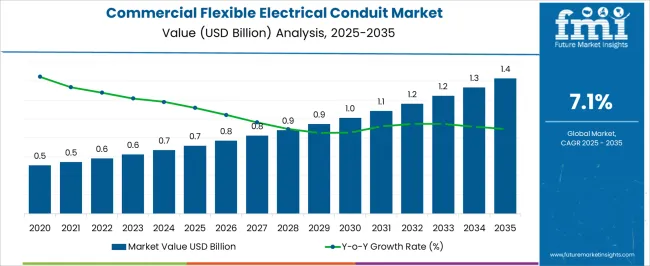

The commercial flexible electrical conduit market is estimated to be valued at USD 0.7 billion in 2025 and is projected to reach USD 1.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

A 5-year growth block analysis provides deeper insight into how expansion is distributed across the forecast horizon. In the first block, 2021 to 2025, the market progresses from USD 0.5 billion to 0.7 billion, adding USD 0.2 billion in value. This early growth is influenced by rising adoption in commercial construction, basic retrofitting works, and safety-compliant wiring applications in small and medium-sized facilities. The second block, spanning 2026 to 2030, marks a stronger phase of expansion as the market climbs from USD 0.7 billion to 1.0 billion, resulting in an incremental gain of USD 0.3 billion. This period is shaped by the implementation of stricter electrical codes, modernization of energy-efficient infrastructure, and the integration of conduits into smart building ecosystems, where flexibility and adaptability are critical.

The third block, from 2031 to 2035, contributes the most significant growth, advancing from USD 1.0 billion to 1.4 billion and creating a USD 0.4 billion absolute opportunity. Factors such as increasing investment in modern commercial complexes, growth of renewable energy installations, and higher demand for durable conduit solutions in complex wiring systems push expansion further. Comparing the three blocks highlights a compounding effect, where each 5-year period contributes greater absolute value than the previous one. This cumulative pattern reflects both rising baseline demand and an acceleration of technology-led adoption, signaling strong long-term potential for manufacturers, contractors, and solution providers in the commercial flexible electrical conduit industry.

| Metric | Value |

|---|---|

| Commercial Flexible Electrical Conduit Market Estimated Value in (2025 E) | USD 0.7 billion |

| Commercial Flexible Electrical Conduit Market Forecast Value in (2035 F) | USD 1.4 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The electrical wiring and cabling market contributes the largest share of about 28-32%, as flexible conduits play a critical role in routing and protecting electrical wiring in commercial facilities while ensuring safety, reliability, and compliance with local and international standards. The construction and infrastructure market adds around 22-25%, since large commercial complexes, office towers, malls, hospitals, and institutional buildings require extensive conduit installations for new construction as well as retrofitting projects where space constraints demand flexible solutions. The industrial equipment and machinery market contributes about 15-18%, with flexible conduits widely used to protect cables in manufacturing units, automation systems, robotics, and heavy-duty equipment exposed to vibration, heat, and mechanical stress.

The telecommunications and data center market provides nearly 10-12%, where conduits are vital for structured cabling, fiber optics, and power routing in high-density environments that demand maximum uptime, fire resistance, and electromagnetic interference protection. Finally, the HVAC and building systems market accounts for about 8-10%, as conduits are utilized to shield wiring, sensors, and control systems in heating, ventilation, and air-conditioning units across commercial facilities.

The commercial flexible electrical conduit market is registering steady growth, supported by rising construction activity, infrastructure upgrades, and the demand for safer, more adaptable electrical wiring systems. Industry publications and manufacturer updates have emphasized the role of flexible conduit in protecting wiring from mechanical damage, moisture, and environmental hazards, making it a preferred choice in both new builds and renovation projects.

Commercial facilities have increasingly adopted flexible conduit systems due to their ease of installation and ability to navigate tight bends without compromising cable protection. In addition, regulatory requirements for electrical safety in commercial structures have prompted wider usage of premium-grade conduits with enhanced durability and fire resistance.

The market outlook is further strengthened by innovations in conduit materials, compatibility with smart building technologies, and increased investments in energy-efficient infrastructure. Growth is anticipated to remain strong as modernization efforts, electrical code compliance, and the expansion of commercial real estate continue to drive demand.

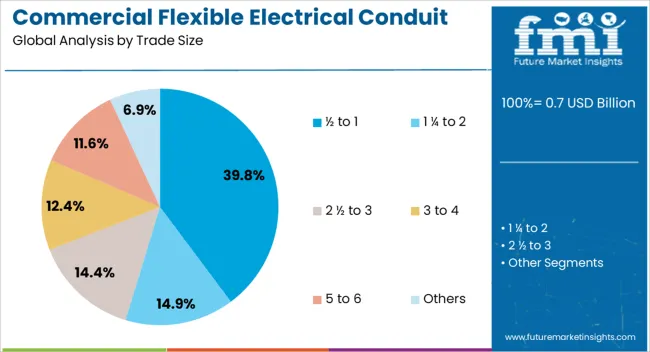

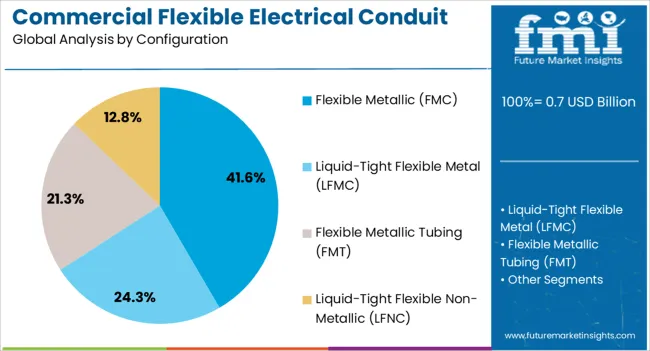

The commercial flexible electrical conduit market is segmented by trade size, configuration, and geographic regions. By trade size, commercial flexible electrical conduit market is divided into ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others. In terms of configuration, commercial flexible electrical conduit market is classified into flexible metallic (FMC), liquid-tight flexible metal (LFMC), flexible metallic tubing (FMT), and liquid-tight flexible non-metallic (LFNC). Regionally, the commercial flexible electrical conduit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ½ to 1 trade size segment is projected to hold 39.8% of the commercial flexible electrical conduit market revenue in 2025, making it the leading size category. This dominance has been driven by the versatility of these sizes in accommodating standard electrical wiring used in most commercial applications. Contractors have preferred this range for its balance between capacity and flexibility, enabling efficient routing in confined spaces such as ceiling voids, wall cavities, and underfloor channels. Electrical standards and building codes frequently specify this trade size for lighting circuits, small power runs, and low-voltage cabling, reinforcing its widespread adoption. Additionally, distributors and suppliers have maintained high stock levels of these sizes due to consistent demand, ensuring easy availability for large-scale and maintenance projects. As commercial developments expand and renovation projects continue, the ½ to 1 trade size segment is expected to maintain its market lead due to its practicality and compliance with common installation requirements.

The flexible metallic conduit (FMC) segment is expected to account for 41.6% of the commercial flexible electrical conduit market revenue in 2025, retaining its top position in configuration preference. Growth in this segment has been fueled by FMC’s proven durability, mechanical protection, and ability to withstand demanding installation environments. Commercial electricians often choose FMC for areas where wiring is exposed to physical contact or vibration, as its metallic construction provides superior resistance to crushing and impact. Building safety guidelines have also favored FMC for applications requiring additional grounding capabilities, contributing to its broad use in critical electrical systems. Furthermore, FMC offers the advantage of flexibility without sacrificing structural integrity, making it suitable for complex routing in commercial interiors. The segment’s adoption is further supported by its compatibility with a range of fittings and connectors, which simplifies assembly and maintenance. With ongoing investment in robust and reliable electrical infrastructure, the FMC segment is expected to remain a mainstay in commercial conduit installations.

The commercial flexible electrical conduit market is expanding as construction, commercial real estate, and industrial sectors demand reliable wiring protection solutions. Growth is driven by increasing urbanization, modernization of electrical networks, and stringent safety regulations. Flexible conduits are widely adopted due to their ease of installation, adaptability in confined spaces, and compatibility with diverse building layouts. However, fluctuating raw material prices, compliance with regional fire and safety standards, and competition from substitutes remain key challenges. Opportunities exist in halogen-free conduits, corrosion-resistant coatings, and conduits designed for smart building integration. Trends highlight demand for energy-efficient buildings, renovation of old infrastructures, and digitized facility management.

The commercial flexible electrical conduit market is expanding as contractors and facility managers seek safe, adaptable wiring systems for modern infrastructure. These conduits are widely used in commercial buildings, data centers, industrial plants, and healthcare facilities where wiring needs to be protected from physical damage, moisture, vibration, and fire risks. Growing investment in commercial construction and retrofitting drives demand for conduits that allow faster installation, reduced maintenance, and compliance with evolving electrical safety standards. Flexible conduits offer significant advantages, including bendability, lightweight installation, and compatibility with multiple wiring types. With increasing emphasis on fire resistance, corrosion protection, and durability, manufacturers are focusing on developing conduits tailored to high-performance environments.

Ensuring compliance with electrical safety codes, fire ratings, and environmental regulations across different regions adds complexity for producers. In addition, flexible conduits must demonstrate consistent performance under mechanical stress, chemical exposure, and extreme temperatures, which demands robust engineering and quality assurance. Supply chain bottlenecks, particularly in construction and industrial projects, may delay product delivery and increase costs for end-users. Buyers increasingly demand conduits backed by certifications, warranties, and after-sales support to minimize downtime. Electrical contractors also prefer suppliers who can provide customization for specific voltage applications, installation environments, and conduit diameters. Overcoming these technical and regulatory constraints requires manufacturers to invest in testing, certification processes, and collaboration with standards authorities.

Growing construction activity in commercial complexes, industrial zones, and urban infrastructure creates strong opportunities for conduit manufacturers. The shift toward prefabricated buildings and modular construction enhances the appeal of conduits designed for quick assembly and adaptability. Suppliers offering value-added services such as technical support, design guidance, and tailored product solutions gain a competitive edge. Integration with smart wiring management systems and innovations in coating technologies improve conduit performance and longevity. Expansion of commercial spaces in Asia-Pacific, North America, and Europe presents a lucrative market outlook. Additionally, rising demand from renewable energy facilities, transportation hubs, and industrial plants expands product applications. Companies focusing on lightweight, high-durability, and fire-rated conduits are well-positioned to capture emerging demand. Enhancing installation efficiency, lifecycle cost savings, and project-specific customization will be key differentiators for manufacturers.

Flexible metallic conduits are increasingly used in applications requiring high durability, while non-metallic conduits are preferred for cost efficiency and easier handling. Smart integration with automated wiring systems, real-time monitoring of electrical loads, and modular conduit assemblies are transforming installation practices. Manufacturers are emphasizing lightweight yet strong materials to reduce labor costs and improve energy efficiency during installation. Collaboration between conduit producers, contractors, and project developers is driving product innovation and life-cycle management. The focus on enhanced safety, rapid installation, and reduced downtime aligns with the needs of commercial construction projects worldwide. Suppliers delivering versatile, technically advanced conduits with certifications and digital support are positioned to lead in the evolving market landscape.

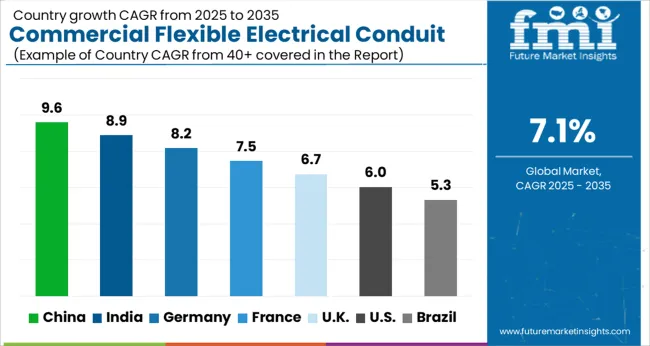

| Country | CAGR |

|---|---|

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| France | 7.5% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

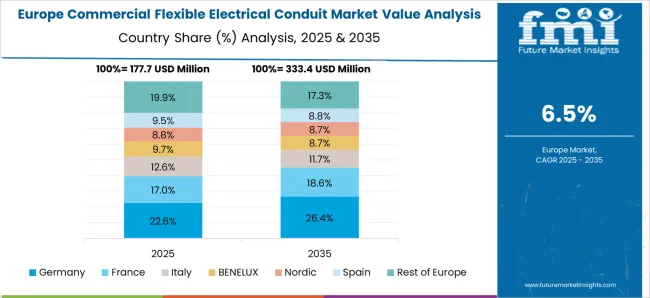

The global commercial flexible electrical conduit market is projected to expand at a CAGR of 7.1% from 2025 to 2035. China (9.6%) and India (8.9%) lead growth, driven by rapid urbanization, construction expansion, and safety compliance needs. France (7.5%) benefits from energy-efficient building codes and smart infrastructure initiatives. The UK (6.7%) emphasizes modernization of commercial facilities and stricter fire-safety standards, while the USA (6.0%) maintains demand from industrial upgrades and retrofitting projects. Growth drivers include rising construction investments, electrical safety regulations, and smart city projects. The analysis covers 40+ countries, with leading markets outlined below.

The commercial flexible electrical conduit market in China is projected to expand at a CAGR of 9.6% from 2025 to 2035, the highest globally. Rapid urbanization, large-scale construction projects, and industrial automation are fueling demand for advanced conduit systems. The country’s focus on smart infrastructure, commercial real estate, and large public utility projects is creating a steady need for flexible conduits that ensure reliable power distribution and protection. The expansion of data centers and the telecom sector is driving additional adoption. Local manufacturing advantages and government investment in urban housing and industrial zones support strong growth. Increasing preference for fire-resistant and easy-to-install conduits enhances demand across the construction value chain.

India’s market for commercial flexible electrical conduits is forecast to grow at a CAGR of 8.9% from 2025 to 2035. Rising investments in commercial construction, including malls, office complexes, and institutional buildings, are significantly boosting conduit demand. The government’s emphasis on smart cities, metro rail projects, and modern airports is also contributing to expansion. Additionally, growth in IT parks, data centers, and healthcare infrastructure is driving large-scale electrical installations. India’s rapidly growing middle class, coupled with increasing demand for reliable power distribution, is pushing adoption of flexible conduit solutions. Domestic conduit manufacturers are scaling capacity, while international players are investing in partnerships and joint ventures. Ease of installation, safety, and adaptability make flexible conduits the preferred choice for developers and contractors.

The commercial flexible electrical conduit market in France is expected to grow steadily at a CAGR of 7.5% from 2025 to 2035. Growth is driven by modernization of existing infrastructure, energy-efficient building retrofits, and new commercial developments. France’s commercial construction sector is benefiting from increasing demand for high-performance conduit systems that provide safety, flexibility, and ease of integration with modern wiring systems. Expansion of the telecom sector, particularly fiber optic and 5G networks, further supports demand. Additionally, the government’s investments in public infrastructure, such as schools, hospitals, and office spaces, are providing momentum. Contractors and facility managers are increasingly shifting toward lightweight, corrosion-resistant, and easy-to-handle conduits to reduce installation time and cost.

The UK's commercial flexible electrical conduit market is projected to grow at a CAGR of 6.7% from 2025 to 2035. Growth is supported by robust commercial building activity in retail, office, and logistics sectors. The expansion of e-commerce warehouses and logistics hubs has significantly increased demand for reliable electrical conduit installations. Upgrades in public infrastructure such as railways, airports, and government buildings are fueling further adoption. The trend toward digital connectivity and rising demand for data centers is another key driver. Despite slower construction growth compared to Asia, the UK market remains strong due to its focus on high-quality, standards-compliant conduit systems for both retrofits and new projects.

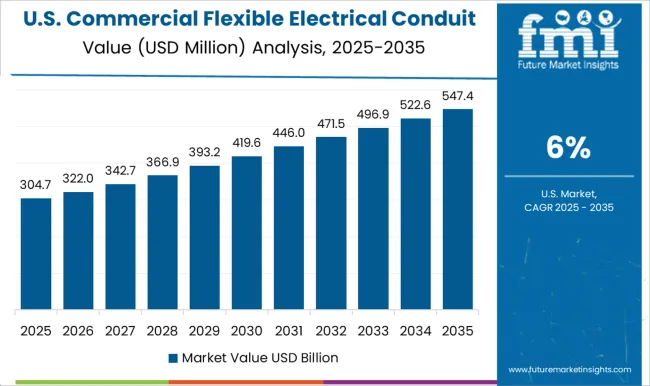

The USA commercial flexible electrical conduit market is forecast to expand at a CAGR of 6.0% from 2025 to 2035. Growth is being driven by large-scale commercial construction projects across retail, office, and institutional sectors, along with steady upgrades in public infrastructure. Expansion in data centers, cloud computing facilities, and telecom infrastructure is significantly boosting demand for advanced conduit systems. Flexible conduits are widely adopted due to their durability, ease of installation, and adaptability to complex layouts. The rise in healthcare and educational construction also adds to market momentum. With strong regulatory oversight on safety and performance, USA developers prefer advanced conduit systems that ensure compliance and long-term reliability.

Competition in the automotive testing, inspection, and certification (TIC) market is defined by global laboratory reach, accreditation portfolios, and ability to align with evolving mobility regulations. Eurofins Scientific competes with advanced analytical testing for materials, emissions, and chemical compliance, appealing to OEMs requiring detailed validation across global supply chains. SGS Group maintains strong leadership through comprehensive vehicle inspection programs, homologation services, and integrated certification platforms spanning safety, performance, and environmental standards. DEKRA SE positions itself as a top player in vehicle testing and roadworthiness inspection, focusing on type approval, crash testing, and advanced driver assistance system (ADAS) evaluations. Bureau Veritas highlights expertise in quality audits, regulatory compliance checks, and end-to-end TIC services tailored to automotive production ecosystems.

Applus+ builds competitive strength through technical services in vehicle inspection and homologation, with strong footholds in Europe and Latin America. UL LLC differentiates through electrical safety, battery certification, and cybersecurity testing, critical for electric and connected vehicles. TÜV Rheinland emphasizes global market access services and functional safety validation, while Intertek Group plc targets materials testing, component certification, and performance validation across powertrain, interiors, and EV systems. Element Materials Technology competes in advanced material, fatigue, and structural testing, positioning itself as a key partner for R&D-heavy OEMs and Tier-1 suppliers.

TÜV SÜD Group offers broad compliance solutions, including ISO certifications, ADAS validation, and EV battery testing, combining strong brand recognition with regulatory expertise. Strategies across the sector focus on expanding laboratory networks, advancing digital testing platforms, and developing capabilities for EVs, autonomous driving, and connected car technologies. Product brochures highlight type approval testing, emissions certification, endurance validation, battery and charging system safety, cybersecurity evaluation, materials durability, and global market access consulting. Collectively, these offerings show a market competing on technical depth, regulatory expertise, and global coverage, where success depends on aligning with rapid innovation cycles and international compliance demands.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.7 billion |

| Trade Size | ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others |

| Configuration | Flexible Metallic (FMC), Liquid-Tight Flexible Metal (LFMC), Flexible Metallic Tubing (FMT), and Liquid-Tight Flexible Non-Metallic (LFNC) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

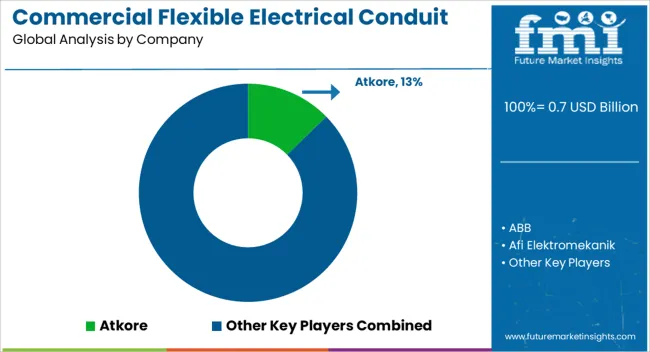

| Key Companies Profiled | Atkore, ABB, Afi Elektromekanik, Anamet Electrical, Bahra Electric, Delikon Electric Flexible Conduit, Eddy Group, Electri-Flex Company, HellermannTyton, Kaiphone Technology, Shanghai Weyer Electric, Southwire Company, United Power, and Whitehouse Flexible Tubing |

| Additional Attributes | Dollar sales by service type (testing, inspection, certification), vehicle type (passenger, commercial, EVs), and stage (R&D, production, post-production). Demand dynamics are driven by stricter safety regulations, EV adoption, and autonomous vehicle development. Regional trends highlight strong growth in Europe and North America due to regulatory enforcement, while Asia-Pacific is expanding rapidly with rising automotive production and EV investments. |

The global commercial flexible electrical conduit market is estimated to be valued at USD 0.7 billion in 2025.

The market size for the commercial flexible electrical conduit market is projected to reach USD 1.4 billion by 2035.

The commercial flexible electrical conduit market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in commercial flexible electrical conduit market are ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6 and others.

In terms of configuration, flexible metallic (fmc) segment to command 41.6% share in the commercial flexible electrical conduit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA