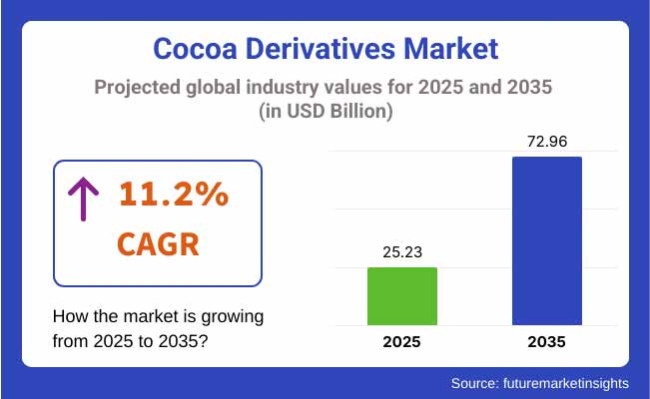

The cocoa derivatives market is estimated to be worth USD 25.23 billion in 2025 and is projected to reach USD 72.96 billion by 2035, expanding at a CAGR of 11.2% over the forecast period. The industry is on an upward trajectory due to the rise in demand for cocoa-based ingredients in various sectors including food, drinks, and cosmetics.

They comprise cocoa butter, cocoa powder, cocoa liquor, and cocoa nibs which are often used as key raw materials in the production of chocolates, bakery items, dairy products as well as in personal care formulations. The trend of consumers choosing higher-end, organic, and fairly traded cocoa products also contributes to the growth of the industry.

The industry's growth is mainly due to the increasing consumption of chocolate and other confectioneries. There is a shift in people's preferences towards chocolate products being more than just typical ones. People now want high-quality chocolate that is artisanal, which in turn accelerates the demand for cocoa derivatives that can give distinct extreme flavors and extraordinary qualities.

The expansion of the industry can also be explained by the prevalence of functional foods and drinks that use cocoa powder to add its positive germ-fighting and non-carcinogenic effects to the product. The cosmetics and personal care industry is also one of the growth drivers in the industry.

Cocoa butter is a well-known skincare and haircare product ingredient because of its moisturizing, anti-aging, and nourishing properties. Manufacturers have been more inclined to embed cocoa-based ingredients in lotions, lip balms, and body creams in line with the trend of natural and clean-label beauty products. Cocoa processing innovations like fermentation and refining techniques technology are responsible for the improvement of the product in terms of quality, consistency, and sustainability.

The cocoa sector is also affected by the focus on the fair trade movement and the sourcing of cocoa products that are grown sustainably as this is becoming an increasing concern of consumers with the environmental and social effects of cocoa production. Undertakings are carrying out full measures about transparency, traceability, and practicing regimes of farming that are sustainable as requested by consumers.

Nevertheless, the industry is also confronted with problems like the changes in cocoa prices, the complications in the supply chain, and the issues of environmental destruction and the employment of child workers in cocoa farming. Also, the regulatory necessities and the related certifications for organic, fair trade, and sustainable sourcing of cocoa present barriers to the compliance of enterprises.

In spite of the obstacles, there is a prospect for significant industry growth. The high demand for plant-based and dairy-free chocolate substitutes is the cause for the rise of various new cocoa products offered in the industry.

Furthermore, the ongoing trend of premiumization in the chocolate sector, combined with the expanding usage of cocoa products in health and nutritional supplements, is supposed to lead to further industry development. The noblesse of companies trying different ways to use cocoa will help bring more sales in the industry, which is growing and will keep on doing so for the years to come.

The industry is under strong demand due to increasing chocolate consumption, trends in functional foods, and increased uses in the cosmetics and pharmaceutical industries. Major derivatives are cocoa butter, cocoa powder, cocoa liquor, and cocoa nibs, which are each targeted towards various industries.

The confectionery and chocolate industry leads the way, fueling demand for high-quality cocoa liquor and butter. Bakeries and beverage manufacturers require versatile cocoa powders for flavoring. The cosmetics and pharmaceutical industries, on the other hand, value cocoa butter for its medicinal and skin-enriching qualities.

Sustainability is also key, with brands emphasizing fair trade sourcing, organic certification, and deforestation-free cocoa sourcing. In addition, health-conscious consumers are asking for low-sugar, high-flavanol cocoa derivatives. With premiumization and sustainable sourcing driving consumer choice, manufacturers focused on traceability, innovation, and functional benefits are becoming leaders in the industry.

The following table offers a comparative analysis of the difference in CAGR across six months for the base year (2024) and the current year (2025) for the industry. The analysis identifies major growth trends and revenue realization patterns, providing stakeholders with a better understanding of the direction of the industry. The first half of the year (H1) is from January to June, whereas the second half (H2) is between the months of July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 10.8% |

| H2 (2024 to 2034) | 11.2% |

| H1 (2025 to 2035) | 10.9% |

| H2 (2025 to 2035) | 11.4% |

During the first half (H1) of the period 2024 to 2034, the company is expected to grow at a CAGR of 10.8%, and then at an increased growth rate of 11.2% during the second half (H2) of the decade 2024 to 2034.

Entrancing the subsequent period, from H1 2025 to H2 2035, the CAGR is expected to elevate to 10.9% in the first half and stay significantly high at 11.4% during the second half. During the first half (H1) the industry experienced a growth of 30 BPS whereas during the second half (H2), the company experienced a decline of 20 BPS.

There have been significant shifts in the industry in the last few years, driven by evolving consumer patterns and advances in technology within the sector. Demand for sustainably sourced and high-quality cocoa grew between 2020 and 2024, as ethical sourcing and transparency became key purchasing drivers. Consumers increasingly wanted premium cocoa butter, powder, and liquor for confectionery, bakery, and functional food applications.

Dark chocolate formats with high antioxidant content were also becoming popular as health-conscious consumers valued nutrition. The increasing popularity of dairy-free and plant-based chocolate also spurred demand for other cocoa derivatives.

To protect their businesses from even greater consumer outcry, manufacturers improved traceability along supply chains, invested in fair-trade certification, and streamlined production processes to preserve the sensory attributes of them without compromising ethical sourcing.

The industry will continue to evolve from 2025 to 2035. AI and blockchain technology in supply chains will meet to promote transparency at the consumer level, with real-time tracking of cocoa origin. Improved processing and fermentation methods will deliver improved flavor profiles with reduced environmental impact. On the back of improved understanding of cognitive and cardiovascular health benefits, highly functional cocoa ingredients, including flavanol-rich cocoa powders, will see rising demand.

Priority agenda will also include climate-resilient cocoa farming practices, with ecologically sustainable production from agroforestry systems and genetic enhancement. With food personalization on the rise, AI-flavored profiling will allow for bespoke blends of taste and health-based customized cocoa derivatives.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Soaring demand for premium, ethically sourced cocoa butter and powder. | Supply chain traceability and real-time tracing by AI in cocoa sourcing. |

| Plant and dairy-free chocolate substitutes. | Tailored cocoa recipes with AI-driven flavor profiles. |

| Higher demand for fair-trade and climate-resilient-cultivated cocoa. | Cocoa and agroforestry farming in Latin America climate-resilient to provide stable income from the crop. |

| Higher dark chocolate intake due to antioxidant opportunity. | Cocoa ingredients functionalized with flavanols to enhance brain health and cardiovascular functions. |

The industry is prone to various risks such as strict food safety regulations, comprising quality standards, pesticide residue limits, and labelling requirements, create barriers. Firms have to comply with international food regulations for sustaining industry credibility and avoiding legal consequences.

Supply chain disruptions in the form of oscillation of cocoa bean prices, the effect of climate change on cocoa yields, and geopolitical tensions in major cocoa-producing countries are central to industry stabilization. Reliance on fair-trade certification and ethical sourcing is a risk factor for enhanced operational complexity.

Consumer concerns related to deforestation, child labor, and ethical sourcing directly tend to influence the choice of the product. Transparency in the supply chain, certifications like the Rainforest Alliance or Fair Trade, and responsible corporate behaviour will be the key factors to gain the trust and loyalty of customers.

Industry dynamics are affected by economic fluctuations, changing diets, and the rising demand for both luxury and organic cocoa items. In order to ensure the long-term growth of the business, the ethical sourcing as well as product differentiation should be the main focus with marketing strategies targeted at sustainability, quality and health benefits as well.

Cocoa Butter Leading Among Cocoa Derivatives by Type

| Segment | Value Share (2025) |

|---|---|

| Cocoa Butter (By Type) | 42% |

The industry is divided into segments based on cocoa butter, cocoa powder, cocoa beans, etc.; cocoa butter and cocoa beans will share the largest industry by 2025, with 42% and 30% of sales, respectively. Cocoa butter leads the world economy, owing to its increasing utilization in the confectionery, cosmetic, and pharmaceutical industries.

In the food industry, it is a standard ingredient in high-end chocolates and baked goods; it is prized for its creaminess, flavor complexity, and melt-in-the-mouth quality. Brands such as Lindt and Godiva highlight the amount of cocoa butter in their products to attract more quality-oriented consumers. Also, owing to its emollient and moisturizing properties, cocoa butter is widely used in skincare products, including body lotions and lip balms, which will further increase demand in its end-use industry.

30% of the total industry size consists of cocoa beans, without a doubt, the building blocks of all cocoa derivatives, such as powder, butter, and liquor. This demand for whole beans stems from the bean-to-bar chocolate phenomena and the artisanal chocolate makers who prefer single-origin beans for distinguishing flavors.

Further, cocoa beans are vital in emerging markets where domestic processing industries are developing, as in West Africa, namely Ghana and Côte d’Ivoire, the world’s two biggest cocoa producers. The growing global demand for premium chocolate and clean-label cosmetics is driving the growth of cocoa butter. At the same time, strict ethical sourcing and traceability initiatives remain important in the global cocoa bean industry.

Bakery & Confectionery Holding the Highest Market Share in Application

| Segment | Value Share (2025) |

|---|---|

| Bakery & Confectionery (By Application) | 55% |

By 2025, the bakery and confectionery segment will dominate the industry with an estimated 55% industry share, while the dairy and frozen desserts segment will contribute 15% to the industry. Bakery and confectionery hold a major share in the application landscape owing to the extensive use of cocoa butter, cocoa powder, and chocolate liquor in chocolates, pastries, cakes, and biscuits.

Companies like Nestlé, Ferrero, and Mondelez make extensive use of them to produce chocolate bars, truffles, and baked goods for a wide consumer industry. Some major drivers of growth are the increasing demand for premium and high-end artisanal chocolates, along with the rising trend for chocolate-embedded baked goods. Also, seasons like holiday seasons and festivals drive the seasonal spike in demand for cocoa products.

In the dairy and frozen desserts scenario, they are the key ingredients in chocolate-flavored ice creams, milkshakes, and puddings. Häagen-Dazs and Ben & Jerry’s, brands that sell indulgent, refrigerated products, incorporate cocoa powder and cocoa liquor into their recipes to improve and diversify flavor profiles.

The unaided trend towards non-dairy innovations (e.g., chocolate desserts containing almond or oat-based cocoa ingredients) is also placing constant demand on cocoa ingredients within the category. In summary, continued innovation in confectionery and dairy will keep them relevant. At the same time, upmarket and premium products that explore rich and chocolatey indulgences ensure that these two segments form a sweet spot in the industry.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

| UK | 5.1% |

| France | 5.8% |

| Germany | 6.3% |

| Italy | 5.2% |

| South Korea | 4.7% |

| Japan | 4.5% |

| China | 4.2% |

| Australia | 5.0% |

| New Zealand | 4.9% |

The USA industry is anticipated to record a CAGR of 5.5% during the period 2025 to 2035. This is driven by growing demand for premium and organic chocolate products as consumers become more quality-focused and eco-friendly. Cocoa-based functional foods and beverages are becoming popular as consumers seek perceived health benefits, and companies are therefore boosting product launches with sustainably sourced ingredients.

Big companies are investing in direct trade and sustainable cocoa cultivation to drive supply chain transparency. Direct-to-consumer sales and online sales are becoming increasingly important drivers of industry growth, with digital platforms providing greater access to specialty cocoa-based products. In addition, the rising influence of artisanal chocolatiers and specialty brands is reshaping competitive pressures with a focus on differentiated flavors and innovative ingredients.

The UK industry is forecast to expand at a CAGR of 5.1% during the forecast period, driven by high consumer demand for dark chocolate and cocoa-content commodities. The trend of vegan and plant-based diets is also the reason for the increased consumption of dairy-free cocoa derivatives, with companies taking the lead in the development of alternative milk chocolates.

The paramount concern here is sustainability, and firms put production into regimes of fair trade and ethical purchasing. The sweets business in the UK is competitive, with upscale brands capitalizing on the trend toward more and less-sugar chocolate. Shopping online and choc subscription clubs are on the increase, and they are also offering consumers greater variety for an array of cocoa items.

France will be forecast to record a CAGR of 5.8% for the industry period of 2025 to 2035 as a result of its established cultural traditions of chocolate consumption and production in an artisanal manner. Demand for premium and gourmet cocoa products is strong, supported by increasing demand for organic and single-origin chocolate. Demand for craftsmanship creates a need for bean-to-bar chocolates and limited-release product lines.

Specialty chocolate businesses are doing well in domestic and export markets, and they have a reputation for confectionery quality. In addition, the use of cocoa derivatives in high-end bakery and patisserie items is increasing, further propelling industry growth. Health-conscious consumers are also finding new applications for cocoa in well-being products, including cocoa-infused teas and functional foods.

Germany's industry is likely to grow at a CAGR of 6.3% with its well-established chocolate industry and robust consumer base that is highly passionate about premium confectionery. The industry is trending towards new-generation products like high-cocoa-content and sugar-free products, which health-conscious consumers favor. German processors are investing in advanced processing technology to improve product quality while maintaining sustainability objectives in mind.

Having such a huge export industry for cocoa products, Germany is one of the world's top traders, making the most of strategic relationships with producing countries. The direction towards individualized chocolate, where consumers are now in a position to choose ingredients and levels of cocoa, is even more à la mode, further segmenting product lines.

Italy will hold a CAGR of 5.2% in the industry, led mainly by its dense chocolate culture and premium artisanal chocolate industry. Italian customers love traditional and handmade chocolates, particularly nutted, dried-fruited, and specialty-filled chocolates.

Applications of cocoa derivatives in desserts, pastries, and gelato are a key driver of demand. There is also an emerging trend for fair-trade and organic cocoa as sustainability becomes a priority for producers and consumers alike. The experiential retail growth trend, in which customers may attend chocolate-making workshops and tastings, is also fueling industry growth.

The South Korean industry for cocoa derivatives will register growth at a CAGR of 4.7% as the demand for Western confectionery and luxury chocolate products grows. Exotic flavors entice South Korean consumers, such as cross-cultural chocolates that blend native flavorings like matcha, red bean, and yuzu with cocoa.

The impact of celebrity and K-pop culture is also driving chocolate consumption patterns. Internet and duty-free mediums are increasing penetration for imported and luxury cocoa items. Furthermore, the growing café culture in South Korea is increasing the demand for cocoa-based sweets and drinks, hence stimulating industry growth.

The Japanese industry will grow at a CAGR of 4.5% during the forecast period, driven by demand for high-quality and good-looking chocolate products. While, indeed, there is much appreciation of craftsmanship among Japanese consumers, there is significant demand for nicely crafted, well-designed, and innovative-flavored handmade chocolates.

Increased demand for health-benefit-boosted functional chocolates that contain probiotics or collagen and similar infused additions contributes a lot to sales as well. Chocolate gift sets that show up seasonally, particularly on holidays like Valentine's Day and White Day, also contribute significantly to sales. An increase in Japan's bean-to-bar chocolatiers that focus on quality and transparency also contributes considerably to industry expansion.

China's industry will expand at a 4.2% CAGR, driven by middle-class expansion and Westernization of consumer patterns. Chocolate consumption is gaining momentum, particularly in urban areas, where premium and imported chocolates are in demand.

Foreign firms are spending a lot on advertising and product localization to tap the industry. The introduction of cocoa-based beverages like chocolate tea and health drinks is also driving the industry. Consumer education is also very crucial, though, since traditional Chinese diets in the past did not involve much consumption of chocolate. Volatility and supply chain issues in the prices of cocoa can also affect the growth rate of the industry.

The Australian industry is anticipated to expand at a CAGR of 5.0% due to increasing demand for organic and ethically produced cocoa products. The increase in bean-to-bar chocolate producers in the country is following the trend of premiumization and direct trade with cocoa producers.

The increasing demand for dark types of chocolate among Australian consumers due to their perceived health benefits is fueling demand for high-cocoa-content products. Urban coffee shop culture is also fueling growth, and the artisanal cocoa-flavored foods and beverages are leading this. Online platforms are also helping introduce specialty and global cocoa products to Australian consumers.

The New Zealand industry for cocoa derivatives is projected to record a CAGR of 4.9% through the demand for organic and responsibly produced chocolates. There is strong consumer demand for domestically based artisanal brands with a focus on ethical sourcing of raw materials and high-quality ingredients. The health-conscious sector is also evolving, with enhanced demand for dark, sugar-free, and functional cocoa ingredients.

The inclusion of cocoa derivatives in gourmet food products like premium ice creams and bakery products is fueling industry development. In addition, growth in direct-to-consumer platforms and chocolate subscription boxes is making specialty cocoa brands more accessible and engaging.

The industry is expected to see an impressive growth trend mainly driven by increasing demand for chocolate and cocoa-based goods in application areas such as confectionery, bakery, and beverages. Key players in the industry include Barry Callebaut, Cargill, and Olam International, and their efforts are centered on innovation, sustainability, and product diversification to meet changing consumer preferences.

A strong emerging trend is also seen as premiumization and artisanal chocolate gain notoriety, thus attracting manufacturers to consume more high-quality cocoa derivatives while adopting sustainable sourcing practices. Moreover, increased awareness regarding the health benefits of cocoa, such as antioxidants, drives the demand for cocoa powders and extracts in health foods and supplements.

The competitive strategies include strategic partnership, acquisition, and investment in research and development, which would boost the product offering and develop supply chain efficiencies. Regulatory considerations concerning food safety and sustainability are also moving the industry because companies must comply with higher consumer expectations regarding transparency and ethical sourcing.

It all boils down to the wide-open growth prospects for the industry as brands adapt to changes in consumer needs while also tapping into new trends manifesting from the food industry's perspective.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Barry Callebaut | 22-26% |

| Cargill | 18-22% |

| Olam International | 14-18% |

| Blommer Chocolate Company | 10-14% |

| ECOM Agroindustrial Corp. | 8-12% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Barry Callebaut | The largest global cocoa processor focuses on sustainability with its "Forever Chocolate" initiative and premium chocolate solutions. |

| Cargill | Provides cocoa ingredients with a focus on traceability, sustainability, and farm-level impact through its Cocoa Promise program. |

| Olam International | Leader in bean sourcing, processing, and supply chain sustainability, promoting eco-friendly cocoa farming. |

| Blommer Chocolate Company | Major North American supplier specializing in chocolate and cocoa ingredients with a strong emphasis on sustainable sourcing. |

| ECOM Agroindustrial Corp. | Focuses on responsible cocoa trading and agricultural sustainability, working closely with farmers to improve yield and quality. |

Key Company Insights

Barry Callebaut (22-26%)

Barry Callebaut is the largest cocoa and chocolate supplier, and it operates in bean sourcing, processing, and premium chocolate production. Forever Chocolate, the firm's initiative, has set ambitions to eradicate deforestation-free cocoa production and become carbon-neutral by 2025, in a very trendy movement towards sustainable activities within the field.

Cargill (18-22%)

Cargill is highly established within the cocoa industry as a major cocoa product supplier, equipped with high-end processing facilities and viable sustainability programs. Such a cocoa program usually helps the supplied Cocoa Promises regain the farmers' incomes, helping to preserve farming land and fostering a new set of classified roads.

Olam International (14-18%)

Being the cocoa division of Olam International, Olam Cocoa stands to facilitate itself in the production of widely used cocoa-derived products, such as cocoa powder, liquor, and butter. In the long run, digital traceability tools and sustainability programs will be promoted to integrate responsible supply chain management into the cocoa value chain.

Blommer Chocolate Company (10-14%)

Blommer manufactures cocoa in North America and offers chocolate and cocoa ingredients to major manufacturers. It promotes fair-trade sourcing, farm support programs, and high-quality cocoa as its top priorities.

ECOM Agroindustrial Corp. (8-12%)

ECOM is the leading cocoa merchandising company specializing in sustainable agriculture supply chains. The company works actively with farmers in the implementation of good agricultural practices, which increase the yield and allow for different kinds of cocoa to be ethically sourced out of their yields.

Other Key Players (30-40% Combined)

By type, the industry is segmented into Cocoa Butter, Cocoa Beans, Cocoa Powder, and Others.

By category, the industry is classified into Organic and Conventional Cocoa Derivatives, catering to varied consumer preferences and industrial applications.

By application, the industry finds applications in Food and Beverages, Bakery and Confectionery, Dairy and Frozen Desserts, Beverages, Personal Care, and Others.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

The industry is slated to reach USD 25.23 billion in 2025.

The industry is predicted to reach a size of USD 72.96 billion by 2035.

Key companies include Barry Callebaut, Cargill, Olam International, Blommer Chocolate Company, ECOM Agroindustrial Corp., Touton S.A., Guan Chong Berhad, JB Foods Limited, The Hershey Company, and Nestlé S.A.

Germany, slated to grow at 6.3% CAGR during the forecast period, is poised for the fastest growth.

Cocoa butter is among the most widely used cocoa derivatives.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Category, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Category, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Category, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Category, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (MT) Forecast by Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 38: Asia Pacific Market Volume (MT) Forecast by Category, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Asia Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by Category, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Category, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Category, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Category, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Category, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Category, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Category, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Category, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Category, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Category, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Category, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Category, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Category, 2023 to 2033

Figure 95: Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Category, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 110: Asia Pacific Market Volume (MT) Analysis by Category, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Asia Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Category, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Category, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 130: MEA Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 134: MEA Market Volume (MT) Analysis by Category, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: MEA Market Attractiveness by Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Category, 2023 to 2033

Figure 143: MEA Market Attractiveness by Application, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cocoa Bean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Fiber Market Size and Share Forecast Outlook 2025 to 2035

Cocoa-Derived Peptides For Skin Repair Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Flavanol Market Analysis - Size, Share & Forecast 2025 to 2035

Cocoa Based Polyphenols Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Shell Fiber Market Analysis - Size, Share & Forecast 2025 to 2035

Cocoa Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cocoa Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cocoa Nibs Market Size, Share, and Forecast 2025-2035

Cocoa Maker Market Size, Growth, and Forecast 2025 to 2035

Cocoa Butter Market Analysis by Product Type, Nature, Form, and End Use Through 2035

Cocoa Liquor Market Analysis by Segments Through 2035

Cocoa Bean Extract Market Trends - Nature & Cocoa Type Insights

Animal Derivatives Market

Soybean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Saffron Derivatives Market Analysis by Product Type, Form, Application, Distribution Channel, and Region Through 2035

Organic Cocoa Market Growth - Applications & Industry Trends

Collagen Derivatives Market Analysis by Source, Dosage Form and Application Through 2035

Diketene Derivatives Market Growth – Trends & Forecast 2022 to 2032

Alkalized Cocoa Powder Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA