The global endoscope reprocessing market is likely to grow from USD 1.8 billion in 2025 to approximately USD 3.5 billion by 2035, recording an absolute increase of USD 1.7 billion over the forecast period. This translates into a total growth of 90.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.6% between 2025 and 2035. The overall market size is expected to grow by nearly 1.9X during the same period, supported by increasing endoscopic procedures, rising awareness about healthcare-associated infections, and growing focus on patient safety and regulatory compliance.

Between 2025 and 2030, the endoscope reprocessing market is projected to expand from USD 1.8 billion to USD 2.5 billion, resulting in a value increase of USD 0.7 billion, which represents 41.2% of the total forecast growth for the decade. This phase of growth will be shaped by increasing adoption of automated endoscope repressors, rising emphasis on infection prevention protocols, and growing penetration of minimally invasive procedures in emerging markets. Healthcare facilities are expanding their endoscope reprocessing capabilities to address the growing demand for safe and efficient reprocessing solutions.

From 2030 to 2035, the market is forecast to grow from USD 2.5 billion to USD 3.5 billion, adding another USD 1 billion, which constitutes 58.8% of the overall ten-year expansion. This period is expected to be characterized by expansion of ambulatory surgical centers, integration of advanced automation technologies in reprocessing systems, and development of eco-friendly disinfection solutions. The growing adoption of single-use endoscopes and enhanced regulatory standards will drive demand for sophisticated reprocessing equipment with improved efficacy and safety profiles.

Between 2020 and 2025, the endoscope reprocessing market experienced robust expansion, driven by increasing awareness of healthcare-associated infections and growing emphasis on patient safety protocols. The market developed as healthcare facilities recognized the need for effective reprocessing solutions to combat cross-contamination risks and ensure compliance with regulatory standards. The COVID-19 pandemic accelerated the adoption of advanced disinfection technologies and highlighted the importance of proper endoscope reprocessing in healthcare settings.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.8 billion |

| Forecast Value in (2035F) | USD 3.5 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

Market expansion is being supported by the increasing volume of endoscopic procedures worldwide and the corresponding demand for effective reprocessing solutions to prevent healthcare-associated infections. Modern healthcare facilities are increasingly focused on patient safety measures that can eliminate cross-contamination risks, reduce infection rates, and ensure compliance with stringent regulatory requirements. The proven efficacy of advanced reprocessing technologies in maintaining endoscope functionality while ensuring complete disinfection makes them essential components of modern healthcare infrastructure.

The growing emphasis on automation and standardization is driving demand for sophisticated reprocessing systems that can deliver consistent results while reducing human error. Healthcare facility preference for integrated solutions that combine cleaning, disinfection, and drying processes in single automated systems is creating opportunities for innovative product development. The rising influence of regulatory guidelines and accreditation standards is also contributing to increased adoption of validated reprocessing protocols across different healthcare settings and geographic regions.

The market is segmented by product, end-use, and region. By product, the market is divided into high-level disinfectants and test strips, detergents and wipes, automated endoscope reprocessors, and endoscope drying, storage, and transport systems. Based on end-use, the market is categorized into hospitals, ambulatory surgical centers, and other healthcare facilities. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The high-level disinfectants and test strips segment is projected to account for 29.7% of the endoscope reprocessing market in 2025, reaffirming its position as the category's core component. Healthcare facilities increasingly understand the critical importance of effective disinfection in preventing healthcare-associated infections and ensuring patient safety. High-level disinfectants provide the necessary antimicrobial efficacy to eliminate bacteria, viruses, and other pathogens from endoscope surfaces, while test strips ensure proper concentration and effectiveness of disinfectant solutions.

This product category forms the foundation of most reprocessing protocols, as it represents the most critical step in the decontamination process. Regulatory compliance requirements and clinical validation continue to strengthen trust in proven high-level disinfectant formulations. With healthcare facilities facing increasing pressure to prevent infections and maintain quality standards, high-level disinfectants and test strips align with both preventative and quality assurance goals. Their essential role in patient safety ensures sustained dominance, making them the central growth driver of endoscope reprocessing market demand.

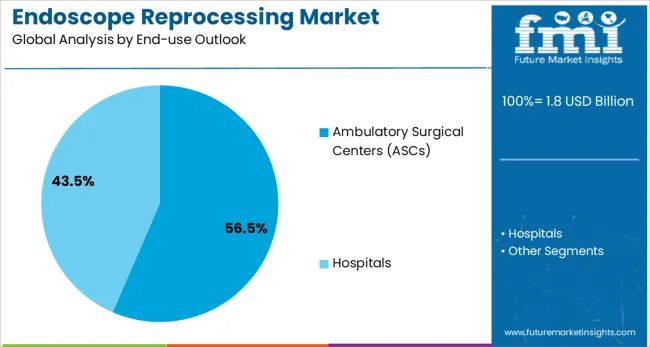

The ambulatory surgical centers (ASCs) segment is forecasted to contribute 56.5% of the endoscope reprocessing market in 2025, reflecting the growing shift toward outpatient procedures and cost-effective healthcare delivery models. Healthcare providers are increasingly recognizing the advantages of ASCs, including shorter patient recovery times, reduced healthcare costs, and improved operational efficiency. This aligns with the broader healthcare trend toward value-based care and patient-centered treatment approaches.

The segment benefits from increasing patient preference for convenient, same-day procedures that allow them to return home quickly while receiving high-quality care. ASCs also offer healthcare systems the ability to optimize resource utilization and reduce overhead costs compared to traditional hospital settings. With heightened focus on healthcare accessibility and operational efficiency, ASCs serve as powerful drivers of market growth, making them a critical component of the modern healthcare delivery landscape and endoscope reprocessing market expansion.

The endoscope reprocessing market is advancing rapidly due to increasing emphasis on infection prevention and growing demand for automated reprocessing solutions. However, the market faces challenges including high equipment costs, complex regulatory requirements, and concerns about chemical exposure risks. Innovation in eco-friendly disinfectants and automated systems continue to influence product development and market expansion patterns.

The growing adoption of automated endoscope reprocessors (AERs) is enabling healthcare facilities to standardize reprocessing protocols and reduce human error in critical disinfection steps. Automated systems offer consistency, traceability, and improved efficiency compared to manual reprocessing methods. Advanced AERs provide comprehensive cleaning, disinfection, and drying cycles that ensure optimal endoscope functionality while maintaining strict infection control standards.

Modern endoscope reprocessing systems are incorporating advanced monitoring technologies such as real-time chemical concentration sensors, automated leak testing, and digital documentation systems to enhance process validation and regulatory compliance. These technologies improve the reliability of reprocessing procedures while providing comprehensive audit trails for quality assurance programs. Advanced monitoring capabilities also enable predictive maintenance and optimize equipment performance throughout the reprocessing lifecycle.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 7% |

| UK | 6.3% |

| USA | 5.6% |

The endoscope reprocessing market is experiencing robust growth globally, with China leading at a 9% CAGR through 2035, driven by healthcare infrastructure expansion, increasing endoscopic procedures, and growing emphasis on infection prevention protocols. India follows at 8.3%, supported by rising healthcare investments, expanding hospital networks, and increasing awareness of patient safety standards. Germany shows steady growth at 7.6%, emphasizing advanced automation technologies and regulatory compliance. France records 7%, focusing on innovative reprocessing solutions and healthcare quality improvement. The UK shows 6.3% growth, prioritizing evidence-based reprocessing protocols and cost-effective healthcare delivery.

The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

Revenue from endoscope reprocessing systems in China is projected to exhibit strong growth with a CAGR of 9% through 2035, driven by rapid expansion of healthcare facilities and increasing adoption of advanced medical technologies among hospitals and surgical centers. The country's growing middle class and improving healthcare accessibility are creating significant demand for high-quality endoscopic procedures and corresponding reprocessing solutions. Major international and domestic medical device manufacturers are establishing comprehensive distribution networks to serve the expanding healthcare infrastructure across tier-1 and tier-2 cities.

Revenue from endoscope reprocessing systems in India is expanding at a CAGR of 8.3%, supported by healthcare infrastructure development, rising medical device investments, and growing emphasis on international quality standards. The country's large patient population and increasing prevalence of chronic diseases requiring endoscopic intervention are driving demand for effective reprocessing solutions. International medical device companies and domestic manufacturers are establishing production and distribution capabilities to serve the growing demand for reliable reprocessing equipment.

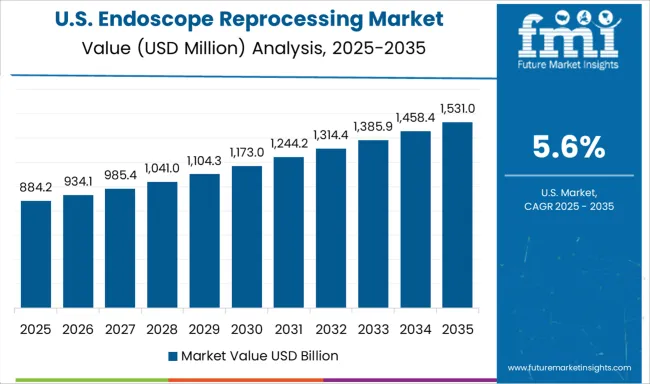

Demand for endoscope reprocessing systems in the USA is projected to grow at a CAGR of 5.6%, supported by stringent regulatory requirements, emphasis on patient safety, and adoption of automated reprocessing technologies. American healthcare facilities are increasingly focused on standardized protocols, process validation, and comprehensive documentation systems. The market is characterized by strong demand for integrated solutions that combine multiple reprocessing functions while ensuring regulatory compliance and operational efficiency.

Revenue from endoscope reprocessing systems in Germany is projected to grow at a CAGR of 7.6% through 2035, driven by the country's strong focus on medical device innovation, regulatory compliance, and healthcare quality standards. German healthcare facilities consistently demand high-performance, automated systems that deliver reliable results while maintaining strict safety protocols.

Revenue from endoscope reprocessing systems in the UK is projected to grow at a CAGR of 6.3% through 2035, supported by evidence-based healthcare policies, patient safety initiatives, and cost-effective healthcare delivery models. British healthcare facilities value proven efficacy, regulatory compliance, and operational efficiency, positioning advanced reprocessing systems as essential components of modern healthcare infrastructure.

Revenue from endoscope reprocessing systems in France is projected to grow at a CAGR of 7% through 2035, supported by the country's emphasis on healthcare quality, medical device innovation, and comprehensive patient safety protocols. French healthcare facilities prioritize clinically validated solutions and advanced technologies that ensure optimal patient outcomes while maintaining operational efficiency.

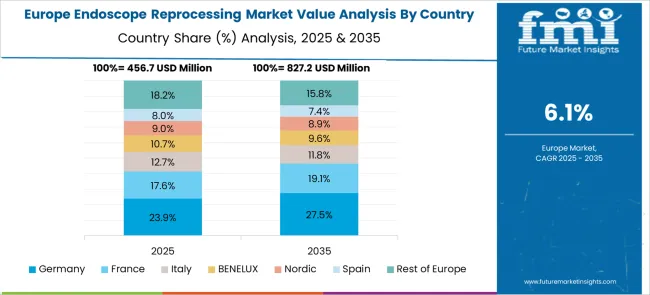

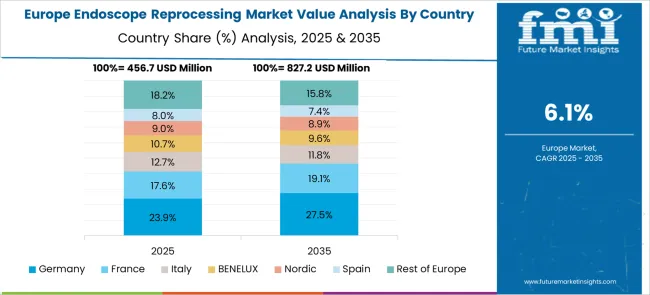

The European endoscope reprocessing market demonstrates sophisticated development across major economies with Germany leading through its precision medical technology excellence and advanced healthcare infrastructure capabilities, supported by companies like Getinge AB pioneering comprehensive reprocessing solutions with focus on high-level disinfectants, automated endoscope reprocessors, and hospital applications while emphasizing infection control and regulatory compliance. The UK shows strength in healthcare safety standards and evidence-based reprocessing protocols, with companies specializing in advanced endoscope reprocessing technologies that meet strict clinical standards and provide consistent decontamination outcomes.

France contributes through companies delivering integrated reprocessing solutions and healthcare technology excellence for comprehensive hospital applications. Italy and Spain demonstrate growth in specialized reprocessing systems for ambulatory surgical centers and endoscopy units. The market benefits from stringent EU medical device regulations, established healthcare infrastructure, and growing emphasis on infection prevention positioning Europe as key center for advanced endoscope reprocessing technologies.

The Japanese endoscope reprocessing market demonstrates steady growth driven by precision healthcare focus, advanced medical technologies, and healthcare system preference for high-quality reprocessing systems ensuring superior infection control and patient safety compliance throughout hospital operations. International companies like Olympus Corporation establish presence through cutting-edge reprocessing technologies aligning with Japan's sophisticated medical device industry and stringent quality standards while incorporating automated processing capabilities and advanced disinfection protocols.

The market emphasizes automated reprocessing systems, precision infection control excellence, and advanced sterilization innovations reflecting Japanese healthcare precision and attention to detail in medical processes. Growing investment in hospital safety technologies supports intelligent reprocessing systems with real-time monitoring, automated validation, and optimized decontamination performance. Japanese healthcare providers prioritize system reliability, consistent infection control outcomes, and regulatory compliance, creating opportunities for premium endoscope reprocessing solutions delivering exceptional performance across hospitals and surgical centers requiring highest safety standards.

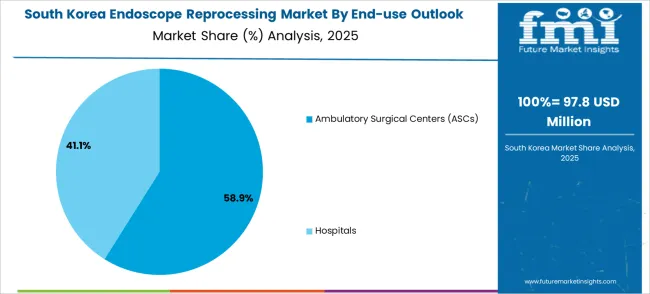

The South Korean endoscope reprocessing market shows exceptional growth potential driven by expanding healthcare infrastructure, increasing adoption of advanced medical technologies, and growing emphasis on patient safety requiring efficient and reliable reprocessing solutions. The market benefits from South Korea's technological advancement capabilities and increasing focus on healthcare quality competitiveness driving investment in modern reprocessing technologies meeting international safety standards and regulatory requirements.

Korean healthcare facilities increasingly adopt automated reprocessing systems, advanced disinfection equipment, and integrated decontamination technologies improving infection control efficiency and patient safety while ensuring regulatory compliance. Growing influence of Korean medical technology innovations in global markets supports demand for sophisticated endoscope reprocessing solutions ensuring clinical excellence while maintaining cost-effectiveness. Integration of smart healthcare principles and digital monitoring technologies creates opportunities for intelligent reprocessing systems with connectivity features, predictive maintenance capabilities, and real-time quality optimization across diverse medical applications.

The endoscope reprocessing market is characterized by competition among established medical device manufacturers, specialized infection control companies, and emerging technology providers. Companies are investing in automation technologies, integrated monitoring systems, eco-friendly disinfectant formulations, and comprehensive service support to deliver effective, reliable, and compliant reprocessing solutions. Product innovation, regulatory expertise, and global distribution capabilities are central to strengthening market presence and customer relationships.

Olympus Corporation, Japan-based, leads the market with 34.0% global value share, offering comprehensive endoscope reprocessing solutions with integrated automation and monitoring capabilities. Fortive Corporation (Advanced Sterilization Products), USA, provides innovative disinfection technologies with emphasis on efficacy and safety. Cantel Medical, USA, delivers specialized infection prevention solutions with focus on regulatory compliance and customer support. Ecolab, USA, focuses on comprehensive healthcare hygiene programs that integrate reprocessing protocols with broader infection control strategies.

Getinge AB and STERIS, operating globally, provide automated reprocessing systems across multiple healthcare segments and geographic markets. Steelco S.p.A, Italy, emphasizes advanced automation technologies and customized solutions for diverse healthcare applications. ARC Group of Companies Inc. provides specialized reprocessing equipment with focus on operational efficiency. Metrex Research, LLC and Shinva Medical Instrument Co., Ltd. offer targeted disinfection solutions with emphasis on cost-effectiveness and reliability. Belimed provides comprehensive sterile processing solutions with integrated reprocessing capabilities.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1.8 billion |

| Product | High-level disinfectants and test strips, Detergents and wipes, Automated endoscope reprocessors, Endoscope drying, storage, and transport systems |

| End-Use | Hospitals, Ambulatory surgical centers, Other healthcare facilities |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Olympus Corporation, Fortive Corporation, Cantel Medical, Ecolab, Getinge AB, STERIS, Steelco S.p.A, ARC Group, Metrex Research, Shinva Medical, Belimed |

| Additional Attributes | Revenue analysis by product category and automation level, regional adoption patterns, competitive market positioning, customer preferences for manual versus automated systems, integration with infection control protocols, innovations in eco-friendly disinfectants, monitoring technologies, and regulatory compliance solutions |

The global endoscope reprocessing market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the endoscope reprocessing market is projected to reach USD 3.5 billion by 2035.

The endoscope reprocessing market is expected to grow at a 6.6% CAGR between 2025 and 2035.

In terms of end-use outlook, ambulatory surgical centers (ascs) segment to command 56.5% share in the endoscope reprocessing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Endoscope Reprocessing Device Market – Trends & Forecast 2025-2035

Endoscope Protective Barrier Covers Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Procedure Kits Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Detergents And Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Tracking Solutions Market

Endoscope Leak Detection Device Market

Sialendoscopes Market Size and Share Forecast Outlook 2025 to 2035

Capsule Endoscope and Workstations Market - Growth & Demand 2025 to 2035

Flexible Endoscopes Market Growth - Trends & Forecast 2025 to 2035

Disposable Endoscopes Market Insights – Size, Share & Forecast 2025 to 2035

Veterinary Endoscopes Market Insights - Trends, Applications & Forecast 2024 to 2034

Chip-on-the-Tip Endoscopes Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Dialyzer Reprocessing Machines and Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA