The global baggage scanner market is expected to experience steady growth over the next decade, driven by increasing security concerns, rising air travel volumes, and the adoption of advanced scanning technologies at airports, railway stations, and border checkpoints.

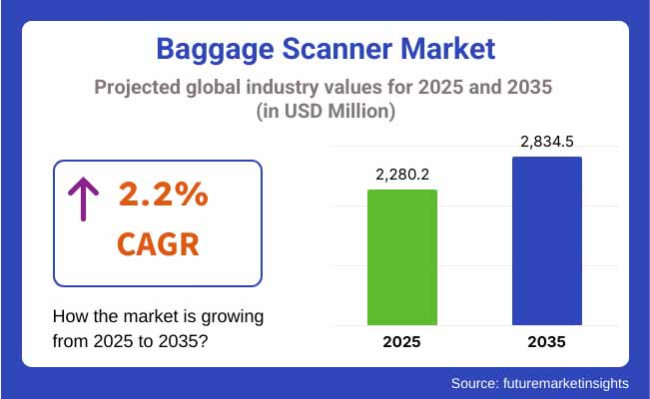

Baggage scanners play a crucial role in ensuring passenger safety and protecting critical infrastructure by detecting contraband, explosives, and other potential threats in luggage and cargo. In 2025, the global baggage scanner market is estimated at approximately USD 2,280.2 million. By 2035, it is projected to grow to around USD 2,834.5 Million, reflecting a compound annual growth rate (CAGR) of 2.2%.

Advancements in imaging technology, such as X-ray and mobile computed tomography (CT) scanners, are enabling faster, more accurate screening processes. While the market growth is somewhat tempered by high initial costs and lengthy replacement cycles, ongoing investments in infrastructure security and the development of more efficient, user-friendly scanning systems are expected to support consistent demand through 2035.

North America is another segmentation of the baggage scanners market. Stringent security regulations, high air travel volumes, and continuous investments in airport infrastructure support North America as a key market for baggage scanners. The USA is a primary contributor here, due in part to the TSA continuing to find ways to use screening more efficiently and to maximize passenger throughput.

The Europe region is another prominent market with established aviation, regulatory requirements, and a shift toward modernizing security. Germany, the United Kingdom and France are among the countries that have been early adopters of next-generation baggage scanners in their airports and public transit stations.

The Asia-Pacific region holds the highest compound annual growth rate (CAGR) among the baggage scanners market due to the rapid urbanization of countries, improved transportation infrastructure, and growing demand for air travel. Countries like China, Japan and India are deploying billions on new airports, high-speed rail networks, and border security, all of which are creating demand for scanning equipment.

Challenges

High Initial Costs, Regulatory Variability, and Privacy Concerns

Some of the restraints in the baggage scanner market include high initial costs of installation, maintenance and integration, particularly for airport security checkpoints, rail terminals, customs and large locations. The scanners generally utilize sophisticated imaging technology (X-ray, CT, or AI-powered systems), which requires heavy capital.

Another major challenge across terrains is how regulatory standards vary from place to place, causing issues of interoperability and equipment certification, consequently stunting global adoption. Moreover, these new technologies based on advanced 3D imaging and booking or biometric-linked scanning have raised significant data protection and privacy concerns, especially in places with stringent data governance, such as the GDPR, making it confusing for end-users to trust and comply.

Opportunities

Aviation Growth, AI Integration, and Smart Border Security Initiatives

Despite these hindrances, the baggage scanner market's potential remains excellent, with robust growth anticipated due to factors such as the growth of worldwide air travel, the increasing number of logistics hubs, and a growing focus on smart and contactless security solutions. It is expected that passenger traffic and cargo movement will see high growth, especially in Asia-Pacific and the Middle East, thus leading to large investments in airports and the modernization of border control.

AI-driven object recognition, automated threat detection, and real-time data analytics are transforming scanner efficiency, speed, and accuracy. Moreover, increasing concerns regarding smuggling, terrorism, and drug trafficking are creating demand for next-generation scanners at customs, defense checkpoints, and government buildings, thus creating new vertical markets.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with TSA, ECAC, IATA, and national aviation security standards. |

| Consumer Trends | Focus on non-invasive, faster screening at airports and transport terminals. |

| Industry Adoption | Airports, metros, and government institutions led hardware-based upgrades. |

| Supply Chain and Sourcing | Dependence on precision imaging components, electronics, and AI software licenses. |

| Market Competition | Dominated by Smiths Detection, Leidos, Rapiscan Systems, Nuctech, and Astrophysics Inc. |

| Market Growth Drivers | Demand driven by terrorism threats, smuggling prevention, and rising passenger traffic. |

| Sustainability and Environmental Impact | Minimal focus on eco-efficiency and power optimization. |

| Integration of Smart Technologies | Introduction of dual-view imaging, object classification, and remote access diagnostics. |

| Advancements in Scanning Technology | Use of X-ray, CT, and dual-energy scanners with basic threat algorithms. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Unified global regulations for AI-enabled baggage scanning, cybersecurity protocols, and privacy mandates. |

| Consumer Trends | Growth in touchless, AI-powered scanning with integrated passenger identity verification. |

| Industry Adoption | Shift toward platform-as-a-service (PaaS) for scanning infrastructure, data analytics, and predictive security. |

| Supply Chain and Sourcing | Movement toward modular, upgradable scanner systems and local component sourcing for supply chain resilience. |

| Market Competition | Entry of AI and cybersecurity-focused scanner startups, platform integrators, and digital twin providers. |

| Market Growth Drivers | Accelerated by automated border control, smart city security, and real-time risk profiling capabilities. |

| Sustainability and Environmental Impact | Shift toward low-power, recyclable scanner builds and green procurement policies in airports. |

| Integration of Smart Technologies | Expansion into quantum-enhanced detection, AI fusion with facial biometrics, and blockchain-based data trails. |

| Advancements in Scanning Technology | Transition to AI-enhanced 4D scanners, automatic liquid and explosive detection, and smart conveyor systems. |

The USA baggage scanner market is growing at a steady pace due to increased investment in airport security infrastructure, modernization in transportation hubs, and a surge in the adoption of AI-powered and 3D imaging scanners. Increasing need for rapid, precise & automated threat detection systems in various public and private sectors will further boost the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 2.3% |

The baggage scanner market in the United Kingdom is growing as a result of constant modernization at major airports, rail stations, and government buildings as well as regulatory obligations for cutting-edge screening technologies. The introduction of CT-based and remote screening solutions is improving security efficiency and throughput, particularly in busy areas.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.1% |

The baggage scanner market throughout the European Union is fueled by strict aviation safety regulations, cross-border security efforts, and the adoption of next-generation scanners combined with AI and automatic threat recognition (ATR). Moreover, smart city development and infrastructure protection projects are propelling the demand for improved baggage screening.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 2.2% |

Growing technological advancements regarding security, increasing emphasis on safety in public events, and consistent investments in transport hubs' modernization. There is also growing momentum toward the use of compact high-resolution scanners, including for subways and commercial centers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.1% |

Niche industries, including advanced passenger screening and border security and inspection systems, are seeing growth in South Korea due to technological advancements in 3D scanning and AI-enabled detection systems, coupled with the country’s focus on smart airport initiatives and integrated transportation security. Market growth is also supported by the growing utilization of baggage scanners in logistics, customs, and cargo industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 2.3% |

The baggage scanner market is on a steady rise because the needs for high-speed security screening solutions are rising in industries such as aviation, border security, transit hubs, and other commercial complexes.

As terrorism, smuggling, and the international movement of contraband continue to be top-of-mind, both governments and private facility operators are turning to greater investment in automated baggage inspection systems that meet high requirements of speed, accuracy, and threat detection capability. The market is segmented by Product Type (X-ray Scanners, Vacuum Systems, RFID) and End Use (Transit Stations, Border Checkpoints, Airports, Commercial Facilities, Others).

| Product Type | Market Share (2025) |

|---|---|

| X-ray Scanners | 62.8% |

The baggage scanners market is mainly dominated by the X-ray scanners segment, which is expected to account for 62.8% of the total market share in 2025. Thanks to their high-resolution imaging system, rapid scan time, and advanced object recognition features, these scanners continue to be the most widely used technology around public infrastructure. They play a critical role in identifying weapons, explosives, drugs, and illicit goods, while also reducing the time taken for examination.

One more crucial type of X-ray baggage scanners is temporarily installed and widely used in places such as airports, border crossings, and railway stations, as well as large venues, where modern systems integrate dual-view or 3D tomography imaging and AI-assisted threat detection. Their scalability and compliance with carry-on and checked baggage inspection make them the worldwide choice for high-security and high-traffic areas.

| End Use | Market Share (2025) |

|---|---|

| Airports | 49.3% |

Among end uses, the airport segment accounts for more than half of the market share in the global baggage scanners market and is expected to reach 49.3% by 2025. As global aviation infrastructure continues to grow and air travel rebounds in a post-pandemic world, airports around the world are making more investments in next-generation screening systems that provide both passenger and operational safety.

Security regulations governed by organizations like the TSA, ICAO, and EASA require strict baggage inspection standards, resulting in a massive rollout of automated, high-speed, low-false-alarm scanners. However, airport-specific requirements, such as the integration with conveyor belts, biometrics and remote monitoring, is pushing for more intelligent and networked screening systems.

With airport passenger volumes on the upswing and likely to remain so, the need for scalable and efficient baggage screening will help drive this segment.

Demand for baggage scanners is on the rise, owing to increasing investment in aviation security infrastructure, the need for advanced threat detection capabilities, and the adoption of AI-based screening technology. With growing requirements by airports, rail terminals, border security, and larger venues, modern scanners now have 3D CT imaging, lane integrators, and dual-energy detection capabilities. Market strategies are still being guided by regulatory mandates and the recovery of global travel.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Smiths Detection (Smiths Group) | 22-26% |

| Leidos Holdings, Inc. | 18-22% |

| OSI Systems, Inc. (Rapiscan) | 14-18% |

| Nuctech Company Limited | 10-14% |

| Analogic Corporation | 6-9% |

| Other Companies (combined) | 20-25% |

| Company Name | Key Offerings/Activities |

|---|---|

| Smiths Detection | In 2024, introduced the HI-SCAN 6040 CTiX with AI-driven threat detection and automated tray return. In 2025, expanded deployments across major European airports in compliance with ECAC Standard 3. |

| Leidos Holdings, Inc. | In 2024, launched the ClearScan™ CT scanner with AI-enabled anomaly detection. In 2025, scaled deployment of automated checkpoint lanes at large USA airport hubs. |

| OSI Systems (Rapiscan) | In 2024, upgraded its RT-Series with enhanced dual-energy imaging and real-time threat recognition. In 2025, deployed AI-assisted object classification across multi-lane screening systems. |

| Nuctech Company Limited | In 2024, released the CX7555D CT scanner featuring automated classification. In 2025, expanded footprint across Southeast Asia and Latin America with cost-effective AI-enhanced baggage scanners. |

| Analogic Corporation | In 2024, introduced ConneCT™ 3D baggage screening system in partnership with USA aviation authorities. In 2025, enhanced the platform with deep learning algorithms for improved resolution and threat differentiation. |

Key Company Insights

Smiths Detection (22-26%)

Smiths Detection leads with a broad portfolio of CT and X-ray scanners, well-aligned with evolving regulatory standards and airport automation goals. The company focuses on AI integration, remote monitoring, and high-throughput checkpoint systems.

Leidos Holdings, Inc. (18-22%)

Leidos is a key player in automated security ecosystems, with a stronghold in the USA market through TSA-compliant CT scanners and intelligent lane management technologies.

OSI Systems - Rapiscan (14-18%)

Rapiscan delivers flexible, modular scanning platforms with a focus on customs, critical infrastructure, and air cargo. Their AI modules and multi-energy imaging technologies support a broad range of threat detection needs.

Nuctech Company Limited (10-14%)

Nuctech leverages cost-efficiency and rapid AI adoption to expand in emerging markets, while improving low-dose radiation imaging and automatic object detection for both civil and government applications.

Analogic Corporation (6-9%)

Analogic is gaining ground with its high-precision 3D CT systems, applying medical imaging expertise to improve threat resolution and AI-powered detection in aviation and border control.

Other Key Players (20-25% Combined)

The overall market size for the baggage scanner market was USD 2,280.2 Million in 2025.

The baggage scanner market is expected to reach USD 2,834.5 Million in 2035.

Growth is driven by the rising global air passenger traffic, increasing security concerns across transportation hubs, growing investments in advanced screening technologies, and strict government regulations for public safety and threat detection.

The top 5 countries driving the development of the baggage scanner market are the USA, China, Germany, the UK, and India.

X-ray and Computed Tomography (CT) Scanners are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by End Use, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by End Use, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 16: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 17: Global Market Attractiveness by End Use, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 34: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 35: North America Market Attractiveness by End Use, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by End Use, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by End Use, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by End Use, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by End Use, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by End Use, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by End Use, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 125: East Asia Market Attractiveness by End Use, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by End Use, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by End Use, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airport Cabin Baggage Scanner Market Size and Share Forecast Outlook 2025 to 2035

3D Scanners Market Size and Share Forecast Outlook 2025 to 2035

DXA Scanner Market Size and Share Forecast Outlook 2025 to 2035

Smart Baggage Handling System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Scanner Market Size and Share Forecast Outlook 2025 to 2035

Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mineral Scanner Market Size and Share Forecast Outlook 2025 to 2035

Thermal Scanner Market Growth – Trends & Forecast 2020-2030

3D Laser Scanner Market Growth - Trends & Forecast 2025 to 2035

Micro-CT Scanners Market

Intraoral Scanner Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Narcotics Scanner Market Size and Share Forecast Outlook 2025 to 2035

Full Body Scanner Market Analysis - Size, Share & Forecast 2025 to 2035

Safety Laser Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mobile LiDAR Scanner Market Size and Share Forecast Outlook 2025 to 2035

Smart Bladder Scanner Market Size and Share Forecast Outlook 2025 to 2035

Robotic X-ray Scanner Market Size and Share Forecast Outlook 2025 to 2035

Global Intraoral IOL Scanner Market Analysis – Size, Share & Forecast 2024-2034

Polygon Mirror Scanner Motor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fixed Scanner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA