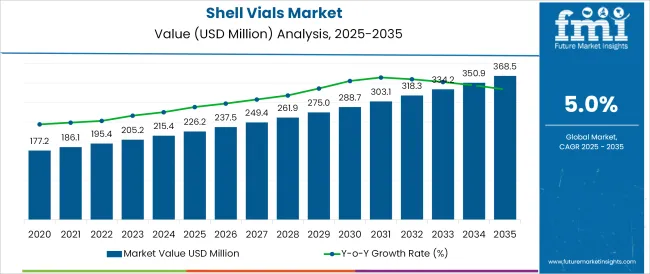

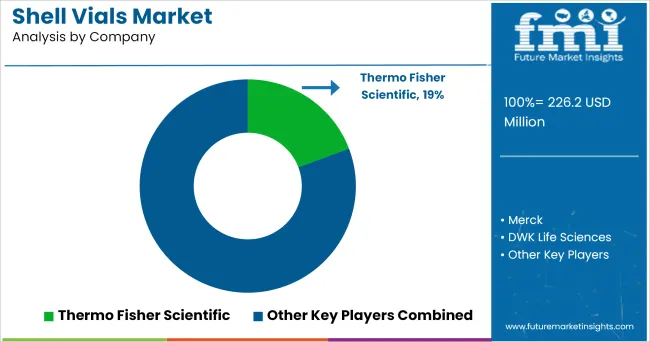

The Shell Vials Market is estimated to be valued at USD 226.2 million in 2025 and is projected to reach USD 368.5 million by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The shell vials market is witnessing steady growth, supported by increased demand for high-purity sample containers in pharmaceutical, diagnostic, and research applications. With greater emphasis on sample integrity, contamination control, and temperature resistance, manufacturers are prioritizing advanced materials and precision manufacturing processes in vial production.

Regulatory frameworks across global pharmaceutical and life sciences sectors are further elevating the importance of certified, chemically stable vials. Industry trends such as growth in chromatographic testing, biological assays, and sterile sampling have heightened the demand for compact, durable shell vials that support automation and ease of labeling.

Material innovations, along with expanded R&D investments by pharmaceutical companies, are reshaping market dynamics. Future opportunities are expected to arise from the integration of automation-ready formats and the development of recyclable or hybrid vial solutions, aligned with evolving sustainability mandates in laboratory and manufacturing settings.

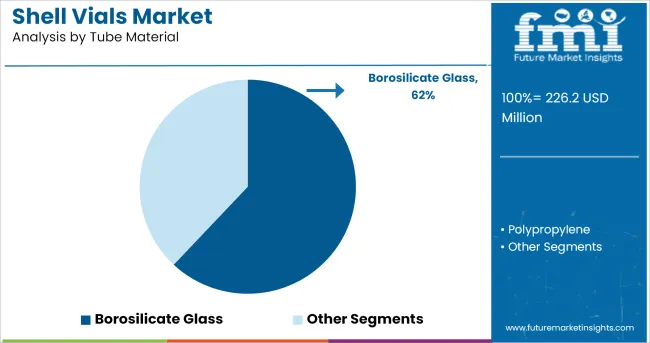

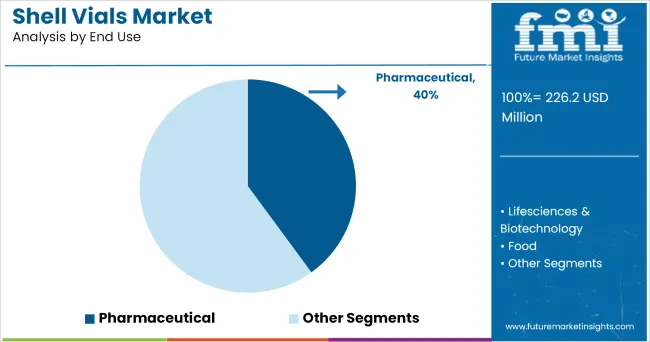

The market is segmented by Tube Material and End Use and region. By Tube Material, the market is divided into Borosilicate Glass and Polypropylene. In terms of End Use, the market is classified into Pharmaceutical, Lifesciences & Biotechnology, Food, and Pathology & Laboratory.

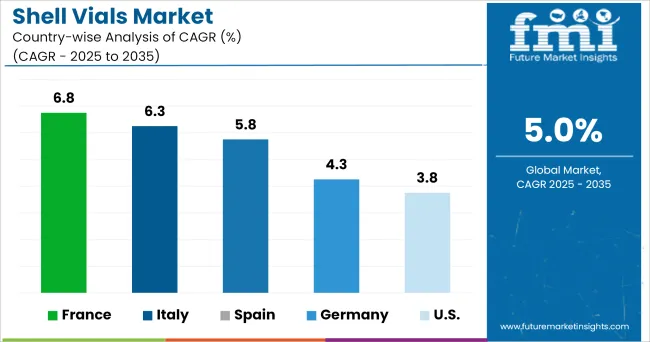

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Borosilicate glass is expected to account for 62.0% of the shell vials market revenue in 2025, making it the leading tube material segment. This dominance is being driven by borosilicate’s superior thermal resistance, chemical inertness, and mechanical durability, which are essential in pharmaceutical and laboratory environments.

The material’s ability to maintain sample purity and prevent leaching under various storage and testing conditions has made it the preferred choice among clinical and analytical professionals. Its low coefficient of thermal expansion enables compatibility with rapid temperature changes, including autoclaving and cryogenic storage.

Moreover, borosilicate glass supports high-clarity visibility for accurate volume readings and inspection, making it ideal for quality-critical applications. Its long-established compliance with international pharmacopoeia standards further reinforces its widespread adoption. As sample sensitivity and precision become increasingly important, the use of borosilicate in shell vial production continues to be favored across regulated and high-stakes testing environments.

The pharmaceutical sector is projected to hold a 40.0% share of the shell vials market revenue in 2025, making it the leading end-use segment. This leadership is being driven by the sector’s reliance on high-integrity containers for sample collection, drug testing, compound storage, and chromatographic analysis. Shell vials play a critical role in maintaining sterility, minimizing evaporation, and ensuring precision in small-volume dosing applications.

The segment’s growth is supported by rising global pharmaceutical R&D investments, expansion of drug discovery pipelines, and stricter validation requirements for analytical results. Demand has further increased due to the sector's shift toward personalized medicine and biologics, which require stringent handling and containment conditions.

Integration of shell vials in automated testing and sample preparation workflows has reinforced their usage across both research laboratories and production facilities. With regulatory scrutiny intensifying and analytical precision becoming central to drug safety and efficacy, pharmaceutical applications continue to drive the majority of demand for shell vials.

Demand from biotechnology and Lifesciences is understood to be the primary end user of the product serving as a crucial consumable in testing and analysis of the desired media. Moreover, the product being used as one time disposable unit coupled with its high intake rate is particularly identified as high volume market. Glass shell vials are featured with straight sided walls to maximize the labeling space.

These seamless and tubular products are typically used for the analysis of specimens, chemicals and play a critical role in viral cultures. The product is also often used in industrial chromatography applications.

It is used for fundamental roles in some HLPC (High Performance Liquid Chromatography) processes, whose applications may include water purification, detection of impurities in pharmaceutical industries and in chromatography analysis of different compounds.

Moreover, shell vials are also essential in biotech and environmental applications. Besides routine HLPC, shell vials are also used for dry storage, dilution, auto sampling and titration applications requiring very low volumes down to microliter and millilitre.

Shell vials are used for biological assays which are used to estimate the concentration of pharmaceutically activated substances in a bulk or formulated product. These products are used as enhanced virus isolation methods which offer an increasing rate of isolation of the viruses without any compromise of the specificity.

Also as compared to traditional isolation techniques and methods, shell vials culture consumes lesser time to accomplish its task.

During the pandemic, sales of the product market skyrocketed, due to its application as a SARS-CoV-2 CPE specificity confirmation by immunofluorescence. The assay is used to measure the phenotypic consequence of viral infection and replication in the cells.

Market growth in North America is significantly driven by an increase in investments research and development, a growing number of pharmaceutical companies and preclinical activities by CROs. Growth of pharma and biotech industry in the region coupled with an expanding pool of investment attracting companies is expected to create many growth opportunities in the region.

Market growth in Europe is significantly driven by an increase in investments research and development in Lifesciences and pharmaceutical companies based in countries such as Germany, UK, France, Switzerland and Russia.

Demand from government sponsored research and academic institutes with a healthy per capita spend in infrastructure in addition to private enterprises is expected to have a profound growth rate of the market growth of shell vials in the region.

Some of the leading manufacturers and suppliers of Shell vials include

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global shell vials market is estimated to be valued at USD 226.2 million in 2025.

The market size for the shell vials market is projected to reach USD 368.5 million by 2035.

The shell vials market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in shell vials market are borosilicate glass and polypropylene.

In terms of end use, pharmaceutical segment to command 40.0% share in the shell vials market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Shell Core Transformer Market Size and Share Forecast Outlook 2025 to 2035

Shell & Tube Heat Exchangers Market

Shellac Market

Eggshell Membrane Powder Market Size and Share Forecast Outlook 2025 to 2035

Clamshell Sealer Market Analysis Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Clamshell Packaging Providers

Clamshell Labelling Machines Market Growth - Trends & Forecast 2022 to 2032

Clamshell Packaging Market by Material Type & Application from 2024 to 2034

Yacht Shell Doors Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Shell Fiber Market Analysis - Size, Share & Forecast 2025 to 2035

ESD Clamshell Market Size and Share Forecast Outlook 2025 to 2035

PET Clamshell Market

Food Clamshells Market Trends – Demand, Growth & Future Outlook 2025 to 2035

Cashew Nutshell Liquid Market Size and Share Forecast Outlook 2025 to 2035

Stock Clamshell Packaging Market

Paperboard Clamshell Boxes Market

Micro Vials Market Size and Share Forecast Outlook 2025 to 2035

Serum Vials Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Polymer Vials Market Insights & Industry Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA