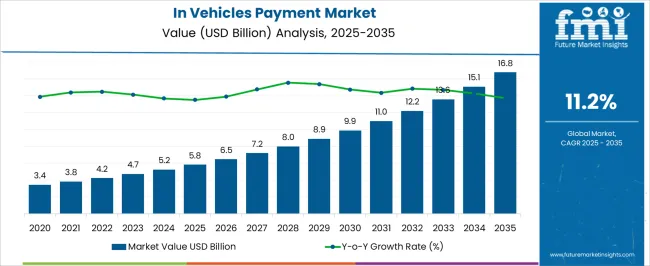

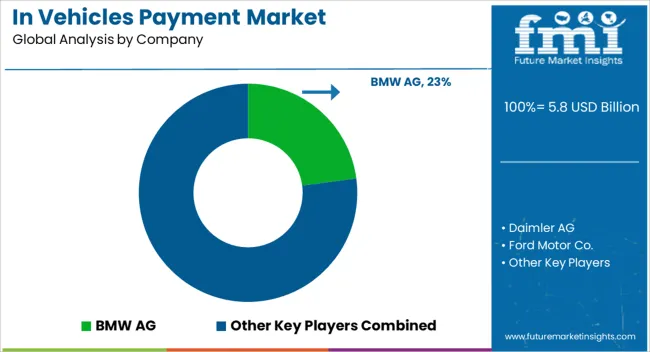

The In Vehicles Payment Market is estimated to be valued at USD 5.8 billion in 2025 and is projected to reach USD 16.8 billion by 2035, registering a compound annual growth rate (CAGR) of 11.2% over the forecast period.

| Metric | Value |

|---|---|

| In Vehicles Payment Market Estimated Value in (2025 E) | USD 5.8 billion |

| In Vehicles Payment Market Forecast Value in (2035 F) | USD 16.8 billion |

| Forecast CAGR (2025 to 2035) | 11.2% |

The in vehicles payment market is experiencing strong momentum as advancements in connected vehicle technology and digital commerce reshape mobility experiences. Increasing consumer preference for seamless and contactless payment methods is propelling adoption within automotive ecosystems. Automakers are integrating payment solutions directly into infotainment systems, enabling drivers to make transactions without leaving their vehicles.

The focus on convenience, time efficiency, and reduced dependency on physical cards or mobile devices is accelerating this trend. Growth is further reinforced by strategic collaborations between automotive manufacturers, payment providers, and fuel retailers, ensuring interoperability and security across platforms. As electric mobility expands, payment solutions tailored for charging stations are becoming critical.

Regulatory frameworks encouraging digital financial inclusion and secure transaction protocols are expected to provide long term support to the market. The overall outlook remains positive as in vehicle payment systems continue to evolve into an integral component of connected mobility infrastructure.

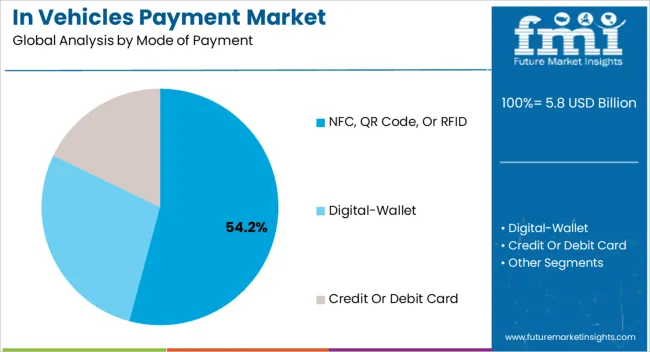

The NFC, QR code, or RFID mode of payment segment is projected to account for 54.20% of total market revenue by 2025, positioning it as the leading payment mode. This dominance is attributed to the ability of these technologies to deliver secure, contactless, and real time transaction experiences.

Their wide compatibility with connected car systems, combined with reduced latency and high convenience, has significantly influenced adoption. NFC and RFID are particularly valued for speed and integration within vehicle infotainment platforms, while QR codes provide cost effective alternatives in regions with limited NFC infrastructure.

The growing consumer preference for frictionless and hygienic payments has further accelerated reliance on these technologies, cementing their position as the dominant payment mode in the in vehicles payment market.

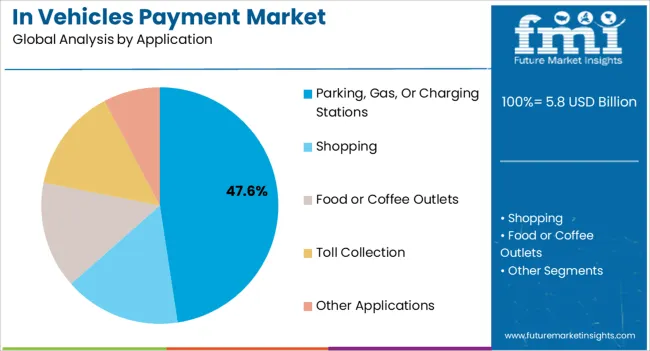

The parking, gas, or charging stations application segment is expected to represent 47.60% of total market revenue by 2025, establishing it as the most significant application area. This leadership is driven by the essential nature of these services in daily commuting and long distance travel, which makes them the most frequent touchpoints for vehicle based transactions.

Increasing urbanization, the rise of smart cities, and the expansion of electric vehicle infrastructure have heightened the need for efficient in vehicle payment solutions in these categories. Drivers benefit from streamlined access, reduced queuing times, and automated billing, while service providers gain from improved customer satisfaction and loyalty.

The integration of secure, real time payment capabilities at parking facilities, fuel stations, and charging points has therefore reinforced this application segment’s role as the cornerstone of the in vehicles payment market.

The vehicle payment market size, in terms of value, reached USD 2,928.4 million in 2020. The market grew at a moderate rate of 9.6% per year from 2020 to 2025, culminating in a market worth USD 4,233.1 million in 2025.

The market recovered fast during the years 2024 and 2024 due to the boom in demand for contactless payment solutions around the world. Furthermore, prominent corporations began to roll out contactless payment solutions for their in-vehicle payment services, resulting in a market resurgence.

Mercedes, for example, launched contactless in-vehicle fuel payment services in Germany in March 2024 to meet the growing need for contactless payment solutions in the face of pandemics.

The growing demand among individuals for contactless payments to avoid any potential virus exposure is likely to contribute to the market's growth during the forecast period.

Widespread social distancing measures imposed by the government in response to the pandemic and growing public safety concerns are projected to drive demand for contactless payment solutions, boosting the implementation of in-vehicle payment services.

The market is expected to increase due to the emphasis of key players such as Mercedes-Benz, General Motors, Honda, Mercedes-Benz, Hyundai, and others on creating contactless linked vehicle payment solutions. Congestion on roads, petrol stations, toll plazas, parking spots, and other locations encourages people to use these payment methods.

The adoption of payment technology in apps can save time and make it easy for customers to order and pay. As a result, infrastructural development of these locations for in-car payment compatibility is likely to drive vehicle payment market growth in the forthcoming years.

During the projection period, the high cost of embedded systems compared to integrated systems is likely to stifle market growth.

Furthermore, cyber-security and vulnerability hazards connected with using in-vehicle payment services, such as security difficulties relating to personal data, card numbers, CVV, PIN, and others, are expected to limit in-vehicle payment system adoption throughout the projected period.

Global demand for in-vehicle payment systems is likely to be fueled by increased digitization in autos, rising usage of IoT, and maturing 5G connection.

Furthermore, increased awareness of various in-vehicle services in underdeveloped and developing economies, as well as expanded uses of these services, are expected to drive market expansion throughout the forecast period.

Vehicles having technology integrated into the user's daily life, allowing the vehicle to interface with external technologies, are known as connected automobiles.

Connected automobiles use their connectivity to provide passengers with in-vehicle payment options. As a result, the global demand for in-vehicle payment systems is likely to rise as connected automobiles become widely adopted and developed.

Key corporations such as Mastercard, Visa, and others are investing in linked auto payment technology, which is expected to have an impact on in-vehicle payment market growth in the forthcoming years.

In vehicle payment market is segmented into the mode of payment, application, and region.

Based on the mode of payment, credit/debit card is the leading segment in the in-vehicle payment market, with an anticipated CAGR of 11.6%. The segment's growth is being driven by consumer preference for using credit and debit cards for contactless payments.

The segment's high adoption rate among people of various ages in established and developing economies for safe and quick transactions is expected to fuel growth throughout the forecast period.

The app/e-wallet segment is expected to increase at a fast rate over the forecast period. Due to their high convenience and fast transaction capability, app and e-wallet payment mechanisms have seen a boom in popularity in recent years.

The expanding popularity of digital payment apps and e-wallets, such as Apple Pay, Google Pay, Amazon Pay, and others, as well as the ability to pay via mobile devices and on-demand apps, are likely to propel the segment forward throughout the forecast period.

| Category | By Mode of Payment |

|---|---|

| Top Segment | Credit or Debit Cards |

| Market Share in Percentage | 45.9% |

| Category | By Application |

|---|---|

| Top Segment | Toll Applications |

| Market Share in Percentage | 28.1% |

Based on application, toll collection is the leading segment in the in vehicle payment market, with an anticipated CAGR of 11.2% through 2035. Due to toll plaza infrastructure development to be compatible with many ways of payment and consumer inclination for contactless delivery, toll plazas have become infrastructural.

Increased customer desire for purchasing through multiple online marketplaces for convenience, combined with significant social distancing guidelines during the pandemic, has influenced the shopping segment growth positively.

The food and coffee segment also experienced a significant increase during the predicted period. The segment is expected to rise due to rising demand for on-the-go snacks and beverages among drivers and passengers. Furthermore, if traffic congestion worsens, people are likely to use in-vehicle payment technologies for food and coffee purchases.

The United States is predicted to continue to dominate the global, in comparison to other countries, in the years ahead. The existence of technological advancement in North America is expected to promote the region's market growth.

The market is primarily driven by the rising penetration of connected automobiles in the United States of America.

Furthermore, the presence of the leading payment service providers, such as Mastercard, Visa, and others, as well as their collaboration with automakers like General Motors, Honda, and others to create in-vehicle payment systems, is projected to drive market expansion throughout the projection period.

| Regional Market Comparison | Global Market Share in Percentage |

|---|---|

| The United States | 17.6% |

| Germany | 7.3% |

| Japan | 2.8% |

| Australia | 1.8% |

| North America | 27.1% |

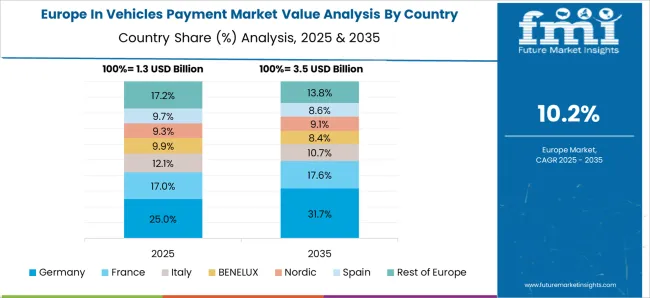

| Europe | 21.7% |

The market is expected to increase due to the presence of a robust automotive sector and the increasing penetration of next-generation connected vehicles during the projected period. France, Germany, and the United Kingdom have a high penetration of linked automobiles in Europe.

Manufacturers' efforts to roll out in-vehicle payment facilities in key nations of Europe are expected to boost vehicle payment market growth. Mercedes, for example, announced ambitions to expand its vehicle payment services across Europe in 2024.

| Regions | CAGR (2025 to 2035) |

|---|---|

| The United Kingdom | 11.6% |

| China | 11.9% |

| India | 15.6% |

The players are concentrating their efforts on building payment solutions in association with a variety of payment solution suppliers. Meanwhile, Google and Amazon have created gadgets that can be connected to a vehicle's console and used with voice commands to assist with shopping, navigation, and other chores.

Recent Developments by the In Vehicles Payment Service Providers

The global in vehicles payment market is estimated to be valued at USD 5.8 billion in 2025.

The market size for the in vehicles payment market is projected to reach USD 16.8 billion by 2035.

The in vehicles payment market is expected to grow at a 11.2% CAGR between 2025 and 2035.

The key product types in in vehicles payment market are nfc, qr code, or rfid, digital-wallet and credit or debit card.

In terms of application, parking, gas, or charging stations segment to command 47.6% share in the in vehicles payment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Infrastructure Projects Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Intellectual Property Support Services Market Size and Share Forecast Outlook 2025 to 2035

Intellectual Property Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Interior Swinging Door Market Size and Share Forecast Outlook 2025 to 2035

Inflatable Spa Hot Tub Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Touch Screen Cash Register Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Intensity Microphone Market Size and Share Forecast Outlook 2025 to 2035

Inflatable U Shaped Travel Pillow Market Size and Share Forecast Outlook 2025 to 2035

Induction Brazing Services Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Integrated Trimming and Forming System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Incline Impact Tester Market Size and Share Forecast Outlook 2025 to 2035

In-line Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Internal Anthelmintics for Cats Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA