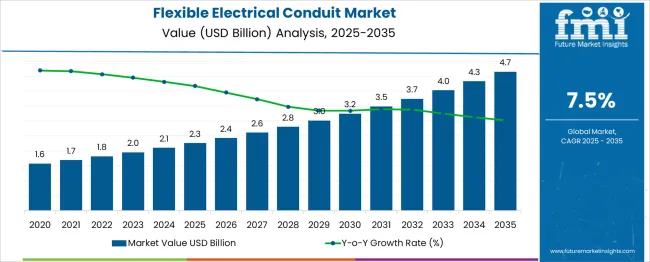

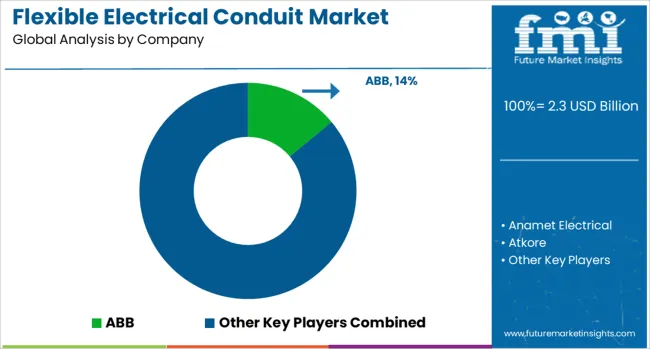

The Flexible Electrical Conduit Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period. Between 2025 and 2027, the market value grows modestly from USD 2.3 billion to USD 2.6 billion, contributing steadily to the total growth.

This early phase reflects foundational growth likely driven by gradual adoption and infrastructure development. The mid-period, spanning 2028 to 2031, shows stronger contributions, with values rising from USD 2.8 billion to USD 3.7 billion. This segment contributes significantly to growth, accounting for expanding applications and increasing industry acceptance.

The latter years, from 2032 to 2035, indicate sustained growth momentum, where the market expands from USD 4.0 billion to USD 4.7 billion. This period contributes a vital portion of overall growth, driven by technological advancements and increased demand for flexible electrical conduits in residential, commercial, and industrial sectors.

The growth contribution index highlights the middle to later years as key growth contributors, demonstrating that the Flexible Electrical Conduit Market’s expansion is both progressive and robust. The balanced contribution across the timeline underscores consistent market development without major fluctuations, reflecting stable demand and steady technological innovation.

| Metric | Value |

|---|---|

| Flexible Electrical Conduit Market Estimated Value in (2025 E) | USD 2.3 billion |

| Flexible Electrical Conduit Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The flexible electrical conduit market is undergoing sustained growth, supported by rising investments in infrastructure, modernization of industrial facilities, and stricter safety standards in electrical installations. Demand is being driven by the need for robust yet adaptable wiring protection solutions across construction, energy, and manufacturing sectors.

Flexibility, durability, and ease of installation are being prioritized by end-users seeking to optimize operational efficiency and reduce maintenance costs. Future expansion is expected to be fueled by technological advancements in materials and design, growing electrification trends, and regulatory emphasis on workplace safety.

Opportunities are also emerging through smart building developments, renewable energy projects, and increased adoption of automation in industrial environments. These factors collectively are paving the way for long-term adoption and competitive differentiation within the market.

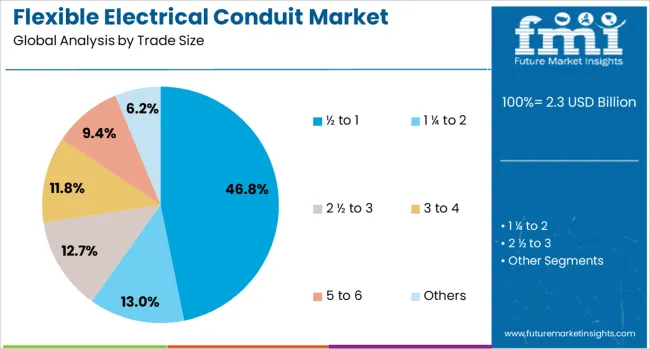

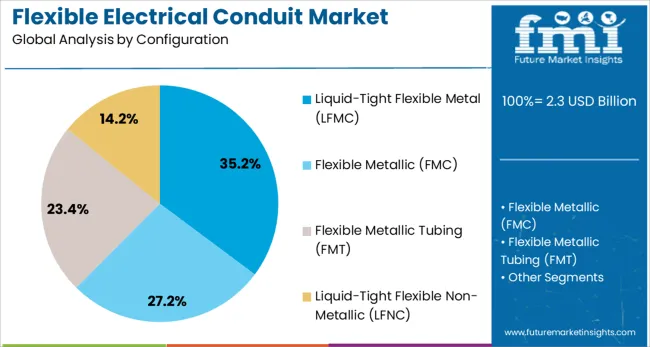

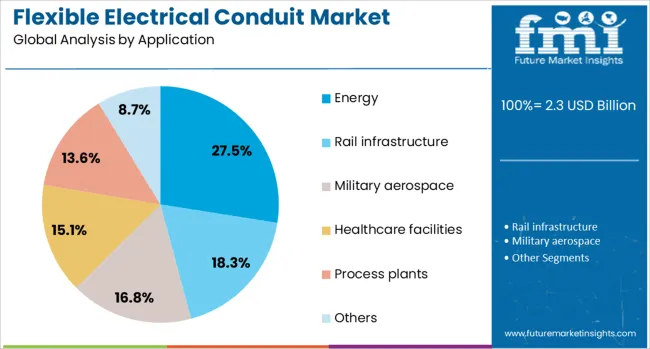

The flexible electrical conduit market is segmented by trade size, configuration, application, end-use, and geographic region. By trade size, the flexible electrical conduit market is divided into ½ to 1, 1¼ to 2, 2½ to 3, 3 to 4, and 5 to 6 inches, among others. In terms of configuration, the flexible electrical conduit market is classified into Liquid-Tight Flexible Metal (LFMC), Flexible Metallic (FMC), Flexible Metallic Tubing (FMT), and Liquid-Tight Flexible Non-Metallic (LFNC). Based on application, the flexible electrical conduit market is segmented into Energy, Rail infrastructure, Military aerospace, Healthcare facilities, Process plants, and Others. By end-use, the flexible electrical conduit market is segmented into Industrial, Residential, and Commercial/utility. Regionally, the flexible electrical conduit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by trade size, the ½ to 1 segment is anticipated to hold 46.8% of the total market revenue in 2025, establishing itself as the leading trade size category. This dominance is attributed to its suitability for a wide range of commercial and residential applications where moderate capacity and flexibility are required.

The segment has benefited from its compatibility with standard electrical fittings and its ability to balance ease of handling with sufficient protection for conductors. Installers have favored this size range for its versatility, allowing for efficient routing through tight spaces while maintaining compliance with safety codes.

Cost efficiency and broad availability in the market have further reinforced its leadership as the preferred choice for diverse installations across multiple industries.

Segmented by configuration, the liquid tight flexible metal LFMC segment is projected to capture 35.2% of market revenue in 2025, positioning it as the dominant configuration. This position has been reinforced by its superior resistance to moisture, oils, and other contaminants, making it ideal for demanding environments.

Adoption has been driven by industries that prioritize durability and ingress protection in both indoor and outdoor settings. The ability to maintain flexibility while offering a sealed, secure pathway for electrical conductors has aligned with the needs of sectors exposed to harsh or wet conditions.

Installers have relied on LFMC for its compliance with rigorous standards and its contribution to system longevity, solidifying its prominence within the configuration landscape.

When segmented by application, the energy sector is expected to account for 27.5% of the total market revenue in 2025, securing its position as the leading application segment. This leadership has been supported by increasing investments in power generation, transmission, and distribution projects that require durable and flexible conduit systems.

The segment has gained momentum as energy facilities seek solutions capable of withstanding demanding operating conditions while facilitating quick installation and maintenance. The ability of flexible conduits to adapt to complex layouts and provide effective protection in high-vibration and high-temperature settings has made them indispensable in energy applications.

The ongoing transition toward renewable energy sources and upgrades to existing power infrastructure have further strengthened the role of this segment as a critical driver of market growth.

The market has been witnessing steady growth due to the increasing demand for efficient electrical wiring protection in commercial, residential, and industrial sectors. Flexible conduits provide enhanced adaptability, ease of installation, and resistance to mechanical stress, chemicals, and moisture. Their ability to accommodate complex routing paths and vibrations has made them preferred choices in modern electrical infrastructure. The market has been supported by expanding construction activities, industrial automation, and electrical grid modernization projects globally. Developments in material technology, such as the use of high-grade plastics, metals, and composite materials, have improved durability and corrosion resistance.

The growth of the flexible electrical conduit market has been significantly influenced by ongoing construction projects, especially in urban and developing regions. Commercial and residential buildings increasingly require reliable wiring protection solutions that can adapt to architectural complexities and space constraints. Flexible conduits have been favored for their ease of bending and routing without compromising cable integrity. Strict electrical safety regulations and standards have mandated the use of conduits to prevent electrical hazards such as short circuits, fire, and physical damage to cables. Additionally, retrofitting older buildings with modern wiring infrastructure has generated demand for flexible conduit systems. Government-driven infrastructure development and smart city initiatives have further encouraged investments in electrical safety equipment. The construction sector’s rising focus on sustainability and code compliance is expected to maintain steady demand for flexible electrical conduits.

Advancements in materials have played a crucial role in improving the performance of flexible electrical conduits. The adoption of thermoplastic polymers, galvanized steel, stainless steel, and aluminum alloys has enhanced conduit resistance to corrosion, abrasion, and environmental factors. Composite materials combining metal and plastic have been introduced to balance flexibility with mechanical strength. Coating technologies and flame-retardant additives have further increased safety profiles by reducing fire risks. These material improvements have extended the service life of conduits, minimizing maintenance and replacement costs. Manufacturers have been investing in research to develop lightweight yet durable conduits that meet diverse application requirements in harsh industrial and outdoor environments. Such innovations have also enabled compliance with evolving standards and customer demands, strengthening market competitiveness and widening the scope of flexible conduit applications.

The rising adoption of industrial automation and smart manufacturing has been driving demand for flexible electrical conduits capable of protecting wiring in dynamic and complex environments. Automated machinery, robotics, and control systems require conduits that can endure repetitive movements, vibrations, and exposure to chemicals or oils. Flexible conduits have been used extensively in factories, assembly lines, and processing plants to ensure reliable power and signal transmission while protecting cables from mechanical damage. Infrastructure modernization projects, including upgrades to power distribution networks and telecommunications systems, have also contributed to market expansion. These projects often involve retrofitting with flexible conduit systems to accommodate new technologies and improve safety. The increasing integration of IoT devices and sensors in industrial setups is expected to further boost the demand for flexible conduits that support data and power cabling in challenging conditions.

The versatile nature of flexible electrical conduits has led to their increasing use across various end-use industries beyond construction and manufacturing. Sectors such as oil and gas, automotive, marine, and aerospace have been utilizing flexible conduits to protect electrical wiring from harsh environments and mechanical stress. In the oil and gas industry, flexible conduits resistant to chemicals and extreme temperatures have been essential for offshore platforms and refineries. The automotive sector has incorporated flexible conduits in wiring harnesses to improve durability and ease of assembly. Marine applications benefit from corrosion-resistant conduits that withstand saltwater exposure. Aerospace uses flexible conduit solutions for complex cable routing and weight reduction. This broad adoption across industries has contributed to steady market growth, supported by specialized product development tailored to sector-specific requirements.

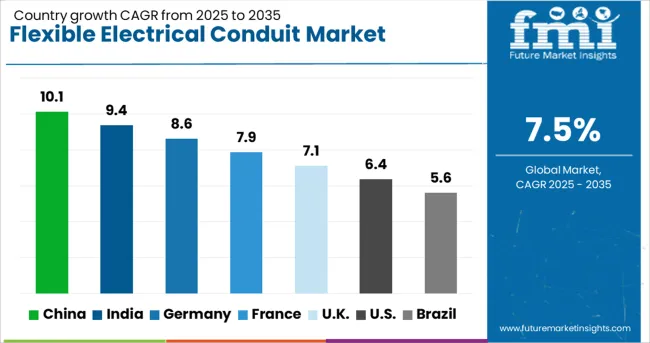

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

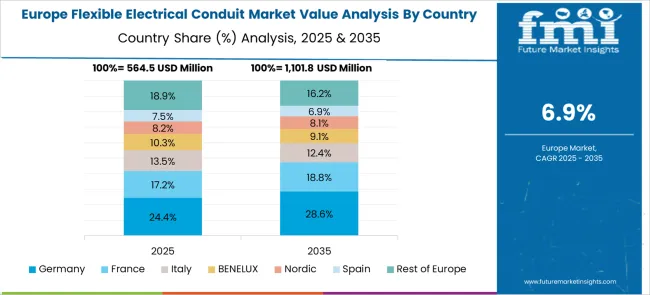

The market is expected to grow at a CAGR of 7.5% between 2025 and 2035, driven by rising demand for versatile wiring protection solutions in construction and industrial applications. China leads with a 10.1% CAGR, supported by rapid infrastructure development and industrialization. India follows at 9.4%, fueled by expanding urbanization and electrical installations. Germany, at 8.6%, benefits from stringent safety standards and technological advancements in conduit materials. The UK, growing at 7.1%, sees steady adoption in commercial and residential sectors. The USA, at 6.4%, experiences demand driven by modernization of electrical infrastructure and safety compliance. This report includes insights on 40+ countries; the top markets are shown here for reference.

The industry in China is expected to grow at a CAGR of 10.1% from 2025 to 2035. Rapid expansion of construction activities and industrial infrastructure projects has intensified demand for durable and easy-to-install conduit solutions. Domestic manufacturers such as Ningbo Yongsheng and Zhongshan Tianyu are investing in product innovation, focusing on corrosion resistance and enhanced flexibility. The electrical conduit market benefits from government initiatives promoting modernization of electrical grids and safety standards. Increasing adoption in renewable energy installations and smart buildings further accelerates growth. Export demand from Southeast Asia also contributes significantly to the overall sales volume.

India is projected to grow at a CAGR of 9.4% through 2035. Expansion in residential and commercial construction supports steady demand. Leading players such as Finolex and Havells focus on introducing lightweight and fire-retardant conduit options to meet evolving safety regulations. Government programs to upgrade urban infrastructure and rural electrification projects drive adoption across regions. Increasing use in industrial automation and renewable energy sectors further expands the market. Rising awareness of electrical safety in the construction sector contributes to stronger sales.

The industry in Germany is forecast to expand at a CAGR of 8.6% during 2025 to 2035. Growth is driven by modernization of industrial facilities and strict adherence to electrical safety standards. Manufacturers like Lapp Group and Phoenix Contact prioritize high-quality materials and innovative conduit designs that provide improved protection against mechanical stress and chemical exposure. Demand is particularly strong in the automotive and manufacturing sectors. Increasing investments in smart factories and Industry 4.0 technologies support conduit adoption. The market is also influenced by tightening environmental regulations impacting product composition.

Demand for flexible electrical conduits in the United Kingdom is anticipated to grow at a CAGR of 7.1% from 2025 to 2035. Growth is fueled by increasing construction activity and upgrade of electrical infrastructure in commercial buildings. Players such as ABB and Polypipe invest in development of conduits that meet fire safety and electrical code compliance requirements. The renewable energy sector, including offshore wind projects, also drives conduit sales. Enhanced focus on energy-efficient buildings is boosting adoption of flexible conduits for HVAC and electrical installations.

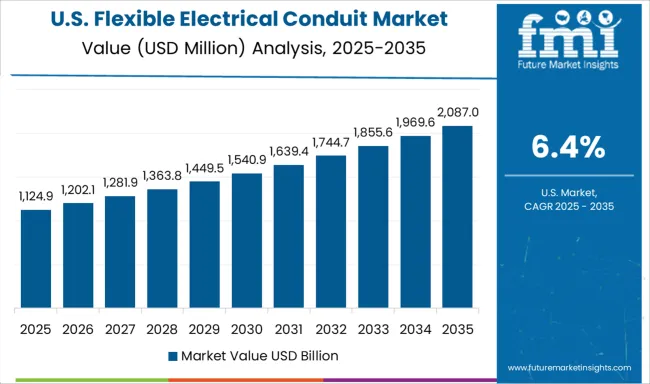

The United States market is projected to grow at a CAGR of 6.4% during 2025 to 2035. Increasing replacement and retrofit activities in aging infrastructure support market expansion. Domestic manufacturers such as Southwire and Thomas & Betts focus on providing versatile conduit solutions compatible with emerging smart grid and automation technologies. Residential renovation projects also contribute to steady demand. Regulatory emphasis on electrical safety and energy efficiency accelerates adoption of advanced conduit products. The industry benefits from collaboration between manufacturers and electrical contractors to customize conduit systems for specific applications.

The flexible electrical conduit market is dominated by a combination of global manufacturers, regional fabricators, and specialized niche players, with competition defined by material technology, application-specific solutions, and service integration. Thomas & Betts (ABB) and Eaton lead globally through extensive product portfolios encompassing EMT, FMC, and liquid-tight flexible conduits, supported by global distribution and technical service networks. These players differentiate by providing bundled solutions with fittings, connectors, and installation guides, targeting industrial, commercial, and high-end residential projects.

Legrand and Hubbell compete by emphasizing modularity, fire resistance, and integrated cabling solutions for smart-building applications, leveraging partnerships with electrical contractors and providing training programs to accelerate adoption. Regional leaders such as Polycab (India) and Hitachi Metals (Japan) focus on cost-efficient manufacturing and localized service support, enabling rapid deployment in price-sensitive emerging markets.

Competition is increasingly shaped by specialized materials (corrosion-resistant alloys, PVC-metal hybrids), IoT-ready conduit integration, and turnkey support services rather than price alone. Strategic differentiation includes pre-fabricated conduit assemblies, contractor training programs, and bundled system warranties. The market also rewards innovation in bend radius optimization, lightweight designs, and enhanced durability, allowing players to capture complex residential, retrofit, and multi-story construction projects. Success is anchored in balancing product performance, compliance with regional electrical codes, and contractor-focused service models across mature and emerging geographies.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Trade Size | ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others |

| Configuration | Liquid-Tight Flexible Metal (LFMC), Flexible Metallic (FMC), Flexible Metallic Tubing (FMT), and Liquid-Tight Flexible Non-Metallic (LFNC) |

| Application | Energy, Rail infrastructure, Military aerospace, Healthcare facilities, Process plants, and Others |

| End Use | Industrial, Residential, Commercial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Anamet Electrical, Atkore, CANTEX, Dongguan FlexGlory Machinery Accessories, Electri-Flex Company, Hubbell, HellermannTyton, Kaiphone Technology, Legrand, Schneider Electric, Southwire Company, and Wienerberger |

| Additional Attributes | Dollar sales by conduit type and end-use sector, demand dynamics across commercial construction, industrial facilities, and infrastructure projects, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in corrosion-resistant materials, flame-retardant coatings, and ease-of-installation designs, environmental impact of raw material extraction, manufacturing emissions, and end-of-life recycling, and emerging use cases in smart building electrical systems, renewable energy installations, and hazardous location wiring. |

The global flexible electrical conduit market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the flexible electrical conduit market is projected to reach USD 4.7 billion by 2035.

The flexible electrical conduit market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in flexible electrical conduit market are ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6 and others.

In terms of configuration, liquid-tight flexible metal (lfmc) segment to command 35.2% share in the flexible electrical conduit market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Electrical Conduit Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Flexible Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Rigid Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Metal Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Scale Non Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA