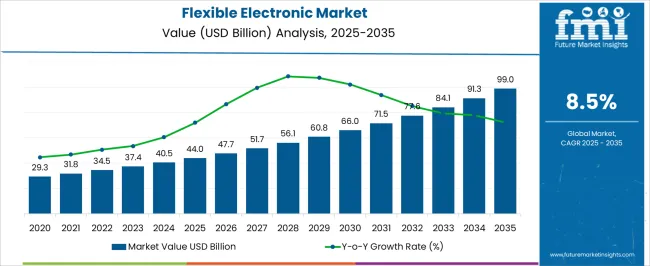

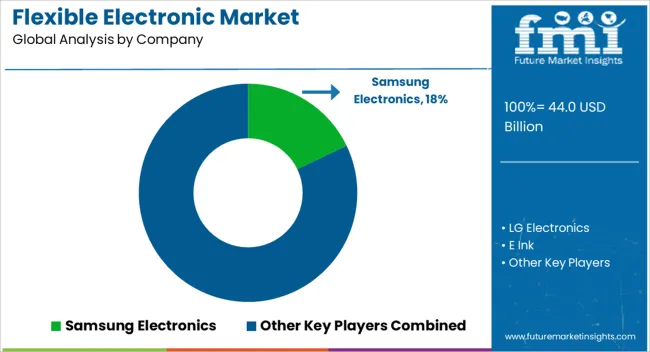

The Flexible Electronic Market is estimated to be valued at USD 44.0 billion in 2025 and is projected to reach USD 99.0 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period.

| Metric | Value |

|---|---|

| Flexible Electronic Market Estimated Value in (2025 E) | USD 44.0 billion |

| Flexible Electronic Market Forecast Value in (2035 F) | USD 99.0 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The flexible electronics market is experiencing robust expansion. Demand is being driven by rising adoption of lightweight, thin, and durable components across multiple industries. Current dynamics reflect strong uptake in consumer electronics, automotive, healthcare, and industrial applications, supported by advancements in material science and manufacturing techniques.

Market players are prioritizing investments in flexible substrates, printed circuitry, and advanced fabrication processes that enhance performance and reliability. The future outlook is shaped by the commercialization of next-generation devices, growth in wearable technologies, and integration of flexible systems into IoT applications. Regulatory focus on energy efficiency and sustainability is further encouraging development of environmentally friendly materials and scalable production methods.

Growth rationale is centered on the adaptability of flexible electronics to diverse end-use applications, improvements in durability and miniaturization, and expanding collaboration between technology providers and device manufacturers These factors collectively underpin sustained revenue growth, increased adoption, and broader global penetration over the forecast horizon.

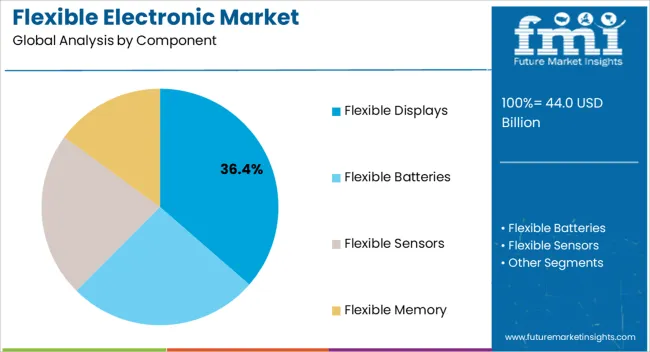

The flexible displays segment, accounting for 36.4% of the component category, has emerged as the leading segment due to widespread adoption in smartphones, tablets, and wearable devices. Its market leadership has been supported by strong consumer preference for high-resolution, lightweight, and bendable display solutions.

Manufacturers have enhanced product lifecycles through innovations in OLED and AMOLED technologies, which have reinforced reliability and performance. Demand growth has been maintained through premium product differentiation in the consumer electronics sector, where flexible displays provide unique design advantages.

Investments in advanced production methods, such as roll-to-roll printing, have reduced costs and improved scalability The segment’s dominance is expected to continue as flexible displays expand into automotive infotainment systems, foldable devices, and next-generation industrial equipment, ensuring sustained share and value contribution.

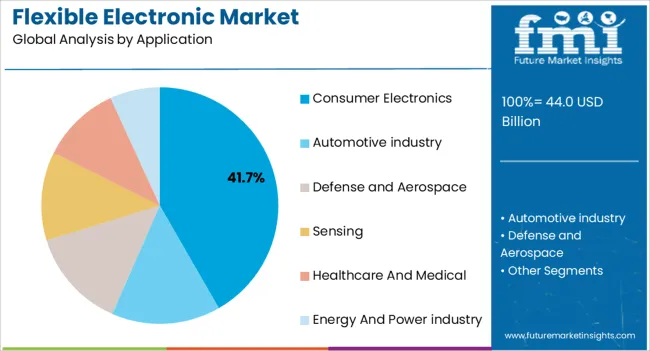

The consumer electronics segment, representing 41.7% of the application category, has held dominance due to continuous innovation in smart devices and the rising demand for compact, lightweight, and multifunctional products. Adoption has been supported by rapid product development cycles and consumer willingness to adopt advanced technologies.

Market expansion has been reinforced by strong global penetration of smartphones, wearables, and flexible tablets. Enhanced user experience, enabled by improved durability and innovative form factors, has further solidified demand.

Continuous integration of flexible components into premium device categories has provided a competitive edge to manufacturers Over the forecast horizon, rising urbanization, growing disposable incomes, and expanding digital lifestyles are expected to sustain the segment’s leadership and strengthen its contribution to overall market growth.

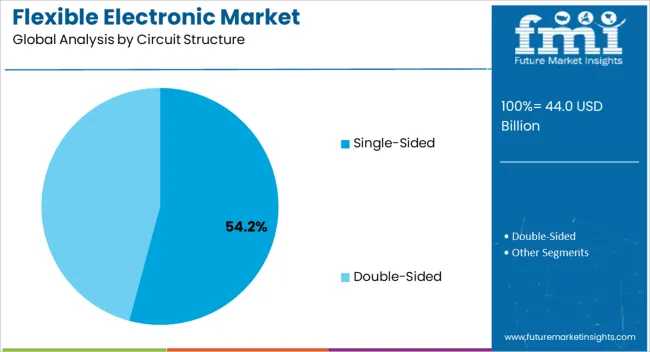

The single-sided circuit structure segment, accounting for 54.2% of the category, has maintained market leadership due to cost-effectiveness, ease of fabrication, and suitability for mass production of flexible electronics. Its dominance has been reinforced by widespread use in applications requiring simple yet reliable designs, including displays, sensors, and wearables.

Production efficiencies and lower material requirements have made single-sided circuits highly attractive to manufacturers seeking scale advantages. Market stability has been supported by established supply chains and mature production processes that ensure consistency and reliability.

Continuous improvements in substrate materials and printing techniques have further enhanced performance The segment is expected to sustain its leading position as single-sided circuits continue to serve as the foundation for high-volume, cost-sensitive applications in consumer electronics and industrial products.

The section presents a detailed analysis of the market's trajectory over time, highlighting its historical performance and the projected growth trends. With a historical CAGR standing at a robust 8.2%, the market has demonstrated resilience and a consistent upward momentum. This steady growth is expected to continue, as evidenced by the projected CAGR of 8.9%, underscoring the market's promising prospects.

The analysis provides key insights into the outlook for the Flexible Electronic Market, shedding light on the factors contributing to its historical success and offering valuable foresight into its anticipated growth trajectory.

| Historical CAGR | 8.2% |

|---|---|

| Forecast CAGR | 8.9% |

Short-term Analysis of Flexible Electronic Market from 2020 to 2025

| 2020 | USD 25,146.3 million |

|---|---|

| 2025 | USD 34,543.3 million |

The market observed a significant rise from USD 25,146.3 million in 2020 to USD 34,543.3 million in 2025, indicating a notable increase in sales and demand. The growing adoption of flexible electronics in various sectors contributed to the market's expansion, reflecting an increasing preference for lightweight and adaptable electronic solutions.

Mid-term Analysis of Flexible Electronic Market from 2025 to 2035

| 2025 | USD 37,065.0 million |

|---|---|

| 2035 | USD 56,767.98 million |

The market experienced a substantial upsurge from USD 37,065.0 million in 2025 to USD 56,767.98 million in 2035, demonstrating a significant growth and market value boost during this period. Continued technological advancements and the integration of flexible electronics in multiple industries propelled the market's upward trajectory, fostering innovation and market development.

Long-term Analysis of Flexible Electronic Market from 2035 to 2035

| 2035 | USD 56,767.98 million |

|---|---|

| 2035 | USD 87,209.3 million |

The market is projected to significantly increase from USD 56,767.98 million in 2035 to USD 87,209.3 million in 2035, highlighting a steady and substantial growth trend over the long term. Increasing investments in research and development, coupled with the rising demand for energy-efficient and portable electronic devices, are anticipated to be key factors driving the market's sustained growth and expansion.

The section provides a detailed analysis of key components and applications in the Flexible Electronic Market. Delving into the specifics, it sheds light on the dominance of the flexible memory component, capturing a significant market share of 24.5% in 2025.

This segment's ascendancy is attributed to its increasing integration in consumer electronics, particularly in IoT applications and wearable devices, facilitated by notable advancements in data storage solutions.

The section also discusses the significance of healthcare and medicine applications, which are projected to hold a substantial market share of 20.4% in 2025. It elucidates the integral role of flexible electronics in wearable health monitoring devices, advanced medical diagnostic tools, and the continual evolution of biomedical devices, all contributing to the growing emphasis on remote healthcare services.

| Attributes | Details |

|---|---|

| Top Component Type | Flexible Memory |

| Market Share in 2025 | 24.5% |

With a significant market share of 24.5% in 2025, the flexible memory component dominates the Flexible Electronic Market, driven by increasing demand in consumer electronics and technological advancements in wearable devices.

The segment has witnessed substantial growth due to its widespread adoption in Internet of Things (IoT) applications, coupled with innovations in data storage solutions that offer higher capacity and durability.

| Attributes | Details |

|---|---|

| Top Application Type | Healthcare and Medicine |

| Market Share in 2025 | 20.4% |

The healthcare and medicine applications segment holds a significant market share of 20.4% in 2025, positioning itself as a leading category in the Flexible Electronic Market. This dominance is attributed to the segment's integration into wearable health monitoring devices, enhanced medical diagnostic capabilities, advancements in biomedical devices, and the growing emphasis on remote healthcare services.

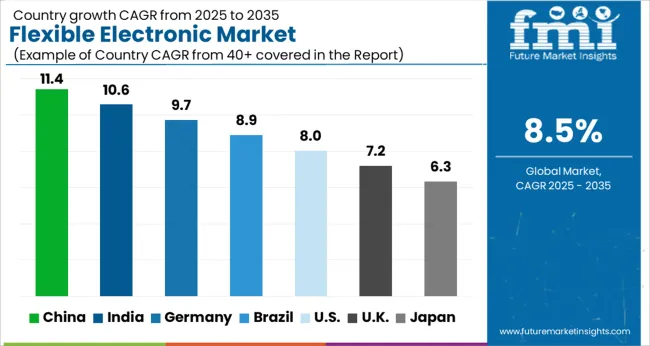

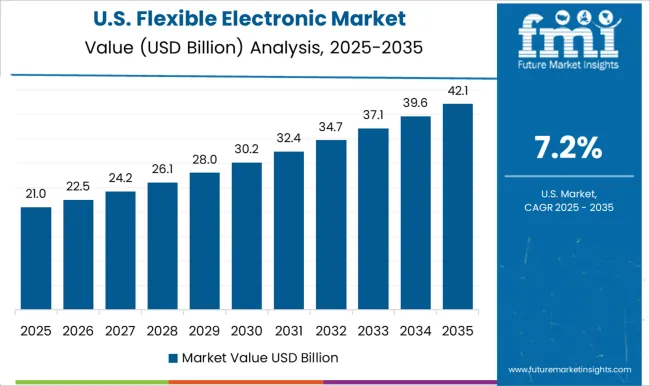

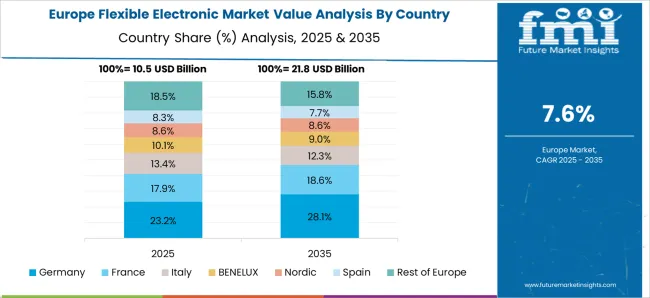

The section analyzes the Flexible Electronic Market across different regions, including North America, Europe, and Asia Pacific. Through an exploration of each region, it delves into the specific factors driving the demand, adoption, and sales of flexible electronics. It offers a detailed analysis of the market, highlighting each country's key trends, regional dynamics, and market growth rates.

North America Flexible Electronic Market

| Countries | CAGR |

|---|---|

| United States | 16.5% |

| Canada | 8.2% |

With a CAGR of 16.5%, the United States demonstrates robust demand for flexible electronics, primarily fueled by:

In Canada, the Flexible Electronic Market is experiencing an 8.2% CAGR, driven by the rising demand for flexible printed circuit boards in the manufacturing sector and the significant adoption of flexible sensors in the healthcare industry.

Europe Flexible Electronic Market

| Countries | CAGR |

|---|---|

| Germany | 6.4% |

| United Kingdom | 8.8% |

| France | 3.4% |

| Italy | 2.9% |

| Spain | 4.5% |

With a CAGR of 6.4%, Germany's Flexible Electronic Market is driven by the robust demand for flexible sensors and displays in the automotive industry, along with the increasing utilization of flexible circuits in industrial automation.

In the United Kingdom, the Flexible Electronic Market is witnessing an 8.8% CAGR, driven by the growing adoption of flexible displays in the hospitality sector.

France's Flexible Electronic Market, with a CAGR of 3.4%, is driven by the significant utilization of flexible displays in the fashion and textile industries.

The Flexible Electronic Market in Italy is witnessing a sluggish 2.9% CAGR through 2035. However, the market is likely to witness a rise in adoption driven by:

Spain's Flexible Electronic Market, with an average CAGR of 4.5% through 2035, adoption is likely to be propelled by the increasing deployment of flexible displays in the retail and hospitality sectors.

Asia Pacific Flexible Electronic Market

| Countries | CAGR |

|---|---|

| India | 7.8% |

| China | 10.2% |

| Japan | 6.9% |

| South Korea | 2.5% |

| Australia | 2.3% |

With a CAGR of 7.8%, India's Flexible Electronic Market is driven by the increasing demand for flexible displays in the retail and e-commerce sectors and the growing adoption of flexible sensors in the healthcare industry.

China's Flexible Electronic Market exhibits a robust CAGR of 10.2%, driven by the significant deployment of flexible displays in the consumer electronics sector and the increasing adoption of flexible sensors in the manufacturing industry.

The Flexible Electronic Market in Japan is anticipated to witness a 6.9% CAGR through 2035. The emphasis on digital innovation and the integration of flexible batteries in energy-efficient solutions further bolsters the market.

South Korea's Flexible Electronic Market, with a sluggish CAGR of 2.5% through 2035, holds potential.

The Flexible Electronic Market in Australia is likely to witness a moderate 2.3% CAGR through 2035. The growth is likely to be propelled by factors such as:

The flexible electronics industry is still in its early stages of development, but it is already attracting a lot of attention from investors and established companies alike. The potential applications for flexible electronics are vast, ranging from wearable devices to smart packaging to medical implants.

The competitive landscape in the flexible electronics industry is fragmented, with a mix of established companies and new entrants. The key players in the flexible electronics industry are investing heavily in research and development to stay ahead of the competition. They are also developing new partnerships and collaborations to bring new products to the market faster.

Here are some examples of what key players are doing to stay at the top in the market:

The key players in the flexible electronics industry face several challenges, including:

There are several investment opportunities for new entrants in the flexible electronics industry. The market is expected to grow rapidly in the coming years, and there is much room for innovation.

Here are some areas where there are investment opportunities for new entrants.

Recent Developments in the Flexible Electronics Industry:

Samsung Electronics developed a fully flexible OLED display that can adhere to and conform to the skin's surface. This could be used for various applications, such as wearable health devices and electronic tattoos.

LG Display revealed its flexible OLED solutions in concept form, including the Virtual Ride indoor stationary bicycle and the Media Chair integrated entertainment center. These concepts show the potential for flexible electronics to be used in various consumer products.

E Ink developed a new electronic paper technology called Kaleido Plus, which has a wider color gamut than previous generations of e-paper. This could make e-readers and other devices with e-paper displays more attractive to consumers.

The global flexible electronic market is estimated to be valued at USD 44.0 billion in 2025.

The market size for the flexible electronic market is projected to reach USD 99.0 billion by 2035.

The flexible electronic market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in flexible electronic market are flexible displays, flexible batteries, flexible sensors and flexible memory.

In terms of application, consumer electronics segment to command 41.7% share in the flexible electronic market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flexible Barrier Films for Electronics Market Size and Share Forecast Outlook 2025 to 2035

Flexible Glass for Flexible Electronics Market Analysis by Application, End User, and Region Through 2035

Flexible Plastic Pouch Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Paper Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Rubber Sheets Market Size and Share Forecast Outlook 2025 to 2035

Flexible Printed Circuit Boards Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Machinery Market Size and Share Forecast Outlook 2025 to 2035

Flexible Foam Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Flexible Protective Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible AC Current Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Flexible End-Load Cartoner Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Screens Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Display Market Size and Share Forecast Outlook 2025 to 2035

Flexible Substrate Market Size and Share Forecast Outlook 2025 to 2035

Flexible Paper Battery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA