General anesthetic drug market on a global level will increase immensely from 2025 through 2035 due to increasing surgeries, the increasing age population of patients, and improvement in technology used in the manufacture of anesthetic drugs Because the healthcare facilities worldwide are developing constantly to perform surgeries, there will surely be a growing demand for quick action, safe, and effective anesthetic drugs.

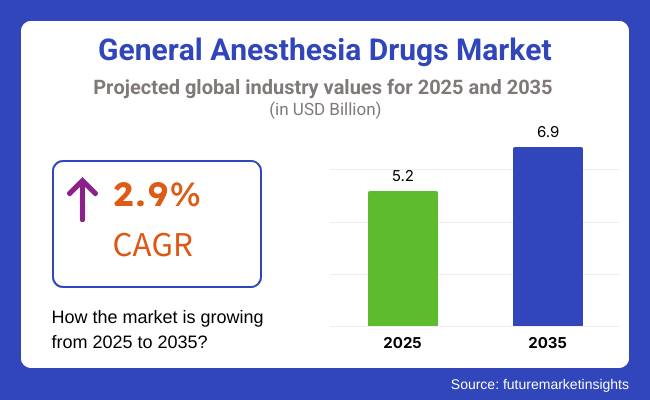

Market size, by our current day estimates, would go up from an estimated value of approximately USD 5.2 Billion during the year 2025 to a value substantially exceeding USD 6.2 Billion in the year 2035 at a rate of annual compound growth of 2.9%.

Among the most powerful drivers of growth is the increasing incidence of chronic conditions like cardiovascular disease, cancer, and orthopaedic disease that are usually treated by way of advanced surgical procedures. Increasing use of minimally invasive surgical methods, including precision and controlled administration of anaesthetic agents, also drives the need for suitable general anaesthetic agents.

New drug delivery techniques such as target-controlled infusion (TCI) and computer-controlled dosing are improving efficacy and safety of anaesthetics and generating increasing demand among medical professionals and anaesthesiologists.

Among the principal drivers is expansion in medical establishments throughout emerging economies. Developing nations such as in Asia, Latin America, and Africa are investing substantially to upgrade their healthcare facilities, and thus good-quality surgery is becoming available at reasonable prices. This is, in turn, causing demand for general anesthetic drugs to surge, especially from nations that have been utilizing low-quality or antiquated anesthetic drugs.

Apart from these determinants, international focus towards maximizing perioperative care and minimizing postoperative complications is fuelling demand for high-quality anaesthetics. Physicians are increasingly aware of the crucial need for anesthetic management in maximizing overall outcomes of surgery, with greater therauptic use of general anaesthesia drug in all branches of medical practice.

The general anesthesia drugs market for the propofol and sevoflurane segments share a significant contribution due to the rather fast, safe and effective means for providers through use of advanced anesthetic agents to induce and also maintain anesthesia.

Such medications are important for enabling smooth surgeries, quicker recovery and fewer complications, and are a standard part of modern-day anesthesia at hospitals, surgical centers and outpatient settings alike.

Propofol, a powerful sedative, was launched onto the European market in 1990 and became one of the most widely used anesthetics with fast-onset, smooth induction stage, rapid recovery and fewer side effects of post-anesthesia.

In contrast to conventional anesthetics, propofol also permits better control of the depth of sedation, thus propofol became a drug of choice for general anesthesia, sedation for minor procedures and ICU sedation in the critically ill patient population.

As outpatient and procedural sedation have increased, and the need for rapid sedation and rapid awakening in intensive care has required fewer and fewer anesthetic agents, propofol- based formulations have become more and more prevalent.

Propofol has effective anti-emetic qualities to help decrease post-operative nausea and vomiting (PONV), to shorten recovery periods, with greater patient comfort and thus better surgical outcomes

The advancing penetration of propofol in procedural anesthesia, encompassing short-duration sedation in endoscopic, dental, and radiological procedures, has reinforced demand, witnessing its growing utilization in non-operating room anesthesia (NORA) locations.

The incorporation of lipid-based propofol formulations with better solubility and less painful injections (as well as a reduction in complications due to lipid metabolism) and propofol toxicity have led to an enhanced drive of adoption and, hence, greater tolerability in some patients by providing a higher level of safety and lower patient tolerability in the hospital setting.

For instance, introduction of next-generation formulations of propofol with improved stability and antimicrobial activity, which has prevented hypersensitivity reactions to a greater extent significantly improves overall growth of the market, offering safer and effective administration of anesthesia.

Its widespread adoption as a part of ICU sedation protocols, particularly for ventilator sedation in cases of COVID-19 and critical care management, has further driven market growth to offer better outcomes in prolonged sedation situations.

Propofol has advantages for rapid induction and smooth recovery, but it is susceptible to acute respiratory depression, hypotension and long-term ICU sedation dependency. Nonetheless, innovations such as AI-assisted anesthesia monitoring, closed-loop systems of propofol delivery, as well as safer co-administration protocols are enhancing efficacy, safety, and accuracy that keep propofol-based anesthetic applications in steady growth within the market.

Sevoflurano has gained good acceptance in market for pediatric anesthesia, outpatient Procedures and maintenance of general anesthesia because of increasing trend for use of inhaled anesthetics for controlled, non-invasive delivery of anesthesia with good patient acceptability.

Sevoflurane has good depth-of-anesthesia control, less airway-irritation, and low metabolic side effects compared with intravenous anesthetics, which makes it a far more suitable inhalation volatile anesthetic for both adult and pediatric patients.

Sevoflurane is growing in popularity in ambulatory surgical centers (ASCs) and day-care surgeries, leading to increased adoption of advanced inhalation anesthesia systems owing to the preference by hospitals and surgical facilities for faster, low-blood-gas solubility anesthetics that increase patient throughput and minimize postoperative complications associated with anesthesia.

Compared to other inhalation anesthetics, sevoflurane provides a smooth induction with rapid elimination and improved emergence rate, all contributing to reduced recovery times, studies suggest.

Increased use of sevoflurane in pediatric anesthesia owing to its lesser airway irritation, minimal cardiovascular depression, and superior safety in the pediatric population has also contributed to the market growth for increasing use of sevoflurane in pediatric surgery, pediatric intensive care, and dental anesthesia.

Its paired multimodal anesthesia expertise has demonstrated opioid-sparing effects, greater hemodynamic stability and lower POCD rates have further propagated its adoption to optimize post-operative outcomes in the elderly or high-risk surgical patients.

This development of environmentally sustainable, low-greenhouse-emission sevoflurane formulations, with lower persistency in atmosphere resulted in decreased negative impact on the environment in turn accelerated the market growth and sustains compliance with sustainability initiatives and regulatory guidelines.

Sevoflurane is increasingly used in emergency and trauma anesthesia including field anesthesia in military and disaster relief settings that have further bolstered market growth by facilitating improved portability as well as rapid onset anesthesia delivery in critical care settings.

Although it possesses several advantages such as fast recovery and non-invasive means of delivery of anesthesia, concerning issues like considerable manufacturing cost, risk for nephrotoxicity at long-term exposure and limitation in long- duration surgeries restrict its application.

In spite of these challenges, advances in vaporizer technologies, AI-assisted inhalation anesthesia monitoring and precision-controlled gas delivery systems are making anesthesia delivery systems more efficient, safer, and more environmentally sustainable, which is driving the demand for sevoflurane-based anesthesia solutions.

The Inhaled anesthesia and intravenous anesthesia segments are two major market drivers, with healthcare providers progressively devising optimal anesthesia delivery approaches, to enhance surgical safety, and patient recovery, as well as procedural efficiency.

Intravenous anesthesia (TIVA) has recently become one of the most consumable anesthesia administration route providing accurate drug titration, predictable pharmacodynamics and airway complications. Compared to inhalation anesthesia, intravenous anesthetics allow for rapid drug onset, more manageable transitions, and a significantly reduced incidence of intraoperative awareness, translating to improved depth-of-anesthesia control.

The increasing demand for total intravenous anesthesia (TIVA) in neurosurgery, orthopedic surgeries and long duration surgeries, has stimulated adoption of advance TIVA delivering systems as the anesthesiologist have a preference for drug infusion strategies that reduce post-operative nausea, maintain stable hemodynamics and limit cognitive side effects.

Studies also suggest that TIVA minimizes airway irritability, maximizes oxygenation, and lowers the risk of post-operative delirium, which is highly useful for high-risk patients.

The market has experienced stronger growth due to the expanding target-controlled infusion (TCI) techniques market, which includes closed-loop anesthesia monitoring, AI-assisted depth-of-anesthesia assessment and even automated propofol-remifentanil titration systems, enabling greater adoption of precision anesthesia delivery.

The combination with IV anesthetic agents and the general application of ambulatory as well as minimally invasive techniques complement these developments, as short-acting, fast-recovery agents for IV anesthesia enhance the establishment of better patient throughput and economic efficiency in outpatient surgery centers.

On the one hand, intravenous anesthesia offers benefits of controlled drug delivery and fewer side effects; however, facing the disadvantages of cost constraints, the need for meticulous monitoring and risk of hypotension and respiratory depression.

Yet end-rising technologies for AI-enhanced anesthesia depth assessment, next-gen infusion pump technologies, and multimodal TIVA approaches are enhancing the efficacy, placement and safety, preserving strong sales momentum for intravenous anesthesia solutions.

Inhaled anesthesia is high demand, especially in pediatric, geriatric and outpatient device procedures owing to the growing implementation of advanced vaporizer technologies and inhalation delivery systems amongst hospitals and other healthcare organizations to deliver patient safety in addition higher user-friendliness.

Compared to intravenous anesthesia, inhaled anesthetics offer ease of titration, lower risks of intraoperative awareness, and quicker emergence from anesthesia, relaying better recovery profiles.

Demand for low-flow anesthesia delivery systems, with less gas consumption, increased cost-efficiency, and improved patient safety, has encouraged use of inhaled anesthetics, since healthcare facilities have embraced sustainability, cost-reduction and controlled anesthesia depth.

The recent prevalance of inhaled anesthesia in robotic-assisted surgery, outpatient procedures, and non-invasive delivery routes, as well as the development of fast-acting agents which has compacted the dynamics of recovery and broadened the depth of penetration for anesthesia into minimally invasive surgery spaces.

North America continues to be on the top rank in the overall anesthetic medicine market because of a well-developed healthcare system, high investment in healthcare research, and a steady rise in surgeries. The United States is especially a major contributor because of high hospital, ambulatory surgery centre, and specialized surgical department numbers.

Canada also is a top regional growth because of the focus on expanding the availability and quality of healthcare.

Population aging is one major contributor, as the older people are likely to need more intensive and more frequent medical attention. The aging process is also propelling demand for the latest anesthetic drugs that ensure rapid recovery and enhanced postoperative treatment. Furthermore, ongoing research by drug companies in North America is providing next-generation anesthetic drugs to the maximum safety and effectiveness.

Europe is the market leader in percentage terms in the overall market of general anaesthesia drugs because of its established healthcare base and strict regulatory environment. United Kingdom, Germany, and France are some of the leading nations contributing the most to surgical procedures and anesthetic research, hence enjoying steady growth in the market.

The concentration of major pharmaceutical drug companies in this area is also a contributing factor.

State-sponsored health programs in most of the nations of Europe guarantee access to surgery as a fundamental right, hence adding to the total surgeries being carried out.

Coupled with the area's emphasis on patient safety and improved post-operative recovery (ERAS) policies, this is developing demand for more recent and more secure anesthetic medication Investment in education and training for anaesthesiologists is also common for the European market with introduction of high-end anaesthesia medication on the cards.

Asia-Pacific is also likely to grow at the highest rate in the market for general anaesthesia drugs due to expanding healthcare infrastructure, rising surgical volumes, and a rapidly growing aging population. China, India, and Japan are the drivers of growth.

In China, ongoing reforms in healthcare as well as investments in sophisticated medical technologies are greatly enhancing the surgical capabilities of the country. The efforts of the Chinese government to improve rural access to healthcare and improve urban hospitals are creating a growing demand for safe and effective anesthetic drugs.

India is also seeing greater use of general anesthetic drugs as access to healthcare improves and medical tourism grows. Japan, being advanced in healthcare technologies, is also continuously creating anesthetic medicines with emphasis on patient comfort and quick recovery.

Asia-Pacific region also has the benefit of increasing numbers of private hospital chains and specialty surgical centers, stimulating demand for premium anesthetic products rising levels of chronic illness and trauma cases also fuel the region's market potential, qualifying Asia-Pacific as a region for future growth.

The Impact of Regulation and Competition in the Market

Challenges from Regulations - As by its nature, General Anaesthesia Drugs is closely regulated to ensure safety and compliance by regulatory bodies. Clinical trials, manufacturing, and post-market surveillance are subject to strict guidelines imposed by regulatory agencies, thus, drug approvals involve a long and expensive process.

In addition, competition from generic anaesthesia drugs continues to put downward pressure on prices, putting pressure on profits for branded drug makers. The way there is appear more to respect regulatory compliance, invest in quality manufacturing, negotiation formulations and delivery mechanism.

In response, companies must create plans for meeting the evolving regulatory environment taking shape within the global sphere, assuring that their aesthetic drugs remain in compliance as environmental and health regulations continue to emerge.

Moreover, the high-cost challenge for conducting robust clinical trials and obtaining timely regulatory clearances exacerbates financial pressures and necessitates firms to pursue collaborative ventures and alternative funding models to secure market position.

Better Drug Formulations and Specifics in Anaesthetic Approach

Stifled by regulatory challenges, yet several innovation in aesthetic formulations and precision anaesthesia techniques can be driving elements of significant growth. Recent innovations, such as ultra-short-acting anaesthetics, opioid-free anaesthesia regimens, and inhalation agents with diminished side effects, are driving market change.

AI-powered anaesthesia delivery systems and dosing strategies personalised for each patient, further improve both efficiency and safety. Furthermore, the rising demand for outpatient and minimally invasive surgeries requires anaesthesia medications that are fast acting with quick recovery times.

Molecular Processing and Entities Attached to Anaesthesia- Pharmaceutical Industry & the Future Recent advancements in anaesthesia strongly suggest that pharmaceutical companies investing in these innovations will have a competitive advantage in the anaesthesia of tomorrow.

The increasing demand for patient-centred care is also driving the demand for personalized anaesthesia solutions, enabling anaesthesiologists to adjust dosages based on individual patient physiology.

Furthermore, a rise in investment towards biotechnology is paving the way for the introduction of bio-based anaesthetics, which have a better safety profile, more excellent elimination rates, lower complications, and a faster recovery of patients against the chemical anaesthetics.

Significant changes in the General Anaesthesia Drugs Market occurred between 2020 and 2024 due to the increasing number of surgical procedures, the growth of critical care services. The increased use of anaesthesia drugs in the ICU in ventilated patients, spurred demand for these types of anaesthetics.

We witnessed the uptake of total intravenous anaesthesia (TIVA) instead of conventional inhalation anaesthetics with improved patient safety and recovery outcomes. But the challenges like disrupted supply chains and increased scrutiny of the environmental impact of inhalation anaesthetics had shifted drug formulations and delivery preferences.

Moreover, this period witnessed an increased focus on digital health solutions to aid anaesthesia management, such as automated drug delivery systems and remote monitoring tools, which improved patient safety and workflow efficiency.

Another major factor driving the evolution of market demand was accelerated growth of ambulatory surgical centres and short-stay hospitals, which required anaesthetics with rapid onset and minimal side effects.

Sustainability-fuelled technology disruption; Opioid-free anaesthesia; AI-assisted anaesthesia delivery; the anaesthesia market is again primed to undergo the next phase of transformative technology driven by sustainability initiatives and drive to bring more safety in surgery.

Advancements in the use of less toxic agents, more precise anaesthetics, and improved metabolism rates will dictate future industry trends. Real-time anaesthesia monitored with the aid of AI and machine learning will lead to reduced variability, allowing for improved patient outcomes.

Demand for sustainable formulations will be driven by the growing focus on green anaesthesia, which seeks to reduce the environmental footprint of aesthetic gases.

The prevalence of same-day surgical procedures and outpatient surgery will enhance the growth of rapid-onset and fast-recovery anaesthetics throughout the forecast period. As robotics becomes more integrated into the very fabric of surgical procedures, anaesthetic-enhancing drugs will be needed, just as minimally invasive, precision-driven techniques will be.

Furthermore, increased access to telehealth and AI-based diagnostics will enable more efficient perioperative planning promoting ideal cosmetic outcomes in diverse patient populations in a variety of healthcare environments. The General Anaesthesia Drugs Market is set to undergo significant changes as these trends continue to evolve.

However, with the potential for disruption comes the responsibility through collaboration for manufacturers, healthcare providers, and regulatory bodies to balance continued innovation with safety, sustainability and patient-centric care. In the decades to come, companies adopting AI, green anaesthesia solutions, and precision medicine will lead.

Strengthening transparency about aesthetic procedures given the continued movement toward patient-driven care models will also bring about a new level of trust between patients and healthcare providers.

Furthermore, industry partnerships with academic research centres will be timely to discover new anaesthetics that are designed to optimally achieve clinical goals and regulatory constraints that continue to evolve in healthcare settings.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Tightening approval processes and growing compliance demands |

| Technological Advancements | Adoption of TIVA and inhalation anaesthetics with fewer side effects |

| Surgical Trends | Growing number of complex surgical procedures and critical care demand |

| Environmental Concerns | Rising awareness of aesthetic gas emissions and regulatory scrutiny |

| Drug Formulation Innovations | Introduction of ultra-short-acting anaesthetics |

| Market Competition | Increased presence of generic anaesthesia drugs impacting pricing |

| Supply Chain Dynamics | COVID-19-related disruptions and pharmaceutical shortages |

| Market Growth Drivers | Rising surgical volumes, aging population, and enhanced critical care |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Slide to sustainable aesthetic complexes with strong regulatory systems integrating sustainability targets |

| Technological Advancements | AI-assisted anaesthesia delivery, smart monitoring, next-generation drug formulations, and robotics-assisted anaesthesia integration. |

| Surgical Trends | Expansion of outpatient and minimally invasive surgeries requiring tailored aesthetic solutions, driven by technological advancements. |

| Environmental Concerns | Development of biodegradable inhalation agents and reduced greenhouse gas impact, aligning with climate change mitigation efforts. |

| Drug Formulation Innovations | Further advancements in patient-specific dosing, alternative pain management solutions, and bio-based anaesthetics for enhanced safety. |

| Market Competition | Shift toward specialized and premium anaesthetics with differentiated value propositions and enhanced therapeutic effects. |

| Supply Chain Dynamics | Strengthened manufacturing resilience, localized production capacities, and digitized supply chain optimization for uninterrupted drug availability. |

| Market Growth Drivers | AI-driven anaesthesia protocols, expansion of same-day surgeries, increased demand for precision medicine, and growing emphasis on perioperative patient safety. |

United States general anesthetic medicines market is rising at a mid-level rate on account of rising number of surgeries, rising demand for intravenous anesthetics, and surging demand for outpatient surgery centers.

With growing numbers of geriatric patients and those with chronic ailments such as cardiovascular disorders, orthopedic conditions, and cancers, more numbers of surgeries are now being conducted on a daily basis in America. Greater use of ambulatory surgery centers (ASCs) is also driving short-acting anesthesia demand such as propofol and sevoflurane as they have the benefit of quick recovery of the patient.

Apart from that, even the United States Food and Drug Administration (FDA) favors the development of new and safer anesthetic drugs while industry giants Baxter, Pfizer, and Fresenius Kabi are investing in new formulation which again raises patient control and anesthetic depth safety.

While increasing need for surgery, increased utilization of short-acting anesthetic pharmaceuticals, and expansion in ambulatory facilities will propel modest expansion in the entire USA market for anesthetics.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 2.6% |

United Kingdom general anaesthesia market is witnessing moderate growth on the back of increasing elective procedures, enhanced use of ambulatory surgical procedures, and spending on safer anesthetic drugs.

United Kingdom's National Health Service (NHS) is making greater investment in operating room facilities, and this is enhancing hospital and ambulatory surgery clinic demand for intravenous and inhalation anesthetics. Short-recovery, fast-onset anesthetics such as desflurane and remifentanil are also gaining demand due to the shift towards day-case procedures.

British drug trade, which has AstraZeneca and GlaxoSmithKline (GSK) as its headquarters, is also investing in the production of the next generation of anesthetic drugs with less side effects and post-operative complications.

Along with increasing levels of elective surgery, increasing ambulatory anesthesia use, and increasing pharmaceutical industry investment in new anesthetics, UK general anesthesia medicine will increase gradually.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.5% |

European general anesthetic drugs market is subjected to continuous growth by virtue of increased surgeries, rise in the usage of inhalation anaesthesia, and technological advancement in anaesthesia monitor devices.

The ageing population in Europe on a mass scale combined with increased healthcare expenditure is propelling greater surgical volumes, particularly cardiovascular, orthopaedic, and oncologic surgery. Germany, France, and Italy are some of the top health technology nations and this is propelling longer and safer anesthetics.

Inhalational anesthetic agents like sevoflurane and isoflurane are increasingly popular with decreased systemic side effects and enhanced safety profiles. Use of AI-based anesthesia monitoring systems is also increasing accuracy in the administration of anesthesia and avoiding overdose and complications.

Since more inhalational anesthetics are required as surgical anesthetic activity increases, the technology is also developed on the anesthesia monitoring systems, hence the European general anesthetic drug market will increase incrementally.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 2.8% |

Japan has long had the oldest population worldwide, propelling surging numbers of orthopedic, cardiac, and neurocognitive operations. This accelerates total growth for sedation serums, notably intravenous sedatives with swift recovery in elderly patients.

Beyond that, Japan's pharmaceutical technology pioneers like Daiichi Sankyo and Takeda Pharmaceuticals lead development of next-generation anesthetics to minimize postoperative complications and rationally manage sedation depth.

As rates of geriatric procedures climb, minimally invasive surgery is ever more commonly employed, and anesthetic safety continually increases, so Japanese demand for general anesthetic drugs will steadily expand.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.7% |

South Korean market of general anesthesia medicines is recording robust growth, driven by growth in sophisticated surgical procedures, rising investments in hospitals, and rising demand for outpatient surgery facilities.

South Korea's rapidly expanding health care sector is driving the development of minimally invasive and robot-assisted surgery, boosting demand for short-acting anesthetics such as etomidate and propofol. Growth in cosmetic and elective surgery, plastic and bariatric surgery etc. also helps in increasing use development of anesthetic drug.

The South Korean government is investing in hospital facilities and medical tourism, thereby again spurring demand for general anesthetic drugs in surgical procedures. Drug companies such as Hanmi Pharmaceutical are also designing new anesthetic drugs with enhanced safety profiles.

With growing adoption of newer-generation surgical techniques, growing hospital investments, and medical tourism, the South Korean general anesthesia drugs market is expected to grow steadily.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 2.8% |

The growing surgical procedures in various healthcare settings, including hospitals, outpatient surgery centers and dental clinics, drive the growth of general anesthesia drugs market. Demand is being driven by factors such as an aging population, increasing prevalence of chronic diseases and new drug delivery systems.

Newer, safer, and more effective anesthetic agents that improve patient outcomes and reduce the time to recovery are all examples of major innovations driving the market. The growing adoption of minimally invasive surgeries, along with regional anesthesia techniques and biotechnology-engineered anesthesia drugs, is changing the market landscape as well.

The pharmaceutical companies and biotechnology ones dominate the market with respect to safer, more effective anesthesia medicines with less damage.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Fresenius Kabi | 18-22% |

| Baxter International Inc. | 15-20% |

| Johnson & Johnson | 10-15% |

| Hikma Pharmaceuticals | 7-12% |

| Mylan N.V. (Viatris) | 5-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Fresenius Kabi | Provides propofol, isoflurane, and sevoflurane general anaesthetic medicines with a focus on enhanced patient safety and best drug delivery. |

| Baxter International Inc. | Parenteral anesthesia specialist for intravenous anesthetics propofol and remifentanil, with emphasis on quick onset, titratable sedation and minimal related adverse consequences. |

| Johnson & Johnson | Innovative anesthesia agents, such as sedatives and analgesics, for general and regional anesthesia. |

| Hikma Pharmaceuticals | Offer generic anesthesia drugs including ketamine and thiopental, with an emphasis on low cost and worldwide delivery. |

| Mylan N.V. (Viatris) | Provides a range of generic anesthetics, such as midazolam and propofol, making anesthesia affordable and accessible. |

Key Company Insights

Fresenius Kabi (18-22%)

Fresenius Kabi is a significant supplier of general anesthesia drugs, which include high-quality anesthetics like propofol, sevoflurane, and isoflurane. The startup is working to enhance patient safety and drug delivery systems to reduce complications and accelerate recovery times.

Baxter International Inc. (15% - 20%)

Most commonly known as a supplier for intravenous anesthetic agents, including propofol and remifentanil that are administered in both general anesthesia and sedation procedures Baxter supports a wide range of surgical disciplines. The company claims rapid onset, accurate dosing, and few side effects, particularly for high-risk surgeries.

Johnson & Johnson (10-15%)

Johnson & Johnson is a leader in sedative and analgesic agents related to both general and regional anesthesia while developing and marketing innovative products to promote greater patient comfort and shorter recovery time. The firm is deeply engaged in packaging solutions for minimally invasive operations.

Hikma Pharmaceuticals (7-12%)

Hikma sells those and other common generic anesthesia drugs, including ketamine and thiopental, at low prices. With an emphasis on cost containment, the company is aiming its solutions at hospitals and outpatient clinics worldwide, particularly in newly developing markets.

Mylan N.V. (Viatris) (5-10%)

Fluorinated agents such as midazolam and propofol, are still in stock by Mylan (Viatris), thus providing safe and efficient midazolam will become more accessible, especially for cash-only medical systems.

Other companies involved in the general anesthesia drugs market are specialized in developing advanced formulations, new or better delivery systems, and expanding the global availability of the drugs as per medical guidelines. These include:

The overall market size for General Anaesthesia Drugs Market was USD 5.2 Billion in 2025.

The General Anaesthesia Drugs Market is expected to reach USD 6.9 Billion in 2035.

The demand for the general anaesthesia drugs market will grow due to the rising number of surgical procedures, increasing prevalence of chronic diseases, advancements in aesthetic drug formulations, and the growing geriatric population, driving the need for safe and effective anaesthesia solutions.

The top 5 countries which drives the development of General Anaesthesia Drugs Market are USA, UK, Europe Union, Japan and South Korea.

Intravenous Anaesthesia and Inhaled Anaesthesia Drive Market to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Drug Class, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Route of Administration, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Drug Class, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Route of Administration, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Drug Class, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Route of Administration, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Drug Class, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Route of Administration, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Drug Class, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Route of Administration, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Drug Class, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Route of Administration, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Drug Class, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Route of Administration, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Drug Class, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Route of Administration, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Drug Class, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Route of Administration, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Drug Class, 2023 to 2033

Figure 22: Global Market Attractiveness by Route of Administration, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Drug Class, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Route of Administration, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Drug Class, 2023 to 2033

Figure 46: North America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Drug Class, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Route of Administration, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Drug Class, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Drug Class, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Route of Administration, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Route of Administration, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Drug Class, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Route of Administration, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Route of Administration, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Drug Class, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Route of Administration, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Drug Class, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Route of Administration, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Drug Class, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Route of Administration, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Drug Class, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Route of Administration, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Drug Class, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Route of Administration, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

General Intelligent Decision-Making Service Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

General Purpose DC Contactor Market Size and Share Forecast Outlook 2025 to 2035

General Surgery Devices Market Insights – Demand and Growth Forecast 2025 to 2035

Generalized Anxiety Disorder Treatment Market Insights by Drug Class, Therapies, Distribution Channel, and Region 2035

General Purpose Electronic Test and Measurement Instruments Market Analysis and Forecast by Product, End Use, and Region Through 2035

Generalized Myasthenia Gravis Management Market - Growth & Treatment Advances 2025 to 2035

Anesthesia Breathing Bags Market Size and Share Forecast Outlook 2025 to 2035

Anesthesia Equipment Market Size and Share Forecast Outlook 2025 to 2035

Anesthesia Machines Market - Size, Share, and Forecast 2025-2035

Anesthesia Ultrasound Systems Market Analysis – Trends & Forecast 2025 to 2035

Dental Anesthesia Delivery Systems Market

Portable Anesthesia Systems Market Growth - Trends & Forecast 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Orphan Drugs Market Size and Share Forecast Outlook 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Retinal Drugs And Biologics Market

Antiviral Drugs Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA