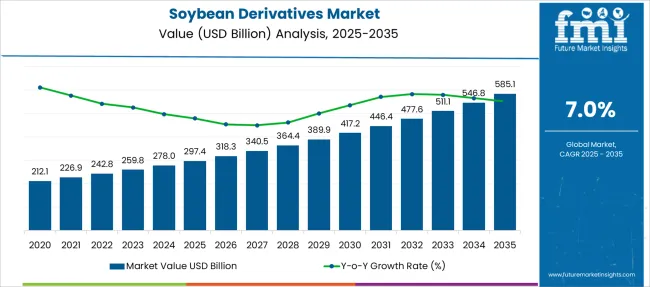

The Soybean Derivatives Market is estimated to be valued at USD 297.4 billion in 2025 and is projected to reach USD 585.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

| Metric | Value |

|---|---|

| Soybean Derivatives Market Estimated Value in (2025 E) | USD 297.4 billion |

| Soybean Derivatives Market Forecast Value in (2035 F) | USD 585.1 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The soybean derivatives market is steadily expanding due to increasing global demand for plant-based ingredients and sustainable raw materials across various industries. With heightened awareness around nutrition and environmental impact, soybean-based products have gained strong traction as alternatives in both food and industrial applications.

Favorable agricultural policies, technological improvements in processing, and an uptick in soy cultivation have also strengthened supply stability and pricing competitiveness. As consumers and manufacturers seek cleaner labels and functional benefits, derivatives such as meal, oil, and lecithin continue to be widely adopted across sectors.

The market outlook remains positive, with further growth driven by the rising vegan and vegetarian population, feed industry expansion, and ongoing innovations in soy-based formulations. An established global trade network and increasing preference for domestic production in key economies are also contributing to improved distribution efficiencies and market penetration.

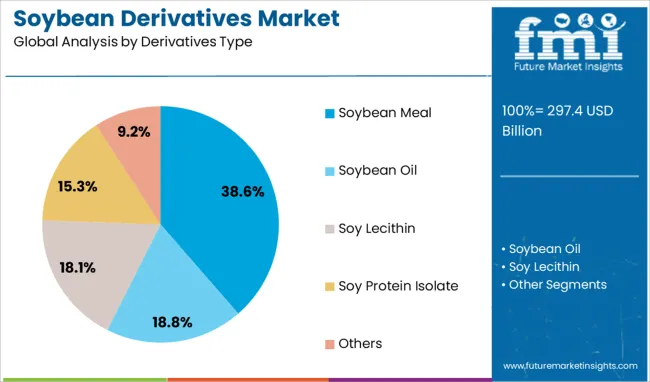

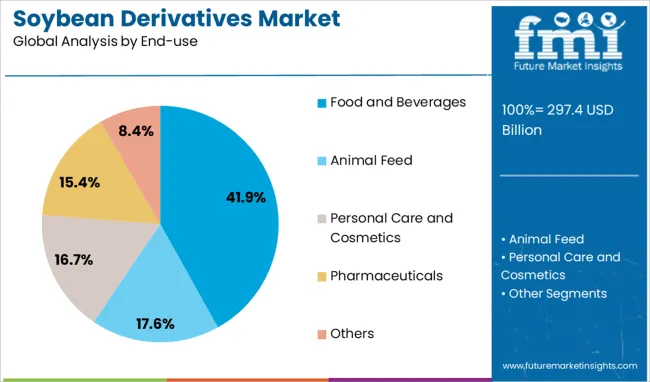

The soybean derivatives market is segmented by derivatives type, end-use, distribution channel and geographic regions. The soybean derivatives market is divided into Soybean Meal, Soybean Oil, Soy Lecithin, Soy Protein Isolate, and Others. The end-use of the soybean derivatives market is classified into Food and Beverages, Animal Feed, Personal Care and Cosmetics, Pharmaceuticals, and Others.

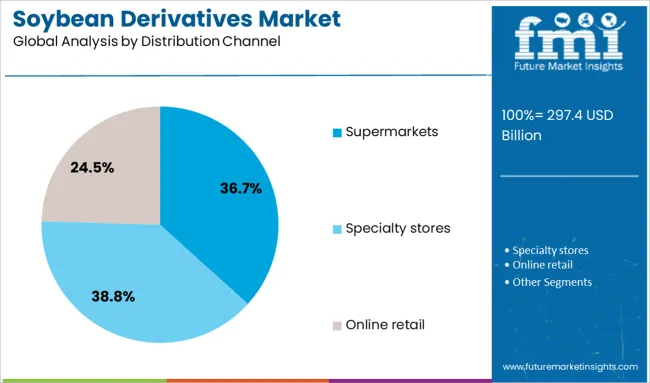

The distribution channel of the soybean derivatives market is segmented into Supermarkets, Specialty stores, and Online retail. Regionally, the soybean derivatives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Soybean meal accounts for 38.6% of the derivatives type segment, establishing itself as a key component in the global soybean derivatives landscape. Known for its high protein content, it is predominantly utilized in animal feed but is witnessing rising incorporation into food applications as well.

The segment’s dominance is supported by the growing demand for affordable and nutrient-dense protein sources, particularly in regions with expanding livestock and aquaculture industries. Moreover, increased attention toward sustainable agriculture and efficient resource utilization has driven soybean meal's adoption in environmentally conscious farming practices.

Manufacturers are focusing on optimizing extraction techniques to enhance nutrient retention and minimize processing costs. Continued expansion of meat and dairy alternatives is expected to diversify soybean meal’s use further, reinforcing its role in meeting the nutritional and economic needs of global supply chains.

The food and beverages end-use segment holds a 41.9% share, reflecting the rising utilization of soybean derivatives in a wide range of consumable products. Health-conscious consumers are increasingly seeking functional ingredients that provide high protein content, improve texture, and offer cholesterol-free benefits, positioning soybean-based components as an ideal fit.

From soy flour and protein concentrates to emulsifiers like soy lecithin, these derivatives are now standard in various packaged foods, dairy alternatives, and bakery products. The segment’s growth is being propelled by the expansion of plant-based diets, supported by both consumer trends and strategic investments by food manufacturers.

Regulatory support for non-GMO and allergen-free formulations further bolsters the segment’s adoption. As product innovation continues and global dietary habits shift, the food and beverages industry is expected to sustain its leadership in the use of soybean derivatives.

Supermarkets lead the distribution channel category with a 36.7% share, driven by their extensive reach, variety, and influence on consumer purchasing behavior. As primary retail outlets for both raw and packaged soybean derivative products, supermarkets provide strong visibility and accessibility to a broad customer base.

Strategic shelf placement, in-store promotions, and private-label offerings have enhanced product uptake among health-conscious and price-sensitive consumers. The trend toward clean eating and informed shopping has led supermarkets to increasingly stock organic, fortified, and specialty soy-based items.

Their partnerships with suppliers enable consistent supply chains and streamlined product innovation rollouts. With urbanization and modern retail formats continuing to grow, the supermarket segment is expected to maintain its prominence in connecting consumers with evolving soybean derivative offerings.

The soybean derivatives market is being propelled by rising global protein demand and expanding biodiesel mandates. Rapid growth in Asia‑Pacific and North America is being driven by feed and food applications. Emerging trends include fortified soy products and enzyme‑enhanced processing for improved nutritional quality.

Opportunities are being created by rising biofuel mandates in the USA and partnerships in developing markets like India and Brazil. However, significant restraints include volatile grain prices and excess soyoil inventories impacting margins. The outlook suggests robust competition among major processors and sustained domestic demand for value‑added soy components.

Demand for soybean derivatives has been driven by population growth and the implementation of biofuel policies. In 2025, USA soybean oil consumption for renewable diesel significantly increased as blending requirements intensified. Similarly, Asia-Pacific witnessed a surge in demand for feed and food components due to the rising need for livestock feed and plant-based protein.

Government programs supporting biodiesel production have incentivized processing expansions. This combination of food security concerns and renewable energy targets has reinforced the demand for soy meal, oil, lecithin, and protein isolates across multiple application segments globally.

Significant opportunities exist in biodiesel production and animal feed industries. In 2025, the demand for soybean oil in renewable diesel projects rose sharply, leading to higher crushing volumes. Countries such as India have created new openings for imports of soy derivatives as local production faced constraints.

Similarly, South American nations like Brazil and Argentina are investing heavily in processing capacity to cater to both domestic and export markets. The feed industry remains one of the fastest-growing application areas, creating strong prospects for processors focused on meal production and distribution networks.

A major trend shaping the market is the adoption of fortified soy products and advanced enzyme-based processing. In 2024, fortified soy beverages and protein isolates became increasingly popular in the functional food segment, particularly in Asia-Pacific. Enzyme processing has emerged as a preferred method for improving yield and enhancing product functionality.

These developments have boosted the appeal of soy derivatives in health-oriented food applications and alternative protein solutions. Increased demand for meat substitutes and fortified beverages indicates that differentiated product development is a core growth strategy among major market players.

Price volatility and oversupply in major markets have presented key challenges for industry growth. In 2025, excessive soymeal inventory in China created downward pressure on prices, impacting processor margins. Farmers in countries like India have also shifted acreage to alternative crops, resulting in fluctuating feedstock availability.

Additionally, global soybean prices have remained vulnerable to weather conditions and trade disruptions, leading to uncertainty in procurement strategies. These constraints have forced producers to adopt hedging practices, optimize production, and explore alternative sourcing models to safeguard operational and financial stability.

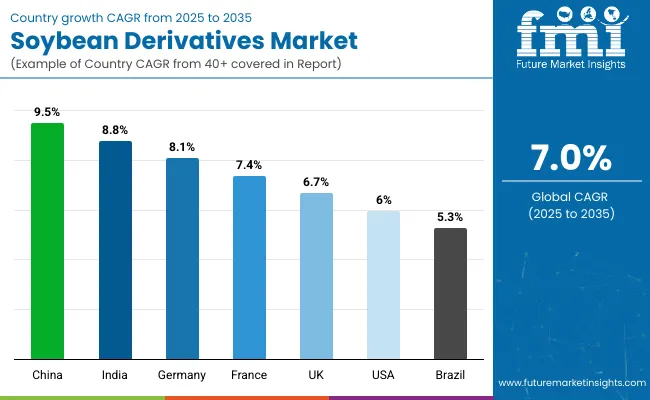

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

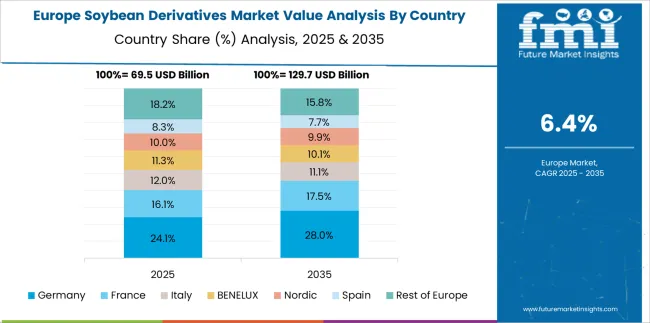

The global soybean derivatives market is projected to grow at a 7% CAGR during 2025–2035. Among major economies, China leads with 9.5% CAGR, driven by rising demand for soybean meal and soy protein in animal feed and food applications. India follows at 8.8%, supported by plant-based nutrition trends and expanding oil processing capacities. France records 7.4%, aligned with EU policies on sustainable sourcing and food security initiatives.

The UK posts 6.7% CAGR, while the United States grows at 6.0%, influenced by stable domestic consumption but increasing demand for soy-based biofuels and alternative proteins. Asia remains the dominant growth hub due to large-scale feed manufacturing and consumer preference for plant proteins, whereas Western markets focus on innovation in soy-based food ingredients and functional applications.

China dominates the soybean derivatives market with a projected 9.5% CAGR, supported by high feed demand in livestock and aquaculture sectors. The country’s reliance on soy protein concentrate for poultry and pig feed has surged, while soy lecithin and soy-based oils gain traction in food processing and packaged goods.

Government-led programs promoting food security and reduced dependency on imports have accelerated investments in domestic crushing facilities. The rise in health-conscious consumers also boosts soy protein isolate consumption in nutritional supplements and plant-based beverages. Strategic imports from Brazil and Argentina sustain raw material availability.

The soybean derivatives market in India is expected to grow at 8.8% CAGR, fueled by rising vegetarian population preferences and growing interest in plant-based proteins. Increased production of soybean oil and meal supports the food, feed, and oleochemical sectors. India’s edible oil industry, one of the largest globally, drives steady imports of soybean for processing.

Domestic manufacturers also capitalize on expanding soy protein isolate and textured soy protein demand in ready-to-cook meals, bakery, and nutraceuticals. Government policies promoting oilseed processing and the availability of cost-effective crushing infrastructure further enhance market development.

France records a 7.4% CAGR, underpinned by robust demand for soy-based products in food, beverages, and feed sectors. The EU’s sustainability regulations promote plant protein inclusion in diets, positioning soy as a key ingredient in meat alternatives and dairy substitutes.

Manufacturers are innovating with soy lecithin for bakery applications and emulsifiers in premium chocolate products. France also imports non-GMO soybeans to align with consumer preferences for traceable and organic products. The development of soy-based bio-components for bioplastics and oleochemicals further widens the application scope, making the market increasingly attractive.

The UK market is forecasted to grow at 6.7% CAGR, driven by rising consumption of plant-based protein in food and beverage categories. Soy protein isolates are widely adopted in meat substitutes, sports nutrition, and fortified food products. The focus on clean-label and allergen-free formulations has prompted innovation in soy lecithin as a natural emulsifier.

Imports dominate the supply chain, with strong sourcing ties to South America. Manufacturers are increasingly developing value-added soy ingredients such as textured protein for hybrid meat products. Retailer sustainability commitments and carbon reduction targets reinforce soy’s role in alternative protein strategies.

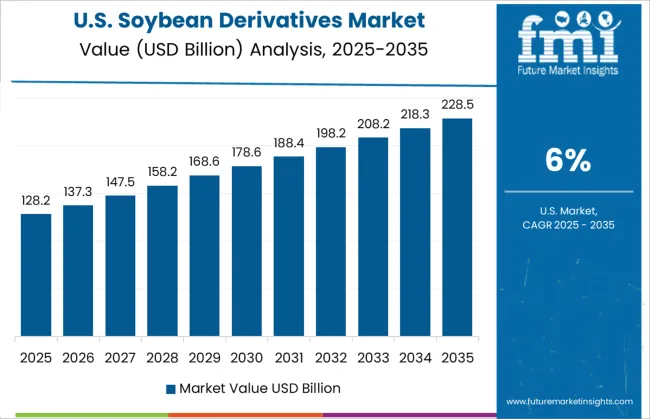

The USA market posts 6.0% CAGR, reflecting moderate growth driven by stable demand for soybean oil and meal in food and feed sectors. However, biofuel policies and renewable diesel production create new opportunities for soybean oil utilization, significantly boosting processing volumes.

Soy protein concentrates and isolates find increasing use in plant-based meat alternatives and functional nutrition products. Major processors like ADM and Cargill invest heavily in capacity expansion and non-GMO product development to cater to evolving consumer expectations. Advanced applications of soy derivatives in personal care and chemical sectors strengthen value-added revenue streams.

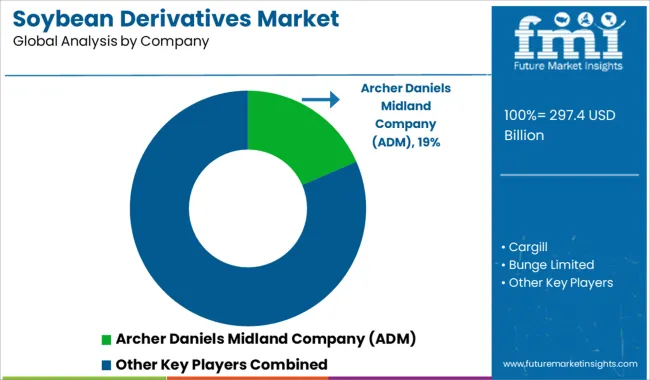

The soybean derivatives market is moderately consolidated, with Archer Daniels Midland Company (ADM) recognized as a leading player due to its extensive global supply chain, advanced processing capabilities, and diverse portfolio spanning soybean oil, meal, protein concentrates, and lecithin. ADM’s strong presence in food, feed, and industrial applications positions it as a dominant force in the sector.

Key players include Cargill, Bunge Limited, Louis Dreyfus Company (LDC), Wilmar International Limited, CHS Inc., AG Processing Inc. (AGP), DowDuPont, Richardson International Limited, Kerry Group plc, Ingredion Incorporated, Fuji Oil Co., Blue Diamond Growers, and Scoular Company.

These companies focus on value-added soybean derivatives for applications in animal feed, edible oils, biodiesel, and functional food ingredients, leveraging technological advancements to improve product quality and yield efficiency. Market growth is driven by rising demand for plant-based protein in food and beverage sectors, increasing soybean meal consumption in animal nutrition, and expanding biodiesel production fueled by renewable energy initiatives.

Leading manufacturers are investing in non-GMO and organic soybean processing, advanced extraction methods, and sustainable sourcing programs to align with evolving consumer preferences and regulatory compliance.

Asia-Pacific remains the largest consumer due to strong feed and oil demand, while North America and Europe are experiencing growth through the adoption of high-protein soy ingredients in plant-based food products and specialty industrial applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 297.4 Billion |

| Derivatives Type | Soybean Meal, Soybean Oil, Soy Lecithin, Soy Protein Isolate, and Others |

| End-use | Food and Beverages, Animal Feed, Personal Care and Cosmetics, Pharmaceuticals, and Others |

| Distribution Channel | Supermarkets, Specialty stores, and Online retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Archer Daniels Midland Company (ADM), Cargill, Bunge Limited, Louis Dreyfus Company (LDC), Wilmar International Limited, CHS Inc, AG Processing Inc (AGP), DowDuPont, Richardson International Limited, Kerry Group plc, Ingredion Incorporated, Fuji Oil Co., Blue Diamond Growers, and Scoular Company |

| Additional Attributes | Dollar sales segmented by derivative type (soymeal, soy oil, soy protein, soy lecithin) and application (feed, food & beverage, biodiesel, industrial). Asia‑Pacific holds the largest share (~43% in 2024), with North America following. Buyers prioritize plant-based proteins, allergen-free emulsifiers, and sustainable sourcing. Innovations include fortified isolates, enzymatic lecithin processing, and resilient supply networks. |

The global soybean derivatives market is estimated to be valued at USD 297.4 billion in 2025.

The market size for the soybean derivatives market is projected to reach USD 585.1 billion by 2035.

The soybean derivatives market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in soybean derivatives market are soybean meal, soybean oil, soy lecithin, soy protein isolate and others.

In terms of end-use, food and beverages segment to command 41.9% share in the soybean derivatives market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soybean Enzymatic Protein Market Size and Share Forecast Outlook 2025 to 2035

Soybean Meal Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soybean Oil Market

Epoxidized Soybean Oil Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the High Oleic Soybean Sector

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Derivatives Market Analysis by Type, Category, Application and Region through 2035

Animal Derivatives Market

Saffron Derivatives Market Analysis by Product Type, Form, Application, Distribution Channel, and Region Through 2035

Collagen Derivatives Market Analysis by Source, Dosage Form and Application Through 2035

Diketene Derivatives Market Growth – Trends & Forecast 2022 to 2032

Rice Bran Derivatives Market Size and Share Forecast Outlook 2025 to 2035

UK Starch Derivatives Market Report – Size, Share & Innovations 2025-2035

Cocoa Bean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

USA Starch Derivatives Market Analysis – Demand, Trends & Outlook 2025-2035

Castor Oil Derivatives Market Growth - Trends & Forecast 2025 to 2035

Naphthalene Derivatives Market Growth & Demand 2025 to 2035

Tamarind Gum Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Azelaic Acid Derivatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

ASEAN Starch Derivatives Market Trends – Growth, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA