The Alkalized Cocoa Powder Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

| Metric | Value |

|---|---|

| Alkalized Cocoa Powder Market Estimated Value in (2025 E) | USD 1.2 billion |

| Alkalized Cocoa Powder Market Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The Alkalized Cocoa Powder market is experiencing steady growth due to the increasing demand for high-quality cocoa products across the global food and beverage industry. The market is being driven by rising consumer preference for premium chocolate, confectionery, and bakery products, where flavor, color, and solubility are critical factors. Alkalization improves the taste profile and color consistency of cocoa powder, making it a preferred choice for manufacturers seeking standardized formulations.

Investments in modern processing technologies and growing awareness about product quality and food safety are further enabling market expansion. The market outlook is positive, with opportunities for innovation in flavor enrichment, sustainable sourcing, and functional cocoa blends. Rising disposable incomes, increasing urbanization, and the growth of the ready-to-drink beverage segment are supporting increased consumption.

Additionally, the expansion of industrial-scale production facilities and the adoption of automated quality monitoring systems are enhancing efficiency and output As demand for diversified chocolate-based and cocoa-infused products continues to grow globally, the market for alkalized cocoa powder is expected to maintain a robust growth trajectory.

The alkalized cocoa powder market is segmented by nature, type, end use, distribution channel, packaging, and geographic regions. By nature, alkalized cocoa powder market is divided into Conventional and Organic. In terms of type, alkalized cocoa powder market is classified into Medium Brown, Light Brown, Dark Brown, Very Dark Brown, Reddish Brown, and Black/Purple. Based on end use, alkalized cocoa powder market is segmented into Food, Bakery And Confectionery, Dressings And Sauces, Desserts And Ice-Creams, Dairy, Cereals, Instant Food Mixes, HoReCa/Foodservice/Household/Retail, Beverages, Alcoholic, Non-Alcoholic, Dietary Supplements, and Personal Care And Cosmetics. By distribution channel, alkalized cocoa powder market is segmented into Direct/B2B, Indirect/B2C, Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, and e-Retail. By packaging, alkalized cocoa powder market is segmented into Retail, Paper Bags, Pouches, Jars, and Bulk. Regionally, the alkalized cocoa powder industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

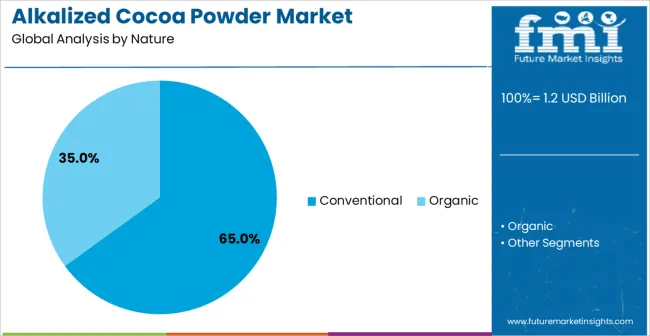

The Conventional nature segment is projected to hold 65.00% of the Alkalized Cocoa Powder market revenue share in 2025, establishing it as the leading type in terms of production and consumption. This dominance is being driven by widespread adoption in mainstream food and beverage applications where traditional cocoa flavor profiles are preferred. Conventional cocoa powder is valued for its consistent taste and compatibility with diverse formulations, including bakery mixes, beverages, and confections.

Growth has been supported by established supply chains, reliable quality standards, and proven processing techniques that ensure product uniformity. Manufacturers benefit from the predictability of flavor and functional performance, allowing large-scale production without compromising quality. Additionally, conventional cocoa powder has been integrated extensively into ready-to-drink mixes, chocolate products, and culinary applications, creating consistent demand from both industrial and commercial buyers.

The preference for conventional cocoa, reinforced by long-standing consumer familiarity and ease of formulation, has solidified its leadership position As global production scales and product standardization becomes increasingly important, conventional cocoa powder is expected to maintain its market share.

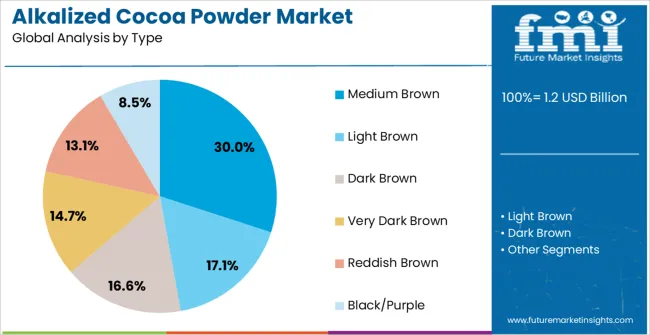

The Medium Brown type segment is expected to account for 30.00% of the Alkalized Cocoa Powder market revenue in 2025, making it a significant contributor to overall demand. The growth of this segment is being driven by its desirable color, which enhances the visual appeal of bakery and confectionery products, while maintaining an acceptable flavor profile. Medium Brown cocoa powder provides manufacturers with flexibility in achieving consistent appearance in chocolate-based products without overpowering bitterness.

Its moderate alkalization level allows for easy blending with other ingredients, which has facilitated adoption in processed foods, beverage mixes, and culinary applications. Increased focus on product aesthetics and standardization in consumer-preferred chocolate and dessert products has accelerated its acceptance.

Furthermore, manufacturers value the segment for its balance between cost-effectiveness and functional performance, supporting production at scale while meeting consumer expectations The ability to maintain consistent color and flavor characteristics across batches has reinforced the prominence of Medium Brown cocoa powder, and this trend is anticipated to continue as product quality standards evolve.

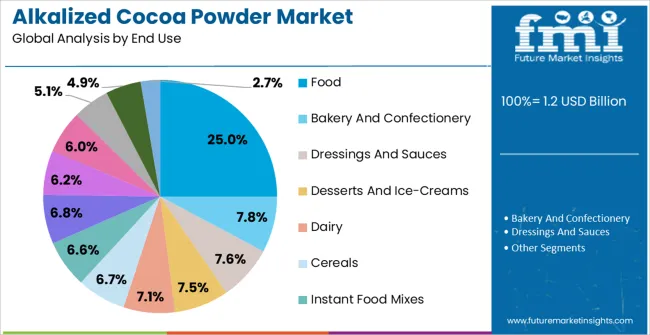

The Food end-use segment is projected to hold 25.00% of the Alkalized Cocoa Powder market revenue in 2025, representing the largest application area for the product. This dominance is being driven by the extensive utilization of alkalized cocoa powder in bakery, confectionery, chocolate, and beverage products, where quality, flavor, and appearance are critical. Alkalization enhances color consistency and solubility, making it ideal for industrial food production and commercial culinary applications.

Growth is also supported by increasing consumer demand for premium and ready-to-eat cocoa-based products in both developed and emerging markets. Manufacturers benefit from the functional versatility of alkalized cocoa powder, which allows consistent product performance across diverse recipes and processes. Additionally, the rise in commercial-scale bakeries, confectionery producers, and chocolate manufacturers has strengthened demand in the food segment.

The preference for cocoa powders that deliver standardized taste and appearance has made the food segment a leading driver of market revenue As the trend for premium and diversified cocoa-infused products continues, the Food end-use segment is expected to sustain its market-leading position.

This suggests a 1.82x growth between 2025 and 2035, driven by the rising demand for improved taste, color, and solubility in cocoa-based applications. The alkalized cocoa powder market is expected to benefit from innovations in processing techniques and product customization aligned with evolving food industry standards.

By 2035, the alkalized cocoa powder market is likely to reach approximately USD 1.38 billion, adding USD 0.38 billion in incremental value during. The remaining USD 0.62 billion is expected to be contributed between 2035 and 2035, indicating a moderately back-loaded expansion pattern. Growth momentum is likely to be reinforced by application diversification and regional penetration.

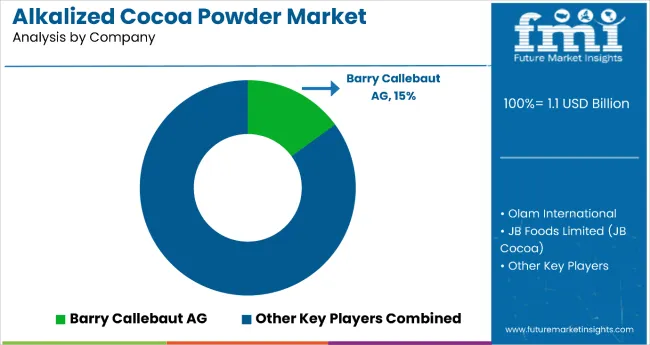

Investments are being made by major players in the alkalized cocoa powder market to enhance competitive strength through optimized alkalization processes, improved product consistency, and ethical sourcing practices. Production capacity is being expanded in key geographies, while R&D initiatives are aligned with consumer preferences for low-fat and low-acid cocoa ingredients. Industry presence is being reinforced through strategic collaborations and product portfolio diversification.

The alkalized cocoa powder market operates under two main parent markets: the cocoa powder market and the global confectionery ingredients market. It is estimated that the alkalized cocoa powder market accounts for nearly 32% of the worldwide cocoa powder market, as both alkalized and natural variants contribute to broader applications.

Within the confectionery ingredients segment, the alkalized cocoa powder market contributes about 12%, largely due to its usage in baking, chocolate fillings, frostings, and instant mixes. These percentages emphasize its strategic relevance across ingredient ecosystems and value chains that span industrial baking, foodservice, and packaged food processing.

The alkalized cocoa powder market is being shaped by rising demand for premium chocolate alternatives, functional beverages, and improved sensory profiles in baking. Innovations in low-fat, high-flavor variants are being introduced to meet clean-label and health-conscious consumer expectations.

Processing enhancements are being implemented to reduce environmental impact. Alkalized cocoa’s expanding use in cosmetics and plant-based protein shakes is also being explored. This multi-industry alignment is supporting the long-term prospects of the alkalized cocoa powder market across global food and personal care domains.

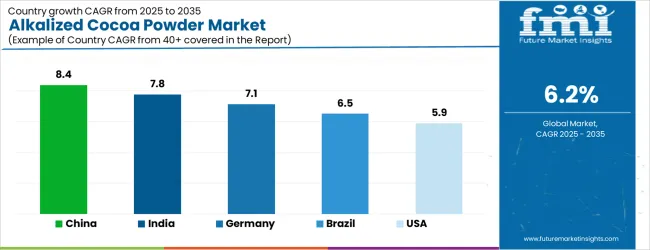

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| Brazil | 6.5% |

| USA | 5.9% |

| UK | 5.3% |

| Japan | 4.7% |

The Alkalized Cocoa Powder Market is expected to register a CAGR of 6.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.4%, followed by India at 7.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.7%, yet still underscores a broadly positive trajectory for the global Alkalized Cocoa Powder Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.1%. The USA Alkalized Cocoa Powder Market is estimated to be valued at USD 413.3 million in 2025 and is anticipated to reach a valuation of USD 413.3 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 60.3 million and USD 30.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Nature | Conventional and Organic |

| Type | Medium Brown, Light Brown, Dark Brown, Very Dark Brown, Reddish Brown, and Black/Purple |

| End Use | Food, Bakery And Confectionery, Dressings And Sauces, Desserts And Ice-Creams, Dairy, Cereals, Instant Food Mixes, HoReCa/Foodservice/Household/Retail, Beverages, Alcoholic, Non-Alcoholic, Dietary Supplements, and Personal Care And Cosmetics |

| Distribution Channel | Direct/B2B, Indirect/B2C, Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, and e-Retail |

| Packaging | Retail, Paper Bags, Pouches, Jars, and Bulk |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Barry Callebaut AG (Bensdorp), Moner Cocoa S.A., CCBOL Group S.R.L., GCB Cocoa Singapore (Carlyle Cocoa Company), Ephoka Europe S.L., Faravari Danehaye Roghani Cocoa Tabriz Co., JB Foods Limited (JB Cocoa Sdn. Bhd.), Indcre SA, Ciranda Inc., and Olam International |

The global alkalized cocoa powder market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the alkalized cocoa powder market is projected to reach USD 2.1 billion by 2035.

The alkalized cocoa powder market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in alkalized cocoa powder market are conventional and organic.

In terms of type, medium brown segment to command 30.0% share in the alkalized cocoa powder market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cocoa Fiber Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Bean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Cocoa-Derived Peptides For Skin Repair Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Flavanol Market Analysis - Size, Share & Forecast 2025 to 2035

Cocoa Based Polyphenols Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Shell Fiber Market Analysis - Size, Share & Forecast 2025 to 2035

Cocoa Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cocoa Nibs Market Size, Share, and Forecast 2025-2035

Cocoa Maker Market Size, Growth, and Forecast 2025 to 2035

Cocoa Derivatives Market Analysis by Type, Category, Application and Region through 2035

Cocoa Butter Market Analysis by Product Type, Nature, Form, and End Use Through 2035

Cocoa Liquor Market Analysis by Segments Through 2035

Cocoa Bean Extract Market Trends - Nature & Cocoa Type Insights

Cocoa Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Cocoa Market Growth - Applications & Industry Trends

Ethylhexyl Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Injectable Cocoa Fillings Market

Cosmetic Sucrose Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Powdered Soft Drinks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA