The global Continuous Glucose Monitoring (CGM) Systems Market is projected to expand significantly, rising from USD 12,835.6 million in 2025 to USD 55,048.4 million by 2035, registering a compound annual growth rate (CAGR) of 15.7%. In 2024, the market generated USD 11,096.4 million in revenue.

The growth trajectory is driven by several interconnected factors: the rising global prevalence of diabetes, the increasing use of wearable healthcare technologies, and broadening reimbursement frameworks across major economies. CGM devices have gained widespread favor due to their ability to provide real-time glucose data, reduce the need for finger-stick testing, and support earlier insulin interventions. The inclusion of remote monitoring features has further enhanced their use in both clinical and home settings, reinforcing CGM as a cornerstone of modern diabetes management

Key industry leaders such as Dexcom, Abbott, Medtronic, and Senseonics are advancing the usability and scalability of CGM systems through ongoing innovation. Product evolution has focused on miniaturization, longer sensor wear periods, and seamless integration with insulin delivery systems and mobile health platforms. The launch of Dexcom’s G7 in late 2023 marked a major milestone, introducing a 15-day sensor with broader insurance coverage for Type 2 diabetes patients.

According to Dexcom CEO Kevin Sayer, all three major USA pharmacy benefit managers now include the G7 in their coverage, expanding access to over 6 million eligible patients. Similarly, Abbott aims to grow its FreeStyle Libre franchise to USD 10 billion in sales by 2028, supported by the launch of Lingo, a consumer-grade CGM intended for wellness users of all ages. These developments address both the clinical and consumer sides of the CGM ecosystem, unlocking new market segments.

North America continues to lead the global CGM systems market, supported by payer policy reforms, guideline updates, and an innovation-friendly environment. The shift in clinical practice guidelines now endorses CGM use not only for insulin-dependent individuals but also for Type 2 diabetes patients on oral medication, broadening the eligible population significantly. Strategic collaborations between CGM manufacturers and retail pharmacy chains are enhancing patient access and adherence through streamlined fulfillment models.

In Europe, countries like Germany, the UK, France, and the Nordics are front-runners, largely due to comprehensive reimbursement systems and strong physician adoption. However, successful market entry in this region requires compliance with EU MDR regulations and alignment with interoperable health IT infrastructures, particularly those linked to national electronic health records.

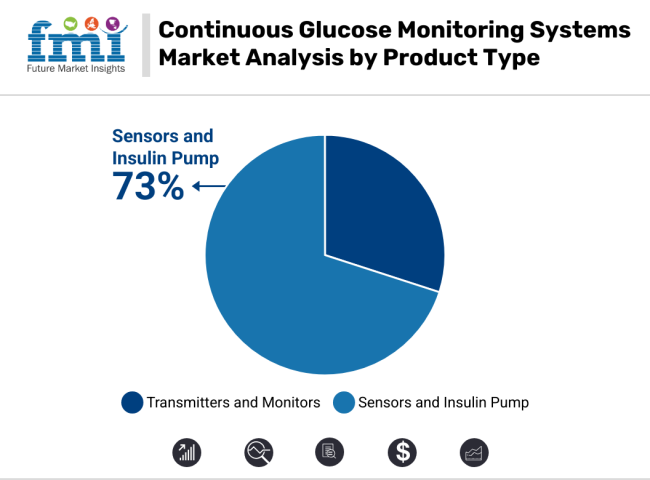

Sensors dominate the CGM market by accounting for approximately 73% of total revenue in 2025, driven by their role in continuous, real-time glucose tracking and their recurring usage cycle. Most CGM sensors require replacement every 7-15 days, depending on the brand, which creates a robust and predictable revenue stream for manufacturers.

The adoption of advanced sensor models such as Dexcom’s G7 and Abbott’s FreeStyle Libre 3, both of which offer factory calibration and extended wear periods, has improved accuracy, user comfort, and biocompatibility accelerating uptake across both Type 1 and Type 2 diabetes patients. The expansion of CGM reimbursement to include non-insulin-dependent Type 2 patients, especially under public health programs like Medicare in the USA, has further catalyzed sensor volume growth and market expansion.

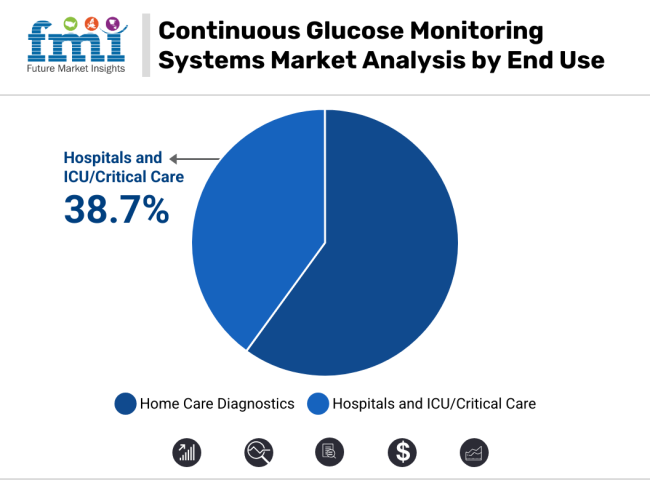

Hospital pharmacies are projected to contribute approximately 38.7% of the total revenue in the CGM systems market in 2025, largely due to their expanding role in both acute and post-acute diabetes management. Hospitals are increasingly integrating CGM systems into care pathways for inpatients with fluctuating glucose levels, such as those in ICUs, undergoing surgery or presenting with diabetic ketoacidosis (DKA). Peer-reviewed studies, such as those published in The Lancet Diabetes & Endocrinology, link CGM usage with fewer hypoglycemic episodes and reduced hospital stay durations.

Many institutions have also incorporated CGM into discharge protocols for newly diagnosed or poorly controlled patients, ensuring therapy continuity via hospital-affiliated outpatient pharmacies. These pharmacies benefit from bulk procurement models under value-based reimbursement contracts, enabling cost-efficient distribution of sensors and transmitters. The rising number of diabetes-related hospital admissions reinforces the role of hospital pharmacies as high-volume, high-impact distribution hubs within the CGM ecosystem.

The increasing number of diabetes, most notably type 2 diabetes, has directly pushed the demand for improved management technologies. More and more people developing diabetes from changed lifestyles mean never before have they needed such consistent and timely feedback on blood glucose levels. All these have improved the devices' attractiveness to a wider population, from children to older adults.

Thirdly, enhanced insurance coverage for CGM systems has rendered them more affordable. With insurers increasingly appreciating the importance of CGMs in averting complications and guiding diabetes management, an increasing number of patients can now afford the devices.

Furthermore, public health efforts and increased awareness of the benefits of CGMs have further promoted their use. With these elements combined, CGM systems are becoming essential to diabetes care throughout North America.

The ever-increasing burden of diabetes has made it one of the most complicated health issues in the region. CGMs empower patients to explicitly monitor glucose levels at all times, thereby minimizing variations and, over time, improving outcomes. The correlation between aging and diabetes brings with it an increased demand for control in the form of devices that specify glucose levels.

This explains why developed healthcare systems such as Europe have been able to advance the engagement of CGMs. Public healthcare set-ups of Germany, France, and the UK have developed in tandem with the necessity to highlight CGMs in lowering complications and improving the quality of life of diabetics. For people across Europe, insurance coverage for CGMs has greatly enhanced accessibility features of the technology for people with diabetes.

The rapidly growing disease burden and related complications caused by diabetes throughout the continent. CGMs are available to any patient and provide these patients with the ability to monitor glucose levels thereby reducing fluctuations and ultimately improving long-term outcomes. With the trend of increasing diabetics aging in society, device demand for better control of glucose levels rises.

Advanced and developed healthcare systems such as Europe have greatly supported the use of CGMs. The public healthcare set-ups of Germany, France, and the UK have been increasingly keen on the importance of using CGMs in reducing complications and improving the quality of life among diabetic patients.

Insurance coverage across most of Europe for CGMs has enhanced accessibility for the use of such technology among a wide range of people with diabetes.

Rapid urbanization and the burgeoning number of people living sedentary lifestyles are all driving factors for the increasing prevalence of diabetes. This gives rise to an escalating demand for the efficient monitoring needed by patients through such devices as continuous glucose monitors (CGMs).

The monitors assist the patients in continuously monitoring their blood glucose levels and obtaining real-time information to avert hazardous fluctuations and long-term complications.

The developed healthcare infrastructure in the region has made these CGMs available. Urban areas, in particular, have a high prevalence of use in CGMs, with the more expansive healthcare centers and specialized clinics providing CGM services. Increased emphasis on preventative medicine and personalized treatment is prompting more individuals to utilize CGM systems as part of their diabetes care.

Governmental initiatives aimed at controlling the diabetes epidemic have rendered CGMs cheaper and educated more people about them. Such initiatives, and advanced CGM technologies, have made them cheaper, more accurate, and user-friendly, thus multiplying the penetration of the systems throughout the region.

Higher Costs Associated with Products and Maintenance are Creating Barriers in Product Adoption

In nations with less extensive healthcare coverage, patients cannot easily access these systems due to their higher price range. Though some countries in the region have added CGMs to their health plans, the payment policies are restricted, and in most cases, the cost remains a burden for individuals.

The problem is one of the constraints against the large-scale use of CGMs, particularly in areas where diabetes technology is not widely available. Until costs become more reasonable or insurance coverage becomes more prevalent, the adoption rate of CGMs will be constrained for most people who would gain from them.

Emphasis on Developing Devices for Paediatric and Elderly Population can bring New Business Opportunities to the Players.

Focusing on Continuous Glucose Monitoring (CGM) device customization for kids and the elderly represents to manufacturers an important means of making the market brighter and meeting the exclusive necessities of these ages.

To make wearing a CGM sensor less troublesome, manufacturers can exploit child-friendly products that include basic functions, child safety mechanisms, and products, like nebulizers, that are appropriate for the younger demographic. Aside from safety function considerations, developers can increase market accessibility by offering unique designs such as stylish and discreet and features connecting the sensors to the app that allow for notifications for parents.

When it comes to the elderly and their issues with reduced dexterity, sight limitations, or cognitive problems, manufacturers may consider incorporating CGMs designed to compensate for these challenges. These devices might include larger screens, less complex controls, and even the use of voice prompts to simplify the process of monitoring glucose for elderly people. Also, with the caregiver alerts and family-member-involving, the safety of the patient is guaranteed, and peace of mind is provided.

The specific targeting of these two groups with unique wants besides the general concern over diabetes management and new spaces for business progress is an absolute plus. The world demographic changes and the rise in kids diagnosed with diabetes mean that the manufacturers of CGM will make a long-term profit only if they focus on these segments.

Such a strategy is a way of addressing the issue of access and client perceived quality of life, groups that are in a precarious situation, which in turn translates today into the opportunity for manufacturers in the diabetes care market to pursue the most profitable products.

CGM system markets are moving fast, propelled by technology changes and patient-centric care approaches. Among the most striking changes in the CGM system are the minimally invasive and even non-invasive CGM device development, which tend to be more comfortable during monitoring and enhance user compliance.

Integrated systems are also emerging, as CGM systems are combined with insulin delivery devices to ease diabetes management with automated insulin dosing more accurately. Another trend worth mentioning is wearable technology, which provides continuous health monitoring for the user, with easy data sharing with healthcare providers.

It will enhance data analysis and provide predictive insight from artificial intelligence, demonstrating how far-reaching these technologies can be. All these developments are ushering in more user-friendly and powerful solutions for diabetic management, empowering users increasingly to take charge of their health.

Overshadowed by the emerging trend of increasing OTC CGM devices gaining popularity in the CGM market is an increasing number of consumer offerings that provide real-time glucose information, allowing for monitoring, thus reducing the need for a prescription.

Abbott Laboratories, for example, launched the Lingo CGM system in September 2024 for continuous glucose monitoring. Another party in the increasing interest in tracking glucose levels for general health and wellness among those without glucose disorders is being attracted more actively.

This trend is lifting the market beyond diabetes and drawing a healthier demographic into it. Moreover, there is also suggestive going towards the incorporation of smart connectivity in CGM systems, coupling them with smartphones and cloud platforms to facilitate remote access for healthcare professionals to monitor different patient data.

There is also revolutionizing the very functionality of CGM systems by machine learning and artificial intelligence, providing users with personalized insights and predictive analytics to manage their glucose levels properly. These are shaping a more accessible, personalized future for glucose monitoring.

The incrementing of use of Continuous Glucose Monitoring (CGM) systems from 2020 to 2024 was the result of the ascendant of diabetes normalization and the desire for more accurate, moment blood glucose tracking. CGM technology was predominantly used by patients with Type 1 and Type 2 diabetes to achieve better glucose control and reduce the complications that appeared due to the changes in blood sugar levels.

This interest was also ignited by the more and more observed awareness concerning early diabetes detection and management, which gradually became one of the crucial topics of public awareness about health.

The progressive availability of more cost-efficient and user-friendly CGM devices with the inclusion of smartphone and insulin pump linkage opened the group to a wider range of patients. Still, with the issues of high prices and the lack of insurance coverage, it was a long way to go, especially in developing countries.

When we analyze the years 2025 to 2035, the CGM market is going to be influenced by the AI power tools that will be utilized in the analytics field, thus the target of analyzing the glucose trends and suggesting the probable phases.

The assimilation of CGMs and wearable technology, as well as the introduction of mobile apps, will be the backbone of the manufacturer's effort to improve the customer experience, which will be conducive to the obtaining of a better human management of diabetes.

The research regarding CGMs for non-diabetic groups, e.g. the pre-diabetics and people with a metabolic syndrome, would be a stimulus for the opening of new markets. The improved coverage of insurance and the incentives of the government will continue to be the main drivers of user adoption.

At the same time, manufacturers' attempts to lower purchase costs will help to solve the issue of the existing price barrier. Furthermore, the new technologies will be the non-invasive monitoring technologies, the more accurate sensors, and the longer-lasting devices for a better patient experience and increased market demand.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Regulatory Landscape Strictly applies FDA and CE regulatory approval for CGM devices, underscoring the importance of accuracy and application for integration with insulin pumps. |

| Technological Advancements | Technological Advances Integration with smartphones and insulin pumps |

| Consumer Demand | Consumer Demand There is an Increasing preference toward on-demand glucose monitoring instead of traditional fingerstick testing. |

| Market Growth Drivers | Rising diabetes prevalence, increasing awareness of CGM benefits, and wearable technologies. |

| Sustainability | Limited focus on sustainability; reliance on disposable sensors and plastic-intensive device components. |

| Supply Chain Dynamics | Dependence on specialized sensor manufacturers; occasional shortages due to semiconductor supply constraints. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Regulatory adaptations must keep pace with AI-based CGM analytics, non-invasive glucose monitoring, and broadened indications. |

| Technological Advancements | Cloud-based diabetes management platforms for non-invasive glucose monitoring; AI-augmented predictive analytics; biodegradable CGM sensors with extended wearability. |

| Consumer Demand | Increased adoption for metabolic health tracking, fitness monitoring, and introduction into emerging markets. |

| Market Growth Drivers | Personalized medicine, AI glucose management, and regulatory support toward open accessibility. |

| Sustainability | Development of biodegradable sensors, recyclable device packaging, and energy-efficient CGM systems. |

| Supply Chain Dynamics | Regionalized production, diversification of suppliers, and increased automation in CGM manufacturing. |

Market Overview

The increasing number of chronic wounds, radiation damage, and neurological disorders is fueling sharply rising United States sales of hyperbaric oxygen therapy equipment. The increasing demographic number and augmented constituent of diabetes are driving higher demand for HBOT in the healing of diabetic foot ulcers.

Advances in technology in the form of portable and multi-place hyperbaric chambers are also propelling the market.It is increasingly used for military and sports medicine applications due to HBOT's therapeutic benefits in managing TBI and sports injuries.

Reimbursement-driven uses with FDA-approved applications such as carbon monoxide poisoning, decompression sickness, and gas embolism treatments are also picking up. Market growth is inhibited due to the high equipment price, regulation, and reimbursement. However, the increasing demand for the benefit of HBOT in stroke rehabilitation and post-COVID-19 illness is expected to drive consistent market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 11.9% |

Market Outlook

Germany has been the latest country to adopt the Continuous Glucose Monitoring (CGM) technology which is powered by a powerful health care system that concentrates on modernization and patient-centered care. The nation’s dedication to preventive healthcare and the management of chronic conditions, which include diabetes, has stimulated a healthy setting for the use of CGM technology. Additionally, Germany's very favorable reimbursement policies are the ones which make it easier to access CGMs for patients.

A surge in awareness of the benefits of continuous glucose monitoring, which is the real titan of this trend, has consequently enhanced glucose metabolism and quality of life. The emergence of new technologies has also added the benefit of making CGMs more efficient, affordable, and user-friendly. This, in turn, has caused them to be adopted at an even greater rate.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 9.3% |

Market Outlook

The rise of diabetes in India, with a surge in demand for continuous glucose monitoring systems, especially among younger generations, is the current trend. The country’s promotion of digital healthcare solutions in cities is a major factor in the accessibility of continuous glucose monitoring systems (CGMs).

In contrast to the situation in rural areas, initiatives focusing on cost-efficiency are the driving force behind the device’s more widespread adoption. The government’s attempt to relieve diabetes and CGM’s incessant message about the advantages of continuous monitoring are why CGMs are increasingly popular in India. As India’s middle class grows, there is a CGM manufacturer that will capitalize on its expanding market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 17.2% |

Market Outlook

According to the latest report from the Preventive Health Network, type 2 diabetes is a serious public health challenge facing China. In pursuing improved health and diabetes rareness, many individuals are trying out solutions like the CGM. To a reasonable degree, the government's move to be more accountable and to embrace advanced technology is a precursor to the adoption of CGM.

Although these devices are high-end products, domestic production capabilities and healthcare partnerships would make the devices more cost-friendly and more available in the urban areas, allowing a larger number of people to use the technology.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 17.8% |

Market Outlook

The upturn in the age of the Japanese population and type 2 diabetes symptoms are major factors in the rise of the demand for professional continuous glucose monitoring systems in Japan. Japan, being one of the world's foremost experts in healthcare innovation, uses CGMs more often for the enhancement of diabetes care.

In addition to the country's healthcare system that guarantees the accessibility of these devices to patients, Japan's healthcare network provides these devices to patients through insurance.

Amid the trend of precision medicine, disease management, and preventive care, Japan is planning to witness a continuous increase in its market for CGM. Together with the high-tech healthcare environment in Japan, all of these changes ensure that CGM technology will be significantly seen in future diabetes management strategies.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.1% |

One major reason behind the expansion of the Continuous Glucose Monitoring (CGM) market is that people are becoming more knowledgeable about the benefits of real-time glucose monitoring, the increasing incidence of diabetes, and the ongoing introduction of CGM.

With the rise in the need for personalized diabetes management, we are now entering the age of next-generation CGM systems, which is marked by their precise consistency, long battery life, and wireless, lightweight integration with cell phones and insulin pumps.

On the other hand, the market is overfilled with competitors, as well as the classic companies of the medical device industry, new companies recognized for their innovation and striving to grab the piece of market share, to become an alternative to the established companies.

The regulatory approval processes and the increased number of healthcare partnerships will play a huge role in the achievement of the company's competitive advantage. Better technology will cause a further increase in competition among companies. They will fight more to give more economical, efficient, and user-friendly CGM solutions that will meet the demands of diabetic patients.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Abbott Laboratories | 55.2% |

| Dexcom, Inc. | 26.5% |

| Medtronic plc | 15.7% |

| Senseonics Holdings, Inc. | 0.23% |

| Other Companies (combined) | 2.4% |

| Company Name | Key Company Offerings and Activities |

|---|---|

| Dexcom, Inc. | Specializes in real-time CGM systems with advanced connectivity and accuracy. |

| Abbott Laboratories | Develops Freestyle Libre CGM devices focusing on affordability and ease of use. |

| Medtronic plc | Offers integrated CGM and insulin pump systems for advanced diabetes management. |

| Senseonics Holdings, Inc. | Provides implantable CGM systems with extended wear duration. |

Key Company Insights

Dexcom, Inc. (26.5%)

Dexcom leads the CGM market with highly accurate real-time glucose monitoring systems featuring seamless smartphone connectivity and AI-driven analytics.

Abbott Laboratories (55.2%)

Abbott’s FreeStyle Libre series has revolutionized the CGM space by offering affordable, sensor-based monitoring solutions with growing adoption worldwide.

Medtronic plc (15.7%)

Medtronic integrates CGM with insulin delivery systems, enhancing personalized diabetes care through closed-loop technologies.

Senseonics Holdings, Inc. (0.2%)

Senseonics is gaining traction with implantable CGM systems offering extended wear and reduced sensor replacement frequency.

Several other companies contribute significantly to the CGM market by developing innovative solutions and expanding their global reach. They include:

The overall market size for continuous glucose monitoring systems market was USD 12,835.6 million in 2025.

The continuous glucose monitoring systems market is expected to reach USD 55,048.4 million in 2035.

Rising cases of chronic wound as well as rise in adoption in private sector has significantly increased the demand for continuous glucose monitoring systems.

The top key players that drives the development of continuous glucose monitoring systems market are Abbott Laboratories, Dexcom, Inc., Medtronic plc, Senseonics Holdings, Inc. and SIBIONICS

Sensors by component in continuous glucose monitoring systems market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Components, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Components, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Components, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Components, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Components, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Components, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Components, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Components, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End Users, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Components, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Users, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 16: Global Market Attractiveness by Components, 2023 to 2033

Figure 17: Global Market Attractiveness by End Users, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Components, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End Users, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 34: North America Market Attractiveness by Components, 2023 to 2033

Figure 35: North America Market Attractiveness by End Users, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Components, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End Users, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Components, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End Users, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Components, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End Users, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Components, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End Users, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Components, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End Users, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Components, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End Users, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Components, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End Users, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Components, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End Users, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Components, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End Users, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Components, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End Users, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Components, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End Users, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Components, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End Users, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Continuous Inkjet Inks Market Forecast and Outlook 2025 to 2035

Continuously Variable Transmission (CVT) Market Size and Share Forecast Outlook 2025 to 2035

Continuous Ambulatory Peritoneal Dialysis Bags Market Size and Share Forecast Outlook 2025 to 2035

Continuous Motion Cartoner Market Size and Share Forecast Outlook 2025 to 2035

Continuous Flow Bioreactors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Continuous Inkjet Printers Market Size and Share Forecast Outlook 2025 to 2035

Continuous Friction Tester Market Size and Share Forecast Outlook 2025 to 2035

Continuous Fryer Machine Market Size and Share Forecast Outlook 2025 to 2035

Continuous Positive Airway Pressure (CPAP) Market Analysis – Size, Share & Forecast Outlook 2025 to 2035

Continuous Miners Market Growth - Trends & Forecast 2025 to 2035

Continuous Renal Replacement Therapy Market Growth – Trends & Forecast 2025-2035

Continuous Peripheral Nerve Block Catheter Market Growth – Trends & Forecast 2025-2035

Market Share Breakdown of Continuous Inkjet Printers Providers

Continuous Thread Metal Cap Market

Continuous Integration Tools Market

Continuous Flow Analyzer Market

Continuous Track Wheels Market

Continuous Ketone Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Continuous Cardiac Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Continuous Hormone Monitoring Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA