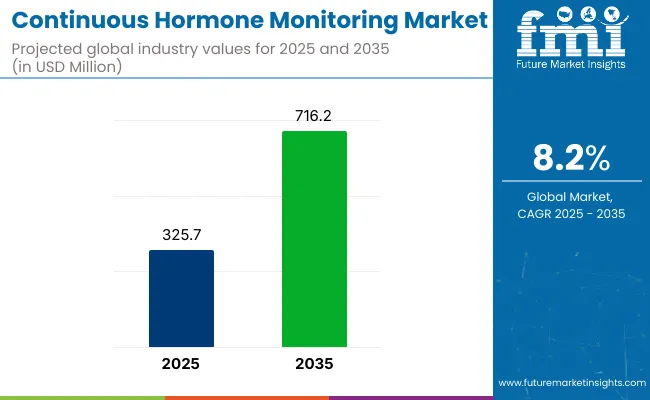

The continuous hormone monitoring market is projected to grow from USD 325.7 million in 2025 to USD 716.2 million by 2035, registering a CAGR of 8.2% during the forecast period. The market growth is being driven by the increasing demand for advanced hormone monitoring systems, which provide real-time insights into hormonal imbalances.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 325.7 million |

| Market Size in 2035 | USD 716.2 million |

| CAGR (2025 to 2035) | 8.2% |

These systems are becoming critical for the management of diabetes, thyroid disorders, reproductive health, and other hormone-related conditions. The adoption of remote monitoring technologies is expected to increase significantly, as healthcare providers aim to offer personalized treatments and improve patient outcomes through continuous and accurate hormone tracking.

As emphasized by Ula Rustamova, CEO of Level Zero Health, in an interview with TechFundingNews (February 18, 2025), “Our innovative remote monitoring technology marks an enormous leap forward in hormone testing, and this funding will enable us to bring this revolutionary solution to market. It captures critical data inaccessible before.” This highlights the growing importance of remote hormone monitoring technologies in revolutionizing the management of hormonal disorders and providing better access to healthcare solutions.

The market is being influenced by continuous advancements in sensor technologies and the integration of AI-powered solutions for real-time hormone tracking. These technologies are enabling devices to become more accurate, efficient, and smarter. As the demand for non-invasive hormone testing rises, the market is expected to continue its growth, particularly in Asia, where China is recognized as a key growth region.

Increased awareness of hormone-related health issues is expected to drive the adoption of these innovative monitoring systems. Strategic investments in research and development and technology partnerships are expected to shape the future of the market, fostering further innovations in continuous hormone monitoring.

The continuous hormone monitoring market is experiencing substantial growth, driven by rising demand for fertility-related applications, urine samples for testing, and the increasing shift to direct-to-consumer sales channels.

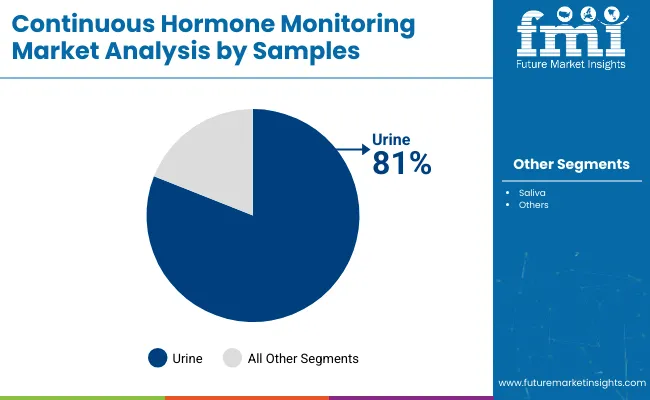

Urine samples are projected to dominate the continuous hormone monitoring market in 2025, accounting for 81% of the market share.

Fertility is projected to account for 65% of the continuous hormone monitoring market share in 2025. This growth is driven by the increasing demand for fertility tracking solutions, especially among women looking to manage reproductive health.

The direct-to-customer sales channel is expected to hold a 62.7% share of the continuous hormone monitoring market in 2025. This preference is driven by consumers increasingly seeking convenience and privacy in hormone testing through at-home kits.

The continuous hormone monitoring market is being driven by advancements in wearable technology and consumer interest in personalized health. Innovations in non-invasive sensors and real-time data are enhancing engagement, while regulatory challenges limit adoption.

Advancements in wearable technology and growing consumer interest in personalized health are driving market growth

The continuous hormone monitoring market is being significantly boosted by advancements in wearable technology and a growing consumer interest in personalized health. Innovations in non-invasive sensors, such as DNA-based biosensors, are enabling real-time tracking of hormones like cortisol, estrogen, and testosterone.

These devices, often integrated with smartphone applications, provide users with continuous insights into their hormonal health, facilitating proactive management of conditions like stress, menopause, and testosterone replacement therapy. The increasing demand for personalized health solutions is further propelling market growth, as individuals seek more tailored and accessible methods to monitor and manage their well-being.

Regulatory hurdles and data privacy concerns are limiting widespread adoption

Despite the promising growth prospects, the continuous hormone monitoring market faces challenges related to regulatory hurdles and data privacy concerns. The development and approval of wearable hormone monitoring devices require compliance with stringent medical device regulations, which can delay market entry and increase costs.

Additionally, the collection and transmission of sensitive health data raise privacy and security issues, necessitating robust data protection measures to gain consumer trust. These factors may hinder the widespread adoption of continuous hormone monitoring technologies, particularly in regions with strict regulatory environments and heightened concerns over data privacy.

The continuous hormone monitoring market is expected to be driven by increasing demand for wearable technologies and rising health awareness. Rapid growth in China and India is anticipated, while the USA and Germany focus on innovations.

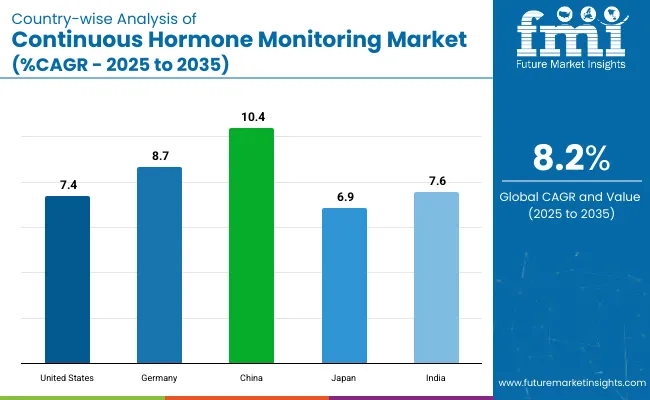

| Countries | CAGR (%) |

|---|---|

| United States | 7.4% |

| Germany | 8.7% |

| China | 10.4% |

| Japan | 6.9% |

| India | 7.6% |

The United States continuous hormone monitoring market is expected to grow at a CAGR of 7.4% through 2035. Growth is being driven by increasing demand for wearable devices and AI-powered hormone monitoring solutions. Leading companies like Abbott, Medtronic, and Dexcom are advancing the development of continuous hormone monitoring technologies.

The continuous hormone monitoring market is projected to grow at a CAGR of 8.7% through 2035. Growth is being supported by advancements in hormone monitoring technologies and a growing demand for personalized healthcare solutions.

The continuous hormone monitoring market is expected to grow at a CAGR of 10.4% through 2035. Expansion is being driven by rapid industrialization, increasing healthcare awareness, and government initiatives to improve healthcare infrastructure.

The continuous hormone monitoring market is projected to grow at a CAGR of 6.9% through 2035. Growth is being supported by an aging population, increased demand for healthcare solutions, and advancements in hormone monitoring technologies.

The continuous hormone monitoring market is expected to grow at a CAGR of 7.6% through 2035. Growth is driven by increasing health awareness, rising prevalence of hormone imbalances, and government initiatives aimed at improving healthcare infrastructure.

Key players like Level Zero Health and Eli Health dominate the market due to their advanced technologies. Level Zero Health developed a wearable patch using DNA-based sensors for continuous hormone monitoring, with €6.6 million in pre-seed funding secured to advance its technology. Eli Health offers the Hormometer, transforming smartphones into real-time hormone analyzers using saliva-based testing to monitor hormones such as cortisol and progesterone.

Other significant players, including POM Health and imi, focus on real-time hormonal data collection and thyroid hormone monitoring, supporting personalized healthcare. Emerging players like HormoneSync and OvaGraph target regional markets with niche wearable devices for fertility tracking and wellness, offering specialized hormone monitoring tools for specific consumer needs.

Recent Continuous Hormone Monitoring Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 325.7 million |

| Projected Market Size (2035) | USD 716.2 million |

| CAGR (2025 to 2035) | 8.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and the Number of Tests |

| Sample Types Analyzed (Segment 1) | Saliva; Urine |

| Applications Covered (Segment 2) | Stress; Sleep; Fertility; Menopause |

| Sales Channels Covered (Segment 3) | Direct to customers; Specialty clinics; Online sales/e-commerce; Retail pharmacy chains; Subscription models |

| Regions Covered | North America; Western Europe; East Asia; South Asia |

| Countries Covered | United States; Canada; United Kingdom; Germany; France; Italy; Spain; Netherlands; China; Japan; South Korea; India; Pakistan; Bangladesh |

| Key Players Influencing the Market | OOVA Inc.; Hormona; Eli Health; Inito Health Tech Private Limited; Mira; Proov |

| Additional Attributes | Dollar sales by sample type (saliva vs urine); Market demand for hormone monitoring in fertility, sleep, and menopause; Trends in subscription models vs one-time purchases; Growth in online sales and e-commerce for health tech products |

The market is segmented into saliva and urine.

The market covers stress, sleep, fertility, and menopause applications.

The market is categorized into direct to customers, specialty clinics, online sales/e-commerce, retail pharmacy chains, and subscription models.

The market spans North America, Western Europe, East Asia, and South Asia.

The market is expected to reach USD 716.2 million by 2035.

The market size is projected to be USD 325.7 million in 2025.

The market is expected to grow at a CAGR of 8.2% from 2025 to 2035.

China is expected to be the fastest growing with a CAGR of 10.4%.

Germany holds the highest market share with a CAGR of 8.7%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Continuous Inkjet Inks Market Forecast and Outlook 2025 to 2035

Continuously Variable Transmission (CVT) Market Size and Share Forecast Outlook 2025 to 2035

Continuous Ambulatory Peritoneal Dialysis Bags Market Size and Share Forecast Outlook 2025 to 2035

Continuous Motion Cartoner Market Size and Share Forecast Outlook 2025 to 2035

Continuous Flow Bioreactors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Continuous Inkjet Printers Market Size and Share Forecast Outlook 2025 to 2035

Continuous Friction Tester Market Size and Share Forecast Outlook 2025 to 2035

Continuous Fryer Machine Market Size and Share Forecast Outlook 2025 to 2035

Continuous Positive Airway Pressure (CPAP) Market Analysis – Size, Share & Forecast Outlook 2025 to 2035

Continuous Miners Market Growth - Trends & Forecast 2025 to 2035

Continuous Renal Replacement Therapy Market Growth – Trends & Forecast 2025-2035

Continuous Peripheral Nerve Block Catheter Market Growth – Trends & Forecast 2025-2035

Market Share Breakdown of Continuous Inkjet Printers Providers

Continuous Thread Metal Cap Market

Continuous Integration Tools Market

Continuous Flow Analyzer Market

Continuous Track Wheels Market

Continuous Ketone Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Continuous Cardiac Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Continuous Glucose Monitoring Device Market - Demand & Future Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA