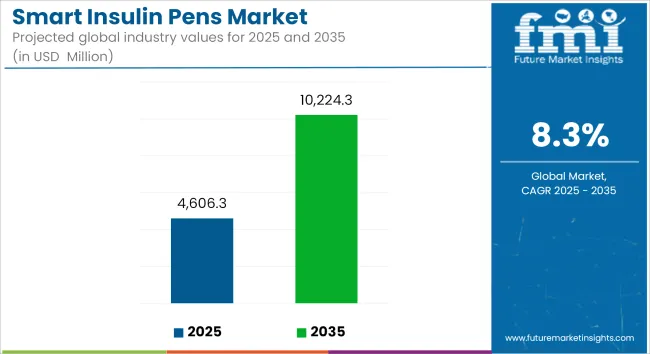

The smart insulin pens market is projected to reach USD 4,606.3 million by 2025 and is expected to grow steadily at a CAGR of 8.3% to reach USD 10,224.3 million by 2035. In 2024, the smart insulin pens market generated roughly USD 4,253.3 million in revenues.

A smart insulin pen is a modern, reusable injection pen equipped with advanced high-tech features, including Bluetooth, which helps diabetic users administer insulin injections more effectively.

An increasing number of cases of diabetes continues to support demand for these insulin delivery devices. Compared to traditional pens, smart pens are more usable, precise, track real-time data, and greatly reduce the chances of a misdosage or missing a dose. Furthermore, the increased popularity of awareness on digital health tools in conjunction with benefits to individualized diabetes management highly encourages their uptake.

Compatibility with increasingly powerful mobile health apps linked to continuous glucose monitoring (CGM) systems vastly increased their value. Additionally, favorable health policies implemented by the government further encourage the adoption of such devices in the market.

Smart insulin pen adoption surged from 2020 to 2024 due to several interrelated factors. The COVID-19 pandemic accelerated the implementation of digital health capabilities, with a further increase in the use of telehealth and remote monitoring. Smart insulin pens that connect with mobile health applications have proven to be valuable tools for remote diabetes management, resulting in a decrease in hospital visits.

Widespread incidence of diabetes, mainly the type 2 variety, has gradually increased the focus on sophisticated solutions for the administration of insulin. FDA and CE marking approvals, and subsequent launches by key players, further enhanced market accessibility. Insurance and reimbursement advances in various regions have increased patient access to these pens. This accessibility is further supported by healthcare providers who has further led to an increase in adoption of smart insulin pens in the market.

There is a growing demand for smart insulin delivery devices, primarily due to the rising prevalence of diabetes, particularly type 2 diabetes. The established healthcare infrastructure, combined with an extensive range of smart pens integrated with healthcare applications and continuous glucose monitoring (CGM) systems, further anticipates market growth.

The regulatory clearances provided by the FDA increased market reach while improved insurance coverage and reimbursement policies greatly enhanced accessibility to these devices. Furthermore, the integration of Bluetooth technology and data analytics is making operations easier and more attractive to patients and clinicians.

An increasing number of diabetes patients and the thrust on digital healthcare solutions are encouraging the uptake of smart insulin pens in Europe. These smart pens receive further encouragement in terms of uptake through an uninterrupted healthcare system and government support for managing diabetes, which enables precise insulin administration and patient compliance.

CE mark approvals and other regulations have driven market growth, while reimbursement policies in key markets, such as Germany, France, and the UK, have helped increase accessibility. Interoperability with mobile applications and continuous glucose monitoring (CGM) devices further facilitates diabetes self-management, thereby encouraging adoption.

With improved healthcare infrastructure and wide insurance coverage, the reach of smart insulin pens increases. Urbanization and lifestyle changes are thus increasing the demand for advanced devices for insulin delivery. The increasing penetration of smartphone connectivity, combined with mobile health applications and continuous glucose monitoring (CGM) systems, is also making this process more convenient. Lastly, both local and global market leaders are expanding their presence in the region, thereby promoting the sale of budgeted smart insulin pens and driving sales growth in the Asia Pacific.

Challenges

Compatibility Issues with Existing Diabetes Management Systems Hinder the Adoption of Smart Insulin Pens

The greatest incompatibility faced by smart insulin pen systems is the limited present interoperability with existing diabetes care systems, such as continuous glucose monitoring (CGM) devices and insulin pumps. Many smart pens have proprietary platforms that do not allow seamless data sharing when a patient is using different brands or types of CGMs and diabetes care apps.

The absence of interoperability can be frustrating for users who use devices for insulin tracking and glucose monitoring. Even therapists have difficulties in integrating smart pen data into electronic health records (EHRs), as they are not compatible with different software systems.

Without a common integration framework, the unrealized potential for real-time insulin adjustments, along with automated analysis, will remain unrealized for patients, thereby undercutting the real-time potential of smart insulin pens in integrated diabetes care. Such compatibility issues would be addressed as a matter of necessity to ensure smooth adoption and improved patient outcomes.

Opportunities

Expansion in Emerging Markets with Government Support Poses New Opportunities in the Market.

Emerging markets in India and China are paving the way for the adoption of smart insulin pens, as demand for insulin treatment increases and government-funded healthcare programs support such initiatives. The government's efforts to invest in digital healthcare infrastructure are further underscoring the need for smart medical devices to better control diseases.

Such programs for public health awareness, prompt detection of diabetes-related effects, and affordability of treatment are providing opportunities for smart insulin pen producers. Other programs, such as reimbursement programs, subsidies, and tax credit facilities for digital healthcare products, are enhancing the affordability of these devices among patients.

With a rise in telemedicine adoption in these markets, connected insulin pens integrated with mobile health platforms can further expedite remote diabetes care, thus boosting their market potential. A rise in regulatory clearances and local manufacturing can further enhance affordability and mass adoption in emerging markets.

Increasing FDA and CE Approvals Driving Market ExpansionSurges the Growth of the Market

A considerable number of smart insulin pens have received FDA approval and the CE marking, increasing the competitive advantage that manufacturers can create to improve market share. Novo Nordisk and Medtronic are among the companies that have been approved, with indications that the products meet the required safety and efficacy levels. Such registrations help boost confidence in physicians, thereby enhancing adoption among healthcare providers and patients.

Growing Partnerships Between Pharma Companies and Tech Firms Anticipate the Growth of the Market

Eli Lilly and Novo Nordisk are collaborating with digital health platforms and software companies to better manage analysis and integration with mobile health apps. Such collaborative efforts are making it possible to develop smart insulin pens that seamlessly interface with continuous glucose monitoring (CGM) systems and cloud platforms that offer up-to-the-minute insights for better diabetes management. In addition, such partnerships with software companies provide currently developing sophisticated and precise insulin-dosing algorithms with the aim of reducing human error.

Availability of Insulin Dosing and Personalized Diabetes Management is an Ongoing Trend in the Market

Smart insulin pens with dosing and monitoring capabilities would analyze trends in blood glucose, the influence of lifestyles on blood glucose, and the history of insulin use for immediate or rapid dose adjustments to minimize the possibility of hypo- or hyperglycemic events. Some smart pens are embedded with coaching functions that are designed to guide patients on when or how much insulin to take or give based on analytics. This capabilities of smart insulin pens are changing the diabetes treatment paradigm.

Expansion of Smart Insulin Pen Adoption in Emerging Markets is an Emerging Trend in the Market

Countries such as China, India, and Brazil are among the emerging markets where adoption is growing due to the increasing incidence of diabetes and the rise in digitalization within the healthcare sector. Their governments are investing in digital health programs and enhancing insurance coverage for more advanced diabetes management technologies. Affordable smart insulin pens, specifically designed for price-sensitive markets, are being launched by both local and international companies, further anticipating market growth.

The year 2020 to 2024 witnessed an enormous growth in the smart insulin pen market because of the increasing incidence of diabetes, improved digital health systems, and the approval of FDA and CE regulatory. With almost all doubt purged by the impending COVID-19 pandemic, telemedicine gained considerable popularity, which was soon followed by virtual platforms for diabetes management. Factors like CGM platform compatibility and AI-based insulin dosing facilitated quick uptake.

Between 2025 and 2035, the abundant uptake of reimbursement policies and increased penetration into developing markets will be the most significant drivers of market growth. Features such as automated insulin titration, superior cloud connectivity, and interoperability with digital health platforms shall continue to redefine the diabetes care paradigm and turn smart insulin pens into a worldwide mass solution.

Shifts in the Smart Insulin Pens Market from 2020 to 2024 and Future Trends 2025 to 2035

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | FDA, EMA, and CFDA approvals are increasing for the digital management of diabetes, its cybersecurity, and its interoperability with mobile apps or continuous glucose monitors (CGMs). Compliance with the GDPR and HIPAA has become extremely important. |

| Technological Advancements | Bluetooth pens keep a watch on dose, cloud-connected and in real-time, checking glucose levels with CGM. AI-powered apps have begun their role in assisting with calculating insulin doses. |

| Consumer Demand | Rising cases of diabetes and rapidly embracing digital health solutions. There will be an increased focus on telemedicine and remote patient care following the COVID-19 pandemic. |

| Market Growth Drivers | Digital health awareness, coupled with regulatory approval, is driving adoption, alongside the necessity for improved insulin control. Growth in remote patient monitoring. |

| Sustainability | Reusable smart pens will decrease medical waste and encourage sustainable designs. Manufacturers have started to add energy-efficient batteries. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter data privacy and AI-based regulations for insulin dosage. Global uniform guidelines on the use of AI in diabetes care and stronger patient data protection acts |

| Technological Advancements | AI-enabled automated insulin pens. Interfaced with a wearable glucose monitor for real-time data usage and automatic adjustment for personalized treatment. |

| Consumer Demand | Increased demand for smart insulin pen adoption in developing countries; Increased demand for personalized, AI-enabled, and subscription-based insulin delivery systems |

| Market Growth Drivers | Emerging markets growth and an inclination toward rising insurance payments, precision dosing through AI, and greener innovations |

| Sustainability | Increasing growth in biodegradable materials, carbon-free productions, and regulations governing sustainable diabetes care solutions |

Market Outlook

High diabetes rates, decent insurance coverage, and rapid technological advancements benefit the USA market. The expansion of telemedicine and increased FDA approvals for automation will support the growth of this market. Future trends include AI-driven insulin dosing, integration of wearable devices, and subscription-based smart pen models to make diabetes management more personalized and affordable.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

Market Outlook

Germany's smart insulin pen market is centered on digital health integration, with diabetes programs funded by the government. The adoption of artificial intelligence-based healthcare solutions, with an emphasis on interoperability with electronic health records, will enhance the adoption in this country. Aging populations and growth reimbursement policies will additionally drive the market through 2035.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.8% |

Market Outlook

Rapid urbanization, rising incidences of diabetes, and government endorsement of digital health programs underlie the market in India. Demand for affordable smart insulin pens is driven by increasing smartphone penetration and declining prices. During the future expansion of the market, public health programs, increased insurance coverage, and the introduction of low-cost AI-enabled insulin delivery systems will make a big difference.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

Market Outlook

Improvements in healthcare infrastructure, state investments in diabetes treatment, and the increasing adoption of digital health technologies have boosted the development of China. Smart insulin pen adoption is most common when coupled with 5G telemedicine platforms. By 2035, domestic development, AI-enabled insulin monitoring, and a strong regulatory background will have set China up as a dominant player in the market.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.2% |

Market Outlook

Technological advancements, heightened health awareness, and an aging population that necessitates advanced diabetes management devices have driven growth in the Japanese economy. The use of AI-driven insulin pens, along with automatic dosing adjustment systems is rising. Robotic healthcare solutions will continue to be customized for diabetes management, coupled with government support for digital medicine. This will spur future growth.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

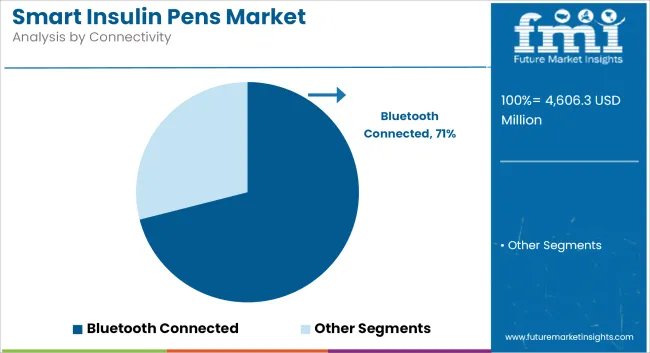

The Bluetooth-connected segment dominates the market owing to its seamless real-time data transfer.

The Bluetooth-enabled segment triumphs due to its ever-ongoing real-time data interchange alongside compatibility with digital health platforms. The pens synchronize with smartphones, continuous glucose monitors (CGMs), and diabetes apps for complete automatic tracking of insulin doses and issuing reminders, along with AI-powered recommendations. The increased use of telemedicine and remote patient monitoring further fuels demand.

Manual data migration is largely replaced by Bluetooth as a medium of connectivity, thereby enhancing compliance and precision in diabetes management. Increasing regulations and insurance reimbursements favoring connected diabetes devices further propel growth in the developed markets by some of the well-known names in the industry, like Novo Nordisk and Medtronic.

USB-connected segment holds a substantial market share due to its affordability and accessibility.

USB-connected segment holds good market share due to its cost-effective nature, making it consumer-friendly in most developing markets as well as healthcare systems with little or no digital infrastructure. This makes USB-connected pens attractive for cost-conscious consumers as well as healthcare professionals who prefer offline storage and manual upload to wireless synchronization.

Additionally, they gain popularity in clinical settings where patients are asked to collect data to report their insulin use. There are also areas where concerns about data privacy or limited internet access lead to the selection of USB-based products for secure insulin monitoring. As Bluetooth technology prevails, USB-connected pens are still a requirement for markets with lower smartphone penetration and digital maturity.

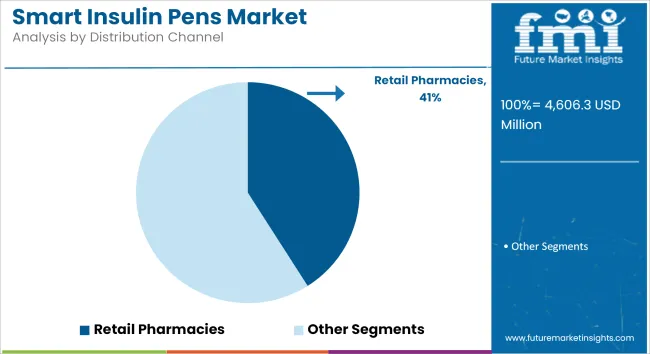

The Retail Pharmacies Segment Dominates the Smart Insulin Pens Market Due to Its Widespread Accessibility.

Retail pharmacies dominate the smart insulin pens market because they are widely available, offer clean and reputable pharmacist advice, and provide secure insurance reimbursements. Consumers prefer to purchase prescription medical devices from local pharmacies that offer medical professional advice on insulin use and digital connectivity options.

Retail chains such as CVS, Walgreens, and Boots have tied up companies, hence ensuring continuance in the availability of stock. In addition to this, insurance companies also follow the same trend for reimbursement purposes, preferring in-store purchases through dispensing pharmacies as major distribution channels. The extensive reach and coverage of retail pharmacies in the urban and rural areas are strong additives to the market leadership position.

E-commerce is rapidly gaining traction, driven by the increasing shift toward online healthcare solutions.

The growth of e-commerce channels has been particularly notable recently, driven by increasing demand for online health services, exclusive sales to consumers, and convenience-based home delivery. Online pharmacies such as Amazon, CVS, and Walmart Online are easily accessible and relatively cheaper compared to subscription-based and automated refill services, thereby making them popular to customers who purchase insulin on repeat.

In addition, telemedicine and digital prescriptions have transformed the customer from purchasing smart insulin pens online to going to stores. The drive towards online purchases has been further strengthened because of the acceleration in adoption caused by the COVID-19 pandemic. The progressive growth trajectory continues with the expansion of e-commerce into developing markets.

The competition among the neglected forces in smart insulin pens is fierce and urgent considering its technology, regulations and all forms of strategic partnerships. The FDA and EMA are shaping future trends that will include data safety and precision in the administration of insulin. The companies also secure a reasonable market share by extending partnerships with telemedicine companies, digital health platforms, and insurance companies to provide better access to patients.

They turn their resources on the direct-to-consumer channel and subscription schemes to retain a large customer base. Regional players continue to pose a challenge as they enter the emerging markets, hence driving pricing strategies and the introduction of localized products.

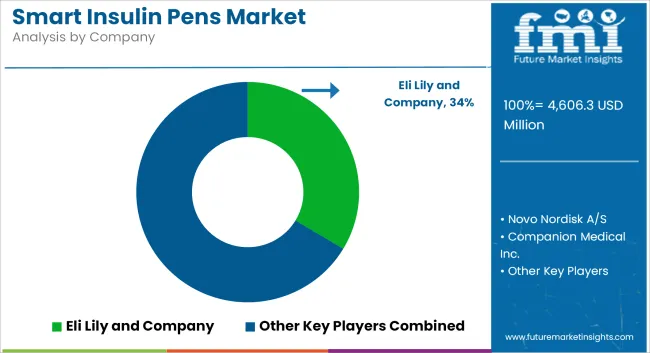

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Eli Lily and Company | 33.6% to 38.5% |

| Novo Nordisk A/S | 20.4% to 22.6% |

| Companion Medical Inc. | 15.1% to 17.2% |

| Sanofi Aventis LLC | 4.6% to 6.8% |

| Other Companies (combined) | 12.1% to 15.4% |

| Company Name | Key Offerings/Activities |

|---|---|

| Eli Lilly | Eli Lilly focuses on integrated diabetes solutions such as the Tempo Smart Insulin Pen, which integrates with the TempoSmart ™ app for real-time insulin monitoring and analytics. |

| Novo Nordisk | NovoPen 6 and NovoPen Echo Plus, featuring Bluetooth connectivity and dose memory tracking, are marketed by the company. The focus lies on the integration of the smart pens with CGMs and diabetes digital management platforms. |

| Sanofi | Sanofi collaborates with biotech firms and software developers to enhance its connected insulin pen solutions, supporting dose monitoring and patient engagement through digital platforms. The company emphasizes global accessibility and affordability. |

| Medtronic | The InPen ™ from Medtronic is a reusable Bluetooth insulin pen whose real-time dose suggestions and dose tracking are shared within the partnered app. The current Medtronic portfolio includes the design and development of AI-enhanced insulin dosing algorithms for personalization in diabetes care. |

Key Company Insights

Novo Nordisk

The leader in diabetes care, Novo Nordisk, has a great reputation in the smart insulin pen segment with NovoPen® 6 and NovoPen Echo® Plus, which boast Bluetooth features and data-recording technology. In fact, the company has a promise to improve digital links and partnerships with CGM companies to help improve diabetes management.

Eli Lilly

Eli Lilly accelerates real-time monitoring and analytics in insulin delivery via the Tempo Smart Insulin Pen and TempoSmart app. Additionally, it collaborates with digital health companies to scale its ecosystem with AI insights and activators at the patient level.

Sanofi

Sanofi concentrates on affordability and global reach and collaborates with connected insulin pen projects and combined digital solutions. Sanofi is pursuing growth in its partnerships of software and glucose monitoring platforms to drive precision dosing and self-management of diabetes.

Other Key Players

Diabetes Type I and Diabetes Type II

Bluetooth Connected and USB Connected

Clinics & Ambulatory Surgical Centers, E-Commerce and Retail Pharmacies

The overall market size for smart insulin pens market was USD 4,606.3 Million in 2025.

The smart insulin pens market is expected to reach USD 10,224.3 Million in 2035.

Growing healthcare infrastructure in developing countries for taking care of increasing diabetic patients anticipates the growth of the smart insulin pens market.

The top key players that drives the development of smart insulin pens market are Eli Lily and Company, Novo Nordisk, Sanofi, Emperra GmbH e-Health Technologies, and Companion Medical Inc.

Bluetooth connected segment by product is expected to dominate the market during the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Connectivity, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Connectivity, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Connectivity, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Connectivity, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Connectivity, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Connectivity, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Connectivity, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Connectivity, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Connectivity, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Connectivity, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Connectivity, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Connectivity, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Indication, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Connectivity, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Connectivity, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Connectivity, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Connectivity, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Connectivity, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Indication, 2023 to 2033

Figure 22: Global Market Attractiveness by Connectivity, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Indication, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Connectivity, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Connectivity, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Connectivity, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Connectivity, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Connectivity, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Indication, 2023 to 2033

Figure 46: North America Market Attractiveness by Connectivity, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Indication, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Connectivity, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Connectivity, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Connectivity, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Connectivity, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Connectivity, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Indication, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Connectivity, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Indication, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Connectivity, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Connectivity, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Connectivity, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Connectivity, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Connectivity, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Indication, 2023 to 2033

Figure 94: Europe Market Attractiveness by Connectivity, 2023 to 2033

Figure 95: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Indication, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Connectivity, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Connectivity, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Connectivity, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Connectivity, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Connectivity, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Indication, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Connectivity, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Indication, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Connectivity, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Connectivity, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Connectivity, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Connectivity, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Connectivity, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 141: MEA Market Attractiveness by Indication, 2023 to 2033

Figure 142: MEA Market Attractiveness by Connectivity, 2023 to 2033

Figure 143: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Insulin Pens Market – Growth & Forecast 2025 to 2035

Smart Meeting Pod Market Size and Share Forecast Outlook 2025 to 2035

Smart Electrogastrogram Recorder Market Size and Share Forecast Outlook 2025 to 2035

Smart Aerial Work Robots Market Size and Share Forecast Outlook 2025 to 2035

Smart Bladder Scanner Market Size and Share Forecast Outlook 2025 to 2035

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Insulin Biosimilar Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA