The clamshell sealer market is expected to grow from USD 2.6 billion in 2025 to USD 4.2 billion by 2035, resulting in a total increase of USD 1.6 billion over the forecast decade. This represents a 61.5% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 4.9%. Over ten years, the market grows by a 1.6 multiple.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.6 billion |

| Industry Value (2035F) | USD 4.2 billion |

| CAGR (2025 to 2035) | 4.9% |

In the first five years (2025–2030), the market progresses from USD 2.6 billion to USD 3.3 billion, contributing USD 0.7 billion, or 43.8% of total decade growth. This phase is shaped by growing demand in foodservice and retail packaging, where clamshell formats ensure visibility and tamper resistance. Convenience-driven packaging adoption further supports expansion.

In the second half (2030–2035), the market grows from USD 3.3 billion to USD 4.2 billion, adding USD 0.9 billion, or 56.2% of the total growth. This acceleration is supported by automation, sustainable plastic alternatives, and integration of heat-sealing with eco-friendly materials. Expanding applications in bakery, electronics, and consumer goods packaging solidify the role of clamshell sealers in efficient, high-volume operations.

From 2020 to 2024, the clamshell sealer market expanded from USD 2.1 billion to USD 2.4 billion, driven by growth in ready-to-eat meals, bakery, and fresh produce packaging. Nearly 70% of revenue was led by OEMs manufacturing heat-sealing and blister-compatible systems. Leaders such as Starview Packaging Machinery, Visual Packaging, and Sonoco Alloyd emphasized sealing strength, food-grade compliance, and ergonomic machine designs. Differentiation focused on cycle time efficiency, multi-cavity sealing, and product protection, while smart inspection technologies remained secondary. Service-based models such as validation checks and maintenance accounted for under 15% of revenues, as most producers opted for upfront equipment procurement.

By 2035, the clamshell sealer market will reach USD 4.2 billion, growing at a CAGR of 4.90%, with smart-enabled sealing and modular automation systems contributing over 40% of market value. Competitive intensity will heighten as providers introduce AI-driven defect detection, cloud-linked production tracking, and recyclable-material compatibility. Established players are pivoting toward hybrid models combining physical sealing with SaaS-driven optimization. Emerging companies such as Packline USA, Alloyd Packaging Solutions, and Belco Packaging Systems are gaining share by delivering energy-efficient sealing machines, customizable tooling, and sustainable-material solutions that address evolving demands in food safety, retail presentation, and regulatory compliance.

The rising demand for tamper-resistant and visually appealing packaging is driving growth in the clamshell sealer market. These machines ensure secure sealing for food, electronics, and consumer goods while maintaining product visibility. Expanding retail and e-commerce sectors are further supporting adoption due to their need for protective, transparent packaging solutions.

Clamshell sealers with automated heat sealing, ultrasonic sealing, and high-speed operation are gaining popularity for enhancing productivity and consistency. Their compatibility with recyclable PET and eco-friendly materials aligns with sustainability goals. Improved sealing strength, reduced labor costs, and adaptability to diverse product sizes reinforce their importance in global packaging operations.

The market is segmented by machine type, sealing technology, packaging material, application, end-use industry, and region. Machine type segmentation includes manual, semi-automatic, and fully automatic clamshell sealers, designed to support varying production capacities and automation levels. Sealing technology covers heat seal, ultrasonic, and radio frequency (RF) clamshell sealers, offering precision, speed, and durability in sealing operations. Packaging material includes PET, PVC, PP, PLA, and paperboard-based clamshells, ensuring versatility across food, consumer goods, and sustainable formats.

Applications span food packaging, pharmaceutical and medical packaging, consumer electronics packaging, cosmetics and personal care packaging, and industrial goods packaging, ensuring broad market use. End-use industries include food and beverage, pharmaceuticals and healthcare, electronics, retail and supermarkets, and cosmetics and personal care. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

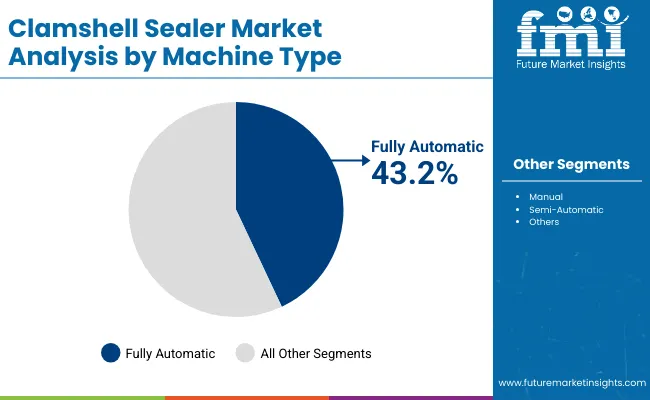

Fully automatic clamshell sealers are projected to account for 43.2% of the market in 2025, as manufacturers prioritize high-throughput operations with minimal manual intervention. These machines integrate automated feeding, sealing, and cutting systems to handle large volumes efficiently. Their precision ensures consistent sealing quality across diverse product categories.

Adoption is reinforced by rising labor costs and the need for standardized, compliant packaging. Industries such as food and consumer electronics favor fully automated systems for scalability and reduced downtime. Their compatibility with multiple sealing technologies further strengthens market leadership.

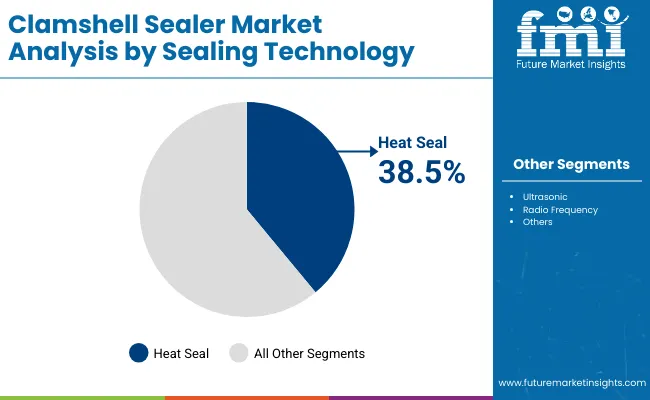

Heat seal clamshell sealers are expected to represent 38.5% of the market in 2025, driven by their simplicity, versatility, and low operating costs. They apply uniform heat and pressure to create durable seals suitable for food, medical, and retail applications.

Their widespread adoption is supported by technological refinements that improve energy efficiency and sealing consistency. Heat sealers are compatible with a wide range of clamshell materials, making them the go-to solution for mid- to large-scale production lines. Their balance of affordability and reliability ensures continued dominance.

PET is projected to hold 41.7% of the market in 2025, reflecting its popularity as a clear, strong, and recyclable material for clamshell packaging. Its barrier properties protect contents from moisture and contaminants while maintaining product visibility. PET clamshells are widely used across food, electronics, and cosmetics packaging.

Adoption is reinforced by global trends favoring recyclable plastics over PVC. PET’s compatibility with automated sealing systems and its ability to meet food safety standards make it the leading choice. Innovations in recycled PET (rPET) further support its dominance in sustainable packaging markets.

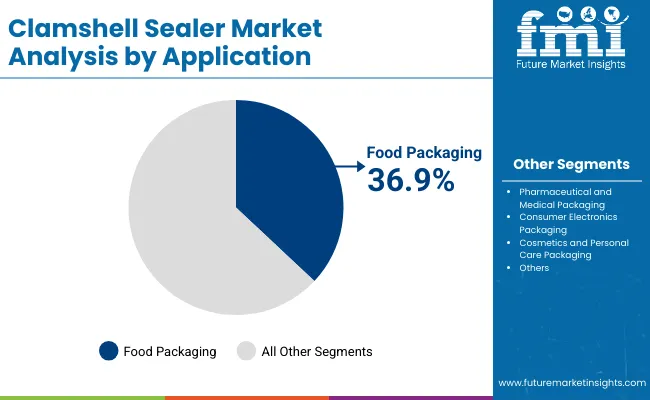

Food packaging is forecast to account for 36.9% of the market in 2025, as clamshells provide secure, tamper-resistant packaging for fresh produce, bakery items, and ready meals. Their transparency enhances product presentation, while strong seals preserve freshness and extend shelf life.

Retailers prefer clamshells for portion control and stackability, supporting efficient merchandising. With rising demand for grab-and-go meals and fresh-cut produce, food packaging continues to drive the largest application share. The segment benefits from both consumer convenience trends and retailer efficiency requirements.

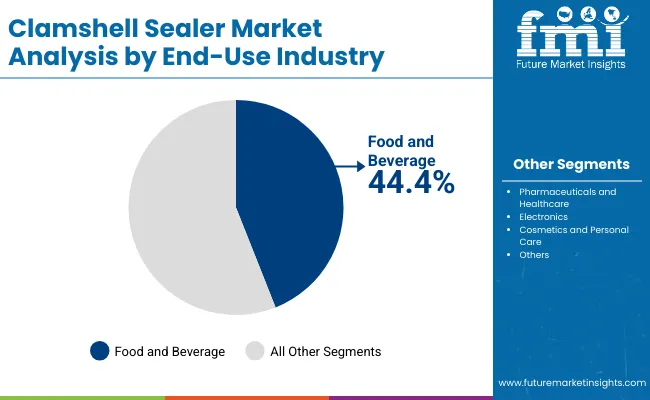

The food and beverage sector is projected to hold 44.4% of the market in 2025, reflecting its reliance on clamshells for both retail-ready and distribution packaging. Clamshell sealers provide the airtight closures necessary to maintain hygiene and meet food safety standards.

Adoption is fueled by the expansion of supermarkets, e-commerce grocery, and foodservice providers. Manufacturers benefit from automation in clamshell sealing, ensuring efficiency in high-volume operations. As global consumption of packaged foods rises, the food and beverage industry remains the core driver of clamshell sealer demand.

The clamshell sealer market is expanding as demand rises for secure, tamper-evident packaging in food, electronics, consumer goods, and pharmaceuticals. Growth in ready-to-eat meals, fresh produce, and retail packaging supports adoption. However, high equipment costs and limited flexibility with non-standard packaging formats act as restraints. Innovations in automation, eco-friendly materials compatibility, and ergonomic machine design are shaping future growth.

Product Safety, Freshness, and Retail Display Appeal Driving Adoption

Clamshell sealers provide airtight and tamper-proof closures that protect contents while enhancing product visibility. In the food industry, they extend shelf life for fresh produce, bakery items, and ready-to-eat meals by preventing contamination. Electronics and personal care goods also benefit from their theft-resistant packaging. Retailers prefer clamshell packaging for its transparent, display-ready design that attracts consumers while ensuring safety. These factors are positioning clamshell sealers as a standard in modern retail packaging.

High Equipment Costs, Packaging Rigidity, and Operational Complexity Restraining Growth

Adoption is hindered by the high upfront costs of industrial clamshell sealers, limiting access for small businesses. Their compatibility is largely restricted to rigid plastic or paperboard formats, reducing flexibility with emerging sustainable designs. Operational complexity, including setup time and maintenance, increases labor dependency. Additionally, rising environmental concerns regarding single-use plastics challenge growth in regions with strict regulations. These restraints slow widespread deployment despite growing demand for secure packaging.

Automation, Eco-friendly Materials, and Ergonomic Designs Trends Emerging

Key trends include automation-driven clamshell sealers that reduce manual intervention and improve consistency in high-volume operations. Manufacturers are innovating sealers that can work with eco-friendly clamshell materials such as recyclable PET and molded fiber. Ergonomic designs with quick-change tooling are gaining popularity to reduce downtime and labor strain. Integration of IoT-based monitoring and energy-efficient heating systems is also emerging. These advancements are positioning clamshell sealers as vital tools for efficient, sustainable, and retail-ready packaging solutions.

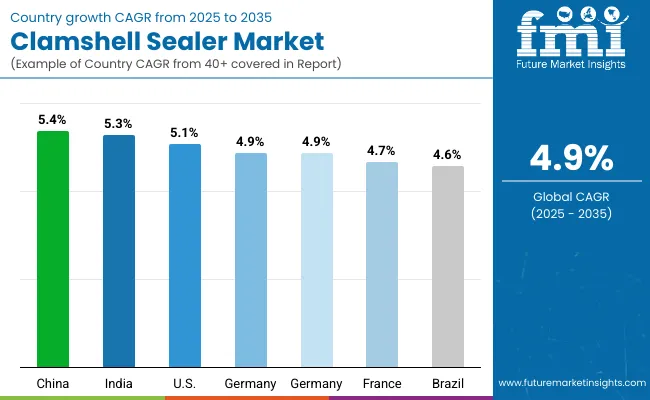

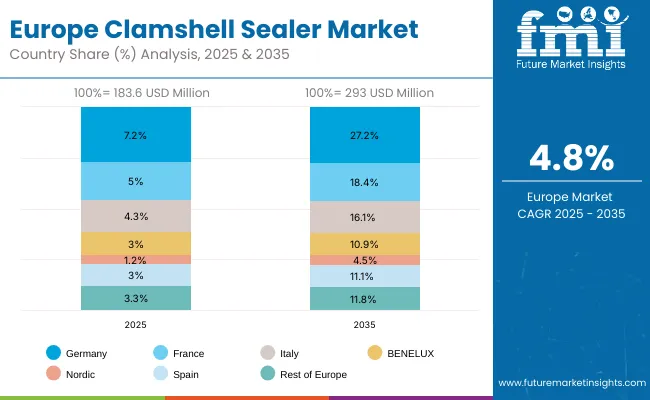

The global clamshell sealer market is expanding steadily, driven by rising demand for tamper-proof, transparent, and durable packaging in food, electronics, and consumer goods. Asia-Pacific is emerging as a high-growth region, with India and China advancing adoption through food processing, retail, and export-focused industries. Developed economies such as the USA, Germany, and Japan are emphasizing automation, eco-friendly materials, and compact sealing systems, ensuring efficiency, compliance, and sustainability while meeting consumer demand for convenience and product protection.

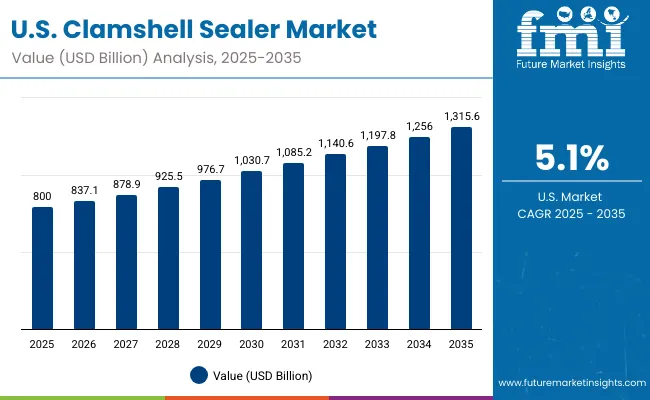

The USA market is projected to grow at a CAGR of 5.1% from 2025 to 2035, supported by strong demand from food packaging, healthcare, and electronics. Retailers and processors prefer clamshell sealing for tamper resistance and product visibility. Automation is a major trend, with smart sealing machines reducing downtime and increasing throughput. Manufacturers are also investing in eco-friendly sealing systems compatible with recyclable plastics, aligning with sustainability mandates and consumer packaging expectations.

Germany’s market is expected to grow at a CAGR of 4.9%, driven by demand in meat, dairy, and premium retail goods. Strict EU sustainability and packaging regulations are pushing adoption of recyclable clamshell materials and sealing systems. German manufacturers are innovating with high-precision sealing technologies to support food safety and extended shelf life. Automation-ready compact sealers are gaining popularity among SMEs, ensuring compliance, efficiency, and reduced environmental impact.

The UK market is forecast to grow at a CAGR of 4.9%, supported by adoption in ready-to-eat meals, bakery items, and personal care products. Rising consumer preference for safe, portable, and tamper-proof packaging is fueling demand. SMEs are adopting cost-effective sealing machines for flexible production. Regulations around packaging waste are pushing the adoption of recyclable clamshell packaging formats, with growing demand for machines compatible with eco-friendly materials and high-volume retail applications.

China’s market is projected to grow at a CAGR of 5.4%, fueled by strong demand in processed food, consumer electronics, and e-commerce packaging. Domestic manufacturers are scaling affordable clamshell sealing systems with automation features for mass adoption. Government sustainability goals are reinforcing the use of recyclable and biodegradable packaging materials. Export-driven demand for electronics and retail goods is accelerating the adoption of tamper-resistant clamshell sealing machines across large-scale and SME facilities alike.

India’s market is forecast to grow at a CAGR of 5.3%, supported by growth in FMCG, fresh produce, and pharmaceutical industries. Rising export activity in fruits, vegetables, and healthcare products is driving adoption of tamper-proof clamshells. SMEs are investing in affordable sealing systems to minimize losses and extend shelf life. Government packaging safety and sustainability initiatives are further supporting demand for recyclable and eco-friendly sealing technologies compatible with diverse applications in India’s packaging ecosystem.

Japan’s market is projected to grow at a CAGR of 4.7%, anchored by demand in electronics, healthcare, and premium foods. Compact, high-precision clamshell sealing machines are favored to suit Japan’s space-constrained facilities. Manufacturers are focusing on recyclable, tamper-proof packaging systems aligned with consumer demand for quality and safety. Innovation is also driven by cultural preference for visually appealing packaging that ensures both product integrity and strong presentation standards.

South Korea’s market is expected to grow at a CAGR of 4.8%, supported by strong adoption in cosmetics, seafood, and electronics. K-beauty brands and food exporters are increasingly using tamper-proof clamshell sealers to meet export standards. Local OEMs are focusing on eco-friendly sealing solutions integrated with automation. Rising demand for secure, attractive packaging formats in retail and exports is reinforcing the role of clamshell sealers in South Korea’s advanced packaging sector.

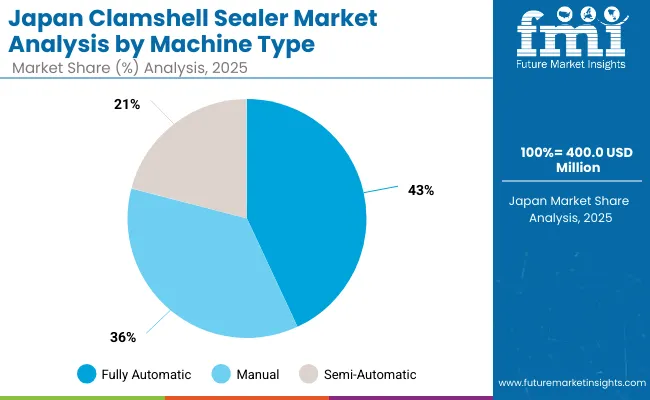

Japan’s clamshell sealer market, valued at USD 400 million in 2025, is dominated by fully automatic machines, which hold 43.2% share, reflecting their efficiency in large-scale, high-speed packaging. Manual clamshell sealers account for 36.1%, showing continued use in small and medium enterprises for cost-effective operations. Semi-automatic sealers capture 20.7%, serving mid-sized production facilities. The dominance of fully automatic systems highlights Japan’s focus on advanced automation to meet consumer and regulatory demands for consistency, hygiene, and productivity. Manual and semi-automatic sealers maintain significance in flexible, lower-volume operations, demonstrating Japan’s balance between cutting-edge automation and versatile small-scale packaging adoption.

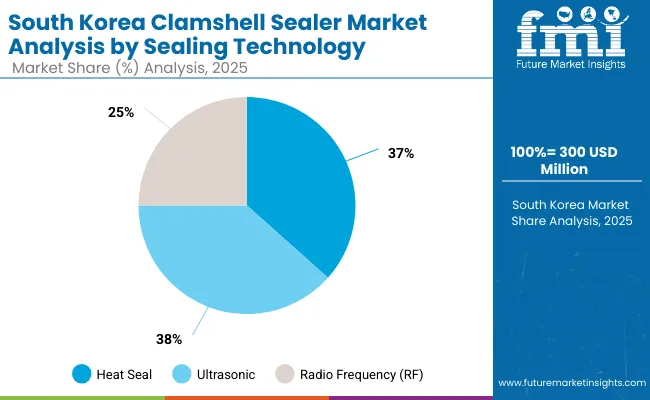

South Korea’s clamshell sealer market, worth USD 300 million in 2025, is led by ultrasonic sealers, which account for 38.4% share, reflecting demand for precision, eco-friendly, and durable sealing. Heat seal clamshell machines follow closely at 36.6%, while radio frequency (RF) sealers represent 25.0%. Ultrasonic sealers dominate due to their ability to reduce material use and ensure tamper-resistant seals in food and medical packaging. Heat sealing remains widely adopted for cost efficiency and simplicity in diverse industries. RF sealing caters to specialized applications requiring secure bonding. This distribution reflects South Korea’s dual focus on technological innovation and versatile sealing solutions.

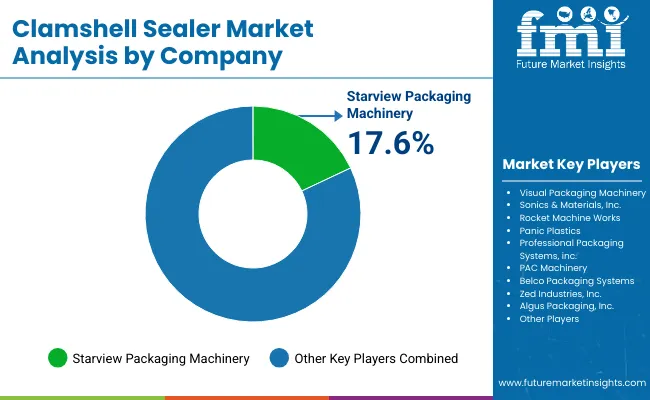

The clamshell sealer market is moderately fragmented, with thermoforming machinery providers, heat-sealing specialists, and packaging automation firms competing across consumer goods, electronics, medical devices, and food sectors. Global leaders such as Starview Packaging Machinery, Visual Packaging Machinery, and Sonics & Materials, Inc. hold notable market share, driven by precision sealing, ultrasonic technology, and compliance with safety and performance standards. Their strategies increasingly emphasize automation, sustainability, and adaptability to custom packaging formats.

Established mid-sized players including Rocket Machine Works, Panic Plastics, and Professional Packaging Systems, Inc. are supporting adoption of semi-automatic and fully automated clamshell sealing equipment featuring ergonomic designs, efficient tooling, and high-volume throughput. These companies are especially active in retail packaging and medical device sectors, offering tailored solutions that enhance product protection and visual merchandising.

Specialized providers such as PAC Machinery, Belco Packaging Systems, Zed Industries, Inc., and Algus Packaging, Inc. focus on customized clamshell sealing solutions for regional markets and niche applications. Their strengths lie in modular engineering, quick tooling changeovers, and integration with downstream packaging processes, enabling manufacturers to improve efficiency, ensure product integrity, and respond to evolving consumer convenience and sustainability demands.

Key Development

| Item | Value |

|---|---|

| Quantitative Units | USD 2.6 Billion |

| By Sealing Technology | Heat Seal Clamshell Sealers, Ultrasonic Clamshell Sealers, Radio Frequency (RF) Clamshell Sealers |

| By Packaging Material | PET (Polyethylene Terephthalate), PVC (Polyvinyl Chloride), PP (Polypropylene), PLA (Polylactic Acid), Paperboard-Based Clamshells |

| By Application | Food Packaging, Pharmaceutical and Medical Packaging, Consumer Electronics Packaging, Cosmetics and Personal Care Packaging, Industrial Goods Packaging |

| By End-Use Industry | Food and Beverage, Pharmaceuticals and Healthcare, Electronics, Retail and Supermarkets, Cosmetics and Personal Care |

| Key Companies Profiled | Starview Packaging Machinery, Visual Packaging Machinery, Sonics & Materials, Inc., Rocket Machine Works, Panic Plastics, Professional Packaging Systems, Inc., PAC Machinery, Belco Packaging Systems, Zed Industries, Inc., Algus Packaging, Inc. |

| Additional Attributes | Fully automatic clamshell sealers dominate due to high throughput and precision, rising demand for ultrasonic and RF sealing for secure and eco-friendly packaging, strong uptake in food, pharma, and electronics applications, and growing adoption of PLA and paperboard-based clamshells supporting sustainability initiatives. Retail and supermarkets drive brand visibility through tamper-evident, transparent clamshell packaging formats. |

The global clamshell sealer market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the clamshell sealer market is projected to reach USD 4.2 billion by 2035.

The clamshell sealer market is expected to grow at a CAGR of 4.9% between 2025 and 2035.

The key machine types in the clamshell sealer market include manual clamshell sealers, semi-automatic clamshell sealers, and fully automatic clamshell sealers.

The fully automatic clamshell sealers segment is expected to account for the highest share of 44.7% in the clamshell sealer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights of Clamshell Packaging Providers

Clamshell Labelling Machines Market Growth - Trends & Forecast 2022 to 2032

Clamshell Packaging Market by Material Type & Application from 2024 to 2034

ESD Clamshell Market Size and Share Forecast Outlook 2025 to 2035

PET Clamshell Market

Food Clamshells Market Trends – Demand, Growth & Future Outlook 2025 to 2035

Stock Clamshell Packaging Market

Paperboard Clamshell Boxes Market

RF Sealer System Market Size and Share Forecast Outlook 2025 to 2035

Bag Sealer Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tray Sealer Machines Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Tray Sealer Machines

Side Sealer Machines Market

Drop Sealers Market

Carton Sealer Machine Market Size and Share Forecast Outlook 2025 to 2035

Bag Re-sealer Market Growth – Size, Trends & Forecast 2025 to 2035

Carton Sealer Market

Vacuum Sealer bags Market

Vacuum Sealer Market

Rotary Sealers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA