The cocoa nibs market is projected to grow from USD 1.13 billion in 2025 to USD 1.64 billion by 2035, reflecting a CAGR of 3.8% during the forecast period. The United States is expected to remain the most lucrative country for cocoa nibs, driven by a strong presence of premium confectionery and health food brands.

Meanwhile, Japan is anticipated to register the fastest growth between 2025 and 2035, owing to increasing demand for functional snacks and antioxidant-rich foods in the country’s aging population.

Growth in the cocoa nibs market is being fueled by rising consumer awareness regarding the health benefits of flavonoids, antioxidants, and magnesium content in cocoa nibs. Organic variants are particularly gaining popularity, as clean-label preferences rise across both commercial and household segments.

The market is further supported by increasing adoption across the food and beverage industry, with applications expanding into protein bars, artisanal chocolate, craft beverages, and even cosmetic formulations. However, fluctuating cocoa bean prices, ethical sourcing concerns, and limited consumer familiarity in emerging economies remain key restraints.

Players are focusing on product innovation, such as flavored nibs, new roasting profiles, and customized packaging, to attract health-conscious and gourmet consumers alike.

Between 2025 and 2035, the market is expected to gradually shift toward premium and specialty cocoa nibs, especially in urban retail and e-commerce channels. Growth will also be driven by the integration of nibs into clean-label packaged foods, rising demand from online natural food stores, and broader adoption in the cosmetics and personal care industry.

Innovations in packaging types, including retail-ready and custom packs, and improvements in traceability and supply chain transparency will be critical to market competitiveness through 2035.

| Attributes | Description |

|---|---|

| Estimated Size (2025E) | USD 1.13 billion |

| Projected Value (2035F) | USD 1.64 billion |

| Value-based CAGR (2025 - 2035) | 3.80% |

The cocoa nibs market is segmented across multiple dimensions including product type (conventional, organic), application (commercial, household), industry application (food industry, beverage industry, cosmetics), end use (retail, food services, online sales), type (raw, roasted, flavored), and packaging type (bulk, retail, custom).

Among these, organic nibs, food industry applications, and online retail channels are attracting the most investment due to evolving consumer preferences, digital shelf expansion, and the increasing demand for healthy, natural snacks. Meanwhile, roasted nibs and retail-ready packaging formats are emerging as strategic growth enablers.

Under the product category, cocoa nibs are classified into conventional and organic types. Organic cocoa nibs are expected to witness the fastest growth during 2025-2035, driven by heightened awareness around pesticide-free and sustainable farming practices.

While conventional nibs continue to dominate in bulk ingredient applications and institutional buying, their growth is likely to remain subdued due to rising clean-label scrutiny. Demand for certified organic cocoa nibs is especially strong in developed markets, where premiumization and transparency influence purchasing decisions.

| Product Type | CAGR (2025 to 2035) |

|---|---|

| Organic Cocoa Nibs | 4.70% |

The cocoa nibs market, by application, is segmented into commercial and household use. In 2025, the commercial segment dominates overall revenue, fueled by usage in chocolate production, artisanal bakeries, functional food manufacturing, and specialty cafes.

These establishments often purchase cocoa nibs in bulk packaging and use them as a premium ingredient in beverages, baked goods, granola, and desserts.

However, the household segment is projected to grow steadily over the forecast period as consumers increasingly incorporate superfoods into their diets.

Online platforms and health-focused grocery stores have enhanced accessibility to smaller retail packs of cocoa nibs, making it easier for at-home consumers to experiment with healthy snacking and home baking. Growth in this segment is also being supported by nutrition influencers and recipe-based marketing efforts.

| Application | CAGR (2025 to 2035) |

|---|---|

| Household | 4.20% |

Based on industry application, the cocoa nibs market is divided into the food industry, beverage industry, and cosmetics industry. The food industry accounts for the highest share and is expected to maintain its dominance throughout the forecast period.

Cocoa nibs are increasingly used in energy bars, granola, cereals, trail mixes, baked goods, and desserts, especially within health-conscious and functional food categories. Their nutrient density and intense flavor make them a favored substitute for chocolate chips or sweetened cocoa in many recipes.

The beverage industry is witnessing steady adoption of cocoa nibs in craft brewing (notably chocolate stouts and porters), smoothies, and dairy-free cacao drinks. While its share remains smaller, this segment is expected to grow consistently as clean-label and botanical beverages continue gaining popularity.

The cosmetics segment is also a notable emerging opportunity, with cocoa nib extracts and powder used in scrubs, masks, and antioxidant creams. However, this remains a niche application, restrained by limited awareness and higher formulation costs.

| Industry Application | CAGR (2025 to 2035) |

|---|---|

| Food Industry | 4.50% |

In terms of end use, the cocoa nibs market is segmented into retail, food services, and online sales. As of 2025, retail, including supermarkets, health food stores, and specialty outlets, accounts for the largest revenue share, owing to wide in-store availability and growing shelf space for superfoods and natural products.

However, online sales are set to experience the fastest CAGR from 2025 to 2035. E-commerce platforms have expanded the global reach of niche cocoa nib brands and enabled direct-to-consumer subscription models. Consumers increasingly prefer the convenience of purchasing organic and flavored cocoa nibs online, supported by filterable product reviews, nutritional labeling, and access to specialty variants not stocked in traditional retail.

The food services segment, which includes restaurants, cafes, bakeries, and institutional buyers, will continue to be a stable contributor, especially for bulk packs used in recipe formulation and dessert customization.

| End Use | CAGR (2025 to 2035) |

|---|---|

| Online Sales | 5.10% |

The cocoa nibs market by type includes raw cocoa nibs, roasted cocoa nibs, and flavored cocoa nibs. Raw cocoa nibs currently hold the dominant share in 2025, primarily due to their perceived nutritional superiority and unprocessed appeal among health-focused buyers. They are widely used in DIY recipes, smoothies, and nutrition-forward meal plans.

Roasted cocoa nibs, however, are expanding their footprint in both retail and commercial applications due to their more intense flavor, better shelf life, and compatibility with confectionery products. They are particularly popular among premium chocolate manufacturers and bakers seeking a deeper cocoa profile.

The fastest-growing sub-segment is flavored cocoa nibs. These include variants infused with vanilla, cinnamon, coffee, or even chili, and are designed for direct consumption or upscale snacking. With increasing demand for indulgent yet healthy options, flavored nibs are resonating with urban millennials and Gen Z consumers. This segment is expected to benefit the most from innovation and product launches during the forecast period.

| Type | CAGR (2025 to 2035) |

|---|---|

| Flavored Cocoa Nibs | 5.30% |

The cocoa nibs market, by packaging type, is segmented into bulk packaging, retail packaging, and custom packaging. As of 2025, bulk packaging holds the largest share, primarily catering to commercial users such as bakeries, beverage producers, and foodservice operations that procure large volumes for daily use.

Retail packaging follows closely, especially for household consumption. This includes pouches, jars, and resealable packs typically available in supermarkets and health food stores. As demand for superfoods grows among end consumers, retail packaging continues to expand in both conventional and organic variants.

The custom packaging segment is expected to witness the fastest growth between 2025 and 2035. It is being driven by niche brands offering limited-edition flavors, personalized labels, and eco-friendly materials tailored for D2C and online channels. Custom packaging also serves as a brand differentiator in an increasingly competitive shelf environment, with consumers valuing not just the product but the sustainability and aesthetic of the packaging.

| Packaging Type | CAGR (2025 to 2035) |

|---|---|

| Custom Packaging | 5.60% |

The cocoa nibs market is being driven by rising global awareness around the health benefits of cocoa-derived products, particularly their antioxidant, anti-inflammatory, and cardiovascular properties. Consumers are increasingly shifting away from processed chocolate towards less refined alternatives like cocoa nibs, which retain their nutritional profile.

The booming functional foods industry, especially in North America, Europe, and East Asia, is supporting this trend. Simultaneously, the growth of vegan, keto, and clean-label diets has positioned cocoa nibs as a favored inclusion in energy bars, baking mixes, granola, and trail snacks. Expansion in e-commerce and online D2C platforms has further enabled access to niche brands and flavored variants, propelling retail and household adoption.

Despite positive growth drivers, the cocoa nibs market faces several restraints. Fluctuating cocoa bean prices, driven by climate volatility and supply chain disruptions in cocoa-producing regions (notably West Africa), remain a significant challenge for manufacturers.

Additionally, cocoa nibs remain a niche product in many emerging economies due to limited consumer awareness and relatively high pricing compared to conventional chocolate products. Stringent certification standards for organic and fair-trade labeling can also increase time-to-market and compliance costs, particularly for smaller players. Lastly, inconsistent taste perception-owing to their bitter profile-limits mass-market penetration.

A few key trends are reshaping the cocoa nibs market landscape. First, there is a rising interest in flavored and infused cocoa nibs (e.g., vanilla, chili, and espresso) designed for snacking. Second, sustainable sourcing and ethical cocoa trade are becoming essential purchase drivers, prompting brands to invest in transparent supply chains.

Third, cross-industry usage is expanding - cocoa nibs are now being formulated into cosmetic products for their exfoliating and antioxidant properties. Packaging innovation, particularly in compostable and resealable formats, is also gaining traction as sustainability becomes a brand imperative.

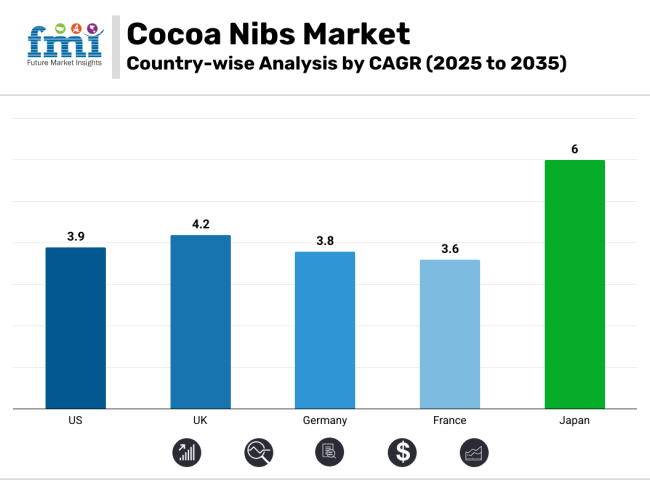

The United States remains the most lucrative market for cocoa nibs, driven by widespread adoption in the natural food, vegan, and organic product categories. From 2025 to 2035, the market is projected to grow steadily, supported by strong consumer interest in superfoods, rising home baking trends, and the presence of major organic food retailers.

Product visibility across both brick-and-mortar and online platforms has further boosted household penetration. The rise in specialty chocolate manufacturing and craft food innovation is reinforcing demand in the commercial segment. The CAGR for the US cocoa nibs market is estimated at 3.9% over the forecast period.

In the United Kingdom, cocoa nibs are gaining popularity as part of clean-label and gut-friendly diets. While awareness was once limited to niche health food enthusiasts, mainstream supermarkets and high-end grocery chains have increasingly introduced organic and flavored cocoa nibs to meet consumer demand.

Growth is also influenced by the expansion of plant-based diets and low-sugar confectionery categories. The UK cocoa nibs market is expected to grow at a 4.2% CAGR between 2025 and 2035.

Germany’s cocoa nibs market benefits from the country’s strong tradition in chocolate and bakery products, combined with an expanding organic food sector.

The adoption of cocoa nibs in functional food innovation and high-protein snacks is supporting both commercial and retail growth. Online sales are especially important in Germany’s evolving health food landscape. The market is expected to expand at a 3.8% CAGR from 2025 to 2035.

France is witnessing steady growth in cocoa nibs consumption due to increasing demand for gourmet ingredients and clean-label baking products. The integration of cocoa nibs into luxury patisserie items and upscale home cooking trends is a key factor.

Retailers and online brands alike are targeting the premium snacking market. The cocoa nibs market in France is projected to grow at a 3.6% CAGR over the forecast period.

Japan is expected to register the fastest growth in the cocoa nibs market between 2025 and 2035. This is driven by a growing consumer base focused on longevity, clean nutrition, and anti-aging benefits.

Cocoa nibs are positioned as a premium health food in Japan’s expanding natural products space, and are being incorporated into snacks, teas, and beauty-focused food formats. Digital channels and boutique stores are the primary distribution hubs. Japan’s cocoa nibs market is forecast to grow at a 6.0% CAGR through 2035.

In this report, Tier 1 companies are defined as globally recognized firms with large-scale production capabilities and established international distribution networks. Tier 2 players are mid-sized companies with regional strength and moderate product diversification. Tier 3 companies include emerging brands, niche players, and startups operating in specific segments or geographies.

The cocoa nibs market is moderately fragmented, with a mix of multinational ingredient suppliers, artisanal food brands, and direct-to-consumer companies. While a few Tier 1 companies have access to upstream cocoa sourcing and manufacturing infrastructure, most of the market growth, especially in flavored and organic variants, is being driven by agile Tier 2 and Tier 3 players focused on innovation and niche positioning.

Tier 2 and Tier 3 players have played a significant role in shaping product trends, particularly in regions such as North America, Europe, and Japan. While Tier 1 firms like Barry Callebaut offer cocoa nibs as part of broader cocoa ingredient portfolios, their focus remains primarily B2B.

In contrast, brands such as Navitas Organics and Sunfood Superfoods (Tier 2) have built strong consumer-facing propositions centered around clean-label, organic, and antioxidant-rich superfoods. This segmentation allows them to command premium pricing and establish loyal followings via both retail and e-commerce platforms.

Key strategies adopted by market players include:

| Attribute | Description |

|---|---|

| Base Year | 2024 |

| Historical Data | 2020 - 2024 |

| Forecast Period | 2025 - 2035 |

| Market Size in 2025 | USD 1.13 billion |

| Market Size in 2035 | USD 1.64 billion |

| CAGR (2025 - 2035) | 3.80% |

| Unit of Measurement | Revenue in USD Billion |

| Report Coverage | Market size, CAGR, segment analysis, country-level trends, dynamics, competition |

| Segments Covered | Product, Application, Industry Application, End Use, Type, Packaging Type |

| Product Segments | Conventional, Organic |

| Application Segments | Commercial, Household |

| Industry Application | Food Industry, Beverage Industry, Cosmetics |

| End Use | Retail, Food Services, Online Sales |

| Types | Raw Cocoa Nibs, Roasted Cocoa Nibs, Flavored Cocoa Nibs |

| Packaging Types | Bulk Packaging, Retail Packaging, Custom Packaging |

| Geographies Covered | Global, with regional and country-level analysis |

| Top Countries Analyzed | United States, United Kingdom, Germany, France, Japan, Canada, South Korea, Italy, Spain, Netherlands |

| Regions Covered | North America, Western Europe, East Asia, Rest of the World |

| Key Companies Profiled | Navitas Organics, Sunfood Superfoods, Barry Callebaut, The Raw Chocolate Company |

| Data Sources | Company Reports, Trade Databases, Import/Export Data, Government Publications, Retail Surveys |

The cocoa nibs market is growing due to rising demand for clean-label, antioxidant-rich superfoods. Increased consumer awareness of health benefits, along with expanding use in snacks, baking, and beverages, is boosting adoption globally.

Organic cocoa nibs are the most in demand, driven by consumer preference for pesticide-free, ethically sourced, and minimally processed ingredients across food and beverage applications.

Online sales channels are the fastest-growing, supported by direct-to-consumer brands, subscription models, and increased availability on e-commerce platforms such as Amazon and health-focused online stores.

Key players include Navitas Organics, Sunfood Superfoods, Barry Callebaut, and The Raw Chocolate Company, all of which are expanding their product offerings and online reach.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cocoa Fiber Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Bean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Cocoa-Derived Peptides For Skin Repair Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Flavanol Market Analysis - Size, Share & Forecast 2025 to 2035

Cocoa Based Polyphenols Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Shell Fiber Market Analysis - Size, Share & Forecast 2025 to 2035

Cocoa Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cocoa Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cocoa Maker Market Size, Growth, and Forecast 2025 to 2035

Cocoa Derivatives Market Analysis by Type, Category, Application and Region through 2035

Cocoa Butter Market Analysis by Product Type, Nature, Form, and End Use Through 2035

Cocoa Liquor Market Analysis by Segments Through 2035

Cocoa Bean Extract Market Trends - Nature & Cocoa Type Insights

Organic Cocoa Market Growth - Applications & Industry Trends

Alkalized Cocoa Powder Market Size and Share Forecast Outlook 2025 to 2035

Ethylhexyl Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Injectable Cocoa Fillings Market

Cosmetic Sucrose Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA