The vehicle scanner market is growing rapidly, driven by increasing demand for advanced security inspection systems across transportation, border control, and government facilities. Rising concerns about contraband smuggling, terrorism, and unauthorized access have prompted widespread deployment of automated scanning solutions.

Technological advancements in imaging, artificial intelligence, and automation have significantly improved detection accuracy and processing speed. The market also benefits from government investments in infrastructure security and public safety modernization.

Increasing vehicle movement across checkpoints, ports, and high-security zones has further accelerated system adoption. With growing integration of cloud-based data management and real-time monitoring, the market outlook remains strong, supported by continuous innovation and global regulatory emphasis on enhanced vehicle inspection standards.

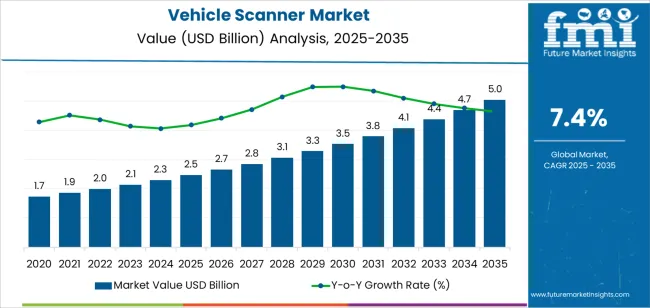

| Metric | Value |

|---|---|

| Vehicle Scanner Market Estimated Value in (2025 E) | USD 2.5 billion |

| Vehicle Scanner Market Forecast Value in (2035 F) | USD 5.0 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

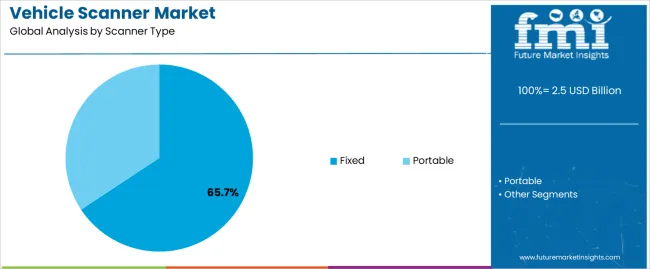

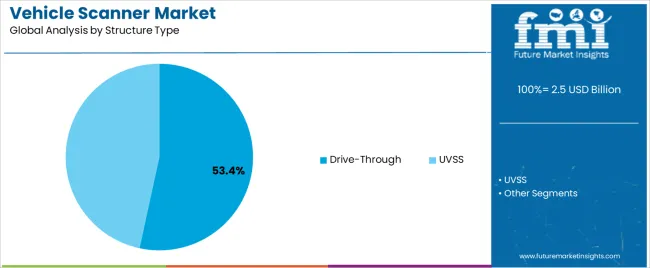

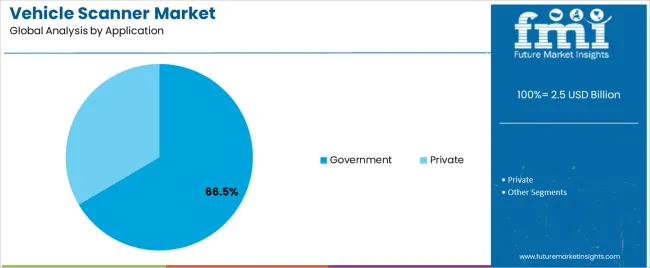

The market is segmented by Scanner Type, Structure Type, Application, and Component and region. By Scanner Type, the market is divided into Fixed and Portable. In terms of Structure Type, the market is classified into Drive-Through and UVSS. Based on Application, the market is segmented into Government and Private. By Component, the market is divided into Camera, Lighting Unit, Barrier, Software, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fixed segment leads the scanner type category with approximately 65.70% share, owing to its high throughput capacity, superior image resolution, and reliability in continuous operation. Fixed vehicle scanners are widely used at border checkpoints, seaports, and high-traffic facilities where automated screening efficiency is essential.

The segment benefits from advancements in X-ray and gamma-ray imaging technologies that enable rapid, non-intrusive inspection. Integration with AI-driven analytics enhances threat detection accuracy and operational speed.

Despite higher initial investment costs, fixed systems offer long-term operational savings and minimal downtime. With governments prioritizing national security and trade facilitation, the fixed segment is expected to maintain its dominant position over the forecast period.

The drive-through segment accounts for approximately 53.40% share within the structure type category, supported by its suitability for high-traffic inspection points and rapid throughput environments. This configuration allows vehicles to be scanned while in motion, minimizing delays and improving processing efficiency.

The segment benefits from deployment across customs checkpoints, parking facilities, and sensitive installations requiring real-time threat detection. Technological enhancements, including automatic number plate recognition (ANPR) and integrated control systems, have improved performance accuracy.

With the need for efficient, contactless security screening solutions rising globally, the drive-through segment is projected to sustain its leading market share.

The government segment dominates the application category, contributing approximately 66.50% share to the vehicle scanner market. This leadership stems from large-scale investments in national security infrastructure, customs modernization, and counter-terrorism initiatives.

Governments across regions are deploying advanced scanning systems at borders, embassies, and military facilities to enhance vehicle screening efficiency and reduce manual intervention. The segment’s growth is reinforced by favorable funding policies and strategic partnerships between public agencies and private technology providers.

As global trade volumes increase and border security regulations tighten, government demand for vehicle scanning systems is expected to remain robust throughout the forecast horizon.

This section provides a detailed analysis of the vehicle scanner market over the past five years and highlights the expected trends in the industry. The market has experienced a substantial historical CAGR of 9.1%, but it is gradually becoming more restrictive. The industry is anticipated to continue to develop at an enduring pace of 7.4% CAGR until 2035.

| Historical CAGR (2020 to 2025) | 9.1% |

|---|---|

| Forecast CAGR (2025 to 2035) | 7.4% |

The high initial investment costs, operational challenges in integrating scanning systems into current infrastructure, privacy and regulatory compliance issues, and other aspects impede the expansion of the vehicle scanner sector.

Crucial factors that are anticipated to disturb the demand for vehicle scanners through 2035 include:

Market players are expected to be shrewd and flexible over the anticipated period, as these challenging attributes position the industry for future success.

Integration of AI and Machine Learning Climb Sharply in the Vehicle Scanner Sector

Algorithms driven by AI become more complex and precise as the technology develops. This has a significant effect on the automotive sector, as AI-powered algorithms improve the precision and effectiveness of vehicle scanning.

The ability of vehicle scanners to scan automobiles more rapidly and precisely than ever before, owing to AI-powered algorithms, is helping propel the market for these cutting-edge scanning technologies.

Consequently, numerous automakers and maintenance facilities are allocating funds toward these sophisticated scanning systems to enhance business processes and boost customer satisfaction in the forthcoming decade.

Emphasis on Multi-Modal Scanning Rumbles in Automobile Economy

The automobile industry is witnessing a surge in demand for rigid vehicle scanners due to the integration of various scanning technologies. Adopting advanced scanning technologies in the industry has become crucial for comprehensive threat detection and prevention.

These scanning technologies include X-ray, millimeter-wave, and terahertz scanning systems, which can identify threats such as explosives, weapons, and other contraband hidden in vehicles.

Employing such rigid vehicle scanners ensures the safety and security of passengers, drivers, and the general public by preventing the entry of dangerous items into vehicles. The increasing emphasis on public safety and the need to comply with stringent government regulations drive the demand for rigid vehicle scanners in the automobile industry.

Amplified Integration with Digital Platforms Soars Vehicle Scanning Demand

The vehicle scanner market is developing due to the integration of scanning data into digital security ecosystems for real-time monitoring and analysis. With the increasing need for enhanced security measures and efficient traffic management, the demand for vehicle scanners has risen significantly in recent years.

Incorporating advanced scanning technologies such as laser scanning, ultrasonic scanning, and magnetic resonance imaging (MRI) has further expanded the scope of the market.

These technologies provide accurate and reliable data on vehicle identification, weight, dimensions, and other parameters, enabling authorities to monitor and regulate traffic flow effectively.

The growing adoption of cloud-based systems and Internet of Things (IoT) technologies has opened up new avenues for the vehicle scanner market, enabling seamless data integration and analysis across multiple platforms and devices. The mounting demand for sophisticated security and traffic management systems is anticipated to propel the market's expansion in the preceding decade.

This section delves into a detailed analysis of specific market sectors within the vehicle scanner industry. The research primarily focuses on two main topics: the portable vehicle scanner segment and the drive-through structure segment.

This section aims to provide a comprehensive examination of these segments, enabling readers to better understand their significance in the broader context of the vehicle scanner industry.

| Attributes | Details |

|---|---|

| Top Scanner Type | Portable Vehicle Scanner |

| Forecasted CAGR from 2025 to 2035 | 7.2% |

During the period from 2025 to 2035, the portable vehicle scanner emerged as the most widely adopted type of vehicle scanner in the industry, exhibiting a CAGR of 7.2%.

However, this CAGR represents a decrease from the prior period of 2020 to 2025, during which the portable vehicle scanner type experienced a higher growth rate of 8.8%. The development of the portable vehicle scanner segment was driven by several factors, which are expected to be discussed further below:

| Attributes | Details |

|---|---|

| Top Structure Type | Drive-Through |

| Forecasted CAGR from 2025 to 2035 | 7.0% |

With a compound annual growth rate of 7.0%, the drive-through vehicle scanner structure became the most popular in the market between 2025 and 2035.

On the other hand, compared to the previous period of 2020 to 2025, when the drive-through vehicle scanner structure enjoyed a greater growth rate of 8.6%, this CAGR reflects a reduction. Some of the elements that propelled the growth of the drive-through vehicle scanner industry are anticipated to be covered in more detail below:

This section delves into the vehicle scanner sectors of some of the most influential nations on the global stage, including the United States, China, Japan, South Korea, and the United Kingdom.

A comprehensive investigation is expected to explore the various factors impacting these countries' demand for, adoption of, and engagement with vehicle scanners. The analysis is anticipated to provide a detailed understanding of the current state of vehicle scanning technology in these nations and their potential for growth in the forthcoming decade.

| Countries | Forecasted CAGR from 2025 to 2035 |

|---|---|

| United States | 7.7% |

| United Kingdom | 8.6% |

| China | 7.9% |

| Japan | 8.5% |

| South Korea | 9.0% |

Through 2035, the vehicle scanner market in the United States is anticipated to expand at a CAGR of 7.7%. In comparison to the CAGR of 9.8% recorded between 2020 and 2025, this growth rate is lower.

The sector is expected to achieve a worth of USD 5 million by 2035, notwithstanding the lackluster expansion. The need for automobile scanners is driven by the following factors, which are likely to be very important for the industry's growth:

With a CAGR of 8.6% until 2035, the car scanner market in the United Kingdom is predicted to expand significantly in the upcoming years. The sector has already demonstrated tremendous promise, with a remarkable 12.9% CAGR predicted between 2020 and 2025.

The market is expected to be worth USD 189.7 million, indicating that the automotive industry has ample room to develop and attract investment. The following are some of the main trends:

China's vehicle scanner market is experiencing a remarkable upswing in demand, with industry experts predicting a CAGR of 7.9%. By 2035, the sector is expected to be valued at a staggering USD 1.7.0 million. Furthermore, China’s automobile scanning industry witnessed a substantial CAGR of 11.3% between 2020 and 2025. The growth is attributed to these trends:

The demand for vehicle scanners in Japan is soaring dramatically, and the industry is anticipated to grow at a CAGR of 8.5% through 2035, meaning that by that year, it should be valued at around USD 492.3 million. The Japan automobile scanner market's prior compound annual growth rate was about 12.8%. Among the main motivators are:

There is a forecast that the vehicle scanner market in South Korea is projected to develop at a potential CAGR of 9.0% by 2035, resulting in a valuation of USD 292.0 million. It should be recalled that the country previously saw a higher CAGR of 15.6% from 2020 to 2025. The following are some of the main trends:

Market players in the vehicle scanner industry are expected to grow substantially in the ensuing decade due to an array of significant parameters. Technological advancements, including sensor technologies, artificial intelligence, and machine learning, should make more complex and precise scanning systems possible.

Integration and interoperability are of utmost importance, with manufacturers concentrating on developing scalable, modular systems that can be easily integrated into preexisting security infrastructure.

Amplified collaboration is also expected between industry players, research institutions, and government agencies to drive innovation and address emerging challenges in vehicle scanning technology. Furthermore, market players prioritize sustainability by developing eco-friendly and energy-efficient scanning solutions.

The vehicle scanner industry players are expected to adapt to evolving market demands and technological advancements to stay competitive and meet the increasingly complex security needs of the automotive sector in the forthcoming decade.

Recent Developments in the Vehicle Scanner Market

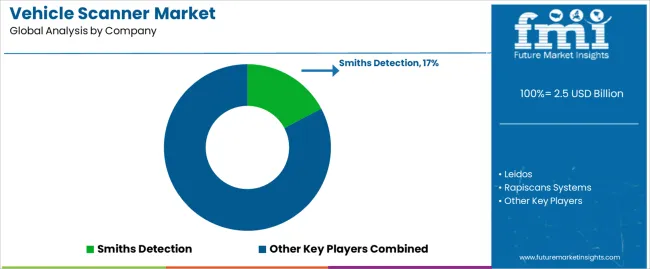

The global vehicle scanner market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the vehicle scanner market is projected to reach USD 5.0 billion by 2035.

The vehicle scanner market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in vehicle scanner market are fixed and portable.

In terms of structure type, drive-through segment to command 53.4% share in the vehicle scanner market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vehicle-to-grid Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Transfer Case Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Barrier System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Acoustic DSP Chips Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Cargo Box Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Jump Starter Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Moving Services Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Security Sensor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle To Vehicle Communication Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Roadside Assistance Market Size and Share Forecast Outlook 2025 to 2035

Vehicle as a Service Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Integrated Solar Panels Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Networking Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-Everything (V2X) Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Armor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Conversion Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Health Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Tracking System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Radar Test System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Interior Air Quality Monitoring Technology Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA