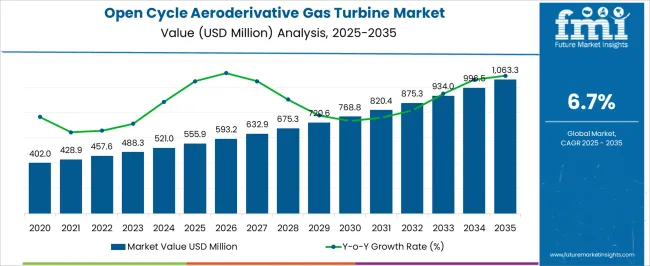

The open cycle aeroderivative gas turbine market is anticipated to grow from USD 555.9 million in 2025 to USD 1,063.3 million by 2035, reflecting a CAGR of 6.7%. The market is expected to experience consistent growth driven by increasing energy demand, industrial expansion, and the shift towards cleaner energy solutions. As industries across the globe continue to prioritize efficiency and sustainability, the demand for open cycle aeroderivative gas turbines, known for their rapid start-up capabilities and operational flexibility, is expected to rise.

The growth trajectory from 2025 to 2030 is expected to be steady, driven by the continued adoption of gas turbines in power generation, especially in regions focusing on enhancing grid stability and reducing CO2 emissions. From 2030 to 2035, the market is anticipated to witness a surge in growth as a result of increasing energy infrastructure investments and the growing focus on renewable energy integration. Open cycle aeroderivative gas turbines, with their adaptability to hybrid and renewable energy systems, are expected to play a pivotal role in facilitating the energy transition.

Key players in the market are expected to innovate with advanced turbine designs, improving fuel efficiency, reducing operational costs, and enhancing system integration. As the market matures, strategic partnerships, regulatory support, and technological advancements will continue to drive expansion, helping to meet the growing global energy demands while addressing environmental concerns.

| Metric | Value |

|---|---|

| Open Cycle Aeroderivative Gas Turbine Market Estimated Value in (2025 E) | USD 555.9 million |

| Open Cycle Aeroderivative Gas Turbine Market Forecast Value in (2035 F) | USD 1063.3 million |

| Forecast CAGR (2025 to 2035) | 6.7% |

The open cycle aeroderivative gas turbine market is strongly influenced by several interconnected parent markets, each contributing to overall demand and growth. The power generation market holds the largest share at 45%, driven by the need for flexible and reliable electricity generation systems that can be rapidly deployed and adjusted to meet fluctuating demand. The oil and gas market contributes 25%, as gas turbines are commonly used in offshore platforms and natural gas processing facilities for power generation and mechanical drive applications.

The industrial and manufacturing market accounts for 15%, with gas turbines providing energy-efficient solutions for large-scale industrial operations and supporting energy-intensive processes. The renewable energy integration market holds a 10% share, driven by the growing trend of hybrid energy systems combining gas turbines with renewable energy sources like solar and wind, providing stability and reliability to intermittent renewable power. The military and defense market represents 5%, where aeroderivative gas turbines are used for mobile power generation in field operations and critical installations.

The power generation and oil and gas sectors account for 70% of overall demand, indicating that traditional energy sectors remain the primary drivers of market growth, while industrial, renewable, and defense applications provide additional opportunities for expansion globally.

The open cycle aeroderivative gas turbine market is experiencing increasing adoption across industrial and utility applications driven by its operational flexibility, rapid start capabilities, and lightweight configuration. These turbines are being preferred in scenarios requiring quick power generation responses such as peak load demands, emergency backups, and mobile power solutions.

Their modularity and lower maintenance requirements make them suitable for off grid and remote installations, especially where grid reliability is limited. The global push for reduced carbon emissions and integration of cleaner combustion technologies has further enhanced the appeal of these gas turbines.

Continued investment in hybrid energy systems and decentralized power infrastructure is expected to strengthen market growth as industries seek efficient and responsive power generation alternatives.

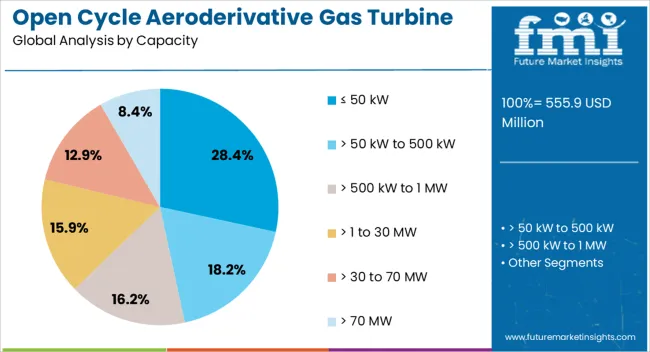

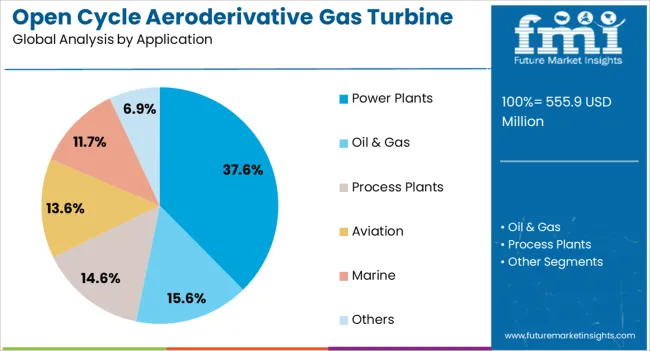

The open cycle aeroderivative gas turbine market is segmented by capacity, application, and geographic regions. By capacity, open cycle aeroderivative gas turbine market is divided into ≤ 50 kW, > 50 kW to 500 kW, > 500 kW to 1 MW, > 1 to 30 MW, > 30 to 70 MW, and > 70 MW. In terms of application, open cycle aeroderivative gas turbine market is classified into Power Plants, Oil & Gas, Process Plants, Aviation, Marine, and Others. Regionally, the open cycle aeroderivative gas turbine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The capacity segment of 50 kW or less is anticipated to account for 28.40% of the overall market revenue by 2025, positioning it as a significant contributor within the category. This dominance is attributed to the rising demand for compact power systems that can operate efficiently in remote, mobile, and off grid environments.

These smaller turbines are commonly used in distributed energy systems, emergency power units, and isolated industrial processes where quick deployment and low operating costs are crucial. The segment's appeal is further reinforced by its adaptability in temporary installations and its ability to support microgrid configurations.

As industries prioritize flexibility and lower energy infrastructure footprints, the demand for turbines in this capacity range continues to grow steadily.

The power plants segment is projected to capture 37.60% of total market revenue by 2025, making it the leading application area in the market. This dominance stems from the increasing integration of aeroderivative turbines in utility scale projects where fast response and high efficiency are required.

These turbines are favored for their ability to ramp up quickly and maintain stability in grids that rely heavily on intermittent renewable sources such as solar and wind. Their lightweight and modular structure allows for simplified installation and maintenance compared to heavy frame turbines.

Additionally, their fuel flexibility and low emissions profiles make them an attractive choice for power producers aiming to meet stringent environmental regulations while maintaining energy security. These factors collectively position power plants as the primary deployment environment for open cycle aeroderivative gas turbines.

Open cycle aeroderivative gas turbines are driven by demand for flexible power generation, rising oil and gas sector requirements, renewable energy integration, and military applications. These dynamics are expected to fuel continued market growth through 2035.

The growing demand for flexible and reliable power generation systems is a key driver for the open cycle aeroderivative gas turbine market. These turbines provide rapid startup capabilities and high operational flexibility, making them ideal for balancing intermittent renewable energy sources like solar and wind. As the global energy mix shifts towards more dynamic and distributed sources, gas turbines offer a quick-response solution to power shortages or grid instability. This adaptability is essential for grid operators and utility companies to maintain consistent electricity supply and meet peak demand. The market is seeing increased investments in both developed and emerging regions to upgrade aging power infrastructure with more efficient systems.

The oil and gas sector continues to be a major contributor to the open cycle aeroderivative gas turbine market. These turbines are commonly used in offshore drilling platforms, gas processing facilities, and in providing power for remote sites. They are highly valued for their reliability and ability to handle challenging operating conditions, such as harsh offshore environments. With the continued global demand for natural gas and oil, especially in remote and offshore locations, gas turbines remain a preferred solution for reliable and efficient power generation. This growing demand in the oil and gas industry is expected to support market growth through the next few years.

Integrating renewable energy sources into the existing energy infrastructure creates challenges for grid stability and energy storage. Open cycle aeroderivative gas turbines provide a solution by offering flexible, on-demand power that can complement renewable generation. They can quickly ramp up or down in response to fluctuating energy production from wind and solar farms, stabilizing the grid when renewable generation is insufficient. This capability positions gas turbines as a crucial element of hybrid energy systems that balance intermittent renewable power with stable, reliable generation. The increasing need for such solutions is pushing demand in markets focused on renewable energy integration.

The use of open cycle aeroderivative gas turbines in military and remote applications is seeing steady growth. These turbines provide reliable, mobile power for military bases, field operations, and critical installations that are often located in inaccessible or harsh environments. Their ability to operate efficiently in remote locations makes them an attractive solution for defense sectors requiring continuous power supply. This application area is expected to grow as nations continue to modernize their defense capabilities and expand their mobile power generation infrastructure to support troops and operations in far-flung areas.

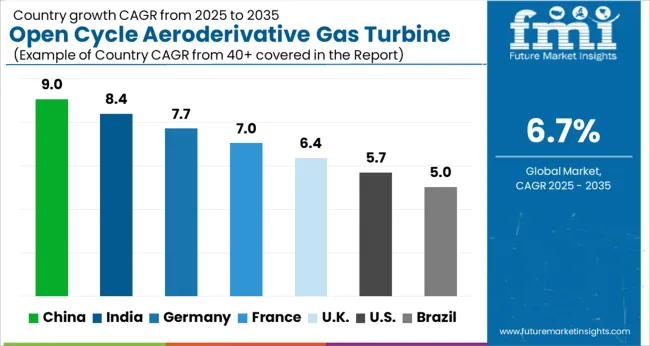

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

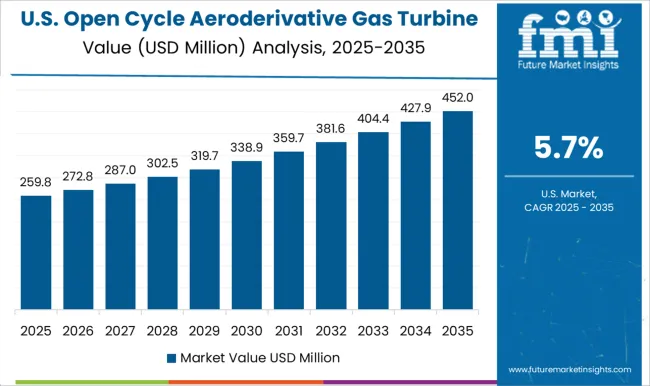

| USA | 5.7% |

| Brazil | 5.0% |

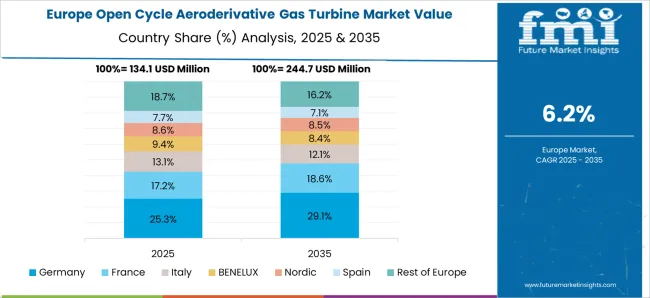

The global open cycle aeroderivative gas turbine market is projected to grow at a CAGR of 6.7% from 2025 to 2035. China leads the expansion at 9.0%, followed by India (8.4%), Germany (7.7%), the UK (6.4%), and the USA (5.7%). Growth in these countries is driven by increasing energy demand, particularly in industries requiring flexible and reliable power generation. China and India are witnessing strong growth due to rapid industrialization and expanding energy infrastructure, particularly in rural and offshore areas. Meanwhile, Germany, the UK, and the USA focus on modernizing existing power generation systems and integrating renewable energy sources. The adoption of aeroderivative turbines in industrial and military applications also contributes to growth in these regions. The analysis spans over 40+ countries, with the leading markets shown below.

The open cycle aeroderivative gas turbine market in China is projected to grow at a CAGR of 9.0% from 2025 to 2035, driven by China’s growing industrial and energy infrastructure demands. As the world’s largest consumer of energy, China continues to focus on expanding and upgrading its power generation capabilities, particularly for flexible and reliable systems like open cycle aeroderivative gas turbines. These turbines are particularly suited for the country’s rapid industrialization, especially in energy-intensive sectors such as manufacturing, petrochemicals, and mining. China’s commitment to reducing carbon emissions is further propelling the adoption of more energy-efficient gas turbines as part of hybrid and renewable energy systems. Offshore and remote power generation needs in China’s vast coastal areas and inland regions create substantial demand for turbines with fast start-up times and high reliability. Domestic manufacturers are expanding their production capacity to meet this demand, while international players are increasingly focusing on collaborations and technology transfers to enter this growing market.

The open cycle aeroderivative gas turbine market in India is expected to expand at a CAGR of 8.4% from 2025 to 2035, as the country continues to modernize its energy infrastructure and increase industrial output. With its rapidly growing population and increasing urbanization, India faces significant energy demands, particularly in rural and remote regions. Aeroderivative gas turbines provide flexible and reliable power solutions, essential for maintaining grid stability and meeting peak demand. India’s increasing reliance on renewable energy sources such as solar and wind also requires backup power systems like gas turbines to ensure energy security. The government's focus on expanding its industrial base, especially in sectors like textiles, chemicals, and steel, further drives the demand for efficient and rapid-start turbines. Domestic manufacturers are expected to invest in expanding turbine production, while foreign companies are likely to strengthen their market presence through joint ventures and strategic partnerships with local players.

The open cycle aeroderivative gas turbine market in Germany is anticipated to grow at a CAGR of 7.7% from 2025 to 2035, driven by the country’s energy transition goals and the increasing need for flexible power solutions. Germany is a global leader in renewable energy adoption, particularly in wind and solar power, but these sources are intermittent, requiring backup systems that can respond quickly to fluctuations in power generation. Open cycle aeroderivative gas turbines are well-suited to meet this demand for quick-start, flexible, and reliable power. Germany’s industrial and manufacturing sectors are significant contributors to energy consumption, and these sectors are increasingly adopting more efficient and cleaner energy solutions. As the country aims for a carbon-neutral economy by 2050, the demand for high-efficiency turbines that can complement renewable power sources and reduce emissions will continue to grow. Manufacturers are focusing on creating turbines with improved fuel efficiency and lower emissions, while local and international players are collaborating to meet the growing demand for high-performance, flexible power generation solutions.

The open cycle aeroderivative gas turbine market in the UK is projected to grow at a CAGR of 6.4% from 2025 to 2035, driven by the country’s increasing investment in energy infrastructure and its shift towards decarbonizing the power generation sector. The UK continues to prioritize the integration of renewable energy, particularly offshore wind, but faces challenges in grid stability due to the intermittent nature of renewable power. Open cycle aeroderivative gas turbines are crucial for maintaining grid stability and meeting peak demand, making them an essential part of the country’s energy mix. The UK’s manufacturing and heavy industries require reliable and flexible power solutions to meet growing demand while reducing emissions. As the government pushes for net-zero emissions by 2050, open cycle gas turbines are expected to play a key role in decarbonizing the power generation sector by complementing renewable sources with clean and efficient backup power.

The open cycle aeroderivative gas turbine market in the USA is expected to grow at a CAGR of 5.7% from 2025 to 2035. This growth is driven by the country’s diverse energy needs, particularly in the power generation and industrial sectors. As the USA transitions to a more sustainable energy mix, the demand for flexible power solutions like open cycle gas turbines is increasing. These turbines can quickly respond to power fluctuations caused by intermittent renewable energy sources such as wind and solar. The USA also faces growing energy demands in remote areas and regions with aging infrastructure, where gas turbines provide a reliable and efficient solution for power generation. In addition, the increasing adoption of natural gas as a cleaner energy source is driving the growth of gas turbines in the power generation sector. Manufacturers are focused on improving the fuel efficiency, emissions performance, and flexibility of these turbines to meet the evolving energy landscape.

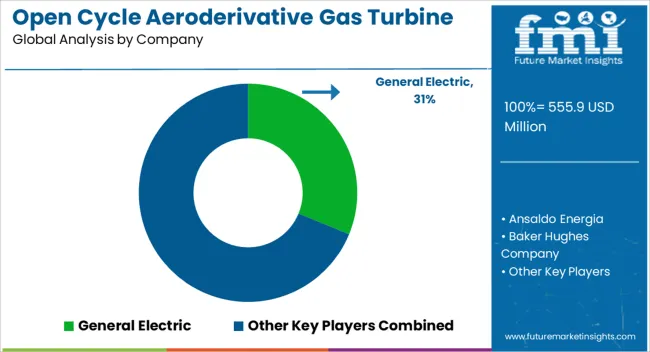

The open cycle aeroderivative gas turbine market is highly competitive, dominated by a few global power equipment giants alongside several regional manufacturers. Major players such as General Electric, Siemens Energy, Rolls-Royce, Mitsubishi Power, and Pratt & Whitney hold significant market shares through their extensive product portfolios, strong service networks, and advanced technological capabilities. These companies compete intensely on efficiency, power output, fuel flexibility, lifecycle costs, and fast-start capability, which are critical in open cycle operations where rapid deployment and peaking power supply are essential.

Smaller regional firms from Asia-Pacific and the Middle East are increasingly entering the market with cost-competitive turbines for localized power generation, especially in industrial and remote area applications. Competitive dynamics are further shaped by long-term service agreements, strategic alliances with EPC contractors, and continuous upgrades to improve thermal efficiency and reduce emissions. Aftermarket support, spare parts availability, and operational reliability have become key differentiators. The market’s competitive landscape is expected to remain consolidated, with the leading players maintaining an edge through continuous innovation and global project execution experience.

| Item | Value |

|---|---|

| Quantitative Units | USD 555.9 Million |

| Capacity | ≤ 50 kW, > 50 kW to 500 kW, > 500 kW to 1 MW, > 1 to 30 MW, > 30 to 70 MW, and > 70 MW |

| Application | Power Plants, Oil & Gas, Process Plants, Aviation, Marine, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | General Electric, Ansaldo Energia, Baker Hughes Company, Bharat Heavy Electricals Limited (BHEL), Capstone Green Energy Corporation, Destinus Energy, Kawasaki Heavy Industries, Ltd., MAN Energy Solutions, Mitsubishi Heavy Industries Ltd., Nanjing Steam Turbine Motor (Group) Co., Ltd., Pratt & Whitney, Rolls-Royce plc, Siemens Energy, United Engine Corporation JSC, VERICOR, and Wartsila |

| Additional Attributes | Dollar sales by product type (e.g., turbines for power generation, industrial applications) and market share by region (e.g., North America, Europe, Asia). |

The global open cycle aeroderivative gas turbine market is estimated to be valued at USD 555.9 million in 2025.

The market size for the open cycle aeroderivative gas turbine market is projected to reach USD 1,063.3 million by 2035.

The open cycle aeroderivative gas turbine market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in open cycle aeroderivative gas turbine market are ≤ 50 kw, > 50 kw to 500 kw, > 500 kw to 1 mw, > 1 to 30 mw, > 30 to 70 mw and > 70 mw.

In terms of application, power plants segment to command 37.6% share in the open cycle aeroderivative gas turbine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Open Cross Flow Cooling Tower Market Size and Share Forecast Outlook 2025 to 2035

Open Source Service Market Size and Share Forecast Outlook 2025 to 2035

Open Radio Access Network Market and Forecast Outlook 2025 to 2035

Open Transition Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Open API Market Size and Share Forecast Outlook 2025 to 2035

Open Mouth Sacks Market Size and Share Forecast Outlook 2025 to 2035

Open Banking Market Analysis - Size, Share, and Forecast 2025 to 2035

Open Source Intelligence Market Trends – Growth & Forecast 2025 to 2035

Open Air Merchandizers and Accessories Market - Industry Innovations & Demand 2025 to 2035

Open Top Cartons Market

Open Gear Lubricants Market

Opening Trim Weatherstrips Market

F-Open Scope Market Size and Share Forecast Outlook 2025 to 2035

F-Open Match Rifle Scope Market Size and Share Forecast Outlook 2025 to 2035

Propene-1,3-Sulfonic Acid Lactone Market Size and Share Forecast Outlook 2025 to 2035

Neopentyl Polyhydric Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Global Neopentyl Glycol (NPG) Market Analysis – Size, Share & Forecast 2025–2035

Lycopene Food Colors Market Growth Share Trends 2025 to 2035

Lycopene Market

LNG Open Rack Vaporizer (ORV) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA