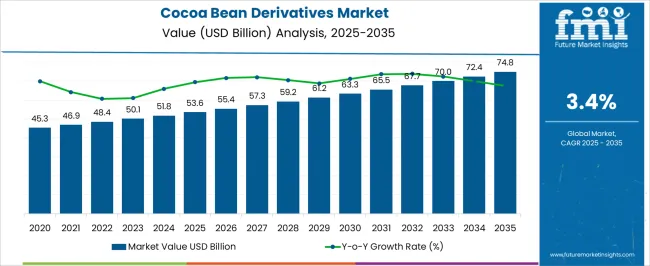

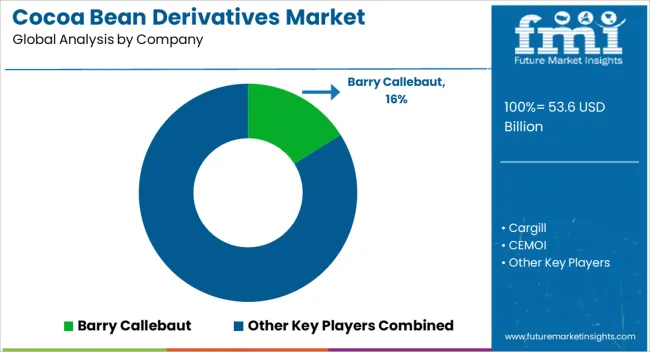

The cocoa bean derivatives market is valued at USD 53.6 billion in 2025 and is projected to reach USD 74.8 billion by 2035, reflecting a CAGR of 3.4%. Observing the growth contribution index, the market demonstrates steady year-on-year increments, rising from USD 55.4 billion in 2026 to USD 72.4 billion in 2034 before reaching the forecasted value. This pattern highlights the consistent demand for cocoa derivatives, including cocoa butter, powder, and liquor, which are widely used in confectionery, beverages, and cosmetic applications.

The growth contribution index underscores how incremental increases in production, refined processing, and global distribution networks are steadily reinforcing market expansion, suggesting a stable growth environment with predictable returns for manufacturers and suppliers. The cocoa bean derivatives market stood at USD 53.6 billion in 2025 and is expected to progress to USD 74.8 billion by 2035, maintaining a CAGR of 3.4%. Year-on-year analysis reveals a controlled upward trajectory, with values moving from USD 57.3 billion in 2027 to USD 70.0 billion in 2033. The growth contribution index indicates that steady consumption patterns in confectionery, chocolate production, and specialty food segments are shaping market expansion.

The moderate growth reflects the market’s resilience and the continued importance of cocoa derivatives in end-use applications where quality, flavor, and formulation consistency are prioritized. The trend also suggests that suppliers who optimize processing efficiency and distribution reliability are positioned to capture sustained value over the decade.

| Metric | Value |

|---|---|

| Cocoa Bean Derivatives Market Estimated Value in (2025 E) | USD 53.6 billion |

| Cocoa Bean Derivatives Market Forecast Value in (2035 F) | USD 74.8 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

The cocoa bean derivatives market has been increasingly recognized as a critical segment within several larger parent industries, each reflecting measurable adoption and operational relevance. Within the chocolate and confectionery market, cocoa bean derivatives account for approximately 8.3%, driven by their essential role in providing flavor, texture, and fat content for chocolate bars, candies, and coated products. In the food ingredients market, the share is estimated at 6.9%, reflecting their incorporation in sauces, dairy products, and specialty food formulations to enhance taste, color, and nutritional profile.

The bakery and snacks market records a penetration of about 5.7%, as cocoa derivatives are utilized in fillings, coatings, and dough to improve sensory appeal and product consistency. Within the beverage ingredients market, cocoa bean derivatives hold roughly 4.8% share, driven by usage in cocoa-based drinks, hot chocolates, and functional beverages where flavor retention and solubility are critical.

In the cosmetic and personal care ingredients market, the share stands at around 3.9%, highlighting adoption for natural fats, antioxidants, and emollients in skin care, hair care, and lip care products. Collectively, these parent sectors indicate that the cocoa bean derivatives market represents approximately 29.6% across these industries, emphasizing its strategic relevance in enhancing product quality, sensory experience, and functional performance. Its adoption has been driven by consistent quality, versatility, and processing efficiency, prompting manufacturers to rely on cocoa derivatives as core ingredients. The market has been shaping competitive approaches in parent industries, reinforcing the importance of high-quality cocoa derivatives in product differentiation, consumer appeal, and operational reliability.

The cocoa bean derivatives market is witnessing stable expansion, supported by consistent demand from the global food and beverage industry and a rising inclination toward natural and premium ingredients. Current market growth is being driven by the increasing use of cocoa-based derivatives in confectionery, bakery, and dairy products, where their flavor, texture, and functional properties are integral to product formulation.

Demand has further strengthened as manufacturers focus on premiumization and product differentiation, with cocoa derivatives often positioned as high-value ingredients. The conventional category continues to dominate due to its cost efficiency and wide availability, despite the growing awareness of organic and specialty variants.

Technological advancements in processing have also improved yield efficiency and quality consistency, which is expected to enhance profitability for producers. Over the forecast period, the market is anticipated to benefit from expanding applications in nutraceuticals, cosmetics, and personal care, driven by the antioxidant properties and sensory appeal of cocoa derivatives, ensuring their sustained relevance in multiple end-use sectors.

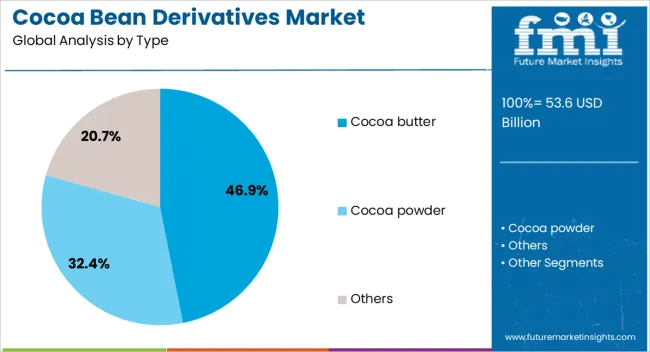

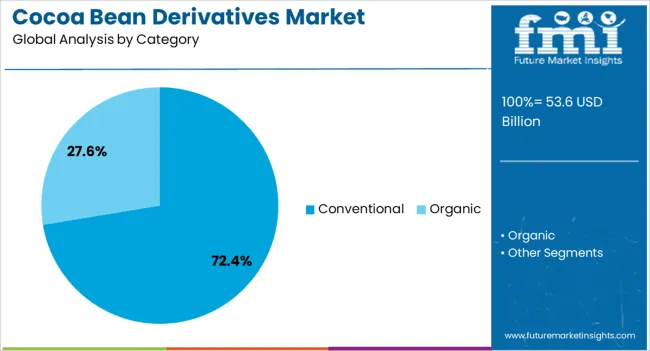

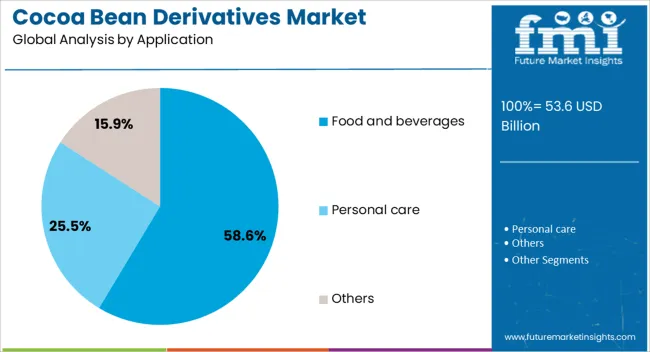

The cocoa bean derivatives market is segmented by type, category, application, and geographic regions. By type, cocoa bean derivatives market is divided into Cocoa butter, Cocoa powder, and Others. In terms of category, cocoa bean derivatives market is classified into Conventional and Organic. Based on application, cocoa bean derivatives market is segmented into Food and beverages, Personal care, and Others. Regionally, the cocoa bean derivatives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cocoa butter segment represents the largest share by type in the cocoa bean derivatives market, accounting for approximately 46.9% of the total. This leading position is sustained by cocoa butter’s critical role in chocolate manufacturing, where it provides the characteristic smoothness, mouthfeel, and stability essential to premium formulations.

Its applications extend beyond confectionery into bakery, cosmetics, and personal care products, where it is valued for its emollient and moisturizing properties. The segment’s dominance is further reinforced by strong demand from emerging economies, where chocolate and cocoa-based products are gaining market penetration.

Supply-side factors, including integrated processing facilities and stable trade flows from major cocoa-producing regions, have also contributed to maintaining its market leadership. With the premium chocolate sector expanding and cosmetic manufacturers increasingly favoring natural moisturizers, cocoa butter is expected to retain its high share, supported by both its multifunctional use and strong consumer recognition.

The conventional category holds a commanding share of approximately 72.4% in the cocoa bean derivatives market, driven primarily by its affordability and widespread accessibility. This segment benefits from established large-scale cocoa farming and processing infrastructure, which enables consistent supply at competitive prices. Conventional cocoa derivatives remain the preferred choice for mass-market food and beverage manufacturers, where cost control and scalability are critical factors.

Their broad application base includes chocolate confectionery, bakery, beverages, and ice cream production, where performance and taste consistency are prioritized. The category’s dominance is further supported by long-standing trade networks between producing countries and major consumer markets, ensuring reliability in supply chains.

While organic and specialty derivatives are gaining attention, conventional products continue to dominate due to their price advantage and compatibility with existing manufacturing processes. This entrenched market position is expected to persist, especially in high-volume product segments across both developed and emerging economies.

The food and beverages application segment leads the cocoa bean derivatives market with a share of approximately 58.6%, reflecting the ingredient’s integral role in a wide range of consumable products. Cocoa derivatives are extensively used for flavoring, coloring, and texturizing purposes in chocolates, bakery goods, dairy desserts, and flavored beverages.

The segment’s strength lies in the rising consumption of chocolate-based products globally, coupled with the diversification of applications into health-oriented and fortified food categories. Innovations such as low-sugar or functional chocolates and cocoa-infused snacks have further expanded its reach.

Large-scale adoption by multinational food manufacturers, supported by efficient global supply chains, has also reinforced the segment’s share. With consumer demand for indulgence and premium experiences persisting alongside the growth of artisanal and craft product categories, the food and beverages segment is expected to maintain its leadership, benefiting from continuous product innovation and stable raw material availability.

The cocoa bean derivatives market has been influenced by growing demand in confectionery, bakery, beverage, and cosmetic industries. Adoption has been driven by consumer preference for chocolate-based products, cocoa-infused beverages, and natural cosmetic formulations. Opportunities are emerging in specialty cocoa powders, high-flavor cocoa extracts, and functional ingredients for premium products. Trends indicate increasing interest in clean-label products, fortified derivatives, and multi-industry applications. Challenges persist in raw cocoa price volatility, seasonal supply fluctuations, and regulatory compliance. Overall, the market outlook remains positive, fueled by evolving consumer preferences and rising product innovation.

The demand for cocoa bean derivatives has been strongly influenced by their widespread use in confectionery, bakery, and beverage industries across global markets. Manufacturers of chocolate, cocoa powder-based drinks, baked goods, and dessert products have been observed increasingly relying on cocoa derivatives to deliver consistent flavor, aroma, and texture profiles. In opinion, this demand has been reinforced by consumers’ preference for chocolate-based indulgences and cocoa-enriched products, which are perceived as high-quality and enjoyable. Functional and specialty cocoa powders are being adopted in beverages, ice creams, and bakery fillings to enhance product richness and sensory experience. Seasonal demand during festivals, promotional events, and gifting periods has further strengthened reliance on cocoa derivatives. Overall, the market demand is being driven by the versatility of cocoa derivatives in multiple food and beverage applications, where quality, taste, and consumer appeal remain the primary drivers for adoption.

Opportunities in the cocoa bean derivatives market have been largely defined by the growing adoption of specialty cocoa extracts, high-flavor powders, and premium formulations for confectionery, beverages, and cosmetic products. Manufacturers and ingredient suppliers have been observed developing enriched cocoa derivatives with higher cocoa solids, unique flavor notes, or functional properties for differentiated product offerings. In opinion, emerging markets and premium segments present strong opportunities due to rising disposable incomes and increasing demand for gourmet or high-quality cocoa products. Functional cocoa derivatives for fortified beverages, protein blends, and cosmetic applications are being explored for added value. Collaboration between ingredient suppliers and food manufacturers is enabling tailored solutions that meet diverse regional taste preferences and product positioning. Overall, opportunities are being reinforced by the demand for enhanced flavor, high-quality ingredients, and multi-industry applications in confectionery, beverages, and personal care sectors.

The cocoa bean derivatives market has been shaped by trends in clean-label ingredients, fortified products, and cross-industry applications in food, beverages, and cosmetics. Manufacturers have been increasingly adopting natural, minimally processed cocoa derivatives to meet growing consumer preference for transparency and product authenticity.

Trends toward fortified cocoa powders and extracts are influencing product development strategies for functional beverages, nutritional supplements, and premium chocolate products. Multi-industry applications, such as cocoa-based skincare formulations and flavored cosmetic products, are further broadening market reach. The integration of cocoa derivatives into diverse product categories ensures versatility and opens up avenues for differentiated offerings. Overall, these trends are expected to influence competitive positioning, drive innovation in formulations, and expand adoption across both established and emerging markets, highlighting cocoa derivatives as a critical ingredient in multiple industries.

The cocoa bean derivatives market has faced persistent challenges related to raw cocoa price volatility, seasonal availability, and stringent regulatory frameworks. Cocoa prices are heavily influenced by crop yields, climatic conditions, and regional production factors, which can disrupt supply chains and affect manufacturing costs.

Fluctuations in raw material availability have occasionally constrained producers’ ability to maintain stable product pricing and consistent quality. Regulatory compliance with food safety, labeling, and quality standards varies across regions, creating additional operational complexities for manufacturers and exporters. The storage, handling, and preservation of cocoa derivatives require careful management to maintain their flavor, aroma, and functional properties.

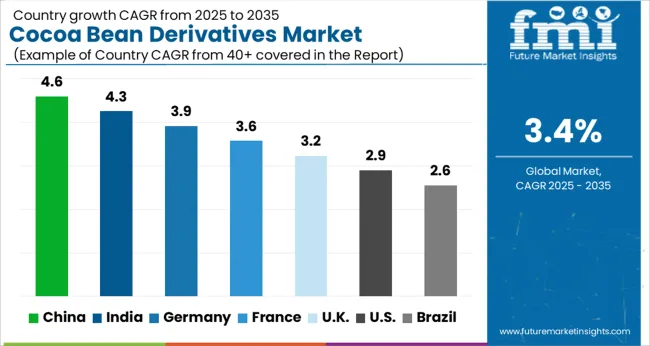

| Country | CAGR |

|---|---|

| China | 4.6% |

| India | 4.3% |

| Germany | 3.9% |

| France | 3.6% |

| UK | 3.2% |

| USA | 2.9% |

| Brazil | 2.6% |

The global cocoa bean derivatives market is projected to grow at a CAGR of 3.4% from 2025 to 2035. China leads with 4.6% growth, followed by India at 4.3%, and Germany at 3.9%. The United Kingdom records 3.2%, while the United States shows 2.9% growth. Expansion is being driven by rising consumption of chocolate, confectionery, and cocoa-based products, along with increasing demand from food, beverage, and cosmetic industries. Emerging markets such as China and India are experiencing higher growth due to growing urban populations, rising disposable income, and increasing interest in premium cocoa products, while developed markets focus on product diversification, health-oriented formulations, and premium confectionery innovations. This report includes insights on 40+ countries; the top markets are shown here for reference.

The cocoa bean derivatives market in China is expanding at a CAGR of 4.6%, driven by increasing demand for chocolate, confectionery, and cocoa-based beverages. Growth is reinforced by rising consumer preference for premium and flavored cocoa products, along with the expansion of bakeries, confectionery outlets, and foodservice channels. Chinese manufacturers are investing in sourcing high-quality cocoa derivatives, improving processing techniques, and expanding distribution networks. Adoption is further strengthened by the growing popularity of cocoa-based functional foods, health-oriented products, and ready-to-drink beverages that incorporate cocoa extracts, powders, and butter.

The cocoa bean derivatives market in India is growing at a CAGR of 4.3%, fueled by rising consumption of chocolate, cocoa spreads, and bakery products. Indian manufacturers are focusing on expanding product portfolios with flavored and fortified cocoa products to meet growing consumer demand. Growth is reinforced by increasing disposable income, urbanization, and the rising popularity of premium and indulgent cocoa-based products. Adoption is further supported by the growth of organized retail, e-commerce channels, and foodservice establishments that offer cocoa-based desserts and beverages across the country.

The cocoa bean derivatives market in Germany is projected to grow at a CAGR of 3.9%, supported by high demand for premium chocolate, confectionery, and bakery ingredients. German manufacturers are investing in high-quality cocoa sourcing, sustainable procurement, and advanced processing techniques to maintain product standards. Growth is reinforced by consumer preference for artisanal chocolate, organic cocoa products, and health-oriented formulations. Adoption is further enhanced by the presence of established chocolate brands, robust distribution networks, and strong demand from foodservice and confectionery industries seeking consistent quality cocoa derivatives.

The cocoa bean derivatives market in the United Kingdom is expanding at a CAGR of 3.2%, driven by consumer demand for chocolate, cocoa beverages, and bakery ingredients. UK manufacturers focus on product diversification, including organic, fair-trade, and functional cocoa offerings. Growth is reinforced by rising consumption in confectionery, bakery, and beverage sectors, along with increasing awareness of cocoa-based health benefits. Adoption is further supported by supermarket chains, specialty stores, and online platforms that facilitate access to a wide variety of cocoa products across the country.

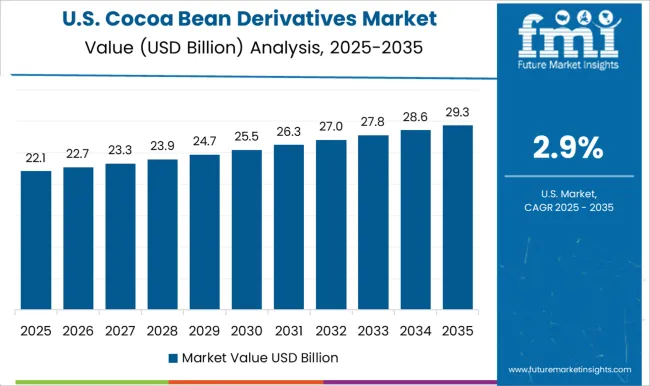

The cocoa bean derivatives market in the United States is growing at a CAGR of 2.9%, supported by steady demand for chocolate, confectionery, and cocoa-based bakery products. USA manufacturers are focusing on premiumization, flavor innovation, and health-oriented cocoa products to meet evolving consumer preferences. Growth is reinforced by increasing consumption in the confectionery, beverage, and functional foods segments. Adoption is further enhanced by strong distribution networks, large-scale retail presence, and the popularity of indulgent and specialty cocoa products that cater to both domestic and international tastes.

The cocoa bean derivatives market is being driven by global chocolate manufacturers, ingredient suppliers, and specialty processors. Barry Callebaut, Cargill, and Nestlé are being positioned as major players through large-scale processing, consistent quality, and extensive supply chain networks that ensure year-round availability. Their strategy is being executed with diversified derivative offerings including cocoa powder, cocoa butter, and cocoa liquor, targeting confectionery, bakery, and beverage industries. Mondelez International, Ferrero, and Olam Group are being recognized for integrating traceable sourcing, sustainability certifications, and high-purity derivatives into their operations, enhancing brand value and product reliability. CEMOI, Cocoa Touton, and ECOM Agroindustrial are being directed toward regional markets, focusing on customer-specific formulations and efficient logistics. Ecuakao Group, Indcre, JB Foods, Moner Cocoa, and Natra are being noted for niche production, small-batch derivatives, and specialized processing techniques. United Cocoa Processor is being evaluated for high-capacity industrial-grade derivatives, ensuring bulk supply and operational consistency.

Competition is being determined by purity, flavor consistency, and traceable sourcing, while market leadership is reinforced by reliability, certifications, and product versatility. Product brochures are being curated as concise, authoritative tools to highlight quality, applications, and derivative variety. Barry Callebaut, Cargill, and Nestlé brochures emphasize cocoa bean origin, derivative specifications, and industrial applicability, using clear visuals and technical data. Mondelez, Ferrero, and Olam brochures focus on traceability, flavor integrity, and multi-sector application examples. CEMOI, Cocoa Touton, and ECOM Agroindustrial brochures highlight regional adaptability, production flexibility, and tailored solutions. Ecuakao, Indcre, JB Foods, Moner Cocoa, and Natra brochures showcase specialty derivatives, high-purity grades, and processing capabilities. United Cocoa Processor brochures underline bulk supply efficiency, consistency, and compliance certifications. Each brochure is being developed as a standalone reference, blending concise specifications, application guidance, and visual diagrams, ensuring cocoa bean derivative offerings are communicated with clarity, credibility, and immediate decision-making appeal for confectioners, food manufacturers, and ingredient buyers.

| Item | Value |

|---|---|

| Quantitative Units | USD 53.6 Billion |

| Type | Cocoa butter, Cocoa powder, and Others |

| Category | Conventional and Organic |

| Application | Food and beverages, Personal care, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Barry Callebaut, Cargill, CEMOI, Cocoa Touton, ECOM Agroindustrial, Ecuakao Group, Ferrero, Indcre, JB Foods, Mondelez International, Moner Cocoa, Natra, Nestlé, Olam Group, and United Cocoa Processor |

| Additional Attributes | Dollar sales by product type (cocoa powder, cocoa butter, cocoa liquor) and application (chocolates, bakery, confectionery, beverages) are key metrics. Trends include rising demand for premium and functional chocolate products, growth in bakery and confectionery sectors, and increasing adoption in health-oriented formulations. Regional adoption, consumer preferences, and technological advancements are driving market growth. |

The global cocoa bean derivatives market is estimated to be valued at USD 53.6 billion in 2025.

The market size for the cocoa bean derivatives market is projected to reach USD 74.8 billion by 2035.

The cocoa bean derivatives market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in cocoa bean derivatives market are cocoa butter, cocoa powder and others.

In terms of category, conventional segment to command 72.4% share in the cocoa bean derivatives market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cocoa Fiber Market Size and Share Forecast Outlook 2025 to 2035

Cocoa-Derived Peptides For Skin Repair Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Flavanol Market Analysis - Size, Share & Forecast 2025 to 2035

Cocoa Based Polyphenols Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Shell Fiber Market Analysis - Size, Share & Forecast 2025 to 2035

Cocoa Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cocoa Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cocoa Nibs Market Size, Share, and Forecast 2025-2035

Cocoa Maker Market Size, Growth, and Forecast 2025 to 2035

Cocoa Butter Market Analysis by Product Type, Nature, Form, and End Use Through 2035

Cocoa Liquor Market Analysis by Segments Through 2035

Cocoa Derivatives Market Analysis by Type, Category, Application and Region through 2035

Cocoa Bean Extract Market Trends - Nature & Cocoa Type Insights

Organic Cocoa Market Growth - Applications & Industry Trends

Alkalized Cocoa Powder Market Size and Share Forecast Outlook 2025 to 2035

Ethylhexyl Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Injectable Cocoa Fillings Market

Cosmetic Sucrose Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Bean Flour Market Size and Share Forecast Outlook 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA