and efficiency to satisfy expanding retail and foodservice demand. Product innovation emphasizes health benefits, convenience, and premium quality. Strategic partnerships broaden distribution channels and market reach. Investments in sustainable production methods sustain growth. Consumer preferences show a strong affinity for nutritious, organic, and clean-label bean flour, driving the continuous expansion of both product variety and output.

Sales of bean flour in France are expected to grow at a CAGR of 5.8% from 2025 to 2035, due to focus on improving nutritional quality and catering to consumers seeking artisanal and health-focused products. Production capacity is growing steadily to meet demand in retail and hospitality sectors. Organic and gluten-free bean flour products are increasingly popular among wellness-oriented consumers. French bakers are innovating by integrating bean flour into traditional and modern recipes for improved texture and nutrition. Government support for plant-based diets aids market growth. Enhanced certifications and product diversification help manufacturers capture niche segments. Supply chain improvements ensure product freshness and authenticity throughout distribution.

Demand for bean flour in the UK is expected to expand at a CAGR of 5.7% from 2025 to 2035, fueled by rising consumer interest in vegan, organic, and allergen-free foods. Manufacturers are increasing output capacity to meet growing orders from large retail and specialty stores. Production innovations respond to organic and clean-label trends. Supportive regulations and public health campaigns promote plant-based dietary shifts. Retail and foodservice sectors witness rapid growth. Supply chain improvements enhance product freshness and availability. Sustainability awareness shapes both production and marketing strategies, reflecting evolving consumer values.

Demand for bean flour in Canada is expected to grow at a CAGR of 5.0% from 2025 to 2035, driven by rising consumer interest in nutritious, plant-based, and clean-label foods. The country’s diverse and multicultural population fuels demand for varied culinary applications, encouraging adoption of bean flour in both traditional and contemporary recipes. Manufacturers are investing in expanding production capacities and developing organic, gluten-free, and specialty bean flour products to satisfy health-conscious consumers. Sustainability and environmental awareness are shaping production practices, with an emphasis on eco-friendly sourcing and manufacturing processes.

The market is moderately fragmented, with a diverse mix of global and regional players operating across product innovations, clean-label certifications, and targeted consumer positioning. Leading companies such as Archer Daniels Midland Company, Bob’s Red Mill Natural Foods, Ottogi Co., Ltd., Damin Foodstuff (Zhangzhou) Co., Ltd., and Bush Brothers and Company dominate strategic sales through organic labeling, value-added formulations, and expanded distribution across e-commerce and retail.

Top-tier firms are adopting competitive pricing, new product developments, and distribution partnerships to penetrate emerging markets and meet rising demand from gluten-free, plant-based, and fortified food categories. Companies are also focusing on regional sourcing and sustainability, with some investing in organic cultivation partnerships to build traceable supply chains. Bob’s Red Mill and GreenMax SandF are particularly expanding their retail footprints in East Asia and North America. At the same time, Ottogi continues to scale up processed bean-based applications in South Korea and international markets.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 5.0 billion |

| Product Type | Black Bean Flour and White Bean Flour |

| Nature | Organic Bean Flour and Conventional Bean Flour |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia, Pacific, East Asia, and Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, and 40+ countries |

| Key Players | The Parade Company, GreenMax SandF, Ottogi Co, Ltd, Damin Foodstuff (Zhangzhou) Co. Ltd., Xi’an Sost Biological Science and Technology, Verde Valle, CandF Foods Inc., Bob’s Red Mill Natural Foods, La Casita S.A., Natural Supply King Global (PTY) Ltd., Bush Company, Inc., Bush Brothers and Company, From The Farmer, Nikken Foods, and Green Image Organic Sdn. Bhd. |

| Additional Attributes | Dollar sales by product type and nature; market share trends; regional demand patterns; competitive landscape; consumer preferences for organic versus conventional bean flour; integration with sustainable sourcing practices; innovations in processing technology; and quality standardization across diverse food applications |

The global bean flour market is estimated to be valued at USD 5.7 billion in 2025.

The market size for the bean flour market is projected to reach USD 10.2 billion by 2035.

The bean flour market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in bean flour market are black and white.

In terms of nature, conventional segment to command 63.5% share in the bean flour market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Bean Flour Manufacturers

Demand for Bean Flour in EU Size and Share Forecast Outlook 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Flour Mixes Market Growth – Specialty Baking & Industry Trends 2025 to 2035

Flour Substitutes Market Analysis by Baked Goods, Noodles, Pastry, Fried Food, Pasta, Bread, Crackers Applications Through 2035

Flour Conditioner Market

Flour Improvers Market

Soybean Enzymatic Protein Market Size and Share Forecast Outlook 2025 to 2035

Soybean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Soybean Meal Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soybean Oil Market

Corn Flour Market Size and Share Forecast Outlook 2025 to 2035

Caribbean Cruises Market Size and Share Forecast Outlook 2025 to 2035

Fava Bean Protein Market Size and Share Forecast Outlook 2025 to 2035

Fava Bean Protein Industry in United States Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Caribbean Destination Wedding Market Trends - Growth & Forecast 2025 to 2035

Fava Beans Market Report – Size, Share & Growth 2025-2035

Cocoa Bean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Pulse Flours Market Size and Share Forecast Outlook 2025 to 2035

Cacao Beans Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA