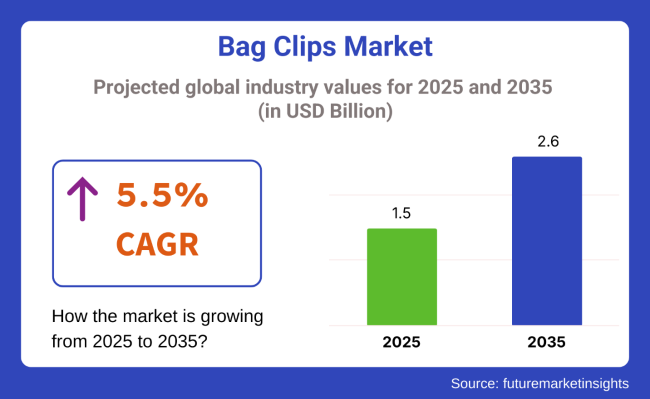

The bag clips market is projected to grow from USD 1.5 billion in 2025 to USD 2.6 billion by 2035, registering a CAGR of 5.5% during the forecast period. Sales in 2024 reached USD 1.4 billion, underscoring the sector's resilience and growing demand across food packaging, household storage, and retail industries

This growth is attributed to the increasing need for handy, reusable, and sustainable sealing products that ensure product freshness and reduce waste.In September 2024, - Kwik Lok, the global leader in bag closures, is excited to announce a strategic partnership with Trustwell, a food industry technology pioneer and comprehensive traceability solutions provider.

This collaboration will provide customers with a comprehensive suite of tools to ensure product safety, regulatory compliance for FSMA and Sunrise 2027, and consumer trust along with unprecedented opportunity for marketing and branding.

"We are thrilled to partner with Trustwell to deliver enhanced value to our customers," said Chris Latta, New Business Development Director at Kwik Lok. "Together, we can provide a comprehensive solution that addresses the critical needs of the food industry in a cost-effective way that build consumer trust"

The shift towards sustainable and eco-friendly packaging solutions is influencing the bag clips market. Manufacturers are focusing on developing clips that are biodegradable, recyclable, and made from renewable resources.

Innovations include the integration of tamper-evident features, easy-open designs, and the use of bioplastics to reduce environmental impact. These advancements align with global sustainability goals and regulatory requirements, making bag clips an attractive option for environmentally conscious consumers.

The bag clips market is poised for significant growth, driven by increasing demand in food packaging, household storage, and retail industries. Companies investing in sustainable materials, innovative designs, and eco-friendly production processes are expected to gain a competitive edge.

As global awareness of environmental issues intensifies and consumer preferences shift towards reusable and sustainable products, the adoption of bag clips is anticipated to rise, offering cost-effective and eco-friendly sealing solutions.

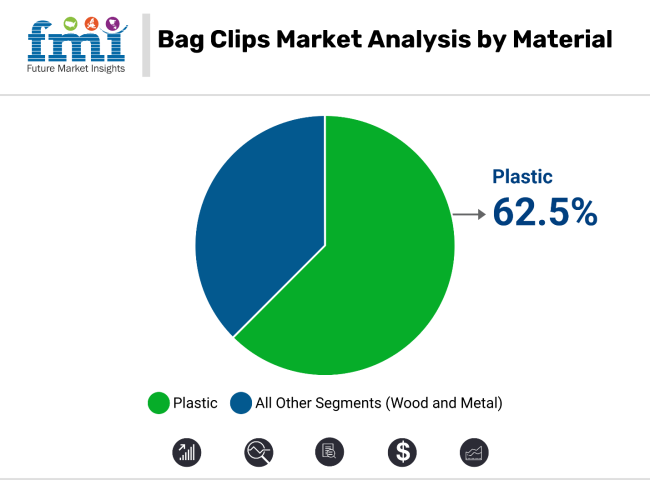

Plastic is projected to lead the material segment in the bag clips market with an estimated 62.5% market share by 2025, due to its versatility, low manufacturing cost, and adaptability across various consumer applications. Predominantly made from polypropylene (PP) and polyethylene (PE), plastic bag clips are widely used for resealing snack bags, frozen food packs, pet food, and other household items requiring short-term airtight closure.

Plastic bag clips are lightweight, durable, and easy to mold into ergonomic shapes, allowing for innovations such as spring-loaded mechanisms, locking hinges, or fold-over designs. Their ease of mass production also supports a wide array of colors, branding elements, and custom sizes, making them appealing for both functional use and promotional merchandising.

In retail environments, plastic clips are frequently bundled with food storage products or offered as multipacks, increasing accessibility for consumers. Many variants are now BPA-free and made with recycled plastic, aligning with growing environmental expectations.

With the continued rise in single-serve and resalable food packaging, plastic bag clips remain a dominant player due to their combination of convenience, affordability, and consumer familiarity sustaining their leadership in both domestic and commercial settings.

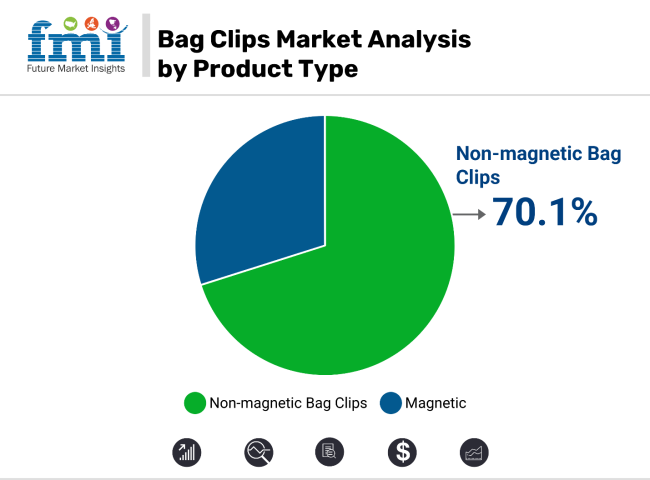

Non-magnetic bag clips are expected to command the largest share of the product type segment in the bag clips market, holding an estimated 70.1% market share in 2025, driven by their simplicity, affordability, and widespread application across household, office, and retail environments. Unlike magnetic clips that require a metallic surface to function optimally, non-magnetic clips offer universal utility and can be used in pantries, freezers, and cupboards without constraints.

These clips come in a variety of forms including hinge clips, Snap-On styles, and foldable grips allowing them to cater to multiple packaging types and sizes. Their design eliminates the risk of magnet degradation or detachment, which is a concern in high-moisture environments such as refrigerators or outdoors.

Non-magnetic clips are particularly favored in foodservice, travel, and storage applications due to their secure grip, reusability, and lightweight structure. Most are dishwasher-safe and ergonomically designed for quick sealing and opening, making them ideal for everyday use.

As consumer preferences lean toward multipurpose, low-maintenance accessories that enhance food freshness and organization, non-magnetic bag clips continue to dominate the segment. Their utility-focused design, low cost, and compatibility with all storage scenarios ensure enduring popularity across global households.

Challenge

Competition from Alternative Storage Solutions

Bag Clips Market to See High Competition Entailing in Low Growth and Adding to the Challenges for Overall Market Dynamics the bag clips market has witnessed augmented growth due to the growth in food manufacturing and consumer spending on packaged and branded edible products. This growth in the bag clips market, however, does not come without the looming threat of competition.

There are many alternative food storage solutions that are convenient solutions for people, they range from resealable plastic bags to airtight containers and vacuum-sealed packaging. Due to their durability, superior sealing function, and kitchen organization, many consumers preferred these alternatives. Moreover, growing environmental concerns about plastic waste also contributed to a stronger move toward reusable and eco-friendly storage solutions.

In order to stay competitive in the evolving market and attract environmentally conscious consumers, manufacturers need to innovate by developing sustainable and biodegradable bag clips that are made with recyclable materials and smart-sealing technologies.

Variability in Material Quality and Durability

The consistency of material quality and product durability remains one of the major restraints in the Bag clips market affecting consumer satisfaction and brand image. Many bag clips are made from cheap plastic, which break easily, causing wasted product & costly, repeat purchases.

Differences in material standards and suppliers across manufacturers also create uncertainty in product reliability which is why consumers are unable to trust brands. One of the points that needs to be addressed is improving material quality with reinforced plastic compounds, more durable and eco-friendly materials, and better quality control so that the products last longer and are more sustainable.

Opportunity

Growing Demand for Eco-Friendly and Sustainable Products

As environmental sustainability gains prominence, more consumers are looking for eco-friendly options that substitute single-use plastic products and lessen environmental footprint. Biodegradable, compostable, and recycled-material bag clips are rising in demand with government regulations promoting sustainable options.

Common Practices That Are Great Will Now be Priority Sustainable Material Investment bamboo, stainless steel, recycled plastics, etc. You are among the different kinds of businesspersons upon which reusability and multifunction can become an assetabilidad of bag clip if you enlarge your product range with aesthetically pleasing adjustable and reusable bag clips, which will help to engage environmentally-conscious end-users to used product again and again and they would like to become a brand ambassador for your product.

Expansion into New Market Segments

Growth opportunities exist for the Bag clips market with expansion into segments adjacent to household food storage market segments, increasing product versatility and breaking barriers and broadening market reach. Effective sealing solutions, such as those offered by Isolated Seal & Packaging, are crucial for industries including pet food packaging, office supplies, travel accessories, and industrial packaging that demand product freshness and quality.

Corporate clients seeking creative marketing solutions may also be drawn to customized and promotional bag clips as branding opportunities. By providing professional designs, heat-resistant materials, and ergonomic features, these companies are adding to their portfolios thanks to its diverse set of offerings, which will not only unlock new revenue streams but will also help to fill gaps in the market.

Trends here is an example of a market trend for Bag clips market for the period of 2020 to 2024 and Future Forecast(2025 to 2035).Bag clips market as key type of the market was the consistent growth between 2020 and 2024, due to increasing consumer demand for food preservation solutions, innovations in material design, and growing awareness of sustainability.

Challenges included competition from alternative storage methods, fluctuations in raw material prices, and disruptions in supply chains. How do companies respond - they better design products, create multi-function bag clips, make use of environmentally friendly materials for eco-conscious consumers. These new features, combined with larger grips, comfortable handles and stylish appearances, encouraged further consumer uptake and expanded their uses beyond just food storage.

Bag clips worldwide The United States leads the Bag clips market owing to robust consumer goods industry, rising demand for kitchen accessories and increasing preference for reusable household products. The stuffing of innovative bag clips and market penetration of major manufacturers and retailers propel the growth of the market.

Increasing awareness regarding food storage solutions, developments of durable materials, and green alternatives also work for the market growth. Smart bag clips come equipped with freshness indicators, airtight sealing mechanism, and other features boosting adoption and consumption in households and commercial kitchens.

Business have also turned their attention to creating sustainable earnings to appeal to environmentally minded consumers, with biodegradable clips and options to design one's own eina. In the USA and elsewhere, the increasing popularity of bulk grocery shopping and meal prepping drives demand for reliable, reusable bag-sealing solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.8% |

The United Kingdom accounts for a significant share of the bag clips market due to growing consumer focus towards sustainable food storage solution and kitchen organization tools in the country. This growing trend of zero waste household also drives demand for reusable bag clips. Market growth is supported by government measures for reducing plastic usage, and the increasing inclination towards biodegradable and recyclable products.

Additionally, innovative multi-functional bag clips with superior sealing capabilities and convenient operation systems are trending. The majority of companies are also defining ergonomic designs, multi-use functionalities, and branding options for promotional merchandise, which is expected to boost market potential. The rising trend of baking out of home, and all types of meals and cooking made at home are propelling the need for the high-quality bag clips to maintain the freshness of its ingredients for long.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.3% |

Germany, France, and Italy dominate the European bag clips market, driven by the strong retail sector, and rising adoption of eco-friendly storage products and sustainable packaging accessories. The drive against single-use plastic in the European Union (EU), combined with regulatory pressures relating to packaging waste results in rapid market growth in the EU.

Moreover, the growing popularity of food delivery services and meal-prep culture has driven the demand for high-quality bag clips that help preserve freshness of food. Manufacturers are also expanding their product offering with heat-resistant and dishwasher-safe clips for both household and commercial use. The latest & innovative product development of bag clips in the EU is further driven by the growing demand of reusable food storage bags and airtight sealing solutions across the region.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.4% |

This is your key to answering the question on whether or not Japan has a Bag clips market. The growing demand for high-quality kitchen tools and food storage solutions that take up less space is fueling the demand in the market. With the need for technological improvements in the country along with its integration with antimicrobial materials, vacuum-sealing features, and compact constructs are aiding the innovation.

Furthermore, high consumer preference toward aesthetic, functional and sustainable home accessories are thrusting companies to manufacture designer, premium bag clips for high-end market. Smart bag clips that keep track of food freshness and tracking features are gaining traction too. With the increasing demand for convenience store culture and packaged food consumption, the need for efficient bag-sealing solutions in Japanese households is further on the rise.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

South Korea is anticipated to witness significant growth in the bag clips market, owing to innovative consumer goods sector, its urban population density, and demand for space-efficient kitchen storage solutions. Government policies that drive the use of greener packaging substitutes and growing use of reusable home accessories are anticipated to encourage market growth.

And with the emphasis in the domestic economy on smart home integration, advanced bag clips that maximize airtightness, monitor freshness, and connect to mobile apps have been created. The proliferation of home organization trends on social media platforms is also driving demand for stylish, ergonomic, and multi-purpose bag clips. The growing use of internet grocery shopping and food delivery businesses in South Korea is also increasing the demand for advanced storage and sealing solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.7% |

IKEA (18-22%)

IKEA holds a leading position in the Bag clips market due to its wide reach to consumers across the globe, economical, ergonomic, and sustainable designs.

Progressive International (14-18%)

For kitchen and household applications, Progressive International specializes in multipurpose bag clips featuring durable construction and strong locking mechanisms.

OXO (Helen of Troy Limited) (11-15%)

Combining smart design, easy-to-grip handles and clever storage options, OXO's bag clips are really practical.

Ziploc (SC Johnson) (8-12%)

The bags have heat-sealed seams for an airtight closure and are part of the Ziploc kingdom of storage products, as they are all about freshness while keeping it simple.

Kuhn Rikon (6-10%)

Kuhn Rikon have stylish, high-performance bag clips with advanced sealing technology, aimed at premium kitchen accessory users.

Other Key Players (35-45% Combined)

The bag clip solutions offered by various regional and global manufacturers focus mainly on sustainable materials, economical pricing, and ease of use. Key players include:

The overall market size for Bag clips market was USD 1.5 Billion in 2025.

The Bag clips market expected to reach USD 2.6 Billion in 2035.

The bag clips market is expected to be driven by rising demand for food storage solutions, an increase in consumer preference towards reusable and eco-friendly products, growing adoption in retail and commercial packaging, and increased e-commerce sales of household convenience products.

The top 5 countries which drives the development of Bag clips market are USA, UK, Europe Union, Japan and South Korea.

Magnetic and Non-Magnetic clips growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Size, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Size, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Size, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Size, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Size, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Material, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Size, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Material, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Size, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Material, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Size, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Size, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 26: Global Market Attractiveness by Material, 2023 to 2033

Figure 27: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Size, 2023 to 2033

Figure 29: Global Market Attractiveness by End Use, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Size, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 56: North America Market Attractiveness by Material, 2023 to 2033

Figure 57: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Size, 2023 to 2033

Figure 59: North America Market Attractiveness by End Use, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Size, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Size, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Size, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Material, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Size, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Size, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Material, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Size, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Size, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Material, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Size, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Material, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Size, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Size, 2023 to 2033

Figure 209: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Material, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Size, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Material, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Size, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bag Closure Clips Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Bag Closure Clip Providers

Bagasse Tableware Products Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-box Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bag Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Bag Closures Market Size and Share Forecast Outlook 2025 to 2035

Bag On Valve Product Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bag Sealer Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bagging Machine Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-Bottle Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Disposable Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Bowls Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-Box Filler Market Insights - Growth & Forecast 2025 to 2035

Bag Market Insights - Growth & Demand 2025 to 2035

Baggage Scanner Market Growth, Trends & Forecast 2025 to 2035

Bag Re-sealer Market Growth – Size, Trends & Forecast 2025 to 2035

Competitive Landscape of Bag-in-Tube Market Share

Market Share Breakdown of Bag-In-Box Manufacturers

Examining Market Share Trends in Bagasse Disposable Cutlery

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA