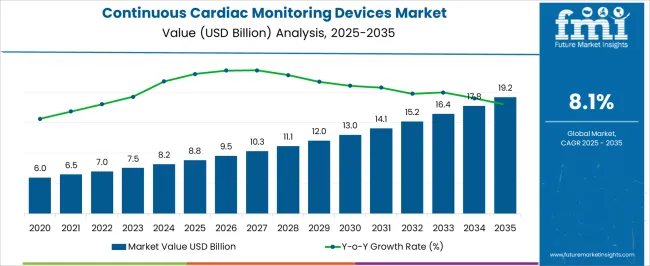

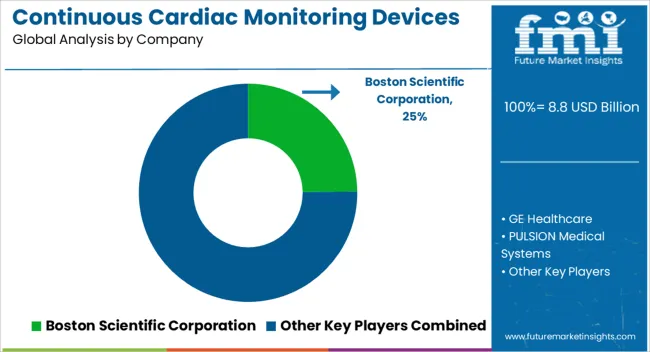

The Continuous Cardiac Monitoring Devices Market is estimated to be valued at USD 8.8 billion in 2025 and is projected to reach USD 19.2 billion by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period.

| Metric | Value |

|---|---|

| Continuous Cardiac Monitoring Devices Market Estimated Value in (2025 E) | USD 8.8 billion |

| Continuous Cardiac Monitoring Devices Market Forecast Value in (2035 F) | USD 19.2 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

The Continuous Cardiac Monitoring Devices market is witnessing significant growth, driven by the rising prevalence of cardiovascular diseases, increasing geriatric population, and the growing need for real-time patient monitoring. Continuous monitoring enables early detection of arrhythmias, myocardial infarctions, and other cardiac abnormalities, improving patient outcomes and reducing hospital readmissions. Technological advancements, including wireless connectivity, miniaturized sensors, and cloud-based data analysis, are enhancing device accuracy, patient comfort, and remote monitoring capabilities.

Integration with electronic health records and hospital information systems allows seamless data sharing, supporting clinical decision-making and proactive care management. Regulatory support and reimbursement frameworks in multiple regions are further boosting adoption in both inpatient and outpatient settings.

The increasing awareness among healthcare providers and patients regarding the benefits of continuous monitoring, along with the shift toward value-based care models, is reinforcing demand As the market evolves, continuous innovation in device modalities, analytics platforms, and patient-centric features is expected to drive sustained growth across hospitals, clinics, and home care environments.

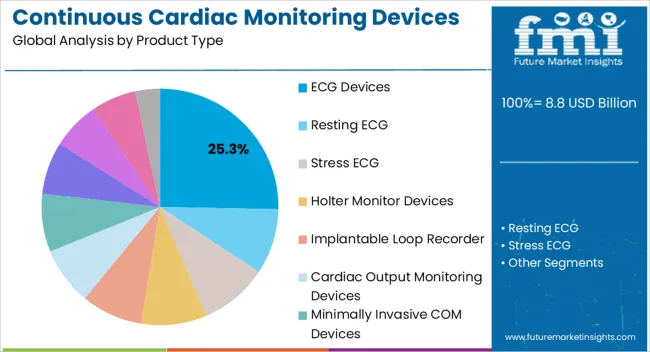

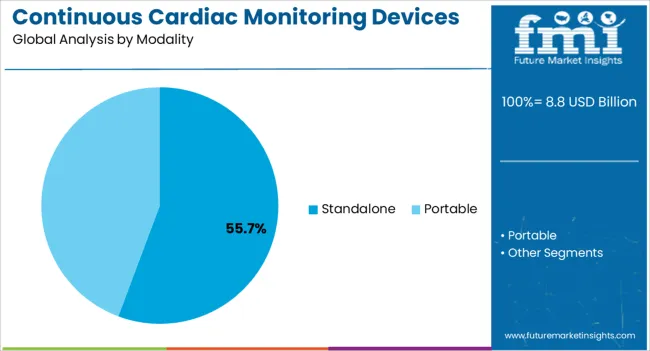

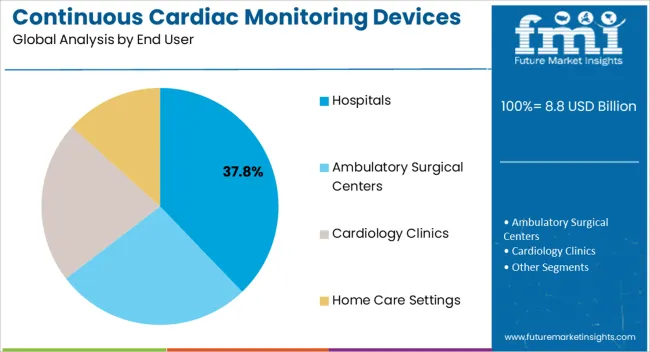

The continuous cardiac monitoring devices market is segmented by product type, modality, end user, and geographic regions. By product type, continuous cardiac monitoring devices market is divided into ECG Devices, Resting ECG, Stress ECG, Holter Monitor Devices, Implantable Loop Recorder, Cardiac Output Monitoring Devices, Minimally Invasive COM Devices, Noninvasive COM Devices, Event Monitors, Pre-Symptom, and Post-Symptom. In terms of modality, continuous cardiac monitoring devices market is classified into Standalone and Portable. Based on end user, continuous cardiac monitoring devices market is segmented into Hospitals, Ambulatory Surgical Centers, Cardiology Clinics, and Home Care Settings. Regionally, the continuous cardiac monitoring devices industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ECG devices segment is projected to hold 25.3% of the market revenue in 2025, establishing it as the leading product type. Its dominance is being driven by widespread clinical acceptance, proven diagnostic accuracy, and integration capabilities with advanced monitoring systems. ECG devices allow continuous detection of cardiac electrical activity, enabling early identification of arrhythmias and other heart conditions, which is critical for patient management.

Miniaturization and wireless connectivity improvements have enhanced patient compliance and comfort, particularly in ambulatory settings. Integration with analytics platforms and electronic health records enables real-time alerts and long-term data tracking, supporting proactive interventions.

The cost-effectiveness, reliability, and clinical validation of ECG devices reinforce their adoption across hospitals and outpatient monitoring programs As cardiovascular disease prevalence rises globally, the demand for ECG-based continuous monitoring solutions is expected to remain strong, supported by technological advancements and increasing clinical reliance on real-time cardiac data for improved patient outcomes.

The standalone modality segment is anticipated to account for 55.7% of the market revenue in 2025, making it the leading modality. Its growth is being driven by the flexibility it provides in deploying continuous cardiac monitoring systems without dependence on centralized networks or integrated platforms. Standalone devices are increasingly adopted in remote, outpatient, and home care settings due to their portability, ease of use, and ability to provide continuous data capture independent of hospital infrastructure.

Advanced features such as cloud-based reporting, automated alerts, and wearable form factors further enhance their appeal. Healthcare providers can leverage these devices to monitor high-risk patients effectively while optimizing workflow and reducing clinical burden.

Regulatory approvals and improvements in device accuracy have also strengthened confidence in standalone modalities As the shift toward patient-centered care and remote monitoring continues, standalone devices are expected to maintain their leading position, supported by growing demand for decentralized, real-time cardiac monitoring solutions.

The hospitals segment is projected to hold 37.8% of the market revenue in 2025, establishing it as the leading end-user category. Growth is driven by the high adoption of continuous cardiac monitoring systems in inpatient settings for critical care, cardiac wards, and post-operative monitoring. Hospitals benefit from real-time patient data, which supports early detection of complications, proactive interventions, and improved clinical outcomes.

Integration with hospital information systems enables seamless data management and analytics, improving workflow efficiency and resource utilization. Investments in hospital infrastructure, along with increasing awareness of the importance of continuous cardiac monitoring for reducing readmissions and mortality rates, further support adoption.

The ability to monitor multiple patients simultaneously and remotely ensures enhanced operational efficiency and patient safety As cardiovascular disease prevalence rises and hospitals increasingly prioritize advanced monitoring capabilities, the sector is expected to maintain its leading share, supported by innovations in device connectivity, data analytics, and patient-centric monitoring solutions.

Cardiovascular disease (CVD) like stroke and heart disease are the leading cause of death across the globe. As per World Health Organization (WHO), 30% of the deaths caused globally in 2008 was due to heart disease which accounted for 17.3 Mn.

Majority of cardiovascular diseases could be managed by early detection of abnormalities in the functioning of heart. Continuous cardiac monitoring devices are used for observation of cardiac activity. Continuous monitoring of heart is mandatory to assess patient’s condition suffering from CVD. Cardiac monitoring devices records and display pressure and electrical waveforms of the cardiovascular system for measurement and treatment.

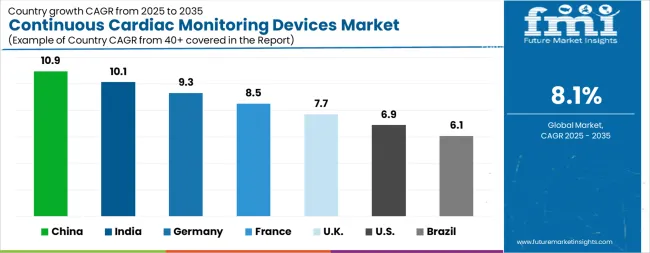

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| UK | 7.7% |

| USA | 6.9% |

| Brazil | 6.1% |

The Continuous Cardiac Monitoring Devices Market is expected to register a CAGR of 8.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.9%, followed by India at 10.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.1%, yet still underscores a broadly positive trajectory for the global Continuous Cardiac Monitoring Devices Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 9.3%. The USA Continuous Cardiac Monitoring Devices Market is estimated to be valued at USD 3.1 billion in 2025 and is anticipated to reach a valuation of USD 6.1 billion by 2035. Sales are projected to rise at a CAGR of 6.9% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 421.6 million and USD 232.8 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.8 Billion |

| Product Type | ECG Devices, Resting ECG, Stress ECG, Holter Monitor Devices, Implantable Loop Recorder, Cardiac Output Monitoring Devices, Minimally Invasive COM Devices, Noninvasive COM Devices, Event Monitors, Pre-Symptom, and Post-Symptom |

| Modality | Standalone and Portable |

| End User | Hospitals, Ambulatory Surgical Centers, Cardiology Clinics, and Home Care Settings |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Boston Scientific Corporation, GE Healthcare, PULSION Medical Systems, Edwards Lifesciences Corporation, Deltex Medical, and LiDCO Group Plc. |

The global continuous cardiac monitoring devices market is estimated to be valued at USD 8.8 billion in 2025.

The market size for the continuous cardiac monitoring devices market is projected to reach USD 19.2 billion by 2035.

The continuous cardiac monitoring devices market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in continuous cardiac monitoring devices market are ecg devices, resting ecg, stress ecg, holter monitor devices, implantable loop recorder, cardiac output monitoring devices, minimally invasive com devices, noninvasive com devices, event monitors, pre-symptom and post-symptom.

In terms of modality, standalone segment to command 55.7% share in the continuous cardiac monitoring devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Continuous Inkjet Inks Market Forecast and Outlook 2025 to 2035

Continuously Variable Transmission (CVT) Market Size and Share Forecast Outlook 2025 to 2035

Continuous Ambulatory Peritoneal Dialysis Bags Market Size and Share Forecast Outlook 2025 to 2035

Continuous Motion Cartoner Market Size and Share Forecast Outlook 2025 to 2035

Continuous Flow Bioreactors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Continuous Inkjet Printers Market Size and Share Forecast Outlook 2025 to 2035

Continuous Friction Tester Market Size and Share Forecast Outlook 2025 to 2035

Continuous Fryer Machine Market Size and Share Forecast Outlook 2025 to 2035

Continuous Positive Airway Pressure (CPAP) Market Analysis – Size, Share & Forecast Outlook 2025 to 2035

Continuous Miners Market Growth - Trends & Forecast 2025 to 2035

Continuous Renal Replacement Therapy Market Growth – Trends & Forecast 2025-2035

Continuous Peripheral Nerve Block Catheter Market Growth – Trends & Forecast 2025-2035

Market Share Breakdown of Continuous Inkjet Printers Providers

Continuous Thread Metal Cap Market

Continuous Integration Tools Market

Continuous Flow Analyzer Market

Continuous Track Wheels Market

Continuous Ketone Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Continuous Glucose Monitoring Device Market - Demand & Future Trends 2025 to 2035

Continuous Hormone Monitoring Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA