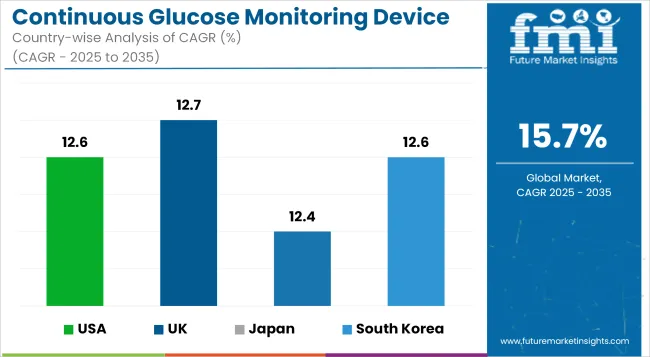

The global continuous glucose monitoring device market is estimated to be valued at USD 12,690.7 million in 2025 and is projected to reach USD 54,553.1 million by 2035, registering a CAGR of 15.7% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 12,690.7 million |

| Industry Value (2035F) | USD 54,553.1 million |

| CAGR (2025 to 2035) | 15.7% |

The continuous glucose monitoring device market has experienced significant momentum as the prevalence of diabetes rises and healthcare providers emphasize tighter glycemic control to reduce long-term complications. Adoption has been driven by growing clinical evidence demonstrating improved outcomes through real-time glucose monitoring and trend analysis. Regulatory endorsements and expanded reimbursement frameworks in major markets have further validated CGM systems as standard of care for patients requiring intensive insulin therapy.

Advances in sensor accuracy, wear duration, and interoperability with insulin delivery systems have enhanced patient adherence and clinician confidence. Digital health platforms integrating CGM data have also strengthened user engagement and remote care capabilities. These trends are anticipated to sustain strong adoption and innovation across the ecosystem.

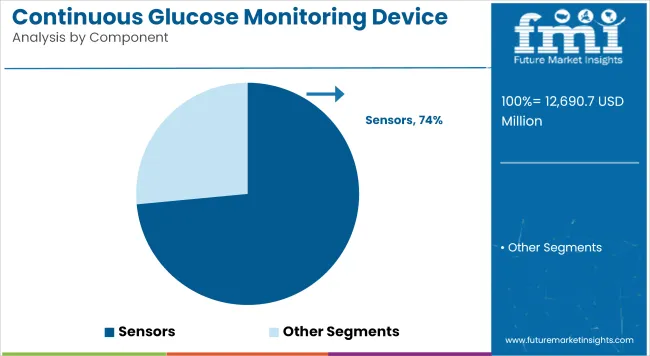

Sensors dominates the continuous glucose monitoring market with a significant revenue share of 73.5%, reflecting their essential function as the core component of the systems. The market has been driven by advances in sensor longevity, biocompatible materials, and calibration-free operation that have improved patient convenience and accuracy. Healthcare providers have prioritized sensors for their ability to deliver real-time glucose trends and predictive alerts, which support proactive therapy adjustments.

Manufacturers have invested heavily in the development of minimally invasive designs that enhance wearability and reduce discomfort. Regulatory approvals and favorable reimbursement policies for sensor replacement have strengthened adoption and recurring revenue streams. All the above factors have positioned sensors as the leading product segment, with continued growth expected over the forecast years.

Diabetes Type I dominates with a revenue share of 55.6% which is attributed to Type I diabetes, which requires continuous glucose monitoring to reduce hypoglycemia and improve glycemic variability. Patients with Type I diabetes have adopted CGM systems to support frequent dosing decisions, enhance safety, and reduce the burden of fingerstick testing.

Reimbursement policies in developed markets have favored coverage for CGM use among individuals with Type I diabetes, reinforcing widespread uptake. Advances in sensor accuracy and connectivity with automated insulin delivery systems have further strengthened clinical outcomes and patient satisfaction.

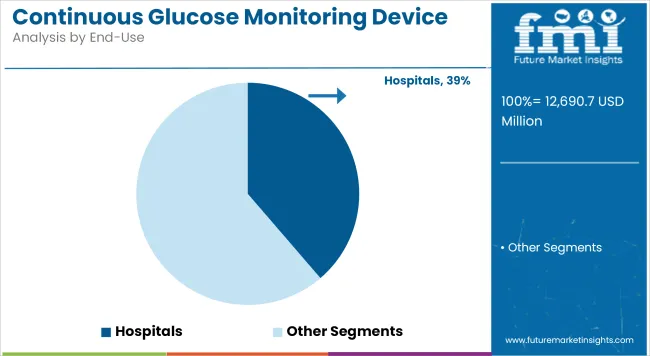

Hospital pharmacies have accounted for 38.7% of revenue, driven by their role in coordinating CGM device dispensing, training, and ongoing patient support. Hospitals have invested in dedicated diabetes education programs and multidisciplinary teams to improve adherence and optimize outcomes.

Reimbursement processes often favor hospital-based procurement to bundle device costs with broader diabetes care services. Integrated supply chains have ensured reliable access to sensors and transmitters, reducing delays in therapy initiation. These factors have positioned hospital pharmacies as the primary distribution channel, with continued growth anticipated as CGM becomes a standard component of inpatient and transitional care pathways.

Staggering Costs and Reimbursement Challenges

CGM systems are quite effective, but even so they are expensive and therefore not within the reach of poor individuals anywhere in the world yet. Replacement of sensors with frequent sensor replacement is another expense for the patient. There also exist reimbursed patterns that vary geographically, and in other countries, insurance for CGM systems is still turned off, restricting access. Insurers are discovering cost-containment strategies and encouraging increased insurance coverage to provide better access to the patient.

Convergence of AI and Sensor Technology Innovations

Growth opportunities lie in nanotechnology, biosensor technology, and artificial intelligence innovations. Technological advancements in long-term, non-invasive, and minimally invasive CGM sensors are balancing the drawback of patient discomfort and sensor wear time. Diabetes management platforms created by AI allow for disease prediction so that patients and clinicians can make informed decisions.

Other than this, companies are developing smart CGM devices with in-built connectivity to smartphones and wearables to enhance the user experience and real-time glucose information. Trends will certainly drive market growth and the effectiveness of diabetes management worldwide.

United States has an enormous market for CGM devices with increasing diabetes prevalence, availability of a well-established healthcare infrastructure, and the evolution of technology. Coverage for CGM considerably enhanced for both Type 1 and Type 2 diabetic individuals. Physicians' and payers' demand for remote patient monitoring is fueling adoption.

More Utilization of AI-based Diabetes Management: America dominates the application of AI-based diabetes management platforms, which may be combined with CGM devices. Technology firms and new players such as startups are developing predictive analytics software that offers real-time predictions of glucose patterns, enabling it to overcome the drudgery of diabetes complications.

With more than 37 million Americans living with diabetes, CGM uptake will experience explosive growth. Improvements in sensor accuracy and insulin pump compatibility have also enabled more accurate glycemic control and patient compliance. Value-based healthcare policy reform is open to using CGM for early intervention and improving patient outcomes.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 12.6% |

The British economy is gaining strength through National Health Service (NHS) initiatives that encourage the use of CGM among Type 1 and Type 2 diabetic patients. Growing necessities for stylish wearables and governmental policy efforts to cover diabetic treatment devices are boosting demand.

Government-reimbursed CGM Access Programmes: The NHS extended coverage for CGM in additional patients with Type 2 diabetes and gestational diabetes. While the UK continues to spend more than £10 billion annually on diabetes care, CGM systems are an expensive intervention that are being researched for the prevention of diabetes complications. Digital health pressure and increasing smart healthcare wearables usage are driving continued market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 12.7% |

The European Union market for CGM is growing with greater awareness, reimbursement, and technological advancements in non-invasive blood glucose monitoring systems. Germany, France, and Italy are the top three most advanced markets for CGM because they possess a robust healthcare system and favorable regulatory climate for digital health.

Development of Non-Invasive CGM Devices: The non-invasive glucose monitoring technology is in development, and several EU-based firms are developing optical and transdermal glucose sensors. Our EU medical device regulations provide a high degree of security and performance, and thus the customer will be more confident. Moreover, the European Commission's initiative to harmonize digital healthcare is influencing the use of CGM in most healthcare environments.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 12.9% |

The Japanese CGM market is growing with the aging population, rising incidence rates of diabetes, and enhanced healthcare Internet of Things (IoT). Remote monitoring systems are in great demand, particularly among older patients and among those patients with limited access to diabetes specialists.

IoT-based CGM Solutions among Elderly People: IoT-based CGM solutions are used across geriatric care services in healthcare facilities in Japan's healthcare sector to enable diabetes management with predictive data analysis and continuous real-time monitoring. The government is pushing digital health solutions aggressively aimed at slowing the steeply rising cost of chronic illness, long-term business opportunity in the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 12.4% |

South Korea is becoming a market driver for CGM owing to higher growth in smart health technology, government aggressive thrust in e-health, and rising incidence of diabetes. South Korea's policy of technology-based healthcare is driving CGM innovation.

Intelligent Healthcare Integration Drives Market Expansion: South Korea's healthcare industry is driving the adoption of AI and big data analytics to enhance the precision and effectiveness of CGM. Government initiatives promoting the application of telemedicine and remote patient monitoring have also boosted the adoption rate of CGM. South Korean tech firms are also developing next-generation devices for CGM that enable sensors with extended lifespan and connectivity.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.6% |

The competitive landscape has been shaped by companies investing in sensor miniaturization, extended wear duration, and factory-calibrated technologies to differentiate their portfolios. Leading manufacturers have prioritized regulatory approvals for next-generation CGM systems and expanded partnerships with digital health platforms to enable data integration. Strategic collaborations with insulin pump makers have been established to support closed-loop therapy adoption. Patient assistance programs and education campaigns have been launched to increase awareness and adherence.

Key Development:

The overall market size for continuous glucose monitoring (CGM) devices was USD 12,690.7 million in 2025.

The continuous glucose monitoring (CGM) device market is expected to reach USD 54,553.1 million in 2035.

The increasing prevalence of diabetes, advancements in CGM technology, rising awareness about diabetes management, and growing healthcare spending are the key factors driving the demand for CGM devices during the forecast period.

The top 5 countries contributing to the development of the continuous glucose monitoring device market are the United States, Germany, Japan, the United Kingdom, and China.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Continuous Inkjet Inks Market Forecast and Outlook 2025 to 2035

Continuously Variable Transmission (CVT) Market Size and Share Forecast Outlook 2025 to 2035

Continuous Ambulatory Peritoneal Dialysis Bags Market Size and Share Forecast Outlook 2025 to 2035

Continuous Motion Cartoner Market Size and Share Forecast Outlook 2025 to 2035

Continuous Flow Bioreactors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Continuous Inkjet Printers Market Size and Share Forecast Outlook 2025 to 2035

Continuous Friction Tester Market Size and Share Forecast Outlook 2025 to 2035

Continuous Fryer Machine Market Size and Share Forecast Outlook 2025 to 2035

Continuous Positive Airway Pressure (CPAP) Market Analysis – Size, Share & Forecast Outlook 2025 to 2035

Continuous Miners Market Growth - Trends & Forecast 2025 to 2035

Continuous Renal Replacement Therapy Market Growth – Trends & Forecast 2025-2035

Continuous Peripheral Nerve Block Catheter Market Growth – Trends & Forecast 2025-2035

Market Share Breakdown of Continuous Inkjet Printers Providers

Continuous Thread Metal Cap Market

Continuous Integration Tools Market

Continuous Flow Analyzer Market

Continuous Track Wheels Market

Continuous Ketone Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Continuous Hormone Monitoring Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Continuous Cardiac Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA