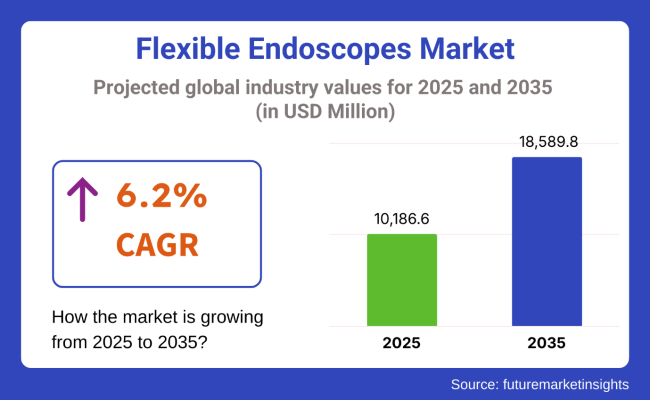

The global flexible endoscopes market is estimated to be valued at USD 10,186.6 million in 2025 and is projected to reach USD 18,589.8 million by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. The current market is driven by the rising prevalence of gastrointestinal, respiratory, and urological diseases alongside heightened demand for minimally invasive diagnostic and therapeutic procedures.

Other factors contributing to the growth of the market includes demand for high-definition imaging and increased penetration of disposable endoscope which is reshaping procedural standards and patient outcomes. The market growth is further influenced by rising patient awareness, favourable reimbursement policies and investments in advanced endoscopic equipment and training support will collective drive the market growth over the forecast period.

Leading manufacturers such as Olympus Corporation, Karl Storz SE & Co. KG, EndoMed Systems and Fujifilm are accelerating market growth through continuous innovation in high-definition and ultra-thin endoscope development, AI-powered diagnostic systems, and introduction of disposable endoscopes. Key factors driving market expansion include the rising incidence of gastrointestinal cancers, increased demand for early disease detection, and regulatory support for infection control and patient safety.

Notably, in March 2024, Olympus launched two bronchoscopes as part of the EVIS X1 Endoscopy System. “We are excited to launch diagnostic and therapeutic bronchoscopes supported by our most advanced endoscopy system. Pulmonologists will have the confidence to expand their reach with bronchoscopes that combine a slim outer diameter, a large working channel and improved imaging.” said Swarna Alcorn, Business Unit Vice President, Olympus Corp.

North America remains the dominant region in the flexible endoscopes market, primarily due to high adoption of advanced medical technologies and robust investment in diagnostic imaging modalities. The region leadership is strengthened by the increasing incidence of colorectal cancer and gastrointestinal disorders, driving demand for early and accurate diagnostic procedures. Key factors contributing to growth include rapid uptake of disposable endoscopes, stringent regulatory standards, and a strong focus on patient safety and infection control.

Ongoing investments in medical staff training and research and development further bolster the region’s market position. Europe’s flexible endoscopes market is characterized by superior preventive healthcare frameworks, early disease detection protocols, and high-quality medical care, especially in countries like Germany, the UK, and France. The region is experiencing robust growth due widespread adoption of high-definition and 3D imaging technologies in endoscopic procedures.

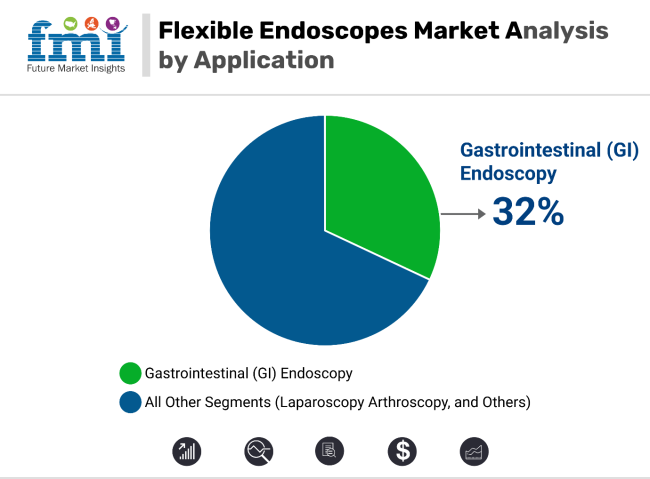

In 2025, gastrointestinal (GI) endoscopy is projected to hold 32% of the revenue share in the flexible endoscopes market. This dominance is attributed to the increasing prevalence of gastrointestinal disorders, including colorectal cancer, inflammatory bowel diseases, and gastrointestinal bleeding, which require early and accurate diagnostic procedures. GI endoscopy is a preferred method for diagnosing and monitoring these conditions due to its minimally invasive nature and ability to provide real-time visualization of the GI tract.

The rise in health awareness, coupled with an aging global population, has significantly contributed to the demand for GI endoscopy procedures. Additionally, advancements in flexible endoscope technology, such as improved image quality and maneuverability, have enhanced diagnostic accuracy and patient outcomes.

The growing emphasis on preventive healthcare and routine screenings, such as colonoscopy for colorectal cancer, has further fueled the growth of the GI endoscopy segment. As the demand for early diagnosis and minimally invasive procedures continues to rise, GI endoscopy is expected to maintain its leading position in the flexible endoscope market.

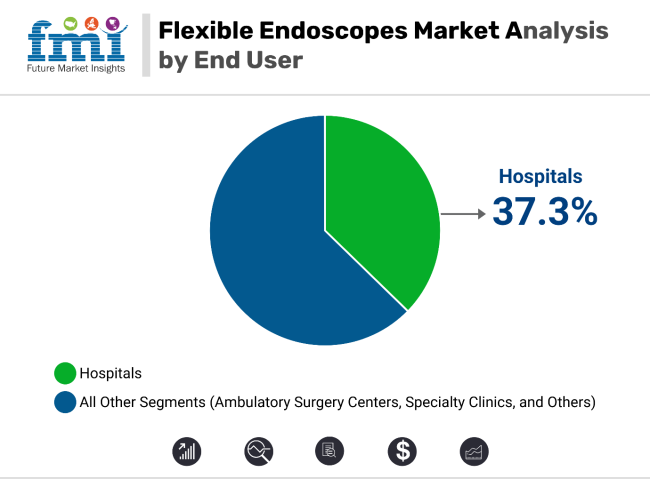

In 2025, hospitals are expected to capture 37.3% of the revenue share in the flexible endoscopes market. This leadership position is driven by the high volume of endoscopic procedures performed in hospital settings, where advanced medical infrastructure and specialized healthcare professionals are readily available. Hospitals are the primary location for both routine and complex endoscopic procedures, particularly in departments such as gastroenterology, pulmonology, and surgery.

The adoption of flexible endoscopes in hospitals has been accelerated by their ability to provide high-quality, real-time imaging for diagnostic and therapeutic purposes, offering better clinical outcomes and reducing the need for invasive surgeries. Additionally, hospitals have the resources to invest in the latest endoscopic technology, enabling more efficient procedures and improved patient safety.

The rise in hospital-based outpatient procedures, coupled with increasing healthcare access and advancements in flexible endoscope systems, has reinforced the dominance of hospitals as the leading end-user segment in the flexible endoscopes market.

High Costs, Infection Control Risks, and Regulatory Compliance

Challenges for the flexible endoscopes market endoscopic systems are expensive, posing a challenge for the market. More so, budget constraints in many healthcare facilities especially in underdeveloped areas has hindered the adoption of HD and robotic-assisted flexible endoscopes. Infection control risks pose another major challenge as reprocessing and sterilization of endoscopes continue to represent key concerns.

The need for stringent regulation has been imposed as improper cleaning or disinfection protocols may lead to cross-contamination and hospital-acquired infections (HAIs). Moreover, compliance with regulatory authorities like FDA, CE Mark, and ISO medical device standards mandates rigorous requirements for reprocessing validation, biocompatibility, and endoscope function, complicating compliance and raising costs.

Growth in Single-Use Endoscopes, AI-Driven Imaging, and Robotic-Assisted Procedures

Nevertheless, some trends are shaping the future of the flexible endoscopes market and rise of a single-use (disposable) endoscopes, AI-powered diagnostics and robotic-assisted endoscopic procedures. The rapidly growing adoption of single-use flexible endoscopes, driven by infection control advantages and regulatory backing, especially strong in bronchoscopy, urology, and gastroenterology segments.

In addition, AI-savvy endoscopy systems are transforming real-time lesion detection, polyp classification, and automated report generation, thereby enhancing diagnostic accuracy. The funneling of increasingly sophisticated robotic-assisted endoscopy systems and advancements in minimally invasive surgery have further popularized the use of flexible endoscopes in complicated surgical procedures.

The flexible endoscopes market in the USA is proliferating at an unprecedented rate due to the rising trend of minimally invasive surgical procedures and increasing demand for detection tests. Key factors driving market growth include the adoption of robotic-assisted endoscopic surgical techniques, rising prevalence of gastrointestinal disorders, and investments in public healthcare infrastructure. Technological innovative regarding disposable and single-use flexible endoscopes remains another factor responsible to drive segmental growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 57.8% |

Due to the growing adoption of AI-assisted and video endoscopy systems, the United Kingdom market for Flexible Endoscopes is expanding at a healthy pace. In the UK, the National Health Service (NHS) is prioritizing endoscopic screenings for early disease detection, especially for gastrointestinal and respiratory conditions. Moreover, the increasing penetration of tele-endoscopy and remote diagnostics is also supporting the demand for the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 57.5% |

The flexible endoscopes market trend in the European Union is expanding due to the growing cases of colorectal cancer, lung disorders, and urological diseases. These HD and 3D imaging technologies are now also more integrated with flexible endoscopy, and they improve the accuracy of the procedure. Tight EU regulations accelerating the production of endoscopes with a high degree of biocompatibility and sterilization-friendly are also driving market trends.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 57.6% |

Japan's flexible endoscopes market is showing remarkable growth, expected due to the changing optical technology, miniaturization, and planned endoscopy. Market growth is fueled by an aging population and a high level of demand for early detection cancer screening procedures. Innovative capsule endoscopy along with ultra-thin endoscopes are also changing the face of the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 57.5% |

In South Korea, the Flexible Endoscopes market is experiencing growth driven by escalating investment in healthcare digitization, robotic-assisted procedures, and endoscopic AI analytics. The demand is fuelled by increasing adoption of 4K and AI-powered visualization systems in hospitals and diagnostic centers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 57.8% |

Factors such as the rising demand for minimally invasive procedures, advancements in high-definition imaging, and AI-powered diagnostics are increasing the growth of flexible endoscopes market. Innovation in next-generation flexible endoscopy solutions is being driven by rising cases of gastrointestinal disorders, increasing prevalence of respiratory diseases, and cancer screening programs.

Hence, companies are targeting in AI-powered image assessment, boosted agility, and advancements in sterilization to increase diagnostic precision, patient safety and operational efficiency.

Olympus Corporation (18-22%)

Olympus leads the flexible endoscope market, offering AI-driven endoscopic imaging, minimally invasive diagnostic solutions, and infection-resistant single-use endoscopes.

Karl Storz SE & Co. KG (12-16%)

Karl Storz specializes in high-definition flexible endoscopy, ensuring AI-powered optical enhancements, ergonomic device designs, and improved maneuverability.

Fujifilm Holdings Corporation (10-14%)

Fujifilm provides ultra-HD flexible endoscopy systems, optimizing AI-assisted lesion detection, high-resolution imaging, and digital endoscopy advancements.

Boston Scientific Corporation (8-12%)

Boston Scientific focuses on single-use endoscopy solutions, integrating AI-powered real-time navigation, infection prevention, and enhanced portability.

Ambu A/S (5-9%)

Ambu develops disposable flexible endoscopes, ensuring AI-driven contamination control, cost-effective imaging, and simplified endoscopy workflows.

Other Key Players (30-40% Combined)

Several medical device manufacturers, AI-driven diagnostic companies, and endoscopy solution providers contribute to next-generation flexible endoscope innovations, AI-powered visualization improvements, and real-time endoscopic diagnostics. These include:

The overall market size for the flexible endoscopes market was USD 10,186.6 million in 2025.

The flexible endoscopes market is expected to reach USD 18,589.8 million in 2035.

Growth is driven by the increasing prevalence of gastrointestinal and respiratory disorders, rising demand for minimally invasive procedures, technological advancements in endoscopic imaging, and expanding applications in diagnostics and surgical interventions.

The top 5 countries driving the development of the flexible endoscopes market are the USA, Germany, China, Japan, and India.

Video Endoscopes and Fiber Optic Endoscopes are expected to command a significant share over the assessment period.

Table 01: Global Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Product

Table 02: Global Market Volume (Units) Analysis and Forecast 2015 to 2033, by Product

Table 03: Global Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Application

Table 04: Global Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by End User

Table 05: Global Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Region

Table 06: North America Market Value (US$ Million) Analysis 2015 to 2022 and Forecast 2023 to 2033, by Country

Table 07: North America Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Product

Table 08: North America Market Volume (Units) Analysis and Forecast 2015 to 2033, by Product

Table 09: North America Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Application

Table 10: North America Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by End User

Table 11: Latin America Market Value (US$ Million) Analysis 2015 to 2022 and Forecast 2023 to 2033, by Country

Table 12: Latin America Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Product

Table 13: Latin America Market Volume (Units) Analysis and Forecast 2015 to 2033, by Product

Table 14: Latin America Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Application

Table 15: Latin America Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by End User

Table 16: Europe Market Value (US$ Million) Analysis 2015 to 2022 and Forecast 2023 to 2033, by Country

Table 17: Europe Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Product

Table 18: Europe Market Volume (Units) Analysis and Forecast 2015 to 2033, by Product

Table 19: Europe Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Application

Table 20: Europe Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by End User

Table 21: South Asia Market Value (US$ Million) Analysis 2015 to 2022 and Forecast 2023 to 2033, by Country

Table 22: South Asia Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Product

Table 23: South Asia Market Volume (Units) Analysis and Forecast 2015 to 2033, by Product

Table 24: South Asia Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Application

Table 25: South Asia Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by End User

Table 26: East Asia Market Value (US$ Million) Analysis 2015 to 2022 and Forecast 2023 to 2033, by Country

Table 27: East Asia Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Product

Table 28: East Asia Market Volume (Units) Analysis and Forecast 2015 to 2033, by Product

Table 29: East Asia Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Application

Table 30: East Asia Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by End User

Table 31: Oceania Market Value (US$ Million) Analysis 2015 to 2022 and Forecast 2023 to 2033, by Country

Table 32: Oceania Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Product

Table 33: Oceania Market Volume (Units) Analysis and Forecast 2015 to 2033, by Product

Table 34: Oceania Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Application

Table 35: Oceania Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by End User

Table 36: Middle East and Africa Market Value (US$ Million) Analysis 2015 to 2022 and Forecast 2023 to 2033, by Country

Table 37: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Product

Table 38: Middle East and Africa Market Volume (Units) Analysis and Forecast 2015 to 2033, by Product

Table 39: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Application

Table 40: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by End User

Figure 01: Global Market Volume (Units), 2015 to 2022

Figure 02: Global Market Volume (Units) & Y-o-Y Growth (%) Analysis, 2023 to 2033

Figure 03: Flexible Endoscope, Pricing Analysis per unit (US$), in 2023

Figure 04: Flexible Endoscope, Pricing Forecast per unit (US$), in 2033

Figure 05: Global Market Value Analysis (US$ Million), 2015 to 2022

Figure 06: Global Market Value Forecast (US$ Million), 2023 to 2033

Figure 07: Global Market Absolute $ Opportunity, 2022 - 2033

Figure 08: Global Market Share Analysis (%), by Product, 2023 to 2033

Figure 09: Global Market Y-o-Y Analysis (%), by Product, 2023 to 2033

Figure 10: Global Market Attractiveness Analysis by Product, 2023 to 2033

Figure 11: Global Market Share Analysis (%), by Application, 2023 to 2033

Figure 12: Global Market Y-o-Y Analysis (%), by Application, 2023 to 2033

Figure 13: Global Market Attractiveness Analysis by Application, 2023 to 2033

Figure 14: Global Market Share Analysis (%), by End User, 2023 to 2033

Figure 15: Global Market Y-o-Y Analysis (%), by End User, 2023 to 2033

Figure 16: Global Market Attractiveness Analysis by End User, 2023 to 2033

Figure 17: Global Market Share Analysis (%), by Region, 2023 to 2033

Figure 18: Global Market Y-o-Y Analysis (%), by Region, 2023 to 2033

Figure 19: Global Market Attractiveness Analysis by Region, 2023 to 2033

Figure 20: North America Market Value Share, by Product, 2023 (E)

Figure 21: North America Market Value Share, by Application, 2023 (E)

Figure 22: North America Market Value Share, by End User, 2023 (E)

Figure 23: North America Market Value Share, by Country, 2023 (E)

Figure 24: North America Market Value Analysis (US$ Million), 2015 to 2022

Figure 25: North America Market Value Forecast (US$ Million), 2023 to 2033

Figure 26: North America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 27: North America Market Attractiveness Analysis, by Application 2023 to 2033

Figure 28: North America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 29: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 30: USA Market Share Analysis (%), by Product, 2023 & 2033

Figure 31: USA Market Share Analysis (%), by Application, 2023 & 2033

Figure 32: USA Market Share Analysis (%), by End User, 2023 & 2033

Figure 33: USA Market Value Analysis (US$ Million), 2023 & 2033

Figure 34: Canada Market Share Analysis (%), by Product, 2023 & 2033

Figure 35: Canada Market Share Analysis (%), by Application, 2023 & 2033

Figure 36: Canada Market Share Analysis (%), by End User, 2023 & 2033

Figure 37: Canada Market Value Analysis (US$ Million), 2023 & 2033

Figure 38: Latin America Market Value Share, by Product, 2023 (E)

Figure 39: Latin America Market Value Share, by Application, 2023 (E)

Figure 40: Latin America Market Value Share, by End User, 2023 (E)

Figure 41: Latin America Market Value Share, by Country, 2023 (E)

Figure 42: Latin America Market Value Analysis (US$ Million), 2015 to 2022

Figure 43: Latin America Market Value Forecast (US$ Million), 2023 to 2033

Figure 44: Latin America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 45: Latin America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 46: Latin America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 47: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 48: Brazil Market Share Analysis (%), by Product, 2023 & 2033

Figure 49 : Brazil Market Share Analysis (%), by Application, 2023 & 2033

Figure 50: Brazil Market Share Analysis (%), by End User, 2023 & 2033

Figure 51: Brazil Market Value Analysis (US$ Million), 2023 & 2033

Figure 52: Mexico Market Share Analysis (%), by Product, 2023 & 2033

Figure 53: Mexico Market Share Analysis (%), by Application, 2023 & 2033

Figure 54: Mexico Market Share Analysis (%), by End User, 2023 & 2033

Figure 55: Mexico Market Value Analysis (US$ Million), 2023 & 2033

Figure 56: Argentina Market Share Analysis (%), by Product, 2023 & 2033

Figure 57: Argentina Market Share Analysis (%), by Application, 2023 & 2033

Figure 58: Argentina Market Share Analysis (%), by End User, 2023 & 2033

Figure 59: Argentina Market Value Analysis (US$ Million), 2023 & 2033

Figure 60: Europe Market Value Share, by Product, 2023 (E)

Figure 61: Europe Market Value Share, by Application, 2023 (E)

Figure 62: Europe Market Value Share, by End User, 2023 (E)

Figure 63: Europe Market Value Share, by Country, 2023 (E)

Figure 64: Europe Market Value Analysis (US$ Million), 2015 to 2022

Figure 65: Europe Market Value Forecast (US$ Million), 2023 to 2033

Figure 66: Europe Market Attractiveness Analysis by Product, 2023 to 2033

Figure 67: Europe Market Attractiveness Analysis by Application, 2023 to 2033

Figure 68: Europe Market Attractiveness Analysis by End User, 2023 to 2033

Figure 69: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 70: Germany Market Share Analysis (%), by Product, 2023 & 2033

Figure 71: Germany Market Share Analysis (%), by Application, 2023 & 2033

Figure 72: Germany Market Share Analysis (%), by End User, 2023 & 2033

Figure 73: Germany Market Value Analysis (US$ Million), 2023 & 2033

Figure 74: Italy Market Share Analysis (%), by Product, 2023 & 2033

Figure 75: Italy Market Share Analysis (%), by Application, 2023 & 2033

Figure 76: Italy Market Share Analysis (%), by End User, 2023 & 2033

Figure 77: Italy Market Value Analysis (US$ Million), 2023 & 2033

Figure 78: France Market Share Analysis (%), by Product, 2023 & 2033

Figure 79: France Market Share Analysis (%), by Application, 2023 & 2033

Figure 80: France Market Share Analysis (%), by End User, 2023 & 2033

Figure 81: France Market Value Analysis (US$ Million), 2023 & 2033

Figure 82: UK Market Share Analysis (%), by Product, 2023 & 2033

Figure 83: UK Market Share Analysis (%), by Application, 2023 & 2033

Figure 84: UK Market Share Analysis (%), by End User, 2023 & 2033

Figure 85: UK Market Value Analysis (US$ Million), 2023 & 2033

Figure 86: Spain Market Share Analysis (%), by Product, 2023 & 2033

Figure 87: Spain Market Share Analysis (%), by Application, 2023 & 2033

Figure 88: Spain Market Share Analysis (%), by End User, 2023 & 2033

Figure 89: Spain Market Value Analysis (US$ Million), 2023 & 2033

Figure 90: BENELUX Market Share Analysis (%), by Product, 2023 & 2033

Figure 91: BENELUX Market Share Analysis (%), by Application, 2023 & 2033

Figure 92: BENELUX Market Share Analysis (%), by End User, 2023 & 2033

Figure 93: BENELUX Market Value Analysis (US$ Million), 2023 & 2033

Figure 94: Russia Market Share Analysis (%), by Product, 2023 & 2033

Figure 95: Russia Market Share Analysis (%), by Application, 2023 & 2033

Figure 96: Russia Market Share Analysis (%), by End User, 2023 & 2033

Figure 97: Russia Market Value Analysis (US$ Million), 2023 & 2033

Figure 98: South Asia Market Value Share, by Product, 2023 (E)

Figure 99: South Asia Market Value Share, by Application, 2023 (E)

Figure 100: South Asia Market Value Share, by End User, 2023 (E)

Figure 101: South Asia Market Value Share, by Country, 2023 (E)

Figure 102: South Asia Market Value Analysis (US$ Million), 2015 to 2022

Figure 103: South Asia Market Value Forecast (US$ Million), 2023 to 2033

Figure 104: South Asia Market Attractiveness Analysis by Product, 2023 to 2033

Figure 105: South Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 106: South Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 107: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 108: India Market Share Analysis (%), by Product, 2023 & 2033

Figure 109: India Market Share Analysis (%), by Application, 2023 & 2033

Figure 110: India Market Share Analysis (%), by End User, 2023 & 2033

Figure 111: India Market Value Analysis (US$ Million), 2023 & 2033

Figure 112: Indonesia Market Share Analysis (%), by Product, 2023 & 2033

Figure 113: Indonesia Market Share Analysis (%), by Application, 2023 & 2033

Figure 114: Indonesia Market Share Analysis (%), by End User, 2023 & 2033

Figure 115: Indonesia Market Value Analysis (US$ Million), 2023 & 2033

Figure 116: Thailand Market Share Analysis (%), by Product, 2023 & 2033

Figure 117: Thailand Market Share Analysis (%), by Application, 2023 & 2033

Figure 118: Thailand Market Share Analysis (%), by End User, 2023 & 2033

Figure 119: Thailand Market Value Analysis (US$ Million), 2023 & 2033

Figure 120: Malaysia Market Share Analysis (%), by Product, 2023 & 2033

Figure 121: Malaysia Market Share Analysis (%), by Application, 2023 & 2033

Figure 122: Malaysia Market Share Analysis (%), by End User, 2023 & 2033

Figure 123: Malaysia Market Value Analysis (US$ Million), 2023 & 2033

Figure 124: East Asia Market Value Share, by Product, 2023 (E)

Figure 125: East Asia Market Value Share, by Application, 2023 (E)

Figure 126: East Asia Market Value Share, by End User, 2023 (E)

Figure 127: East Asia Market Value Share, by Country, 2023 (E)

Figure 128: East Asia Market Value Analysis (US$ Million), 2015 to 2022

Figure 129: East Asia Market Value Forecast (US$ Million), 2023 to 2033

Figure 130: East Asia Market Attractiveness Analysis by Product, 2023 to 2033

Figure 131: East Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 132: East Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 133: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 134: China Market Share Analysis (%), by Product, 2023 & 2033

Figure 135: China Market Share Analysis (%), by Application, 2023 & 2033

Figure 136: China Market Share Analysis (%), by End User, 2023 & 2033

Figure 137: China Market Value Analysis (US$ Million), 2023 & 2033

Figure 138: Japan Market Share Analysis (%), by Product, 2023 & 2033

Figure 139: Japan Market Share Analysis (%), by Application, 2023 & 2033

Figure 140: Japan Market Share Analysis (%), by End User, 2023 & 2033

Figure 141: Japan Market Value Analysis (US$ Million), 2023 & 2033

Figure 142: South Korea Market Share Analysis (%), by Product, 2023 & 2033

Figure 143: South Korea Market Share Analysis (%), by Application, 2023 & 2033

Figure 144: South Korea Market Share Analysis (%), by End User, 2023 & 2033

Figure 145: South Korea Market Value Analysis (US$ Million), 2023 & 2033

Figure 146: Oceania Market Value Share, by Product, 2023 (E)

Figure 147: Oceania Market Value Share, by Application, 2023 (E)

Figure 148: Oceania Market Value Share, by End User, 2023 (E)

Figure 149: Oceania Market Value Share, by Country, 2023 (E)

Figure 150: Oceania Market Value Analysis (US$ Million), 2015 to 2022

Figure 151: Oceania Market Value Forecast (US$ Million), 2023 to 2033

Figure 152: Oceania Market Attractiveness Analysis by Product, 2023 to 2033

Figure 153: Oceania Market Attractiveness Analysis by Application, 2023 to 2033

Figure 154: Oceania Market Attractiveness Analysis by End User, 2023 to 2033

Figure 155: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 156: Australia Market Share Analysis (%), by Product, 2023 & 2033

Figure 157: Australia Market Share Analysis (%), by Application, 2023 & 2033

Figure 158: Australia Market Share Analysis (%), by End User, 2023 & 2033

Figure 159: Australia Market Value Analysis (US$ Million), 2023 & 2033

Figure 160: New Zealand Market Share Analysis (%), by Product, 2023 & 2033

Figure 161: New Zealand Market Share Analysis (%), by Application, 2023 & 2033

Figure 162: New Zealand Market Share Analysis (%), by End User, 2023 & 2033

Figure 163: New Zealand Market Value Analysis (US$ Million), 2023 & 2033

Figure 164: Middle East and Africa Market Value Share, by Product, 2023 (E)

Figure 165: Middle East and Africa Market Value Share, by Application, 2023 (E)

Figure 166: Middle East and Africa Market Value Share, by End User, 2023 (E)

Figure 167: Middle East and Africa Market Value Share, by Country, 2023 (E)

Figure 168: Middle East and Africa Market Value Analysis (US$ Million), 2015 to 2022

Figure 169: Middle East and Africa Market Value Forecast (US$ Million), 2023 to 2033

Figure 170: Middle East and Africa Market Attractiveness Analysis by Product, 2023 to 2033

Figure 171: Middle East and Africa Market Attractiveness Analysis by Application, 2023 to 2033

Figure 172: Middle East and Africa Market Attractiveness Analysis by End User, 2023 to 2033

Figure 173: Middle East and Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 174: GCC Countries Market Share Analysis (%), by Product, 2023 & 2033

Figure 175: GCC Countries Market Share Analysis (%), by Application, 2023 & 2033

Figure 176: GCC Countries Market Share Analysis (%), by End User, 2023 & 2033

Figure 177: GCC Countries Market Value Analysis (US$ Million), 2023 & 2033

Figure 178: Türkiye Market Share Analysis (%), by Product, 2023 & 2033

Figure 179: Türkiye Market Share Analysis (%), by Application, 2023 & 2033

Figure 180: Türkiye Market Share Analysis (%), by End User, 2023 & 2033

Figure 181: Türkiye Market Value Analysis (US$ Million), 2023 & 2033

Figure 182: South Africa Market Share Analysis (%), by Product, 2023 & 2033

Figure 183: South Africa Market Share Analysis (%), by Application, 2023 & 2033

Figure 184: South Africa Market Share Analysis (%), by End User, 2023 & 2033

Figure 185: South Africa Market Value Analysis (US$ Million), 2023 & 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flexible Plastic Pouch Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Paper Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Rubber Sheets Market Size and Share Forecast Outlook 2025 to 2035

Flexible Printed Circuit Boards Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Machinery Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electronic Market Size and Share Forecast Outlook 2025 to 2035

Flexible Foam Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Flexible Protective Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible AC Current Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Flexible End-Load Cartoner Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Screens Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Display Market Size and Share Forecast Outlook 2025 to 2035

Flexible Substrate Market Size and Share Forecast Outlook 2025 to 2035

Flexible Paper Battery Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Tubing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA