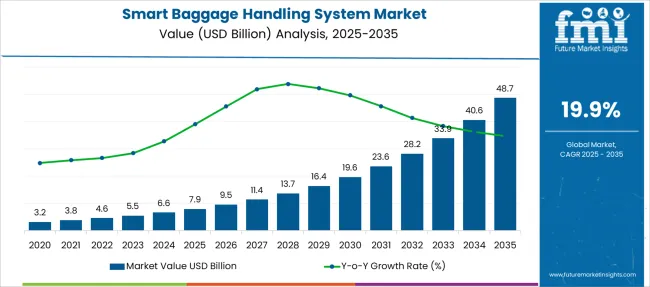

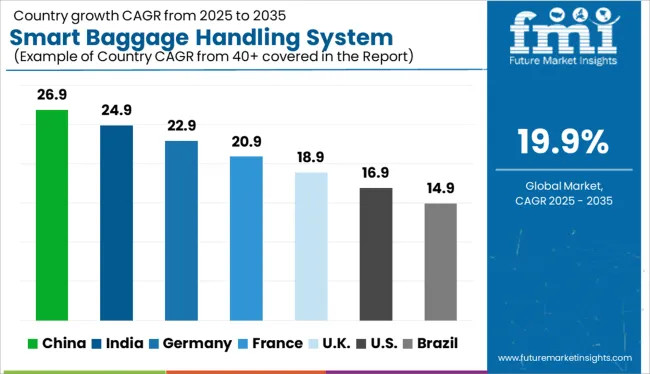

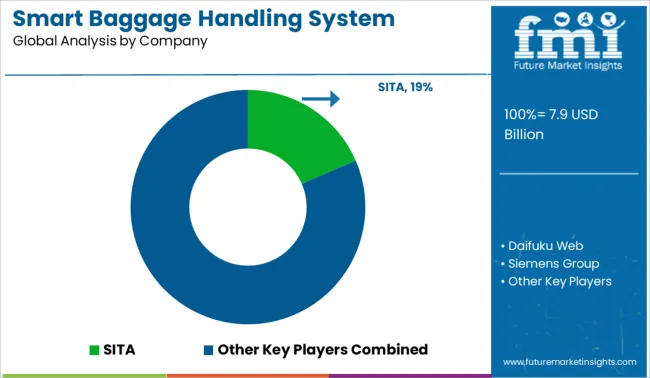

The Smart Baggage Handling System Market is estimated to be valued at USD 7.9 billion in 2025 and is projected to reach USD 48.7 billion by 2035, registering a compound annual growth rate (CAGR) of 19.9% over the forecast period.

| Metric | Value |

|---|---|

| Smart Baggage Handling System Market Estimated Value in (2025 E) | USD 7.9 billion |

| Smart Baggage Handling System Market Forecast Value in (2035 F) | USD 48.7 billion |

| Forecast CAGR (2025 to 2035) | 19.9% |

The smart baggage handling system market is growing rapidly as airports worldwide focus on improving operational efficiency and passenger experience. Increasing air traffic volumes have pushed airport authorities to adopt advanced technologies that streamline baggage processing and reduce mishandling.

Technological improvements have led to the development of sophisticated automated sorting, tracking, and security screening systems. The rising emphasis on minimizing baggage loss and delays has driven investment in integrated smart baggage solutions.

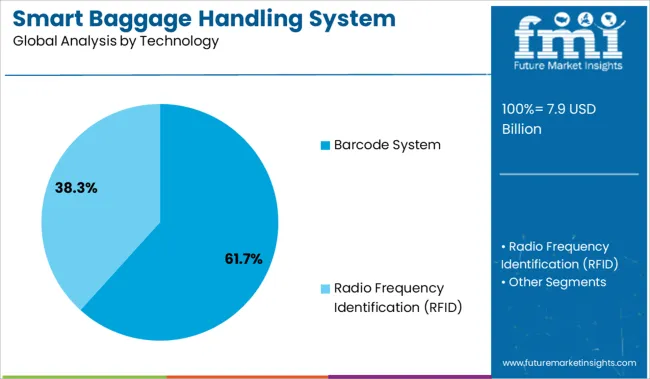

Enhanced barcode and RFID systems offer accurate real-time tracking, allowing better baggage flow management and improved customer satisfaction. Additionally, regulations on security and increasing passenger expectations have further accelerated technology adoption. Market growth is projected to continue as airports modernize their infrastructure to handle growing passenger numbers. Segment growth is expected to be led by the airport transportation type, barcode system technology, and sorting smart baggage handling systems as the primary solution.

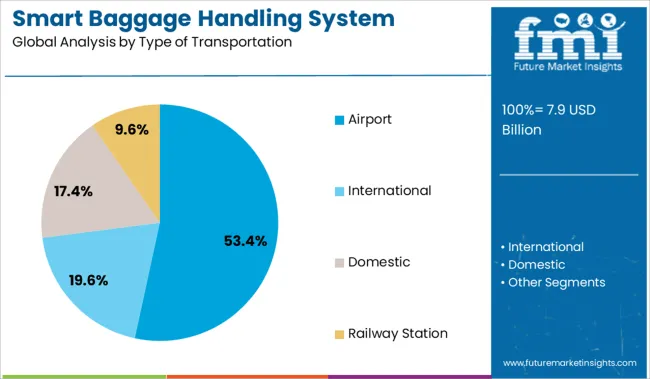

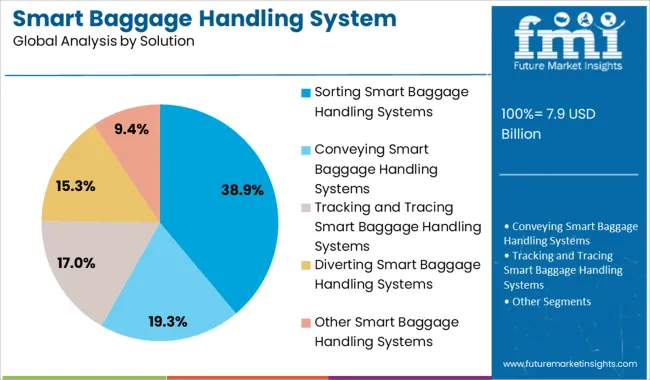

The market is segmented by Type of Transportation, Technology, and Solution and region. By Type of Transportation, the market is divided into Airport, International, Domestic, and Railway Station. In terms of Technology, the market is classified into Barcode System and Radio Frequency Identification (RFID). Based on Solution, the market is segmented into Sorting Smart Baggage Handling Systems, Conveying Smart Baggage Handling Systems, Tracking and Tracing Smart Baggage Handling Systems, Diverting Smart Baggage Handling Systems, and Other Smart Baggage Handling Systems. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The airport segment is expected to contribute 53.4% of the smart baggage handling system market revenue in 2025, maintaining its lead among transportation types. The growth in this segment is attributed to the high volume of baggage handled daily at airports and the critical need to improve baggage throughput.

Airports have increasingly implemented smart systems to enhance baggage sorting, reduce wait times, and minimize errors. The segment benefits from ongoing airport expansions and modernization projects focused on passenger convenience and operational efficiency.

Growing international and domestic air travel demand has also fueled investments in advanced baggage systems. As airports aim to provide seamless travel experiences, the adoption of smart baggage handling solutions is expected to intensify.

The barcode system segment is projected to hold 61.7% of the market revenue in 2025, positioning it as the leading technology type. Barcode systems have been widely adopted for their reliability and cost-effectiveness in tracking and managing baggage. Their ability to integrate with existing airport infrastructure and provide real-time data has made them popular among airport operators.

Recent advancements have enhanced barcode scanning accuracy and speed, supporting efficient baggage routing and minimizing mishandling. Despite emerging technologies, barcode systems remain preferred due to their simplicity and widespread acceptance.

The segment is expected to retain prominence as airports continue to upgrade their baggage tracking capabilities while balancing investment costs.

Sorting smart baggage handling systems are projected to account for 38.9% of the market revenue in 2025, making them the dominant solution segment. These systems automate the classification and distribution of baggage to various destinations within the airport, significantly improving processing speed and accuracy.

The adoption of sorting solutions has been driven by the need to handle increasing passenger volumes and complex flight schedules efficiently. Enhanced sorting capabilities reduce human errors and contribute to smoother baggage transfers and connections.

With airports expanding and upgrading their infrastructure, sorting systems have become essential for optimizing baggage logistics. The segment’s growth is expected to continue as airports focus on reducing delays and improving overall operational performance.

As per the Smart Baggage Handling System Market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, market value of the Smart Baggage Handling System Market increased at around 19.9% CAGR.

A considerable growth in the number of passengers, an expansion in airport operating efficiency, and developments in intermodal transportation are the main forces driving the expansion of the smart baggage handling system industry.

The increasing frequency of terrorist attacks or global terrorism at airports as well as railway stations, the increased emphasis on the installation of technically sophisticated scanners, the growth and expansion of the security and surveillance industry, particularly in developing economies, and rising public expenditure for the fast evolution of intermodal transportation systems are the key factors driving the growth of the smart baggage handling system market.

The smart baggage handling systems market is the system established at trains and airports that oversee transporting luggage from the check-in area to the loading area aboard aircraft, airplanes, or railways. Smart baggage handling technologies oversee monitoring baggage weight, scanning luggage for security, and automatically reading bag data. Increased investment in R&D operations, as well as an increase in the number of people traveling by air daily, will drive up market value. Rising public safety procedures, along with growing smart city initiatives or infrastructure development projects, will generate attractive growth prospects for the industry.

The expansion of the travel and tourism industry, as well as the increasing incidents of luggage mismanagement or misplacing, will drive market growth. The increasing proliferation of the internet of things & linked gadgets will pave the way for market expansion.

During the projected period, North America Smart Baggage Handling System Market is projected to hold the largest global share, with a size of over USD 15 Billion.

North America is expected to grow rapidly owing to several airport expansion proposals in the United States and Canada. Since North America tops the baggage mishandling incidents, government officials have taken steps to spend on luggage handling equipment. The number of luggage mishandling incidents can be reduced by deploying large-capacity baggage handling devices. Furthermore, the large number of people traveling on voyages within the area has increased demand throughout North America.

Also, Asia-Pacific smart baggage handling systems industry is best positioned to grow in the coming years. This is due to factors such as increasing air passenger traffic, an increase in cruise tourists, and impending airport redevelopment projects. Moreover, investments in rail networks and the country’s economic growth have increased the demand for such systems. Furthermore, countries such as India, Japan and China are seeing an increase in the number of people traveling by sea and air.

This is due to the fact that the government is substantially investing in technological development and forming partnerships to gain a competitive benefit in the industry. For example, the Airport Authority of India (AAI) purchased CTX 9800DSi higher-speed explosive detection systems (EDS) in May 2020 to hold baggage screening at nine Indian airports. This partnership with Smiths Detection Group Co. Ltd. was valued at around USD 50 Million.

The United States is expected to account for the highest market share of USD 48.7 Billion by the end of 2035 with an expected CAGR of 21.7% by the end of 2035. The federal government of the United States recently invested around USD 3.7 Billion in airport infrastructure. This involves the deployment of high-capacity mechanized baggage handling equipment to meet the demand to handle enormous volumes of varied sizes of bags.

Air carriers and airport authorities are collaborating to install innovative baggage handling technologies across North America. For example, Delta Airlines spent USD 3.2 Billion in May 2020 to add face recognition for travelers utilizing self-service luggage drop systems at Atlanta International Airport.

Radio Frequency Identification segment is forecasted to grow at the highest CAGR of around 21.8% during 2025-2035. RFID decreases luggage mistreatment by nearly 20%, resulting in an improved passenger experience. It is a simple technique to get baggage improper handling track records to comply with IATA Resolution 753. RFID technology is being invested in by key airline corporations to provide passengers with a better traveling experience. For example, Delta Airlines invested around USD 3.2 Million in May 2020 to deploy RFID luggage tracking equipment at 344 stations across the globe.

Moreover, Indian Railways in February 2024, put RFID technology on lines to track the whereabouts of rolling equipment, freight vehicles, and passenger coaches. Since it is used by most of the airlines worldwide, barcode technology is likely to have the largest market share. Barcodes are inexpensive and straightforward to use. However, only a few airports can handle both barcode and RFID-tagged luggage as a hybrid solution. A hybrid approach provides a greater scan rate than either technology alone. RFID deployment via a hybrid solution might be the first step toward completing RFID implementation.

The Conveying segment of the smart baggage handling system market is forecasted to grow at the highest CAGR of around 20.5% during 2025-2035. The exponential expansion in domestic and international air and sea passenger capacity has prompted baggage handling system makers to look for methods to improve current smart baggage handling technologies. According to the Société Internationale de Télécommunications Aéronautiques (SITA), the rate of luggage mishandling decreased in 2020, as compared to 2020 due to an increase in automation shown in increased usage of conveyor baggage handling systems (BHS).

Few of the top smart baggage handling systems companies control a large portion of the overall sales. These firms, which hold a sizable portion of the industry, are concentrating on growing their clientele internationally. The key players in smart baggage handling systems market are utilizing strategic innovations and teamwork projects to boost their market shares as well as profitability. Some of recent market developments are as follows:

In July 2024, SITA, the worldwide air transport IT supplier, announced the takeover of Safety Line S.A.S., a Paris-based start-up focusing on digital solutions of aviation safety and efficiency. This takeover will expand SITA's Digital Day during Operation offering, assisting airlines in driving greater economies and fuel savings on the aircraft whilst taking instant and long-term efforts to minimize their carbon impact.

Considering air transport accounts for around 3% of global carbon emissions, airlines are under increasing pressure to cut their overall emissions. Simultaneously, the COVID-19 epidemic necessitates airlines to make their aircraft operations leaner, particularly by decreasing costly fuel usage. Safety Line has effectively used predictive analytics to improve aeroplane operations, adding significantly to SITA's existing offering. SITA will speed the implementation of sustainable technologies that can be combined with its existing portfolio of airline and airport solutions due to this purchase.

In April 2020, Daifuku Co., Limited, a Japanese material handling equipment provider, has paid an undisclosed price for Hyderabad-based warehouse automation firm Vega Conveyors and Automation. Vega becomes a 100% subsidiary of Daifuku following the acquisition, even though its promoter, Srinivas Garimella, will continue to lead the firm as a part of the agreement, which includes an earn-out arrangement. Earn-out is a price structure in which a portion of the purchased price is determined by the success of the firm after the acquisition.

In June 2024, Smiths Detection, a provider of detection and screening technologies, announced the acquisition of PathSensors, a premier bio-technology solutions and environmental-testing firm. Smith’s Detection's sensing capabilities throughout the CBRNE (biological, chemical, radiological, nuclear, and explosive) spectrum will be expanded due to the purchase, allowing the company to respond promptly to emerging threats.

PathSensors offers high-speed, very sensitive pathogen detection and biothreat solutions, as well as a proven approach for diagnosing biological hazards in minutes. The company's client base is like Smiths Detection's for chemical-threat detection, but it also allows for development into adjacent areas such as food and farming security.

Similarly, recent developments related to companies’ Smart Baggage Handling System Market have been tracked by the team at Future Market Insights, which are available in the full report.

The global smart baggage handling system market is estimated to be valued at USD 7.9 billion in 2025.

The market size for the smart baggage handling system market is projected to reach USD 48.7 billion by 2035.

The smart baggage handling system market is expected to grow at a 19.9% CAGR between 2025 and 2035.

The key product types in smart baggage handling system market are airport, international, domestic and railway station.

In terms of technology, barcode system segment to command 61.7% share in the smart baggage handling system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA