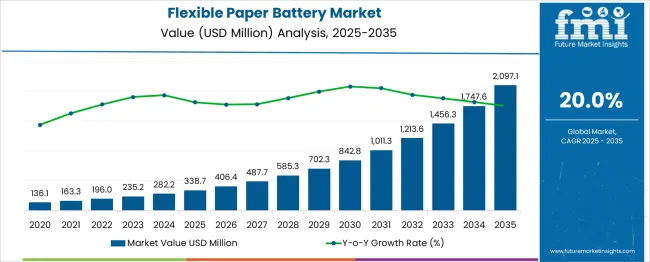

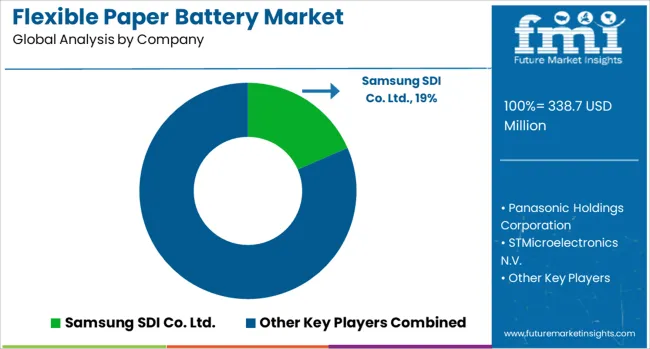

The Flexible Paper Battery Market is estimated to be valued at USD 338.7 million in 2025 and is projected to reach USD 2097.1 million by 2035, registering a compound annual growth rate (CAGR) of 20.0% over the forecast period.

| Metric | Value |

|---|---|

| Flexible Paper Battery Market Estimated Value in (2025 E) | USD 338.7 million |

| Flexible Paper Battery Market Forecast Value in (2035 F) | USD 2097.1 million |

| Forecast CAGR (2025 to 2035) | 20.0% |

The flexible paper battery market witnesses increasing demand for compact, lightweight, and environmentally friendly energy storage solutions for next-generation electronics. These batteries, known for their biodegradability and flexible form factor, are increasingly being adopted in wearable devices, smart packaging, and low-power IoT applications.

The convergence of miniaturized electronics and the push for sustainable alternatives to traditional battery materials drives the market. Ongoing advancements in nanocellulose substrates, conductive inks, and energy-dense chemistries are accelerating commercial viability.

The future trajectory remains positive, with growing R&D investments focused on improving energy density, cycle stability, and compatibility with emerging flexible electronic systems. As consumer electronics, medical devices, and smart sensors evolve, flexible paper batteries are expected to become integral components in supporting portable, flexible, and eco-conscious technologies.

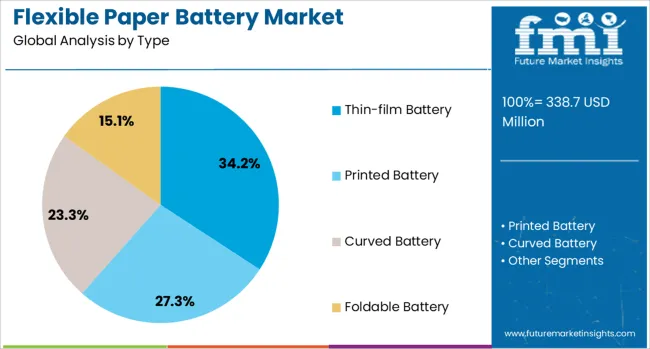

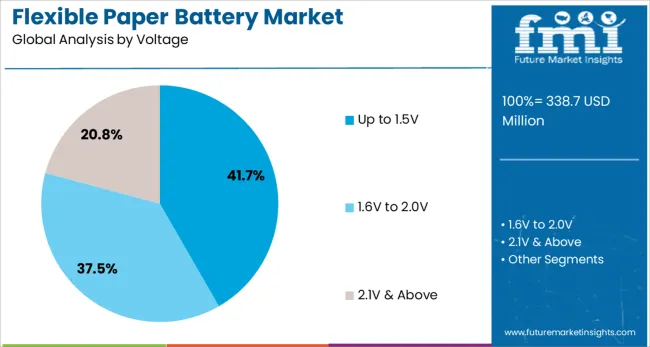

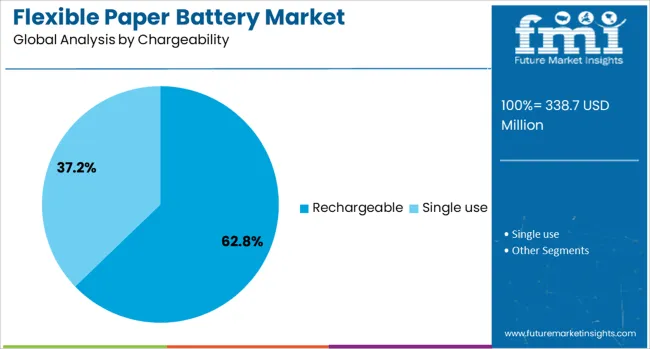

The flexible paper battery market is segmented by type, voltage, chargeability, electrolyte, material, and application and geographic regions. By type of the flexible paper battery market is divided into Thin-film Battery, Printed Battery, Curved Battery, and Foldable Battery. In terms of voltage of the flexible paper battery market is classified into Up to 1.5V, 1.6V to 2.0V, and 2.1V & Above. Based on chargeability of the flexible paper battery market is segmented into Rechargeable and Single use. By electrolyte of the flexible paper battery market is segmented into Aqueous and Non-aqueous. By material of the flexible paper battery market is segmented into Graphene, Lithium, Silver, and Carbon Nanotubes. By application of the flexible paper battery market is segmented into Smart Packaging, Smart Cards, Consumer Electronics, Medical Devices, Entertainment, Transportation, Energy Harvesting, and Others. Regionally, the flexible paper battery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The thin-film battery segment leads the flexible paper battery market with a 34.2% share, driven by its high compatibility with compact and flexible electronic applications. Thin-film configurations offer advantages such as minimal thickness, enhanced mechanical flexibility, and the ability to operate efficiently in low-power environments.

These attributes make them particularly suitable for integration in medical patches, smart cards, and wearable sensors where form factor constraints are critical. Growth in this segment is further supported by improvements in solid-state electrolyte formulations and deposition techniques that enhance performance and safety.

As consumer and industrial demand increases for devices requiring low-profile energy sources, the thin-film battery segment is expected to remain at the forefront of innovation, with continued adoption across healthcare, electronics, and packaging sectors.

The up to 1.5V segment holds a commanding 41.7% market share within the voltage category, supported by its widespread suitability for low-voltage electronic applications. Batteries in this range are widely utilized in devices that require minimal energy output but demand compactness, reliability, and safe discharge characteristics.

Their integration into disposable medical diagnostics, smart labels, and remote sensors has contributed significantly to segment expansion. Manufacturers continue to develop novel electrode and electrolyte compositions to enhance voltage consistency and operational stability at these lower ranges.

As the need for lightweight and flexible power solutions grows, especially in single-use or ultra-portable electronics, this voltage range is expected to maintain strong relevance and steady demand.

The rechargeable segment dominates the chargeability category with a 62.8% market share, driven by the growing need for sustainable and reusable power solutions in wearable and consumer electronics. Rechargeable flexible paper batteries offer advantages such as reduced long-term cost, lower environmental impact, and greater user convenience, making them increasingly attractive in high-use applications.

Technological advancements have significantly improved recharge cycle life and energy retention, which are critical factors for performance-sensitive products. Additionally, ongoing research in flexible electrode materials and solid electrolytes continues to enhance the safety and efficiency of rechargeable formats.

As the market shifts toward greener energy alternatives and circular product design, the rechargeable segment is positioned to expand further, reinforcing its leadership in the flexible paper battery market.

Flexible paper batteries are gaining traction in wearables, medical devices, and smart packaging due to their lightweight and adaptable design. Compatibility with printed electronics and thin-film technologies is driving demand for low-cost, high-performance energy solutions across various applications.

The use of flexible paper batteries has grown due to their lightweight construction and adaptability for compact devices. Adoption in wearable electronics, smart packaging, and medical sensors has been encouraged by rising consumer demand for flexible energy solutions that maintain reliability without adding bulk. Manufacturers have prioritized designs compatible with curved surfaces, enabling broader application in health monitoring devices and smart cards. Demand has increased because traditional rigid batteries fail to deliver similar flexibility and weight advantages. Integration into single-use diagnostic kits and IoT-connected devices is considered a critical driver since it enables improved mobility and cost efficiency. This trend has been supported by partnerships between material developers and electronics firms to create scalable solutions for mass production.

The flexible paper battery sector has been strengthened by its compatibility with printed electronics and thin-film technologies. Production processes that allow printing conductive layers on biodegradable substrates have accelerated interest among packaging companies aiming for compact power sources. The advantage of using low-cost fabrication methods with improved energy density is attracting investment in next-generation energy storage formats. Manufacturers have started exploring hybrid chemistries that combine zinc-based or lithium-based materials with paper substrates for superior discharge performance. Growth is expected to remain strong in electronic labels, pharmaceutical packaging, and portable sensors, where thin profiles are essential. This shift toward lighter and safer alternatives is anticipated to drive new partnerships in supply chains involving chemical producers, converters, and device manufacturers.

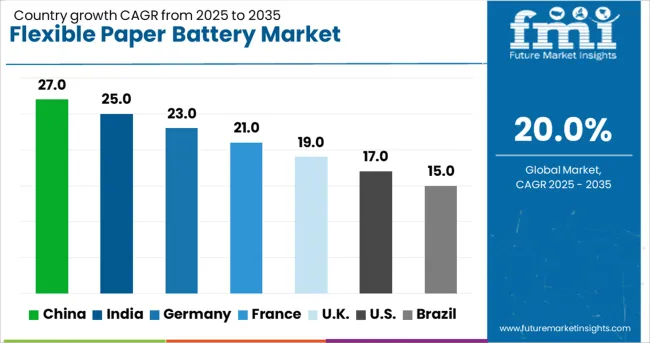

| Country | CAGR |

|---|---|

| China | 27.0% |

| India | 25.0% |

| Germany | 23.0% |

| France | 21.0% |

| UK | 19.0% |

| USA | 17.0% |

| Brazil | 15.0% |

The flexible paper battery market, projected to grow at a global CAGR of 20.0% from 2025 to 2035, shows strong variation across leading countries. A 27.0% CAGR is being recorded in China, a BRICS member, supported by large-scale manufacturing capacity and integration into wearable and smart packaging applications. A 25.0% CAGR is being achieved in India, another BRICS member, where demand is driven by healthcare devices and low-cost energy solutions for connected systems. Germany, an OECD member, is observing a 23.0% CAGR fueled by advancements in printed electronics and strong adoption across medical sensors. The United Kingdom, an OECD member, is reporting a 19.0% CAGR as innovation centers drive development in thin-film energy storage technologies. The United States, also an OECD member, shows a 17.0% CAGR backed by investment in consumer electronics and diagnostic device integration. Rapid growth in BRICS nations, particularly China and India, signals significant production and export opportunities, while OECD countries are maintaining momentum through innovation and strategic partnerships. The report includes a detailed analysis of over 40 countries, with the top five shared for reference.

The United Kingdom is anticipated to grow at a 19.0% CAGR, fueled by research-led innovation in thin-film energy storage and healthcare technology integration. This acceleration is attributed to the commercialization of printed electronics and thin-film battery technologies that improved discharge efficiency. Research funding in universities and R&D centers created pathways for scalable production, while government-backed innovation funds promoted adoption in wearables and digital authentication systems. Increased collaborations between material suppliers and device manufacturers introduced eco-friendly alternatives to lithium-ion batteries in packaging and medical sensors.

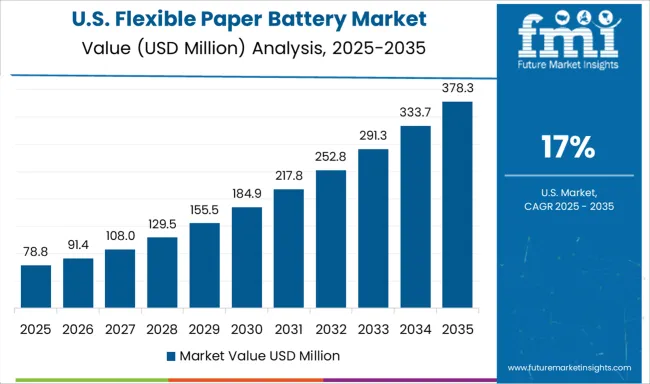

The US market increased from 9.0% CAGR during 2020-2024 to 17.0% for 2025-2035, driven by rising integration in smart packaging, diagnostic kits, and low-power IoT devices. Increased funding in advanced material research accelerated the introduction of hybrid chemistries capable of enhancing battery safety and energy density. Medical device manufacturers adopted flexible energy components for connected health monitoring tools to meet stringent compliance requirements. Strategic partnerships between battery innovators and consumer electronics brands stimulated faster prototyping and commercialization. The growth trajectory was strengthened by expanding industrial applications for printed and thin-film technologies in pharmaceutical packaging and asset tracking.

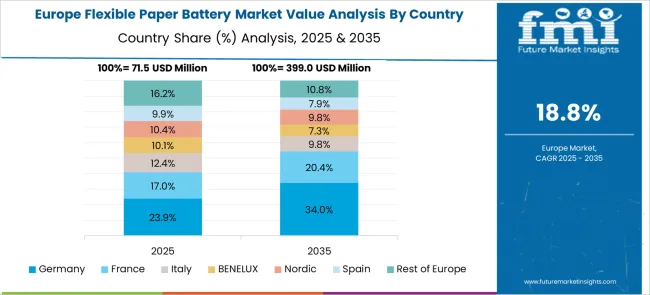

The CAGR in Germany progressed from 10.2% in 2020-2024 to 23.0% during 2025-2035, with strong momentum from innovations in printed energy technologies. Enhanced demand from smart pharmaceutical packaging, combined with government incentives for eco-friendly energy solutions, influenced wider adoption. Industrial suppliers focused on improving thin-film deposition methods to reduce production costs and improve durability. German electronic component manufacturers leveraged domestic R&D infrastructure to build niche applications in logistics and connected healthcare systems. Increased participation in EU-funded projects for sustainable energy alternatives created export advantages for German companies producing flexible energy solutions for electronic labels and tracking devices.

India moved from 11.8% /CAGR during 2020–2024 to 25.0% for 2025-2035, attributed to increasing adoption across consumer wearables and medical devices. Domestic production received a boost from Make-in-India policies encouraging energy storage innovation. Cost-effective zinc-based paper batteries dominated local manufacturing clusters, while global partnerships introduced advanced chemistries to improve energy density. Growth was accelerated by the surge in electronic exports and increased e-commerce penetration of portable healthcare devices. State-funded research programs strengthened the ecosystem for flexible energy technologies that could meet both industrial and consumer demand at affordable price points.

The flexible paper battery market in China is projected to grow at a CAGR of 27.0% between 2025 and 2035, maintaining its leadership position through aggressive manufacturing expansion. Government-driven initiatives for next-generation energy storage supported localized production in Guangdong and Jiangsu clusters. Large-scale adoption occurred in electronic labels, connected medical diagnostics, and payment authentication systems requiring ultra-thin energy components. Partnerships with multinational electronics brands brought advanced hybrid chemistries and automated printing processes into commercial use. The market’s high-growth trajectory is further reinforced by its integration with the country’s robust IoT infrastructure and extensive consumer electronics supply chain.

In the flexible paper battery market, major players are focusing on ultra-thin energy storage systems optimized for smart wearables, medical diagnostics, and IoT-based packaging applications. Companies like Samsung SDI Co. Ltd. and Panasonic Holdings Corporation have invested heavily in advanced chemistries and roll-to-roll manufacturing processes to enhance energy density and production scalability. These brands are working on integration with flexible substrates, ensuring compatibility with next-generation consumer electronics and pharmaceutical tracking systems. Specialized innovators such as BrightVolt Solid State Batteries and Enfucell OY are targeting niche applications through printable and paper-based battery designs. Their strategies involve cost-efficient fabrication for single-use medical devices and smart labels requiring low-profile energy solutions. STMicroelectronics N.V., leveraging its semiconductor expertise, is collaborating with material science companies to develop hybrid micro-energy platforms for sensor-driven ecosystems.

| Item | Value |

|---|---|

| Quantitative Units | USD 338.7 Million |

| Type | Thin-film Battery, Printed Battery, Curved Battery, and Foldable Battery |

| Voltage | Up to 1.5V, 1.6V to 2.0V, and 2.1V & Above |

| Chargeability | Rechargeable and Single use |

| Electrolyte | Aqueous and Non-aqueous |

| Material | Graphene, Lithium, Silver, and Carbon Nanotubes |

| Application | Smart Packaging, Smart Cards, Consumer Electronics, Medical Devices, Entertainment, Transportation, Energy Harvesting, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Samsung SDI Co. Ltd., Panasonic Holdings Corporation, STMicroelectronics N.V., BrightVolt Solid State Batteries, and Enfucell OY |

| Additional Attributes | Dollar sales, share, competitive landscape, pricing trends, raw material availability, regional demand outlook, adoption in medical devices and wearables, R&D pipeline, cost reduction strategies, and regulatory compliance requirements. |

The global flexible paper battery market is estimated to be valued at USD 338.7 million in 2025.

The market size for the flexible paper battery market is projected to reach USD 2,097.1 million by 2035.

The flexible paper battery market is expected to grow at a 20.0% CAGR between 2025 and 2035.

The key product types in flexible paper battery market are thin-film battery, printed battery, curved battery and foldable battery.

In terms of voltage, up to 1.5v segment to command 41.7% share in the flexible paper battery market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flexible Plastic Pouch Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Rubber Sheets Market Size and Share Forecast Outlook 2025 to 2035

Flexible Printed Circuit Boards Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Machinery Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electronic Market Size and Share Forecast Outlook 2025 to 2035

Flexible Foam Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Flexible Protective Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible AC Current Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Flexible End-Load Cartoner Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Screens Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Display Market Size and Share Forecast Outlook 2025 to 2035

Flexible Substrate Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Tubing Market Size and Share Forecast Outlook 2025 to 2035

Flexible Barrier Films for Electronics Market Size and Share Forecast Outlook 2025 to 2035

Flexible Frozen Food Packaging Market Growth - Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA