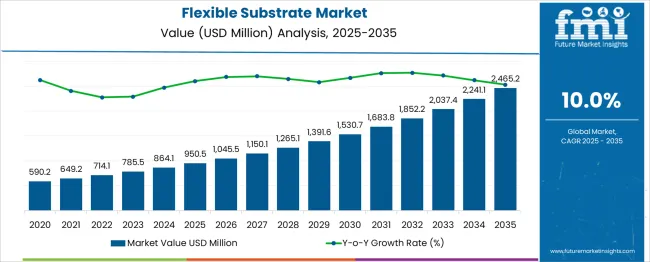

The Flexible Substrate Market is estimated to be valued at USD 950.5 million in 2025 and is projected to reach USD 2465.2 million by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period. Growth momentum analysis shows a strong and accelerating pattern across the forecast horizon, with early gains (2025–2030) adding USD 580 million as the market moves from USD 950.5 million to USD 1,530.7 million, driven by rapid adoption in flexible electronics, OLED displays, wearable devices, and thin-film solar panels.

This initial phase reflects increasing penetration of polymer-based and metal foil substrates, supporting lightweight and bendable designs for consumer electronics. The later period (2030–2035) demonstrates even stronger momentum, contributing USD 934.5 million as the market climbs from USD 1,530.7 million to USD 2,465.2 million, reflecting intensified demand for next-generation flexible circuits in 5G, IoT, and advanced automotive applications.

Rising integration of flexible substrates into medical implants and aerospace systems further boosts market acceleration. Competitive positioning will favor manufacturers developing high thermal stability substrates, ultra-thin barrier coatings, and eco-friendly material solutions aligned with evolving performance and sustainability benchmarks. The compounding growth trajectory underscores a transition from niche applications to mainstream adoption, making this segment a critical enabler in future electronics manufacturing.

| Metric | Value |

|---|---|

| Flexible Substrate Market Estimated Value in (2025 E) | USD 950.5 million |

| Flexible Substrate Market Forecast Value in (2035 F) | USD 2465.2 million |

| Forecast CAGR (2025 to 2035) | 10.0% |

The flexible substrate market captures a distinctive value in advanced material ecosystems. Within the flexible electronics and circuit materials market, it holds 25–28%, driven by integration into foldable displays, flexible PCBs, and stretchable sensors. In the consumer electronics segment, its share reaches 30–32%, reflecting widespread use in smartphones, smartwatches, and wearables where flexibility is essential. For the medical and wearable devices market, it contributes 10–12%, as flexible films are integrated into health patches and diagnostic devices. In the solar and renewable energy film substrate category, the share is 8–10%, used in emerging roll-to-roll solar cells and bending photovoltaic modules. Within aerospace, automotive, and sensor applications, flexible substrates account for 5–6%, where weight-sensitive electronic interfaces and conformal sensors are increasingly adopted.

The market growth is propelled by ongoing miniaturization of electronics, rising demand for foldable and conformable devices, and rapid expansion of medical wearables. Innovations in polymer substrates, transparent conductive films, and fabrication methods like roll-to-roll coating are enhancing manufacturability and performance, positioning flexible substrate materials as mission-critical components in next-generation electronics and renewable energy systems.

The Flexible Substrate market is witnessing accelerated growth as manufacturers increasingly prioritize lightweight, bendable, and high-performance materials across modern electronics and smart devices. The market's advancement is being supported by technological progress in printed electronics, the rising demand for flexible displays, and the growing need for compact and portable electronic products.

Future growth is expected to be reinforced by the integration of flexible substrates in emerging areas such as foldable smartphones, wearable sensors, and next-generation medical devices. Additionally, cost advantages associated with roll-to-roll processing and substrate miniaturization are creating opportunities for widespread adoption.

Government initiatives aimed at boosting domestic manufacturing and the shift toward sustainable, low-power electronics are further influencing this expansion. As industries transition toward thinner, lighter, and more durable materials to meet the requirements of advanced electronics and energy systems, flexible substrates are projected to remain central to this transformation, providing a resilient platform for future innovation..

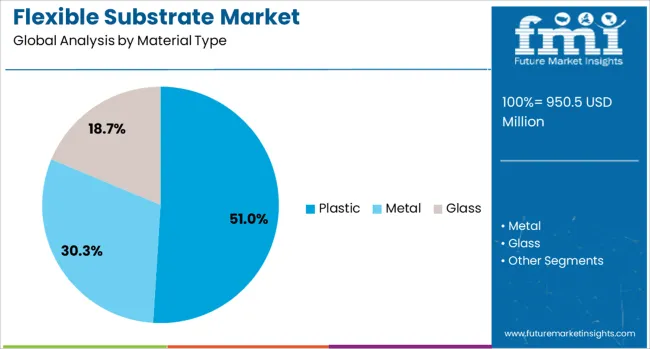

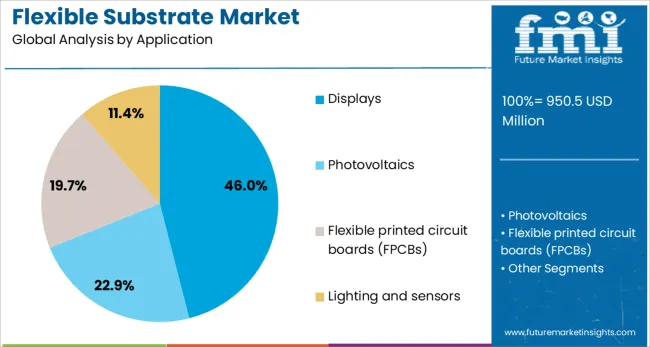

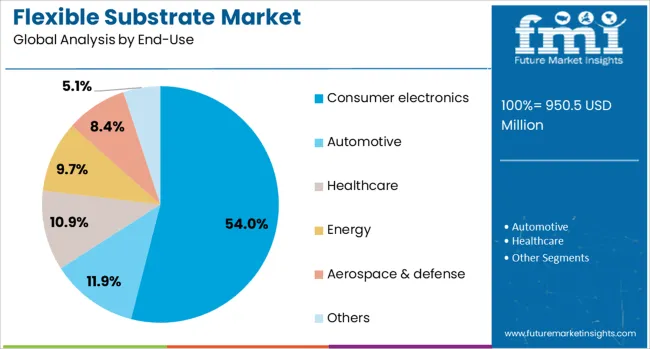

The flexible substrate market is segmented by material type, application, and end-use and geographic regions. The flexible substrate market is divided into Plastic, Metal, and Glass by material type. The flexible substrate market is classified into Displays, Photovoltaics, Flexible printed circuit boards (FPCBs), and Lighting and sensors. The flexible substrate market is segmented based on end-use into Consumer electronics, Automotive, Healthcare, Energy, Aerospace & defense, and Others. Regionally, the flexible substrate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic subsegment within the material type segment is expected to hold 51% of the Flexible Substrate market revenue share in 2025, making it the dominant material in use. The leadership of this subsegment has been driven by the inherent advantages of plastic substrates including light weight, high flexibility, and cost-effective mass production. Their thermal and mechanical durability has allowed them to be widely adopted in high-performance electronics where bending, folding, or stretching capabilities are critical.

Plastic substrates have also been increasingly utilized in flexible circuit boards, OLED panels, and photovoltaic modules due to their compatibility with advanced deposition technologies. Manufacturers have favored plastics due to their adaptability in roll-to-roll fabrication processes, which enable efficient scaling for commercial applications.

As the need for portable and wearable electronics rises globally, plastic has been recognized as the most versatile and scalable solution in material selection. Its dominance in the market is expected to be sustained by continued improvements in polymer engineering and demand for flexible electronics..

The displays subsegment in the application category is anticipated to represent 46% of the Flexible Substrate market revenue share in 2025, positioning it as the leading area of application. This has been driven by the rapid evolution of consumer electronics requiring ultra-thin, bendable display modules, including smartphones, tablets, and wearable screens.

The transition toward flexible OLED and AMOLED technologies has further intensified the demand for substrates that can accommodate curved and foldable designs. The displays subsegment has also benefited from innovations in display backplane materials and improvements in manufacturing precision, allowing higher resolution and better power efficiency.

As flexible substrates continue to be optimized for conductivity and durability, they have been adopted as the foundation layer for cutting-edge display panels. This application has grown substantially due to the commercial launch of foldable and rollable screens, and the expected adoption of these technologies across multiple device categories is projected to reinforce the segment’s top market position..

The consumer electronics subsegment within the end-use category is projected to account for 54% of the Flexible Substrate market revenue share in 2025, making it the dominant area of end use. The widespread integration of flexible substrates in smartphones, wearable devices, and next-generation laptops has played a central role in this growth. Enhanced product design flexibility, coupled with growing consumer preference for lightweight and durable devices, has supported the increased use of flexible substrates in electronic assemblies.

This end-use segment has also benefited from greater adoption of energy-efficient technologies and the miniaturization of electronic components, where flexible substrates enable compact configurations without compromising performance. Consumer electronics manufacturers have been deploying these materials to meet the rising expectations for device innovation, portability, and connectivity.

In response to market competition and evolving design standards, the use of advanced substrates that support flexible circuitry and bendable screens has become more prevalent. These trends are expected to sustain the segment's leadership in the foreseeable future..

Flexible substrates consist of bendable materials such as polyimide, polyethylene terephthalate, or metal foils used in printed electronics, wearable devices, and flexible display technologies. Their use has increased in applications like flexible solar panels, rollable screens, RFID tags, and medical sensors. Growth has been influenced by demand for low-profile, conformable circuit platforms capable of bending without losing electrical performance.

Suppliers providing substrates with controlled thermal expansion, excellent dielectric strength, and consistent surface finish have been favored. Products enabling reliable adhesion, high throughput processing, and thermal and moisture stability continue to shape selection in prototyping and mass-production environments.

Demand for flexible substrates has been strengthened by next-generation consumer electronics requiring thin and bendable circuit elements for foldable phones, smart wearables, and conformal medical sensors. Compact design requirements and form factor innovation in automotive infotainment displays and flexible lighting strips have encouraged module-level integration. The ability to conform to curved surfaces and support wearable or rollable formats has become important in product differentiation. Equipment and product manufacturers aiming for seamless assembly and compact electronics platforms continue to rely on flexible materials. High frequency signal integrity, thermal resistance, and manufacturability improvements have reinforced interest in advanced substrate types.

The elevated cost of specialty film substrates and complex fabrication steps such as surface treatment, lamination, or thermal curing has limited growth. Precise control of thickness, dielectric uniformity, and adhesion during multilayer processing requires skilled quality control and equipment calibration. Variability in the substrate coefficient of thermal expansion across lots may compromise reliability under thermal cycles. Integration of flexible substrates into automated assembly lines requires custom fixtures and process validation, increasing setup time and cost. Component placement precision and registration tolerance challenges are intensified on bendable platforms. Inconsistent supplier certification or limited aging data hinders confidence among automotive and medical grade consumers.

Opportunities exist in the development of application-specific substrate formulations tailored to sectors such as wearable health monitors, flexible photovoltaics, and soft robotics. Co-engineering partnerships with electronics OEMs to deliver substrate and assembly system packages enable faster deployment. Expansion into smart label packaging and low-cost RFID implementations continues to unlock high-volume use cases. Development of substrates compatible with roll-to-roll processing and additive printed electronics supports scalable fabrication. Growth in flexible sensor networks for structural monitoring or smart textiles presents an ongoing application space. Subscription or volume-agreement concepts with substrate suppliers help reduce cost uncertainty for product developers launching flexible hardware lines.

Hybrid substrate designs combining metal foil reinforcement, polymer overlays, or mesh structures are being developed to balance flexibility with mechanical strength. Adoption of digital printing platforms for conductive inks on flexible films has accelerated prototyping and product iteration speed. Growth in barrier-coated films that resist moisture and oxygen has improved longevity for wearable and display applications. Standards for flexible object durability under bending cycles and temperature extremes are emerging. Integration with edge computing modules or flexible battery packs is influencing substrate design. Recycling protocols and end-of-use traceability systems for thin-film substrates are being explored to improve lifecycle transparency. Standardized interface layers for chip and connector attachments continue to enhance manufacturing compatibility.

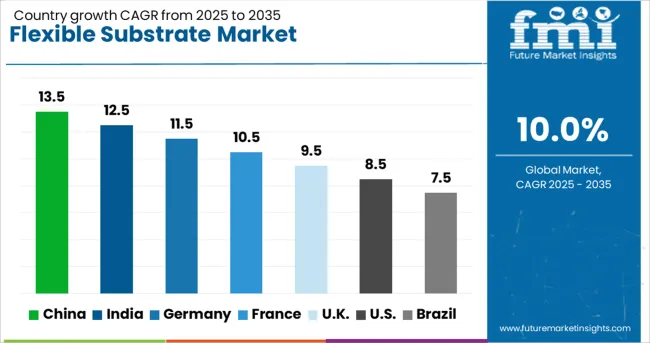

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

The flexible substrate market is projected to grow at a CAGR of 10.0% from 2025 to 2035, driven by the rising adoption of flexible electronics, wearable devices, OLED displays, and advanced photovoltaic systems. China, a leading BRICS economy, dominates with a CAGR of 13.5%, fueled by large-scale electronics manufacturing and rapid integration of flexible displays. India, also part of BRICS, follows at 12.5%, driven by consumer electronics growth and government-backed solar initiatives. Among OECD nations, Germany grows at 11.5%, focusing on automotive electronics and printed circuits, while the United Kingdom records 9.5% and the United States posts 8.5%, supported by innovation in aerospace, healthcare, and energy applications. The analysis includes over 40 countries, with the top five detailed below.

China is expected to register a CAGR of 13.5% through 2035, driven by rapid development in flexible OLED panels, printed circuit boards, and next-generation wearable devices. Strong manufacturing capabilities and government-backed initiatives for electronics innovation make China a global hub for flexible substrate production. Manufacturers are investing heavily in polyimide films and transparent conductive materials, targeting applications in foldable smartphones, automotive displays, and 5G-enabled devices. Integration of flexible substrates in solar power systems and energy storage solutions adds further momentum. Strategic collaborations between domestic players and international electronics giants continue to reinforce the dominance of China in this sector.

India is projected to post a CAGR of 12.5% through 2035, supported by strong growth in electronics manufacturing, renewable energy projects, and IoT-enabled devices. Government programs promoting domestic electronics and large-scale solar deployments are creating a favorable environment for flexible substrate adoption. Indian manufacturers are introducing cost-effective options for consumer electronics, while global firms cater to high-end requirements in medical and automotive electronics. Expanding applications in wearable healthcare devices and smart sensors further boost the market outlook. Partnerships between Indian startups and international technology firms are accelerating access to advanced materials and high-performance flexible substrates.

Germany is expected to grow at a CAGR of 11.5% through 2035, driven by technological advancements in automotive electronics, industrial automation, and healthcare equipment. Flexible substrates are increasingly used in high-performance printed circuits and OLED lighting solutions, supporting energy-efficient design trends. German firms lead in developing biodegradable and recyclable materials, aligning with EU directives for sustainable electronics production. Growth in electric vehicles and autonomous driving technologies has accelerated adoption of advanced flexible circuits in safety and infotainment systems. Strong collaborations between research institutions and manufacturing companies continue to foster product innovation and improve reliability in demanding environments.

The United Kingdom is forecasted to record a CAGR of 9.5% through 2035, driven by demand for wearable electronics, flexible healthcare devices, and aerospace applications. Manufacturers are developing transparent conductive films and flexible polyimide substrates to meet performance needs in medical sensors and monitoring devices. Growth in smart infrastructure projects and renewable energy systems creates new opportunities for substrate integration in advanced electronics. Research partnerships between UK universities and global firms are focusing on miniaturization and multi-functional designs for industrial and consumer markets. The rise in consumer preference for portable devices further accelerates flexible substrate deployment.

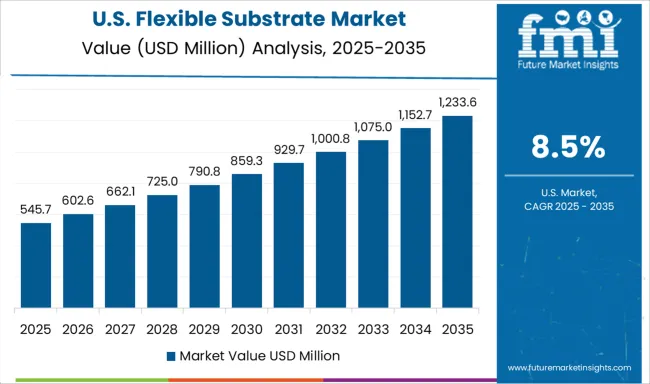

The United States is expected to grow at a CAGR of 8.5% through 2035, supported by applications in aerospace systems, defense electronics, and high-end consumer devices. Flexible substrates are increasingly used in printed sensors, RFID tags, and OLED displays, enabling lightweight and compact designs. USA manufacturers are investing in high-strength polyimide films and advanced organic substrates to improve durability and thermal resistance. Growth in electric vehicles and energy storage applications creates demand for reliable, flexible materials. Strategic collaborations between tech firms and research institutions are accelerating the commercialization of flexible electronics in healthcare monitoring and military-grade devices.

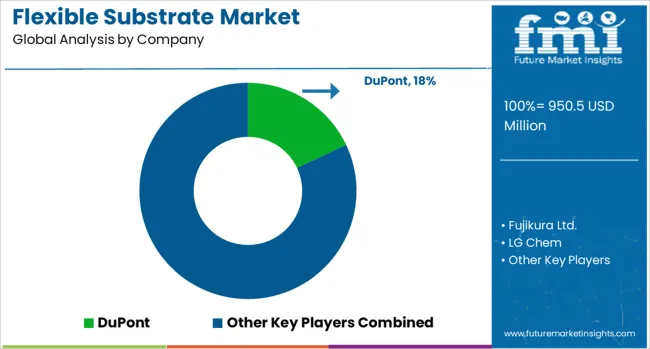

The flexible substrate market is dominated by global material and electronics giants such as DuPont, Fujikura Ltd., LG Chem, 3M Company, Sumitomo Electric Industries, Flexium Interconnect, and Nippon Electric Glass Co., Ltd. DuPont leads with advanced polyimide films and flexible electronic materials used in OLED displays, flexible printed circuits, and wearable devices. Fujikura and Flexium Interconnect specialize in flexible printed circuit substrates, serving high-reliability applications in automotive electronics, smartphones, and IoT devices. LG Chem focuses on developing polymer-based substrates for next-generation display technologies, emphasizing mechanical flexibility and high thermal stability.

3M Company offers adhesive and functional film solutions that enhance durability and performance in flexible electronic assemblies, while Sumitomo Electric Industries leverages material science expertise to supply high-strength, lightweight substrates for communication and sensor systems. Nippon Electric Glass stands out with glass-based flexible substrates designed for high-frequency applications in advanced displays and semiconductor packaging. Competitive advantages in this market depend on properties such as dimensional stability, dielectric performance, and adaptability to miniaturized electronic designs. Entry barriers are high due to the complexity of manufacturing, demand for precision engineering, and strict quality standards in electronics and display applications. Strategic initiatives include investment in next-generation flexible materials for foldable smartphones, transparent displays, and flexible solar panels, along with partnerships with OEMs to accelerate adoption.

| Item | Value |

|---|---|

| Quantitative Units | USD 950.5 Million |

| Material Type | Plastic, Metal, and Glass |

| Application | Displays, Photovoltaics, Flexible printed circuit boards (FPCBs), and Lighting and sensors |

| End-Use | Consumer electronics, Automotive, Healthcare, Energy, Aerospace & defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DuPont, Fujikura Ltd., LG Chem, 3M Company, Sumitomo Electric Industries, Flexium Interconnect, and Nippon Electric Glass Co., Ltd. |

| Additional Attributes | Dollar sales by material type (polyimide, PET, metal foils, flexible glass) and application (flexible displays, printed electronics, solar cells, medical devices), with demand fueled by lightweight, thin, and bendable electronics. Regional dynamics indicate Asia-Pacific as the dominant production hub due to strong consumer electronics manufacturing, while North America and Europe lead in advanced R&D for high-performance flexible substrates. Innovation trends include development of ultra-thin glass substrates, low-cost roll-to-roll processing for mass production, and integration of conductive layers for multifunctional electronic systems. |

The global flexible substrate market is estimated to be valued at USD 950.5 million in 2025.

The market size for the flexible substrate market is projected to reach USD 2,465.2 million by 2035.

The flexible substrate market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in flexible substrate market are plastic, _polyimide (pi), _polyethylene naphthalate (pen), _polyethylene terephthalate (pet), metal, _aluminum, _copper and glass.

In terms of application, displays segment to command 46.0% share in the flexible substrate market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flexible Packaging Paper Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Pouch Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Rubber Sheets Market Size and Share Forecast Outlook 2025 to 2035

Flexible Printed Circuit Boards Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Machinery Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electronic Market Size and Share Forecast Outlook 2025 to 2035

Flexible Foam Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Flexible Protective Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible AC Current Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Flexible End-Load Cartoner Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Screens Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Display Market Size and Share Forecast Outlook 2025 to 2035

Flexible Paper Battery Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Tubing Market Size and Share Forecast Outlook 2025 to 2035

Flexible Barrier Films for Electronics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA