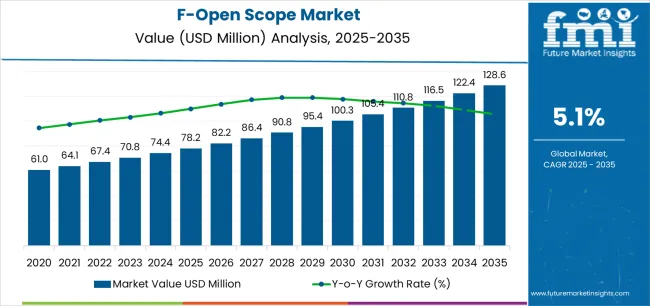

The global F-Open scope market, valued at USD 78.2 million in 2025, is projected to reach USD 128.6 million by 2035, growing at a compound annual growth rate (CAGR) of 5.1%. Demand is expected to increase by USD 50.4 million over the forecast period, with the market size expanding 1.6 times by 2035. The market is driven by increasing demand in precision shooting sports, tactical equipment, and specialized measurement tools, alongside technological advancements in optical and mechanical design. Between 2025 and 2030, the market will grow from USD 78.2 million to USD 101.3 million, contributing 45.9% of the decade’s growth.

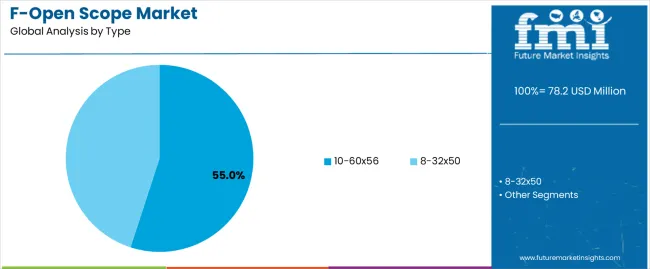

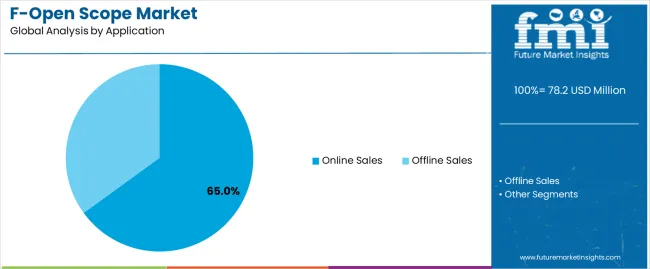

The second phase, from 2030 to 2035, is expected to account for 54.1% of the growth, driven by broader adoption in non-traditional regions and innovations such as smart optics. The 10-60x56 type segment dominates, accounting for 55% of the market due to its wide magnification range, clarity, and light transmission, making it ideal for long-range shooting. Online sales lead in applications, accounting for 65% of the market, driven by the convenience of e-commerce platforms. Key drivers include the rising popularity of precision shooting, technological advancements, and increased consumer demand for high-performance optics. However, high costs, regulatory restrictions, and market specialization pose challenges.

Market expansion is supported by evolving user expectations for higher performance such as improved clarity, wider fields of view, lightweight construction, integrated electronics or mounting options and by growth in segments such as recreational shooting, hunting, law-enforcement/military optics, and specialized measurement/inspection devices. Further, increasing global participation in shooting sports and growing investment by defense/tactical users bolster demand for advanced scopes.

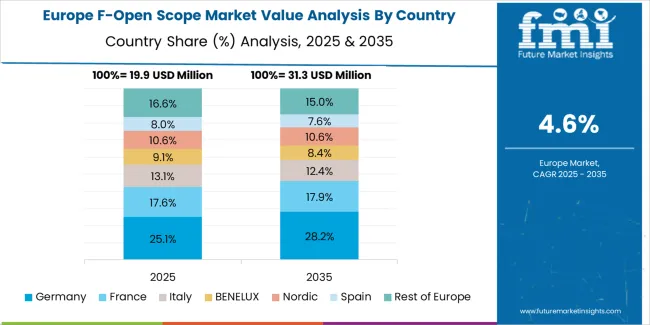

The regional landscape is shaped by established markets in North America and Europe, with increasing growth from the Asia Pacific region as recreational shooting, tactical gear accessibility and sporting culture expand. Manufacturers are adopting global supply chains and leveraging cost-efficient production hubs while also focusing on premium product differentiation.

From a supply-chain perspective, the F-Open Scope market is impacted by the sourcing of precision optics, coatings, housing materials (aluminium, aircraft-grade metals, composites), as well as electronics/integration in advanced models. Volatility in raw-material prices, logistical disruptions, and regulatory changes (e.g., export controls on optics/tactical gear) can affect cost structure and margins across the value chain.

Between 2025 and 2030, the market is projected to grow from USD 78.2 million to approximately USD 101.3 million (assuming a uniform CAGR), representing an increase of about USD 23.1 million, roughly 45.9 % of the total forecast growth for the decade. This phase is expected to be characterised by rising product innovations, expansion in recreational and tactical applications, and increased penetration into emerging markets.

From 2030 to 2035, the market is forecast to grow from approximately USD 101.3 million to USD 128.6 million, adding about USD 27.3 million, which constitutes approximately 54.1 % of the overall ten-year expansion. This period is expected to be shaped by broader adoption in non-traditional regions, maturation of premium product segments, increased aftermarket/accessory demand, and perhaps integration of new functionalities (e.g., smart optics).

| Metric | Value |

|---|---|

| Market Value (2025) | USD 78.2 million |

| Market Forecast Value (2035) | USD 128.6 million |

| Forecast CAGR (2025-2035) | 5.1% |

The F-Open scope market is growing due to its increasing use in a variety of industries, particularly in scientific research, medical diagnostics, and quality control applications. F-Open scopes provide high precision and reliability, making them ideal for capturing detailed measurements in complex environments. As industries demand more accurate data and imaging solutions, the adoption of advanced scopes continues to rise.

The growth in research and development (R&D) activities across multiple sectors, including pharmaceuticals, biotechnology, and material sciences, is fueling the need for better tools such as F-Open scopes. These devices are highly valued for their ability to capture detailed visual information and assist in high-precision applications, such as microscopic imaging and inspection, where accuracy is paramount.

Technological advancements in optical and digital technologies are enhancing the capabilities of F-Open scopes, making them more accessible and efficient. Despite these advances, high initial investment costs and specialized training requirements may limit their adoption in smaller enterprises or regions with limited technical infrastructure.

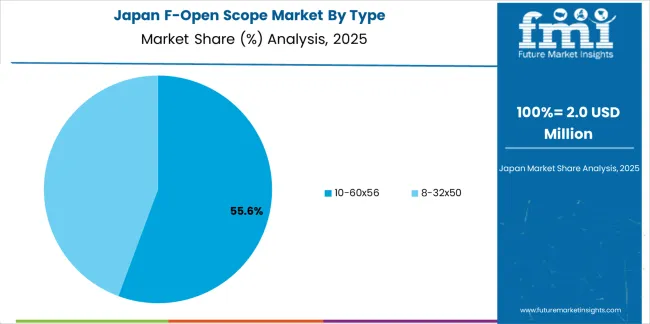

The F-Open scope market is segmented by type and application. By type, the market is divided into 10-60x56 and 8-32x50, with 10-60x56 leading the market. Based on application, the market is categorized into Online Sales and Offline Sales, with Online Sales accounting for the largest share. This segmentation highlights the growing demand for F-Open scopes across various platforms and the shift towards online shopping in the sporting and outdoor equipment industry.

The 10-60x56 type segment holds a significant share of the F-Open scope market, accounting for approximately 55%. This type is preferred for its high magnification range, making it suitable for long-range precision shooting, including sports like long-range target shooting and hunting. The 10-60x56 scope offers superior clarity, excellent light transmission, and a wide field of view, which are critical factors for accurate shooting at extended distances. These features have made it a popular choice among professional shooters and enthusiasts.

The demand for 10-60x56 scopes is driven by the increasing popularity of precision sports and hunting, where long-range shooting is a key focus. As shooting sports continue to grow globally, particularly in regions like North America and Europe, the demand for high-performance optics like the 10-60x56 is expected to rise. Manufacturers continue to innovate, improving the durability and performance of these scopes, which further boosts their appeal. The combination of performance, versatility, and innovation in this segment is likely to ensure its continued dominance in the market.

The Online Sales segment leads the F-Open scope market, accounting for 65% of the market share. The growth of online shopping platforms has significantly impacted the sales of sporting equipment, including F-Open scopes. Consumers increasingly prefer the convenience of browsing a wide variety of scopes, comparing features and prices, and making purchases from the comfort of their homes. Online sales also allow consumers to access specialized products that may not be available at local retail stores.

The rise of e-commerce platforms, such as Amazon, eBay, and specialized sporting goods websites, has further contributed to the growth of the Online Sales segment. These platforms offer easy access to detailed product descriptions, customer reviews, and competitive pricing, making it easier for buyers to make informed decisions. The convenience of home delivery and promotions offered by online stores has made purchasing F-Open scopes online more appealing. As e-commerce continues to grow, the Online Sales segment is expected to maintain its dominance in the F-Open scope market.

The F Open scope market covers high performance scopes designed for the F Open class of long range rifle competition, where shooters demand extreme magnification, ultra fine reticles, superior optical clarity, and precision adjustment capability. Growth is driven by increased participation in long range and precision shooting sports, as well as by advances in optical technology and materials. However, the niche nature of the segment, high costs, and regulatory restrictions on firearms and accessories in some regions restrain the market’s broader expansion.

One major trend is the pursuit of higher magnification and extreme clarity optics, allowing competitors to engage targets at longer ranges with greater confidence. Another trend is the development of specialised reticles and adjustment systems tailored to F Open shooters, offering micro MOA increments, ultra fine windage and elevation control, and turret calibration specifically for match conditions. There’s increasing integration of digital or optical hybrid features such as illuminated reticles, ballistic calculators, external adjustment readouts, and connectivity to mobile apps or external ballistic devices. The move towards premium materials, such as high grade glass, large objective lenses, carbon fiber bodies, and advanced coatings, is also notable. Moreover, globalisation of F Open competitions is pushing manufacturers to offer region specific models and support services, while customisation and limited edition optics are becoming more popular among serious competitors.

The growth of the F Open scope market is driven by the rising popularity of long range precision shooting and the increasing number of F Open competitions worldwide. Skilled shooters are seeking equipment that delivers measurable performance advantages in highly competitive match settings, which drives demand for top end scopes. Technological advancements in optical engineering, such as improved lens systems, coatings, mechanical precision of turrets, and reduced optical aberrations, also stimulate upgrading and replacement cycles. Moreover, the rise in disposable income of enthusiasts, access to specialised shooting clubs, and the growth of custom built precision rifles all contribute to the market’s expansion. The prestige and visibility of match successes using premium optics further fuel brand investment and marketing, generating interest from new entrants in the sport.

Despite the growth potential, the F Open scope market faces several constraints. First, the high cost of premium scopes limits adoption largely to serious competitors or clubs, restricting market size and making the segment niche rather than mass market. Second, regulatory restrictions on firearms and certain optical accessories in various countries complicate distribution, importation, and use of high magnification scopes. Third, the specialised nature of F Open competition means that many shooters may use more general purpose optics, which reduces the number of buyers for purpose built F Open scopes. Also, the rapid pace of upgrade cycles can lead to inertia or disappointment among users if new models do not offer significantly enhanced performance. Finally, supply chain and manufacturing precision challenges, such as stringent calibration and mechanical tolerances, increase cost and limit economies of scale, which in turn keeps pricing elevated.

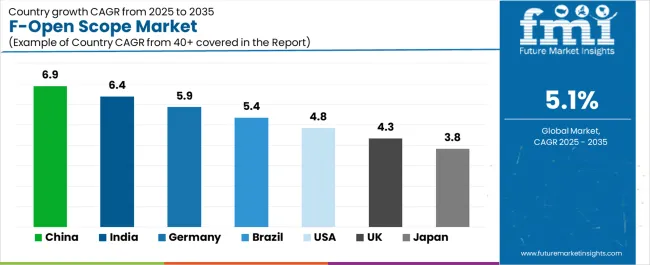

| Country | CAGR (%) |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| Brazil | 5.4% |

| USA | 4.8% |

| UK | 4.3% |

| Japan | 3.8% |

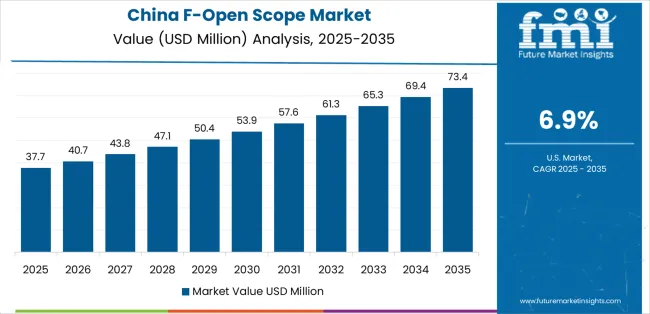

The F-Open scope market is experiencing significant growth, with China leading at a 6.9% CAGR and India following closely at 6.4%, driven by rapid digitalization, industrial expansion, and increasing demand for flexible data management solutions. Developed markets such as Germany (5.9% CAGR), Brazil (5.4% CAGR), and the USA (4.8% CAGR) contribute steadily, driven by the need for scalable and real-time data processing across various industries, including manufacturing, logistics, and retail. The UK (4.3% CAGR) and Japan (3.8% CAGR) show moderate growth, benefiting from ongoing digital transformation, smart city initiatives, and the rise of automation technologies. As global industries continue to prioritize efficiency, scalability, and digital solutions, the F-Open scope market is poised for continued growth.

China leads the F-Open scope market with a 6.9% CAGR, driven by its rapidly expanding technological infrastructure and increasing adoption of innovative solutions across various sectors. As one of the world’s largest manufacturing and technology hubs, China has a high demand for F-Open scope systems, particularly in industries like telecommunications, healthcare, and logistics, where real-time data management and system efficiency are critical. The Chinese government’s significant investments in smart city projects, automation, and digital infrastructure have increased the adoption of advanced technologies. The growing number of tech startups and innovations in artificial intelligence (AI) and big data analytics further drives the need for efficient, flexible F-Open scope solutions. As the Chinese economy continues its digital transformation, the market for these solutions is expected to grow at a strong pace.

India is witnessing strong growth in the F-Open scope market, with a 6.4% CAGR, driven by rapid digitalization, infrastructure development, and the increasing need for innovative solutions in industries like manufacturing, logistics, and healthcare. India’s fast-growing e-commerce and retail sectors are also contributing to the demand for efficient data management systems, where F-Open scope solutions play a crucial role. The government's Digital India initiative, which aims to enhance digital infrastructure and promote technological innovations, further fuels market growth. The increasing adoption of cloud computing, IoT, and AI technologies across various industries is driving the demand for solutions that offer scalability, flexibility, and real-time data processing. As the Indian economy continues to expand, the need for F-Open scope systems will continue to grow, supporting the market’s expansion.

Germany is experiencing steady growth in the F-Open scope market, with a 5.9% CAGR, driven by its strong industrial base, focus on digital transformation, and growing demand for advanced technological solutions. The country’s automotive, manufacturing, and engineering sectors rely heavily on flexible and scalable data management systems for efficient operations and decision-making. The increasing implementation of Industry 4.0 and automation in industrial sectors further boosts the demand for F-Open scope systems. Germany’s well-developed infrastructure and focus on smart city solutions create opportunities for the widespread adoption of these systems. As Germany continues to innovate in manufacturing and digital infrastructure, the demand for F-Open scope systems is expected to rise steadily, contributing to market growth.

Brazil is witnessing moderate growth in the F-Open scope market, with a 5.4% CAGR, fueled by the country’s expanding digital economy and increasing need for technological solutions in industries like retail, logistics, and manufacturing. The rise of e-commerce, combined with the growing need for efficient inventory and supply chain management systems, is driving the adoption of F-Open scope solutions. Brazil’s investment in smart city initiatives and infrastructure projects contributes to the increasing demand for innovative data management solutions. As Brazil continues to modernize its industrial and commercial sectors and embrace digital transformation, the demand for scalable and flexible F-Open scope systems will continue to grow, further propelling market expansion.

The USA is experiencing steady growth in the F-Open scope market, with a 4.8% CAGR, driven by the increasing adoption of digital solutions across a wide range of industries, including healthcare, finance, retail, and logistics. As USA businesses focus on improving operational efficiency and data management capabilities, the demand for flexible, scalable, and real-time data processing systems like F-Open scope solutions has risen. The country’s well-developed digital infrastructure, combined with its focus on innovation and smart technologies, further supports the growth of this market. The increasing focus on cloud computing, AI, and IoT across various sectors in the USA continues to drive demand for efficient, high-performance data management solutions. As digital transformation accelerates in the USA, the F-Open scope market is expected to continue its steady growth.

The UK is experiencing moderate growth in the F-Open scope market, with a 4.3% CAGR, driven by increasing demand for flexible and efficient data management systems in industries like healthcare, logistics, and retail. The UK’s ongoing digital transformation and focus on smart city initiatives are contributing to the adoption of F-Open scope solutions. The government’s emphasis on improving public sector services through digital technologies, along with the rise of e-commerce and retail innovations, is also driving the market. Furthermore, the UK’s strong focus on adopting cloud-based technologies and IoT solutions in various industries fuels the need for scalable, high-performance data management systems. As the UK continues to modernize its infrastructure and industries, the demand for F-Open scope systems is expected to grow steadily.

Japan is witnessing steady growth in the F-Open scope market, with a 3.8% CAGR, driven by technological innovation and the country’s emphasis on digital transformation. Japan’s advanced manufacturing sector, combined with its strong focus on automation, robotics, and smart technologies, is fueling the demand for flexible and scalable data management solutions. The country’s growing adoption of AI, IoT, and cloud computing in various sectors is contributing to the need for efficient data processing and management systems like F-Open scope. Japan’s aging population and the increasing focus on healthcare innovations further support the demand for advanced data management solutions in the healthcare and public sectors. As Japan continues to innovate in industrial automation and smart technologies, the F-Open scope market is expected to experience steady growth.

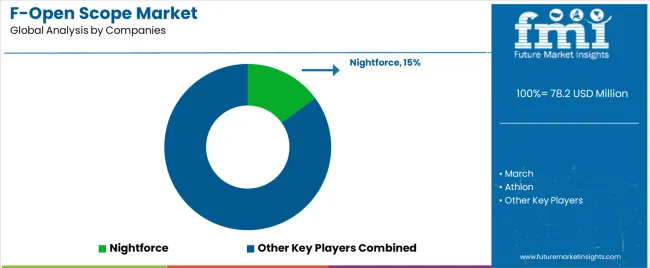

The F-Open scope market is competitive, with several key players offering high-performance optical solutions tailored to precision shooting in disciplines like long-range shooting and F-Class competitions. Night force leads the market with a 15% share, known for its premium scopes that combine durability, clarity, and advanced reticle technology, making it a popular choice among competitive shooters and hunters. Nightforce’s strong reputation for innovation and reliability ensures its continued leadership in this space.

Other notable players in the market include March, Athlon, and Sightron, each offering specialized products aimed at precision and high-performance optics. March is known for its precision engineering, offering scopes that excel in long-range shooting, while Athlon combines quality and affordability, catering to both professional and amateur shooters. Sightron also offers a range of F-Open scopes that emphasize clarity and ruggedness for high-level competitive use.

Delta Optical, Kahles, and Vortex are also significant competitors, each bringing unique innovations to the market. Delta Optical focuses on high-quality optics with competitive pricing, while Kahles is renowned for its advanced optical technology and exceptional build quality. Vortex is recognized for offering reliable, high-performance scopes at various price points, making it a favorite among both beginners and seasoned professionals.

Other brands like Schmidt & Bender, Trijicon, Savage, and Sightmark further diversify the market by offering scopes with unique features and tailored solutions for precision shooters. These companies are constantly innovating, focusing on enhancing performance, durability, and user-friendly features, which drives competition in the F-Open scope market.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | 10 60×56, 8 32×50 |

| Application | Online Sales, Offline Sales |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, Japan, South Korea, India, Australia & New Zealand, ASEAN, Rest of Asia Pacific, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, Rest of Europe, United States, Canada, Mexico, Brazil, Chile, Rest of Latin America, Kingdom of Saudi Arabia, Other GCC Countries, Turkey, South Africa, Other African Union, Rest of Middle East & Africa |

| Key Companies Profiled | Nightforce, March, Athlon, Sightron, Delta Optical, Kahles, Vortex, Schmidt & Bender, Trijicon, Savage, Sightmark |

| Additional Attributes | Dollar sales by type and application categories, market growth trends, market adoption by classification and application segments, regional adoption trends, competitive landscape, advancements in F-open scope technologies, integration with shooting and sporting equipment. |

The global f-open scope market is estimated to be valued at USD 78.2 million in 2025.

The market size for the f-open scope market is projected to reach USD 128.6 million by 2035.

The f-open scope market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in f-open scope market are 10-60x56 and 8-32x50.

In terms of application, online sales segment to command 65.0% share in the f-open scope market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

F-Open Match Rifle Scope Market Size and Share Forecast Outlook 2025 to 2035

Otoscope Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Protective Barrier Covers Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Reprocessing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Borescope Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Procedure Kits Market Size and Share Forecast Outlook 2025 to 2035

Telescope Box Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Detergents And Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Reprocessing Device Market – Trends & Forecast 2025-2035

Endoscope Tracking Solutions Market

Borescope Inspection Camera Market

Endoscope Leak Detection Device Market

Microscope Digital Camera Market Size and Share Forecast Outlook 2025 to 2035

Stethoscope Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Stethoscope Market – Growth, Demand & Forecast 2025 to 2035

Stroboscope Market

Anomaloscope Market Size and Share Forecast Outlook 2025 to 2035

Oscilloscope Market Size and Share Forecast Outlook 2025 to 2035

Duodenoscope Market Size and Share Forecast Outlook 2025 to 2035

Bronchoscopes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA