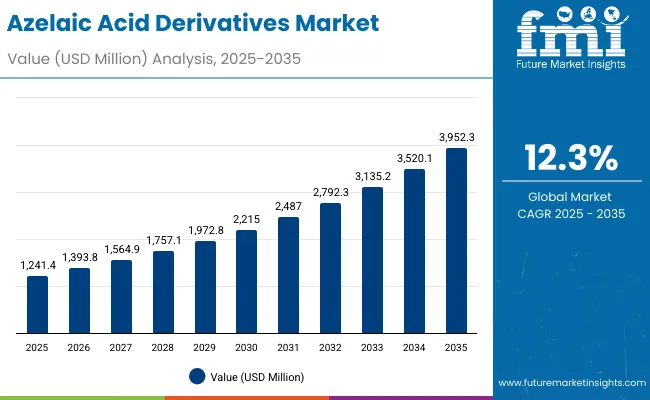

The Azelaic Acid Derivatives Market is expected to record a valuation of USD 1,241.4 million in 2025 and USD 3,952.3 million in 2035, with an increase of USD 2,710.9 million, which equals a growth of more than 218% over the decade. The overall expansion represents a CAGR of 12.3% and a more than 3X increase in market size.

Azelaic Acid Derivatives Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,241.4 million |

| Market Forecast Value in (2035F) | USD 3,952.3 million |

| Forecast CAGR (2025 to 2035) | 12.3% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,241.4 million to USD 2,215.0 million, adding USD 973.6 million, which accounts for 35.9% of the total decade growth. This phase records steady adoption in acne care, pigmentation reduction, and anti-inflammatory applications, driven by dermatological awareness and rising demand for dermatologist-tested and clinical-grade claims. Creams and lotions dominate this period as they cater to over 42% of daily-use formulations, serving both prescription and OTC skincare.

The second half from 2030 to 2035 contributes USD 1,737.3 million, equal to 64.1% of total growth, as the market jumps from USD 2,215.0 million to USD 3,952.3 million. This acceleration is powered by widespread consumer adoption of e-commerce, the premiumization of clean-label and vegan azelaic acid products, and deeper penetration in emerging economies such as India and China. Serums and gels, alongside targeted spot treatments, capture a rising share above 50% by the end of the decade. Digital-first brands with subscription models further drive specialty beauty and pharmacy channels, expanding consumer reach globally.

From 2020 to 2024, the Azelaic Acid Derivatives Market grew from an estimated USD 800 million to USD 1,150 million, driven by acne-focused solutions and dermatologist-backed products. During this period, the competitive landscape was dominated by specialist skincare brands controlling nearly 70% of revenue, with leaders such as Paula’s Choice, The Ordinary, and La Roche-Posay focusing on acne treatments and pigmentation reduction. Differentiation relied heavily on concentration efficacy (10%-20% azelaic acid formulations), skin sensitivity tolerability, and affordability. Vegan and clean-label claims gained traction but were still niche, contributing less than 15% of the total market value.

Demand for azelaic acid derivatives is expected to expand to USD 1,241.4 million in 2025, and the revenue mix will shift as serums, gels, and spot treatments grow to over 55% share by 2035. Traditional leaders face rising competition from clinical-grade entrants offering prescription-strength formulations, while digital-native brands emphasize vegan, cruelty-free, and subscription-based models. Major companies are pivoting to omnichannel strategies, with e-commerce and specialty beauty stores gaining market share over mass retail. Competitive advantage is moving away from price alone to clinical validation, consumer trust, and brand positioning around safe, effective skin transformation.

Advances in clinical skincare have established azelaic acid as a gold standard for acne treatment, pigmentation correction, and inflammatory skin conditions. Its multifunctional nature anti-inflammatory, brightening, and acne-combating makes it versatile across dermatologist prescriptions and consumer beauty routines. Growing awareness of long-term skin health has expanded its adoption in serums and spot treatments, which are increasingly favored for precision skincare.

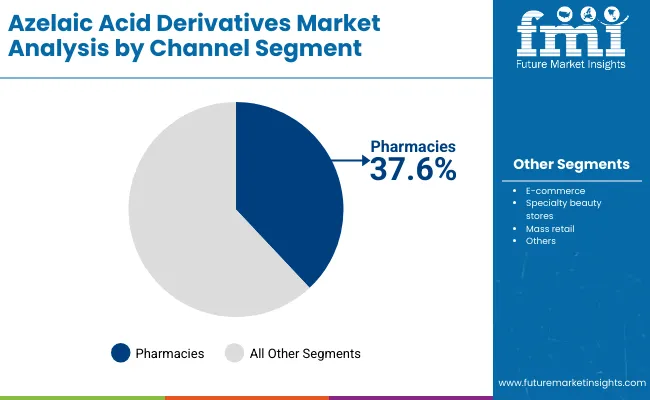

Pharmacy-driven distribution has provided credibility, with 37.6% market share in 2025, while e-commerce is rising sharply due to consumer preference for online consultations, product education, and subscription convenience. The rise of vegan, clean-label, and dermatologist-tested claims has further boosted consumer trust and market expansion. Segment growth is expected to be led by acne treatment applications, cream and lotion formats in the early phase, and serums and gels in the later decade due to premiumization and personalization. Countries such as India (CAGR 19.4%) and China (CAGR 17.3%) will act as key accelerators, while the USA maintains its position as the largest individual market.

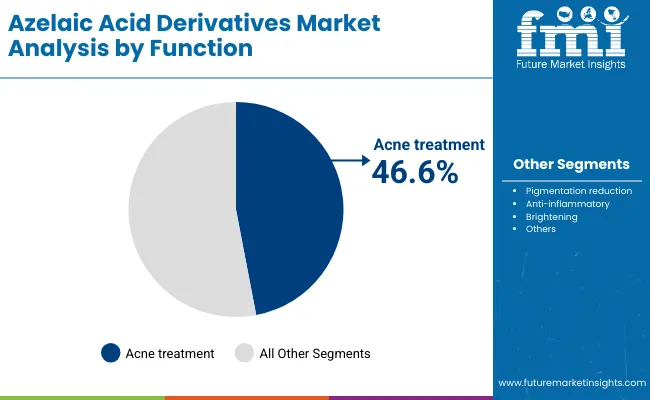

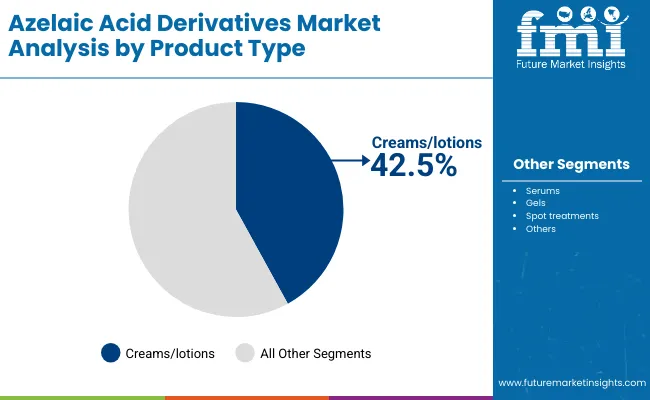

The market is segmented by function, product type, channel, claim, and geography, highlighting the demand for multifunctional skincare supported by dermatological efficacy. Functions include acne treatment, pigmentation reduction, anti-inflammatory, and brightening. Product types encompass creams/lotions, serums, gels, and spot treatments. Channels include pharmacies, e-commerce, specialty beauty stores, and mass retail. Claims highlight dermatologist-tested, clinical-grade, vegan, and clean-label. Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

| Function Segment | Market Value Share, 2025 |

|---|---|

| Acne treatment | 46.6% |

| Others | 53.4% |

The acne treatment segment is projected to contribute nearly half of the Azelaic Acid Derivatives Market revenue in 2025, maintaining its lead as the dominant function category. This is driven by the high prevalence of acne among younger demographics, rising prescription usage, and growing adoption of OTC azelaic acid formulations. With its dual benefits of reducing acne-causing bacteria and soothing inflammation, the segment will continue to anchor the market. Expansion in tele-dermatology and online pharmacy platforms further fuels its reach.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Creams/lotions | 42.5% |

| Others | 57.5% |

Creams and lotions hold the largest share in 2025 due to their accessibility, affordability, and widespread consumer acceptance. Positioned as both prescription and OTC solutions, they cater to acne management and pigmentation reduction, serving as the first-choice entry point for azelaic acid adoption. Their ease of use and compatibility with daily skincare routines ensure broad applicability across demographics. By 2035, serums and gels are expected to gain faster growth, but creams and lotions remain an essential backbone of the market.

| Channel Segment | Market Value Share, 2025 |

|---|---|

| Pharmacies | 37.6% |

| Others | 62.4% |

Pharmacies are expected to hold the dominant channel share in 2025, underscoring consumer reliance on trusted medical retail formats for dermatology-backed solutions. Their credibility in dispensing clinical-grade skincare has solidified their importance in early adoption markets such as the USA and Europe. However, with e-commerce platforms scaling globally, the online channel is forecasted to outpace traditional retail growth by 2035, particularly in Asia-Pacific.

Drivers

Rising Prevalence of Acne, Pigmentation, and Skin Sensitivity Disorders

The foremost driver for the Azelaic Acid Derivatives Market is the growing incidence of acne and hyperpigmentation, especially among younger populations in both developed and emerging markets. According to global dermatology studies, acne affects nearly 85% of people aged 12-24, and pigmentation issues rank among the top three dermatological concerns worldwide. Azelaic acid derivatives offer a dual-action benefit: they are highly effective against acne-causing bacteria while simultaneously reducing post-inflammatory hyperpigmentation.

This versatility positions them as a first-choice ingredient for both prescription and OTC dermatology products. The market is further propelled by a rise in consumer awareness about skin health, with patients increasingly seeking safer alternatives to harsher treatments like benzoyl peroxide or retinoids. As more consumers turn to multi-functional, skin-friendly active ingredients, azelaic acid adoption will accelerate across both clinical and cosmetic segments.

Expansion of Clean-Label, Vegan, and Dermatologist-Tested Skincare Products

Another major growth driver is the strong consumer preference shift toward clean-label, vegan, cruelty-free, and dermatologist-tested formulations. Azelaic acid derivatives naturally fit into these claims due to their plant and grain origins (derived from wheat, barley, or rye) and their proven safety profile. Brands such as The Ordinary, Paula’s Choice, and La Roche-Posay have leveraged this positioning effectively, making azelaic acid a hero ingredient in their clean and minimalist skincare portfolios.

In addition, clinical validation and dermatologist endorsements boost consumer trust, especially in markets like the USA and Europe where clinical-grade performance strongly influences purchasing behavior. The convergence of clinical efficacy and ethical claims is fueling the rapid premiumization of azelaic acid derivatives, expanding their appeal across mass, specialty, and luxury skincare segments.

Restraints

Competition from Established Actives such as Retinoids and Niacinamide

A major restraint in the market is the intense competition azelaic acid derivatives face from other well-established skincare actives like retinoids, niacinamide, salicylic acid, and vitamin C. These ingredients already dominate consumer awareness, brand marketing, and clinical skincare formulations. For instance, niacinamide is often promoted as a multifunctional ingredient for brightening and barrier support, directly competing with azelaic acid’s pigmentation reduction and anti-inflammatory roles. Similarly, retinoids remain the gold standard for acne and anti-aging, leaving azelaic acid in a secondary position unless heavily differentiated. This competitive overlap makes it challenging for brands to justify premium pricing or establish strong consumer loyalty around azelaic acid without significant marketing investments.

Limited Consumer Awareness and Delayed Results

While dermatologists widely recognize the benefits of azelaic acid, mainstream consumer awareness remains relatively low compared to more “trendy” actives like hyaluronic acid or vitamin C. Furthermore, azelaic acid derivatives often require consistent use over several weeks before visible results are observed. This delayed gratification effect creates friction with consumers who expect rapid improvements in acne and pigmentation. Misconceptions about irritation (despite azelaic acid being generally well-tolerated) also hinder adoption among sensitive-skin consumers. Together, these factors slow down product penetration in mass retail channels and require brands to invest significantly in education campaigns, dermatologist collaborations, and transparent clinical trial communication.

Key Trends

Shift Toward Serums, Spot Treatments, and Personalized Skincare

While creams and lotions currently dominate the market (42.5% share in 2025), the fastest-growing trend is the rise of serums, gels, and spot treatments. Consumers are increasingly drawn to targeted solutions that promise precision benefits such as fading dark spots or addressing localized breakouts rather than relying solely on general creams. This trend aligns with the broader movement toward personalized skincare, where azelaic acid concentrations are adjusted for individual needs (e.g., 10% for sensitive users, 15-20% for severe acne). By 2035, serums and spot treatments are expected to capture a larger market share, driven by premium packaging, subscription models, and digital-first consumer engagement through e-commerce platforms.

Strong Growth in Emerging Markets (India, China, and Southeast Asia)

The market is witnessing its strongest acceleration in Asia, particularly India and China, which are forecasted to grow at CAGRs of 19.4% and 17.3%, respectively. Rising disposable incomes, increasing urbanization, and heightened interest in clinical skincare are fueling demand. Consumers in these regions are also more open to dermatologist consultations and telemedicine services, which directly promote azelaic acid derivatives as part of acne and pigmentation treatment regimens. The adoption of e-commerce giants like Tmall in China and Nykaa in India further supports distribution expansion, enabling international brands to penetrate regional markets quickly. By 2035, these countries will significantly increase their global share, making Asia-Pacific a hub for future demand.

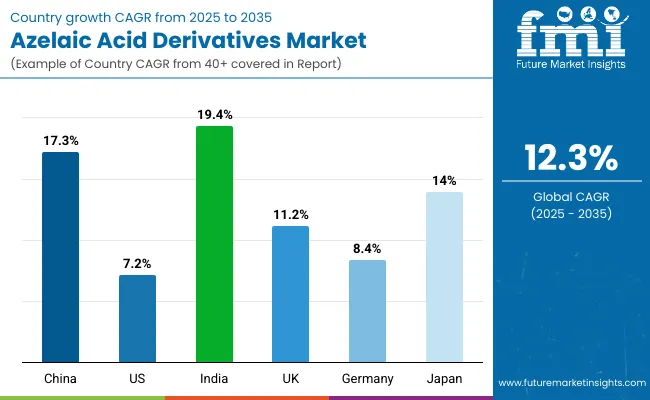

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 17.3% |

| USA | 7.2% |

| India | 19.4% |

| UK | 11.2% |

| Germany | 8.4% |

| Japan | 14.0% |

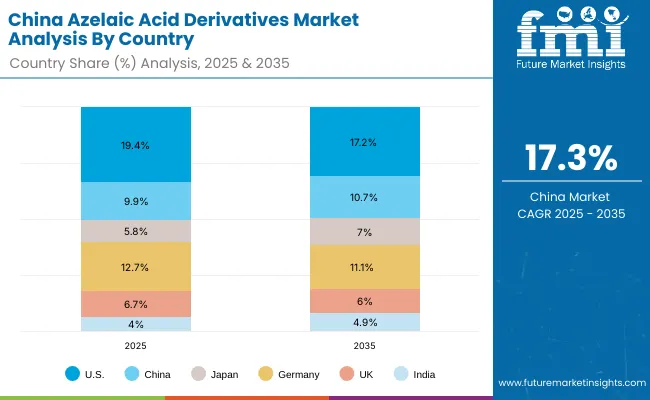

The Azelaic Acid Derivatives Market shows significant country-level variation in growth trajectories between 2025 and 2035, reflecting differences in consumer maturity, dermatological awareness, and retail access. India (CAGR 19.4%) and China (CAGR 17.3%) are the fastest-growing markets, driven by a rising middle class, expanding e-commerce ecosystems, and high unmet needs for acne and pigmentation solutions. Dermatology consultations and telemedicine are gaining traction in these regions, accelerating prescription-based azelaic acid adoption. Japan also records a strong 14.0% CAGR, supported by advanced skincare routines, high consumer trust in clinical-grade formulations, and demand for brightening products that align with local beauty standards. Together, Asia-Pacific economies are projected to outpace North America and Europe in relative growth, though starting from a smaller base.

In contrast, mature markets such as the USA (7.2% CAGR), Germany (8.4% CAGR), and the UK (11.2% CAGR) show steadier but slower growth, reflecting saturation in acne and pigmentation treatment segments. In the USA, azelaic acid adoption is already established through both prescription and OTC channels, but competition with retinoids and niacinamide limits acceleration. Germany’s growth is modest, anchored by pharmacies and clinical endorsements, while the UK demonstrates stronger momentum due to consumer interest in vegan, dermatologist-tested, and clean-label claims. These developed markets will remain the largest revenue contributors in absolute terms, but their share of the global market is expected to decline as emerging economies drive the next wave of expansion.

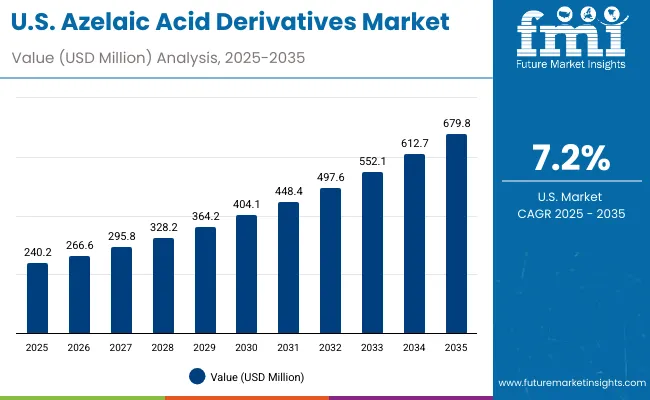

| Year | USA Azelaic Acid Derivatives Market (USD Million) |

|---|---|

| 2025 | 240.2 |

| 2026 | 266.6 |

| 2027 | 295.8 |

| 2028 | 328.2 |

| 2029 | 364.2 |

| 2030 | 404.1 |

| 2031 | 448.4 |

| 2032 | 497.6 |

| 2033 | 552.1 |

| 2034 | 612.7 |

| 2035 | 679.8 |

The Azelaic Acid Derivatives Market in the United States is projected to grow at a CAGR of 7.2%, driven by increasing adoption of clinical-grade skincare and prescription formulations. Dermatologists widely prescribe azelaic acid for acne and pigmentation, reinforcing its strong positioning in pharmacies. Over-the-counter (OTC) formulations are gaining visibility in retail and e-commerce, especially among consumers seeking gentler alternatives to retinoids and benzoyl peroxide. Digital-native skincare brands are boosting consumer awareness through direct-to-consumer (D2C) education campaigns and subscription-based models. Clean-label, vegan, and dermatologist-tested claims resonate strongly with USA consumers, further pushing demand across both specialty beauty stores and online platforms.

The Azelaic Acid Derivatives Market in the United Kingdom is expected to grow at a CAGR of 11.2%, supported by demand for vegan, cruelty-free, and dermatologist-tested products. The UK consumer base is highly receptive to clean-label skincare, and azelaic acid has gained traction as a trusted active for sensitive skin and long-term acne management. Premium brands such as Paula’s Choice, La Roche-Posay, and The Ordinary have captured strong market shares by positioning azelaic acid within multi-step skincare routines. Additionally, pharmacies and specialty beauty retailers remain critical in reinforcing credibility, while e-commerce platforms like Boots and Cult Beauty ensure broad availability. The growing popularity of tele-dermatology consultations also supports wider adoption.

India is witnessing rapid growth in the Azelaic Acid Derivatives Market, which is forecast to expand at a CAGR of 19.4% through 2035, the fastest among global markets. Rising disposable incomes, urbanization, and heightened awareness of acne and pigmentation disorders are fueling strong demand. Adoption is expanding beyond tier-1 cities into tier-2 and tier-3 regions, supported by cost-effective launches and expanding e-commerce distribution. Dermatologists increasingly prescribe azelaic acid as a safer alternative for long-term acne management, while digital pharmacies and telemedicine platforms are accelerating access across smaller cities. Mass-market appeal is also supported by affordable creams and lotions, while premium serums and spot treatments cater to affluent urban consumers.

The Azelaic Acid Derivatives Market in China is expected to grow at a CAGR of 17.3%, one of the highest globally. Growth is driven by strong consumer demand for brightening and pigmentation correction solutions, alongside rising awareness of acne care in urban centers. E-commerce giants such as Tmall and JD.com play a pivotal role in accelerating brand adoption, especially for international players. Local skincare brands are also innovating with affordable formulations, making azelaic acid accessible to younger consumers. Municipal and regional dermatology clinics are promoting clinical-grade products, while social media platforms such as Xiaohongshu are creating viral awareness around azelaic acid benefits. As demand for high-efficacy, clean-label skincare rises, China is positioned to become one of the most dynamic markets globally.

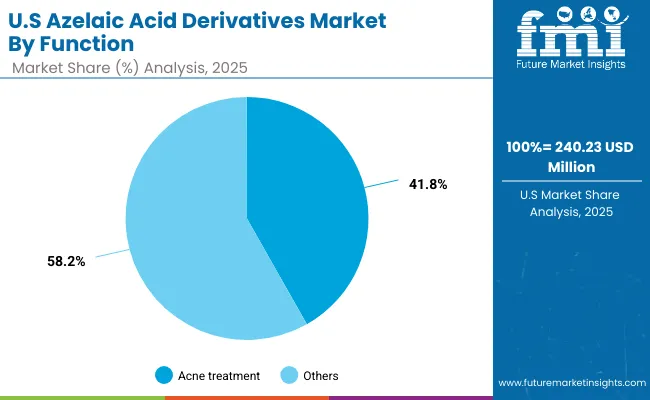

| Function Segment | Market Value Share, 2025 |

|---|---|

| Acne treatment | 41.8% |

| Others | 58.2% |

The USA Azelaic Acid Derivatives Market is valued at USD 240.23 million in 2025, with acne treatment leading at 41.8% share, followed by other applications such as pigmentation reduction, anti-inflammatory use, and brightening at 58.2%. The dominance of acne treatment reflects the high prevalence of acne among adolescents and young adults, as well as dermatologists’ reliance on azelaic acid as a safe, prescription-supported active. The segment benefits from established pharmacy distribution, strong clinical validation, and increasing OTC adoption across mass retail and e-commerce channels.

This advantage positions acne treatment products as an essential tool for addressing long-term dermatological concerns, particularly among consumers seeking gentler alternatives to retinoids and benzoyl peroxide. Pigmentation correction and brightening applications are gaining momentum, especially in multi-active formulations. As clean-label and vegan positioning grows in importance, brands are expected to further expand azelaic acid offerings beyond acne into holistic skin health routines.

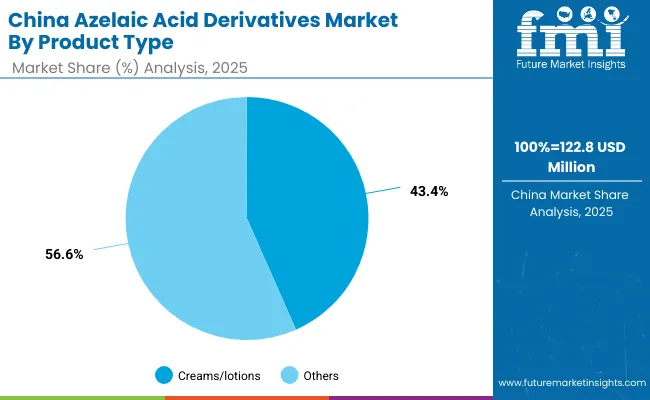

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Creams/lotions | 43.4% |

| Others | 56.6% |

The China Azelaic Acid Derivatives Market is valued at USD 122.8 million in 2025, with creams and lotions leading at 43.4% share, followed by serums, gels, and spot treatments at 56.6%. The dominance of creams and lotions is a direct outcome of China’s skincare culture, where moisturizers and daily-use formulations remain the preferred format for acne and pigmentation care. These products are affordable, accessible through both pharmacies and e-commerce platforms, and trusted by dermatologists for sensitive-skin use.

This advantage positions creams and lotions as the foundation of consumer adoption in early stages. However, the “others” segment, which includes serums and spot treatments, is rapidly gaining momentum, fueled by premiumization, influencer-led marketing, and high adoption among younger consumers seeking precision skincare. By 2035, serums are expected to capture a much larger share as Chinese consumers increasingly favor multifunctional, higher-concentration solutions.

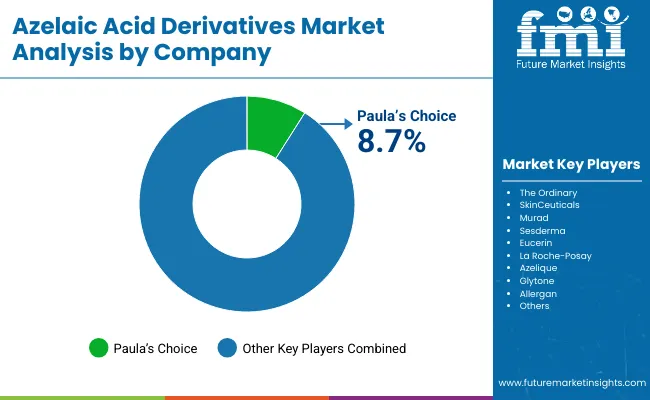

The Azelaic Acid Derivatives Market is moderately fragmented, with a mix of dermatology-backed leaders, clinical-grade innovators, and niche-focused indie brands competing across multiple skincare applications. Market leader Paula’s Choice holds the largest individual share at 8.7% in 2025, driven by its cult-favorite 10% Azelaic Acid Booster, which has become a benchmark product globally. Its success is reinforced by strong dermatologist endorsements, effective positioning for acne and pigmentation, and a trusted clean-label identity.

Other leading players, including The Ordinary, SkinCeuticals, Murad, Eucerin, and La Roche-Posay, strengthen the landscape with clinical-grade positioning and diverse product portfolios across creams, serums, and gels. Their strategies emphasize dermatologist-tested claims, e-commerce expansion, and collaborations with dermatology clinics to boost credibility. Indie brands like Azelique and Glytone focus on niche positioning, offering targeted azelaic acid spot treatments and gel formulations, while Allergan leverages its pharmaceutical expertise to anchor prescription-strength azelaic acid derivatives in dermatology practices.

Competitive differentiation is shifting away from concentration percentages alone toward ecosystem strength combining clean-label claims, e-commerce strategies, dermatologist endorsements, and personalized skincare offerings. Subscription-based models, AI-driven product recommendations, and multifunctional hybrid formulations are emerging as critical levers for sustainable competitive advantage.

| Item | Value |

|---|---|

| Quantitative Units | USD 3,952.3 million |

| Function | Acne treatment, Pigmentation reduction, Anti-inflammatory, Brightening |

| Product Type | Creams/lotions, Serums, Gels, Spot treatments |

| Channel | Pharmacies, E-commerce, Specialty beauty stores, Mass retail |

| Claim | Dermatologist-tested, Clinical-grade, Vegan, Clean-label |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Paula’s Choice, The Ordinary, SkinCeuticals, Murad, Sesderma, Eucerin, La Roche- Posay, Azelique, Glytone, Allergan |

| Additional Attributes | Dollar sales by function and product type, adoption trends in acne treatment and pigmentation reduction, rising demand for dermatologist-tested and vegan claims, segment-specific growth in creams/lotions and serums, e-commerce and pharmacy channel expansion, integration of clinical-grade positioning with consumer skincare, regional trends influenced by Asia-Pacific premiumization, and innovations in nanotechnology-based formulations and hybrid actives. |

The Azelaic Acid Derivatives Market is estimated to be valued at USD 1,241.4 million in 2025.

The market size for the Azelaic Acid Derivatives Market is projected to reach USD 3,952.3 million by 2035.

The Azelaic Acid Derivatives Market is expected to grow at a 12.3% CAGR between 2025 and 2035.

The key product types in the Azelaic Acid Derivatives Market are creams/lotions, serums, gels, and spot treatments.

In terms of function, the acne treatment segment will command 46.6% share in the Azelaic Acid Derivatives Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Azelaic Acid Market

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Boric Acid Market Forecast and Outlook 2025 to 2035

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Dimer Acid-based (DABa) Polyamide Resin Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA