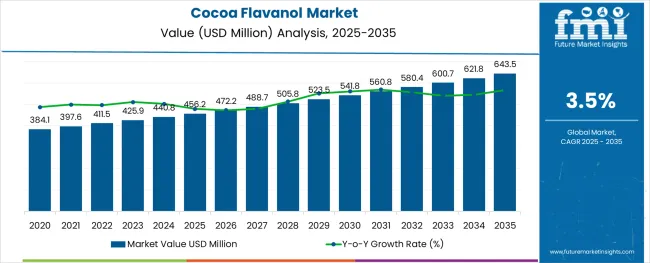

The cocoa flavanol market was estimated at USD 456.2 million in 2025 and is forecast to grow to USD 643.5 million by 2035, at a 3.5% CAGR. Powdered flavanol-rich cocoa extracts are preferred for inclusion in supplements, fortified drinks, and confections, while liquid concentrates remain niche.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 456.2 million |

| Industry Value (2035F) | USD 643.5 million |

| CAGR (2025 to 2035) | 3.5% |

It is argued that brands offering standardized flavanol profiles (>30% purity), transparent sourcing, and clear health claims will outperform generic cocoa suppliers. Inconsistent extraction quality and variable regulatory frameworks are being cited as adoption barriers unless certification standards and safety validation are strengthened. Consolidation is expected as leading ingredient firms integrate flavanol-specific capabilities to secure high-value natural antioxidant portfolios.

The cocoa flavanol market holds a niche share within its parent markets. In the cocoa and chocolate market, it accounts for approximately 3-5%, as cocoa flavanols are one of the many bioactive compounds in cocoa. Within the functional foods market, the share is around 2-3%, driven by the increasing use of cocoa flavanols in foods with added health benefits.

In the nutraceuticals market, the share is about 4-6%, as cocoa flavanols are widely used in supplements. In the health and wellness food market, its share is approximately 2-3%, reflecting growing interest in heart-healthy foods. In the natural antioxidants market, the share is around 1-2%, as cocoa flavanols contribute to the antioxidant properties of various products.

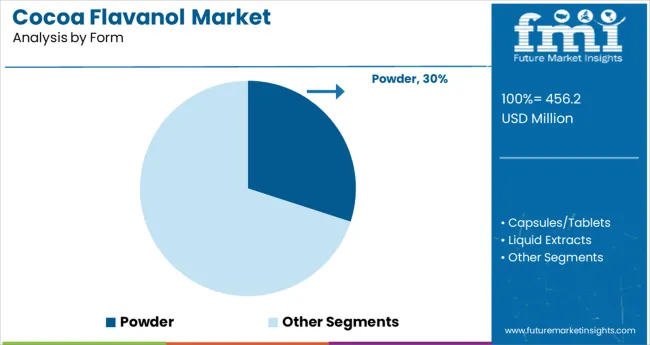

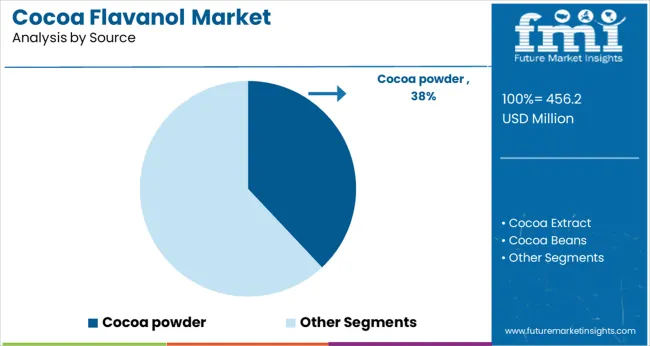

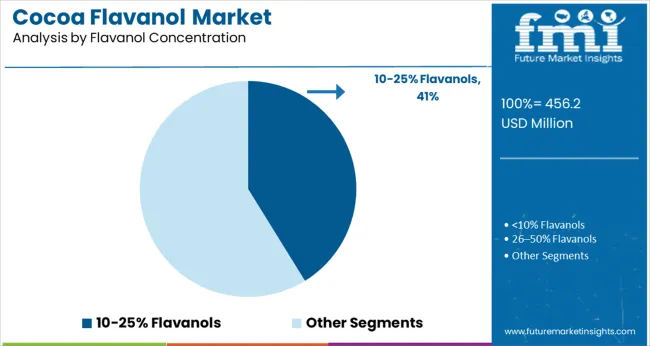

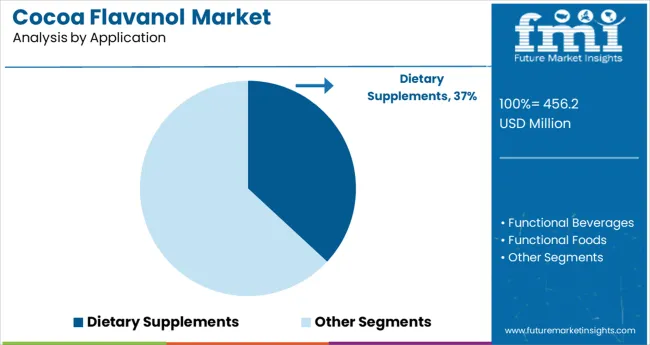

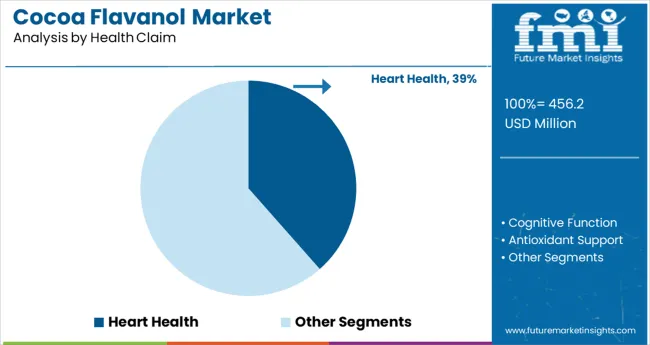

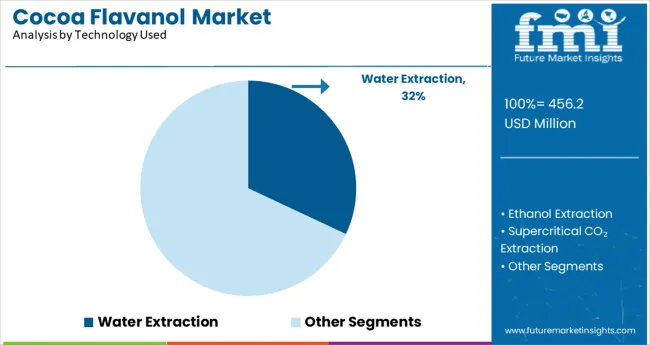

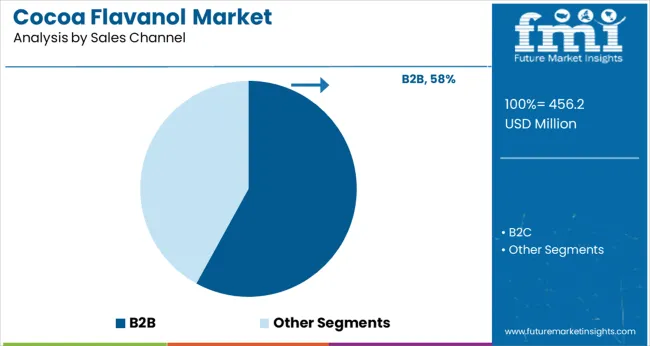

In 2025, the cocoa flavanol market will be led by powder form with 30% share, cocoa powder as the primary source at 38%, 10-25% flavanol concentration at 41%, dietary supplements at 37% in applications, heart health claims at 39%, water extraction technology at 32%, and B2B sales channels at 58%.

Powder form is expected to dominate the cocoa flavanol market in 2025, holding a 30% market share. Cocoa flavanol powder is highly versatile and widely used across various applications, including dietary supplements, beverages, and functional foods. Its easy incorporation into food and drink formulations, as well as its long shelf life, makes it a preferred form for both consumers and manufacturers.

Additionally, powdered cocoa flavanol provides a concentrated source of antioxidants, making it ideal for health-focused products. The rise in consumer interest in functional foods and beverages is further driving the demand for cocoa flavanol powder.

Cocoa powder is expected to capture 38% of the market share in 2025 as the dominant source of cocoa flavanols. Cocoa powder is rich in bioactive compounds, including flavanols, which have been shown to support cardiovascular health, cognitive function, and overall wellness.

As a widely accepted ingredient in both the food and supplement industries, cocoa powder is increasingly being incorporated into health-oriented products such as energy bars, protein powders, and functional beverages. The demand for natural and minimally processed ingredients has further solidified cocoa powder’s position as the leading source of cocoa flavanols.

Flavanol concentrations between 10-25% are projected to capture 41% of the market share in 2025. This concentration range strikes the optimal balance between health benefits and product versatility, making it ideal for various dietary and functional applications.

It is particularly popular for its cardiovascular health benefits, with several studies linking moderate flavanol intake to reduced risk factors for heart disease. Products in this concentration range are commonly used in dietary supplements and functional foods, as they offer sufficient potency while maintaining an acceptable taste and texture profile.

Dietary supplements are expected to dominate the application segment with 37% of the market share in 2025. Cocoa flavanols, particularly in powder and capsule form, are increasingly being used to support heart health, cognitive function, and overall wellness.

The growing trend towards preventative healthcare and the increasing demand for plant-based, clean-label supplements will continue to drive the popularity of cocoa flavanols in this segment. As awareness of flavanol’s health benefits continues to rise, more consumers will seek out dietary supplements fortified with cocoa flavanols as part of their daily health regimen.

Heart health claims are expected to capture 39% of the health claim segment in 2025, making it the dominant focus of cocoa flavanol products. The flavanols found in cocoa have been extensively studied for their positive effects on heart health, including improving blood flow, reducing blood pressure, and supporting overall cardiovascular function.

As consumers become more aware of the importance of heart health and the benefits of cocoa flavanols, products with heart health claims will continue to drive the market. This trend will be further supported by clinical research and regulatory approval of cocoa-based health claims.

Water extraction is projected to hold 32% of the market share in 2025, making it the leading technology in cocoa flavanol extraction. This method is preferred for its ability to extract high-quality flavanols while maintaining the natural composition and health benefits of cocoa.

Water extraction is a clean, environmentally friendly process that does not require harsh chemicals, aligning with consumer demand for natural and sustainable products. This technology is particularly favored in the production of functional foods and dietary supplements, where purity and ingredient transparency are highly valued.

B2B sales channels are expected to dominate with 58% of the market share in 2025. As cocoa flavanols are widely used in industrial applications such as food and beverage manufacturing, dietary supplements, and pharmaceutical products, the B2B model is essential for distributing large quantities to manufacturers, ingredient suppliers, and health product companies.

B2B channels ensure a steady supply of cocoa flavanols to meet the growing demand for functional ingredients in consumer products. As the market expands, B2B sales channels will continue to drive growth and facilitate the integration of cocoa flavanols into diverse product lines.

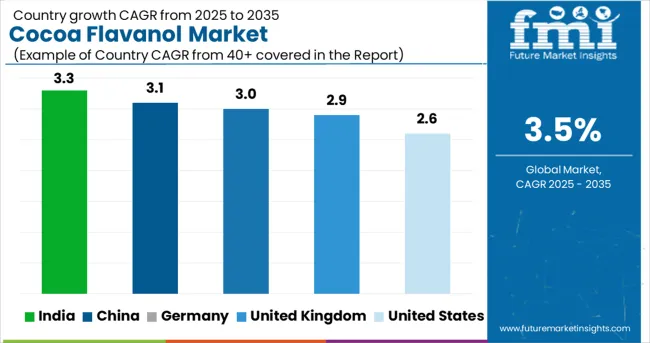

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 2.6% |

| United Kingdom | 2.9% |

| China | 3.1% |

| India | 3.3% |

| Germany | 3% |

Global cocoa flavanol market demand is projected to rise at a 3.5% value-based CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, India leads at 3.3%, followed by China at 3.1%, and the United Kingdom at 2.9%, while the United States posts 2.6%, and Germany records -3%.

These rates translate to a growth premium of -5% for India, -11% for China, and -24% for Germany versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: growing demand for health-focused food products in India and China, along with stable but slower growth in the more mature markets of the United States, Germany, and the United Kingdom, driven by established cocoa consumption habits.

Cocoa flavanol sales in the United States are projected to grow at a 2.6% CAGR from 2025 to 2035. The market is expanding through cardiovascular health positioning across functional chocolates and supplement categories. Medical professionals increasingly recommend flavanol capsules as complementary support for circulatory function.

Brands are focusing on low-processed, unsweetened cocoa products with quantified flavanol content to meet wellness claims. Supermarkets and pharmacies are expanding shelf space for flavanol-enhanced products aimed at aging consumers. The inclusion of cocoa flavanols in preventive health bundles and subscription models reflects rising acceptance of these compounds as everyday dietary components.

In the United Kingdom, cocoa flavanol market growth is expected at a 2.9% CAGR through 2035. British consumers are adopting polyphenol-rich diets, leading to a rise in flavanol-centric product launches within confectionery and nutraceutical spaces. Health-focused retailers are promoting low-sugar cocoa powders labeled with precise flavanol levels.

Elderly consumers and wellness-conscious millennials are driving demand for cardiovascular and cognitive health-supportive products. Chocolatiers are adjusting production methods to retain natural flavanol concentrations, offering an edge in premium-positioned items. Distribution via pharmacy chains and online wellness stores is increasing across major cities.

China’s cocoa flavanol market is forecasted to expand at a CAGR of 3.1% from 2025 to 2035. Urban consumers, especially young professionals, are seeking nutritional benefits in low-sugar dark chocolates and functional beverages. Multinational firms are launching beauty and metabolic health supplements fortified with standardized flavanol extracts.

Flavanol-enhanced snack bars and instant cocoa mixes are being promoted as performance boosters. Cross-border e-commerce imports remain key to premium flavanol product availability, while local firms are partnering with research institutions to validate claims. China’s regulatory structure is increasingly favorable for functional food claims linked to flavanol bioactivity.

India’s cocoa flavanol market is estimated to grow at a CAGR of 3.3% between 2025 and 2035. Urban nutrition brands are incorporating flavanols into wellness beverages and immunity powders. Cocoa flavanol products targeting heart health and blood pressure support are being promoted through direct-to-consumer platforms.

Ayurveda-based companies are integrating cocoa flavanols with traditional botanicals in ready-mix sachets and daily-use capsules. Growing consumer interest in clean-label and scientifically validated ingredients is supporting broader adoption. Demand is highest in Tier 1 and Tier 2 cities, where preventive health behavior is most active.

Germany’s cocoa flavanol market is forecasted to grow at a CAGR of 3% during 2025-2035. German consumers prioritize clinical validation, driving interest in flavanol supplements marketed with EFSA-compliant claims. Pharmacies are stocking single-origin cocoa powders with lab-certified flavanol concentrations.

Regional health insurers and senior wellness programs include flavanol products in prevention-focused initiatives. Local manufacturers are refining low-temperature processing to ensure flavanol preservation in chocolate formats. Sales of cognitive and vascular health-focused nutraceuticals containing cocoa flavanols continue to rise in wellness channels across Bavaria, Baden-Württemberg, and North Rhine-Westphalia.

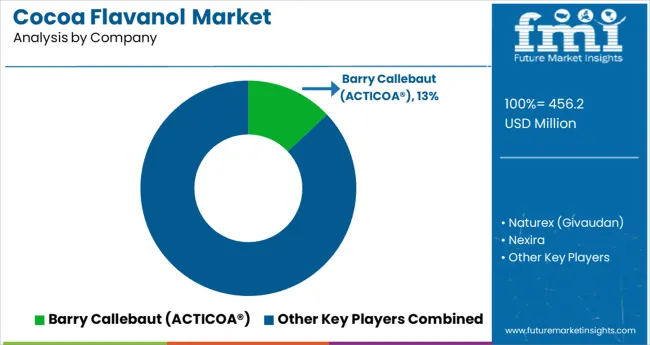

In the cocoa flavanol market, product positioning has revolved around concentration levels, certification strength, and ingredient flexibility. Barry Callebaut is leading by supplying ACTICOA® flavanol-rich cocoa powder to global pharmaceutical and consumer beverage manufacturers, supported by vertically integrated sourcing from West African farms and press-ready processing streams.

Givaudan’sNaturex unit and Nexira have targeted functional beverage and supplement sectors through modular powder systems and private-label blending for European formulators. Indena has delivered clinical-grade extracts for nutraceutical applications in North America. Mars’ CocoaVia® brand has capitalized on consumer-brand pull in USA retail channels, leveraging DTC subscriptions and FDA-approved structure/function claims, while navigating EU novel-food registration and flavanol content labeling.

Recent Industry News

| Attribute Category | Details |

|---|---|

| Industry Size (2025E) | USD 456.2 million |

| Projected Industry Value (2035F) | USD 643.5 million |

| Value-based CAGR (2025-2035) | 3.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD million / Volume in metric tons |

| By Form | Powder, Capsules/Tablets, Liquid Extracts, RTD Drinks, Chocolates/Bars |

| By Source | Cocoa Powder, Cocoa Extract, Cocoa Beans |

| By Flavanol Concentration | <10% Flavanols, 10-25% Flavanols, 26-50% Flavanols, > 50% Flavanols |

| By Application | Dietary Supplements, Functional Beverages, Functional Foods, Pharmaceuticals, Cosmetics & Personal Care |

| By Health Claim | Heart Health, Cognitive Function, Antioxidant Support, Skin Health, Blood Pressure Management |

| By Technology Used | Water Extraction, Ethanol Extraction, Supercritical CO₂ Extraction, Membrane Filtration |

| By Sales Channel | B2B (Ingredient Supply), B2C (Retail Supplements & Products) - Online Retail, Specialty Stores, Pharmacies, Supermarkets |

| By Region | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, Italy, Netherlands, Spain, India, China, Japan, South Korea, Indonesia, Australia, Saudi Arabia, South Africa, United Arab Emirates |

| Key Players | Barry Callebaut (ACTICOA®), Naturex (Givaudan), Nexira, Indena S.p.A., Mars Inc. (CocoaVia ®) |

| Additional Attributes | Dollar by sales, share by form and flavanol content, innovation in flavanol extraction, cross-industry health claims validation, consumer acceptance in cardiovascular wellness, and increased usage in clinical-grade formulations |

Form segmentation includes powder, capsules/tablets, liquid extracts, RTD drinks, and chocolates/bars.

Sources include cocoa powder, cocoa extract, and cocoa beans.

Concentration levels are segmented into <10% flavanols, 10-25% flavanols, 26-50% flavanols, and >50% flavanols.

Applications cover dietary supplements, functional beverages, functional foods, pharmaceuticals, and cosmetics & personal care.

Health claims include heart health, cognitive function, antioxidant support, skin health, and blood pressure management.

Extraction technologies include water extraction, ethanol extraction, supercritical CO₂ extraction, and membrane filtration.

Sales channels are segmented into B2B (ingredient supply) and B2C (retail supplements & products), which includes online retail, specialty stores, pharmacies, and supermarkets.

Regional analysis includes North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, and the Middle East & Africa.

The industry is estimated to be USD 456.2 million in 2025.

The industry is projected to reach USD 643.5 million by 2035, with a CAGR of 3.5% from 2025 to 2035.

The source segment, specifically cocoa powder, holds the largest share at 38% in 2025.

India has the highest projected CAGR at 3.3% from 2025 to 2035.

The leading player in the industry is Barry Callebaut (ACTICOA®), with a 13% industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cocoa Fiber Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Bean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Cocoa-Derived Peptides For Skin Repair Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Based Polyphenols Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Shell Fiber Market Analysis - Size, Share & Forecast 2025 to 2035

Cocoa Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cocoa Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cocoa Nibs Market Size, Share, and Forecast 2025-2035

Cocoa Maker Market Size, Growth, and Forecast 2025 to 2035

Cocoa Derivatives Market Analysis by Type, Category, Application and Region through 2035

Cocoa Butter Market Analysis by Product Type, Nature, Form, and End Use Through 2035

Cocoa Liquor Market Analysis by Segments Through 2035

Cocoa Bean Extract Market Trends - Nature & Cocoa Type Insights

Organic Cocoa Market Growth - Applications & Industry Trends

Alkalized Cocoa Powder Market Size and Share Forecast Outlook 2025 to 2035

Ethylhexyl Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Injectable Cocoa Fillings Market

Cosmetic Sucrose Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA