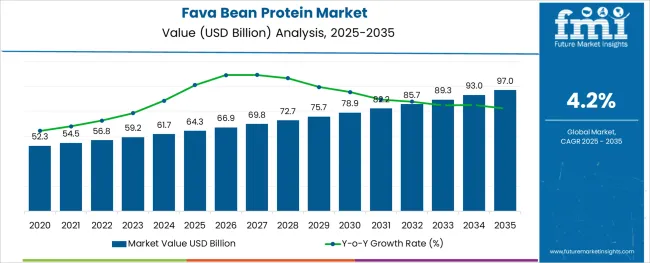

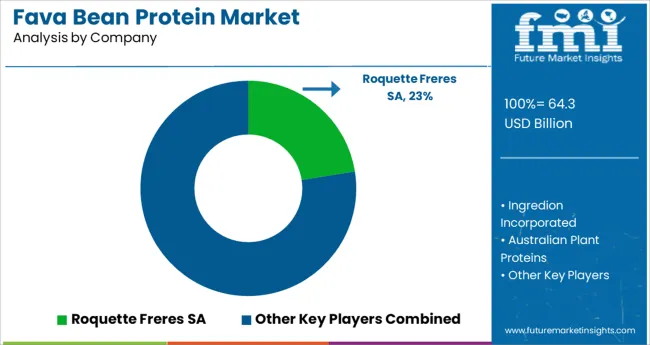

The Fava Bean Protein Market is estimated to be valued at USD 64.3 billion in 2025 and is projected to reach USD 97.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

The fava bean protein market is experiencing strong growth, driven by increasing consumer interest in plant-based nutrition and sustainable protein sources. Nutritional studies and health trends have highlighted the benefits of fava bean protein as a high-quality, allergen-friendly alternative to animal proteins. Rising awareness of dietary health and environmental concerns has encouraged food manufacturers to incorporate fava bean protein into a variety of products.

The market has also benefited from expanding applications in human nutrition where demand for plant-based supplements and functional foods is growing rapidly. Additionally, the food and beverages industry is actively adopting fava bean protein for its functional properties such as emulsification and water retention.

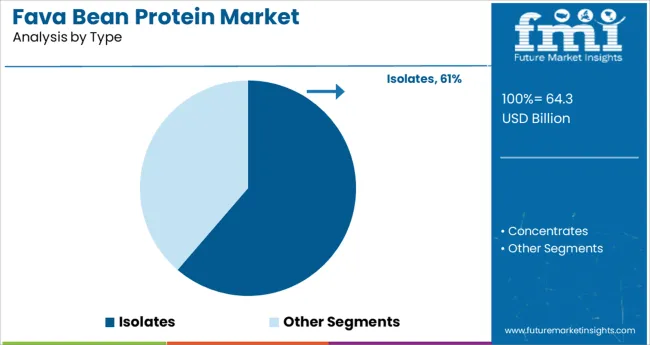

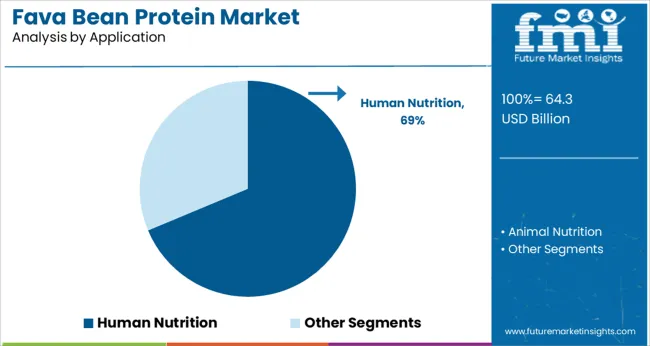

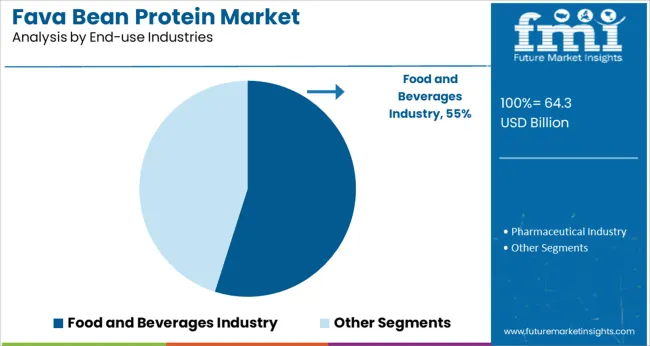

Future growth is expected to be fueled by continued innovation in product formulations and growing consumer preference for clean-label ingredients. Segment growth is projected to be led by isolates as the preferred protein type, human nutrition as the dominant application, and the food and beverages industry as the primary end-use sector.

The market is segmented by Type, Application, and End-use Industries and region. By Type, the market is divided into Isolates and Concentrates. In terms of Application, the market is classified into Human Nutrition and Animal Nutrition. Based on End-use Industries, the market is segmented into Food and Beverages Industry and Pharmaceutical Industry. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The isolates segment is projected to contribute 61.3% of the fava bean protein market revenue in 2025, maintaining its lead as the most widely used protein type. The high protein content and purity offered by isolates make them ideal for use in nutritional supplements and food formulations. Their neutral flavor profile and functional versatility have made isolates attractive to manufacturers aiming to enhance protein levels without compromising taste or texture.

The segment’s growth is supported by advances in extraction technologies that improve yield and protein quality. Additionally, isolates are favored in clean-label and allergen-free product lines, aligning with consumer demand for health-conscious ingredients.

As plant-based nutrition continues to expand, the isolates segment is expected to remain dominant in the market.

The human nutrition segment is expected to account for 68.7% of the fava bean protein market revenue in 2025, positioning it as the largest application area. This segment has expanded due to growing consumer focus on protein-rich diets for muscle health, weight management, and overall wellness. Fava bean protein is increasingly incorporated into protein powders, meal replacements, and nutritional bars, providing a plant-based alternative to traditional protein sources.

Health-conscious consumers and athletes have driven demand for products that support performance and recovery. The segment’s growth is also influenced by rising interest in vegan and vegetarian lifestyles, as well as increased awareness of food allergies and sensitivities.

As product innovation continues, the human nutrition segment is expected to maintain its leading role.

The food and beverages industry segment is projected to contribute 54.9% of the fava bean protein market revenue in 2025, making it the leading end-use industry. Growth in this segment is driven by the incorporation of fava bean protein in a wide range of products including bakery, snacks, dairy alternatives, and beverages. Manufacturers are leveraging the functional properties of fava bean protein to improve texture, nutritional value, and shelf life.

Consumer trends favoring plant-based and clean-label products have encouraged the development of new formulations using fava bean protein. The segment benefits from increasing investments in product development and expanded distribution channels in both developed and emerging markets.

As food innovation accelerates and consumer demand for sustainable protein grows, the food and beverages industry segment is expected to remain a key driver of market expansion.

As a result, demand for plant-based proteins has increased significantly, fueling demand for fava bean protein over the predicted period. Increased marketing access, improved agronomic practices around the world, and the growing adoption of an integrated approach to crop improvement are some of the other significant factors that are expected to drive the sales of fava bean protein.

The growing emphasis on collaborative research initiatives is projected to play a critical role in enhancing fava bean quality, a factor that is expected to boost the demand for fava bean protein throughout the assessment period. Collaborative research projects all across the world have helped to provide lucrative opportunities for the global fava bean protein market growth.

Due to its low cost, high protein content, and low allergenicity, manufacturers favor fava beans over other plant-based protein sources such as soy protein components and pea protein. As a result, the demand for fava bean protein is projected to grow during the forecast period.

Furthermore, while pea and wheat proteins account for a sizable portion of the vegetable- or plant-based protein market, manufacturers are focusing on expanding their protein portfolio by turning to novel sources. This, in turn, is projected to increase the sales of fava bean protein during the projected period.

In the next few years, the above-mentioned factors are projected to encourage plant protein manufacturers to enter the fava bean protein market.

The use of novel protein sources such as fava beans in the extraction of protein concentrates is increasing in response to the growing sales of fava bean protein and high-quality plant-based proteins.

Consumer processing, nutritional, and specialty demand for fava bean protein are determining manufacturers' and other stakeholders' future plans in the fava bean protein market.

Given the increased demand for fava bean protein in a variety of food and beverage end-uses and applications, major market participants are concentrating on altering product attributes to fulfil specific end-user demands. The sales of fava bean protein is growing as manufacturers are attempting to improve the flavor, texture, and taste of fava bean protein powders to appeal to various types of end users.

Furthermore, rising public knowledge of the fava bean's health benefits is predicted to boost fava bean protein concentrate extraction. In terms of texture, nutrition, and savory profile, fava bean protein powders are predicted to become a popular trend in the fava bean protein market.

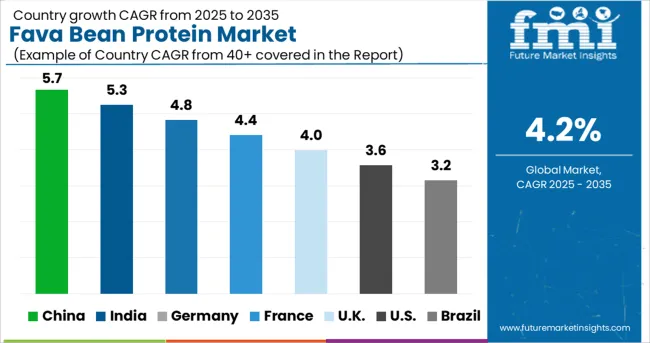

In 2024, Asia Pacific accounted for more than 40.0 percent of the global fava bean protein market. It is an essential element in a range of traditional meals in countries such as India and China. One of the elements fueling demand for fava bean protein in the region is the growing use of roasted seeds as a low-fat snack in India and surrounding countries. China and Australia are two of the world's top producers of fava beans.

From 2025 to 2035, North America is expected to rise by more than 2%. The increased importance of plant-based protein sources in the United States and Canada as a result of rising concerns about glutamate disorders and lactose intolerance is predicted to boost overall fava bean protein consumption.

Key players in the fava bean protein market are BI Nutraceuticals, Alberta Pulse Growers, Prairie Fava., Puris Proteins, LLC., Dunns (Long Sutton) Limited, Sun Impex B.V., Nuttee Bean Co., Vestkorn Milling AS, Roquette Frères, GrainCorp Limited., Centre State Exports Pty Ltd, Australian Plant Proteins.

Market participants are using innovative ways of extracting fava bean protein concentrates, taking into account the customer preference for pulses as a healthier choice of plant-based protein source. As a result, this is projected to drive the sales of fava bean protein during the forecast period.

Key Developments

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 4.2% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2014 to 2020 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered | Type, Application, End use industries, Region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK., France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | BI Nutraceuticals; Alberta Pulse Growers; Prairie Fava.; Puris Proteins; LLC.; Dunns (Long Sutton) Limited; Sun Impex B.V.; Nuttee Bean Co.; Vestkorn Milling AS; Roquette Frères; GrainCorp Limited.; Centre State Exports Pty Ltd; Australian Plant Proteins. |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global fava bean protein market is estimated to be valued at USD 64.3 billion in 2025.

It is projected to reach USD 97.0 billion by 2035.

The market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types are isolates and concentrates.

human nutrition segment is expected to dominate with a 68.7% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fava Bean Protein Industry in United States Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fava Beans Market Report – Size, Share & Growth 2025-2035

Bean Flour Market Size and Share Forecast Outlook 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Bean Flour Manufacturers

Soybean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Soybean Meal Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soybean Oil Market

Soybean Enzymatic Protein Market Size and Share Forecast Outlook 2025 to 2035

Caribbean Cruises Market Size and Share Forecast Outlook 2025 to 2035

Caribbean Destination Wedding Market Trends - Growth & Forecast 2025 to 2035

Cocoa Bean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Cacao Beans Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cocoa Bean Extract Market Trends - Nature & Cocoa Type Insights

Coffee Bean Grind Machine Market Trends - Growth & Forecast 2025 to 2035

Competitive Landscape of Locust Bean Gum Providers

Vanilla Bean Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bambara Beans Market Size and Share Forecast Outlook 2025 to 2035

Demand for Bean Flour in EU Size and Share Forecast Outlook 2025 to 2035

Green Coffee Bean Extract Market Analysis by Form, Application, and Distribution Channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA