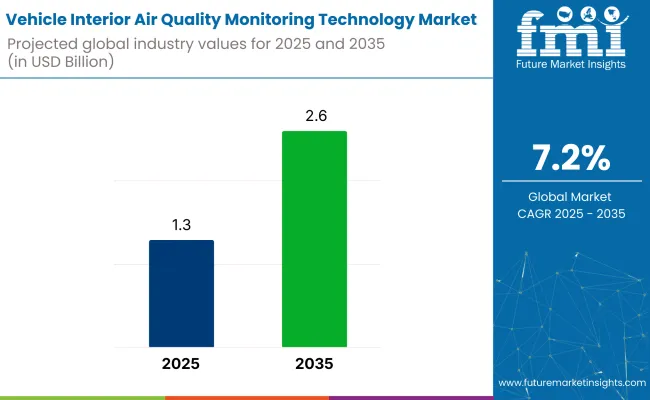

The global vehicle interior air quality monitoring technology market is forecasted to grow from USD 1.3 billion in 2025 to USD 2.6 billion by 2035, registering a CAGR of 7.2% during the forecast period.

The growing concerns regarding indoor air quality and health implications are encouraging the adoption of air filtration and monitoring systems in cars. Consumer awareness about air quality and health-related issues is further accelerating industry adoption. Increased demand for electric vehicles (EVs) and autonomous vehicles (AVs) is also contributing to the industry expansion.

Advanced sensor technologies and smart vehicles are being utilized to create sophisticated real-time air quality monitoring systems for vehicle interiors. These systems are designed to detect pollutants, allergens, and volatile organic compounds (VOCs) in the cabin air. “Advances in sensor technology and smart vehicles mean that how and when we use our cars is changing. Just as air pollution and indoor air quality have become a requirement for healthy homes, car cabin air quality is now also under scrutiny,” said Dr. John McKeon, CEO of Allergy Standards Limited (ASL).

The vehicle interior air quality monitoring technology industry forms a small but growing share across its broader parent segments. Within the automotive cabin air quality sensors industry, it holds a substantial 30-35% share, as core monitoring modules integrate with filtration and ventilation systems. In the wider automotive environmental sensors industry, its contribution is approximately 10-12%, competing with sensors for temperature, humidity, and ambient light.

Within the vehicle HVAC and air filtration systems segment, air quality monitoring accounts for 8-10%, supporting adaptive filtration and climate control. Its share in the smart vehicle electronics category stands at 5-7%, driven by rising demand for health-focused connected features. Across the expansive automotive electronics industry, its presence remains typically under 1% but is gaining strategic importance.

The vehicle interior air quality monitoring technology market is experiencing strong growth, driven by investments in hardware, infrared-based detection, and cabin air quality monitoring, fueled by concerns over air quality and regulations.

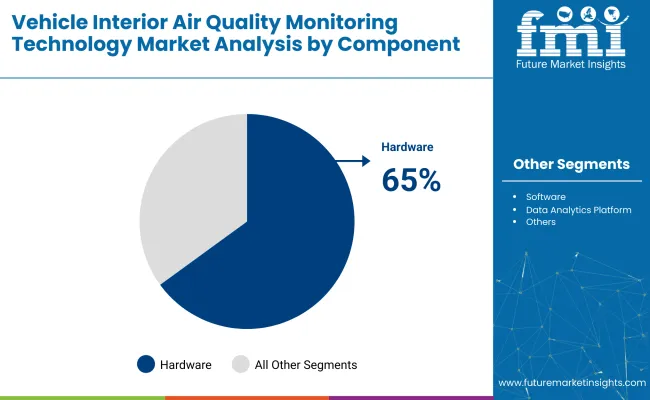

The hardware component is expected to dominate the market, accounting for 65% of the share by 2025. This dominance is driven by the increasing demand for sensors, controllers, and other components that are essential for real-time monitoring and management of cabin air quality.

Companies such as Honeywell and Bosch are leading the charge in providing high-quality sensors that measure particulate matter, carbon dioxide, and volatile organic compounds. These hardware components are integrated into vehicle air conditioning systems, offering real-time analysis of indoor air conditions, improving cabin comfort, and promoting passenger health.

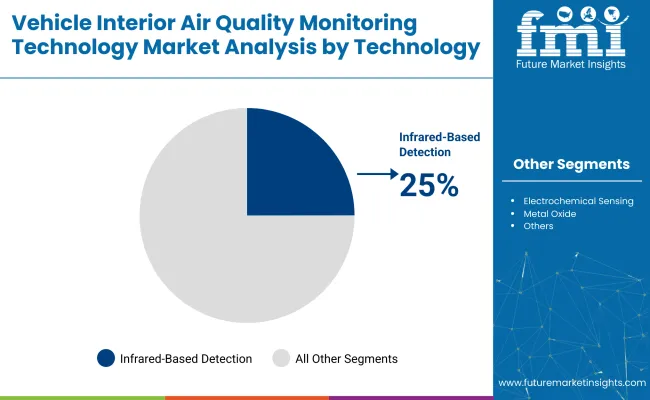

Infrared-based detection technology is projected to capture 25% share by 2025. This technology offers a non-invasive, efficient method for detecting and monitoring harmful gases such as carbon dioxide and nitrogen dioxide within the vehicle cabin.

Companies like Osram and Raytheon are enhancing infrared-based detection systems with greater sensitivity and accuracy, enabling better detection of particulate matter and other contaminants in the air. As vehicle manufacturers and consumers increasingly prioritize health-conscious solutions, infrared-based detection is becoming an essential component in vehicle interior air quality systems, contributing to safer driving environments.

Passenger cars are expected to dominate the vehicle type segment, holding a 55% share in 2025. The growing focus on cabin air quality for personal vehicles is being driven by rising awareness of health risks associated with air pollution and increasing regulatory requirements for air quality control systems.

Leading automotive manufacturers, including Toyota and Ford, are incorporating advanced air quality monitoring systems into their vehicles to meet consumer demand for cleaner, healthier driving environments. This trend is further bolstered by the integration of smart technologies and eco-friendly materials that enhance cabin air circulation and filtration, driving adoption in passenger vehicles.

Cabin air quality monitoring is projected to capture a 35% share in 2025. This application focuses on detecting and managing pollutants such as carbon monoxide, particulate matter, and allergens inside the vehicle cabin. Companies like Denso and Valeo are pioneering technologies that enable real-time air quality monitoring systems, allowing for automatic adjustments to the vehicle's ventilation system.

This functionality is crucial for maintaining a comfortable and safe environment for passengers, especially in urban areas where air quality is often compromised. As consumer demand for cleaner air in vehicles continues to rise, cabin air quality monitoring is becoming a standard feature in modern vehicles.

The vehicle interior air quality monitoring market is growing due to increased consumer awareness, stricter regulations, and technological advancements. However, high implementation costs and integration complexities could limit widespread adoption.

Heightened Regulation and Awareness Propel Adoption

Demand for in-cabin air quality solutions is being supported by consumer health priorities and compliance with air pollution legislation. Vehicle manufacturers have been required to install particulate and gas sensors that track cabin pollutants. In markets such as Europe and North America, air quality benchmarks have been mandated, pushing OEMs toward system-wide deployment.

Cost and Technical Complexity Constrain Broader Rollout

Adoption has been slowed by elevated system costs and compatibility issues with traditional vehicle platforms. High-precision sensors, embedded analytics, and calibration processes have increased unit pricing. Retrofitting legacy models with smart air systems has proven operationally intensive, especially for low-margin manufacturers.

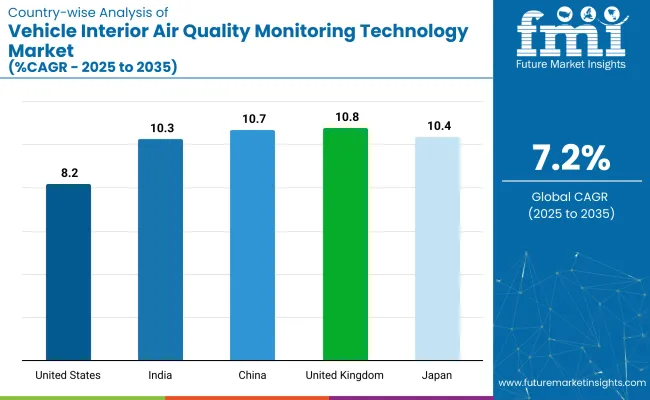

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 8.2% |

| United Kingdom | 10.8% |

| China | 10.7% |

| India | 10.3% |

| Japan | 10.4% |

During 2025 to 2035, an average CAGR of 9.8% is projected to be recorded by OECD participants in the vehicle interior air-quality monitoring technology industry. A rise of 10.8% is expected to be registered by the United Kingdom, enabled by tightened in-cabin VOC directives and wellness-centric trim features. An increase of 10.4% is forecast to be observed in Japan, supported by sensor integration within hybrid and battery-electric platforms, whereas 8.3% growth is anticipated to be experienced by the United States, aided by premium SUV refresh cycles.

BRICS economies are projected to post a mean of 10.5%; China’s 10.8% trajectory is being propelled by electric-vehicle production quotas that require active filtration, and India’s 10.3% outlook is being driven by passenger-car emission norms and heightened cabin-hygiene awareness. A global expansion rate of 7.2% is set to be observed, reflecting regulatory impetus and occupant-well-being priorities.

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

The United States vehicle interior air quality monitoring technology market is expected to grow at a CAGR of 8.2% through 2035. Growth is being supported by increasing consumer demand for better air quality and health-conscious living. Leading automotive companies such as Ford, General Motors, and Tesla are integrating advanced air quality sensors and filtration systems into vehicles.

Government regulations and industry standards promoting cleaner environments are encouraging innovation. Rising awareness about the effects of air pollution on health and the growing focus on electric vehicles further drive industry demand. Continuous advancements in air quality sensors and real-time monitoring systems support industry expansion.

The United Kingdom vehicle interior air quality monitoring technology market is projected to grow at a CAGR of 10.8% through 2035. Growth is being supported by rising consumer awareness about air quality and its impact on health. Major automotive manufacturers such as Jaguar Land Rover, BMW, and Volvo are focusing on the integration of advanced air purification and monitoring technologies in vehicles.

Increasing government focus on emission reduction and efforts drive product development. Innovations in smart air quality sensors and filtration systems enhance performance. Moreover, regulatory frameworks ensuring healthier driving environments contribute to the industry’s growth in the UK.

The vehicle interior air quality monitoring technology market in China is expected to grow at a CAGR of 10.7% through 2035. Expansion is being driven by rapid industrialization, increasing automotive sales, and rising health concerns related to air pollution. Leading automotive brands like BYD, Geely, and SAIC Motor are investing in product innovation and expanding their portfolios.

Government regulations on pet food safety and nutritional standards enhance consumer confidence. Distribution channels including veterinary clinics and e-commerce platforms are being strengthened. Awareness of pet health conditions like obesity, renal disorders, and allergies is increasing demand. Product development focusing on ingredient quality supports industry growth.

The vehicle interior air quality monitoring technology market in China is anticipated to grow at a CAGR of 10.3% through 2035. Growth is driven by increasing consumer awareness, growing urbanization, and a rising middle class. Automotive companies such as Tata Motors, Mahindra & Mahindra, and Hyundai India are incorporating air quality monitoring systems in vehicles to cater to health-conscious consumers.

Increased demand for electric vehicles and stringent environmental regulations are driving the adoption of advanced air quality monitoring technologies. Innovations in air purification systems and sensors ensure the quality of cabin air, while government support for automotive technologies accelerates industry growth.

The vehicle interior air quality monitoring technology market in Japan is projected to grow at a CAGR of 10.4% through 2035. Growth is supported by the country’s emphasis on advanced radar technologies and strategic defense initiatives. Key players such as Mitsubishi Electric, NEC Corporation, and the Japan Aerospace Exploration Agency (JAXA) are actively developing sophisticated space radar systems.

Investments in satellite-based radar for environmental monitoring, defense surveillance, and disaster management are prioritized. Technological innovation, strong government support, and international collaborations further propel industry growth.

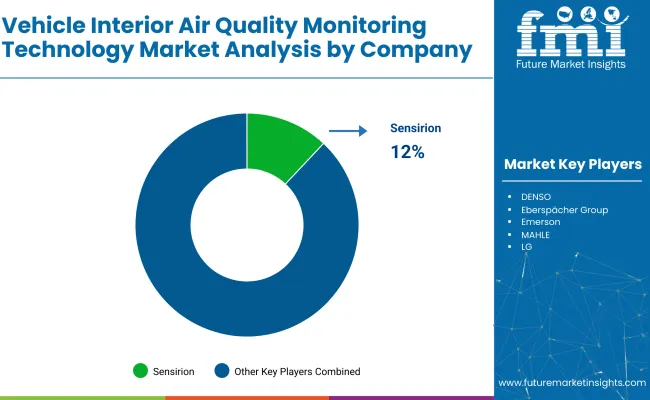

The market is led by established suppliers such as DENSO, Honeywell International, and Bosch, known for their advanced air quality sensors and integration within HVAC systems. These companies maintain a strong presence across automotive OEM platforms, focusing on in-cabin wellness and regulatory compliance. Mid-tier contributors like Emerson and MAHLE support the industry with modular monitoring solutions that align with evolving emissions standards.

Niche-focused firms such as SGS address specific use cases, including air-quality compliance testing and certification. Rising consumer health concerns, stricter in-cabin VOC limits, and growing urban air pollution are compelling OEMs to adopt advanced sensor systems. This shift is accelerating the integration of real-time air monitoring in both passenger and commercial vehicles.

Recent Vehicle Interior Air Quality Monitoring Technology Industry News

| Report Attributes | Details |

|---|---|

| Current Total Industry Size (2025) | USD 1.3 billion |

| Projected Industry Size (2035) | USD 2.6 billion |

| CAGR (2025 to 2035) | 7.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units, |

| Components Analyzed (Segment 1) | Software: Data analytics platforms; Real-time monitoring dashboards; Others Hardware: Gas sensors; Humidity & temperature sensors; Odor sensors; Others Service: Installation & integration; Calibration & maintenance |

| Technologies Analyzed (Segment 2) | Infrared-based detection; Electrochemical sensing; Photoionization detection; Metal oxide semiconductors; Others |

| Vehicle Types Covered (Segment 3) | Passenger cars: Sedan; Hatchback; SUV Commercial vehicles: Light commercial vehicle; Heavy commercial vehicle; Buses & coaches |

| Applications Covered (Segment 4) | Cabin air quality monitoring; HVAC system integration; Real-time driver & passenger health alerts; Fleet health management; Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa |

| Countries Covered | United States; Canada; United Kingdom; Germany; France; Italy; Spain; Belgium; Sweden; China; India; Japan; Australia; Singapore; South Korea; Southeast Asia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE |

| Key Players | DENSO; Eberspächer Group; Emerson; Honeywell International Inc; LG; MAHLE; Mechanical Simulation; Robert Bosch; Sensirion; SGS |

| Additional Attributes | Dollar sales by component (hardware vs software vs services); Growth of cabin air quality monitoring systems in electric vehicles; Integration with autonomous driving technologies; OEM vs aftermarket adoption trends; Regulatory push for improved in-cabin air quality systems |

The industry is segmented by component into software (data analytics platforms, real-time monitoring dashboards, and others), hardware (gas sensors, humidity & temperature sensors, odor sensors, and others), and service (installation & integration, calibration & maintenance).

The industry includes infrared-based detection, electrochemical sensing, photoionization detection, metal oxide semiconductors, and others.

The industry is segmented by vehicle type into passenger cars (sedan, hatchback, SUV), commercial vehicles (light commercial vehicle, heavy commercial vehicle, buses & coaches).

The industry includes cabin air quality monitoring, HVAC system integration, real-time driver & passenger health alerts, fleet health management, and others.

The industry covers North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The industry was valued at USD 1.3 billion in 2025.

It is projected to reach USD 2.6 billion by 2035.

The industry is expected to grow at a CAGR of 7.2% from 2025 to 2035.

A 65% share is projected to be held by hardware in 2025.

Cabin air quality monitoring is anticipated to hold a 35% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Quality Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Air Quality Monitoring Equipment Market Growth - Trends & Forecast 2025 to 2035

Air Quality Monitoring Software Market

HVAC Air Quality Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Airline Technology Integration Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Monitoring System Market

Vehicle Speed Monitoring System Market Growth - Trends & Forecast 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aircraft Cabin Interiors Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Health Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Indoor Air Quality Monitor Market Size and Share Forecast Outlook 2025 to 2035

Rugged Air Quality Monitors Market Insights - Growth & Forecast 2025 to 2035

Connected Vehicle Technology Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicles and Aircraft Simulations Market Growth - Trends & Forecast 2025 to 2035

Commercial Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Automotive Cabin Air Quality Sensors Market Size and Share Forecast Outlook 2025 to 2035

USA Automotive and Aircraft Interior Genuine Leather After Market Growth – Trends & Forecast 2025 to 2035

Interior Swinging Door Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA