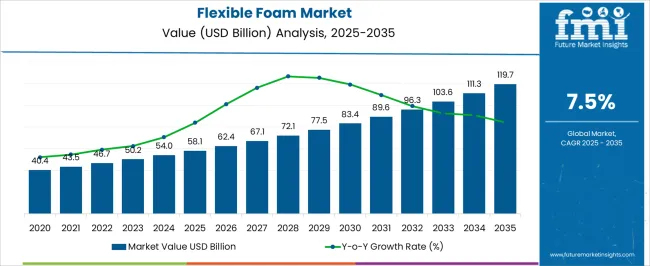

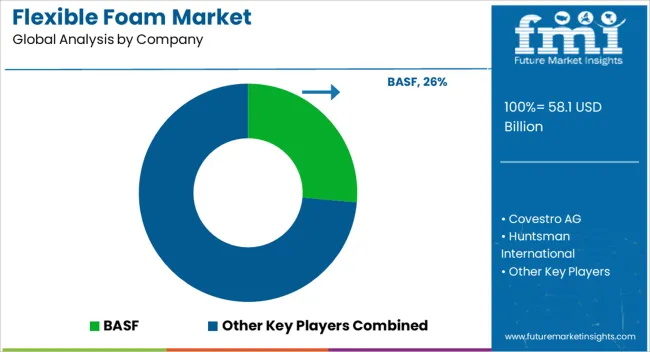

The flexible foam market is estimated to be valued at USD 58.1 billion in 2025 and is projected to reach USD 119.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

The global flexible foam market is projected to grow from 58.1 USD billion in 2025 to 119.7 USD billion by 2035, registering a CAGR of 7.5%. Saturation point analysis indicates periods where market expansion approaches maturity thresholds in specific regions or segments, highlighting phases of slower growth as adoption nears its practical limits. In the initial years, from 2025 to 2028, growth remains steady, fueled by rising demand in bedding, furniture, automotive, and construction applications, with significant room for penetration in emerging markets.

Between 2029 and 2032, accelerated uptake is observed due to technological innovations in high-resilience, memory, and bio-based flexible foams, which open new application areas and enhance product differentiation. Minor deceleration appears around 2033–2034, signaling early signs of saturation in mature regions such as North America and Western Europe, where widespread use has reached near-optimal penetration and incremental demand is largely replacement-driven.

By 2035, overall growth continues but with moderated pace in certain developed regions, while emerging economies sustain expansion due to urbanization, increasing disposable incomes, and industrialization. The annual progression from 58.1 USD billion to 119.7 USD billion illustrates that while the market demonstrates strong long-term growth, saturation points influence regional growth dynamics and segment-specific adoption rates.

| Metric | Value |

|---|---|

| Flexible Foam Market Estimated Value in (2025 E) | USD 58.1 billion |

| Flexible Foam Market Forecast Value in (2035 F) | USD 119.7 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The flexible foam market is strongly shaped by five interconnected parent markets, each contributing differently to overall demand and growth. The furniture and bedding sector holds the largest share at 64.7%, driven by the widespread use of flexible foam in mattresses, cushions, and upholstery, offering comfort and durability. The automotive industry contributes 20%, with flexible foams utilized in vehicle seats, headrests, armrests, and interior panels, providing lightweight and cushioning solutions.

The packaging sector accounts for 5%, employing flexible foams for protective packaging materials, ensuring product safety during transit. The medical and healthcare industry holds a 5% share, using flexible foams in medical devices, wound care products, and cushioning applications. Finally, the construction and insulation sector represents 5%, incorporating flexible foams for thermal and acoustic insulation in buildings.

Collectively, the furniture and bedding, automotive, and packaging sectors account for 90% of overall demand, highlighting that comfort, safety, and protection remain the primary growth drivers, while medical and construction applications provide steady, complementary demand across regions globally.

The flexible foam market is experiencing significant growth, supported by its increasing adoption across furniture, automotive, bedding, and construction industries. Demand is being driven by the material’s unique properties, including lightweight structure, durability, cushioning performance, and adaptability to varied applications. Rising consumer preference for comfortable and ergonomically designed furniture and bedding is influencing the use of flexible foam in commercial and residential settings.

Technological advancements in foam formulations, such as enhanced resilience, fire retardancy, and environmental compliance, are further expanding its application potential. Increasing investments in real estate, hospitality, and office infrastructure are also driving the market, as foam products are essential for seating, upholstery, and interior design solutions.

Additionally, sustainability trends are encouraging manufacturers to adopt recycled or bio-based flexible foam variants, which support environmentally responsible production As urbanization accelerates and the demand for functional, high-quality interior products rises, the flexible foam market is positioned for sustained growth, with manufacturers focusing on product innovation, customization, and integration of advanced materials for enhanced performance.

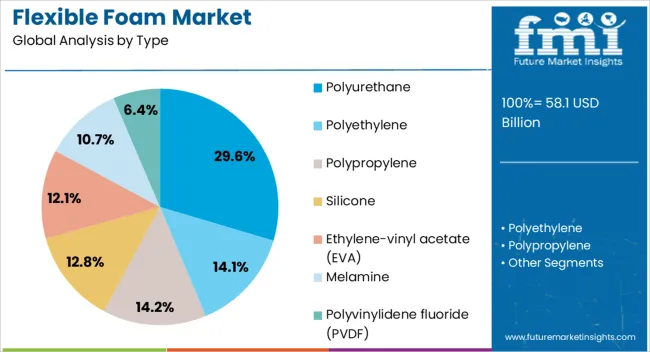

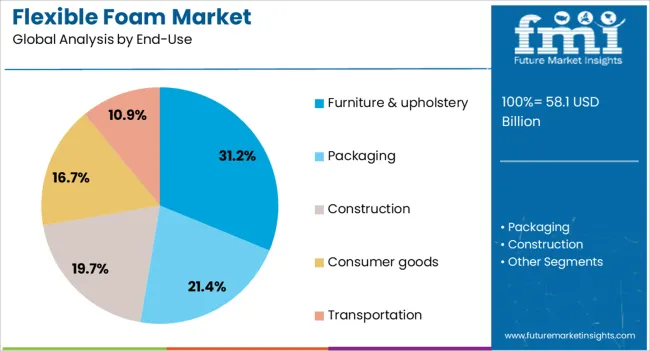

The flexible foam market is segmented by type, end-use, and geographic regions. By type, flexible foam market is divided into polyurethane, polyethylene, polypropylene, silicone, ethylene-vinyl acetate (EVA), melamine, and polyvinylidene fluoride (PVDF). In terms of end-use, flexible foam market is classified into furniture & upholstery, packaging, construction, consumer goods, and transportation. Regionally, the flexible foam industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyurethane type segment is projected to account for 29.6% of the flexible foam market revenue share in 2025, establishing it as the leading product type. Its dominance is being driven by superior cushioning performance, resilience, and versatility, which enable its use in diverse applications such as furniture, automotive seating, and bedding. Polyurethane foam is favored for its ability to maintain shape over time while providing optimal comfort and support, which increases its preference in high-demand environments.

Advances in manufacturing technology have allowed improvements in density control, durability, and fire safety, enhancing its overall performance characteristics. The material’s adaptability to various shapes and ergonomic designs has reinforced its adoption among furniture and mattress manufacturers seeking customizable solutions.

Cost-efficiency and scalability further strengthen its position in the market, as polyurethane foam can be produced in different grades to meet a wide range of performance and budgetary requirements Rising consumer demand for comfortable, durable, and functional products continues to drive growth in this segment globally.

The furniture and upholstery end-use segment is anticipated to hold 31.2% of the flexible foam market revenue share in 2025, making it the largest application category. Its leadership is being supported by the growing need for ergonomic and comfortable seating solutions in residential, commercial, and hospitality settings. Flexible foam is widely employed in sofas, chairs, mattresses, and cushions to provide durability, support, and comfort while allowing for versatile designs and aesthetic finishes.

The segment is also benefiting from increasing urbanization, rising disposable income, and consumer preference for high-quality home furnishings. Innovations in foam density, memory retention, and fire retardancy have further expanded its suitability for furniture and upholstery applications.

Manufacturers are increasingly focusing on developing sustainable and eco-friendly foam products to align with environmental regulations and consumer expectations, which is reinforcing adoption The ongoing demand for furniture that combines comfort, style, and functionality is expected to sustain the growth of this end-use segment, ensuring that furniture and upholstery continue to be the largest driver of revenue within the flexible foam market.

The flexible foam market is expanding due to rising demand in furniture, bedding, automotive, and industrial applications. Regulatory compliance, including flammability and chemical emission standards, ensures product safety, performance, and environmental adherence. Technological advancements in formulations, production techniques, and foam properties improve comfort, durability, and functionality, enabling diverse end-use applications. Growth in residential, commercial, and industrial sectors, along with rising consumer awareness and disposable incomes, further supports market expansion. Manufacturers are investing in innovative, high-performance, and eco-compliant foam solutions to meet evolving industry requirements, positioning flexible foams as a critical material for comfort, protection, and industrial utility worldwide.

The flexible foam market is growing steadily due to its extensive use in furniture, mattresses, and bedding products. Consumers increasingly prefer comfort, durability, and ergonomic support, driving adoption of polyurethane and memory foams. Residential and commercial sectors are major contributors, with sofas, chairs, and mattresses requiring high-quality, resilient foam materials. Product innovations such as hypoallergenic, anti-microbial, and temperature-responsive foams are gaining traction. Retail growth, e-commerce expansion, and rising disposable incomes in emerging markets further fuel demand. Manufacturers focus on lightweight, cost-effective, and performance-optimized foams to cater to evolving consumer preferences and enhance overall end-user experience.

Regulations related to fire safety, chemical emissions, and environmental impact influence the flexible foam market significantly. Foam products must comply with flammability standards, VOC limits, and material safety guidelines, particularly for mattresses, furniture, and automotive applications. Compliance with international standards such as CertiPUR-US ensures consumer safety and product reliability. Environmental and waste disposal regulations are also encouraging the adoption of bio-based foams and recyclable materials. Manufacturers focus on safe chemical formulations, low-emission products, and sustainable production practices to maintain compliance, reduce liability, and enhance brand credibility in both domestic and global markets.

Technological innovations in foam production, including high-resilience foams, viscoelastic foams, and hybrid formulations, are shaping market dynamics. Developments in blowing agents, additives, and chemical formulations improve durability, flexibility, comfort, and thermal resistance. Customizable density, thickness, and firmness allow application-specific solutions for furniture, automotive seating, and bedding. Advanced molding techniques, automated production lines, and quality control measures ensure uniformity and performance consistency. R&D efforts focus on enhancing lifecycle, comfort, and load-bearing capacity while reducing material consumption and production costs. These innovations expand the range of applications and strengthen competitive differentiation.

The flexible foam market is supported by increasing demand in automotive, packaging, and industrial applications. Automotive seats, headrests, and interior panels require lightweight, high-durability foam materials with excellent comfort and vibration absorption properties. Protective packaging, insulation, and acoustic applications in construction and industrial equipment also utilize flexible foams. Urban development, rising automotive production, and growth in consumer electronics and industrial machinery drive the need for specialized foam products. Manufacturers are focusing on multi-functional foams that offer cushioning, thermal insulation, noise reduction, and vibration control to address diverse industrial and commercial requirements effectively.

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

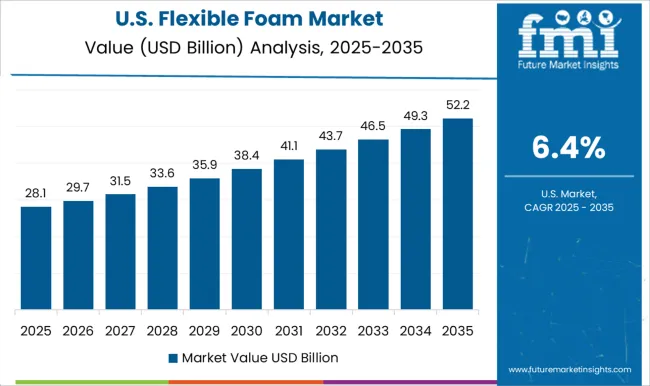

| USA | 6.4% |

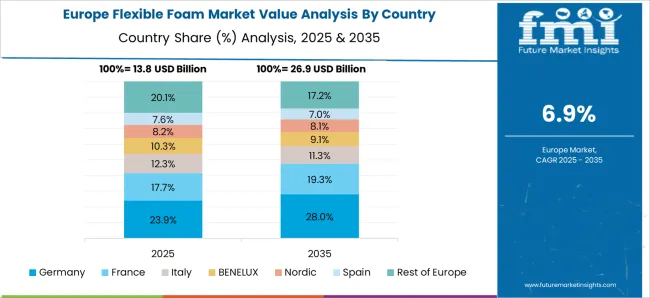

| Brazil | 5.6% |

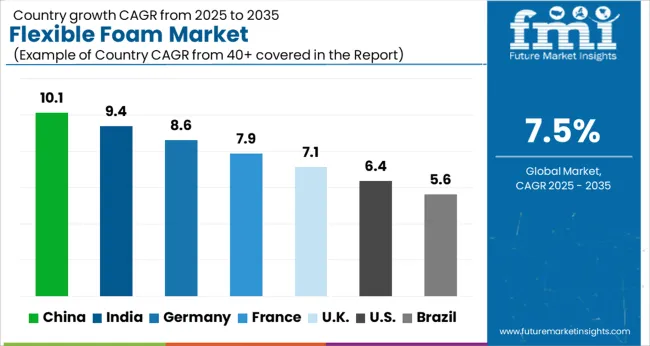

The global flexible foam market is projected to grow at a CAGR of 7.5% from 2025 to 2035. China leads expansion at 10.1%, followed by India at 9.4%, Germany at 8.6%, the UK at 7.1%, and the USA at 6.4%. Growth is driven by rising demand in furniture, automotive, bedding, and packaging applications, along with increasing adoption of high-resilience and specialty foam products. China and India dominate production and consumption due to large-scale manufacturing capacities and growing end-use industries, while Germany, the UK, and the USA focus on advanced foam formulations, customization, and performance-oriented applications to meet evolving consumer and industrial requirements. The analysis covers over 40 countries, with the leading markets detailed below.

The flexible foam market in China is projected to grow at a CAGR of 10.1% from 2025 to 2035, driven by rapid growth in furniture, automotive, bedding, and construction sectors. Rising urbanization, increasing disposable incomes, and expanding consumer demand for comfort and ergonomic products are fueling adoption. Manufacturers are focusing on innovations in polyurethane, memory foam, and bio-based foam variants to enhance durability, resilience, and sustainability. Industrial collaborations are enabling advanced processing techniques, quality control, and customization for diverse applications. Demand from automotive interiors, mattresses, upholstered furniture, and packaging is further accelerating market expansion. Government investments in residential and commercial construction projects also support high-volume adoption of flexible foam solutions across industrial and commercial segments.

The market in India is expected to grow at a CAGR of 9.4% from 2025 to 2035, fueled by rising demand in mattresses, furniture, automotive seating, and packaging industries. Consumers increasingly prefer durable, comfortable, and ergonomically designed foam products. Manufacturers are investing in advanced production techniques, memory foam variants, and customized solutions to meet industrial and consumer requirements. Growth in urban housing, hospitality, and automotive sectors is driving flexible foam adoption, while government initiatives in infrastructure development and residential projects further strengthen the market. Partnerships with global technology providers support R&D, quality improvement, and environmentally friendly foam solutions. The market reflects rising interest in high-performance, versatile foam materials that cater to both commercial and domestic applications.

Germany’s flexible foam market is projected to grow at a CAGR of 8.6% from 2025 to 2035, driven by industrial demand from automotive, furniture, bedding, and technical applications. Adoption of high-quality polyurethane, memory foam, and specialty foam variants is rising due to durability, comfort, and compliance with EU environmental regulations. Manufacturers are investing in R&D, innovative processing, and high-performance foam materials for automotive interiors, mattresses, and upholstered furniture. Collaborations with European and global suppliers facilitate access to advanced formulations, sustainable alternatives, and enhanced production efficiency. Growth is further supported by the increasing adoption of foam in technical and industrial applications, including packaging, insulation, and vibration damping.

The UK flexible foam market is expected to grow at a CAGR of 7.1% from 2025 to 2035, influenced by demand in furniture, bedding, automotive interiors, and packaging applications. Consumers and industries are adopting memory foam, polyurethane foam, and specialty variants for enhanced comfort, resilience, and versatility. Manufacturers focus on improving product quality, reducing environmental impact, and customizing foam solutions to meet diverse needs. Growth in residential, commercial, and automotive sectors drives adoption, while collaborations with technology providers and material suppliers support R&D and advanced production processes. Increasing interest in ergonomically designed mattresses, furniture, and technical foam applications is further accelerating market growth across industrial and consumer segments.

The USA flexible foam market is projected to grow at a CAGR of 6.4% from 2025 to 2035, driven by rising demand in furniture, bedding, automotive seating, and industrial applications. Adoption is encouraged by the need for durable, comfortable, and versatile foam solutions across consumer and industrial segments. Manufacturers are focusing on advanced polyurethane, memory foam, and eco-friendly variants, alongside process optimization and quality control enhancements. Growth in residential, commercial, and automotive sectors supports market expansion, while collaborations with global suppliers and technology providers facilitate product innovation and high-performance foam solutions. Increasing consumer preference for ergonomic, durable, and high-quality foam products further reinforces market growth in the United States.

Competition in the flexible foam market is shaped by material performance, application diversity, and innovation in formulation. BASF leads with high-performance polyurethane foams for furniture, automotive, bedding, and insulation applications, emphasizing durability, resilience, and comfort. Covestro AG competes with flexible polyurethane solutions for automotive seating, mattresses, and specialty industrial applications, focusing on lightweight formulations, process efficiency, and mechanical performance. Huntsman International differentiates through custom polyurethane systems, offering tailored density, hardness, and flame-retardant properties for diverse end uses.

Dow Chemical Company provides a wide range of flexible foam grades, targeting bedding, furniture, automotive, and acoustic insulation markets, emphasizing consistency, environmental compliance, and cost-effectiveness. Recticel offers specialty foam solutions with enhanced comfort, resilience, and thermal properties, catering to both consumer and industrial applications. Mid-sized and regional players differentiate through specialty foams, customizable density, and niche applications in mattresses, automotive seating, and acoustic insulation.

Strategies emphasize innovation in bio-based polyols, flame-retardant additives, and performance optimization. R&D focuses on reducing emissions, improving durability, and enhancing comfort and resilience, while collaborations with furniture manufacturers, automotive OEMs, and bedding brands support rapid adoption. Companies highlight cost-effective production, lightweight design, and compliance with environmental and safety standards.

Product brochure content is detailed and technical. Flexible foam offerings include slabstock, molded, and specialty foams with specifications on density, hardness, compression set, tensile strength, and resilience. Application guidelines for mattresses, furniture, automotive seating, and acoustic solutions are provided. Packaging formats, storage recommendations, and processing instructions are described. Performance attributes such as thermal insulation, vibration damping, flame retardancy, and comfort are highlighted, reflecting a market focused on versatility, durability, and end-use adaptability.

| Items | Values |

|---|---|

| Quantitative Units | USD 58.1 billion |

| Type | Polyurethane, Polyethylene, Polypropylene, Silicone, Ethylene-vinyl acetate (EVA), Melamine, and Polyvinylidene fluoride (PVDF) |

| End-Use | Furniture & upholstery, Packaging, Construction, Consumer goods, and Transportation |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF, Covestro AG, Huntsman International, Dow Chemical Company, and Recticel |

| Additional Attributes | Dollar sales by foam type (polyurethane, memory, latex) and application (furniture, automotive, bedding, packaging), share by region and end-use segment, growth trends, performance properties, regulatory compliance, emerging formulations, and competitive positioning. |

The global flexible foam market is estimated to be valued at USD 58.1 billion in 2025.

The market size for the flexible foam market is projected to reach USD 119.7 billion by 2035.

The flexible foam market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in flexible foam market are polyurethane, polyester, polyether, polyethylene, cross linked, non-cross linked, polypropylene, silicone, ethylene-vinyl acetate (eva), melamine and polyvinylidene fluoride (pvdf).

In terms of end-use, furniture & upholstery segment to command 31.2% share in the flexible foam market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flexible Polymer Foam Market

Flexible Colored PU Foams Market Growth - Trends & Forecast 2025 to 2035

Flexible Packaging Paper Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Pouch Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Rubber Sheets Market Size and Share Forecast Outlook 2025 to 2035

Flexible Printed Circuit Boards Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Machinery Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electronic Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Flexible Protective Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible AC Current Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Flexible End-Load Cartoner Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Screens Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Display Market Size and Share Forecast Outlook 2025 to 2035

Flexible Substrate Market Size and Share Forecast Outlook 2025 to 2035

Flexible Paper Battery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA