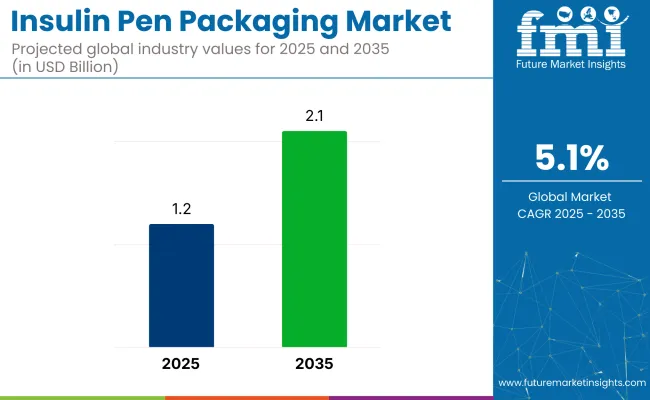

The global insulin pen packaging market is forecasted to grow from USD 1.2 billion in 2025 to USD 2.1 billion by 2035, at a CAGR of 5.1% during the forecast period. The industry growth is driven by the increasing prevalence of diabetes, especially type 1 and type 2 diabetes, which require insulin injections for management.

The adoption of insulin pen devices is being fueled by the rising demand for convenient, easy-to-use, and discreet drug delivery systems. As packaging evolves, it is becoming more advanced, offering enhanced protection and functionality.

The insulin pen packaging industry is regarded as a small but specialized segment within its parent industries. Approximately 2-4% of the insulin delivery devices industry is accounted for by this segment, with insulin pens being considered the dominant format and their packaging treated as a minor cost component.

Within the injection pen category, insulin pens are recognized as the primary application, and their packaging is estimated to be assigned roughly 2-3% of the segment. In the parenteral packaging industry-including vials, syringes, and pens-a share of around 3-5% is attributed to insulin injector packaging.

Its contribution to the broader pharmaceutical packaging industry is viewed as marginal, with less than 1% being represented due to the category’s broad coverage. In the emerging smart medical device packaging segment, a niche share of under 2% is associated with insulin pens, as limited adoption of connected insulin systems has been observed.

In May 2025, SCHOTT Pharma announced the launch of a new 1.5 ml ready-to-use (RTU) glass cartridge, designed for compatibility with Ypsomed’s UnoPen® platform. This launch signals the ongoing collaboration between SCHOTT Pharma and Ypsomed, aimed at advancing primary packaging solutions for injectable drug delivery devices.

The new RTU cartridge is intended to support the growing demand for reliable, high-quality packaging in the diabetes care sector. A joint development of the 10 ml cartriQ® cartridge for Ypsomed’s YpsoDose patch injector was also detailed in technical publications in 2023, highlighting the companies’ commitment to innovation in large-volume injectable packaging.

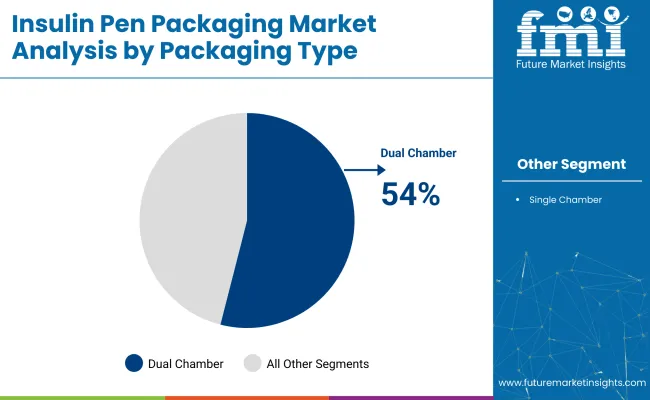

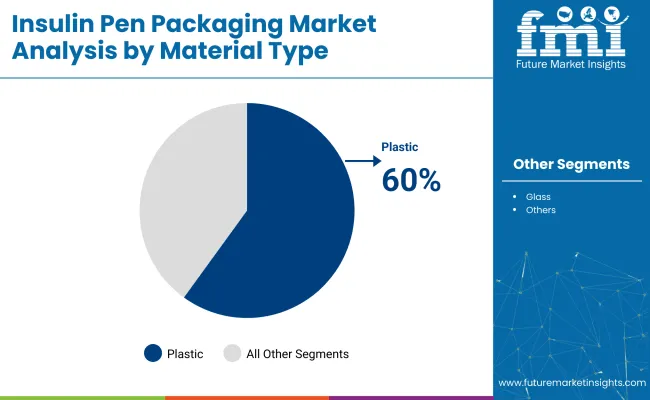

The industry has been segmented chiefly by packaging type, end-use application, and material composition. A 54% share has been held by dual-chamber packaging, while diabetes care has been attributed 71%, and plastic materials have been assigned 60%. These proportions have been interpreted as evidence that safe, user-centric, and scalable formats are being favored across the industry.

Dual chamber insulin pens are expected to dominate the packaging segment in 2025, holding a 54% share. This type of packaging allows for precise dosing and compatibility with both insulin and other medications, making it a preferred option for patients who require combination therapies.

The diabetes care segment is expected to dominate the market, holding a 71% share in 2025. This growth is fueled by the increasing global prevalence of diabetes and the rising trend of home-based diabetes management, boosting the demand for insulin injector packaging solutions designed specifically for diabetes care.

Plastic is expected to account for 60% of the material type share in insulin pen packaging by 2025. The material’s versatility, lightweight nature, and cost-effectiveness make it the preferred choice for manufacturers of insulin injector packaging.

The market is being driven by rising diabetes prevalence and advancements in insulin delivery devices. However, high regulatory requirements and the need for cost-effective solutions are limiting industry growth.

Increasing Diabetes Rates Drive Innovation in Smart Insulin Administration

Rising diabetes cases are increasing the use of connected insulin pens for better glycaemic management. Demand for patient-centric, prefilled cartridges is being accentuated because dosing accuracy and self-administration convenience are increasingly prioritized by endocrinologists and payors alike. Premium packaging that supports real-time data capture and tamper-evidence is being favored to reduce pharmacovigilance risks and recalls.

Regulatory Hurdles and Affordability Constraints Threaten Industry Momentum

Strict regulatory hurdles and cost controls are limiting the potential for industry expansion. Packaging compositions are being required to satisfy stringent ISO 11607 and USP <1207> integrity criteria, prolonging validation cycles. Price caps are being imposed by payors, which is squeezing profit margins. Smaller converters are being deterred from investing in new barrier or sensor technologies.

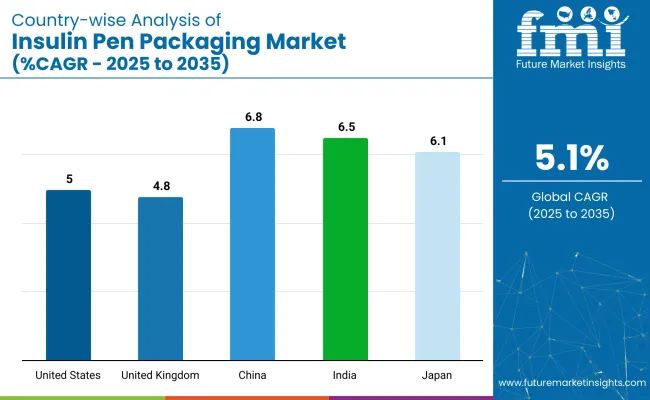

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5% |

| United Kingdom | 4.8% |

| China | 6.8% |

| India | 6.5% |

| Japan | 6.1% |

Faster growth has been recorded in BRICS economies, where China (6.8%) and India (6.5%) have outpaced the global average of 5.1%. This performance has been supported by rising diabetes prevalence, increased government procurement, and expanded contract manufacturing capacity. In China, demand has been reinforced by the adoption of smart insulin pens and investment in health infrastructure.

In India, public insulin access and export-oriented packaging have been prioritised. More moderate expansion has been observed in OECD industries, with Japan (6.1%), the United States (5.0%), and the United Kingdom (4.8%) progressing within a stable reimbursement environment. Japan’s growth has been shaped by high-purity biologic packaging needs. Volume growth is being led by BRICS. Regulatory benchmarks are being set by OECD nations.

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

Demand for insulin injector packaging in the United States is projected to rise at a CAGR of 5% through 2035, closely aligning with the global growth trajectory. As an OECD member, the industry is being shaped by well-established diabetes management systems and strict regulatory compliance.

Adoption is being driven by advancements in tamper-evident and ergonomically designed formats. These formats are tailored to support the growing use of smart insulin pens and home-based therapies.

Investment in advanced packaging technologies is being undertaken by leading insulin manufacturers, positioning the USA as a benchmark for safety and design functionality. Uptake across public and private healthcare sectors is being supported by favourable reimbursement structures.

Sales for insulin injector packaging in the United Kingdom are projected to grow at a CAGR of 4.8% through 2035. Growth is being driven by rising demand for user-friendly and eco-conscious packaging. Leading pharmaceutical companies such as Novo Nordisk and Sanofi are introducing innovative packaging solutions designed to improve the convenience and safety of insulin delivery.

With growing healthcare awareness and a rise in diabetes cases, strong demand for packaging that ensures ease of use and better patient compliance is being observed. Regulatory frameworks are influencing material choices in insulin injector packaging.

China is expected to grow at a CAGR of 6.8% through 2035. Expansion is being driven by rising diabetes cases and increasing government investments in healthcare. Major companies such as Sinovac Biotech and Novo Nordisk are rapidly scaling their insulin pen production and packaging to meet growing demand.

Government healthcare initiatives and policies promoting affordable diabetes care further stimulate industry growth. Innovations in packaging, focusing on ease of use, safety features, and Resource depletion worries, are driving the industry. Industry expansion in China is being supported by improvements in healthcare infrastructure and increased government investment.

Sales of insulin injector packaging in India is expected to grow at a CAGR of 6.5% through 2035. Growth is driven by the increasing number of diabetes patients and rising demand for convenient insulin delivery solutions. Companies such as Biocon, Mylan, and Sanofi are expanding their portfolios with advanced packaging solutions for insulin pens.

Government initiatives to improve healthcare access and diabetes care are further driving industry growth. The growing preference for easy-to-use, portable, and safe insulin delivery systems is increasing demand for insulin injectors packaging. Continuous innovations in packaging materials and design enhance the user experience and industry adoption.

Demand for insulin injector packaging in Japan is projected to grow at a CAGR of 6.1% through 2035. Growth is being supported by an aging population, increasing diabetes cases, and advancements in healthcare. Leading pharmaceutical companies like Novo Nordisk and Eli Lilly are innovating packaging designs that improve insulin pen usability and patient adherence.

Demand for more efficient, secure, and user-friendly packaging solutions is growing among diabetic patients. Japan’s healthcare infrastructure, combined with strong regulatory standards for medical devices, supports the adoption of innovative packaging technologies, ensuring steady industry growth.

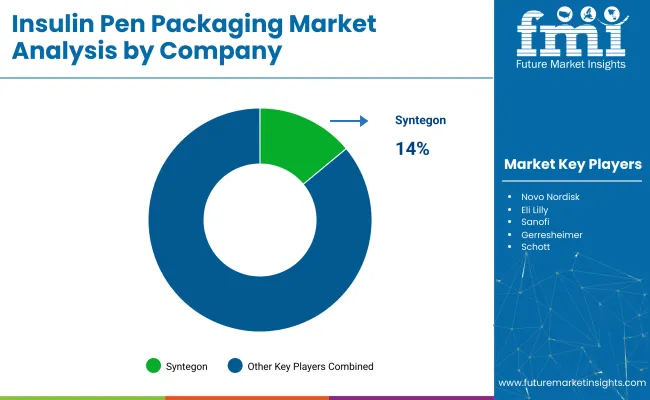

The industry is characterised by a semi-fragmented structure, consisting of dominant automation firms, specialised packaging-equipment manufacturers, and emerging regional suppliers. A leadership position has been maintained by Syntegon (Germany), supported by precision-engineered systems and integration of GMP-compliant safety features across automated lines.

AAE (Advanced Assembly Equipment) and Bausch + Ströbel are being positioned as key players, delivering high-speed, cost-optimised packaging machinery for insulin pen assemblies. Customised equipment solutions are being offered by AIPAK and Shanghai Marya Pharmatech, addressing domestic regulatory protocols and mass-industry demand.

Emerging firms such as Imatics India and LINGWEN are focusing on modular packaging innovations. Contract Pharma services are being increasingly utilised to improve scalability and reduce capital outlay for pharmaceutical producers.

Recent Insulin Pen Packaging Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 1.2 billion |

| Projected Industry Size (2035) | USD 2.1 billion |

| CAGR (2025 to 2035) | 5.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Packaging Types Analyzed (Segment 1) | Dual Chamber, Single Chamber |

| End Uses Analyzed (Segment 2) | Diabetes Care, Other Healthcare Applications |

| Material Types Analyzed (Segment 3) | Plastic, Glass, Other Materials |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Novo Nordisk, Eli Lilly, Sanofi, Gerresheimer, Schott, Becton Dickinson, F. Hoffmann-La Roche, Syringe Manufacturing Co., Medtronic |

| Additional Attributes | Dollar sales, share by packaging and material type, rising demand in diabetes care, innovations in dual-chamber designs, expansion of plastic-based packaging formats in emerging industry s, regional adoption trends in injectable therapy |

The industry is segmented into dual chamber and single chamber packaging types.

The industry covers diabetes care and other healthcare applications.

The industry includes plastic, glass, and other materials.

The industry spans North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is expected to reach USD 2.1 billion by 2035.

The industry size is projected to be USD 1.2 billion in 2025.

The industry is expected to grow at a CAGR of 5.1%.

Dual chamber formats are estimated to capture a 54% share in 2025.

Syntegon leads the industry with an estimated 14% share in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA