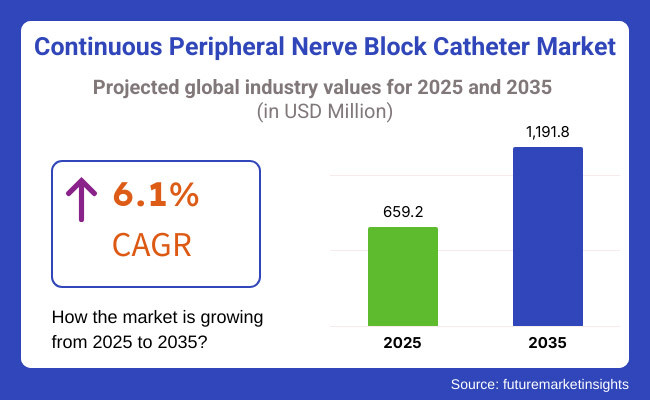

In the coming years the continuous peripheral nerve block catheter products market is expected to reach USD 659.2 million by 2025 and is expected to steadily grow at a CAGR of 6.1% to reach USD 1,191.8 million by 2035. In 2024, continuous peripheral nerve block catheter have generated roughly USD 621.3 million in revenues.

Continuous Peripheral Nerve Block Catheter (CPNB) is a device used for local, and sustained pain management of patients. It is used as local anesthetics by applying as specific peripheral nerves for an extended duration. This catheter is positioned near the relevant nerve or nerve bundles, with a permanent pump dispensing.

It finds its major application in postoperative pain relief, chronic pain relief, post-traumatic pain relief, and surgical or labor pain relief. Furthermore, constant and targeted pain management can provide much more uniform management with fewer side effects compared to systemic analgesics.

Use of this catheters into patients have witnessed faster recovery of patients, especially those undergoing arthroplasties or orthopedic procedures. Effective pain control tends to make them satisfied with the discharge, thus CPNB has become popular in contemporary management of pain.

From the years 2020 to 2024, the uptake of continuous peripheral nerve block catheter (CPNB) is attributed to a few past crucial events such as the COVID-19 pandemic. Pandemic inquisitively raised the need for alternatives to opioid pain management. Increased side effects caused by opioids led to an increase in demand for CPNB. Moreover, technological advances have made catheter placement safer, easier, and more accessible. Integration of ultrasound guidance further enhanced nerve identification and success rates of CPNB.

Furthermore, with the ideal patient recovery in mind, especially for elective surgeries, CPNB increase application focuses on the improvement of pain relief, speed of recovery, and rehabilitation. Alongside this trend, the increased interest in least invasive procedures has steered demand for regional anesthetic techniques and increased CPNB usage.

Increased number of patients are averse to opioids in North America, and therefore, medical practitioners have been forced to seek alternatives for pain management, one of which is a regional anesthetic approach like the CPNB, which would be able to produce excellent pain relief without the connected risk of opioid addictive behavior.

With new technology, especially through the ultrasound, nerve block placement becomes safer and more accurate, paving the way for CPNB to be adopted as a proven and trusted technique. The push toward Enhanced Recovery After Surgery (ERAS) protocols, which minimize postoperative pain and speed recovery, has made the adoption of CPNB easier since it fits quite well with short hospital stays and mobilization.

CPNB provides targeted and sustained analgesia with minimal or no systemic drug adverse effects. It is the composite of all these that fuel the trend of acceptance of CPNB within the scope of today's pain management practice.

The acknowledgement of the great risk posed by opioid use has compelled medical systems to search for other alternatives for pain management. CPNB stands out as a safer and more successful alternative to managing postoperative and acute pain without the usage of opioids and their unwarranted side effects.

Fast-forward to the emergence of more recent technologies especially in ultrasound-guided techniques to allow for more effective and safer placements of nerve blocks thereby increasing overall success of CPNB. This allowed for a broader application of CPNB in surgical disciplines ranging from orthopedic to thoracic.

ERAS protocols in European healthcare systems have increasingly been directed towards strategies which aim for minimal opioid use, early recovery, and less postoperative pain. Lastly, almost all the successful clinical outcomes of CPNB in enhancing patient outcomes, decreasing complications, and facilitating faster recovery have accounted for its increasing use in European healthcare systems.

CPNB is emerging as one of those important methodological approaches for its specificity and efficacy, particularly with the improved infrastructure in healthcare. Since opioids are now a reality, it has been increasingly leading to an alternative movement toward safer non-opioid systems.

Human factors for clinicians to embrace CPNB in Asia with the abuse regulations of opioids are much more favorable and minimize dependence on opioids in post-operative and chronic pain. Ultrasound-guided nerve blocks have gradually developed into a much improved process, which became safer, more precise, and more convenient for operators to carry out. Also, increased health investment will create more improvement in access to quality medical services in emerging economies.

High-impact use of CPNB in Asia during the last few years is the result of growing emphasis on improved recovery after surgery (ERAS) programs, since it reduces pain, allows for early ambulation, and minimizes the length of stay after surgery. CPNB demand in the Asia Pacific market is being driven in great part by these factors.

Challenges

Technical Difficulties Associated with Catheter Placement Hindering Adoption in the Market

Ultrasound-Assisted CPNB technique helps with accuracy, improper catheter position may end up damaging the nerve, dislodging the catheter, or simply causing inadequate analgesia. In a few cases, patients may develop complications in the form of either infection at the site of catheter insertion or local anesthetic toxicity. Furthermore, the process requires trained clinicians with special expertise to place and confirm correct placement, which is limiting in trained professional health systems that are less accessible.

Continuous monitoring and management of the catheter will complicate care more so for patients with comorbidities. This increases resource requirements for implementing CPNB, hence limiting its acceptance in some environments or geographical areas where healthcare infrastructure is not great.

Opportunities

Growing Demand for Opioid-sparing Pain Management Solutions Poses New Business Opportunities for the Market Players

Among the most promising arenas for continuous peripheral nerve block catheter (CPNBs) lies the growing requirement for opioid-sparing pain management strategies. The opioid crisis, landscapes of which have developed mainly in North America and parts of Europe, has created a strong impetus for finding ways of treating pain that minimize opioid dependence and associated side effects.

CPNB provides an extremely localized method of pain management achieving long-term analgesia without opioid systemic side effects, making it ideal for postoperative pain management in joint replacement surgery, whereby opioid utilization has been historically very high.

Since healthcare systems are now laying a major focus on patient recovery and safety, the CPNB would elegantly fit under Enhanced Recovery After Surgery (ERAS) pathways in reducing narcotic consumption, improving recovery times, and shortening length of hospital stay.

Increase Success Rate and Safety with the use of Continuous Peripheral Nerve Block Catheter Anticipates its Market Growth

Continuous Peripheral Nerve Block Catheters utilizes cutting-edge ultrasound guidance in its application. It has been the CPNB that was most greatly improved in terms of the probability of success and safety of the procedure as a result of ultrasound-guided nerve localization. There was advanced nerve block given with a view toward precision and with fewer consequent complications like nerve injury or inadequate pain relief.

It will also include ultrasound guidance for real-time imaging while allowing the clinician to manipulate catheter placement accordingly. This, therefore, increased the confidence of healthcare practitioners to employ CPNB for daily procedures like orthopedic surgeries, trauma management, and postoperative pain management anticipates its future market growth.

Improved Post-surgical Recovery Rate Anticipates the Growth of the Market

The enhanced recovery after surgery protocols that hospitals and ambulatory surgery centers are adopting, CPNB catheters will become more and more prevalent. CPNB catheters are for continuous infusion of anesthetic near target nerves, and exist for the purpose of local pain relief after orthopedic, trauma, and abdominal procedures.

Opioid intake is reduced, risk of systemic side effects decreases, and length of hospitalization is shortened, and thus making CPNB catheters the preferred option for multimodal pain control approaches.

Growing Adoption of Continuous Peripheral Nerve Block Catheter in Ambulatory Care Clinics is Ongoing Trend in Market

Increasing use of continuous nerve blocks for ambulatory and home treatment is one of the prominent ongoing trend in the industry. With growing advancements in catheter technology, home infusion pumps, and patient education, there are increased efforts to see more and more patients using nerve block therapy from the comfort of their homes. Enhanced recovery after surgery (ERAS) protocols serve as the key driver, focusing on early discharge with subsequent self-management by the patients.

Provision of CPNB at home also minimizes the risk of hospital-acquired infection while optimizing recovery via rehabilitation and early mobility compared to inpatients. This is a more-remarked trend in North America and Europe where outpatient care and home health care services are becoming the increasingly prioritized area.

Emphasis of Manufacturers towards Development of Smart Catheters and Sensors Surges its Market Growth

Companies are designing intelligent catheters equipped with integrated sensors capable of monitoring infusion rates, identifying catheter migration, and allowing real-time information delivery to clinicians through associated platforms.

These innovations are capable not only of augmenting patient safety and pain management, but they also provide distance treatment and are very much appreciated in outpatient and home care settings. The transformation through technology is in line with the latest trend toward personalized, data-based healthcare.

From 2020 to 2024, the Continuous Peripheral Nerve Block (CPNB) catheter market grew steadily mainly due to demands for efficient postoperative pain relief and opioid-sparing strategies. The COVID-19 pandemic initially paused elective procedures and hence created impacts on demand, but as the surgical activities normalized, elective procedures resumed quickly.

The result was increased demand for CPNB catheters for regional pain relief, sparked by the growing trend toward Enhanced Recovery after Surgery (ERAS) programs in orthopedics, general, and trauma surgeries.

From future prospects i.e., during forecast period 2025 to 2035, the introduction of smart technologies such as sensor-tipped catheters and remote monitoring systems will enhance placement of catheters, adjust infusion rates for optimal delivery, and increase safety.

Growth will also come from the rising number of outpatient procedures and increased emphasis on home-pain management and pain relief alternatives to opioids. Product development will most likely push market growth with time, besides some of these factors, particularly in developed healthcare markets

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Regulatory agencies have put up a stricter provision on ensuring that Continuous Peripheral Nerve Block Catheters (CPNB) have safety and efficacy levels that are at the level of international medical standards such as FDA clearance and CE marking. Apart from this, devices are currently given most importance with respect to safety and quality, as well as appropriate training for healthcare professionals. |

| Technological Advancements | With the advances in ultrasound guidance and real-time monitoring systems, precision is enhanced further for the insertion of CPNB catheters and improving patient safety. Again, there is greater usage of portable infusion pumps, which promotes much better post-surgery rehabilitation. |

| Consumer Demand | Amidst the larger demand for CPNB, patient and clinician advocacy for organ-cultured pain management continues. Most of the urban populace, especially from the developed countries, has been the adopters of intravenous CPNB |

| Market Growth Drivers | The emergence of the CPNB market is propelled mainly by the factors such as the rise in the number of orthopedic procedures and joint replacement procedures undertaken, along with a growing focus on Enhanced Recovery After Surgery (ERAS) protocols. The opioid epidemic has also sped up the use of CPNB as an alternative mode of pain relief. |

| Sustainability | Manufacturers turn their attention to developing CPNB devices which would behighly energy-efficient, less invasive, and not too dependent on infrastructure while cuttingcosts of delivering care. Further focus widens to creating cost-effective and easily-accessible devices. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | By 2035, the regulatory framework is expected to evolve with more robust global standards, especially in terms of device integration with digital health tools. Enhanced focus on patient safety, ethical application in pain management, and interoperability with other healthcare systems will shape the CPNB market |

| Technological Advancements | By 2035, CPNB technology will likely integrate AI-powered pain management systems, enabling more personalized, real-time adjustments to pain relief. Increased automation, remote monitoring, and home-use solutions will expand the scope of CPNB in both inpatient and outpatient settings. |

| Consumer Demand | By 2035, as the global focus on non-invasive, opioid-free pain management continues, the demand for CPNB will expand significantly. Its use will be increasingly prevalent in outpatient care and home-based settings, driven by patient preference for safer, long-lasting pain relief without systemic side effects. |

| Market Growth Drivers | The market will see significant expansion by 2035, driven by the growing aging population, increased surgical procedures, and a continuing trend toward opioid-sparing pain management. Personalized pain management approaches, supported by advancements in CPNB technologies, will be a key driver of future growth. |

| Sustainability | With an increase in the aging population, a growing number of surgical procedures, and a trending acceptance of other non-opioid alternatives for pain management, the market will experience extensive growth by 2035. Personalized pain management, along with continuing advancement of the technologies related to CPNB, will be a key driver in future growth. |

The opioid epidemic in the USA is one of the biggest catalysts prompting an increase in demand for Continuous Peripheral Nerve Block Catheters (CPNB). CPNB is now being increasingly used by practitioners to provide opioid-free pain relief, especially after surgeries in orthopedic replacement joint and trauma settings.

Moreover, there has been an increased overall movement toward patient-oriented care, with CPNB providing an undeniably stronger and more targeted form of pain management. The rising application of ambulatory and home CPNB solutions and the development of portable infusion pumps will continue to fuel growth in the next few years.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.8% |

Market Outlook

The increasing concern regarding enhanced recovery after surgery (ERAS) guidelines and the rise in minimally invasive surgeries in Germany have led to a proliferation of Continuous Peripheral Nerve Block Catheters (CPNB). CPNB is on the rise in Germany in a state with highly developed health care systems that increasingly resort to CPNB for postoperative pain management in orthopedic procedures.

The gentle and sustained approach among health care providers and regulatory agencies toward opioid-free pain management is a further propeller to the continuous peripheral nerve block (CPNB) through regional anesthesia methods. The future of CPNB in Germany is promising since ongoing advancements in ultrasound-guided catheter placement are expected to augment its uptake.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.1% |

Market Outlook

In India, the use of CPNB has largely been motivated by the increasing number of surgical procedures, particularly orthopedic surgeries, and a gradually increasing focus on minimally invasive surgery (MIS). CPNB is already considered a fairly valid alternative to opioid pain management as health infrastructure gets better- especially in a country where there is increasing concern regarding opioid abuse.

The escalating issues surrounding chronic pain and the growing geriatric population will be an additional driving factor in the necessitating secure, non-opioid pain management alternatives. Over time, the market will grow slowly as CPNB becomes more widely available in urban and rural areas.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.7% |

The growing number of surgical procedures, including orthopedic and trauma surgeries, was closely associated with the fast growth of healthcare services in China over the last few years. The greater awareness that their government had about ways to reduce opioid usage because of health risks motivated the adoption of CPNB.

In addition, the regulations interested in minimizing surgical recovery periods also encourage using CPNB for managing postoperative pain under the ERAS protocols introduced by China. Future growth in the market for CPNB in China will be steered by technological improvements in ultrasound-guided nerve blocks.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 4.8% |

Increased usage Continues in Japan with the Continuous Peripheral Nerve Block Catheters (CPNB), so much so that the country is well endowed with the aging populace and the large number of orthopedic operations, such as hip or knee replacements. CPNB is used within the Japanese health system focusing on recovery time and quality of life making it applicable widely in postoperative pain treatment.

The further interest in minimally invasive techniques and opioid-free pain control has boosted the acceptance of such solutions like CPNB. The market shows much promise within Japan, especially with technology improvements enhancing catheter placement and efficacy.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

The Non-Stimulating Catheters Segment Dominate the market owing to its Simple and Easier Use

Non-Stimulative Catheters make the leading segment in the CPNB market owing to their easier and quicker way to insert. since they do not depend on nerve stimulation for localization, making the procedure shorter and more effective. The introduction of ultrasound-guided techniques has also contributed immensely to non-stimulating catheter placements, making it almost as effective as using stimulating catheters, but without needing electric stimulation.

Non-stimulating catheters yield lesser discomfort to patients, hence improving the level of patient satisfaction. These are the reasons why such catheters are the most preferred for standard and simpler nerve blocks, adding to the supremacy in this market.

The Ability of Stimulating Catheters to provide precise nerve localization aid it hold Substantial Share

Stimulating Catheters will hold an important share in this segment mostly due to their specific capability to locate the nerve accurately. The electrical stimulation aspect lends itself to immediate feedback to know how close the catheter is to the nerve when it involves very complicated or deep nerve blocks such spinal and upper extremity nerve blocks. This makes stimulating catheters the number one choice for high-resolution procedures. Although these procedures take time to complete and are not comfortable for the patient, they have their important use where precision in pain management becomes paramount for the success of the procedure. The stimulating catheters will continue to take a large proportion in this regard, particularly for specialty procedures.

The Increasing use of Continuous Peripheral Nerve Block Catheters in Complex, High-volume Surgeries helps it lead the market

The hospital segment leads the Continuous Peripheral Nerve Block Catheter market since hospitals have a complex and large number of surgeries for highly equipped medical centers providing care for high-risk patients, making these hospitals suitable venues for major surgeries and trauma and orthopedic surgeries in which CPNB is extensively utilized.

The anesthesiologists working in these settings are well trained and are provided with sophisticated monitoring equipment that allows them to place CPNBs accurately. With the severity of postoperative pain management in these hospitals, CPNB is a major player in opioid-free pain management, thereby cementing its position in the hospital.

Increasing trend of Minimally Invasive Procedures aid Ambulatory Surgical Centers to grow at a Substantial Growth Rate

The demand for minimally invasive and outpatient methods is extending growth potential for the Ambulatory Surgical Center market. ASCs are considered better than the old hospital scenario with respect to cost savings, surgery, and recovery in one's own environment.

On the other hand, with the focus on Enhanced Recovery After Surgery (ERAS) pathways, CPNB finds acceptance among the ASCs for its ability to sustain effective local pain management without resorting to opioids, even more so in current times when there is a great need for pain control without opioid use. Further adding to the attractiveness of the space for ASCs would be the introduction of handheld infusion pumps allowing patient care at home after some procedures without compromising safety of the patients.

The continuous peripheral nerve block catheter (CPNB) market is going through tough competition among many competitive players in the field at present since there is escalating demand for safe and innovative non-opioid analgesic treatment solutions. These companies have developed improvements on catheters, ultrasound technology, and infusion pumps to enhance performance accuracy and safety for the patient.

Another area that is experiencing the fastest growth is providing solutions aimed at reducing complications associated with nerve block procedures. Therefore, smarter and safer devices are being developed. Furthermore, manufacturers are making cost-efficient solutions in order to satisfy users from both developed and emerging regions, rendering them affordable to most users.

The trends that continue to increase competition include the expansion of ambulatory surgery centers and growing outpatient services with companies at war to provide portable, easy-to-use, and effective systems that can be implemented across various clinical domains. Clinical alliances and regulatory approvals are also adding to the competitive advantage since they provide firms an avenue to fight for market share and credibility among healthcare providers.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| B. Braun Melsungen AG | 33.6% to 38.5% |

| Teleflex Incorporated | 20.4% to 22.6% |

| Halyard Health, Inc. | 50.1% to 17.2% |

| TELEFLEX MEDICAL | 4.6% to 6.8% |

| Other Companies (combined) | 12.1% to 15.4% |

| Company Name | Key Company Developments and Activities |

|---|---|

| B. Braun Melsungen AG | B. Braun brought out a newly launched CPNB system which is ultrasound-guided to better the process of carrying out nerve block procedures. They also advocated for ecological sustainability through the use of green packaging and energy-efficient parts within their lines of operation and also increased reach in outpatient services |

| Teleflex Incorporated | Teleflex has introduced a provocative CPNB catheter whose main use is improved localization of nerves to improve placement. The firm developed a range of options for opioid-free pain management and started looking at applications of home care for CPNB, meaning it can now stand alone in terms of outpatient use of the catheter |

| Halyard Health, Inc. | Their latest CPNB catheter is non-stimulating and applicable for minimal invasive procedures, thus enhancing patient comfort. Education and training of the health professions were championed to help spur the CPNB use in ambulatory surgical centers (ASCs) for post-operative pain management |

| TELEFLEX MEDICAL | TELEFLEX MEDICAL launched the CPNB system compatible with ultrasound, enhancing the accuracy and safety of performing such procedures. The company also extended its line to include portable infusion pumps for home use of CPNB aimed at complementing the rising need in the field for solutions regarding outpatient pain management |

Key Company Insights

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. They include:

These companies focus on expanding the reach of continuous peripheral nerve block catheter, offering competitive pricing and cutting-edge innovations to meet diverse needs.

Stimulating Catheter (Open Tip Catheter Stimulating Catheter and Closed Tip Catheter Stimulating Catheter), Non-Stimulating Catheter (Open Tip Catheter Non-Stimulating Catheter and Closed Tip Catheter Non-Stimulating Catheter) and Over-The-Needle Catheter

Nerve Stimulation Based Insertion and Ultrasound Based Insertion

Trauma Cases, Upper Extremity Surgeries, Lower extremity Surgeries, Pain Management and Other Indications

Hospitals, and Ambulatory Surgical Centers

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for continuous peripheral nerve block catheter market was USD 659.2 million in 2025.

The continuous peripheral nerve block catheter market is expected to reach USD 1,191.8 million in 2035.

Increase in adoption of continuous peripheral nerve block catheter as an alternative to opiod analgesics anticipates the growth of the market.

The top key players that drives the development of continuous peripheral nerve block catheter market are B. Braun Melsungen AG, Teleflex Incorporated, Halyard Health, Inc., TELEFLEX MEDICAL and Epimed International

Non-stimulating catheter segment by product is expected to dominate the market during the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Insertion Technique, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Insertion Technique, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Insertion Technique, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Insertion Technique, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Insertion Technique, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Insertion Technique, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Insertion Technique, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Insertion Technique, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Insertion Technique, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Insertion Technique, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Insertion Technique, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Insertion Technique, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Insertion Technique, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Insertion Technique, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Insertion Technique, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Insertion Technique, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Indication, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Insertion Technique, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Indication, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Insertion Technique, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Insertion Technique, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Insertion Technique, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Insertion Technique, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Insertion Technique, 2023 to 2033

Figure 28: Global Market Attractiveness by Indication, 2023 to 2033

Figure 29: Global Market Attractiveness by End User, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Insertion Technique, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Indication, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Insertion Technique, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Insertion Technique, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Insertion Technique, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Insertion Technique, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Insertion Technique, 2023 to 2033

Figure 58: North America Market Attractiveness by Indication, 2023 to 2033

Figure 59: North America Market Attractiveness by End User, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Insertion Technique, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Indication, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Insertion Technique, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Insertion Technique, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Insertion Technique, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Insertion Technique, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Insertion Technique, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Indication, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Insertion Technique, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Indication, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Insertion Technique, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Insertion Technique, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Insertion Technique, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Insertion Technique, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Insertion Technique, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Indication, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Insertion Technique, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Indication, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Insertion Technique, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Insertion Technique, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Insertion Technique, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Insertion Technique, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Insertion Technique, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Indication, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Insertion Technique, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Indication, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Insertion Technique, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Insertion Technique, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Insertion Technique, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Insertion Technique, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Insertion Technique, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Indication, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Insertion Technique, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Indication, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Insertion Technique, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Insertion Technique, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Insertion Technique, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Insertion Technique, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Insertion Technique, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Indication, 2023 to 2033

Figure 209: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Insertion Technique, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Indication, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Insertion Technique, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Insertion Technique, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Insertion Technique, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Insertion Technique, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Indication, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Insertion Technique, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Indication, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Peripheral Micro Catheters Market Trends – Industry Forecast 2024-2034

Peripheral Intravenous Catheter Market Size and Share Forecast Outlook 2025 to 2035

Peripherally Inserted Central Catheter Analysis by Product Type by Indication and by End User through 2035

Demand for Peripherally Inserted Central Catheter in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Peripherally Inserted Central Catheter in Japan Size and Share Forecast Outlook 2025 to 2035

Continuous Inkjet Inks Market Forecast and Outlook 2025 to 2035

Blockchain Interoperability Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Food Traceability Market Size and Share Forecast Outlook 2025 to 2035

Continuously Variable Transmission (CVT) Market Size and Share Forecast Outlook 2025 to 2035

Continuous Ambulatory Peritoneal Dialysis Bags Market Size and Share Forecast Outlook 2025 to 2035

Continuous Motion Cartoner Market Size and Share Forecast Outlook 2025 to 2035

Blockchain AI Market Size and Share Forecast Outlook 2025 to 2035

Peripheral T-Cell Lymphoma Treatment Market Size and Share Forecast Outlook 2025 to 2035

Continuous Cardiac Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Continuous Ketone Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Continuous Flow Bioreactors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Block Sack Market Size and Share Forecast Outlook 2025 to 2035

Peripheral Embolization Device Market Size and Share Forecast Outlook 2025 to 2035

Blockchain Messaging Apps Market Size and Share Forecast Outlook 2025 to 2035

Blockchain in Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA