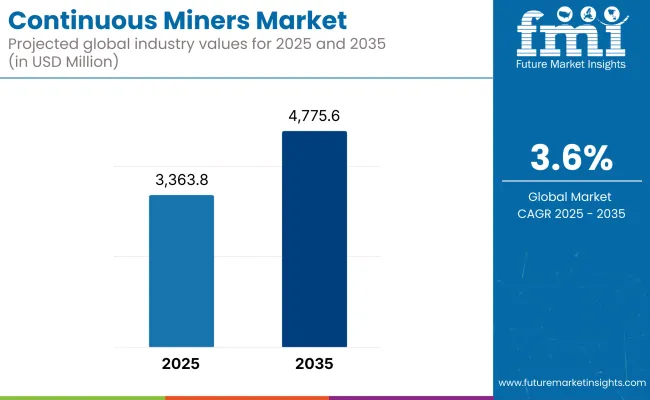

The Continuous Miners Market is set for significant expansion over the next decade, with its market value projected to grow from USD 3,363.8 Million in 2025 to USD 4,775.6 Million by 2035, reflecting a CAGR of 3.6%. This growth is driven by increasing global demand for coal and minerals, the need for higher efficiency in underground mining operations, and advancements in automation and electrification technologies.

The increase of the focus on mine safety, operational efficiency, and cost reduction is the factor for the adoption of continuous miners in underground coal and soft rock mining. These machines are the main actors in the modernization of mining operations through the continuous cutting, material transport, and ventilation enhancements that they offer, which in turn, reduces downtime and increases productivity. Besides this, governmental macroeconomic policies that are promoting the automation and sustainability in the mining sector are also the main drivers of the market demand.

The mining sector, particularly underground coal mining, is dependent on continuous miners the most. These machines are widely used in room-and-pillar mining methods, efficiencies up by production and at the same time cutting down manual work. With the increase in the focus on worker safety and the assurance of regulatory compliance, automated and remote-controlled continuous miners are emerging as the mainstream in the industry.

The North American Continuous Miners Market is on the rise due to the ongoing coal mining activities in the USA and Canada and the automation focus in underground mining. The very strict mine safety rules set by MSHA (Mine Safety and Health Administration) are the driving force behind the use of the advanced continuous miners with dust suppression and, real-time monitoring systems.

The region is also experiencing the electrification investment mainstream, with battery-powered continuous miners proving their worth by the reduction of carbon emissions. Meanwhile, the fluctuating coal demand and the environmental policies that stand against fossil fuels are the challenges in front of the market.

Europe's market progress occurs not only due to moving towards sustainable mining through automation but at the same time, the switch in mineral extraction too. Countries like Germany, Poland, and Russia go on to utilize continuous miners for the extraction of coal and potash. The EU's aim to lower carbon emissions was the foundation for improvements in electric and hybrid continuous miners, thus cutting energy use.

On the contrary, the decreasing coal production in western Europe and the regulatory pressure on the fossil fuel industry represent obstacles in the way of the market's growth. The risks that investment in rare earth mineral mining and automation can sustain are self-evident.

Asia-Pacific is the fastest-growing market, proving its worth as driven by the increasing coal and mineral extraction activities in China, India, and Australia. The government initiatives on underground mining efficiency improvement made by BTS and rising energy demand are driving the continuous miner’s usage boom. The coal production volume achieved by China and India's funding in underground mine mechanization are key growth factors.

The Nation's emphasis on improved safety standards and mining technological development further supports the market. Nevertheless, the hefty investment spent on purchasing equipment and the different regulatory frameworks cross-border are the potential bottlenecks.

The Middle East & Africa (MEA) Continuous Miners Market is in good condition as it is being driven by the higher number of metals and minerals such as phosphate, diamonds, and gold. South Africa plays a significant role in underground mining, with continuous miners being implemented for coal and platinum production.

However, along with infrastructural gaps, the high costs related to advanced mining machinery lead to obstacles along the way. The latest trends in digital mining technology adoption automation will bring a big boost to the market.

High Initial Costs & Maintenance Expenses

Continuous miners are highly capital-intensive, needing huge money for the purchase, installation, and maintenance. Small and medium-sized mining companies are the ones that are mostly faced with financial struggles when it comes to policymaking sustainable mining development in this regard.

Regularly needed servicing, replacing of the constant wore drum knives, and ongoing drawdown costs of the moving parts are the most significant operational costs. The manufacturers are fending this off by developing low-cost models that, as a rule, have longer service intervals and predictive maintenance technologies.

Environmental Regulations & Carbon Emission Concerns

Repressive environmental regulations due to harmful emissions and fossil fuel dependence offer difficulties in coal mining activities, particularly in the developed areas. All over the world, governments are creating policies to ban coal mining, which forces companies to find other alternative forms of income.

The promotion of renewable energy is a long-term risk for the coal mining sector wich consequently affects the demand of continuous miners. However, it is anticipated that the introduction of electric and hybrid continuous miners will aid in this regard and cut down on the environmental impact while also complying with the changing regulations.

Safety Risks & Workforce Shortages

Underground mining is still a high-risk task despite the new automation technologies, as the total mining environment is still subjected to hazards, like roof falling, methane explosions, and dust cloud and toxic gas. Keeping the worker safe and holding to the strict mine regulations are the two major challenges.

The industry is concurrently facing a labor shortage with the imbalance of a lack of experienced workers in underground operations. The investments in the remote control and autonomous continuous miners can solve part of the problems by decreasing human exposure to dangerous conditions.

Supply Chain Disruptions & Equipment Availability

The mining sector is demanding for continuously available, stable components which include the likes of cutting heads, conveyor belts, and hydraulics. The geopolitical fragmentation caused by the war, trade restrictions, and the unavailability of raw materials is a cause of major global supply chain disruptions.

Consequently, they all lead to equipment downtime and higher costs. Mining companies are looking for local manufacturers or alternative suppliers for the purpose of the maintenance of continuous operations without major downtimes.

Adoption of Automation & AI in Mining Operations

The fusion of automation and artificial intelligence (AI)and in mining is the backbone of the revolution. With autonomous navigation, real-time data analytics, and AI-driven cutting optimization, continuous miners are operating much in a more effective, profitable, and safer way than before.

The demand for remote-controlled and tele operated continuous miners is predicted to be at its peak, especially in deep and hazardous underground mining environments. The companies that choose to go digital in the mining sector will benefit from a competitive advantage in the upcoming market alienation.

Electrification & Sustainable Mining Solutions

The shift towards battery-electric continuous miners become stronger as mining companies are focussing on the reduction of CO2 emissions and compliance with environmental standards. Battery-operated continuous miners, on the other hand, are using batteries in place of diesel engines which consequently cuts fuel consumption as well as ventilation costs in the underground mines.

The advancement of the continuous miners into more environmentally-friendly technologies is anticipated to result in the discovery of the future of low emissions and energy-efficient continuous miners.

Rising Demand for Minerals & Rare Earth Elements

The ongoing demand for other types of minerals that are used in making batteries such as lithium, copper, and rare earth elements will create new markets for continuous miners. The manufacturing of these minerals is of paramount importance for the production of batteries, electronics, and the realization of clean energy.

Nations all over are involved in exploring new mineral sources to limit imports, which will have a direct effect on the demand for new mining machines. Continuous miners can be modified to work in soft rock mining and to fulfill the ever-growing demand for critical good minerals globally.

Expansion of Underground Mining Operations

With the concern over environmental issues and land-use constraints, the underground mining sector is being prioritized for mineral extraction compared to surface mining. The very development of miners under the ground in various parts such as Australia, Canada, and South Africa is pushing for high-performance continuous miners. New technologies along with room-and-pillar mining methods that continuously mine are proving their worth, thus making underground mining more feasible and efficient.

The miners market for continuous has enjoyed a constant upward trend from 2020 to 2024, which is mainly attributable to the booming demand for coal, minerals, and the demand for underground miners. With the turn toward the automation side, the mining sector got a boost, those companies which went on the path of investment in the high-tech extended the productivity and safety.

The evidence of the prevalence of that encouraging regulation is the adoption of continuous miners which are equipped with such features as dust suppression, remote operation, and real-time monitoring.

The expectations for the market are, very high. They foresee-a greater part of it transformed with the amalgamation of AI, automation, and electric-powered continuous miners. Sustainability problems and tighter regulations will influence the battery-oriented switch to the hybrid miners, targeting carbon reduction and less reliance on diesel machines.

Emerging economies, especially in the Asia-Pacific region, will witness great growth in the mining sector, while the developed countries will focus on increased efficiency and underground mining for applications in renewable energy sectors, for instance, lithium and rare earth metals.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Implementation of mining safety regulations (MSHA, EU directives) strictly enforced the use of proper ventilation and dust control. Different regions have different environmental restrictions on coal mining. |

| Technological Advancements | The launch of remote-operated continuous miners, real-time monitoring systems, and automation to create a safer and more productive working environment. |

| Industry-Specific Demand | Strong requirement in coal and soft rock mining. The covered area underground will rise due to the loss of the open-pit operation's resources. |

| Sustainability & Circular Economy | The implementation of emission reduction measures has started with the better utilization of ventilators and the control of dust. The improvement of fuel efficiency is the focus in the case of diesel-powered miners. |

| Market Growth Drivers | The search for critical minerals in battery and renewable energy industries, higher coal and minerals usage, and mining safety regulatory laws. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Carbon emissions from mining operations are now under government scrutiny like never before. Electric-powered mining equipment and sustainable practices are strictly mandated. |

| Technological Advancements | AI-based automation, electric and hybrid continuous miners, and self-diagnosing systems that cut out bring down downtimes and maintenance costs. |

| Industry-Specific Demand | Growth in demand for renewable energy sectors' rare earth minerals, lithium, and copper and the increased application of hard rock mining underground. |

| Sustainability & Circular Economy | Transference to electric and hybrid continuous miners. Recycling and repurposing of mining waste for sustainability. Adoption of AI-based energy efficiency solutions. |

| Market Growth Drivers | Mine equipment electrification, slash and burn efficiency via automation, and critical minerals demand for battery and renewable energy industries. |

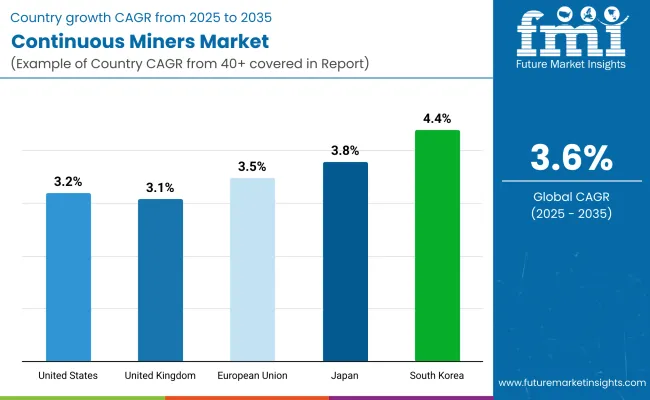

The USA continuous miner market is propelled by the constant demand for coal and other minerals utilized in power generation, construction, and industrial applications. Despite the regulatory issues related to coal mining, the technological advancements have been in the area of autonomous and emission-reducing mining machines which are keeping the market in a good and profitable state. The rise of continuous miners in underground metal mining also owes to the safety regulations and productivity improvements.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

The UK continuous miners market demonstrates a low growth rate which is due to the developments of the underground mineral extractions and other infrastructure. During the period coal mining has decreased owing to the implementation of rules to protect the environment, the demand and supply of potash, gypsum, and salt mining stand strong in the market. The urgings of the mining sector to trade in a greener way are the mainspring of the new technology in the field of electric and hybrid continuous mining tools.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.1% |

The operations of continuous miners for the European Union market mainly depend on the stringent environmental regulations that are responsible for the transformation of the mining industry. Coal mining is excluded from being used in some countries, however, there is a lot of output of other minerals such as lithium, copper, and rare earth metals due to the transitional phase from fossil fuel energy to renewable energy sources and to battery production. The EU is also emphasizing on the implementation of sustainable mining practices which are the reason for the increase in funding for the purchase of advanced, energy-efficient mining equipment.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.5% |

The continuous miners market in Japan is primarily driven by the country's emphasis on automation and cutting-edge mining technologies. Despite Japan's limited ability to extract minerals from the earth, it is the second most significant user of continuous miners in salt, limestone, and other industrial mineral mining. The surge in the use of robotics and AI-powered mining equipment in the processes is the factor that not only makes the work more efficient but also frees up labor forces.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.8% |

The continuous miners market in South Korea is witnessing growth owing to the need for raw materials used in industrial and manufacturing sectors. The country mainly depends on imports for most of the essential minerals, but mining operations for limestone and metals lead to the advanced mining equipment needed by domestic companies. The mining sector's digital transformation drive is a strong motivator for the proliferation of artificially intelligent monitoring and forecasting maintenance systems in continuous miners.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

Diesel Miners Lead in Flexibility and Mobility

The diesel-powered continuous miners have been widely utilized in underground mining operations owing to their mobility, independence from the electrical grid constraints, and ability to operate out in the field. Such machines are particularly advantageous in locations where the electrical infrastructure is underdeveloped or where mobility of equipment is vital.

The growing popularity of the heavy-duty, fuel-efficient miners is the reason why manufacturers have begun to develop diesel-engine powered machines with state-of-the-art engineering that cuts emissions and enhances fuel efficiency.

Integration of smart monitoring systems and automated controls is promoting safer operations while minimizing downtime, thus, making diesel continuous miners the preferred equipment of choice for those companies who are eager to raise the level of production.

Electric-Powered Miners Gain Popularity for Sustainable Mining

Electric-powered continuous miners are gaining traction due to their lower operational costs, reduced emissions, and compliance with stringent environmental regulations. These machines offer high efficiency and are particularly suited for underground mining operations where ventilation and air quality management are critical concerns.

The push toward sustainable mining practices and decarbonisation is encouraging mining companies to invest in electric-powered continuous miners, as they contribute to lower carbon footprints and improved worker safety. Advancements in battery technology and electrification are making electric-powered miners more viable for deep and long wall mining applications, further expanding their market potential.

Coal Mining Remains the Largest Application Segment

Coal mining continues to be the dominant application for continuous miners, as these machines offer unmatched efficiency in extracting coal seams with minimal blasting requirements. The increasing demand for coal in power generation, steel manufacturing, and industrial applications is driving the adoption of continuous miners in both developed and developing regions.

Governments and mining companies are investing in modernizing coal mining operations with automated and remotely controlled continuous miners to enhance productivity and worker safety. The ongoing transition toward cleaner coal technologies and improved mine reclamation strategies is further influencing the adoption of advanced continuous mining equipment in the sector.

Rock Salt Mining Benefits from Automation and Efficiency Improvements

The demand for continuous miners in rock salt mining is rising, driven by increasing consumption of salt for industrial, chemical, and de-icing applications. Continuous miners offer a more controlled and efficient extraction process, thus, resulting in a reduction of material loss and improvement of yield quality compared to traditional mining techniques.

The shift towards automation and precision mining processes is also accelerating the deployment of continuous miners in rock salt mining, thus, increasing the operators' productivity while at the same time reducing the risks to operations. The increase in the demands for the pharmaceutical and the food grade applications of rock salts high purity is the reason behind mining companies funding advanced continuous mining technologies for better resource extraction and processing efficiency.

The global continuous miners market is driven by the increasing demand for efficient underground mining operations, particularly in coal, potash, and soft rock mining. Automation, safety improvements, and environmental regulations are shaping the industry, prompting major manufacturers to invest in smart mining technologies.

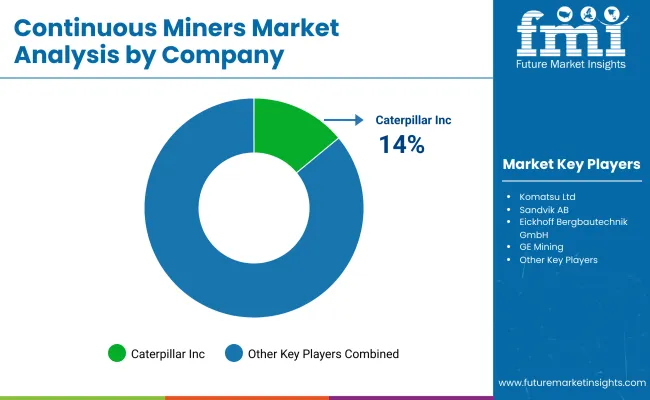

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Caterpillar Inc. | 14-19% |

| Komatsu Ltd. (Joy Global) | 12-16% |

| Sandvik AB | 10-14% |

| Eickhoff Bergbautechnik GmbH | 6-10% |

| GE Mining (Wabtec Corporation) | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Caterpillar Inc. | Advanced automated continuous miners with high cutting efficiency. Focus on battery-electric mining. |

| Komatsu Ltd. (Joy Global) | Specializes in high-capacity continuous miners with real-time monitoring and predictive maintenance. |

| Sandvik AB | Develops hard rock continuous miners with high-speed cutting and dust suppression systems. |

| Eickhoff Bergbautechnik GmbH | Precision-engineered longwall mining continuous miners with advanced automated control systems. |

| GE Mining (Wabtec Corporation) | Electric and hybrid-powered continuous miners with IoT-enabled performance tracking. |

Key Company Insights

Caterpillar Inc.

Being the top-down underground mining equipment manufacturer, Caterpillar Inc. features high-performance continuous miners, which are the designed special machines for maximum productivity and durability. The area of interest for the company is automation, remote monitoring and electrification to promote safety and efficiency. Continuous coal, potash, and hard rock mining mode flourishing as a result of the entrance of Caterpillar and its strategic partnerships and technological advancements.

Komatsu Ltd.

Komatsu Ltd. is a company in the business of high-capacity continuous miners mainly dealing with coal and soft rock mining applications. The equipment from this company comes with the integration of various systems such as smart automation, real-time performance tracking, and AI-based predictive maintenance. Komatsu is betting on the future with the launch of battery-powered electric mining equipment, a process that run-in parallel with the global fight against greenhouse gas emissions and effort to boost the sustainability of underground mining.

Sandvik AB

Sandvik AB is a pioneer in high-tech mining methods, providing hard rock continuous miners with the latest high-speed cutting and dust suppression systems. The company is the leader in the field of autonomous mining technology, thus developing the solutions which will both raise productivity and cut operational risks. Besides, Sandvik is moving forward in South America and Asia-Pacific, concentrating on the manufacture of green, energy-efficient mining tools.

Eickhoff Bergbautechnik GmbH

The identification of Eickhoff Bergbautechnik GmbH is its precisely engineered continuous miners, special lifeline long wall mining applications. The company pays particular attention to high-power cutting heads and new automated control systems, which lead to optimizing coal extraction efficiency. Eickhoff continues its innovation with mining tools that produce low emissions and are highly reliable, along with the company making its presence in Europe, Russia, and North America.

GE Mining (Wabtec Corporation)

GE Mining, which is now a division of Wabtec Corporation, specializes in making electric and hybrid-powered continuous miners, with a focus on eco-friendly energy and emissions-reducing technologies. The company is pioneering the movement towards sustainable underground mining by integrating intelligent analytics and machine-learning-based operational enhancements.

The global Continuous Miners market is projected to be approximately USD 3,363.8 Million in 2025.

The market is anticipated to grow at a compound annual growth rate (CAGR) of approximately 3.6% from 2025 to 2035.

By 2035, the Continuous Miners market is expected to reach approximately USD 4,775.6 Million.

The drum continuous miners segment is projected to lead the market, driven by their efficiency in coal and ore extraction processes.

Key players in the Continuous Miners market include: Caterpillar Inc., Komatsu Ltd. (Joy Global), Sandvik AB, Eickhoff Bergbautechnik GmbH and GE Mining (Wabtec Corporation).

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Continuous Inkjet Inks Market Forecast and Outlook 2025 to 2035

Continuously Variable Transmission (CVT) Market Size and Share Forecast Outlook 2025 to 2035

Continuous Ambulatory Peritoneal Dialysis Bags Market Size and Share Forecast Outlook 2025 to 2035

Continuous Motion Cartoner Market Size and Share Forecast Outlook 2025 to 2035

Continuous Cardiac Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Continuous Ketone Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Continuous Flow Bioreactors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Continuous Inkjet Printers Market Size and Share Forecast Outlook 2025 to 2035

Continuous Friction Tester Market Size and Share Forecast Outlook 2025 to 2035

Continuous Fryer Machine Market Size and Share Forecast Outlook 2025 to 2035

Continuous Glucose Monitoring Device Market - Demand & Future Trends 2025 to 2035

Continuous Hormone Monitoring Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Continuous Emission Monitoring System Market Growth - Trends & Forecast 2025 to 2035

Continuous Positive Airway Pressure (CPAP) Market Analysis – Size, Share & Forecast Outlook 2025 to 2035

Continuous Glucose Monitoring Systems Market is segmented by transmitters and monitors, sensors and insulin pump from 2025 to 2035

Continuous Renal Replacement Therapy Market Growth – Trends & Forecast 2025-2035

Continuous Peripheral Nerve Block Catheter Market Growth – Trends & Forecast 2025-2035

Market Share Breakdown of Continuous Inkjet Printers Providers

Continuous Thread Metal Cap Market

Continuous Integration Tools Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA