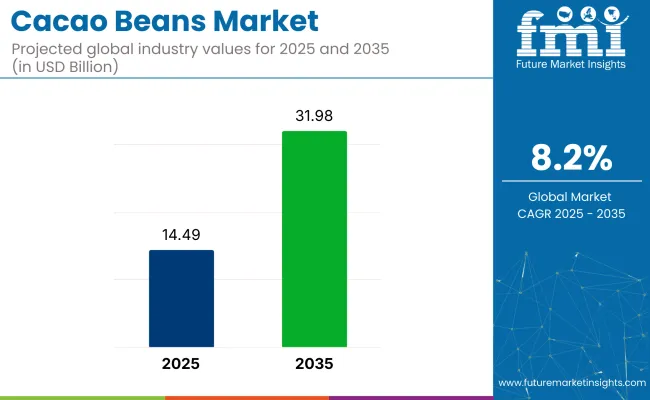

The cacao beans market is expected to reach USD 14.49 billion in 2025, with projected growth to USD 31.98 billion by 2035, reflecting a CAGR of 8.2% over the forecast period. Expansion is supported by stricter traceability regulations and growing investments in premium-grade, high-fermentation cacao types.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 14.49 billion |

| Industry Value (2035F) | USD 31.98 billion |

| CAGR (2025 to 2035) | 8.2% |

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 14.49 billion |

| Industry Value (2035F) | USD 31.98 billion |

| CAGR (2025 to 2035) | 8.2% |

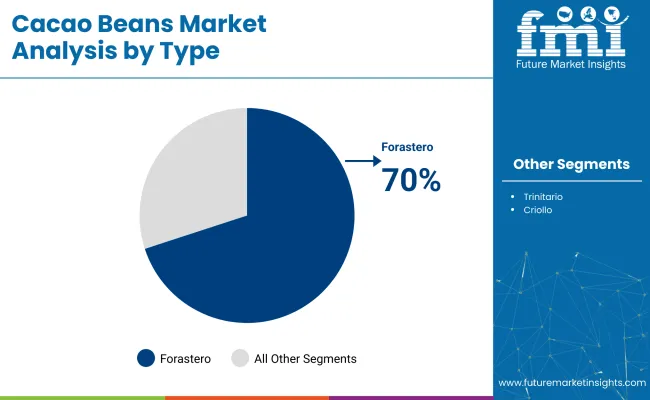

Manufacturers in the chocolate industry are now favoring Forastero beans for their stable fat content and predictable roasting outcomes, securing a dominant share by 2035. The segment for fermented beans is also rising, expected to comprise 60% of total demand, as flavor-enhancing volatile compounds gain preference among bean-to-bar makers and industrial processors alike. In the United States and parts of Western Europe, vertically integrated sourcing models have gained pace, linking cooperatives and midstream processors directly with premium retail chocolate labels.

Despite the expansion of organic and specialty varieties, conventional cacao continues to lead-accounting for nearly 70% of total use-due to its high availability and lower input costs. Côte d'Ivoire, Ghana, and Ecuador remain at the center of supply-side transformation, where investments are flowing into controlled fermentation, trace-tagging of smallholder output, and quality-aligned drying systems. These changes are helping stabilize quality consistency across batches exported to North America and Europe.

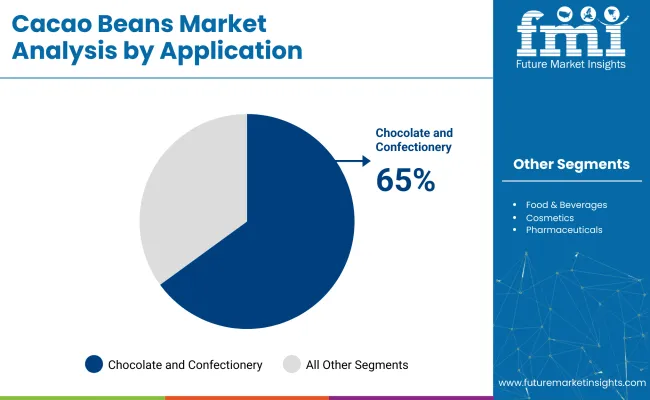

Cacao beans contribute only 1-2% to the total agricultural products market, given their crop-specific nature and concentrated growing regions. In the food and beverage segment, their share rises to around 4-6%, fueled by their integral function in chocolate, flavored beverages, and baked goods.

The chocolate industry remains heavily dependent on cacao beans, with the product commanding a 20-30% share of input value. In cosmetics and personal care, cacao-derived actives are gaining ground for their antioxidant profiles, leading to a modest 1-2% share. In the nutraceuticals sector, the share is estimated at 2-3%, with cacao powders and extracts incorporated into supplements marketed for mood, cardiovascular support, and energy metabolism.

The cacao beans market has been segmented by type into criollo, forastero, and trinitario. It has been segmented by application into chocolate and confectionery, food and beverages, cosmetics, and pharmaceuticals. It has been segmented by processing into fermented and unfermented.

It has been segmented by nature into conventional and organic. It has been segmented by region into North America, Latin America, Western Europe, Eastern Europe, Balkans and Baltic, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and Middle East and Africa.

Forastero beans are projected to account for 70% of total volume in 2025. Their dominance is supported by high yield, disease resistance, and compatibility with mass processing. These attributes make them the default choice for large-scale cocoa processors and chocolate manufacturers.

Chocolate and confectionery are projected to account for 65% of total cacao bean applications in 2025. The segment benefits from high-frequency production cycles, standardized formulation needs, and strong consumer preference for cocoa-based products.

Fermented beans are expected to dominate with a 60% share by processing, due to their role in flavor precursors and reducing bitterness. Manufacturers of premium and mainstream chocolate require fermented beans to ensure consistency in product taste and aroma.

Conventional cacao beans are projected to hold 70% share in 2025, largely due to their scalability, cost advantages, and compatibility with global sourcing systems. These beans serve the requirements of commercial processors operating across multiple geographies.

Innovation in hybrid propagation and regulatory traceability protocols are reshaping sourcing models and production outcomes in the cacao beans market. Yield stabilization, compliance mandates, and technological traceability systems are emerging as defining levers of structural change.

Hybrid Bean Development Reshaping Yield Strategies

Hybrid varietals are being prioritized to overcome crop variability and improve yield density. Trinitario cultivars, blending Forastero durability with Criollo flavor, are being introduced in Ghana, Ecuador, and Nigeria. Genetic trials by Barry Callebaut and Mars are accelerating commercial rollouts, with propagation packs distributed through public-private partnership schemes. Certification-linked premiums are being tied to hybrid performance, compelling commercial farms to abandon legacy types.

Traceability Enforcement Altering Supplier Practices Globally

EU deforestation-linked legislation is mandating geo-tagged farm mapping and timestamped harvest logs, pressuring producers to overhaul documentation protocols. Cooperatives in Ghana and Côte d’Ivoire are digitizing compliance using platforms like Farmforce and Sourcemap. Untraceable lots are facing exclusion from premium import pipelines.

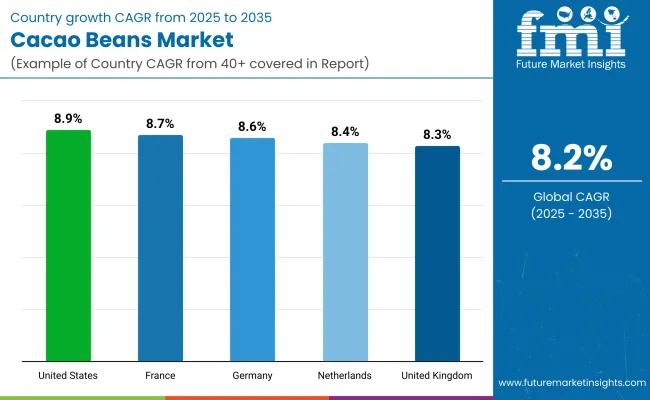

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 8.9% |

| France | 8.7% |

| Germany | 8.6% |

| Netherlands | 8.4% |

| United Kingdom | 8.3% |

The United States cacao beans market is growing at a CAGR of 8.9%, driven by the rising demand for high-quality, direct trade cacao and artisanal chocolate products. With California and Oregon fostering small-scale roasters and bean-to-bar ventures, the shift toward quality-first sourcing is reshaping the industry.

France, growing at 8.7% CAGR, benefits from strong sourcing agreements with Ghana and Ivory Coast, alongside INRAE-supported post-harvest improvements that help enhance single-origin French chocolate. In Germany, the cacao bean market is expanding at 8.6% CAGR, with Hamburg as Europe’s largest import hub. Key players like Barry Callebaut focus on stabilizing supply chains through forward contracting and customs facilitation.

In ASEAN, the Netherlands is emerging as a key player, with Amsterdam handling over 600,000 MT annually. The country’s focus on advanced processing and strong trade ties with Ghana and Cameroon positions it for continued growth at 8.4% CAGR. The United Kingdom also sees strong growth at 8.3% CAGR, leveraging post-Brexit trade deals with Peru for premium cacao beans and fostering innovation with grants for small-scale processors.

The report covers in-depth analysis of 40+ countries. The top five countries have been shared as a reference.

The USA cacao beans market is expected to grow at a CAGR of 8.9% from 2025 to 2035. Latin America remains the primary supply source, with consistent bean volumes arriving through Gulf Coast ports. California and Oregon are seeing a build-out of small-scale roasters and bean-to-bar manufacturers. They receive favorable state-level food processing grants. USDA programs have lowered inspection delays, encouraging higher import turnover. These trends are reshaping USA bean procurement from a commodity model to a quality-first approach that favors direct trade.

France’s cacao beans market is projected to expand at a CAGR of 8.7% through 2035. Leading processors based in Normandy and Nouvelle-Aquitaine maintain exclusive sourcing agreements with Ghanaian and Ivorian cooperatives. Support from INRAE for post-harvest fermentation improvement projects aligns with rising demand for terroir-specific chocolate. Government trade missions have prioritized long-term bean security through diplomatic cacao accords. France’s domestic consumption of high-flavor craft chocolate remains strong, driving bean imports toward higher-quality origins.

Germany’s cacao beans industry is forecast to grow at a CAGR of 8.6% from 2025 to 2035. Hamburg serves as the central import gateway, accounting for the largest cacao bean volume in continental Europe. Key processors such as Barry Callebaut and ADM continue forward contracting with West African growers to mitigate price fluctuations. The government’s foreign trade strategy recognizes cacao as a strategic raw material, easing custom procedures for certified beans. Domestic demand for couverture and industrial chocolate supports bean throughput throughout the year.

The Netherlands’ cacao beans market is anticipated to grow at a CAGR of 8.4% between 2025 and 2035. Amsterdam handles the highest volume of imported cacao beans in the EU, exceeding 600,000 MT annually. Zaanstad continues to attract investment in advanced processing units tailored for high-grade fermentation profiles. The Ministry of Foreign Affairs provides strategic funding to support sourcing agreements with cooperatives in Ghana and Cameroon. Dutch ports are benefitting from procedural upgrades that improve turnaround for bean imports and intra-EU shipments.

The United Kingdom’s cacao beans market is expected to grow at a CAGR of 8.3% through 2035. Post-Brexit trade frameworks have removed tariffs on premium cacao sourced from Central and South America. Scotland has emerged as a hub for bean-to-bar manufacturing, backed by regional enterprise grants. Import routes via Bristol and Felixstowe have been optimized for temperature-sensitive beans. Industry associations have expanded training initiatives on fermentation and drying methods for new chocolate brands entering the UK market.

The cacao beans market has an intense competition, with companies like Barry Callebaut AG, Cargill, Inc., Olam International, Nestlé S.A., Blommer Chocolate Company, and Mars, Inc. dominating the space. These players leverage strategic acquisitions and cutting-edge processing technologies to maintain their foothold in the industry. Emerging players like Meiji Holdings Co., Ltd., Puratos Group, and Touton S.A. also carve out their niches through regional expansions and specialized product offerings.

Despite the strong presence of global giants, the market remains fragmented due to ongoing innovation, regional market dynamics, and the diverse needs of the chocolate and confectionery industries. Competitive strategies vary, focusing on product differentiation and growing demand for high-quality cocoa.

| Report Attributes | Key Insights |

|---|---|

| Estimated Market Value (2025) | USD 14.49 billion |

| Projected Market Value (2035) | USD 31.98 billion |

| CAGR (2025 to 2035) | 8.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion |

| Type | Criollo, Forastero, Trinitario |

| Application | Chocolate & Confectionery, Food & Beverages, Cosmetics, Pharmaceuticals |

| Processing | Fermented, Unfermented |

| Nature | Conventional, Organic |

| Region | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players | Barry Callebaut AG, Cargill, Inc., Olam International, Nestlé S.A., Blommer Chocolate Company, Mars, Inc., Meiji Holdings Co., Ltd., Puratos Group, ECOM Agroindustrial Corp., Touton S.A., Others |

| Additional Attributes | Dollar sales, CAGR trends, type distribution, application demand, processing trends, organic vs. conventional, competitor dollar sales & market share, regional growth patterns, size preferences |

As per Type, the industry has been categorized into criollo, forastero, and trinitario.

As per Application, the industry has been categorized into chocolate & confectionery, food & beverages, cosmetics, and pharmaceuticals.

As per Processing, the industry has been categorized into fermented and unfermented.

As per Nature, the industry has been categorized into conventional and organic.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

The projected market value of the Cacao Beans Market in 2025 is 14.49 billion USD.

The forecast market value of the Cacao Beans Market by 2035 is 31.98 billion USD.

The expected CAGR for the Cacao Beans Market from 2025 to 2035 is 8.2%.

The Forastero cacao beans segment will lead the Cacao Beans Market in 2035, with a 70% market share.

United States is expected to experience the highest growth with a CAGR of 8.9%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fava Beans Market Report – Size, Share & Growth 2025-2035

Bambara Beans Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA