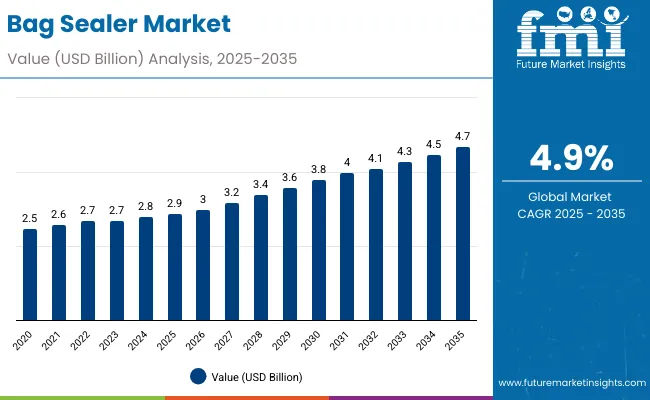

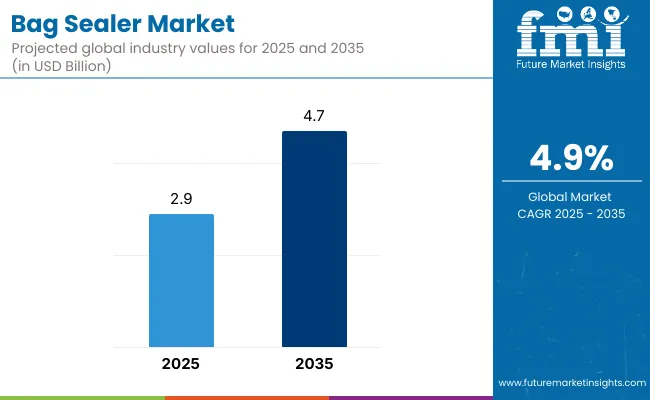

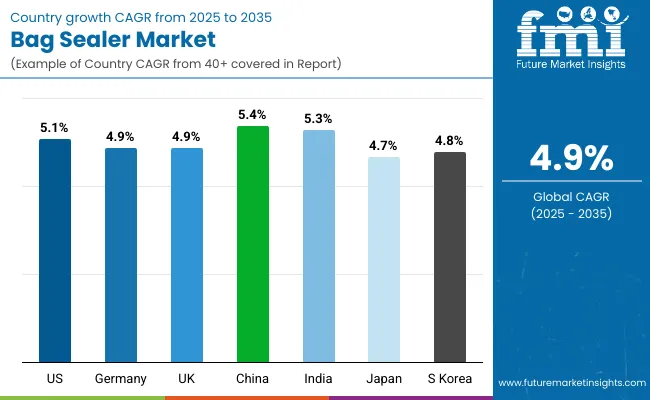

The bag sealer market is expected to grow from USD 2.9 billion in 2025 to USD 4.7 billion by 2035, resulting in a total increase of USD 1.8 billion over the forecast decade. This represents a 62.1% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 4.9%. Over ten years, the market grows by a 1.6 multiple.

| Metric | Value |

|---|---|

| Bag Sealer Market Estimated Value in (2025 E) | USD 2.9 billion |

| Bag Sealer Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

In the first five years (2025 to 2030), the market progresses from USD 2.9 billion to USD 3.6 billion, contributing USD 0.7 billion, or 38.9% of total decade growth. This phase is shaped by rising adoption in food and pharmaceutical packaging for extended shelf life and secure sealing. Growth is reinforced by semi-automatic and fully automatic sealers supporting higher efficiency.

In the second half (2030 to 2035), the market grows from USD 3.6 billion to USD 4.7 billion, adding USD 1.1 billion, or 61.1% of the total growth. This acceleration is supported by technological upgrades such as ultrasonic sealing, smart sensors, and energy-efficient designs. Expansion into e-commerce and industrial packaging further boosts demand, ensuring bag sealers remain integral to secure and reliable packaging operations.

From 2020 to 2024, the bag sealer market grew from USD 2.3 billion to USD 2.7 billion, supported by increasing packaging needs in food, pharmaceuticals, and e-commerce. Nearly 70% of revenue came from OEMs producing heat, impulse, and continuous band sealers tailored for diverse applications.

Leaders such as AudionElektro, PAC Machinery, and APM emphasized sealing precision, durability, and compatibility with multiple bag materials. Differentiation relied on sealing width, speed, and hygiene compliance, while IoT-enabled monitoring and predictive analytics remained secondary. Service-driven revenues from calibration and maintenance contracts represented under 18% of the total, with capital investments dominating procurement.

By 2035, the bag sealer market will reach USD 4.7 billion, growing at a CAGR of 4.90%, with automation-enabled and smart sealing systems accounting for over 40% of market value. Competitive intensity will rise as providers introduce eco-friendly sealing materials, AI-driven defect detection, and real-time traceability.

Established leaders are transitioning to hybrid models pairing equipment sales with SaaS-based quality optimization. Emerging companies such as OK International, Plexpack, and Packworld USA are gaining share by offering modular sealing platforms, recyclable-material compatibility, and energy-efficient sealing technologies that meet evolving sustainability demands across food, healthcare, and industrial packaging sectors.

The increasing demand for secure, airtight, and contamination-free packaging across food, pharmaceuticals, and consumer goods is driving growth in the bag sealer market. These machines extend product shelf life, ensure freshness, and enhance safety in distribution. Rising e-commerce and global trade activities are further accelerating adoption.

Advanced bag sealers with continuous band sealing, impulse sealing, and vacuum sealing technologies are gaining popularity for their ability to improve efficiency and reliability. Their compatibility with various packaging materials and adjustable sealing widths enhances versatility. Energy-efficient designs and integration with automated production lines align with sustainability and operational cost reduction goals.

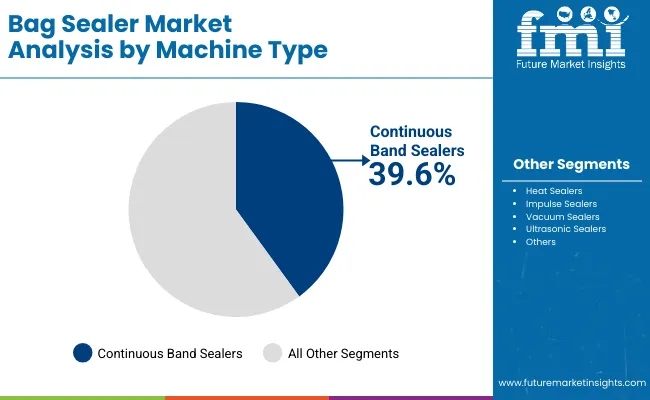

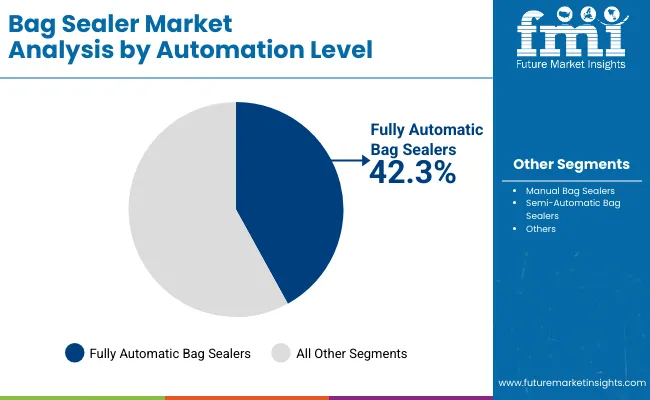

The market is segmented by machine type, automation level, sealing width, application, end-use industry, and region. Machine type segmentation includes heat sealers, impulse sealers, continuous band sealers, vacuum sealers, and ultrasonic sealers, ensuring efficiency across packaging formats. Automation level covers manual, semi-automatic, and fully automatic bag sealers, supporting both small-scale and high-volume operations. Sealing width segmentation includes up to 5 mm, 6 mm-10 mm, and above 10 mm, aligning with packaging durability and performance needs.

Applications include food packaging, pharmaceutical packaging, industrial packaging, consumer goods packaging, and agricultural products packaging, catering to multiple sectors. End-use industries include food and beverage, pharmaceuticals and healthcare, retail and e-commerce, chemicals, and agriculture. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Continuous band sealers are forecast to hold 39.6% of the market in 2025, as they enable uninterrupted sealing for large production volumes. These machines are valued for their ability to handle a wide range of bag materials and sizes, delivering consistent quality at scale. Their integration with conveyors supports automated packaging lines.

Adoption is driven by food and industrial packaging sectors requiring efficiency and durability. Features like adjustable temperature, digital controls, and embossing enhance flexibility. With growing demand for high-throughput sealing, continuous band sealers remain a leading choice for mid-to-large scale manufacturers.

Fully automatic machines are projected to account for 42.3% of the market in 2025, reflecting rising demand for labor-saving, precision-driven sealing systems. These machines streamline operations by automatically adjusting sealing pressure, temperature, and timing, ensuring reliable results.

Industries prefer them for large-scale, standardized packaging where efficiency and compliance are critical. Integration with coding, labeling, and inspection modules enhances their utility. As automation trends expand, fully automatic bag sealers dominate due to their ability to cut costs and improve throughput.

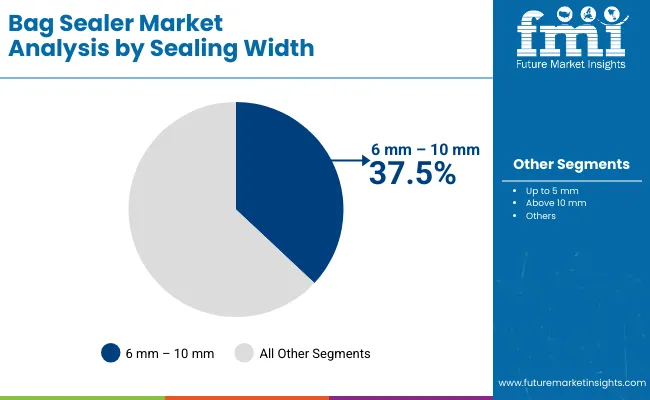

Sealers with 6 mm -10 mm widths are expected to represent 37.5% of the market in 2025, offering a strong yet flexible seal across diverse packaging needs. This width provides adequate strength for food, pharmaceutical, and industrial applications without excessive material use.

Their balance of durability and efficiency makes them a widely adopted standard. Adjustable machines that handle variable widths add to their appeal. With product safety and presentation both essential, this range continues to anchor bag sealer demand.

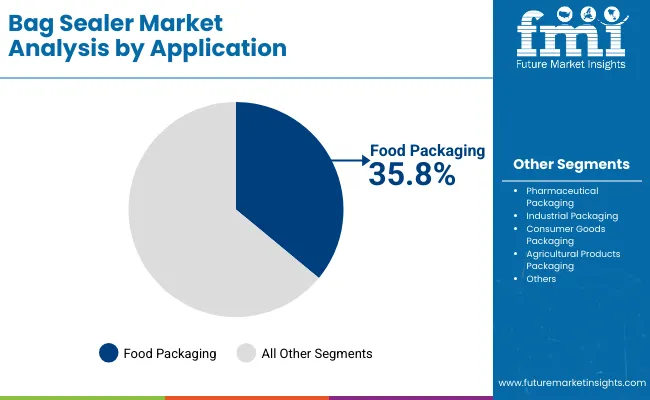

Food packaging is forecast to hold 35.8% of the market in 2025, as bag sealers play a critical role in preserving freshness, extending shelf life, and ensuring hygiene. Sealers accommodate a wide variety of formats, from snack pouches to frozen food bags.

The sector’s dominance is reinforced by rising packaged food consumption worldwide. Consumer preference for convenient, portion-controlled packs drives greater machine adoption. With regulatory emphasis on food safety, reliable sealing solutions remain indispensable in this application.

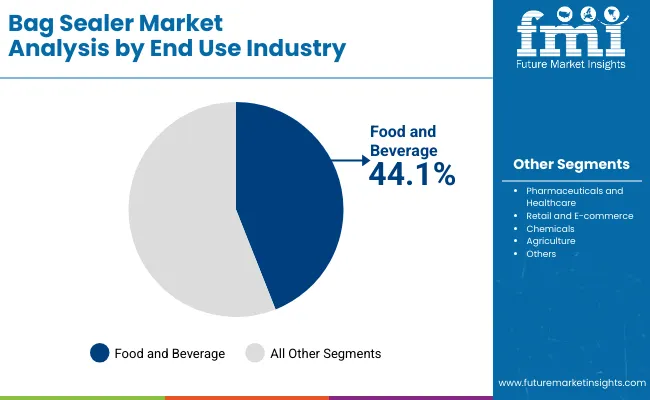

The food and beverage industry is projected to account for 44.1% of the market in 2025, reflecting its reliance on sealed packaging for safety, branding, and distribution. Bag sealers ensure airtight closure across dry goods, frozen foods, and beverages.

Adoption is supported by rapid growth in retail, e-commerce, and quick-service restaurants. Food manufacturers prefer versatile sealers compatible with high-barrier films and sustainable packaging. As global food trade expands, this industry continues to drive the largest share of market demand.

The bag sealer market is growing as demand increases for secure, tamper-evident packaging across food, pharmaceuticals, e-commerce, and industrial goods. Rising consumption of packaged foods and online retail shipments supports adoption. However, high maintenance costs and limited automation in low-end models restrain growth. Innovations in energy-efficient sealing, IoT-enabled monitoring, and sustainable material compatibility are defining future opportunities.

Product Protection, Extended Shelf Life, and E-commerce Growth Driving Adoption

Bag sealers are vital for ensuring airtight and tamper-proof packaging, preserving product freshness and safety. Food and beverage sectors rely on them to extend shelf life by reducing contamination risks. Pharmaceutical companies use sealers to meet strict compliance and safety requirements, while e-commerce and retail sectors value them for secure order fulfillment. Their role in consumer trust, brand protection, and efficient packaging makes them critical across industries.

High Maintenance Costs, Technical Limitations, and Market Fragmentation Restraining Growth

Market expansion faces barriers due to frequent maintenance needs of heating elements and sealing components, which raise operational costs. Technical limitations in low-cost models, such as inconsistent sealing quality, restrict adoption in high-volume operations. Smaller firms often struggle with the high upfront investment required for automated sealers. Additionally, the fragmented market landscape leads to quality inconsistencies across manufacturers. These restraints slow adoption, particularly in resource-constrained regions.

Automation, Smart Features, and Sustainable Packaging Trends Emerging

Key trends include the development of automated bag sealers that reduce manual labor and enhance speed in high-throughput operations. Smart sealers with IoT-enabled controls now offer real-time monitoring, predictive maintenance, and data analytics for quality assurance. Compatibility with recyclable and biodegradable films is becoming a focus, aligning with sustainability goals. Compact, portable sealers are also gaining popularity in small-scale retail and household use. These advancements are positioning bag sealers as adaptable, sustainable, and efficiency-driven packaging tools.

The global bag sealer market is expanding consistently, fueled by demand in food, pharmaceuticals, e-commerce, and retail sectors where secure and tamper-proof packaging is critical. Asia-Pacific is emerging as a high-growth hub, with China and India leading adoption due to growing processed food consumption and rising export activity. Developed economies such as the USA, Germany, and Japan are focusing on automation-ready sealers, energy-efficient systems, and eco-friendly film compatibility, ensuring safety, durability, and compliance with sustainability and regulatory packaging requirements.

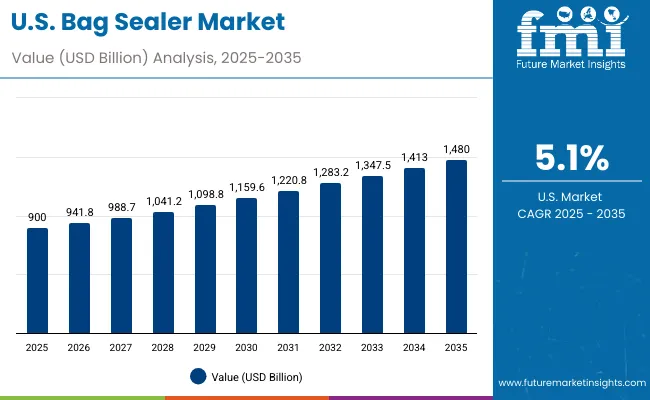

The USA market is projected to grow at a CAGR of 5.1% from 2025 to 2035, supported by strong adoption in food, healthcare, and e-commerce packaging. Automation is driving demand for high-speed impulse and continuous band sealers. Manufacturers are investing in smart sealers with IoT integration, enabling real-time monitoring and quality control. The growing focus on eco-friendly packaging films is also shaping innovations in USA bag sealing technology for improved efficiency and compliance.

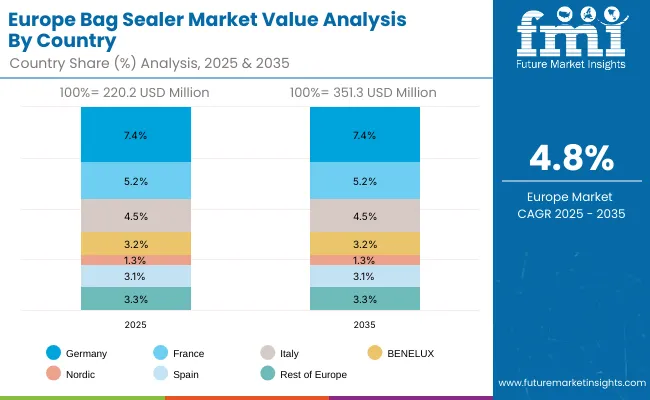

Germany’s market is expected to grow at a CAGR of 4.9%, supported by strict EU sustainability mandates and demand from food and chemical industries. Companies are adopting advanced bag sealers compatible with recyclable and biodegradable films. German OEMs are emphasizing energy-efficient sealing systems integrated with predictive maintenance features. Strong demand is also emerging from pharmaceutical and industrial goods packaging, reinforcing Germany’s position as a hub for precision-engineered sealing solutions.

The UK market is forecast to grow at a CAGR of 4.9%, driven by growth in FMCG, pharmaceuticals, and retail. Rising demand for convenience packaging and compliance with waste reduction mandates are accelerating adoption. SMEs and startups are increasingly investing in compact, cost-effective sealing systems. With e-commerce expansion, automated sealers designed for high-volume operations are becoming more critical to maintaining efficiency and packaging integrity.

China’s market is projected to grow at a CAGR of 5.4%, fueled by large-scale food processing, e-commerce, and pharmaceutical industries. Domestic manufacturers are producing cost-effective sealers with automation and smart features for mass adoption. Government support for packaging modernization and export activity is accelerating growth. Cold chain logistics and online food retail are further boosting demand for reliable sealing solutions, positioning China as a leading market in the bag sealer industry.

India is forecast to grow at a CAGR of 5.3%, supported by rising demand in FMCG, agriculture, and pharmaceuticals. Affordable, versatile sealing systems are in demand among SMEs, while large firms invest in fully automated, high-capacity machines. Government food safety initiatives and rising exports are also reinforcing growth. Bag sealers are playing a vital role in preventing spoilage, ensuring hygiene, and supporting compliance with global packaging regulations in India’s export-driven economy.

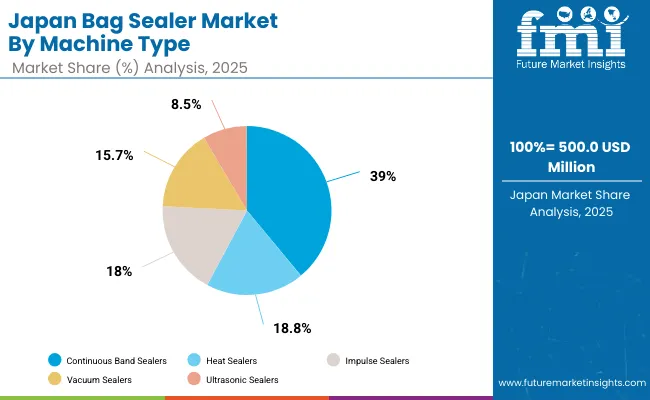

Japan’s market is projected to grow at a CAGR of 4.7%, driven by demand in electronics, pharmaceuticals, and high-quality food packaging. Compact, high-precision sealers are preferred to meet space constraints and rigorous safety standards. Manufacturers are focusing on automation-ready machines compatible with recyclable and bio-based films. Japan’s emphasis on innovation and sustainability is pushing demand for advanced sealing solutions that ensure durability, product integrity, and compliance with global packaging norms.

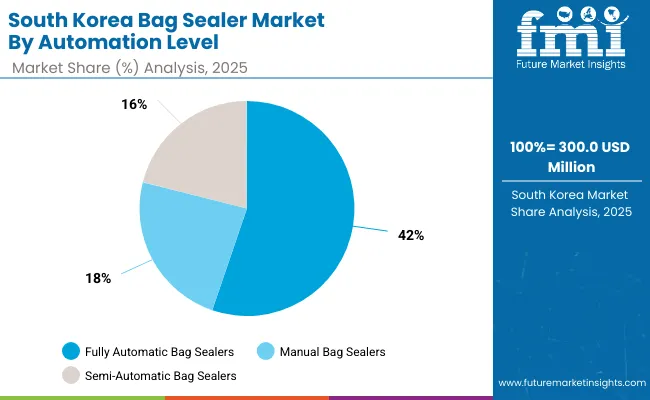

South Korea’s market is expected to grow at a CAGR of 4.8%, supported by adoption in cosmetics, pharmaceuticals, and seafood industries. Export-driven growth in K-beauty and processed foods is accelerating demand for secure, reliable bag sealing systems. Manufacturers are developing automation-ready sealers with high precision and eco-friendly film compatibility. Increasing exports and strong domestic retail packaging trends are reinforcing demand for efficient, sustainable bag sealer technologies in South Korea.

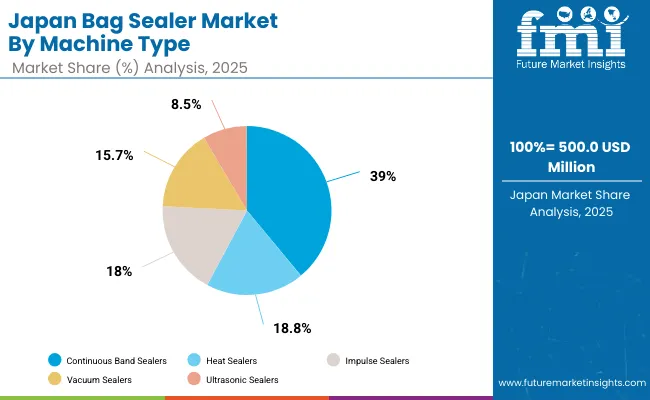

Japan’s bag sealer market, valued at USD 500 million in 2025, is dominated by continuous band sealers, which hold 40.4% share owing to their efficiency and reliability in high-speed packaging. Heat sealers account for 19.3%, impulse sealers 16.9%, vacuum sealers 14.7%, and ultrasonic sealers 8.7%. Continuous band sealers lead due to their versatility in food and consumer goods applications. Heat and impulse sealers remain popular in small and medium-scale operations. Vacuum sealers are essential for perishable packaging, while ultrasonic sealers, though smaller, are rising with eco-friendly demand. This distribution highlights Japan’s diverse packaging needs and focus on efficiency.

South Korea’s bag sealer market in 2025, worth USD 300 million, is led by fully automatic sealers, capturing 43.7% share, driven by automation in food, pharmaceuticals, and retail packaging. Manual bag sealers follow with 17.2%, reflecting their continued use in small businesses and cost-conscious operations. Semi-automatic bag sealers account for 16.9%, serving mid-scale facilities. The dominance of fully automatic sealers reflects South Korea’s focus on modernizing packaging lines to improve productivity and meet regulatory standards. Manual and semi-automatic options remain important in niche sectors where flexibility, affordability, and lower production volumes guide equipment choice, balancing advanced and traditional adoption.

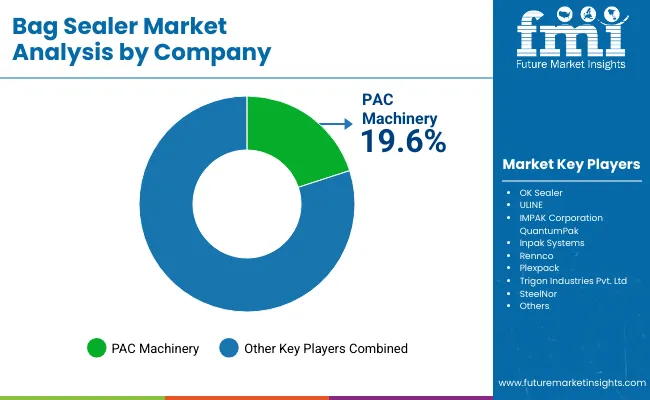

The bag sealer market is moderately fragmented, with global packaging machinery providers, regional equipment manufacturers, and automation specialists competing across food, pharmaceutical, chemical, and retail sectors. Global leaders such as PAC Machinery, OK Sealer, and ULINE hold notable market share, driven by continuous band sealers, impulse sealing systems, and compliance with international packaging standards. Their strategies increasingly emphasize speed, seal integrity, and adaptability across diverse packaging substrates.

Established mid-sized players including IMPAK Corporation, QuantumPak, and Inpak Systems are supporting adoption of advanced sealing systems featuring temperature precision, automatic conveyor integration, and customizable sealing widths. These companies are especially active in high-volume packaging environments, offering versatile sealing options, reduced downtime, and reliable solutions for industrial and consumer product packaging.

Specialized providers such as Rennco, Plexpack, Trigon Industries Pvt. Ltd, and SteelNor focus on tailored sealing solutions for regional markets and niche industries. Their strengths lie in compact and modular designs, energy-efficient sealing technology, and integration with downstream packaging lines, enabling businesses to achieve cost-effective operations, enhanced sealing performance, and compliance with evolving sustainability requirements.

Key Development

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| By Machine Type | Heat Sealers, Impulse Sealers, Continuous Band Sealers, Vacuum Sealers, Ultrasonic Sealers |

| By Automation Level | Manual Bag Sealers, Semi-Automatic Bag Sealers, Fully Automatic Bag Sealers |

| By Sealing Width | Up to 5 mm, 6 mm - 10 mm, Above 10 mm |

| By Application | Food Packaging, Pharmaceutical Packaging, Industrial Packaging, Consumer Goods Packaging, Agricultural Products Packaging |

| By End-Use Industry | Food and Beverage, Pharmaceuticals and Healthcare, Retail and E-commerce, Chemicals, Agriculture |

| Key Companies Profiled | PAC Machinery, OK Sealer, ULINE, IMPAK Corporation, QuantumPak, Inpak Systems, Rennco, Plexpack, Trigon Industries Pvt. Ltd, SteelNor |

| Additional Attributes | Rising demand for continuous band and vacuum sealers in high-throughput food and pharma packaging, increasing adoption of ultrasonic sealers for precision and energy efficiency, growing role of fully automatic machines in e-commerce fulfillment, agricultural sector driving use of durable sealers for bulk packaging, and emphasis on packaging consistency and tamper-resistance supporting market expansion globally. |

The global bag sealer market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the bag sealer market is projected to reach USD 4.7 billion by 2035.

The bag sealer market is expected to grow at a CAGR of 4.9% between 2025 and 2035.

The key automation levels in the bag sealer market include manual bag sealers, semi-automatic bag sealers, and fully automatic bag sealers.

The fully automatic bag sealers segment is projected to account for the highest share of 41.2% in the bag sealer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bag Re-sealer Market Growth – Size, Trends & Forecast 2025 to 2035

Blood Bag Tube Sealer Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Sealer bags Market

Tamper Evident Bag Sealers Market

Bagasse Tableware Products Market Size and Share Forecast Outlook 2025 to 2035

Bag Closure Clips Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-box Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bag Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Bag Closures Market Size and Share Forecast Outlook 2025 to 2035

Bag On Valve Product Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bagging Machine Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-Bottle Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Disposable Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Bowls Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-Box Filler Market Insights - Growth & Forecast 2025 to 2035

Bag Market Insights - Growth & Demand 2025 to 2035

Bag Clips Market Insights – Demand, Trends & Forecast 2025 to 2035

Baggage Scanner Market Growth, Trends & Forecast 2025 to 2035

Competitive Landscape of Bag-in-Tube Market Share

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA