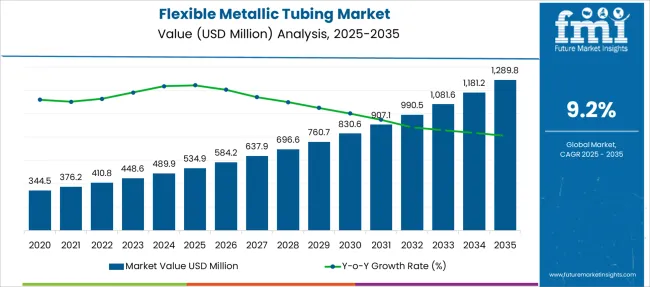

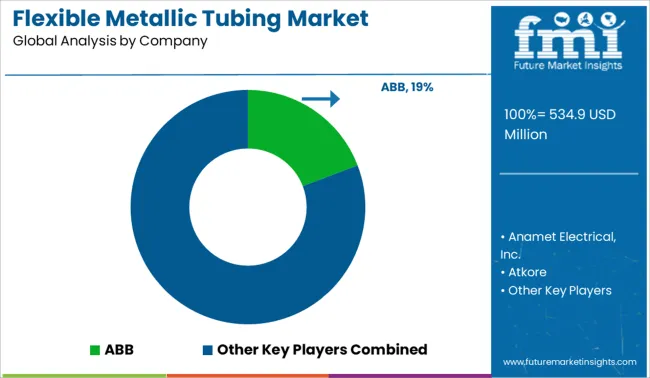

The Flexible Metallic Tubing Market is estimated to be valued at USD 534.9 million in 2025 and is projected to reach USD 1289.8 million by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period.

| Metric | Value |

|---|---|

| Flexible Metallic Tubing Market Estimated Value in (2025 E) | USD 534.9 million |

| Flexible Metallic Tubing Market Forecast Value in (2035 F) | USD 1289.8 million |

| Forecast CAGR (2025 to 2035) | 9.2% |

The flexible metallic tubing market is growing steadily, driven by increasing demand for reliable and adaptable piping solutions across various industrial sectors. The energy industry’s expansion, especially in oil and gas as well as renewable sources, has intensified the need for tubing that can withstand high pressures and temperature variations. Advances in manufacturing techniques have improved product durability and flexibility, making these tubes suitable for complex installations where rigid piping is impractical.

Industrial end users are adopting flexible metallic tubing for its ease of installation and maintenance, reducing downtime and operational costs. Growing infrastructure development and modernization efforts have further boosted market demand.

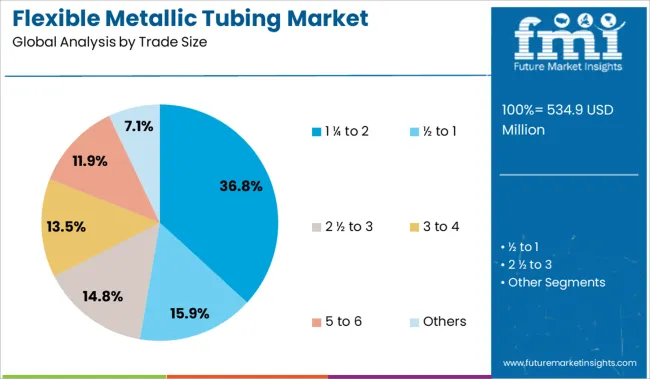

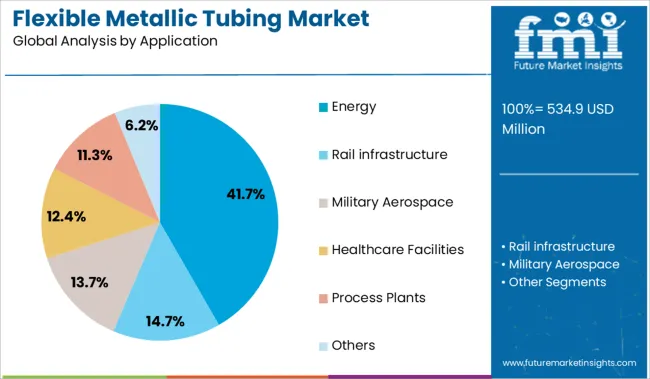

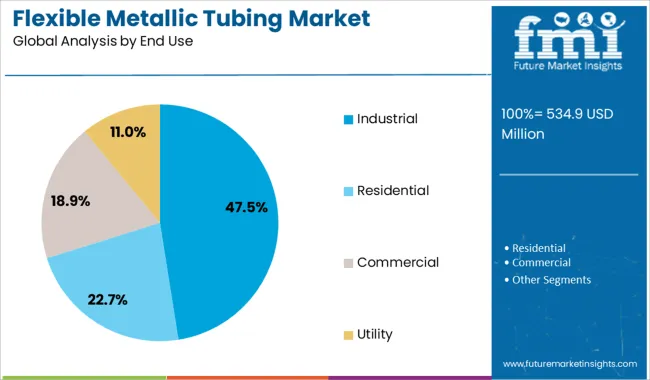

The outlook remains positive as industries continue to prioritize safety and efficiency in fluid and gas transport systems. Segmental growth is expected to be led by the 1 ¼ to 2 inch trade size range, energy sector applications, and industrial end use due to their high consumption rates.

The market is segmented by Trade Size, Application, and End Use and region. By Trade Size, the market is divided into 1 ¼ to 2, ½ to 1, 2 ½ to 3, 3 to 4, 5 to 6, and Others. In terms of Application, the market is classified into Energy, Rail infrastructure, Military Aerospace, Healthcare Facilities, Process Plants, and Others. Based on End Use, the market is segmented into Industrial, Residential, Commercial, and Utility. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 1 ¼ to 2 inch trade size segment is projected to contribute 36.8% of the flexible metallic tubing market revenue in 2025, making it the leading size category. This segment has gained prominence due to its widespread use in medium-scale piping systems that balance flow capacity with installation flexibility. Its size fits well in applications requiring moderate fluid volumes without demanding oversized tubing.

Construction and retrofit projects prefer this range because of its adaptability and cost-effectiveness. As industries seek to optimize system design and reduce material waste, the 1 ¼ to 2 inch tubing remains a preferred choice for many operational setups.

The segment’s compatibility with diverse fittings and connectors further supports its dominant position.

The energy application segment is expected to hold 41.7% of the market revenue in 2025, maintaining its lead among various uses. This segment’s growth is driven by the stringent requirements for tubing in energy production and distribution, including oil and gas extraction, power generation, and renewable energy systems. Flexible metallic tubing is favored for its ability to handle corrosive environments and temperature fluctuations typical of energy sector operations.

Increasing investments in offshore and onshore energy infrastructure have amplified demand for reliable tubing solutions. Furthermore, the segment benefits from growing environmental regulations that require durable and leak-resistant piping systems.

As the energy industry evolves with new technologies and stricter safety standards, flexible metallic tubing remains critical for operational success.

The industrial end-use segment is projected to account for 47.5% of the flexible metallic tubing market revenue in 2025, solidifying its position as the leading consumer. Industrial sectors such as manufacturing, chemical processing, and automotive have adopted flexible metallic tubing for its strength, corrosion resistance, and flexibility in complex machinery layouts.

The need for efficient fluid handling and gas conveyance has propelled its use in critical systems where traditional rigid pipes may not suffice. Maintenance and safety protocols in industrial environments have also emphasized the replacement of older piping with more adaptable tubing solutions.

Expansion in emerging markets’ industrial bases and modernization of existing facilities continue to support the segment’s growth. The versatility of flexible metallic tubing in various industrial processes ensures sustained demand.

The industry faces supply-side constraints from raw material price volatility, import dependency, and limited fabrication capacity in some regions. Simultaneously, stricter quality standards and regulatory fragmentation are increasing compliance costs and hindering cross-border scalability.

Despite strong market fundamentals, the industry is challenged by volatility in raw material prices, especially stainless steel and other specialty alloys, which directly influence tubing costs. Supply chain inefficiencies, including lead time delays and dependency on imports for high-grade alloys, constrain manufacturers’ responsiveness to bulk orders. Smaller manufacturers struggle with limited access to advanced fabrication machinery, which hampers their ability to scale production to meet industrial-grade specifications, particularly in regions where infrastructure development is lagging.

The market also faces growing scrutiny around product performance, especially in applications with high safety requirements such as nuclear, aerospace, and chemical processing. Increasing enforcement of international quality certifications (e.g., ISO, ASTM) adds to production costs and time for compliance testing. Inadequate standardization across regions—such as differing pressure ratings and material grades- poses export hurdles for manufacturers aiming to expand into multiple countries. These fragmented regulations often lead to design modifications, which limit cost optimization and standard production cycles.

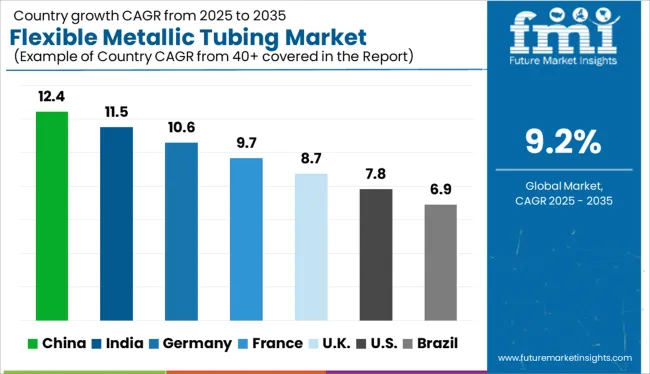

| Country | CAGR |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| France | 9.7% |

| UK | 8.7% |

| USA | 7.8% |

| Brazil | 6.9% |

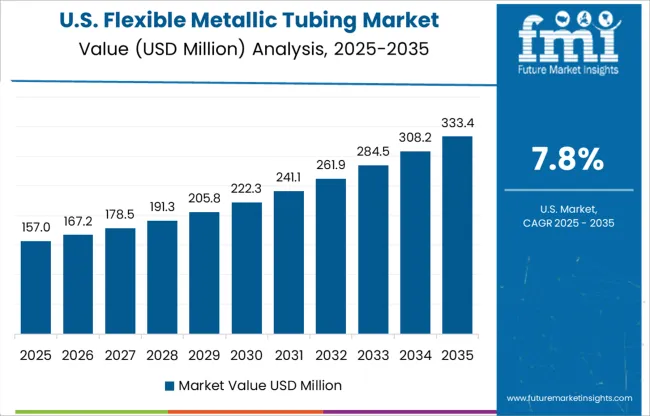

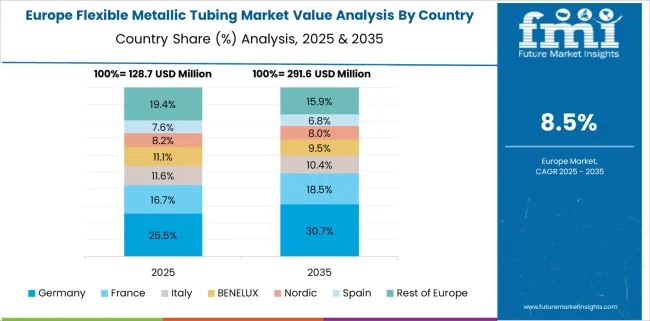

The global flexible metallic tubing market is projected to expand at a CAGR of 9.2% from 2025 to 2035, supported by rising applications in HVAC, energy infrastructure, and industrial automation. Demand is further amplified by the need for corrosion-resistant, high-durability tubing solutions across diverse end-use sectors. BRICS economies are outperforming the global average, with China growing at 12.4% and India at 11.5%. This growth is driven by large-scale urbanization, expansion of oil and gas pipelines, and modernization of building systems. China’s strong industrial base and India’s infrastructure pipeline, especially in power and metro rail networks, are significant contributors. In the OECD cluster, Germany leads with a 10.6% CAGR, owing to its strength in precision engineering and industrial retrofits. The UK (8.7%) and the US (7.8%) show solid adoption across aerospace, defense, and smart construction projects. ASEAN countries, while smaller in market size, are increasingly integral as manufacturing hubs and exporters of cost-effective metallic tubing solutions.

The CAGR for the UK flexible metallic tubing market increased from approximately 6.4% during 2020–2024 to 8.7% for 2025–2035, reflecting enhanced industrial pipeline upgrades and broader retrofitting efforts in mechanical and HVAC infrastructure. Between 2020 and 2024, demand was subdued due to post-Brexit regulatory disruptions and stagnant manufacturing growth. However, as of 2025, rising investments in energy-efficient building systems and automotive exhaust management are driving renewed momentum. Industrial retrofits in Tier-2 cities, coupled with OEM contracts for aerospace-grade tubing, have contributed to long-term growth projections. British manufacturers have also scaled exports within the EU and EFTA, following harmonization with regional metal standards.

India’s market registered a CAGR increase from 7.9% during 2020–2024 to 11.5% for 2025–2035, supported by accelerated infrastructure development and urban pipeline projects. Earlier growth was moderate due to limited precision manufacturing capabilities and low per capita industrial tubing consumption. From 2025 onward, the “Make in India” initiative and PLI schemes have prompted expansion in domestic tubing production. Strong demand in railways, refineries, and high-rise building systems is fueling long-term growth. Local firms have also begun partnering with global OEMs to supply flexible metallic tubing tailored for subcontinental climatic conditions.

Germany's market experienced a strong CAGR climb from 8.3% in 2020–2024 to 10.6% during 2025–2035, driven by a resurgence in manufacturing investments and automation in industrial systems. During the earlier phase, slower demand came from supply chain issues and decelerated construction in Northern Germany. From 2025 onward, however, smart factory integrations across automotive hubs and wider energy transition projects, including hydrogen infrastructure, have necessitated high-precision metallic tubing. Regulatory alignment with EU pressure equipment directives has also fostered strong local production for domestic and intra-EU sales.

China saw its CAGR grow from 8.6% between 2020–2024 to 12.4% for 2025–2035, with rapid industrial expansion and increased adoption of automated assembly lines being key drivers. The initial phase witnessed base-level demand from core sectors like HVAC, shipbuilding, and chemical processing. In the 2025–2035 period, national investments in smart manufacturing clusters across Jiangsu, Zhejiang, and Guangdong are accelerating demand for high-durability tubing solutions. Local manufacturers are also enhancing quality benchmarks to match global pressure and temperature standards, enabling international expansion.

India’s market registered a CAGR increase from 7.9% during 2020–2024 to 11.5% for 2025–2035, supported by accelerated infrastructure development and urban pipeline projects. Earlier growth was moderate due to limited precision manufacturing capabilities and low per capita industrial tubing consumption. From 2025 onward, the “Make in India” initiative and PLI schemes have prompted expansion in domestic tubing production. Strong demand in railways, refineries, and high-rise building systems is fueling long-term growth. Local firms have also begun partnering with global OEMs to supply flexible metallic tubing tailored for subcontinental climatic conditions.

In the flexible metallic tubing market, key players focus on delivering high-quality, durable solutions for industries like oil & gas, automotive, and construction. Companies such as ABB, Atkore, and Southwire Company leverage advanced manufacturing capabilities and broad product portfolios to meet diverse application needs. HellermannTyton and Electri-Flex Company emphasize innovation in flexible conduit and tubing systems, enhancing installation efficiency and compliance with international standards. Regional specialists like Dongguan FlexGlory Machinery Accessories, Shanghai Weyer Electric, and Kaiphone Technology concentrate on cost-effective production and localized supply chains, catering to growing demand in Asia-Pacific markets. Anamet Electrical, Bahra Electric, and Whitehouse Flexible Tubing maintain a strong presence through customized solutions and flexible manufacturing processes, supporting global customers with reliable and scalable tubing products.

| Item | Value |

|---|---|

| Quantitative Units | USD 534.9 Million |

| Trade Size | 1 ¼ to 2, ½ to 1, 2 ½ to 3, 3 to 4, 5 to 6, and Others |

| Application | Energy, Rail infrastructure, Military Aerospace, Healthcare Facilities, Process Plants, and Others |

| End Use | Industrial, Residential, Commercial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Anamet Electrical, Inc., Atkore, Afi Elektromekanik, Bahra Electric, Delikon Electric Flexible Conduit, Dongguan FlexGlory Machinery Accessories Co., Ltd., Eddy Group Limited, Electri-Flex Company, HellermannTyton, Kaiphone Technology Co. Ltd., Southwire Company, LLC., Shanghai Weyer Electric Co., Ltd., United Power, and Whitehouse Flexible Tubing |

| Additional Attributes | Dollar sales trends, market share by region and application, CAGR forecasts, raw material price impacts, competitive landscape, supply chain risks, regulatory changes, and emerging end-use sectors driving demand. |

The global flexible metallic tubing market is estimated to be valued at USD 534.9 million in 2025.

The market size for the flexible metallic tubing market is projected to reach USD 1,289.8 million by 2035.

The flexible metallic tubing market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in flexible metallic tubing market are 1 ¼ to 2, ½ to 1, 2 ½ to 3, 3 to 4, 5 to 6 and others.

In terms of application, energy segment to command 41.7% share in the flexible metallic tubing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flexible Packaging Paper Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Pouch Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Rubber Sheets Market Size and Share Forecast Outlook 2025 to 2035

Flexible Printed Circuit Boards Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Machinery Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electronic Market Size and Share Forecast Outlook 2025 to 2035

Flexible Foam Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Flexible Protective Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible AC Current Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Flexible End-Load Cartoner Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Screens Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Display Market Size and Share Forecast Outlook 2025 to 2035

Flexible Substrate Market Size and Share Forecast Outlook 2025 to 2035

Flexible Paper Battery Market Size and Share Forecast Outlook 2025 to 2035

Flexible Barrier Films for Electronics Market Size and Share Forecast Outlook 2025 to 2035

Flexible Frozen Food Packaging Market Growth - Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA