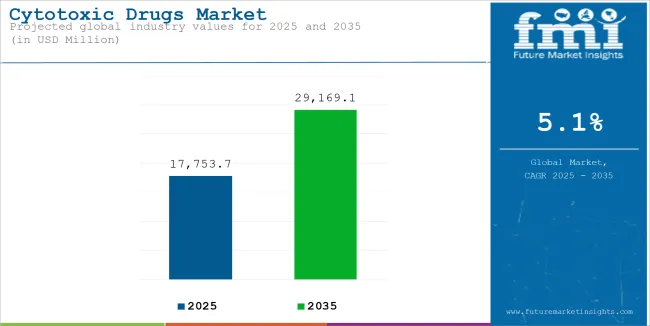

The global sales of cytotoxic drugs is estimated to be worth USD 17,753.7 million in 2025 and anticipated to reach a value of USD 29,169.1 million by 2035. Sales are projected to rise at a CAGR of 5.1% over the forecast period between 2025 and 2035. The revenue generated by cytotoxic drugs in 2024 was USD 17,001.5 million.

Cytotoxic drugs inhibit the growth of rapidly dividing cancer cells. This class of agents’ works by disrupting the action of DNA replication or protein synthesis that usually happens during the cell division cycle. Due to this mechanism of action, cytotoxic drugs are very widely used during the chemotherapy regimen. Apart from inhibiting cell growth, cytotoxic agents also target normal cells and produce features of side effects.

A major driving force for the market is the increasing incidence of cancer globally, which can be explained by an increasing number of aging populations, lifestyle- and environmental-related risks. The growing demand and development of effective drug formulations with improved efficacy, causing minimal side effects, shall continue to expand the acceptance of cytotoxic drugs in oncology treatments globally.

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 17,001.5 million |

| Estimated Size, 2025 | USD 17,753.7 million |

| Projected Size, 2035 | USD 29,169.1 million |

| CAGR (2025 to 2035) | 5.1% |

There has been growing enthusiasm for cytotoxic drugs in combination therapy regimens, especially in combination with immunotherapies, such as immune checkpoint inhibitors. These combinations increase the efficacy of cancer treatment by working through complementary mechanisms of both drug classes.

Cytotoxic drugs act upon the tumor burden by targeting and killing rapidly dividing cancer cells, which, in turn, exposes the tumor antigens that assist immune checkpoint inhibitors (e.g., pembrolizumab or nivolumab) to activate the immune system much more efficiently.

Clinical results have provided significant areas of improvement in the survival of combinations in various cancers. For example, in advanced stages, platinum-based cytotoxic chemotherapy combined with pembrolizumab has become the first line of treatment for advanced NSCLC.

Repeated studies demonstrate that the regimen is more likely to prolong the period before the disease progresses compared to cisplatin alone, by approximately 6–9 months, as well as the likelihood of overall survival, by more than 50%.

However, the success of such combinations is not confined to NSCLC alone. In TNBC, the addition of atezolizumab (an immune checkpoint inhibitor) to paclitaxel (a cytotoxic drug), improved response rates and disease control by several-fold. With cancer treatment continuing to evolve, strategically embedded cytotoxic drugs are cemented into combination regimens, equally endorsing their positions in current oncology protocols, ensuring better patient outcomes and expanding their market relevance.

The global cytotoxic drugs market's compound annual growth rate (CAGR) for the first half of 2024 and 2025 is compared in the table below. This analysis provides important insights into the performance of the industry by highlighting significant shifts and trends in revenue generation.

The first half (H1) is the period from January to June, and the second half (H2) is July to December. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 6.2%, followed by a slightly lower growth rate of 5.8% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 6.2% (2024 to 2034) |

| H2 | 5.8% (2024 to 2034) |

| H1 | 5.1% (2025 to 2035) |

| H2 | 4.7% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 5.1% in the first half and remain relatively moderate at 4.7% in the second half. In the first half (H1) the industry witnessed a decrease of 110 BPS while in the second half (H2), the industry witnessed a decrease of 110 BPS.

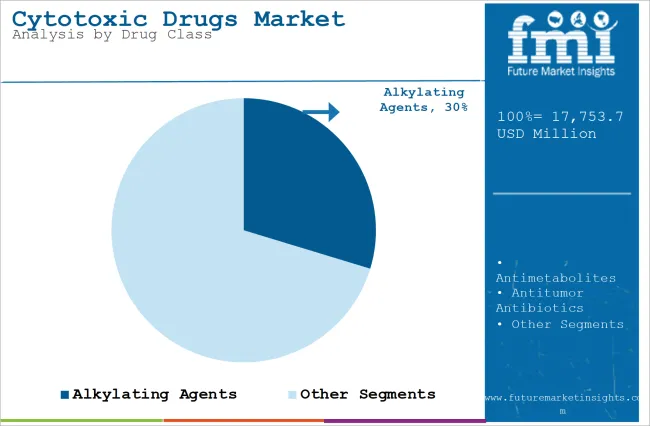

The section contains information about the leading segments in the industry. Based on drug class, the alkylating agents segment is expected to account for 29.7% of the global share in 2023.

| By Drug Class | Alkylating Agents |

|---|---|

| Value Share (2025) | 29.7% |

The alkylating agents segment is projected to be a dominating segment in terms of revenue, accounting for almost 29.7% of the market share in 2025.

The alkylating agents segment is projected to be a dominating segment due broad application of the alkylating agents in treating different types of cancers. These agents damage the DNA in cancer cells directly and thus impede their replication and growth. Such mechanism of action provides broad therapeutic scope in rapidly dividing and slow-growing tumors, making these agents highly effective.

Alkylating agents have great value in that they treat cancers like leukemia, lymphoma, breast carcinoma, and ovarian carcinoma. In most cases, they will be included in the standard drug regimens, either alone or with other drug classes.

On the other hand, the segment enjoys a robust pipeline of improved formulations and generic versions, thereby making it readily available and inexpensive. With oncologists' dependence on alkylating agents for first-line and combination therapies, this segment will likely remain dominant in the cytotoxic drugs market.

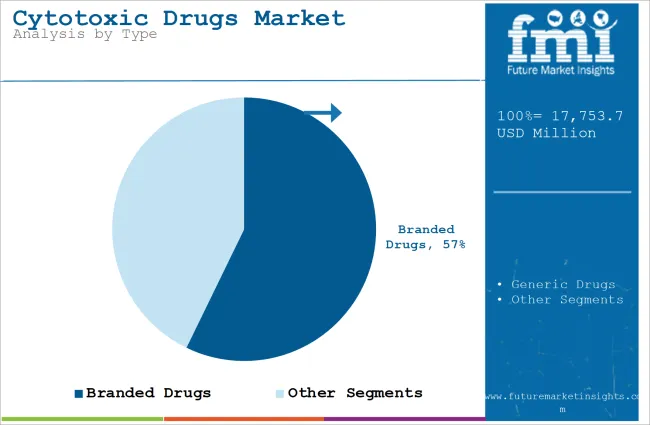

| By Type | Branded Drugs |

|---|---|

| Value Share (2025) | 57.2% |

The branded drugs segment will dominate the industry in terms of revenue, accounting for almost 57.2% of the market share in 2025.

The branded drugs segment is expected to lead the market as their established efficacy, brand recognition, and clinical usage extensively justify them in cytotoxic drugs. Branded cytotoxic drugs are gold standard for the treatment of cancers and thus command strong validation of the extensive clinical nature with a highly trusted safety profile. Strong research, marketing, and long-term clinical data drive the adoption by oncologists of such cytotoxic drugs.

Furthermore, branded drugs lead in innovation since pharmaceutical companies are major investors in novel formulations and better delivery methods. Though expensive, patients and providers of healthcare are willing to pay a premium for branded cytotoxic drugs because they have been proven effective and are available in combination therapy regimens. As cancer treatment protocols continue evolving, the branded drugs segment will be the laggard that drives both market share and revenue growth.

Rising prevalence of cancer is driving the market growth

Cancer continues to affect a broad spectrum of populations, due to causes such as change in lifestyle, change in environmental exposures, and genetic predispositions. As the number of cases rises, healthcare systems turn to an effective and available way to combat the disease.

For instance, according to the Globocan report 2022, there were around 19,976,499 number of cases of cancer globally. Out of which lung cancer being most prevalent.

Cytotoxic drugs continue to play central roles in the treatment of cancer in targeting and killing cells that rapidly divide. Effectiveness across various cancer types ensures the continued use of these agents in chemotherapy regimens. Oncologists prescribe these agents both as monotherapy and combination therapy modalities to maximize therapeutic outcomes.

In response to the increasing need, pharmaceutical companies set about new cytotoxic formulations, improving existing ones to enhance efficacy and diminish side effects. Governments and healthcare organizations are prioritizing access to these treatments to ensure their widespread adoption. Thus, increasing number of cases of cancer would increase the demand cytotoxic drugs.

Growing government and NGO initiatives for cancer care is driving the industry growth

Government and NGO programs are vital in encouraging the use of cytotoxic drugs, particularly in resource-limited areas. Governments and NGOs give priority to cancer care and make efforts to ensure greater access to treatment and minimize costs for patients. Subsidies, health care reforms, and targeted programs can help reduce the cost of cancer therapies, and more people would be able to benefit from such life-saving interventions.

Organizations such as the World Health Organization (WHO) and regional health bodies implement strategies for cancer prevention and treatment, focusing on accessible chemotherapy. Funding for procurement, distribution, and local production of cytotoxic drugs often accompanies these efforts, facilitating their integration into public healthcare systems.

The NGOs raises awareness on other cancer treatment methods and partner with governments to expand healthcare structures. Their lobbying advocates for cytotoxic drugs in a country's programs on controlling cancers, thus raising their consumption. These initiatives therefore help in developing sustainable frameworks of care for cancer, through public and private collaborations.

This would mean that support provided to increase availability of cytotoxic drugs enhances the adoption as standard treatment and strengthens their positions in oncology markets worldwide.

Rising chemotherapy procedures act as an opportunity in the market

Since chemotherapy remains the mainstay of cancer care, demand for cytotoxic drugs increases accordingly. Cytotoxic agents continue to play a major role in controlling or eliminating cancer cells in most cancers, including solid tumors and hematological malignancies.

Advancements in chemotherapy protocols increase the use of combination therapies and subsequently, of cytotoxic drugs. Such drugs become incorporated into regimes alongside targeted therapies and immunotherapies for more effective treatments and an ever-expanding role in the clinical application.

As the global cancer burden continues to rise, the number of chemotherapy procedures is likely to increase, and thus, the demand for cytotoxic drugs will be continuous. Hospitals and oncology centers are expanding their chemotherapy services, which increases the procurement of cytotoxic agents.

This increasing trend enables pharmaceutical companies the chance to be involved in establishing new cytotoxic formulae and forms of drug deliveries that have become more effective without causing harmful adverse effects, not to mention helping address specific diseases of different natures of malignancy. The rising number of chemotherapy procedures solidifies the demand for cytotoxic drugs, offering continued market expansion.

Emergence of targeted therapies may restrict market growth

One major constraint in the market of cytotoxic drugs is the increasing trend of personalizing the treatments for cancer with targeted therapies. Since researches keep advancing, therapies like monoclonal antibodies and small molecule inhibitors are increasingly more preferred since these can selectively target the cancerous cells with a much smaller extent of tissue damage.

These are perceived as being less toxic as well as being more effective in many types of cancers and, therefore, the preferred treatment choices of the oncologists as well as their patients.

Targeted therapies are based on the genetic makeup of the specific tumors, thereby tailoring a treatment that can be very personalized. It minimizes the use of the traditional cytotoxic drugs that hit both the cancerous and normal cells with resultant side effects. As more people get targeted therapies, the consumption of cytotoxic drugs may drop especially for those cancers where targeted therapies have proved more effective.

Targeted therapies have reduced the growth prospects for cytotoxic drugs since they compete with traditional treatments and provide fewer side effects for patients and potentially better results. Thus, this may limit the growth for this industry.

The global cytotoxic drugs industry recorded a CAGR of 4.2% during the historical period between 2020 and 2024. The growth of cytotoxic drugs industry was positive as it reached a value of USD 29,169.1 million in 2035 from USD 17,753.7 million in 2025.

Previously, treatment of cancer included only surgery, radiation, or chemotherapy-based cytotoxic drugs. All these treatments aimed at removing or damaging tumors that often caused severe effects not only in the malignancy but also at the level of the normal tissues. Chemotherapy was inappropriately used as the first line of treatment with specifications and efficacy limitations.

Currently, cancer treatment has been modified with combinations of different therapies in addition to targeted therapy. Combination therapy is where the cytotoxic drug is given along with immunotherapy or targeted therapy, enhancing effectiveness but at the cost of fewer side effects.

Targeted therapy specifically targets some specific molecular targets or genetic mutations that prove to be vital for the survival of cancer cells. These types of therapy have revolutionized the management of cancer, improving survival rates and quality of life for patients.

The market growth is driven by the introduction of biosimilar cytotoxic drugs, through which affordable alternatives to original branded treatments are being offered. It provides an extensive approach for accessibility and affordability of already existing branded cytotoxic drugs.

Since costs involve major limitations in resource-poor areas, affordable generic drugs simultaneously lead to greater access to life-saving medicines. Cost-effective biosimilars reduce the ever-increasing health system pressure and improve the access to cancer therapies, newly developed version-based safe drugs.

The increasing market availability of more biosimilars allows for increased competition, lower prices, and better uptake of cytotoxic drugs worldwide as a component of cancer treatment regimens.

Tier 1 companies are the industry leaders with 39.2% of the global industry. These companies stand out for having a large product portfolio and a high production capacity. These industry leaders also stand out for having a wide geographic reach, a strong customer base, and substantial experience in manufacturing and having enough financial resources, which enables them to enhance their research and development efforts and expand into new industries.

The companies within tier 1 have a good reputation and high brand value. These companies frequently get involved in strategies such as acquisition and product launches. Prominent companies within tier 1 include Bristol-Myers Squibb, F. Hoffmann-La Roche Ltd, Novartis AG and Pfizer.

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a market share of 28.4% worldwide. These firms may not have cutting-edge technology or a broad global reach, but they do ensure regulatory compliance and have good technology. The players are more competitive when it comes to pricing and target niche markets.

Key Companies under this category include Teva Pharmaceuticals, Viatris, Baxter, and Hikma Pharmaceuticals.

Compared to Tiers 1 and 2, Tier 3 companies offer cytotoxic drugs, but with smaller revenue spouts and less influence. These companies mostly operate in one or two countries and have limited customer base. The companies such as Sun Pharmaceutical Industries, Cipla, and others falls under tier 3 category. They specialize in specific products and cater to niche markets, adding diversity to the industry.

The market analysis for cytotoxic drugs in various nations is covered in the section below. An analysis of important nations in North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa of the world has been mentioned below.

It is projected that the United States will maintain its leading position in North America through 2035, holding a value share of 81.7%. By 2035, China is expected to experience a CAGR of 6.3% in the Asia-Pacific region.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 4.4% |

| Germany | 3.8% |

| UK | 4.1% |

| France | 4.4% |

| China | 6.3% |

| South Korea | 5.7% |

| India | 6.8% |

Germany’s cytotoxic drugs market is poised to exhibit a CAGR of 3.8% between 2025 and 2035. The Germany holds highest market share in European market.

In Germany, initiatives of the government and NGOs have driven cytotoxic drug adoption, mainly in resource-constrained settings. The German healthcare system, through public health insurance, covers the cost of essential cancer treatments, such as cytotoxic drugs, making chemotherapy accessible to patients throughout the country.

Germany is also an active participant in global cancer prevention strategies led by organizations such as the WHO, which focus on improving early detection, treatment, and access to affordable therapies.

NGOs operating in Germany assist by promoting anti-cancer crusades, donating money, and collaborating with the state to ensure a fair distribution of treatments. Efforts to upgrade the physical structures of treatment centers, such as those within remote regions, enable more convenient access to cytotoxic drugs. These efforts assist in alleviating the financial hardships associated with administering cytotoxic drugs and ensure more people embrace this form of chemotherapy in the overall cancer treatment interventions in Germany.

United States is anticipated to show a CAGR of 4.4% between 2025 and 2035.

The oncology pipeline is growing in the United States, and it remains a key driver of demand for cytotoxic drugs. More than 1,000 oncology drugs are under development, with many including cytotoxic components. Companies are focusing on this class of drugs because research is constantly evolving, along with improvements in drug formulations, delivery systems, and combination therapies.

More and more, drugs with proven cytotoxic potency will advance toward approval in a clinical trial environment and will increase their place within the treatment repertoire for cancer therapy.

The United States government along with regulatory institutions such as the FDA is proactively supporting such drug development processes by offering accelerated approval, conducting research grants and innovative therapy finding. Additionally, healthcare service providers are more than willing to incorporate new drugs in their existing protocols for most types of cancers.

This pipeline growth not only strengthens the market for cytotoxic drugs but also assures that patients are treated with more targeted and effective options, further propelling adoption in oncology practices all over the USA.

China is anticipated to show a CAGR of 6.3% between 2025 and 2035.

The incidence of cancer among all demographics in China is one of the major drivers for the demand of cytotoxic drugs. Due to the growing age and changing lifestyles, the incidence of cancer is gradually increasing in the country, and hence, cancer treatment becomes a priority in national healthcare. This trend is further compounded by environmental factors and increased urbanization, leading to higher numbers of diagnosis of cancer.

The Chinese government responded by investing in cancer care infrastructure, increasing the access to treatment, and promoting the availability of essential therapies such as cytotoxic drugs. Cytotoxic drugs are incorporated into the routine treatments in hospitals and oncology centers as they struggle to meet the rising number of cancer patients.

With cancer impacting more people across different age groups, the need for cytotoxic drugs in China is still increasing, which has been a major growth opportunity for the market and has further spread cancer therapies throughout the country.

In terms of this market, the companies involved are resorting to multiple strategies to retain a competitive position. These involve product innovation to create advanced therapies like combination treatments, and new drug delivery systems to ensure greater efficacy and compliance from the patient.

Strategic partnerships and collaborations with research institutions and healthcare providers are being utilized to broaden their product portfolio. Geographical expansion into the emerging markets, particularly China and India, has been another strategic priority for these companies, where growth in the healthcare infrastructure and awareness is strong.

Companies also have been spending money on the campaigns and educational programs for raising early diagnosis and the treatment uptake.

Recent Industry Developments in Cytotoxic Drugs Market

In terms of drug class, the industry is divided into alkylating agents, antitumor antibiotics, antimetabolites, plant alkaloids, and others.

In terms of type, the industry is segregated into branded drugs and generic drugs

In terms of application, the industry is divided into breast cancer, prostate cancer, lung cancer, pancreatic cancer, and other.

In route of administration, the industry is segregated into oral and parenteral

In terms of distribution channel, the industry is divided into hospital pharmacies, retail pharmacies and online pharmacies.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA) have been covered in the report.

The global cytotoxic drugs industry is projected to witness CAGR of 5.1% between 2025 and 2035.

The global cytotoxic drugs industry stood at USD 17,001.5 million in 2024.

The global cytotoxic drugs industry is anticipated to reach USD 29,169.1 million by 2035 end.

China is expected to show a CAGR of 6.3% in the assessment period.

The key players operating in the global cytotoxic drugs industry Bristol-Myers Squibb, F. Hoffmann-La Roche Ltd, Novartis AG, Pfizer, Teva Pharmaceuticals, Viatris, Baxter, Hikma Pharmaceuticals, Sun Pharmaceutical Industries, Cipla, and Others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Route Of Administration, 2017 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Drug Type, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Route Of Administration, 2017 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Drug Type, 2017 to 2033

Table 10: North America Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Route Of Administration, 2017 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Drug Type, 2017 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 17: Western Europe Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 18: Western Europe Market Value (US$ Million) Forecast by Route Of Administration, 2017 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Drug Type, 2017 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Route Of Administration, 2017 to 2033

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Drug Type, 2017 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 26: APEJ Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 27: APEJ Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 28: APEJ Market Value (US$ Million) Forecast by Route Of Administration, 2017 to 2033

Table 29: APEJ Market Value (US$ Million) Forecast by Drug Type, 2017 to 2033

Table 30: APEJ Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 31: Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 32: Japan Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 33: Japan Market Value (US$ Million) Forecast by Route Of Administration, 2017 to 2033

Table 34: Japan Market Value (US$ Million) Forecast by Drug Type, 2017 to 2033

Table 35: Japan Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 36: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 37: MEA Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 38: MEA Market Value (US$ Million) Forecast by Route Of Administration, 2017 to 2033

Table 39: MEA Market Value (US$ Million) Forecast by Drug Type, 2017 to 2033

Table 40: MEA Market Value (US$ Million) Forecast by End User, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Route Of Administration, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Route Of Administration, 2017 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Route Of Administration, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Route Of Administration, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Drug Type, 2017 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Route Of Administration, 2023 to 2033

Figure 23: Global Market Attractiveness by Drug Type, 2023 to 2033

Figure 24: Global Market Attractiveness by End User, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Route Of Administration, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 29: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Route Of Administration, 2017 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Route Of Administration, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Route Of Administration, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Drug Type, 2017 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 46: North America Market Attractiveness by Product, 2023 to 2033

Figure 47: North America Market Attractiveness by Route Of Administration, 2023 to 2033

Figure 48: North America Market Attractiveness by Drug Type, 2023 to 2033

Figure 49: North America Market Attractiveness by End User, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Route Of Administration, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Route Of Administration, 2017 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Route Of Administration, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Route Of Administration, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Drug Type, 2017 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Route Of Administration, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Drug Type, 2023 to 2033

Figure 74: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) by Route Of Administration, 2023 to 2033

Figure 78: Western Europe Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 79: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 80: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Western Europe Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 87: Western Europe Market Value (US$ Million) Analysis by Route Of Administration, 2017 to 2033

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Route Of Administration, 2023 to 2033

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Route Of Administration, 2023 to 2033

Figure 90: Western Europe Market Value (US$ Million) Analysis by Drug Type, 2017 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 97: Western Europe Market Attractiveness by Route Of Administration, 2023 to 2033

Figure 98: Western Europe Market Attractiveness by Drug Type, 2023 to 2033

Figure 99: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 100: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 102: Eastern Europe Market Value (US$ Million) by Route Of Administration, 2023 to 2033

Figure 103: Eastern Europe Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 104: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Route Of Administration, 2017 to 2033

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Route Of Administration, 2023 to 2033

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Route Of Administration, 2023 to 2033

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Drug Type, 2017 to 2033

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 121: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 122: Eastern Europe Market Attractiveness by Route Of Administration, 2023 to 2033

Figure 123: Eastern Europe Market Attractiveness by Drug Type, 2023 to 2033

Figure 124: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 125: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 126: APEJ Market Value (US$ Million) by Product, 2023 to 2033

Figure 127: APEJ Market Value (US$ Million) by Route Of Administration, 2023 to 2033

Figure 128: APEJ Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 129: APEJ Market Value (US$ Million) by End User, 2023 to 2033

Figure 130: APEJ Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: APEJ Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 132: APEJ Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: APEJ Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: APEJ Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 135: APEJ Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 136: APEJ Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 137: APEJ Market Value (US$ Million) Analysis by Route Of Administration, 2017 to 2033

Figure 138: APEJ Market Value Share (%) and BPS Analysis by Route Of Administration, 2023 to 2033

Figure 139: APEJ Market Y-o-Y Growth (%) Projections by Route Of Administration, 2023 to 2033

Figure 140: APEJ Market Value (US$ Million) Analysis by Drug Type, 2017 to 2033

Figure 141: APEJ Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 142: APEJ Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 143: APEJ Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 144: APEJ Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 145: APEJ Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 146: APEJ Market Attractiveness by Product, 2023 to 2033

Figure 147: APEJ Market Attractiveness by Route Of Administration, 2023 to 2033

Figure 148: APEJ Market Attractiveness by Drug Type, 2023 to 2033

Figure 149: APEJ Market Attractiveness by End User, 2023 to 2033

Figure 150: APEJ Market Attractiveness by Country, 2023 to 2033

Figure 151: Japan Market Value (US$ Million) by Product, 2023 to 2033

Figure 152: Japan Market Value (US$ Million) by Route Of Administration, 2023 to 2033

Figure 153: Japan Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 154: Japan Market Value (US$ Million) by End User, 2023 to 2033

Figure 155: Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 157: Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: Japan Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 160: Japan Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 161: Japan Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 162: Japan Market Value (US$ Million) Analysis by Route Of Administration, 2017 to 2033

Figure 163: Japan Market Value Share (%) and BPS Analysis by Route Of Administration, 2023 to 2033

Figure 164: Japan Market Y-o-Y Growth (%) Projections by Route Of Administration, 2023 to 2033

Figure 165: Japan Market Value (US$ Million) Analysis by Drug Type, 2017 to 2033

Figure 166: Japan Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 167: Japan Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 168: Japan Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 169: Japan Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 170: Japan Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 171: Japan Market Attractiveness by Product, 2023 to 2033

Figure 172: Japan Market Attractiveness by Route Of Administration, 2023 to 2033

Figure 173: Japan Market Attractiveness by Drug Type, 2023 to 2033

Figure 174: Japan Market Attractiveness by End User, 2023 to 2033

Figure 175: Japan Market Attractiveness by Country, 2023 to 2033

Figure 176: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) by Route Of Administration, 2023 to 2033

Figure 178: MEA Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 179: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 180: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 182: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 185: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 186: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Route Of Administration, 2017 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by Route Of Administration, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Route Of Administration, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by Drug Type, 2017 to 2033

Figure 191: MEA Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 192: MEA Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 193: MEA Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 194: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 195: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 196: MEA Market Attractiveness by Product, 2023 to 2033

Figure 197: MEA Market Attractiveness by Route Of Administration, 2023 to 2033

Figure 198: MEA Market Attractiveness by Drug Type, 2023 to 2033

Figure 199: MEA Market Attractiveness by End User, 2023 to 2033

Figure 200: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cytotoxicity Assays Market Size and Share Forecast Outlook 2025 to 2035

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Orphan Drugs Market Size and Share Forecast Outlook 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Retinal Drugs And Biologics Market

Antiviral Drugs Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Drugs Market Outlook – Growth, Demand & Forecast 2025-2035

Depression Drugs Market

Parenteral Drugs Packaging Market

Brain Tumor Drugs Market Forecast & Analysis: 2025 to 2035

Infertility Drugs Market Analysis - Size, Share & Forecast 2025 to 2035

Expectorant Drugs Market Trend Analysis Based on Drug, Dosage Form, Product, Distribution Channel, and Region 2025 to 2035

Cannabinoid Drugs Market

Clot Busting Drugs Market Size and Share Forecast Outlook 2025 to 2035

Psychotropic Drugs Market Growth - Industry Trends & Outlook 2025 to 2035

Critical Care Drugs Market Analysis – Trends, Demand & Forecast 2024-2034

Anti-Malarial drugs Market

Antimetabolite Drugs Market Size and Share Forecast Outlook 2025 to 2035

Fish-Oil Based Drugs Market Analysis – Trends, Share & Growth Forecast 2024-2034

Plasma-Derived Drugs Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA