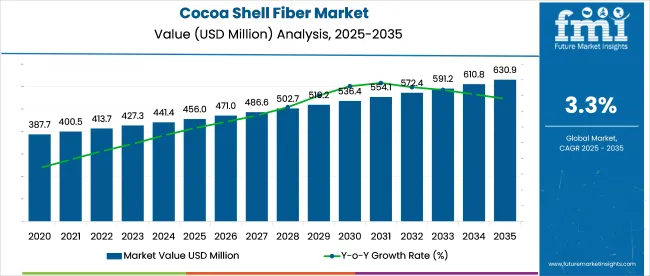

The cocoa shell fiber market is estimated at USD 456 million in 2025 and is projected to reach USD 630.9 million by 2035, growing at a CAGR of 3.3%. Growth has been driven by increased demand for dietary fiber-rich cocoa husk derivatives in applications such as bakery, cereals, animal feed, and nutraceuticals.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 456 million |

| Projected Market Size in 2035 | USD 630.9 million |

| CAGR (2025 to 2035) | 3.3% |

Powdered cocoa shell is preferred for its ease of incorporation and fiber density, while whole-shell uses remain confined to niche uses in animal bedding and bioenergy. It is argued that premium positioning through natural flavor blends and traceable sourcing will differentiate leading brands. However, inconsistent processing standards and supply variability may limit growth unless quality certification and infrastructure consolidation are prioritized.

In a March 2025 interview with ConfectioneryNews, Oded Brenner, CEO and Co-founder of Blue Stripes, emphasized the growing role of upcycled cacao partsincluding shells and pulpin product innovation. His company’s model centers on full cacao utilization, transforming by-products into value-added food ingredients.

Brenner stated, “The culinary and health potential hidden in the cacao fruit upcycled parts is one core reason behind manufacturers interest in the entire cocoa pod’s potential.” He also addressed market economics, noting, “The potential of increasing revenues without growing additional cacao and maximising the efficiency of the cacao agriculture is the main factor that can assist with the ‘cacao crisis’ which is happening because of low profits from the current cacao farming operations.”

The industry holds a niche share within its parent markets. In the food ingredients market, it accounts for approximately 1-2%, as it is used as a fiber source in functional foods. Within the natural fiber market, its share is around 2–3%, driven by the increasing use of sustainable and plant-based fibers in various applications.

In the agricultural byproducts market, the share is about 3-4%, as cocoa shells are a byproduct with value-added potential. In the sustainable products market, the share is around 2–3%, reflecting the demand for eco-friendly materials. In the biodegradable materials market, the share is approximately 1-2%, due to its natural and biodegradable properties.

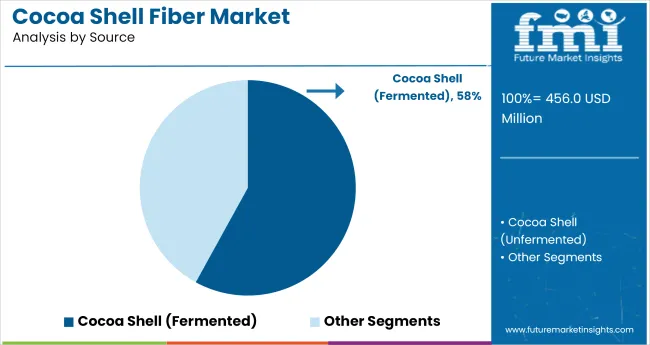

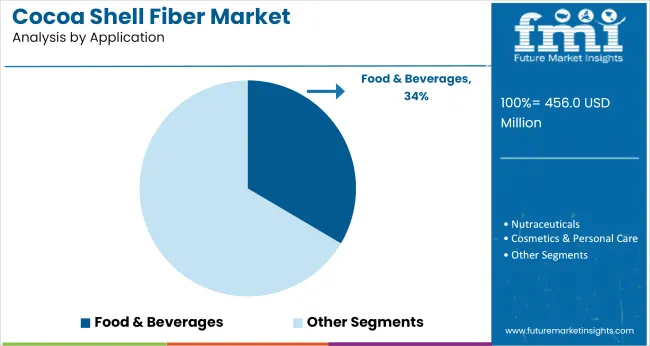

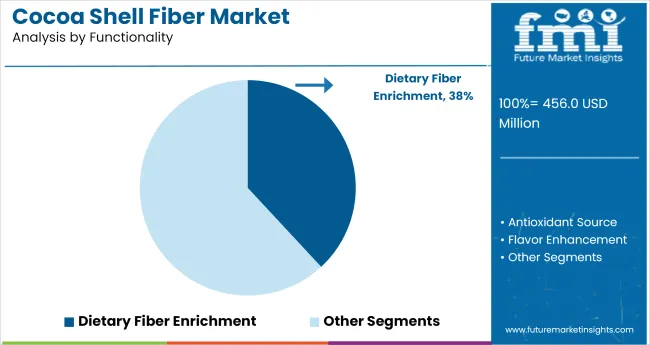

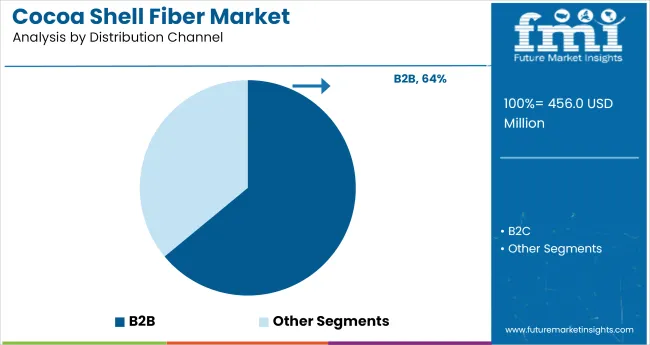

In 2025, the cocoa shell fiber market will be led by fermented cocoa shell source at 58%, powder form at 56.8%, food & beverage (including bakery) applications at 34%, dietary fiber enrichment functionality at 38%, and B2B distribution channels with 64% market share.

Fermented cocoa shell is expected to dominate the source segment in 2025, holding 58% of the market share. Cocoa shell, especially in its fermented form, is rich in fiber, antioxidants, and other beneficial compounds that enhance its appeal in various applications.

The fermentation process improves the bioavailability of these nutrients, making fermented cocoa shell fiber particularly valuable in functional foods, supplements, and animal feed. Its sustainability, as an upcycled byproduct of the cocoa industry, further drives its popularity. With increasing demand for natural, nutrient-dense ingredients, fermented cocoa shell will continue to lead in the market.

Powdered cocoa shell fiber is projected to hold 56.8% of the market share in 2025. The powder form of cocoa shell fiber offers versatility and ease of use in food and beverage formulations. It is highly preferred for its ability to be easily incorporated into baked goods, smoothies, protein bars, and other products.

Powdered cocoa shell fiber retains the natural nutrients of cocoa shell while being easy to handle, store, and transport, making it the top choice for both manufacturers and consumers. As demand for fiber-rich, clean-label products continues to rise, powder form will remain dominant in the market.

The food & beverage sector, including bakery applications, is expected to account for 34% of the industry share in 2025. Cocoa shell fiber is increasingly being used in the food industry to enrich dietary fiber content in products such as bread, cakes, cookies, and beverages.

As consumers seek healthier and more functional foods, the demand for fiber-enriched products is increasing. Cocoa shell fiber’s ability to improve texture, enhance nutritional value, and offer a clean-label ingredient makes it a popular choice for manufacturers in the bakery and broader food and beverage sectors.

Dietary fiber enrichment is expected to capture 38% of the market share in 2025. Cocoa shell fiber is particularly valued for its high fiber content, which is essential for digestive health, satiety, and blood sugar regulation. As awareness of the health benefits of dietary fiber grows, its inclusion in food products has become a key driver of the market.

Cocoa shell fiber provides a cost-effective and sustainable source of dietary fiber, making it a popular choice for food manufacturers aiming to meet the increasing consumer demand for functional foods with added health benefits.

B2B distribution channels are projected to dominate the market, holding 64% of the share in 2025. B2B channels, including ingredient suppliers and manufacturers, are critical for the distribution of cocoa shell fiber to large-scale producers in the food, beverage, and animal feed industries.

B2B sales enable manufacturers to source cocoa shell fiber in bulk at competitive prices, facilitating mass production of fiber-enriched products. The continued demand for plant-based, sustainable ingredients in food manufacturing further strengthens the B2B sales channel as the preferred method for cocoa shell fiber distribution.

The cocoa shell fiber market is experiencing growth driven by increasing demand for high-fiber ingredients in food and beverage products. However, challenges such as inconsistent raw material quality, processing complexities, and limited consumer awareness are hindering broader adoption.

Rising Demand for High-Fiber Ingredients

The industry is benefiting from the growing consumer preference for high-fiber ingredients in food and beverage products. Cocoa shell fiber, derived from the by-products of cocoa processing, is rich in dietary fiber, antioxidants, and other bioactive compounds. These nutritional benefits make it an attractive addition to various products, including bakery items, snacks, and dietary supplements. As consumers become more health-conscious and seek functional foods, the demand for cocoa shell fiber is on the rise.

Challenges in Raw Material Quality and Processing

Despite its benefits, the industry faces challenges related to raw material quality and processing complexities. The quality of cocoa shells can vary depending on the source and processing methods, leading to inconsistencies in the final fiber product. Additionally, the extraction of fiber from cocoa shells requires specialized equipment and energy-intensive procedures, contributing to high production costs. These factors can limit the scalability and affordability of cocoa shell fiber, hindering its widespread adoption in the food industry.

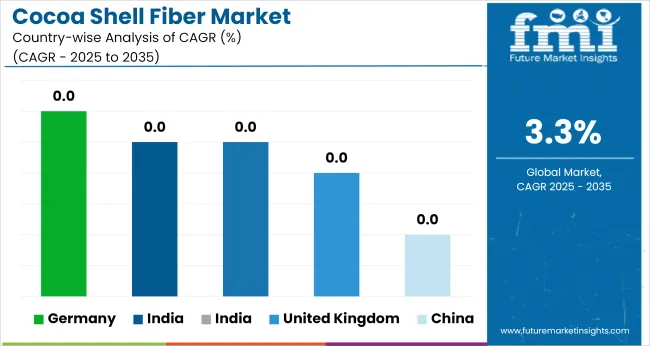

| Countries | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.2% |

| China | 3% |

| India | 3.3% |

| Germany | 3.4% |

| Australia | 3.1% |

Global cocoa shell fiber market demand is projected to rise at a 3.3% value-based CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, India leads at 3.3%, followed by Australia and the United Kingdom, at 3.1% and 3.3%, while China posts 3%, and Germany records the slowest growth at -3.4%.

These rates translate to a growth premium of -1% for India, -1% for Australia, and -6% for Germany versus the baseline, while China shows slower growth. Divergence reflects local catalysts: steady demand for sustainable ingredients in India and the United Kingdom, while Germany experiences more limited growth due to market maturity, and China sees slower adoption of cocoa shell fibers due to limited consumer focus on eco-friendly fibers.

Sales of cocoa shell fiber in the United Kingdom are projected to grow at a CAGR of 3.2% between 2025 and 2035. Bakery and cereal producers are incorporating cocoa shell fiber to boost gut health appeal in premium snack lines. Retailers are offering cocoa shell blends in fortified breakfast foods that align with digestive wellness positioning. Food manufacturers benefit from access to traceable cocoa supply chains via Ghana and West Africa, which feed into European processing hubs.

Demand for cocoa shell fiber in China is projected to grow at a CAGR of 3% from 2025 to 2035. Local manufacturers are using the fiber in biscuit coatings, prebiotic drink powders, and meal replacements. Cocoa processors are entering the functional ingredient segment by valorizing byproducts like shell fiber. Traditional Chinese wellness brands use cocoa shell in herbal formulations, citing its antioxidant properties.

India’s cocoa shell fiber market is forecasted to grow at a CAGR of 3.3% through 2035. Regional confectioners are repurposing cocoa shell residue into fibrous additives for baked goods. Startup ventures are experimenting with cocoa shell blends in diabetic-friendly food and nutraceuticals. Demand is increasing across metros for ingredients that support satiety and gut health.

Cocoa shell fiber demand in Germany is expected to grow at a CAGR of 3.4% during 2025 to 2035. German producers are focusing on circular ingredient systems where cocoa shell is utilized in baked goods, cereals, and sports nutrition. Leading chocolate processors are expanding into dietary fiber lines to cater to clean-label product reformulations. The EU’s tightening rules on food waste valorization are aligning with cocoa shell’s renewed use in food.

The industry in Australia is projected to grow at a CAGR of 3.1% from 2025 to 2035. Food startups are marketing cocoa shell as a gluten-free, low-calorie alternative for baked goods. The ingredient has gained traction in health-forward snacks and artisanal baking mixes. Local cocoa processing is limited, but imports are used for repurposing waste into value-added dietary products.

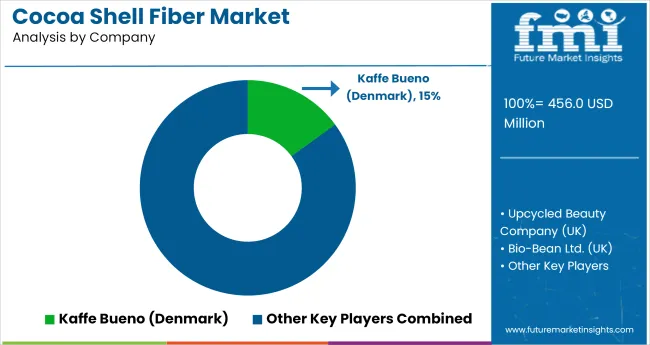

In the cocoa shell fiber market, focus has been placed on sourcing traceable pod husks and shells and developing product-grade versatility. ofi has secured leadership by converting residual cocoa shells into high-fiber ingredients and biomass energy, backed by factory-integrated infrastructure across Europe, ASEAN, and Latin America.

Barry Callebaut follows by offering micro-ground fiber for food and nutraceutical firms and leveraging its global cocoa processing footprint. Cargill supplies brewer-grade and food-grade fiber via ingredient co-manufacturing, while Nestlé channels shells into internal circular-economy streams.

JB Cocoa and UK-based Bio Bean (not listed but comparable) have niche coverage through artisanal flours and biomass initiatives. Regulatory control over solvent residues and dietary-fiber claims has governed labeling across EU and USA markets.

| Attribute Category | Details |

|---|---|

| Industry Size (2025E) | USD 456 million |

| Projected Industry Value (2035F) | USD 630.9 million |

| Value-based CAGR (2025–2035) | 3.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD million / Volume in metric tons |

| By Source | Cocoa shell (fermented), cocoa shell (unfermented) |

| By Form | Powder, granules, extract/concentrate |

| By Application | Food & beverage (bakery - bread, muffins, cookies; confectionery - chocolates, candies; functional beverages; dairy - yogurt, ice cream), nutraceuticals (dietary supplements, fiber supplements), animal feed (livestock, pet food), cosmetics & personal care (exfoliants, masks & scrubs), others (bioplastics, fertilizer additive) |

| By Functionality | Dietary fiber enrichment, antioxidant source, flavor enhancement, colorant agent |

| By Distribution Channel | B2B (ingredient suppliers, manufacturers), B2C (retail, online platforms) |

| By Region | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, Netherlands, Spain, India, China, Japan, South Korea, Indonesia, Australia, Saudi Arabia, South Africa, United Arab Emirates |

| Key Players | Barry Callebaut, Olam Food Ingredients ( ofi ), Cargill, Nestlé (internal usage in circular economy initiatives), JB Cocoa |

| Additional Attributes | Dollar by sales, share by source and functionality, valorization trends in cocoa byproducts, fiber-enriched bakery innovation, cross-sector usage in colorant and antioxidant formulations, and application in clean-label food and personal care formats |

Source segmentation includes Cocoa Shell (Fermented) and Cocoa Shell (Unfermented).

Form categories include Powder, Granules, and Extract/Concentrate.

Applications span Food & Beverage (Bakery, Confectionery, Functional Beverages, Dairy), Nutraceuticals (Dietary Supplements, Fiber Supplements), Animal Feed (Livestock, Pet Food), Cosmetics & Personal Care (Exfoliants, Masks & Scrubs), and Others such as Bioplastics and Fertilizer Additives.

Functionality segmentation includes Dietary Fiber Enrichment, Antioxidant Source, Flavor Enhancement, and Colorant Agent.

Distribution channels are segmented into B2B (Ingredient Suppliers, Manufacturers) and B2C (Retail, Online Platforms).

Regional analysis includes North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, and the Middle East & Africa.

The industry is estimated to be USD 456 million in 2025.

The industry is projected to reach USD 630.9 million by 2035, with a CAGR of 3.3% from 2025 to 2035.

The cocoa shell (fermented) source segment leads the industry with a 58% share.

India has the highest projected CAGR at 3.3% from 2025 to 2035.

The leading player in the industry is Olam Food Ingredients (ofi), holding a 14% industry share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cocoa Bean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Cocoa-Derived Peptides For Skin Repair Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Flavanol Market Analysis - Size, Share & Forecast 2025 to 2035

Cocoa Based Polyphenols Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cocoa Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cocoa Nibs Market Size, Share, and Forecast 2025-2035

Cocoa Maker Market Size, Growth, and Forecast 2025 to 2035

Cocoa Derivatives Market Analysis by Type, Category, Application and Region through 2035

Cocoa Butter Market Analysis by Product Type, Nature, Form, and End Use Through 2035

Cocoa Liquor Market Analysis by Segments Through 2035

Cocoa Bean Extract Market Trends - Nature & Cocoa Type Insights

Cocoa Fiber Market Size and Share Forecast Outlook 2025 to 2035

Organic Cocoa Market Growth - Applications & Industry Trends

Alkalized Cocoa Powder Market Size and Share Forecast Outlook 2025 to 2035

Ethylhexyl Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Injectable Cocoa Fillings Market

Cosmetic Sucrose Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Shell Core Transformer Market Size and Share Forecast Outlook 2025 to 2035

Shell Vials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA