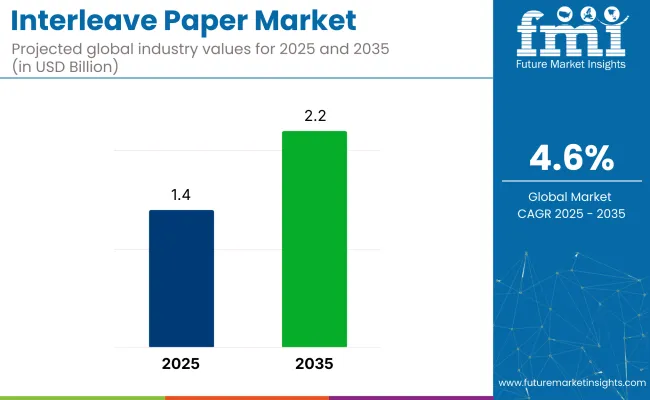

The interleave paper market is forecast to grow from USD 1.4 billion in 2025 to USD 2.2 billion by 2035, reflecting a 4.6% CAGR. Used across food, electronics, and automotive sectors, interleave paper protects goods from abrasion and contamination.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 1.4 billion |

| Market Size (2035) | USD 2.2 billion |

| CAGR (2025 to 2035) | 4.6% |

Rising demand for packaged meat, frozen foods, and bakery items has fueled adoption. Increased reliance on recyclable, biodegradable materials, especially paper-based barriers, has aligned with packaging trends that prioritize material efficiency and reduced plastic use. In industrial applications, interleave paper is gaining traction for component wrapping. As processed food consumption and regulatory pressure on plastic grow, interleave paper adoption continues to accelerate globally.

Interleave paper accounts for modest shares across its parent industries due to its specialized use in protective layering and product separation. Within the packaging materials market, it captures around 1.5-2.0%, primarily driven by its role in food, electronics, and metal sheet packaging. In the industrial paper products market, it contributes approximately 2.2%, used in high-volume manufacturing sectors requiring surface protection.

The specialty paper market sees a 3.8% share, as interleave paper falls under customized paper solutions with niche functionality. In the food packaging market, its share reaches about 2.5%, supporting meat, bakery, and frozen food applications. Lastly, within the broader pulp and paper market, interleave paper constitutes less than 1%, given its narrow scope compared to printing, tissue, and containerboard segments.

The interleave paper market is experiencing significant changes as manufacturers enhance product offerings. Mondi has expanded its range of protective interleave films for food packaging with improved durability. Stora Enso now provides specialized papers that meet strict food safety requirements. UPM Specialty Papers offers temperature-resistant options for baked goods, while Ahlstrom and Glatfelter produce medical-grade papers with protective properties.

E-commerce companies increasingly utilize these papers for safeguarding delicate items. The sector faces ongoing challenges from material cost variations and competition from synthetic alternatives. Companies are concentrating on developing stronger, more adaptable paper solutions to address diverse packaging needs in foodservice, healthcare, and industrial applications.

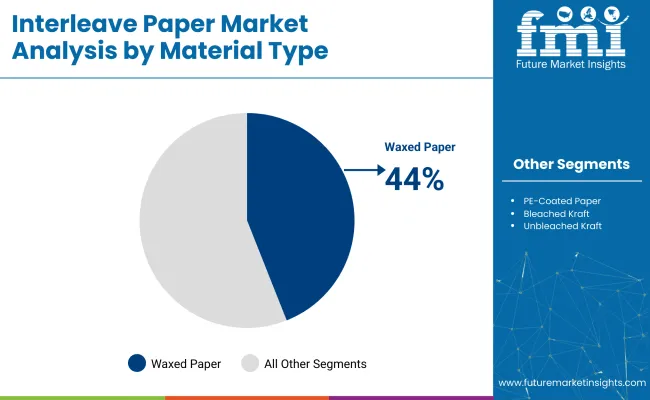

High-speed automation has driven the adoption of low-GSM interleave papers for lamination, wrapping, and separation across sectors. Waxed paper will comprise 44% of usage due to its moisture and grease resistance. Surface protection leads applications with a 58% share, while the metal and glass industries account for 47% of total consumption.

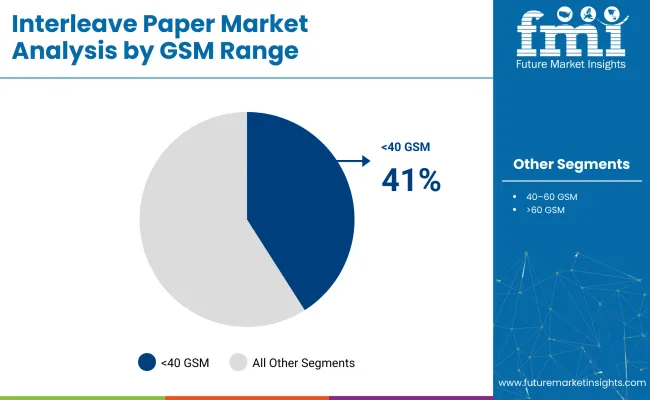

Papers below 40 GSM are projected to account for 41% of the global market in 2025, driven by their use in automated lamination, wrapping, and separation of high-volume items. These variants offer easy stackability and facilitate clean detachment in conveyor systems.

In food processing and electronics, such formats enable speed without compromising material integrity. Xamax Industries, Twin Rivers Paper Company, and Hankuk Paper Co. have commercialized low-GSM grades that are compatible with high-speed lines.

Waxed paper is expected to represent 44% of interleave material consumption in 2025. Its appeal lies in its barrier properties-moisture resistance, grease repellence, and temperature stability-making it a go-to option in food, mechanical, and electronic packaging.

Manufacturers such as Kanemo Shoji Co., Nagara Paper Mfg. Co., and Ahlstrom have increased the output of wax-coated grades suited for vacuum packing and manual layering. The non-stick nature also supports repetitive use in automated systems.

Surface protection is projected to dominate applications with a 58% share in 2025. This demand stems from the need to safeguard processed metals, coated sheets, and precision optics during handling and transit. Interleave paper in this segment ensures the prevention of scratches, dust, and pressure marks.

Companies such as Flexlink LLC, Papierverarbeitungswerk Franz Veit GmbH, and Daio Paper have refined anti-abrasive coatings and anti-static formats tailored to sheet separation tasks. Cold-rolled steel, automotive parts, and laminated glass remain core end-use areas.

Metal and glass applications are expected to make up 47% of interleave paper consumption in 2025. These sectors rely on interleaves for layering polished aluminum, mirror-finished steel, and annealed glass sheets during processing, storage, and shipment.

Suppliers such as Nissho Iwai Paper, PacPro Inc., and RHEINMAGNET deliver format-specific rolls that resist curling and dust adhesion. In the steel industry, papers prevent weld spatter and oxidation, while in the glass sector, they reduce static buildup and breakage during transit.

The interleave paper sector has been shaped by automation demands, format miniaturization, and coating technology upgrades. Trends reflect rising customization for food, glass, and electronics use cases. Suppliers now focus on thinner gauges, recyclable coatings, and anti-static variants to meet evolving downstream performance expectations.

Coated Variants and Format Customization Define Innovation in 2025

Format Inconsistency and Moisture Control Challenge Quality Compliance

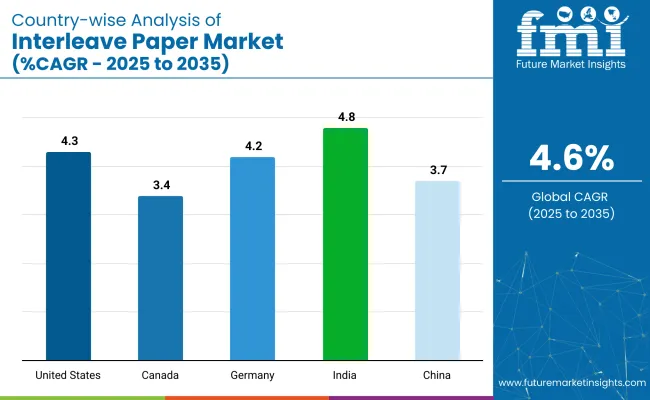

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.3% |

| Canada | 3.4% |

| Germany | 4.2% |

| China | 3.7% |

| India | 4.8% |

Global demand for interleave paper is projected to grow at a 4.2% CAGR from 2025 to 2035. Among the five profiled markets out of 40 covered, India leads at 4.8%, followed by the United States at 4.3%, Germany at 4.2%, China at 3.7%, and Canada at 3.4%. These growth rates translate to a +14% premium for India, +2% for the United States, and 0% for Germany as the baseline.

China shows a -12% deficit and Canada a -19% deficit compared to the baseline. Divergence in growth is driven by factors such as the fast-growing retail and food sectors in India, strong demand for packaging in the United States, and steady but moderate growth in China and Canada, with Germany exhibiting slow growth due to a more mature market.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

A CAGR of 4.3% has been projected for the United States from 2025 to 2035. Demand stems from widespread use in precision packaging, especially for foodservice, meat processing, and electronics. Interleaving in frozen meat processing has been favored due to USDA-sanctioned materials meeting direct-contact safety norms.

Paper converters in the Midwest have scaled operations to serve regional protein-processing clusters. Stainless steel fabricators and optics manufacturers have increased procurement of wax-coated interleaving rolls for scratch-free shipping. Equipment upgrades in secondary packaging lines have been aligned to match interleaving widths.

Canada’s market is forecast to grow at 3.4% CAGR by 2035. Usage has remained concentrated in processed food and pharmaceutical interpackaging, with rising penetration into printing and metal sheet dispatch. Canadian food safety regulations continue to push adoption of food-contact safe interleaving paper, particularly in the poultry and seafood sectors.

Bleached and wax-laminated grades are being used for cheese portioning by Quebec-based dairies. Western Canada’s print media units have shifted to bleached paper interleaves to prevent ink smearing during transport.

Germany is projected to expand at a CAGR of 4.2% over the forecast period. Interleave paper demand has remained firm across automotive metal coils, consumer electronics, and artisanal meat packaging. With REACH-driven material compliance, usage of acid-free and neutral pH interleaves has increased.

Sheet metal dispatch centers in Bavaria and Saxony have standardized poly-coated paper for coil protection. Small-format food vendors and organic butchers prefer food-grade interleave rolls for contact packaging. Domestic manufacturers are focusing on cellulose-purified substrates to align with EU chemical regulations.

China’s interleave paper market is forecast to grow at 3.7% CAGR through 2035. Packaging of smartphone components, ceramic parts, and printed electronics is driving conversion across eastern manufacturing zones. Guangdong-based auto electronics clusters are sourcing wax-coated interleaves for multi-layer packaging.

Growth in food processing and fresh meat exports has also prompted higher usage of food-grade bleached interleave sheets. Large-format interleave paper rolls have gained traction in metal dispatch, with eastern steel service centers installing precision unwinding systems.

India is expected to post a 4.8% CAGR by 2035-fastest among profiled countries. Expansion is driven by its processed food sector and rising usage in automotive sheet packaging. Bengaluru and Pune’s electronics hubs have adopted silicone interleave sheets in LED and PCB logistics. Meat processors are using anti-grease kraft interleave rolls for regional and institutional supply chains. Small-format printers and textile exporters have shifted to interleaved rolls to prevent abrasion during shipment.

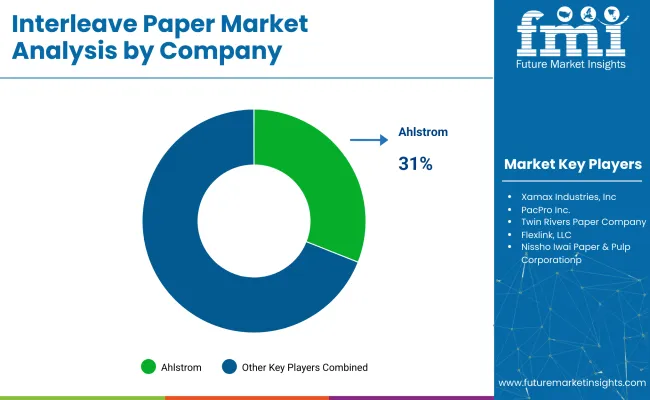

Leading Player - Ahlstrom 31% Market Share

The interleave paper industry is shaped by a fragmented supplier landscape, with established players like Ahlstrom, Xamax Industries, and Twin Rivers Paper Company driving product development. Ahlstrom has launched dual-layer wax-coated sheets designed for food-grade wrapping. Twin Rivers has expanded capacity for lightweight kraft interleaves targeting bakery and glass industries. Nissho Iwai Paper & Pulp Corporation has introduced static-control grades tailored for optics and electronics packaging in Asia.

Emerging suppliers such as Kanemo Shoji, Nagara Paper, and Hankuk Paper are scaling moisture-resistant paper formats through direct collaborations with manufacturers in precision industries. Flexlink and Papierverarbeitungswerk Franz Veit GmbH support European steel clients with dimension-specific formats. Entry barriers include pulp sourcing, coating infrastructure, and regulatory compliance, keeping the interleave paper market regionally fragmented.

Recent Interleave Paper Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.4 billion |

| Projected Market Size (2035) | USD 2.2 billion |

| CAGR (2025 to 2035) | 4.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Material Types Analyzed | Waxed Paper, PE-Coated Paper, Bleached Kraft, Unbleached Kraft |

| GSM Range Analyzed | <40 GSM, 40-60 GSM, >60 GSM |

| Applications Analyzed | Metal & Glass Industry (Sheet Separators, Surface Protection), Food Packaging (Meat Interleaves, Bakery Sheets), Electronics (Static Shielding Paper) |

| End-Use Industries Analyzed | Metal Processing, Food Industry, Electronics, Automotive |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, India, Japan, South Korea, Brazil, Mexico, UAE, South Africa |

| Leading Players | Xamax Industries, Inc., PacPro Inc., Twin Rivers Paper Company, Flexlink, LLC, Nissho Iwai Paper & Pulp Corporation, Kanemo Shoji Co., Ltd., Nagara Paper Mfg. Co., Ltd., Hankuk Paper Co., Ltd., Ahlstrom, Papierverarbeitungswerk Franz Veit GmbH |

| Additional Attributes | Dollar sales growth by material type, regional demand trends, competitive landscape, pricing strategies, packaging innovations, and supply chain insights. |

The segment includes Waxed Paper, PE-Coated Paper, Bleached Kraft, and Unbleached Kraft.

This is categorized into <40 GSM, 40-60 GSM, and >60 GSM.

The market includes Metal & Glass Industry (Sheet Separators, Surface Protection), Food Packaging (Meat Interleaves, Bakery Sheets), Electronics (Static Shielding Paper).

Segmented into Metal Processing, Food Industry, Electronics, and Automotive.

Industry dynamics evaluated across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The market size is projected to be USD 1.4 billion in 2025 and USD 2.2 billion by 2035.

The expected CAGR is 4.6% from 2025 to 2035.

Papers with a GSM of <40 dominate the market with a 41% share in 2025.

Ahlstrom is the leading company in the market, holding a 31% market share.

India is projected to grow at a CAGR of 4.8% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Recycling Market Size and Share Forecast Outlook 2025 to 2035

Paper Release Liners Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA