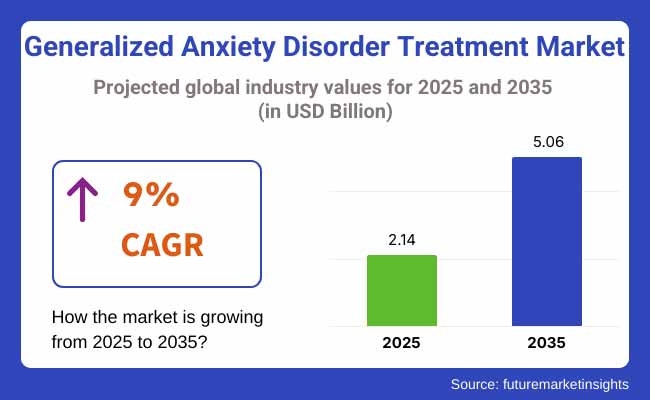

The global generalized anxiety disorder treatment market is valued at USD 2.14 Billion in 2025. It is expected to grow at a CAGR of 9% and reach USD 5.06 Billion by 2035. The global GAD treatment market is projected to grow significantly from 2025 and 2035, led by increasing awareness of mental illness and the expanding range of available treatments. The increasing cases of anxiety disorders and advancements in both pharmacological and non-pharmacological treatments are driving industry growth.

In 2024, the generalized anxiety disorder (GAD) treatment landscape covers aspects such as disease progression, industry prognosis, various elements influencing industry growth, competitive aspects, emerging trends, income potential, etc. There was an increase in prescribing SSRIs (Selective Serotonin Reuptake Inhibitors) and SNRIs (Serotonin-Norepinephrine Reuptake Inhibitors).

The segment is showing early traction during the forecast period. SSRIs, SNRIs, and cognitive behavioral therapy (CBT) are becoming more popular as first-line treatments for generalized anxiety disorder (GAD), reflecting their established efficacy in managing anxiety symptoms. This is helping the industry grow. Furthermore, increased government spending and investment in mental health facilities are also likely to spur demand.

The segment for generalized anxiety disorder (GAD) treatment is characterized by steady growth facilitated by increased awareness of mental health, improved diagnosis rates, and advancements in both pharmacological and digital therapeutics.

Pharmaceutical companies, mental health startups, and telehealth providers will benefit as demand for innovative treatments and personalized care expands. Traditional benzodiazepine manufacturers should be cautious about regulatory changes and evolving treatment preferences.

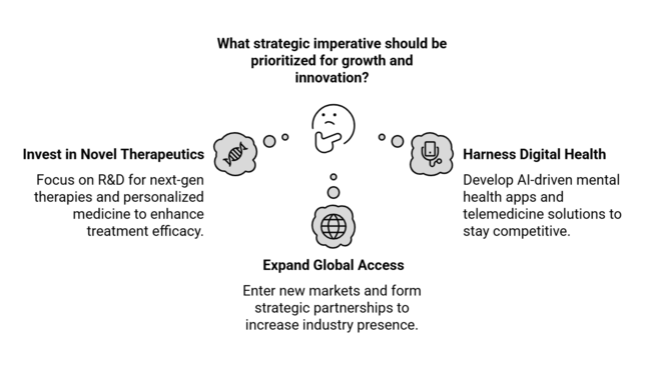

Invest in Novel Therapeutics and Personalized Medicine

Pharmaceutical companies must focus on R&D for next-gen therapies, such as GABA modulators, neurosteroid therapies, and psychedelic-assisted therapies. Creating personalized medicine strategies through genetic profiling and AI-based mental health solutions will improve the efficacy of treatments and sector position.

Harness Digital Health and Telemedicine Integration

Firms will need to keep pace with the growth of digital therapeutics and telehealth platforms by developing AI-driven mental health apps, virtual therapies, and remote monitoring tools. Collaboration with insurers to provide reimbursement for digital mental health offerings will further propel adoption.

Expand Global Industry Access and Strategic Partnerships

Expanding into regions with increasing mental health awareness, such as Asia-Pacific and Latin America, will open new revenue streams. Partnerships with healthcare providers, digital health companies, and distribution networks will enhance industry penetration, while strategic M&As can drive innovation and portfolio growth more quickly.

| Risk | Probability / Impact |

|---|---|

| Regulatory Restrictions on Medications - Stricter regulations on benzodiazepines and emerging psychedelic treatments may limit segment growth. | High Probability / High Impact |

| Slow Adoption of Digital Therapeutics - Resistance from traditional healthcare providers and lack of reimbursement policies could hinder growth in telehealth-based anxiety treatments. | Medium Probability / High Impact |

| R&D and Clinical Trial Failures - High costs and uncertainties in developing novel therapeutics may delay innovation and sector entry. | Medium Probability / Medium Impact |

| Priority | Immediate Action |

|---|---|

| Expansion of Digital Therapeutics | Conduct feasibility study on AI-driven mental health apps and teletherapy adoption rates. |

| Regulatory Compliance & Drug Approvals | Engage with regulatory bodies to streamline approval pathways for novel anxiety treatments. |

| Industry Penetration in Emerging Regions | Develop strategic partnerships with local healthcare providers in Asia-Pacific and Latin America. |

To stay ahead, company must accelerate investments in digital therapeutics, drug development, and global growth strategies to stay ahead of the proactive and innovative approaches in the dynamic GAD treatment landscape. The emergence of AI-based mental health products and personalized medicine presents a strategic opportunity to differentiate and enhance patient outcomes.

Additionally, strengthening partnerships between emerging sectors like Asia-Pacific and Latin America will generate alternative revenue sources. The roadmap, therefore, needs to focus on achieving a good balance between innovative techniques and scalability to ensure effective R&D implementation and commercial strategies.

Regional Variance:

High Variance:

Convergent & Divergent Perspectives on ROI:

Consensus:

Variance:

Shared Challenges:

Regional Differences:

Pharmaceutical Companies:

Healthcare Providers:

Patients:

Alignment:

Divergence:

USA:

Western Europe:

Japan/South Korea:

High Consensus: Affordability, accessibility, and regulatory hurdles remain key concerns worldwide.

Key Variances:

Strategic Insight: A "one-size-fits-all" approach will not work. Segment leaders must tailor strategies-digital-first solutions in the US, sustainable pharma in Europe, and stigma-reduction campaigns in Asia-to drive adoption and growth.

| Country/Region | Regulatory Impact |

|---|---|

| United States (USA) | Stricter FDA approval processes slow down new drug launches; state-level mental health parity laws increase insurance coverage. Telehealth expansion policies drive digital therapy adoption; psychedelic-assisted therapy legalization in select states fuels R&D in ketamine/psilocybin treatments. |

| European Union (EU) | EU Mental Health Strategy 2023 to 2028 promotes funding for next-gen treatments; strict drug safety regulations extend approval timelines; GDPR compliance for digital therapeutics affects AI-driven mental health solutions; carbon-neutral drug manufacturing policies encourage sustainable pharma innovations. |

| Japan | Slow approval for novel treatments limits access to next-gen drugs; national insurance policies favor generics, restricting premium-priced medications; limited enforcement of mental health regulations results in low adoption of psychedelic and digital therapies. |

| South Korea | Government incentives for digital health investments encourage AI-driven therapy models; low insurance reimbursement for psychotherapy and advanced medications limits segment growth; logistical challenges in rural areas slow treatment accessibility. |

| Canada | Legalization of psychedelic-assisted therapy (Psilocybin, MDMA) for mental health treatment accelerates research and clinical trials; government funding for mental health programs improves accessibility of new therapies. |

| Australia | Recent regulatory approval for psilocybin and MDMA-based treatments positions the country as a leader in psychedelic medicine; Medicare expansion for mental health services increases adoption of digital therapeutics and therapy-based treatments. |

Generalized anxiety disorder drugs landscape in the USA is the biggest and fastest growing in the global segment, expected to grow with a CAGR of 10.2% during the forecast period - 2025 to 2035. AI-powered mental health diagnostics, telehealth-adjacent therapy models, and new drugs like neurosteroids and psychedelics have unlocked investment opportunities in the USA sector.

Regulatory improvements, including state-level mental health parity laws, as well as FDA fast-tracking for novel treatments, are also likely to spur the approval of new drugs. In addition, the recent legalization of psychedelic-assisted therapy in some states is incentivizing R&D for alternative treatment options for treatment-resistant anxiety.

The rise of telehealth services and AI-based cognitive behavioral therapy (CBT) programs will help bridge treatment gaps, particularly in rural areas with limited psychiatric care. Partnerships with large pharmaceutical companies will also be key in bringing next-generation treatments to the USA sector.

The UK GAD treatment landscape is anticipated to witness a CAGR of 9.5% from 2025 to 2035, owing to government-led mental health initiatives and high healthcare access. One of the biggest growth drivers for the telehealth mental health sector is the expansion of the National Health Service (NHS) to offer digital mental health services.

The UK is also leading the way in psychedelic research, with numerous clinical trials assessing ketamine, psilocybin and MDMA-assisted therapy for anxiety disorders. Therefore, although the adoption of private healthcare is becoming more common, a vast number of patients still use public healthcare, which can delay the adoption of next-gen treatments. Still, growing awareness of mental health disorders, increased telehealth adoption, and government-backed mental health programs, the UK industry will keep accelerating.

Between 2025 and 2035, GAD treatment landscape will experience a CAGR of 8.7%, bolstered by universal healthcare coverage, healthy levels of government funding for mental health research, and early adoption of digital therapeutics. The Mental Health & Well-being Strategy of the French government emphasizes accessible treatment options, the use of telepsychiatry and AI-based mental health diagnostics.

France has been more cautious when it comes to psychedelic-assisted therapy, and many of its rigid drug regulations have delayed the introduction of treatments based on ketamine and psilocybin.

However, increasing patient demand is expected to drive gradual policy shifts over time. In France, the industry penetration for premium-priced novel drugs is limited by the often-slow reimbursement process for new treatments. At the same time, shortages of psychologists and long waits for therapy have increased the use of self-help apps and digital mental health platforms.

Germany is expected to offer strong growth opportunities in the GAD treatment segment, with a CAGR of 9.2% between 2025 and 2035. Germany’s established mental healthcare infrastructure, strong insurance system, and strong performances of pharmaceutical R&D promote industry growth. With Europe focusing on green and climate-friendly production, the country has been leading the way in sustainable drug manufacturing, as strict EU laws demand carbon-neutral pharmaceuticals.

Germany is also one of the pioneers of insurance-approved digital therapeutics (DiGA) in Europe, where doctors can prescribe CBT apps and AI-based therapy models for anxiety disorders.

Germany’s Federal Joint Committee imposes stringent clinical evaluation standards that may prolong the clinical development timeline of any new therapies. However, consistently high investment in mental health innovation, a rising telemedicine penetration rate, and high patient awareness continue to drive steady annual growth in Germany’s mental health sector.

The GAD treatment landscape in Italy is expected to grow at a CAGR of 8.5% over the 10-year period between 2025 and 2035 and this growth will be driven by the rise in mental health awareness campaigns and insurance covering psychiatric treatments by the government. In fact, the National Health Service guarantees access to mental healthcare, but long waitlists for therapy sessions have increased demand for digital therapy solutions.

In Italy, the adoption of psychedelic-based treatments is limited in comparison to the UK and Germany, and conservative regulatory policies have slowed segment entry for both ketamine and psilocybin therapies.

Low public investment in mental health R&D relative to other European countries contributes to this innovation deficit. But the Italian sector is likely to progress, propelled by factors such as higher demand for alternative therapies, more funding for private healthcare investment, and development of telepsychiatry services.

The GAD treatment sector in South Korea is projected to register a CAGR of 8.0% from 2025 to 2035 due to high stigma associated with mental health disorders leading to low adoption of treatment The government is working to normalize mental health care by expanding insurance coverage and subsidizing digital mental health solutions.

A key growth driver is the surge of interest in AI-powered mental health platforms, especially among South Korean youth. Big hospital networks in Seoul, meanwhile, are getting into the act, funding VR-based exposure therapy and robotic-assisted treatments. But gradual regulatory reforms and cultural resistance to psychiatric drugs persist as major barriers.

Japan's sector is predicted to grow at a CAGR of 7.8%, while cultural stigma and lack of mental health infrastructure will hinder accessibility. The Japanese government is rolling out new policies to increase insurance reimbursement for both therapy and emerging drugs, but uptake has been slower than what we would expect in Western SECTORs.

Some alternative, non-pharmaceutical treatments are gaining popularity in Japan, including meditation apps and herbal medicines. Regulatory hesitance toward psychedelic-assisted therapies temper industry growth. Developing mental health and AI support systems is expected to be on the rise, especially in corporate wellness initiatives.

China's Generalized Anxiety Disorder (GAD) treatment landscape is expected to grow at a robust CAGR of 10.5% from 2025 to 2035. The Chinese government has upgraded mental care by increasing public healthcare insurance coverage of psychiatric treatment and financing local pharma R&D to curb dependence on overseas medicines. Telemedicine platforms such as ping an good doctor and WeDoctor are increasingly contributing to making treatment more accessible, particularly in remote regions.

Artificial intelligence-powered mental health chatbots and virtual therapy sessions are increasingly popular. Nevertheless, challenges include stringent foreign drug importation regulations, cultural resistance to psychiatric medication, and urban-rural disparities in mental health services. Despite these challenges, the industry is likely to boom through digital health technologies, enhanced domestic drug manufacturing, and mental health initiatives sponsored by the government.

Australia and New Zealand's treatment landscape for GAD will register a CAGR of 9.3% between 2025 and 2035, driven by advanced mental health policy, increasing adoption of teletherapy, and new psychedelic-assisted treatments. Australia led the world in psychedelic-assisted therapy by making MDMA and psilocybin treatments for extreme mental illness legal, spurring research and investment in next-generation anxiety treatments.

Increased Medicare coverage for mental health care has made medication and therapy more affordable, and AI-based mental health apps such as MindSpot and Beyond Blue are tackling treatment gaps, especially among rural and indigenous populations.

High treatment costs, long waiting times for mental health professionals in remote regions, and difficulties scaling psychedelic-assisted therapy remain major barriers. In spite of these issues, government support for mental health research and lenient regulatory environments are likely to propel future industry growth.

The Generalized Anxiety Disorder (GAD) treatment sector in India would grow at a CAGR of 9.8% during 2025 to 2035 with increased awareness about mental health, the availability of broader digital healthcare solutions. Programs like Ayushman Bharat and Tele-MANAS are improving access to mental health care, especially in rural areas.

AI-driven mental health apps like Wysa and Mindhouse are also making therapy more accessible, while India has a strong generic pharma sector helps to generate affordable drugs. However, mental illness stigma, protracted drug approval procedures, and unequal access to psychiatrists are impediments to sector growth.

India may need to reconsider its laws as psychedelic-assisted therapy remains illegal, but global trends could drive regulatory changes. Future growth will be driven by mental health insurance expansion, corporate wellness programs, and increased investment in telepsychiatry.

The GAD treatment landscape by drug class will be led by antidepressants, which are expected to maintain their dominance with a 7.5% CAGR with 48% industry share. The Generalized Anxiety Disorder (GAD) treatment sector by drug class is dominated by antidepressants, which continue to maintain their dominance with their proven efficacy and extensive prescription.

The segment of SSRIs and SNRIs continues to be the first choice due to their long-term safety and efficacy. Buspirone is gaining momentum especially with growing concerns about benzodiazepine addiction driving healthcare providers towards safer alternatives.

Benzodiazepine use is expected to decline due to stricter regulatory guidelines and growing concerns about addiction risks. As research on new pharmacological solutions progresses, non-addictive and rapid-acting treatment options are expected to shape the future of the GAD drug market.

Therapy-based treatments are experiencing strong growth, with the segment expected to expand at a 9.5% CAGR, slightly outpacing the overall sector. The treatment for Generalized Anxiety Disorder (GAD) is shifting towards options that don't rely on medication. Cognitive Behavioral Therapy (CBT) remains the top choice, with its popularity increasing as digital tools make therapy more accessible.

Mindfulness-Based Cognitive Therapy (MBCT), a method that blends mindfulness practices with cognitive therapy, is growing even faster at about 9% annually as more people look for natural and alternative treatments.

Interpersonal Therapy (IPT) is also becoming more popular, but at a slower pace. There is increasing use of online therapy and AI-powered mental health apps. These technologies are expected to raise the demand for therapy, particularly among younger people and city residents.

The fastest-growing segment in the GAD treatment sector is online pharmacies, propelling the distribution channel segment to a 10.5% CAGR in 2025 to 2035. The segment for GAD treatments is changing at a rapid pace, with online healthcare models increasing their foothold. Hospital pharmacies still play a major role and are projected to expand due to inpatient mental healthcare and structured treatment strategies.

Retail pharmacies are still a robust player due to the convenience of care that they offer patients with instant medication access. Still, the online pharmacy is anticipated to be the fastest-growing segment, driven by expansion in telemedicine, home delivery, and approvals for e-prescriptions. Healthcare digitalization and increasing online penetration are likely to dramatically reorganize GAD treatment accessibility and distribution on a global basis.

The major companies in the Generalized Anxiety Disorder (GAD) treatment sectors are implementing a combination of pricing strategies, innovations, strategic collaborations, and global expansions. Pricing has been and remains a key competitive component of generic versus branded medications, while leading pharmaceutical producers focus their resources on premium-priced novel therapeutics that offer better efficacy with fewer adverse effects.

Key growth strategies for major players include strategic mergers and acquisitions (M&A) to enhance their product portfolios and reach into new sectors. They are increasingly forming partnerships with mental health startups, digital health companies, and academic institutions, particularly in areas such as teletherapy integration and AI-powered cognitive therapy solutions.

The company will continue to expand globally, with firms entering high-growth economies across the Asia-Pacific region, Latin America, and the Middle East via working with regulatory agencies.

Key Developments

Johnson & Johnson Acquires Intra-Cellular Therapies (January 2024)

FDA Grants Breakthrough Therapy Designation to MindMed's MM-120 (March 2024)

The most frequently used treatments are antidepressants (SSRIs, SNRIs), benzodiazepines, buspirone, and cognitive behavioral therapy (CBT). Newer therapies, such as psychedelic-assisted therapy and online mental health services, are also being developed.

GAD treatment is increasingly incorporating AI-powered mental health apps, teletherapy, and wearable sensors, enabling more personalized, accessible, and data-driven care.

Large pharma firms such as Pfizer, Eli Lilly, Johnson & Johnson, and GSK are investing in new treatments, while biotech companies such as MindMed and Biogen are researching alternative treatments.

Regulatory bodies such as the FDA, EMA, and MHRA ensure that new drugs and treatments are safe and effective before they are made available to the general public.

Several next-generation therapies, such as psychedelics (MM-120), novel antidepressants, and neurostimulation treatments, are in development and have the potential to enhance long-term outcomes.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Therapies, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Therapies, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Therapies, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Therapies, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Therapies, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Therapies, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Therapies, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Therapies, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Therapies, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Therapies, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Therapies, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Therapies, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 17: Global Market Attractiveness by Drug Class, 2023 to 2033

Figure 18: Global Market Attractiveness by Therapies, 2023 to 2033

Figure 19: Global Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Therapies, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Therapies, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Therapies, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Therapies, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 37: North America Market Attractiveness by Drug Class, 2023 to 2033

Figure 38: North America Market Attractiveness by Therapies, 2023 to 2033

Figure 39: North America Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Therapies, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Therapies, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Therapies, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Therapies, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Drug Class, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Therapies, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Therapies, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Therapies, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Therapies, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Therapies, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 77: Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 78: Europe Market Attractiveness by Therapies, 2023 to 2033

Figure 79: Europe Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Therapies, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Therapies, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Therapies, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Therapies, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 97: South Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Therapies, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Therapies, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Therapies, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Therapies, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Therapies, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 117: East Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Therapies, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Therapies, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Therapies, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Therapies, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Therapies, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 137: Oceania Market Attractiveness by Drug Class, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Therapies, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Therapies, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Therapies, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Therapies, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Therapies, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 157: MEA Market Attractiveness by Drug Class, 2023 to 2033

Figure 158: MEA Market Attractiveness by Therapies, 2023 to 2033

Figure 159: MEA Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anxiety Disorders And Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Opioid Use Disorder Treatment Industry Analysis by Opioid Antagonists and Opioid Agonists and Partial Agonists through 2035

Market Positioning & Share in the Opioid Use Disorder Treatment Sector

Alcohol Use Disorder Treatment Market Growth - Demand & Innovations 2025 to 2035

Cannabis Use Disorder Treatment Market – Trends & Innovations 2025 to 2035

Bipolar Disorder Drugs and Treatment Market Overview – Trends & Forecast 2025 to 2035

Substance Use Disorder Treatment Market Size and Share Forecast Outlook 2025 to 2035

Frontotemporal Disorders Treatment Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Opioid Use Disorder Treatment Providers in Europe

Major Depressive Disorder (MDD) Treatment Market Analysis – Growth & Forecast 2025 to 2035

Lymphoproliferative Disorder Treatment Market

Amino Acid Metabolism Disorders Treatment Market Growth – Trends & Forecast 2024-2034

Lipoprotein Metabolism Disorders Treatment Market

Demand for Cannabis Use Disorder Treatment in Japan Size and Share Forecast Outlook 2025 to 2035

Post-Traumatic Stress Disorder (PTSD) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Paediatric Neuropsychiatric Disorders Treatment Market

Australia & NZ Opioid Use Disorder Treatment Market Analysis – Size, Share & Forecast 2025-2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA