The open source service market is experiencing robust growth driven by widespread digital transformation, cost optimization initiatives, and the increasing reliance on flexible software infrastructure. Organizations are adopting open source solutions to enhance scalability, reduce vendor dependency, and accelerate innovation cycles. Current market dynamics reflect heightened demand for managed services and consulting support as enterprises modernize legacy systems and migrate workloads to open platforms.

The future outlook is supported by the integration of open source technologies into enterprise IT ecosystems, expansion of cloud-native applications, and growth in community-driven software development. Strategic collaborations between enterprises and open source service providers are fostering innovation and improving interoperability.

Growth rationale is reinforced by the global emphasis on secure, transparent, and customizable software solutions Continued investment in automation, cybersecurity, and containerized environments is expected to sustain market momentum and position open source services as a cornerstone of enterprise digital strategies.

| Metric | Value |

|---|---|

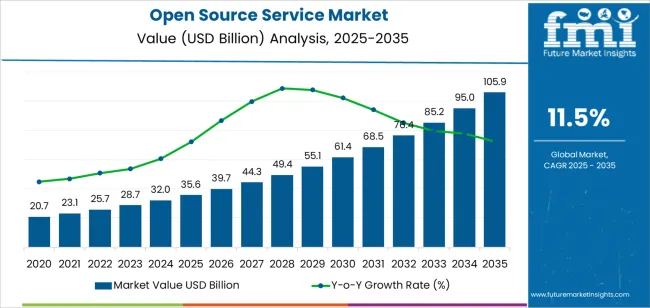

| Open Source Service Market Estimated Value in (2025 E) | USD 35.6 billion |

| Open Source Service Market Forecast Value in (2035 F) | USD 105.9 billion |

| Forecast CAGR (2025 to 2035) | 11.5% |

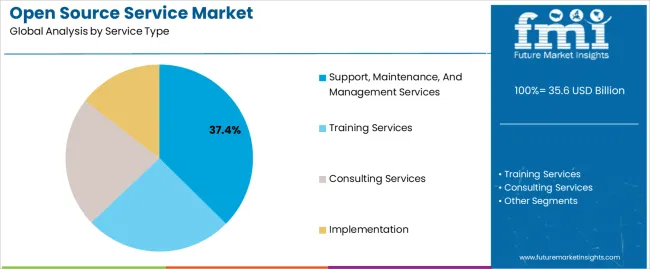

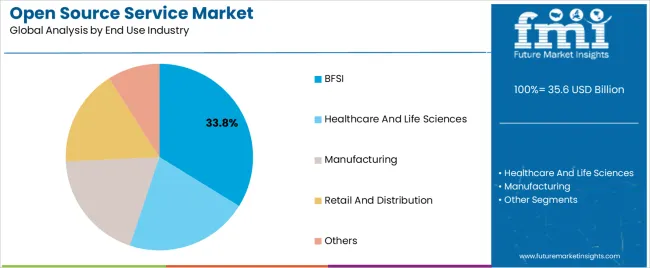

The market is segmented by Service Type and End Use Industry and region. By Service Type, the market is divided into Support, Maintenance, And Management Services, Training Services, Consulting Services, and Implementation. In terms of End Use Industry, the market is classified into BFSI, Healthcare And Life Sciences, Manufacturing, Retail And Distribution, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The support, maintenance, and management services segment, holding 37.40% of the service type category, has been leading the market due to the growing need for continuous system optimization and operational reliability. Enterprises are increasingly outsourcing maintenance and management functions to specialized service providers to ensure uptime, performance consistency, and compliance.

The segment’s prominence is being driven by the complexity of open source ecosystems that require regular updates, patch management, and performance monitoring. Rising adoption of DevOps practices and container orchestration tools has intensified the demand for managed open source services.

Moreover, service providers are integrating AI-based monitoring and predictive analytics to enhance system stability and proactively resolve issues These advancements are expected to strengthen client retention and enable scalable support frameworks, maintaining the segment’s dominant position within the open source service market.

The BFSI segment, accounting for 33.80% of the end use industry category, has emerged as a key contributor to the market due to the sector’s focus on digital innovation, regulatory compliance, and cybersecurity. Financial institutions are adopting open source technologies to modernize core banking systems, streamline data management, and enhance digital customer engagement.

Cost efficiency and flexibility offered by open source solutions are aligning with the strategic objectives of banks and insurance companies. The segment’s growth is being driven by large-scale implementation of open source middleware, APIs, and cloud frameworks that support real-time processing and analytics.

Additionally, collaboration with fintech firms and open source communities is fostering rapid innovation As data governance and security frameworks continue to evolve, the BFSI sector’s reliance on open source service providers for maintenance, integration, and risk management is expected to strengthen further over the forecast period.

Support, maintenance, and management services are poised to propel the open source service market with a 16.3% CAGR through 2035.

| Attributes | Details |

|---|---|

| Service Type | Support, Maintenance, and Management Services |

| CAGR (2025 to 2035) | 16.3% |

This rising popularity is attributed to:

Based on end users, the BFSI segment is expected to generate significant revenue in the open source service market, exhibiting a 16.1% CAGR from 2025 to 2035.

| Attributes | Details |

|---|---|

| End Use | BFSI |

| CAGR (2025 to 2035) | 16.1% |

This section examines the open source service market across various countries, encompassing the United Kingdom, the United States, China, South Korea, and Japan. The table illustrates each country's CAGR, projecting the anticipated market expansion up to 2035.

| Countries | Forecasted CAGR from 2025 to 2035 |

|---|---|

| South Korea | 18.3% |

| United Kingdom | 17.7% |

| Japan | 17.6% |

| China | 16.9% |

| United States | 16.8% |

South Korea is rapidly establishing itself as a formidable force in the open source service market, showcasing CAGR of 18.3% from 2025 to 2035. This remarkable surge underscores South Korea's unwavering commitment to innovation and technological advancement, propelling it to the forefront of the open source revolution.

With leading tech companies like Samsung and LG investing in open source projects and collaboration initiatives, South Korea fosters a vibrant open source software development and adoption ecosystem.

Government initiatives to promote open data policies and encourage collaboration in the tech community are driving market expansion. The adoption of open source solutions in key sectors like telecommunications, finance, and healthcare is fueling market growth and driving innovation in South Korea.

The United Kingdom is a formidable force in the open source service market, showcasing a remarkable CAGR of 17.7% projected through 2035. The country has a robust tech ecosystem home to innovation hubs like London's Silicon Roundabout, fostering a conducive environment for open source software development and adoption.

The government has taken several initiatives to promote digital innovation and entrepreneurship, coupled with favorable regulatory frameworks that encourage the proliferation of open source solutions across industries.

The United Kingdom's strong emphasis on cybersecurity and data privacy regulations enhances trust and reliability in open source services, driving adoption among businesses seeking secure and transparent software solutions.

Japan solidifies its pivotal role in the open source service market, showcasing unwavering growth momentum with an impressive CAGR of 17.6%. This trajectory underscores Japan's commitment to innovation and technological advancement, positioning the nation as a frontrunner in driving the evolution of open source solutions worldwide.

With a rich history of technological innovation and a strong emphasis on research and development, Japan is witnessing a surge in open source software development and adoption. Moreover, initiatives like the Japan Open Source Software Association and government support for open source projects drive market expansion.

Versatility and cost-effectiveness of open source solutions appeal to Japanese businesses seeking to enhance efficiency and innovation, further driving market growth and adoption.

China is poised to revolutionize the open source service market, showcasing an astounding compound annual growth rate (CAGR) of 16.9% from 2025 to 2035.

With its rapidly evolving tech landscape and unparalleled innovation capabilities, China is not just participating but leading the charge in shaping the future of open source services worldwide.

With a massive pool of tech talent and a thriving startup ecosystem, China is witnessing a surge in open source software development and adoption. Moreover, initiatives like the China Open Source Cloud Alliance and government-backed projects to promote open source technologies are driving market expansion.

Adopting open source solutions aligns with China's efforts to reduce dependence on foreign technology and enhance technological self-reliance, further boosting market growth.

The United States is unequivocally establishing itself as a powerhouse in the open source service market, boasting an impressive projected CAGR of 16.8% anticipated to endure until 2035.

This steadfast emergence underscores the nation's unwavering commitment to technological innovation and its relentless pursuit of excellence in the digital realm.

With renowned tech hubs like Silicon Valley and a thriving startup culture, the United States is at the forefront of open source software development and adoption. The presence of major tech giants and industry leaders investing heavily in open source projects further fuels market expansion.

The United States government's initiatives to promote open data policies and encourage collaboration in the software development community create a conducive environment for the growth of open source services.

The versatility and scalability of open source solutions appeal to businesses across various sectors, driving widespread adoption and market growth.

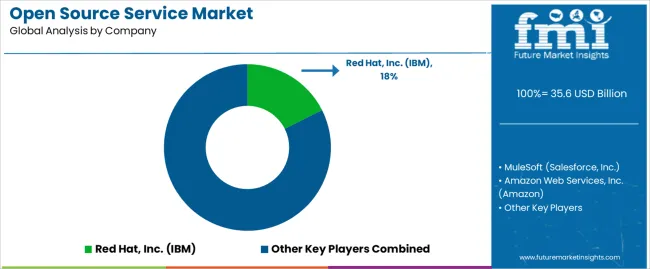

Many key companies actively contribute to global growth by investing heavily in open source projects. Leading technology firms such as IBM, Red Hat (now part of IBM),

Microsoft, and Google are among those providing financial support, technical expertise, and resources to foster innovation and community development. These companies recognize the strategic importance of open source software in driving digital transformation.

In addition to technology giants, established open source vendors and service providers, such as Canonical, SUSE, and Docker, are expanding their global presence by entering new markets and forming partnerships with local organizations and enterprises.

These companies offer comprehensive solutions for deploying, managing, and optimizing open source software across diverse industries and use cases.

By customizing their offerings to meet the specific needs and preferences of different regions and market segments, these vendors are effectively driving adoption and fueling the growth of the open source service market on a global scale.

Recent Developments

The global open source service market is estimated to be valued at USD 35.6 billion in 2025.

The market size for the open source service market is projected to reach USD 105.9 billion by 2035.

The open source service market is expected to grow at a 11.5% CAGR between 2025 and 2035.

The key product types in open source service market are support, maintenance, and management services, training services, consulting services and implementation.

In terms of end use industry, bfsi segment to command 33.8% share in the open source service market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Open Radio Access Network Market and Forecast Outlook 2025 to 2035

Open Cycle Aeroderivative Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Open Transition Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Open API Market Size and Share Forecast Outlook 2025 to 2035

Open Mouth Sacks Market Size and Share Forecast Outlook 2025 to 2035

Open Banking Market Analysis - Size, Share, and Forecast 2025 to 2035

Open Air Merchandizers and Accessories Market - Industry Innovations & Demand 2025 to 2035

Open Top Cartons Market

Open Gear Lubricants Market

Opening Trim Weatherstrips Market

Open Source Intelligence Market Trends – Growth & Forecast 2025 to 2035

Neopentyl Polyhydric Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Global Neopentyl Glycol (NPG) Market Analysis – Size, Share & Forecast 2025–2035

Lycopene Food Colors Market Growth Share Trends 2025 to 2035

Lycopene Market

Cyclopentanone Market Size and Share Forecast Outlook 2025 to 2035

Can Opener Market Analysis – Growth & Industry Outlook 2025 to 2035

Easy Open Packaging Market Size and Share Forecast Outlook 2025 to 2035

Twist Open - Twist Close Caps Market Size and Share Forecast Outlook 2025 to 2035

Dicyclopentadiene DCPD Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA