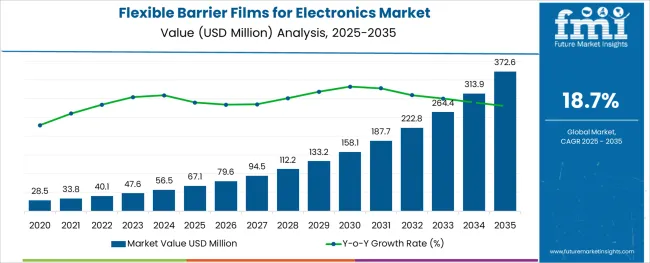

The Flexible Barrier Films for Electronics Market is estimated to be valued at USD 67.1 million in 2025 and is projected to reach USD 372.6 million by 2035, registering a compound annual growth rate (CAGR) of 18.7% over the forecast period.

The flexible barrier films for electronics market is expanding steadily due to rising demand for lightweight, moisture resistant, and transparent materials used in next generation electronic components. As manufacturers move toward flexible and foldable device architectures, there is growing reliance on high performance films that offer superior barrier properties while maintaining flexibility and optical clarity.

Advances in encapsulation technologies and roll to roll manufacturing processes are further driving scalability and cost efficiency. Environmental durability, improved thermal stability, and compatibility with organic electronic materials have become critical features, particularly in wearables, displays, and photovoltaic systems.

Global investment in solar energy and smart electronics, combined with increasing demand for miniaturized consumer devices, continues to support market growth. The long term outlook remains positive as innovation accelerates in flexible substrates and device integration across consumer and industrial applications.

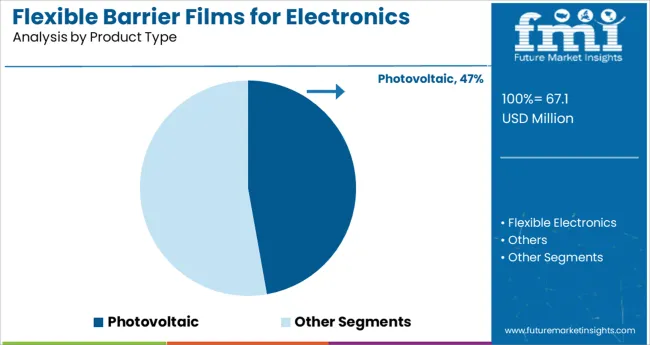

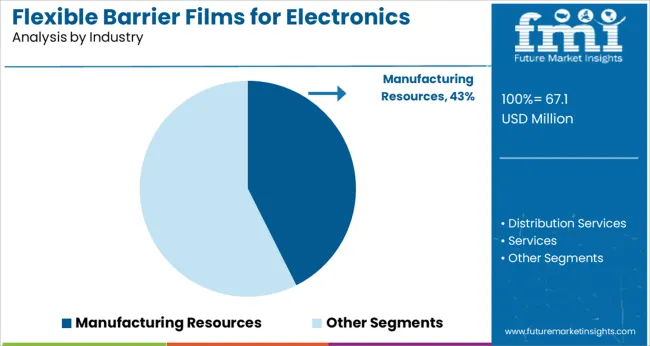

The market is segmented by Product Type and Industry and region. By Product Type, the market is divided into Photovoltaic, Flexible Electronics, and Others. In terms of Industry, the market is classified into Manufacturing Resources, Distribution Services, Services, Public Sector, and Infrastructure. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The photovoltaic segment is projected to contribute 47.20% of total revenue by 2025 within the product type category, making it the most dominant segment. This is driven by growing adoption of flexible solar panels in both consumer electronics and building integrated photovoltaics.

Flexible barrier films are essential in these applications to protect sensitive photovoltaic materials from oxygen, moisture, and mechanical stress without compromising flexibility. The increasing deployment of off grid solar solutions and portable energy systems has elevated the demand for reliable encapsulation materials that can endure harsh environmental conditions.

As the renewable energy sector continues to prioritize lightweight and adaptable solar technologies, the use of high performance flexible barrier films in photovoltaic applications remains a key growth enabler.

The manufacturing resources segment is expected to account for 42.60% of market revenue by 2025 within the industry category, establishing it as the leading sector. This growth is being supported by widespread use of flexible barrier films in the production of electronic components, semiconductors, and printed circuit boards.

Their ability to maintain component integrity under variable thermal and humidity conditions makes them essential in cleanroom and automated assembly environments. Manufacturing operations benefit from these films’ role in safeguarding product quality during fabrication, storage, and shipment.

As production volumes scale in line with demand for compact and multifunctional electronics, the importance of high performing barrier materials has increased significantly. This trend continues to position the manufacturing resources sector at the forefront of the flexible barrier films for electronics market.

The flexible barrier films for electronics market demand is estimated to grow at a 18.7% CAGR between 2025 and 2035 in comparison with 12.7% CAGR registered during the historic period (2020 to 2024).

Increasing demand for electronic devices with short response time is expected to boost the market growth during the forecast period. Electronic displays are chemically sensitive and likely to react with the environment, making it easier to encapsulate the device to protect it from chemicals, moisture and oxygen.

The increasing complexity of designing various electronic products such as smartwatches, smartphones, laptops, tablets are driving the adoption of flexible barrier films for electronics in the manufacturing of electronic products.

Flexible electronics, such as wearable technologies are gaining momentum in the market due to their flexible and stretchy properties. Its flexible properties make it easy to use on a variety of substrates such as flex glass, plastic, and paper. The increasing demand for a variety of uniquely designed consumer and industrial products and the growing use of various innovative materials in the manufacture of consumer products have increased the demand for flexible electronics worldwide.

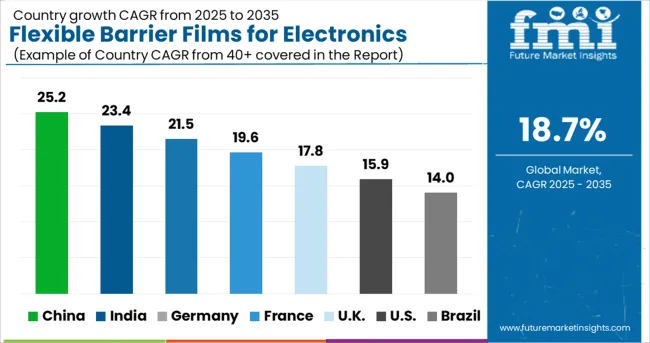

The North America to hold highest market share of 28.6% for the flexible barrier films for electronics market and South Asia Pacific is estimated to grow by highest CAGR of 20.1% during the forecast period of 2025 to 2035.

Increasing number of flexible barrier films for electronics market players across North America is expected to fuel the further market growth for flexible barrier films. In addition, increased investment in product features and business expansion by major vendors is expected to boost the market during the forecasted period. Many market players are finding lucrative opportunities in emerging markets such as India, with large populations and new innovations, driving demand in South Asia and Pacific region.

The USA is predicted to remain the most attractive market during the forecast period. According to the study, the USA flexible barrier films for electronics market is set to account highest market share of 17.8% in 2024.

USA has the largest market share in the flexible barrier films for electronics market during the forecast period. Rising demand for the smart wearables combined and consumer electronics is fuelling the demand for flexible electronics in the country.

The United States has some advantages when it comes to flexible electronics, with the world's largest and best research universities, United states has world-class companies with the competencies, equipment, process technology, and intellectual property associated with flexible electronics, some of which are engaged in significant pre-competitive research and development (RD).

The market for flexible barrier films in India is estimated to grow at highest CAGR of 10.4% during the forecast period. India is one of the world's most dynamic economies. Many Indian companies and universities have invested in developing next-generation technologies such as flexible electronics. India is the fastest growing economy in the world. India has a strong position in flexible barrier films for the electronics market. As a result, the innovation and application potential of related technologies are expected to be realized sooner in India.

The china flexible barrier films for electronics market accounted for the market share of 12.5% in 2024. China has little equipment and materials infrastructure to support flexible electronics manufacturing. At the same time, the country is seeing a surge in investment from companies looking to enter the production of AMOLED (active-matrix organic light-emitting diode) displays. This is due to market potential consisting of consumer demand and government willingness to fund large scale investments in production capacity.

Moreover, China will have a significant impact on the development of global competition in the flexible barrier films for electronics. This is because the market can create massive demand through increased production efficiency and yield.

Flexible electronics to held the largest market share of flexible barrier films for electronics market during forecast period which is accounted for 45.6% in 2024. The growth of flexible electronics segment is due to its portability, low manufacturing cost, and light weight as compared to rigid substrates. With the ability to roll, bend, fold, and adjust, The flexible electronics have applications in the gaming and entertainment industry which enables new and intuitive user interfaces.

Flexible barrier films are widely used in numerous electronic devices for protection against moisture, dust etc. The industries that fall within this domain are the primary producers of consumer electronics, mechatronic components and sensors that are the primary users of flexible barriers. Demand for rising consumer electronics further pushes the growth of the manufacturing industry and its demand for flexible barrier films, allowing this sector to have held the largest market share of 24.5% in 2024.

The flexible electronics market is fragmented. Primarily focused on improving efficiency, manufacturers offer technologically innovative products that offer a range of benefits in terms of energy efficiency and product design. Business players invest in research and development to strengthen their market position.

| Attribute | Details |

|---|---|

| Market Value in 2025 | USD 33.8 Million |

| Market CAGR 2025 to 2035 | 18.7% |

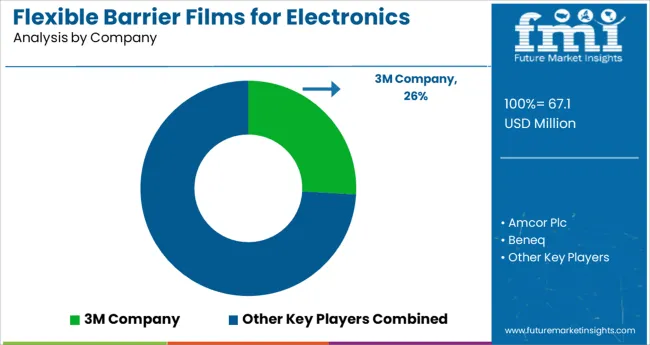

| Share of top 5 players | Around 35% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value |

| Key Region Covered | North America; Latin America; Europe; East Asia; South Asia Pacific; and the Middle East Africa |

| Key Countries Covered | USA, Canada, Germany, UK, France, Italy, Spain, Russia, China, Japan, South Korea, India, Malaysia, Indonesia, Singapore, Australia New Zealand, GCC Countries, Turkey, Northern Africa, and South Africa |

| Key Segments Covered | Product Type, Industry and Region |

| Key Companies Profiled | 3M Company; Amcor Plc; Beneq; Eastman Chemical Company; Fraunhofer Polo Alliance; Honeywell International Inc.; Materion Corporation; Sigma Technologies Int'l, LLC.; Alcan Packaging; Tera-Barrier Films Pte Ltd; Toppan Printing Co., Ltd.; General Electric. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global flexible barrier films for electronics market is estimated to be valued at USD 67.1 million in 2025.

It is projected to reach USD 372.6 million by 2035.

The market is expected to grow at a 18.7% CAGR between 2025 and 2035.

The key product types are photovoltaic, flexible electronics and others.

manufacturing resources segment is expected to dominate with a 42.6% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flexible Packaging Paper Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Pouch Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Rubber Sheets Market Size and Share Forecast Outlook 2025 to 2035

Flexible Printed Circuit Boards Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Machinery Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electronic Market Size and Share Forecast Outlook 2025 to 2035

Flexible Foam Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Flexible Protective Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible AC Current Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Flexible End-Load Cartoner Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Screens Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Display Market Size and Share Forecast Outlook 2025 to 2035

Flexible Substrate Market Size and Share Forecast Outlook 2025 to 2035

Flexible Paper Battery Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Tubing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA