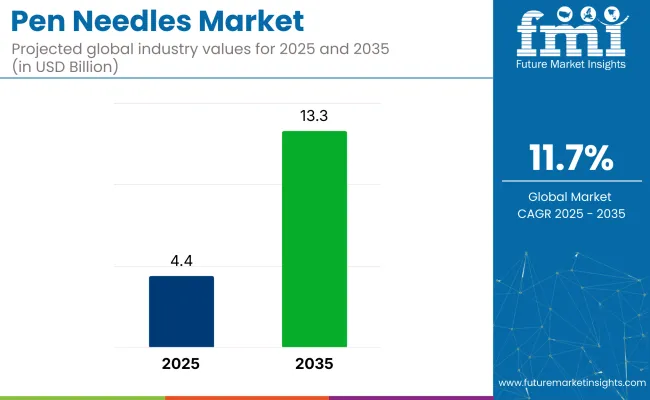

The global pen needles market is poised for robust growth over the next decade, with its industry value projected to rise from USD 4.4 billion in 2025 to USD 13.3 billion by 2035. This strong upward trajectory represents a CAGR of 11.7%, underscoring the increasing significance of diabetes management and broader chronic disease care.

As these needles become more integral to injectable therapies, especially for insulin delivery, they are becoming a vital component of the healthcare industry’s response to rising chronic disease prevalence. The industry’s growth reflects not only the rising number of patients requiring daily injections but also a shift in preferences toward user-friendly and less invasive devices that enhance patient compliance.

In May 2024, DevdattKurdikar, CEO of Embecta Corp., emphasized the ongoing importance of insulin in diabetes management during a Bank of America investor conference, stating, “Insulins have been around for 100 years.

Mechanistically, we don’t see insulin going away because of GLP-1.” Embecta, the world’s largest producer of disposable insulin pen needles and syringes, has been facing increased competition from GLP-1 drugs like Novo Nordisk's Ozempic, leading to declining profits and the exploration of a potential sale. Despite these challenges, Embecta continues to manufacture approximately 8 billion syringes and insulin pen needles annually, serving over 100 countries.

The industry holds a specialized share within its parent markets. In the medical devices market, it accounts for approximately 1-2%, as these needles are a specific device used primarily for injectable drug delivery systems. Within the diabetes care market, the share is around 15-18%, driven by the widespread use of insulin pens and other injectable medications for managing diabetes.

In the injectables market, these needles contribute about 10-12%, as they are a critical component of injectable drug delivery systems, particularly for chronic conditions. Within the pharmaceuticals market, the share is approximately 2-3%, as these needles are used to administer various injectable drugs. In the home healthcare market, their share is around 8-10%, as more patients use insulin pens for self-administering medications at home.

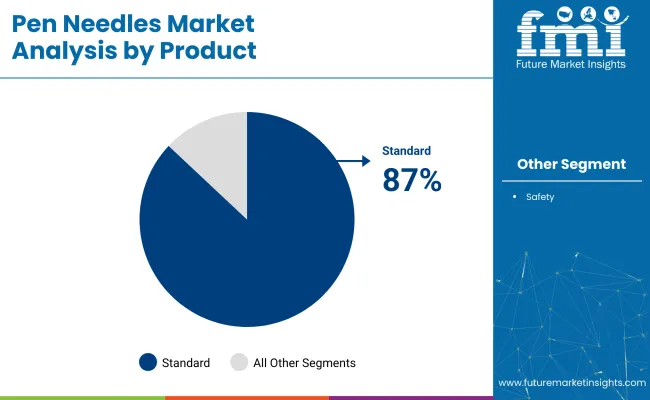

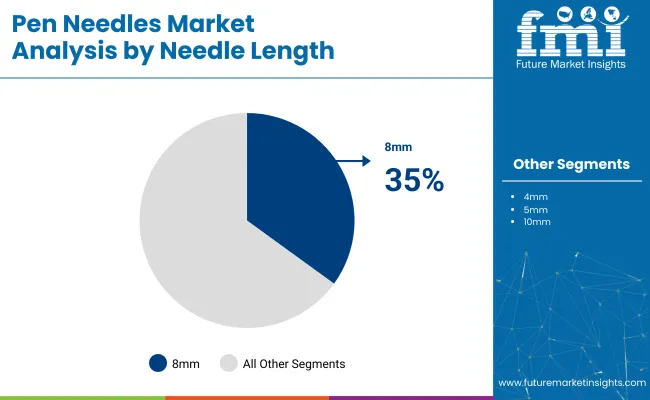

The industry is expected to grow significantly in 2025, with standard pen needles leading at 87% industry share, the 8mm needle length capturing 35%, and insulin therapy driving the application segment with 75% industry share.

Standard ones are projected to dominate the industry in 2025, holding an 87% share. Their widespread availability, cost-effectiveness, and ease of use make them the preferred choice for routine insulin administration. These needles are compatible with most insulin pens and are trusted by both healthcare providers and patients.

While safety ones are gaining traction for reducing needlestick injuries, standard ones remain the leader due to their affordability, especially in price-sensitive regions and among patients with limited access to healthcare. Their long-standing presence and familiarity among users further cement their dominance in the industry.

The 8mm pen needle is projected to capture 35% of the industry share in 2025. This needle length remains popular due to its clinical effectiveness, long-standing use, and compatibility with a broad range of patients. The 8mm needle is particularly effective for individuals with higher BMI, ensuring accurate subcutaneous insulin delivery and reducing the risk of intramuscular injection.

In regions with rising obesity rates and limited access to personalized needle length recommendations, the 8mm needle is often prescribed as a universal solution. Despite the increasing preference for shorter needles, the 8mm segment remains dominant due to its reliable clinical outcomes.

The insulin segment is expected to dominate the application category with 75% industry share in 2025. Insulin therapy remains the cornerstone of diabetes management, especially for individuals with type 1 diabetes and advanced type 2 diabetes. The global rise in diabetes prevalence, driven by aging populations and increasing obesity rates, fuels the demand for insulin injections.

When paired with insulin pens, these needles offer a convenient, discreet, and accurate method for delivering insulin, significantly improving patient adherence. The growing availability of diabetes care and technological advancements in insulin delivery devices ensure the continued dominance of the insulin segment in the industry.

The industry is growing due to the rising global prevalence of diabetes and the increasing trend of self-administration, supported by improved patient education and technological innovations. Regional growth is strongest in Asia-Pacific, driven by expanding healthcare access and rising investments in diabetes care, while advancements in needle technology continue to enhance comfort and safety.

Rising Diabetes Prevalence and Self-Administration Trends

The industry is expanding due to the rising global prevalence of diabetes and the increasing trend of self-administration. As the number of diabetes cases grows, especially in developing regions, there is a higher demand for convenient and effective insulin delivery systems.

They offer a practical solution, allowing patients to self-administer insulin easily and discreetly. This trend is further supported by improved patient awareness, better education, and technological advancements that simplify the use, boosting adherence and disease management.

Technological Advancements and Regional Growth Opportunities

Technological advancements in needle design are also contributing to the industry's growth. Manufacturers are developing thinner, shorter, and more comfortable with features that reduce pain and minimize injection-related complications. Safety-enhanced designs are preventing needlestick injuries, appealing to both patients and healthcare providers.

Regionally, Europe currently dominates the industry, but the Asia-Pacific region is emerging as the fastest-growing due to improved healthcare access, increased diagnosis rates, and rising investments in diabetes care, particularly in countries like India and China.

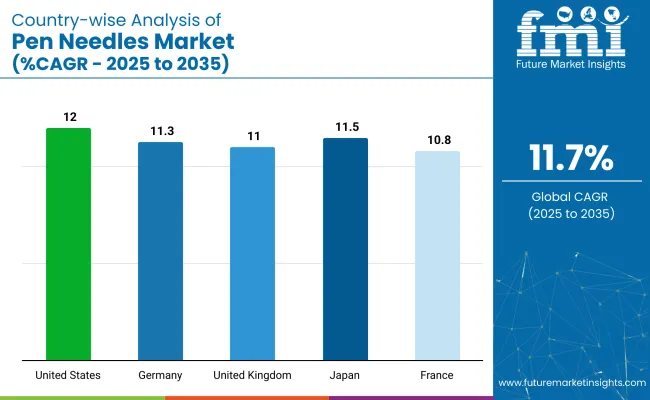

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 12% |

| Germany | 11.3% |

| United Kingdom | 11% |

| Japan | 11.5% |

| France | 10.8% |

The industry demand is projected to rise at an 11.7% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, the United States leads at 12%, followed by Japan at 11.5%, Germany at 11.3%, the United Kingdom at 11%, and France at 10.8%.

These rates translate to a growth premium of +2% for the United States and -1% for Japan, while Germany, the United Kingdom, and France show slightly lower growth compared to the global baseline. Divergence reflects local catalysts: increased demand for diabetic care and needle-free alternatives in the United States, steady adoption of advanced needle technologies in Japan, and well-established healthcare systems in Germany, the United Kingdom, and France.

The United States industry, projected to post a 12% CAGR through 2035, is driven by high diabetes prevalence and strong payor coverage that normalizes home injection. Device makers are refining cannula walls, lubrication coatings, and anti-coring tips to reduce penetration force for aging and pediatric users.

Retailers bundle these needles with CGMs and smart caps, widening adherence ecosystems. Direct-to-patient channels, powered by telehealth prescriptions, shorten refill cycles and capture real-time feedback on needle comfort. Parallel moves by employers to subsidize digital diabetes programs boost product visibility beyond traditional pharmacies, making these needles a core element of integrated chronic-care kits.

The industry in France is forecast to expand at a 10.8% CAGR by 2035 as public clinics shift newly diagnosed patients from vials to pens within 30 days of initial prescription. Domestic preference for ultra-short, 32-gauge formats reflects clinician focus on lipohypertrophy prevention.

E-prescription integration with national health cards accelerates automatic renewal, while regional tele pharmacies handle doorstep delivery to mobility-impaired seniors. French start-ups collaborate with design institutes to develop recyclable needle hubs, aligning with EU waste-reduction directives. Industry players also leverage social-media campaigns featuring dietitians to highlight the comfort advantages of single-use safety needles for active lifestyles.

Japan, expected to log an 11.5% CAGR through 2035, relies on these needles to sustain independent living among super-aged populations. Hospitals promote “same-day discharge” for stable diabetics, issuing compact starter packs with 4 mm tapered needles and visual insertion guides.

Domestic OEMs integrate RFID tags in outer caps to sync with smartphone dosing diaries, supporting nationwide IoT-health initiatives. Rural prefectures deploy nurse-led home-visiting services that train patients in safe disposal and site rotation. Meanwhile, health insurers offer premium discounts to policyholders uploading adherence data from Bluetooth-enabled pen attachments, anchoring demand for compatible needle SKUs.

The industry in Germany is set to grow at an 11.3% CAGR to 2035, bolstered by statutory insurance that reimburses up to 365 needles per patient annually. National diabetes centers emphasize structured education, boosting awareness of correct gauge selection and single-use protocols.

Local manufacturers introduce color-coded hub systems to simplify needle length identification for multilingual migrant populations. Digital health-app prescriptions-DiGA-now bundle pen-needle coaching modules, urging app users to photograph injection sites for remote nurse feedback. Large e-pharmacies leverage same-day delivery in metro areas, reshaping supply patterns away from brick-and-mortar chemists.

Pen-needle demand in the United Kingdom, projected to rise at an 11% CAGR through 2035, is reinforced by NHS directives that favor pens over syringes for primary-care initiation. Community practice nurses conduct quarterly virtual check-ins assessing needle rotation habits, reducing injection-site complications.

Manufacturers co-develop screw-on safety shields compatible with NHS-procured insulin pens, targeting elderly users with limited dexterity. Regional disparities spur mobile clinical vans distributing free starter kits in underserved coastal towns. Concurrently, private online pharmacies industry subscription packs bundling these needles with hypo-treats, capturing tech-savvy millennials managing type 1 diabetes.

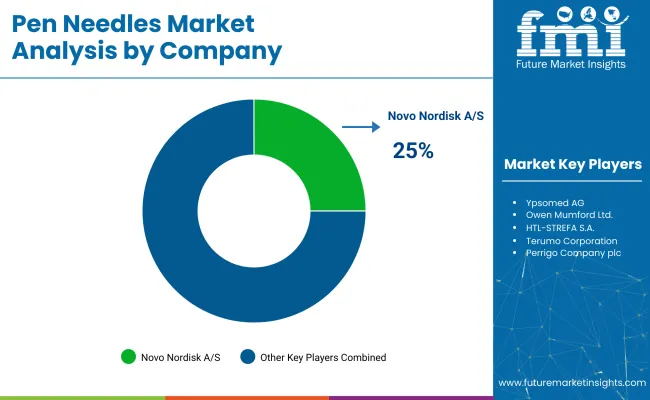

Leading Company - Novo Nordisk A/S Industry Share - 25%

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as Novo Nordisk A/S, Becton, Dickinson and Company, and Terumo Corporation lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across insulin therapy, GLP-1 therapy, and growth hormone therapy sectors.

Key players including Owen Mumford Ltd., Ypsomed AG, and HTL-STREFA S.A. offer specialized solutions tailored to specific applications and regional industries. Emerging players, such as Allison Medical, Inc., Artsana S.p.A., and UltiMed, Inc., focus on innovative technologies and cost-effective solutions, expanding their presence in the global industry.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 4.4 billion |

| Projected Industry Size (2035) | USD 13.3 billion |

| CAGR (2025 to 2035) | 11.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in units |

| Product Analyzed (Segment 1) | Standard Pen Needles And Safety Pen Needles. |

| Needle Length Covered (Segment 2) | 4mm, 5mm, 6mm, 8mm, 10mm, and 12mm. |

| Therapy Covered (Segment 3) | Insulin, Glucagon-Like-Peptide-1(GLP-1), And Growth Hormone. |

| Regions Covered | North America, Western Europe, East Asia, South Asia |

| Countries Covered | United States; Canada; United Kingdom; Germany; France; Italy; Spain; Netherlands; China; Japan; South Korea; India; Pakistan; Bangladesh |

| Key Players Influencing the Industry | Becton, Dickinson and Company, Novo Nordisk A/S, Ypsomed AG, Owen Mumford Ltd., HTL-STREFA S.A., Terumo Corporation, Allison Medical, Inc., Artsana S.p.A., Trividia Health, Inc., Perrigo Company plc. |

| Additional Attributes | Dollar sales, industry share, growth rates, key segments, regional demand, competitive landscape, emerging trends, pricing strategies, customer preferences, regulatory environment, and innovation opportunities to optimize product development and industry positioning. |

The industry is segmented into standard and safety pen needles.

The industry covers 4mm, 5mm, 6mm, 8mm, 10mm, and 12mm.

The industry is categorized into insulin, glucagon-like-peptide-1(GLP-1), and growth hormone.

The industry spans North America, Western Europe, East Asia, and South Asia.

The industry is expected to reach USD 13.3 billion by 2035.

The industry size is projected to be USD 4.4 billion in 2025.

The industry is expected to grow at a CAGR of 11.7% from 2025 to 2035.

The USA is expected to be the fastest growing with a CAGR of 12%.

Standard pen needles, accounting for over 87% of the industry in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pentane Market Size and Share Forecast Outlook 2025 to 2035

Penile Cancer Treatment Market Size and Share Forecast Outlook 2025 to 2035

Penetration Testing Market Size and Share Forecast Outlook 2025 to 2035

Penile Prosthesis Market

Pentaerythritol Market

Spent Grain Flour Market Size, Share and Growth Forecast Outlook 2025 to 2035

Open Cross Flow Cooling Tower Market Size and Share Forecast Outlook 2025 to 2035

Open Source Service Market Size and Share Forecast Outlook 2025 to 2035

Open Radio Access Network Market and Forecast Outlook 2025 to 2035

Open Cycle Aeroderivative Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Open Transition Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Spending In Digital Customer Experience and Engagement Solutions Market Size and Share Forecast Outlook 2025 to 2035

Open API Market Size and Share Forecast Outlook 2025 to 2035

Open Mouth Sacks Market Size and Share Forecast Outlook 2025 to 2035

Open Banking Market Analysis - Size, Share, and Forecast 2025 to 2035

Open Source Intelligence Market Trends – Growth & Forecast 2025 to 2035

Open Air Merchandizers and Accessories Market - Industry Innovations & Demand 2025 to 2035

Open Top Cartons Market

Spend Analysis Software Market

Open Gear Lubricants Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA